Biomea Fusion Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biomea Fusion Bundle

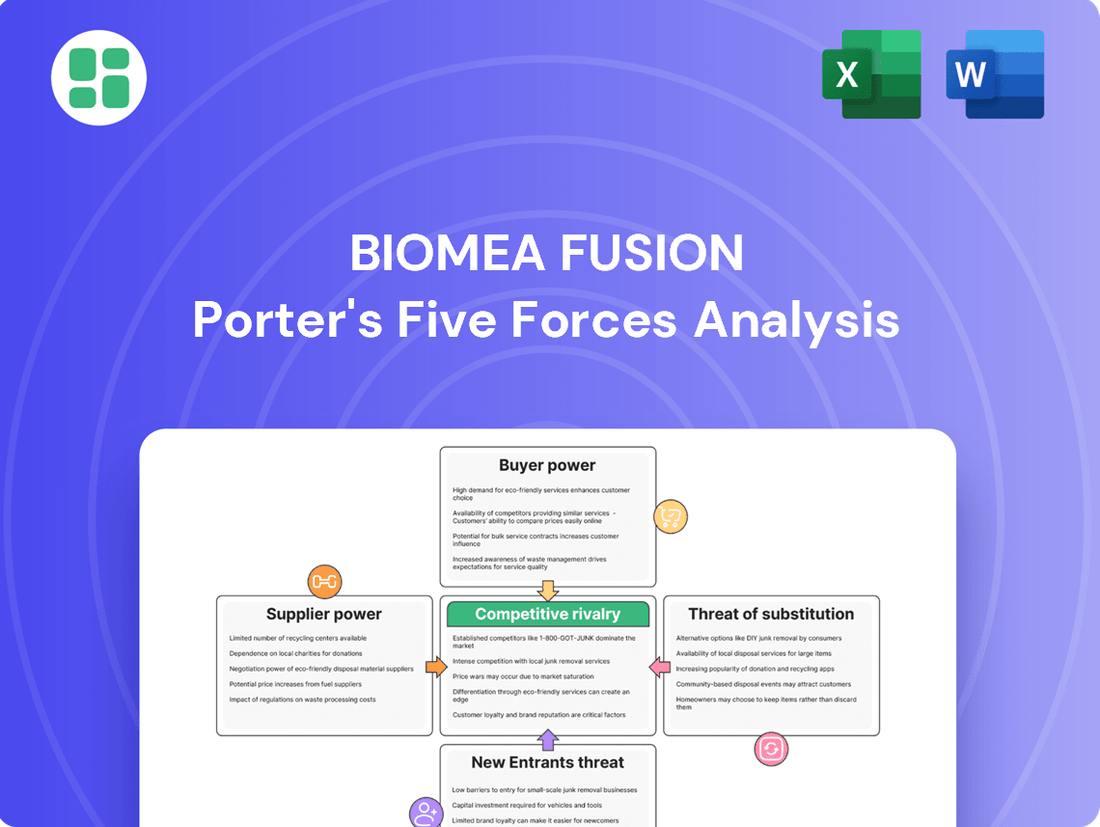

Biomea Fusion operates within a dynamic biotech landscape, facing significant competitive pressures. Understanding the interplay of these forces is crucial for strategic planning. Our analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sector.

The complete report reveals the real forces shaping Biomea Fusion’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The biopharmaceutical sector's reliance on a select group of specialized suppliers for crucial raw materials and Active Pharmaceutical Ingredients (APIs) significantly amplifies supplier bargaining power. These suppliers often possess unique proprietary technologies or control essential manufacturing processes, giving them considerable leverage over drug developers.

Biomea Fusion, a company in its clinical stages, is particularly susceptible to this. Its dependence on these specialized suppliers for the consistent quality and timely delivery of components for its drug candidates, such as icovamenib (BMF-219) and BMF-650, means any disruption or price increase from these suppliers can directly impact Biomea Fusion's development timelines and costs.

Biomea Fusion, like many biopharmaceutical firms, likely relies on Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) for critical functions. These specialized entities offer unique expertise and infrastructure that can be difficult and costly for Biomea Fusion to replicate internally, thereby granting CROs and CMOs significant leverage.

The specialized nature of CROs and CMOs, coupled with the high costs associated with switching providers, translates to considerable bargaining power. For instance, the global CRO market was valued at approximately $40 billion in 2023 and is projected to grow substantially, indicating a robust demand for their services and a consolidation of expertise that benefits these organizations.

Suppliers of patented technologies, specialized lab equipment, and proprietary software can hold significant sway. For instance, companies providing critical components for drug discovery platforms, like Biomea's FUSION™ System, can leverage their unique offerings. This reliance on specialized, often protected, intellectual property means Biomea may face limited supplier choices and potentially higher costs for essential inputs.

Highly Skilled Labor and Scientific Talent

The biopharmaceutical industry, including companies like Biomea Fusion, relies heavily on a specialized workforce. This includes scientists with expertise in areas like irreversible small molecule inhibitors, as well as medical and regulatory professionals. The demand for this talent often outstrips the supply, particularly in cutting-edge fields.

The scarcity of highly skilled labor and scientific talent in niche areas grants these professionals and the institutions that cultivate them considerable leverage. Biomea Fusion, like its peers, must actively compete to attract and retain this essential expertise to drive its research and development forward. For instance, in 2024, the demand for biopharmaceutical researchers with advanced degrees continued to be robust, with many roles remaining open for extended periods.

- High Demand for Niche Expertise: The biopharma sector's need for specialized scientific and medical talent, especially in areas like genetic engineering and precision medicine, creates a competitive hiring landscape.

- Talent Scarcity Drives Power: A shortage of professionals with specific skills, such as those in developing novel therapeutic modalities, empowers these individuals and their training institutions.

- Retention is Key for Biomea: Biomea Fusion's ability to advance its clinical pipeline and research depends on its success in attracting and retaining top-tier scientific and medical talent.

- Competitive Compensation: In 2024, average salaries for senior research scientists in the biopharmaceutical sector saw an increase, reflecting the intense competition for talent.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers hold significant bargaining power for Biomea Fusion. The pharmaceutical industry's intricate and ever-changing regulatory environment necessitates specialized expertise. Consultants, legal firms, and regulatory affairs specialists are essential suppliers, particularly given Biomea Fusion's history with clinical holds, such as the one experienced with BMF-210 in late 2023. Their ability to navigate FDA interactions and ensure compliance is crucial for the company's progress, potentially allowing them to command higher fees or more favorable terms.

The complexity of pharmaceutical regulations means that specialized knowledge is not easily replicated. Companies like Biomea Fusion rely on these external experts to manage critical aspects of drug development and approval. For instance, the successful navigation of FDA requirements for Investigational New Drug (IND) applications and subsequent clinical trials demands a deep understanding of specific guidelines and precedents. This reliance can amplify the bargaining power of these service providers, especially when their track record demonstrates success in similar challenging scenarios.

In 2024, the pharmaceutical regulatory landscape continued to evolve, with increased scrutiny on clinical trial data integrity and manufacturing processes. Service providers adept at meeting these heightened standards are in high demand. Biomea Fusion's need for such specialized support, particularly in light of prior regulatory hurdles, positions these suppliers favorably in negotiations. Their ability to mitigate risks and accelerate approvals translates directly into value for Biomea Fusion, strengthening their negotiating position.

Key factors influencing the bargaining power of regulatory and compliance service providers include:

- Specialized Expertise: Deep knowledge of FDA regulations and drug approval processes.

- Criticality of Services: Essential for navigating regulatory hurdles and ensuring compliance.

- Past Performance: Demonstrated success in managing clinical holds and FDA interactions.

- Industry Demand: High demand for specialized regulatory services in the evolving pharmaceutical market.

Suppliers in the biopharmaceutical industry, particularly those providing specialized raw materials, APIs, and contract services, wield significant bargaining power. This is due to the highly technical nature of their offerings and the limited number of qualified providers, which can increase costs and impact development timelines for companies like Biomea Fusion.

The reliance on Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) is a prime example, with the global CRO market valued at approximately $40 billion in 2023. These entities possess unique infrastructure and expertise that is costly for Biomea Fusion to replicate, granting them considerable leverage in negotiations.

Furthermore, suppliers of patented technologies and proprietary software essential for drug discovery platforms, such as Biomea's FUSION™ System, also benefit from limited alternatives, potentially leading to higher input costs for the company.

The bargaining power of suppliers is further amplified by the scarcity of specialized talent in the biopharmaceutical sector. In 2024, demand for experienced researchers remained high, driving up compensation and strengthening the position of skilled professionals and their employers.

What is included in the product

This analysis dissects Biomea Fusion's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Effortlessly identify and address competitive threats with a visual, easy-to-understand breakdown of each Porter's Five Forces element.

Customers Bargaining Power

The primary customers for Biomea Fusion's commercialized drugs are significant healthcare payers, such as private insurance companies and government health programs. These large entities possess substantial bargaining power, influencing market access, drug formulary placement, and ultimately, reimbursement rates. For instance, in 2024, Medicare Part B drug spending in the US alone exceeded hundreds of billions of dollars, highlighting the immense financial leverage these payers hold.

Biomea Fusion's future profitability will be significantly shaped by its negotiations with these powerful customers. The biopharmaceutical industry is experiencing increasing price pressures, making successful price and access negotiations with payers a critical factor for Biomea's commercial success and revenue generation.

Hospitals and clinics are pivotal in the healthcare ecosystem, acting as the primary decision-makers for drug procurement and patient treatment. Their influence is substantial, as they can select from a range of competing pharmaceuticals, thereby shaping physician prescribing habits and negotiating for favorable pricing and essential support services. This intermediary role grants them significant leverage.

The presence of Group Purchasing Organizations (GPOs) amplifies the bargaining power of healthcare providers. These organizations aggregate the purchasing volume of numerous hospitals and clinics, creating a consolidated demand that pharmaceutical companies must address. For instance, in 2023, GPOs were estimated to represent over 90% of U.S. hospital purchasing volume, demonstrating their considerable market influence and ability to secure more competitive terms from drug manufacturers.

Patients, though not direct payers, wield considerable indirect influence on Biomea Fusion's market success. Their advocacy through patient groups and their demand for effective treatments can shape market perception and adoption. For instance, patient adherence to therapies for chronic conditions like diabetes, where Biomea Fusion is developing drugs like icovamenib, is critical. In 2024, the global diabetes drug market was valued at over $100 billion, highlighting the immense impact of patient adherence and preference on revenue.

Availability of Alternatives and Treatment Guidelines

The bargaining power of customers is significantly influenced by the availability of alternatives. For conditions like diabetes and obesity, numerous established treatments exist, including widely available generics and other branded therapies. This broad selection empowers patients and their physicians to choose options that may be more cost-effective or perceived as equally effective, thereby limiting Biomea Fusion's pricing flexibility.

Clinical practice guidelines and physician consensus also play a crucial role. When established treatment pathways recommend specific therapies, Biomea's novel treatments must demonstrate a clear and substantial benefit over existing options to justify premium pricing. For instance, if current guidelines for type 2 diabetes management already incorporate a range of effective medications, Biomea's new therapy would need to show a marked improvement in outcomes or a significant reduction in side effects to gain widespread adoption and command higher prices.

- Market Share of Generic Diabetes Medications: In 2024, generic diabetes medications, such as metformin and sulfonylureas, continue to hold a substantial share of the market due to their low cost and proven efficacy.

- Physician Adoption Rates: Studies in late 2023 and early 2024 indicated that physician adoption of new diabetes therapies is often contingent on robust, long-term clinical trial data demonstrating superiority or significant advantages over existing treatments.

- Obesity Treatment Landscape: The obesity market in 2024 features several approved medications, including GLP-1 receptor agonists, which have demonstrated significant weight loss, setting a high bar for new entrants.

Clinical Data and Real-World Evidence

As a clinical-stage company, Biomea Fusion's customer power hinges on the strength and durability of its clinical trial data. For its lead diabetes and obesity candidates, demonstrating compelling efficacy and safety is paramount to persuading payers and providers to choose its treatments over established alternatives. Positive outcomes from ongoing Phase 2 trials, expected to report key data in 2024, will be a critical factor.

The ability of Biomea Fusion to generate robust real-world evidence (RWE) following product launch will further solidify customer trust and enhance its market position. This RWE will be vital in demonstrating long-term benefits and patient satisfaction, directly impacting the bargaining power of both patients and healthcare providers.

- Clinical Trial Data Strength: Biomea's future customer power is directly linked to the efficacy and safety data from its ongoing clinical trials, particularly for its diabetes and obesity programs.

- Payer and Provider Adoption: Compelling clinical profiles are essential to overcome the bargaining power of payers and providers who can choose from existing treatment options.

- Real-World Evidence (RWE): Post-launch RWE will be crucial in building long-term customer confidence and market acceptance, thereby mitigating customer bargaining power.

Biomea Fusion faces substantial customer bargaining power from large healthcare payers like insurance companies and government programs, who control reimbursement and market access. In 2024, the sheer scale of spending by entities like Medicare Part B, which exceeded hundreds of billions of dollars, underscores their leverage in negotiating drug prices.

Furthermore, hospitals and clinics, often acting through Group Purchasing Organizations (GPOs) which represent over 90% of U.S. hospital purchasing volume as of 2023, can aggregate demand to secure favorable terms. The availability of numerous existing diabetes and obesity treatments, including low-cost generics, also empowers customers by providing viable alternatives and limiting Biomea's pricing flexibility.

| Customer Segment | Bargaining Power Factor | Example/Data Point (2023-2024) |

|---|---|---|

| Healthcare Payers | Purchasing Volume & Reimbursement Control | Medicare Part B drug spending exceeded hundreds of billions in 2024. |

| Hospitals & Clinics | Procurement Decisions & GPO Aggregation | GPOs accounted for >90% of U.S. hospital purchasing volume in 2023. |

| Patients | Treatment Preference & Adherence | Global diabetes drug market valued at >$100 billion in 2024. |

| Overall Market | Availability of Alternatives | Significant market share held by generic diabetes medications in 2024. |

Preview the Actual Deliverable

Biomea Fusion Porter's Five Forces Analysis

This preview showcases the complete Biomea Fusion Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning needs.

Rivalry Among Competitors

Biomea Fusion faces fierce competition in the diabetes and obesity arenas. Major pharmaceutical players, boasting established blockbusters and vast marketing budgets, are significant rivals. For instance, Novo Nordisk's Ozempic and Wegovy, both GLP-1 receptor agonists, have seen explosive growth, with Novo Nordisk reporting a 2024 Q1 revenue increase of 20% year-over-year, largely driven by these products. Numerous other biotech firms are also actively developing innovative therapies, intensifying the need for substantial R&D and commercialization investment.

The diabetes and obesity markets are heavily populated by established pharmaceutical giants. Companies like Novo Nordisk, Eli Lilly, and Sanofi already offer a broad spectrum of treatments, from traditional insulin and metformin to newer classes like SGLT2 inhibitors and GLP-1 agonists. For instance, Novo Nordisk's Ozempic and Wegovy, both GLP-1 receptor agonists, have seen remarkable sales growth, with Ozempic generating over $15 billion in revenue in 2023.

Biomea Fusion's investigational therapies, icovamenib and BMF-650, face a significant challenge in carving out market share against these deeply entrenched competitors. To succeed, these novel treatments must not only offer comparable efficacy but also demonstrate clear differentiation and superior patient outcomes. This could involve advantages in side effect profiles, convenience of administration, or addressing specific unmet needs within the patient population.

The diabetes and obesity markets are massive, with projections suggesting the global diabetes care market will reach approximately $77.7 billion by 2025, and the obesity market is also experiencing significant growth. This vast potential naturally draws in numerous players, from established pharmaceutical giants to nimble biotech firms, all vying for a substantial share.

The intense competition is fueled by a relentless pursuit of novel treatment modalities. Companies are heavily investing in research and development for new drug classes, such as GLP-1 receptor agonists and dual GIP/GLP-1 agonists, as well as exploring innovative combination therapies. This aggressive R&D landscape means a crowded pipeline, where the speed to market with truly differentiated and effective treatments is a critical success factor.

Product Differentiation and Clinical Outcomes

Biomea Fusion's competitive rivalry is significantly shaped by its product differentiation strategy, particularly concerning its irreversible small molecule inhibitors. The company's success hinges on demonstrating superior efficacy and safety profiles compared to existing treatments. For instance, icovamenib's potential for beta-cell regeneration offers a unique mechanism of action that could set it apart in the diabetes market.

The convenience of oral administration for BMF-650 also presents a strong differentiating factor, potentially appealing to a broader patient base. Gaining market share in this arena requires not just novel mechanisms but also compelling clinical evidence. Biomea Fusion must present robust and durable clinical data to establish a competitive advantage.

- Efficacy and Safety: Demonstrating statistically significant improvements in key clinical endpoints and a favorable safety profile is crucial.

- Mechanism of Action: Unique biological pathways, such as beta-cell regeneration for icovamenib, can create a distinct market position.

- Administration Convenience: Oral formulations like BMF-650 offer patient convenience, a key differentiator in chronic disease management.

- Clinical Data Durability: Long-term, high-quality clinical trial results are essential to build trust and secure market adoption.

R&D Investment and Pipeline Depth

Competitive rivalry in the biopharmaceutical sector, particularly for companies like Biomea Fusion, is intensely fueled by the need for continuous innovation. Success hinges on substantial investments in research and development to identify new therapeutic targets, create novel drug compounds, and broaden the product pipeline. This R&D intensity directly impacts a company's ability to compete effectively and maintain market share.

Biomea Fusion's strategic decision to concentrate its R&D efforts on diabetes and obesity, while simultaneously exploring partnerships for its oncology assets, exemplifies this competitive dynamic. This approach aims to channel resources into areas with significant unmet medical needs and market potential, thereby enhancing its competitive standing in these specific therapeutic areas. Such strategic focus is crucial for navigating the high-stakes R&D landscape.

- R&D Spending: The global biopharmaceutical R&D spending reached an estimated $225 billion in 2023, highlighting the significant capital required to stay competitive.

- Pipeline Value: The average value of a drug in Phase 3 clinical trials can exceed $1 billion, underscoring the high stakes involved in pipeline development.

- Therapeutic Area Focus: Companies often specialize to gain a competitive edge; for instance, the diabetes market is projected to grow significantly, with an estimated market size of over $70 billion by 2025.

- Partnership Trends: In 2024, there was a notable increase in R&D collaborations and licensing deals, with over $100 billion in announced transactions, as companies sought to de-risk R&D and access external innovation.

Biomea Fusion operates in highly competitive diabetes and obesity markets, facing established pharmaceutical giants with extensive resources and blockbuster drugs. Companies like Novo Nordisk, with its GLP-1 agonists Ozempic and Wegovy, reported a 20% year-over-year revenue increase in Q1 2024, demonstrating the market dominance of existing players. The intense rivalry necessitates significant R&D investment and a clear strategy for differentiation.

The market's attractiveness, with the global diabetes care market projected to reach $77.7 billion by 2025, fuels this competition. Biomea Fusion's success hinges on its investigational therapies, icovamenib and BMF-650, demonstrating superior efficacy, safety, and convenience over current treatments. For instance, icovamenib's potential for beta-cell regeneration offers a unique mechanism of action.

The biopharmaceutical industry's R&D spending, estimated at $225 billion in 2023, underscores the high bar for entry and innovation. Biomea Fusion's focus on diabetes and obesity, coupled with strategic partnerships, aims to navigate this demanding landscape by concentrating resources on areas with significant unmet needs.

| Competitor | Key Products | 2023 Revenue (Approx.) | 2024 Q1 Growth (Approx.) |

| Novo Nordisk | Ozempic, Wegovy | $33.7 billion | 20% |

| Eli Lilly | Mounjaro, Trulicity | $34.1 billion | 26% |

| Sanofi | Lantus, Toujeo, Ozempic | $47.4 billion | 3.2% |

SSubstitutes Threaten

The threat of substitutes for Biomea Fusion’s novel diabetes and obesity treatments is substantial, primarily stemming from the well-established standard-of-care options already in widespread use. Patients and healthcare providers are familiar with and have access to a broad spectrum of existing therapies. This includes various oral medications, insulin injections, and increasingly popular GLP-1 agonists, such as semaglutide, which have demonstrated efficacy and are deeply integrated into current treatment protocols.

Lifestyle modifications, including diet and exercise, serve as significant substitutes for pharmaceutical treatments in managing conditions like diabetes and obesity. These non-pharmacological approaches can be pursued as primary interventions, especially in the early stages of disease or for less severe cases.

For instance, the Centers for Disease Control and Prevention (CDC) reported in 2023 that over 38 million Americans have diabetes, with a substantial portion of these cases being type 2, which is highly responsive to lifestyle changes. This highlights a considerable segment of the market where drug therapies might be bypassed or delayed.

Behavioral therapy also plays a crucial role, helping individuals adopt and maintain healthier habits. The effectiveness of these combined lifestyle interventions can directly impact the demand for Biomea Fusion's drug therapies, potentially reducing the addressable market for their products.

Surgical interventions, such as bariatric surgery and other metabolic procedures, present a significant threat of substitution for pharmaceutical treatments aimed at obesity and diabetes. These invasive procedures can offer substantial and long-lasting weight loss and even remission of type 2 diabetes for many patients. For instance, in 2024, studies continue to highlight the sustained efficacy of procedures like gastric bypass and sleeve gastrectomy in improving metabolic health, potentially reducing the need for ongoing medication for a considerable patient segment.

Emerging Drug Classes and Different Modalities

The biopharmaceutical landscape is a hotbed of innovation, with new drug classes and therapeutic approaches consistently emerging. These advancements can present significant threats of substitution for existing treatments. For instance, while Biomea Fusion focuses on small molecule inhibitors for diabetes, the growing field of gene and cell-based therapies, though in earlier development for this specific indication, could eventually offer alternative treatment paradigms.

The potential for these novel modalities to address underlying disease mechanisms rather than just symptoms could make them highly competitive substitutes. By 2024, the global gene therapy market was valued at approximately $14.5 billion and is projected to grow substantially, indicating a strong investor and research focus on these alternative approaches.

- Emerging Gene and Cell Therapies: These modalities aim to correct genetic defects or leverage cellular functions, offering a different approach to disease management than traditional small molecules.

- Potential for Curative Treatments: While early for diabetes, the long-term promise of gene and cell therapies lies in their potential for more durable or even curative outcomes, which could displace symptomatic treatments.

- Market Growth in Novel Modalities: The increasing investment and development in areas like gene editing (e.g., CRISPR) and CAR-T cell therapy highlight the industry's shift towards more advanced therapeutic platforms.

Generics and Biosimilars

The threat of substitutes for Biomea Fusion's innovative therapies is primarily linked to the eventual emergence of generics and biosimilars for existing treatments. Once patents on current standard-of-care drugs expire, lower-priced generic versions can significantly erode the market share and pricing power of branded alternatives. For instance, the U.S. market for blockbuster drugs like Humira, facing biosimilar competition, saw significant price erosion. In 2023, AbbVie reported a substantial decline in Humira sales in the U.S. due to biosimilar entry, highlighting the financial impact of substitutes.

While Biomea's lead candidates, like BMF-219, are novel and target specific mechanisms, the long-term competitive landscape will likely include biosimilars for biologic drugs that may be used in conjunction with or as alternatives to Biomea's therapies. The U.S. biosimilars market is growing, with the FDA approving numerous biosimilars across various therapeutic areas. For example, by early 2024, over 40 biosimilars had been approved in the U.S., indicating a robust pipeline of potential substitutes for established biologics.

The potential for future biosimilar competition, even for therapies that are not direct substitutes for Biomea's current pipeline, can influence market share and pricing assumptions during the commercialization phase. This necessitates a careful evaluation of the long-term value proposition and market dynamics. The global biosimilars market was valued at approximately $25 billion in 2023 and is projected to grow significantly in the coming years, underscoring the persistent threat of these lower-cost alternatives.

The existence of established, lower-cost treatments that address similar patient needs, even if through different mechanisms, also represents a form of substitution. Biomea must demonstrate a clear clinical and economic advantage over existing options to command premium pricing and secure market share against both direct generics/biosimilars and alternative treatment modalities.

The threat of substitutes for Biomea Fusion's treatments is significant, encompassing established standard-of-care medications and lifestyle interventions. Patients and physicians are accustomed to existing therapies like oral drugs, insulin, and GLP-1 agonists, which have proven efficacy. Lifestyle changes, including diet and exercise, remain powerful substitutes, particularly for type 2 diabetes, a condition affecting over 38 million Americans as of 2023 according to the CDC.

Surgical options like bariatric procedures also present a strong substitute threat, offering sustained weight loss and potential diabetes remission. By 2024, research continues to validate the long-term benefits of these surgeries, potentially reducing the need for ongoing pharmaceutical management for many patients.

The evolving biopharmaceutical landscape introduces emerging gene and cell therapies as future substitutes. The global gene therapy market, valued at approximately $14.5 billion in 2024, signifies substantial investment in these advanced modalities that could offer more fundamental disease correction than current symptomatic treatments.

Furthermore, the eventual expiration of patents for current blockbuster drugs, leading to generic and biosimilar competition, poses a significant long-term threat. The U.S. market has already witnessed substantial price erosion for branded drugs like Humira following biosimilar entry in 2023. With over 40 biosimilars approved in the U.S. by early 2024, this trend underscores the persistent pressure from lower-cost alternatives.

| Substitute Category | Examples | Key Considerations for Biomea Fusion |

|---|---|---|

| Existing Standard-of-Care | Oral antidiabetics, Insulin, GLP-1 agonists (e.g., semaglutide) | Demonstrate superior efficacy, safety, or convenience to justify market penetration. |

| Lifestyle Interventions | Diet, Exercise, Behavioral Therapy | Highlight the role of pharmacotherapy in conjunction with or when lifestyle changes are insufficient. |

| Surgical Interventions | Bariatric surgery (gastric bypass, sleeve gastrectomy) | Position therapies as alternatives or adjuncts for patients not suitable or responsive to surgery. |

| Emerging Novel Therapies | Gene therapy, Cell therapy | Monitor R&D advancements and prepare for potential disruption by curative or more durable treatments. |

| Generics and Biosimilars | Lower-cost versions of existing branded drugs | Anticipate pricing pressures and focus on differentiation and intellectual property protection. |

Entrants Threaten

Entering the biopharmaceutical sector, particularly for novel drug development, demands substantial capital. This is due to the extensive funding needed for rigorous research, preclinical testing, and multiple phases of expensive clinical trials. For instance, the median cost to bring a new drug to market in 2023 was estimated to be around $2.6 billion, a figure that encompasses both successes and the significant costs of failures.

The threat of new entrants in the biopharmaceutical space, particularly for companies like Biomea Fusion, is significantly mitigated by the incredibly long and complex regulatory approval processes. Bringing a new drug to market involves years of rigorous preclinical and clinical testing, demanding substantial capital and expertise.

The Food and Drug Administration (FDA) imposes stringent requirements at every stage, and the potential for clinical holds, as Biomea Fusion itself experienced, highlights the inherent risks and delays. This arduous journey, often taking over a decade and costing hundreds of millions, if not billions, of dollars, acts as a formidable barrier, deterring many potential new competitors from even attempting to enter.

Success in the biopharmaceutical sector, particularly in developing innovative therapies like irreversible small molecule inhibitors, hinges on specialized scientific knowledge and robust intellectual property. Biomea Fusion's FUSION™ System exemplifies this, representing a proprietary research platform that is difficult for competitors to replicate.

The creation of novel irreversible small molecule inhibitors demands highly specialized scientific expertise and substantial investment in protecting intellectual property. This significant barrier makes it challenging for new companies to enter the market and compete effectively with established players possessing strong patent portfolios.

Established Distribution Channels and Market Access

New entrants in the biopharmaceutical sector, like those looking to compete with Biomea Fusion, face significant hurdles in establishing robust distribution channels and securing essential market access. This involves cultivating deep relationships with pharmaceutical wholesalers, a network of pharmacies, and crucial payer organizations.

Building these intricate networks and negotiating favorable reimbursement terms is a lengthy and resource-intensive endeavor, inherently favoring established players who already possess these critical connections and a proven track record.

- Distribution Network Complexity: Establishing a nationwide or global distribution network for pharmaceuticals requires significant investment in logistics, warehousing, and compliance, a barrier new entrants often struggle to overcome.

- Payer Relationships: Gaining favorable formulary placement and reimbursement from major health insurance providers and government payers is a complex negotiation process that incumbents have honed over years.

- Market Access Costs: The cost of market access, including promotional activities, sales force deployment, and patient support programs, can be substantial, making it difficult for new entrants to compete on a level playing field.

- Regulatory Hurdles: Navigating the complex regulatory landscape for drug distribution and reimbursement adds another layer of difficulty for new companies entering the market.

Patient Recruitment for Clinical Trials

The threat of new entrants into the clinical trial space for companies like Biomea Fusion is significantly influenced by the challenge of patient recruitment. Successfully enrolling the right participants, particularly for trials focused on specific or rare conditions, is a major hurdle. This difficulty can deter new players who lack established relationships with patient advocacy groups and experienced clinical sites.

Competition for trial participants is fierce, with numerous companies vying for the same patient pools. Furthermore, complex trial protocols and the essential requirement for diverse patient cohorts add layers of difficulty. These factors can lead to substantial delays in study timelines and escalate operational costs, effectively raising the barrier to entry for any new organization attempting to establish itself in this demanding sector.

- Patient Recruitment Challenges: Securing eligible patients is a primary obstacle for new entrants in clinical trials.

- Competition for Participants: A crowded market means new companies face intense competition for trial subjects.

- Protocol Complexity and Diversity Needs: Intricate study designs and the demand for varied patient demographics increase recruitment difficulty and cost.

- Impact on Entry Barriers: These recruitment hurdles significantly raise the cost and time required for new companies to enter the clinical trial landscape.

The threat of new entrants for Biomea Fusion is considerably low due to the immense capital required for drug development. The average cost to bring a new drug to market in 2023 was approximately $2.6 billion, a figure that includes the substantial expenses associated with failures. This high financial barrier deters many potential competitors from entering the biopharmaceutical arena.

Furthermore, the stringent regulatory landscape, exemplified by the FDA's rigorous approval processes, presents a significant hurdle. Biomea Fusion's own experience with clinical holds underscores the inherent risks and delays involved, often extending timelines to over a decade and costing hundreds of millions to billions of dollars, which acts as a powerful deterrent.

The need for specialized scientific knowledge and robust intellectual property protection, as seen in Biomea Fusion's proprietary FUSION™ System for irreversible small molecule inhibitors, creates another substantial barrier. Replicating such advanced platforms and securing comprehensive patent portfolios is extremely challenging for new market entrants.

New companies also face difficulties in establishing essential distribution channels and securing market access. This involves building relationships with pharmaceutical wholesalers, pharmacies, and payer organizations, a complex and resource-intensive process that favors established players with existing networks and proven track records.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for R&D, clinical trials, and regulatory submissions. | Deters entry due to financial risk and scale of investment. |

| Regulatory Hurdles | Lengthy and complex FDA approval processes. | Increases time-to-market and risk of failure. |

| Intellectual Property | Need for novel scientific expertise and strong patent protection. | Difficult to replicate proprietary platforms and secure IP. |

| Market Access & Distribution | Establishing relationships with payers and distribution networks. | Favors incumbents with established connections and infrastructure. |

| Patient Recruitment | Challenges in enrolling specific patient populations for clinical trials. | Leads to delays and increased costs, particularly for niche indications. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of the competitive landscape.