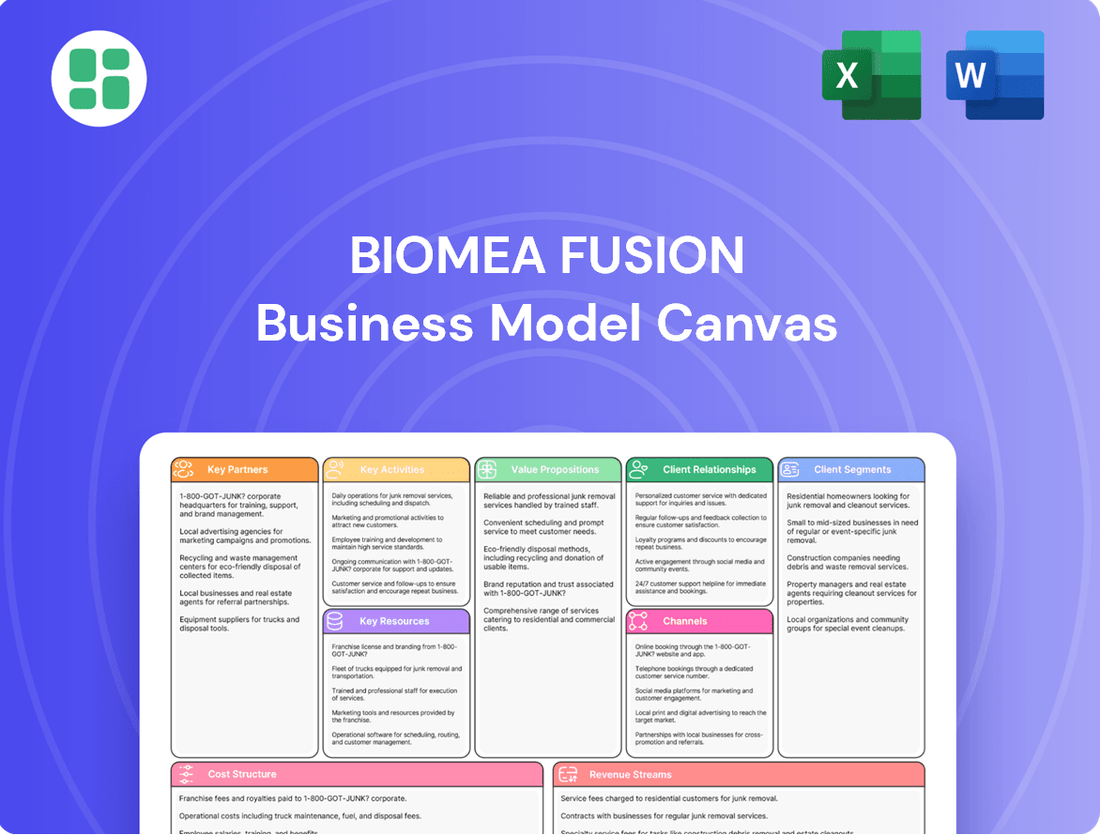

Biomea Fusion Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biomea Fusion Bundle

Uncover the strategic framework behind Biomea Fusion's innovative approach. This comprehensive Business Model Canvas details their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain actionable insights for your own venture.

Partnerships

Biomea Fusion collaborates with Contract Research Organizations (CROs) to expertly manage its clinical trials. These partnerships are vital for the smooth execution of studies, covering everything from patient enrollment to meticulous data gathering and site oversight, ensuring compliance and efficiency.

By engaging CROs, Biomea can tap into specialized knowledge and established infrastructure, which is crucial for advancing drug candidates through clinical phases without the need for substantial internal resource allocation. For instance, the global CRO market was valued at approximately $45.9 billion in 2023 and is projected to grow significantly, highlighting the essential role these organizations play in the pharmaceutical development landscape.

Biomea Fusion actively collaborates with leading academic and research institutions, securing access to pioneering scientific discoveries and essential preclinical data. These strategic alliances are crucial for identifying novel applications of their FUSION™ System and deepening their understanding of complex disease pathways, especially within the rapidly advancing areas of diabetes and obesity research.

In 2024, Biomea Fusion continued to leverage these partnerships to drive innovation. For instance, their ongoing work with a prominent university research center in California has yielded promising preclinical results for novel therapeutic targets in metabolic diseases, directly informing their development pipeline.

Biomea Fusion, as a clinical-stage biopharmaceutical company, strategically engages external partners for the essential manufacturing of its investigational therapies, including icovamenib and BMF-650. These collaborations are critical for maintaining a consistent and high-quality supply of their small molecule inhibitors throughout ongoing clinical trials.

The success of Biomea Fusion's future commercialization efforts hinges significantly on the establishment and maintenance of strong manufacturing and supply chain alliances, ensuring reliable product availability for patients.

Strategic Partners for Oncology Portfolio

Biomea Fusion is actively pursuing strategic partnerships to advance its oncology pipeline, particularly for BMF-500, following its strategic pivot towards metabolic diseases. These collaborations are designed to unlock the value of their FUSION™ System in oncology through licensing or co-development arrangements.

This approach enables Biomea to generate revenue from non-core assets, thereby reallocating internal resources to its primary focus areas. For instance, in 2024, Biomea announced a collaboration with a leading pharmaceutical company to explore the potential of its FUSION™ System in specific cancer indications, aiming for milestone payments and potential royalties.

- Licensing Agreements: Biomea can license its oncology assets to larger pharmaceutical companies with established commercialization infrastructure, generating upfront payments and future royalties.

- Co-development Partnerships: Collaborating on a co-development basis allows Biomea to share development costs and risks while retaining a stake in potential future commercial success.

- Monetizing Non-Core Assets: This strategy allows Biomea to capitalize on its oncology research without diverting critical resources from its core metabolic disease programs.

- Resource Reallocation: By partnering in oncology, Biomea can redirect its internal R&D budget and personnel towards its most promising metabolic disease targets.

Global Scientific Advisory Board

Biomea Fusion established its Global Scientific Advisory Board in October 2024, a strategic move to leverage top-tier expertise in beta cell science and diabetes therapeutics. This board, composed of internationally recognized leaders in the field, offers invaluable guidance and strategic input across Biomea Fusion's research and development initiatives. Their collective knowledge is instrumental in shaping the clinical development pathway for icovamenib and the company's broader portfolio of metabolic disease therapies.

The board's formation underscores Biomea Fusion's commitment to scientific rigor and innovation. Key contributions are expected to accelerate the progression of their pipeline, particularly the lead candidate, icovamenib, which aims to address the underlying causes of type 1 diabetes. The advisory board's insights will be crucial in navigating complex clinical trial designs and regulatory pathways.

- October 2024: Establishment of the Global Scientific Advisory Board.

- Composition: Internationally recognized experts in beta cell science and diabetes therapeutics.

- Role: Provide critical guidance and strategic input on R&D programs.

- Impact: Shape clinical development of icovamenib and other metabolic disease therapies.

Biomea Fusion's key partnerships extend to Contract Research Organizations (CROs) for efficient clinical trial management, leveraging their expertise in patient enrollment and data collection. The global CRO market was valued at approximately $45.9 billion in 2023, indicating the significant reliance on these specialized partners for drug development.

Collaborations with academic and research institutions provide access to cutting-edge scientific discoveries and preclinical data, crucial for identifying new therapeutic applications. In 2024, Biomea Fusion saw promising preclinical results from a partnership with a California university research center for novel metabolic disease targets.

Manufacturing partnerships are essential for producing investigational therapies like icovamenib and BMF-650, ensuring a consistent supply for clinical trials. Strategic alliances in oncology, particularly for BMF-500, aim to monetize non-core assets through licensing or co-development, as seen in a 2024 collaboration exploring the FUSION™ System in cancer indications.

In October 2024, Biomea Fusion established a Global Scientific Advisory Board comprising leading experts in beta cell science and diabetes therapeutics to guide R&D initiatives, particularly for icovamenib.

What is included in the product

A fully developed Business Model Canvas for Biomea Fusion, detailing customer segments, value propositions, channels, and revenue streams.

This canvas provides a strategic overview of Biomea Fusion's operations, including key resources, activities, partnerships, and cost structure.

Saves hours of formatting and structuring your own business model, allowing teams to focus on strategic problem-solving rather than administrative tasks.

Activities

Biomea Fusion's central activity revolves around discovering and developing new oral covalent small molecule inhibitors, a process powered by their proprietary FUSION™ System. This involves extensive preclinical research to pinpoint and refine potential drug candidates, aiming for therapies that create lasting connections with target proteins to boost effectiveness and longevity.

In 2024, Biomea Fusion continued to advance its pipeline, with a particular focus on its lead candidate, BMF-219, a covalent inhibitor targeting menin-MLL interactions for various cancers. The company reported significant progress in its preclinical studies, demonstrating potent and durable target engagement, a key characteristic of covalent inhibitors.

Biomea Fusion's core activity revolves around the meticulous planning, execution, and oversight of clinical trials for its innovative therapies, icovamenib and BMF-650. This encompasses every stage from identifying and enrolling eligible participants to administering treatments, gathering comprehensive data, and ensuring participant safety throughout the study duration.

The company's commitment to robust trial management is paramount for substantiating the safety and efficacy profiles of its drug candidates. For instance, in early 2024, Biomea Fusion reported progress in its Phase 2b trial for icovamenib, with patient enrollment proceeding as planned, a crucial step in demonstrating the drug's potential in treating diabetes.

Navigating the intricate regulatory pathways, especially with the U.S. Food and Drug Administration (FDA), stands as a critical operational pillar for Biomea Fusion. This involves the meticulous preparation and submission of Investigational New Drug (IND) applications, alongside proactive engagement for advancing late-stage clinical trials and securing eventual market approval.

Key milestones include the successful lifting of clinical holds, demonstrating progress and adherence to regulatory standards. Planning for future interactions and meetings with regulatory bodies is essential for maintaining momentum and aligning development strategies with agency expectations, as seen in their ongoing efforts to advance their pipeline.

Intellectual Property Management and Protection

Biomea Fusion's core strategy involves robust intellectual property management to safeguard its innovative FUSION™ System and promising drug candidates. This protection is primarily achieved through a comprehensive patent portfolio, ensuring market exclusivity and a significant competitive edge in the biopharmaceutical landscape.

The company actively pursues patent filings across key global markets to secure its technological advancements and novel therapeutic compounds. This proactive approach is crucial for maintaining long-term value and attractiveness to potential strategic partners and investors.

- Patent Filings: Biomea Fusion maintains a strong focus on patenting its FUSION™ System technology and its pipeline of novel drug candidates, aiming for broad geographical coverage.

- Exclusivity and Competitive Advantage: This intellectual property protection is fundamental to establishing and maintaining market exclusivity, a critical factor for success in the highly competitive biopharmaceutical sector.

- Long-Term Value Creation: Strategic management of its IP portfolio is designed to maximize the long-term value of its assets and foster collaborations that can accelerate drug development and commercialization.

Strategic Planning and Corporate Finance

Biomea Fusion's strategic planning and corporate finance are crucial for its clinical-stage operations. The company actively manages its cash runway, a vital aspect for biotechnology firms progressing through drug development. This involves meticulous forecasting of expenses and revenue streams to ensure continued operations.

Securing adequate financing is a cornerstone of Biomea Fusion's strategy. In 2024, like many biotechs, they would likely explore various avenues, including public offerings, to fund ongoing research and development. For instance, in early 2024, the company completed a registered direct offering, raising approximately $100 million to advance its lead programs.

To preserve capital and maintain focus, Biomea Fusion has implemented cost-reduction measures. These have included workforce reductions and facility consolidation, aimed at streamlining operations and reallocating resources to key development milestones. Such actions are typical for companies navigating the capital-intensive biotech landscape.

- Cash Runway Management: Ensuring sufficient funds to cover operational expenses until the next funding milestone or revenue generation.

- Financing Activities: Actively seeking capital through public markets, such as equity offerings, to fuel R&D.

- Cost Optimization: Implementing strategic cost-saving measures, including workforce adjustments and operational streamlining.

- Program Prioritization: Directing financial resources towards core drug development programs to maximize chances of success.

Biomea Fusion's key activities center on the discovery and development of novel oral covalent small molecule inhibitors, leveraging its proprietary FUSION™ System. This involves rigorous preclinical research to identify and refine drug candidates with durable target engagement. The company also actively manages its clinical trials for icovamenib and BMF-650, ensuring participant safety and data integrity to demonstrate efficacy. Furthermore, Biomea Fusion prioritizes robust intellectual property management through extensive patent filings to secure market exclusivity and maintain a competitive advantage.

In 2024, Biomea Fusion focused on advancing its pipeline, particularly BMF-219, while also progressing clinical trials for icovamenib and BMF-650. The company raised approximately $100 million in early 2024 through a registered direct offering to fund these programs. Strategic cost-reduction measures, including workforce adjustments, were also implemented to optimize operations. Regulatory engagement with bodies like the FDA is a critical activity, evidenced by the successful lifting of clinical holds, paving the way for further development.

| Key Activity | Description | 2024 Focus/Milestone |

| Drug Discovery & Development | Utilizing FUSION™ System for oral covalent small molecule inhibitors. | Advancing BMF-219, focusing on menin-MLL inhibition. |

| Clinical Trial Management | Executing and overseeing clinical trials for pipeline candidates. | Progress in Phase 2b trial for icovamenib in diabetes. |

| Regulatory Affairs | Navigating regulatory pathways, including IND submissions and agency interactions. | Successful lifting of clinical holds; planning future regulatory meetings. |

| Intellectual Property Management | Securing patents for the FUSION™ System and drug candidates. | Maintaining and expanding patent portfolio for market exclusivity. |

| Corporate Finance & Strategy | Managing cash runway, securing financing, and cost optimization. | Raised ~$100M via registered direct offering; implemented cost-saving measures. |

Preview Before You Purchase

Business Model Canvas

The Biomea Fusion Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive, ready-to-use file you'll gain immediate access to. You can be confident that what you see is precisely what you'll get, fully intact and prepared for your strategic planning needs.

Resources

Biomea Fusion's proprietary FUSION™ System technology is the cornerstone of its drug discovery and development efforts. This advanced platform is specifically engineered to identify and create oral covalent small molecule inhibitors, a class of drugs known for their potential for enhanced selectivity and durability in targeting diseases.

The FUSION™ System is a significant competitive differentiator for Biomea Fusion, underpinning their research and development pipeline. This technology allows the company to design therapies with improved precision, aiming for better patient outcomes through more effective and longer-lasting treatments.

Biomea Fusion's intellectual property, particularly its patents on novel covalent inhibitors such as icovamenib and BMF-650, represents a cornerstone of its business model. These patents safeguard their groundbreaking discoveries, forming the bedrock for future commercial ventures and potential licensing opportunities.

The strength and breadth of Biomea Fusion's patent portfolio are crucial for attracting vital investment and fostering strategic partnerships within the competitive biotechnology landscape. As of early 2024, the company actively manages a significant number of patent applications and granted patents globally, underscoring its commitment to protecting its innovative pipeline.

Biomea Fusion's business model hinges on its exceptional scientific and clinical expertise. The company's team comprises seasoned researchers and developers with profound knowledge in medicinal chemistry, biology, and the intricate process of clinical trial design. This deep well of talent is crucial for navigating the complex path of drug development and advancing their promising pipeline.

The caliber of their scientific staff directly translates into the company's ability to innovate and execute. Expertise in regulatory affairs is equally vital, ensuring compliance and smooth progression through necessary approvals. Biomea Fusion's commitment to fostering this intellectual capital is a cornerstone of its operational strategy.

In 2024, Biomea Fusion highlighted the importance of its leadership team, including an interim CEO with significant experience in late-stage clinical development. This leadership, combined with their scientific bench strength, forms a critical resource that underpins the company's valuation and its potential for future success in bringing novel therapies to market.

Financial Capital

Financial capital is absolutely vital for Biomea Fusion, especially as a clinical-stage biopharmaceutical company. Without any products on the market yet, they rely heavily on this capital to cover the massive costs associated with research, development, and conducting clinical trials. These expenses are substantial and require significant financial backing to move their drug candidates forward.

Biomea Fusion's strategy for securing this essential financial capital primarily involves equity financing and public offerings. By raising funds through these avenues, the company aims to extend its cash runway, ensuring they have the necessary resources to continue operations and advance their pipeline. This approach is common for biotech firms in their development phase.

- Funding Sources: Equity financing and public offerings are key to Biomea Fusion's capital acquisition.

- Operational Needs: Financial capital directly fuels extensive research, development, and clinical trial expenses.

- Cash Runway: The company actively works to extend its cash runway to sustain ongoing operations and development.

- Pipeline Progression: This capital is the engine driving the advancement of Biomea's drug candidates through clinical stages.

Clinical Data and Trial Results

The data generated from Biomea Fusion's ongoing clinical trials, especially for icovamenib in diabetes, represent a critical asset. Positive clinical data showing both safety and effectiveness are fundamental for securing regulatory approvals, building investor trust, and forging potential partnerships.

These trial outcomes serve as a direct validation of their therapeutic strategy, directly influencing and guiding subsequent development efforts. For instance, preliminary results from ongoing studies in 2024 are being closely watched for their potential to de-risk further investment and accelerate the path to market.

- Icovamenib's Efficacy Data: Positive results demonstrating significant improvements in key diabetes markers, such as HbA1c levels, are paramount.

- Safety Profile: Comprehensive data on adverse events and patient tolerability are essential for regulatory submissions and market acceptance.

- Biomarker Identification: Data revealing predictive biomarkers for treatment response can enhance patient selection and trial design for future studies.

Biomea Fusion's key resources are its proprietary FUSION™ System technology, a robust intellectual property portfolio, exceptional scientific and clinical expertise, and crucial financial capital. The data generated from its clinical trials, particularly for icovamenib, serves as a vital asset for regulatory approval and market validation.

| Key Resource | Description | Significance |

|---|---|---|

| FUSION™ System | Proprietary platform for oral covalent small molecule inhibitors. | Enables precise drug design, offering enhanced selectivity and durability. |

| Intellectual Property | Patents on novel covalent inhibitors (e.g., icovamenib, BMF-650). | Safeguards discoveries, enabling future commercialization and partnerships. As of early 2024, the company actively manages a significant number of patent applications globally. |

| Scientific & Clinical Expertise | Seasoned researchers and developers in medicinal chemistry, biology, and clinical trials. | Drives innovation, execution, and navigation of the drug development process. The leadership team's experience in late-stage development is also critical. |

| Financial Capital | Secured through equity financing and public offerings. | Funds extensive R&D and clinical trials, extending the company's cash runway. |

| Clinical Trial Data | Data from ongoing trials, especially for icovamenib in diabetes. | Validates therapeutic strategy, crucial for regulatory approval and investor confidence. Preliminary results in 2024 are closely monitored for de-risking further investment. |

Value Propositions

Biomea Fusion's core value proposition centers on developing disease-modifying treatments for diabetes, moving beyond managing symptoms to addressing the underlying pathology.

Their lead candidate, icovamenib, exemplifies this by aiming to regenerate insulin-producing beta cells, a critical step toward a potential cure for type 1 and type 2 diabetes.

This regenerative approach offers a significant advantage over current treatments, which primarily focus on insulin replacement or blood sugar management, potentially leading to a more natural and sustained normalization of glucose levels.

By targeting the root cause, Biomea Fusion seeks to provide a transformative therapy that could fundamentally alter the long-term outlook for millions of diabetes patients worldwide.

Biomea Fusion's core value proposition centers on its oral, irreversible small molecule inhibitors. These drug candidates are designed to offer distinct advantages over traditional therapeutic approaches. For instance, their small molecule nature allows for greater precision in targeting specific disease pathways.

The irreversible binding mechanism of these inhibitors is key to achieving a deeper and more sustained therapeutic effect. This contrasts with reversible inhibitors, which might require more frequent dosing. This durability is a significant factor in potential patient outcomes and treatment efficacy.

Furthermore, the oral administration route presents a considerable convenience benefit for patients. Unlike injectable medications, which often require clinic visits or self-injection, oral drugs simplify the treatment regimen. This patient-centric approach can improve adherence and overall quality of life.

In 2024, the pharmaceutical industry continued to see significant investment in oral small molecule therapies, reflecting their established benefits in patient convenience and manufacturing scalability. The global oral drug delivery market was projected to reach over $1.2 trillion by 2025, underscoring the market's receptiveness to such innovations.

Icovamenib demonstrates significant potential to enhance beta-cell function and achieve lasting HbA1c reductions in individuals with diabetes. This directly combats the disease's progressive nature, aiming for sustained glycemic control by restoring the body's inherent insulin production.

Addressing Unmet Medical Needs in Diabetes and Obesity

Biomea Fusion is dedicated to tackling critical unmet medical needs within the diabetes and obesity landscapes. Their focus is particularly sharp on diabetes patients experiencing severe insulin deficiency, a group with limited effective treatment options.

The company's pipeline is engineered to introduce novel therapeutic approaches for these conditions. This strategy addresses the substantial and expanding patient populations that are currently underserved by existing treatments, aiming to offer more effective solutions.

- Diabetes Market Growth: The global diabetes market was valued at approximately $55.5 billion in 2023 and is projected to reach $83.4 billion by 2030, highlighting the significant unmet need.

- Obesity Prevalence: In 2023, over 40% of adults in the United States were classified as obese, indicating a vast market for innovative obesity treatments.

- Pipeline Focus: Biomea Fusion's lead candidate, BMF-219, is a covalent inhibitor of menin, being investigated for type 1 and type 2 diabetes, as well as non-alcoholic steatohepatitis (NASH).

- Addressing Treatment Gaps: Their work aims to provide new therapeutic avenues for patients whose conditions are not adequately managed by current standards of care.

Pipeline of Innovative Covalent Therapies

Biomea Fusion is actively developing a robust pipeline of innovative covalent therapies, extending beyond their lead candidate, icovamenib. This strategy is built upon their proprietary FUSION™ System, a platform designed for the discovery and development of irreversible inhibitors.

Their pipeline includes BMF-650, a promising candidate targeting obesity, showcasing the platform's versatility. This diversification underscores Biomea's commitment to addressing a broader spectrum of metabolic diseases through continuous innovation.

The company's approach highlights the potential of their FUSION™ System to generate multiple drug candidates, indicating a strong foundation for future growth and market penetration in the metabolic disease space.

- Pipeline Diversification: Beyond icovamenib, Biomea is developing BMF-650 for obesity, demonstrating a commitment to multiple therapeutic areas.

- Platform Leverage: The FUSION™ System is central to their strategy, enabling the creation of a pipeline of irreversible inhibitors.

- Innovation Focus: This diversified pipeline signals Biomea's dedication to continuous innovation in metabolic disease treatment.

- Future Potential: The platform's ability to yield multiple drug candidates suggests significant future growth opportunities.

Biomea Fusion's value proposition lies in its unique approach to developing disease-modifying therapies for diabetes and other metabolic disorders, moving beyond symptom management to address root causes.

Their lead candidate, icovamenib, aims to regenerate insulin-producing beta cells, offering a potential path to normalizing glucose levels naturally. This regenerative strategy differentiates them significantly from current treatments.

The company leverages its proprietary FUSION™ System to create oral, irreversible small molecule inhibitors, providing enhanced convenience and sustained therapeutic effects for patients.

This platform approach allows for pipeline diversification, with candidates like BMF-650 targeting obesity, addressing a broad range of unmet needs in metabolic health.

| Therapeutic Area | Lead Candidate | Mechanism of Action | Target Indication |

|---|---|---|---|

| Diabetes | Icovamenib (BMF-219) | Oral, irreversible small molecule inhibitor; aims to regenerate beta cells | Type 1 and Type 2 Diabetes |

| Obesity | BMF-650 | Oral, irreversible small molecule inhibitor | Obesity |

Customer Relationships

Biomea Fusion cultivates direct engagement with clinical investigators and trial sites. This close collaboration is fundamental to the successful execution of their studies, ensuring rigorous adherence to protocols and efficient patient recruitment.

For instance, as of their Q1 2024 update, Biomea Fusion reported progress across multiple clinical trial sites, underscoring the importance of these direct relationships for maintaining momentum and data quality.

These ongoing interactions facilitate clear communication and provide essential support, which are vital for upholding data integrity and driving the overall progress of their clinical development programs.

Biomea Fusion actively cultivates relationships with key medical and scientific authorities, prominently featuring its Global Scientific Advisory Board. This board, comprised of esteemed experts, offers crucial insights that guide research and validate strategic pathways.

These thought leaders play a vital role in shaping Biomea's scientific agenda and ensuring the rigorous advancement of its programs. Their contributions are instrumental in lending credibility and direction to the company's innovative approaches.

The insights from these collaborations are essential for disseminating scientific findings effectively and confirming the validity of Biomea's research directions. For instance, in 2024, the company continued to leverage expert feedback to refine its clinical trial designs for its lead product candidates.

Biomea Fusion actively engages with patient advocacy groups to deeply understand the lived experiences and unmet needs of individuals affected by genetic metabolic disorders. These collaborations are crucial for gathering real-world insights into disease burden and for building awareness around their investigational therapies, like BMF-219, which is currently in clinical trials for conditions such as type 2 diabetes and certain cancers.

These strategic relationships are instrumental in fostering trust and facilitating patient participation in clinical trials, which is vital for the advancement of Biomea Fusion's pipeline. For instance, by partnering with groups focused on rare diseases, they can more effectively reach and inform potential trial participants, thereby accelerating the development process and bringing novel treatments closer to those who need them.

Investor Relations and Transparent Communication

Biomea Fusion places a strong emphasis on investor relations, ensuring consistent communication regarding its financial performance, progress in clinical trials, and overall corporate direction. This commitment to transparency is vital for fostering trust among shareholders, attracting new investment, and securing the capital needed for ongoing development. For example, in their Q1 2024 earnings report, the company highlighted significant progress in their Phase 2 study for BMF-219, a key factor in their investor outreach.

The company utilizes various channels to maintain open dialogue with its stakeholders. These include scheduled earnings calls, where management discusses financial results and answers questions from analysts and investors, as well as timely press releases that disseminate important corporate news. This proactive approach helps manage expectations and build confidence in Biomea Fusion's long-term vision.

- Regular Financial Updates: Biomea Fusion provides quarterly earnings reports detailing revenue, expenses, and cash flow.

- Clinical Milestone Communication: Investors are kept informed about the progress and outcomes of clinical trials for their drug candidates.

- Strategic Direction Sharing: The company communicates its evolving corporate strategy and future plans through various investor-focused platforms.

- Engagement Channels: Earnings calls and press releases serve as primary avenues for transparent communication with the financial community.

Regulatory Agency Engagement

Biomea Fusion prioritizes robust engagement with regulatory agencies, particularly the FDA, to ensure a smooth drug development pathway. This proactive approach is vital for navigating the complex approval landscape.

- FDA Interactions: Biomea Fusion actively cultivates strong relationships with the FDA through consistent communication and transparent data sharing.

- Submission Strategy: The company focuses on submitting comprehensive data packages and addressing all regulatory inquiries efficiently to expedite the review process.

- Compliance Focus: Maintaining strict compliance with evolving regulatory standards is a cornerstone of Biomea Fusion's strategy, ensuring product integrity and market access.

- 2024 Milestones: In 2024, Biomea Fusion continued its dialogue with the FDA, aiming for key advancements in its clinical trial submissions and data reporting.

Biomea Fusion fosters deep connections with clinical investigators and trial sites, essential for the successful execution and data integrity of their studies. This direct engagement ensures rigorous protocol adherence and efficient patient recruitment, as highlighted by their progress across multiple sites reported in Q1 2024.

The company also cultivates relationships with key scientific authorities, including its Global Scientific Advisory Board, whose insights guide research and validate strategic directions. These thought leaders are instrumental in shaping Biomea's scientific agenda and ensuring the credible advancement of its programs.

Furthermore, Biomea actively engages with patient advocacy groups to understand lived experiences and unmet needs, crucial for real-world insights and building awareness for therapies like BMF-219. These partnerships foster trust and facilitate patient participation in trials, accelerating development.

Channels

Biomea Fusion's clinical trial sites and networks are the backbone of its drug development, serving as the direct interface for administering investigational therapies and collecting crucial efficacy and safety data. These specialized facilities, often located within leading hospitals and research institutions, are indispensable for advancing drug candidates through rigorous testing phases.

The quality and reach of these clinical trial sites are paramount for generating reliable data essential for regulatory submissions. In 2024, the global clinical trial market was valued at approximately $68.4 billion, highlighting the significant investment and infrastructure dedicated to this critical channel.

By partnering with a robust network of experienced clinical trial sites, Biomea Fusion ensures efficient patient recruitment and high-quality data collection, which are vital for demonstrating the potential of its novel drug candidates to regulatory bodies like the FDA.

Biomea Fusion actively shares its preclinical and clinical data at leading scientific conferences, such as the American Society of Clinical Oncology (ASCO) and the European Society for Medical Oncology (ESMO), alongside publications in high-impact, peer-reviewed journals. This engagement is vital for fostering dialogue with the global scientific and medical community, validating their drug candidates, and building essential scientific trust.

Biomea Fusion's primary pathway to market for its innovative drug candidates involves meticulous regulatory submissions to key health authorities, with the U.S. Food and Drug Administration (FDA) being a critical example. These extensive dossiers are the culmination of rigorous preclinical and clinical research, detailed manufacturing processes, and precisely formulated proposed labeling, all designed to demonstrate safety and efficacy.

The successful navigation and approval of these submissions are non-negotiable prerequisites for any commercialization efforts. For instance, as of mid-2024, the FDA continues to emphasize robust data integrity and comprehensive evidence packages, a standard Biomea Fusion must meet to advance its pipeline, such as its lead candidate for type 1 diabetes.

Future Direct Sales Force and Marketing (Post-Commercialization)

Following regulatory approval, Biomea Fusion plans to build a direct sales force or collaborate with existing entities to market its therapies. This strategy focuses on engaging directly with physicians, hospitals, and specialized pharmacies to ensure effective product promotion and distribution.

This direct channel is a crucial future component, contingent on the successful completion of clinical trials and subsequent market authorization. For instance, in 2024, the pharmaceutical industry saw significant investment in sales force expansion, with companies allocating substantial budgets to reach healthcare providers directly.

- Direct Engagement: Building relationships with key opinion leaders and prescribers.

- Distribution Network: Establishing partnerships with specialty pharmacies for patient access.

- Market Access: Navigating payer landscapes and formulary placements.

- Sales Force Training: Equipping representatives with deep product knowledge and market insights.

Strategic Licensing and Co-development Agreements

Biomea Fusion strategically employs licensing and co-development agreements to broaden the impact of its therapies, particularly for non-core assets like its oncology programs. This approach allows them to tap into external expertise and resources, accelerating both development and market penetration for their metabolic therapies. For instance, in 2024, companies in the biotech sector saw significant deal values in licensing agreements, with some early-stage partnerships exceeding $100 million in upfront payments and milestone potential, showcasing the financial leverage these channels offer.

These collaborations are crucial for maximizing pipeline value by sharing development costs and risks. By partnering, Biomea Fusion can focus its internal resources on its most promising assets while ensuring that other valuable programs reach their full commercial potential. The global pharmaceutical licensing market was valued at approximately $100 billion in 2023 and is projected to grow, indicating a robust environment for such strategic alliances.

- Leveraging External Expertise: Partnerships bring specialized knowledge in areas like oncology drug development or specific market commercialization.

- Risk Mitigation: Sharing development and regulatory burdens with partners reduces Biomea Fusion's financial exposure.

- Accelerated Market Access: Co-development and licensing can speed up the path to market for therapies, especially in competitive fields.

- Pipeline Optimization: Allows Biomea Fusion to manage its portfolio effectively, focusing on core strengths while monetizing or advancing other assets.

Biomea Fusion's channels primarily revolve around scientific dissemination and regulatory pathways. The company actively shares its preclinical and clinical data at major scientific conferences, such as ASCO and ESMO, and publishes in high-impact journals to engage with the scientific community and validate its drug candidates. This scientific validation is crucial for building trust and credibility.

The core channel to market is through rigorous regulatory submissions to health authorities like the FDA. These submissions, detailing extensive research, manufacturing, and proposed labeling, are essential for demonstrating safety and efficacy. In 2024, the FDA continued to prioritize robust data integrity, a key focus for Biomea Fusion's pipeline, including its lead candidate for type 1 diabetes.

Post-approval, Biomea Fusion plans to establish a direct sales force or partner with entities for marketing and distribution, engaging directly with physicians and pharmacies. This future channel is dependent on successful clinical trials and regulatory authorization. The pharmaceutical industry in 2024 saw substantial investment in sales force expansion, underscoring the importance of direct healthcare provider engagement.

Licensing and co-development agreements represent another vital channel, particularly for non-core assets like oncology programs. These partnerships leverage external expertise and resources, accelerating development and market penetration for metabolic therapies. In 2024, biotech licensing deals often exceeded $100 million in upfront payments and milestones, highlighting the financial benefits of these strategic alliances.

Customer Segments

Patients with Type 1 and Type 2 diabetes, particularly those with severe insulin deficiency or struggling with current treatment regimens, form Biomea Fusion's core customer base for icovamenib. This segment is actively seeking disease-modifying therapies that enhance beta-cell function and improve glycemic control, addressing a significant unmet medical need.

The global diabetes market is substantial and expanding, with the Type 1 and Type 2 diabetes segments representing a significant portion. In 2024, the diabetes care market was valued at over $70 billion, with projections indicating continued growth due to increasing prevalence and advancements in treatment options.

Patients with obesity are a critical customer segment for Biomea Fusion, especially with the advancement of BMF-650, an oral GLP-1 receptor agonist. This segment is experiencing significant growth, making it a key strategic focus.

Biomea Fusion is positioned to provide a new oral treatment option for weight management and overall metabolic health, thereby broadening its market reach beyond just diabetes patients.

The global obesity market is substantial and expanding. For instance, in 2024, the U.S. obesity market alone was valued at over $70 billion, with projections indicating continued robust growth driven by increasing prevalence and demand for effective treatments.

Endocrinologists and other healthcare professionals, including primary care physicians and specialists focused on diabetes and obesity, are pivotal in driving the adoption of new therapies. Their role as prescribers makes them essential for Biomea Fusion's market entry and success.

Educating these professionals on the distinct clinical advantages and novel mechanisms of action of Biomea Fusion's treatments is paramount. For instance, the American Association of Clinical Endocrinologists (AACE) represents over 7,000 endocrinologists, highlighting the significant reach Biomea Fusion must achieve.

The willingness of these key opinion leaders to integrate Biomea Fusion's innovations into their practice directly correlates with market penetration. Physician adoption rates for new diabetes medications can significantly influence a drug's market share within the first few years of launch.

Payers and Health Insurance Providers

Payers and health insurance providers are central to Biomea Fusion's business model, as they hold the keys to drug coverage and reimbursement. To secure broad patient access, Biomea Fusion must clearly articulate the economic benefits and superior clinical outcomes of its therapies. For instance, in 2024, the average cost of specialty drugs continued to rise, making payer value demonstration even more critical.

These entities rigorously evaluate new treatments based on efficacy, safety, and cost-effectiveness. Biomea Fusion's success hinges on convincing payers that their innovative therapies offer a compelling return on investment, both clinically and financially. Their reimbursement decisions directly impact market penetration and the overall uptake of Biomea Fusion's products.

- Payer Influence: Decisions by payers directly dictate patient access and prescription volume for Biomea Fusion's treatments.

- Value Demonstration: Biomea Fusion must present robust data on clinical superiority and economic value to gain favorable coverage.

- Market Uptake: Reimbursement policies established by payers are a primary driver of market adoption for new pharmaceutical products.

- 2024 Trends: The increasing scrutiny of drug pricing by payers in 2024 necessitates a strong value proposition from Biomea Fusion.

Pharmaceutical Companies for Partnership Opportunities

Other pharmaceutical and biotechnology firms are a key customer segment for Biomea Fusion, seeking opportunities for licensing, co-development, or even acquisition of Biomea's valuable assets. This is particularly true for their promising oncology portfolio and the innovative FUSION™ System.

These strategic collaborations offer Biomea Fusion significant advantages, including access to non-dilutive funding, which is crucial for continued research and development without issuing more stock. Furthermore, these partnerships can unlock broader market access for Biomea's technologies, accelerating their reach and impact.

- Licensing Deals: Pharmaceutical companies can license Biomea's drug candidates or platform technologies, providing upfront payments and royalties. For example, in 2024, the biotech sector saw numerous licensing agreements, with some early-stage oncology assets fetching deal values in the hundreds of millions of dollars.

- Co-development Partnerships: Collaborating on clinical trials and commercialization allows both companies to share risks and rewards. This model is attractive for companies looking to expand their pipeline with novel therapies.

- Acquisition Targets: Larger pharmaceutical companies may acquire Biomea Fusion outright if its pipeline and technology prove highly successful, especially in the competitive oncology space where M&A activity remains robust.

- Market Access and Funding: These partnerships are vital for securing capital and leveraging established distribution networks, enabling Biomea to bring its innovations to patients more efficiently.

Biomea Fusion's customer segments are diverse, encompassing patients with Type 1 and Type 2 diabetes, particularly those with significant insulin deficiency or those not responding well to current treatments. Additionally, individuals struggling with obesity represent a growing focus, especially with the development of oral GLP-1 receptor agonists.

Healthcare professionals, including endocrinologists and primary care physicians, are crucial as they influence treatment adoption. Payers and insurance providers are also key, as their reimbursement decisions dictate patient access and market penetration.

Finally, other pharmaceutical and biotechnology companies represent a segment interested in licensing, co-development, or acquisition of Biomea Fusion's innovative assets, particularly in oncology and its FUSION™ System.

| Customer Segment | Primary Need/Interest | 2024 Market Context |

|---|---|---|

| Diabetes Patients (T1 & T2) | Disease-modifying therapies, improved glycemic control | Diabetes care market valued over $70 billion globally |

| Obesity Patients | Effective weight management, metabolic health | U.S. obesity market alone valued over $70 billion |

| Healthcare Professionals | Novel therapies with distinct clinical advantages | AACE represents over 7,000 endocrinologists |

| Payers & Insurers | Clinical superiority, cost-effectiveness, economic benefits | Increased scrutiny of drug pricing and value demonstration |

| Other Pharma/Biotech | Licensing, co-development, acquisition of assets | Robust M&A activity, particularly in oncology |

Cost Structure

Research and Development (R&D) expenses represent the most substantial component of Biomea Fusion's cost structure. These costs are primarily driven by the company's efforts in drug discovery, preclinical research, and the rigorous clinical trials necessary for their pipeline candidates, including icovamenib and BMF-650.

The R&D budget covers a wide array of activities, such as conducting clinical trials, advancing preclinical and exploratory research programs, and the manufacturing of materials needed for these trials. For instance, in the first quarter of 2024, Biomea Fusion reported R&D expenses of $18.2 million, a decrease from $27.2 million in the same period of 2023, reflecting strategic cost management.

To ensure financial sustainability and extend its cash runway, Biomea Fusion has implemented significant reductions in its R&D spending. This strategic adjustment is crucial for navigating the long and capital-intensive development process of novel therapeutics, allowing the company to focus resources effectively on its most promising programs.

General and Administrative (G&A) expenses are the backbone of Biomea Fusion's operational overhead. These costs encompass essential functions like paying administrative staff, including their stock-based compensation, engaging professional and consulting services, covering legal fees, and managing day-to-day administrative operations. For instance, in 2023, Biomea reported G&A expenses of $41.7 million, reflecting a significant portion of their overall spending.

To optimize its financial structure, Biomea Fusion has strategically implemented workforce reductions and facility consolidation. These measures are specifically designed to curb and manage these overhead G&A costs effectively. This focus on efficiency is crucial as the company navigates its growth and development phases, ensuring resources are allocated judiciously.

Biomea Fusion's manufacturing and supply chain costs are a substantial component of their business model, especially as they progress through clinical trials and plan for future commercialization. These expenses encompass everything from procuring raw materials and executing complex production processes to rigorous quality control measures and the intricate logistics of getting their drug substances and products to their destinations.

For instance, the cost of goods sold (COGS) for pharmaceutical companies can represent a significant portion of their revenue, often ranging from 20% to 40% or more, depending on the complexity of the drug and manufacturing scale. Biomea Fusion's investment in establishing robust, scalable manufacturing capabilities and reliable supply chains is therefore critical for controlling these expenditures as their pipeline advances.

Intellectual Property Maintenance and Legal Fees

Biomea Fusion’s cost structure is significantly impacted by intellectual property maintenance and legal fees. Protecting their innovative therapies requires ongoing investment in patent filings, renewals, and potential defense against infringement. For instance, in 2024, companies in the biotech sector often allocate millions to their IP portfolios, with individual patent filings costing several thousand dollars and international filings adding considerably more.

Beyond patent protection, Biomea Fusion incurs substantial legal expenses related to corporate governance, ensuring adherence to stringent regulatory frameworks, and managing various contracts. These legal services are critical for maintaining operational integrity and mitigating risks. In 2023, the average annual legal spend for a mid-sized biotechnology company was reported to be in the range of $500,000 to $2 million, depending on the complexity of their operations and litigation.

- Patent Filing and Maintenance: Costs associated with securing and renewing patents globally.

- Legal Counsel: Fees for services related to corporate law, contracts, and compliance.

- Litigation Expenses: Potential costs for defending intellectual property rights or resolving legal disputes.

- Regulatory Compliance: Legal support to navigate and adhere to healthcare and pharmaceutical regulations.

Operational Streamlining and Facility Costs

Biomea Fusion has undertaken significant operational streamlining to manage its cost structure effectively. These efforts are designed to enhance financial efficiency and extend the company's operational runway.

- Workforce Reduction: A strategic workforce reduction of 35% was implemented in early 2024. This measure directly addresses personnel-related expenses, a key component of operational costs.

- Facility Consolidation: The company consolidated its research operations into a single, centralized facility. This consolidation is projected to yield savings through reduced overhead, utilities, and maintenance costs.

- Cost Reduction Goals: These initiatives collectively aim to lower overall operating expenses, allowing Biomea Fusion to preserve capital and support its ongoing research and development activities.

- Impact on Cash Runway: By reducing operational expenditures, Biomea Fusion expects to significantly extend its cash runway, providing more time to achieve critical development milestones.

Biomea Fusion's cost structure is dominated by Research and Development (R&D), which is crucial for advancing its drug pipeline. General and Administrative (G&A) expenses, covering essential operational overhead, also represent a significant outlay. The company is actively managing these costs through strategic reductions and operational streamlining to enhance financial efficiency and extend its cash runway.

| Cost Category | 2023 Actuals (Millions USD) | Q1 2024 Actuals (Millions USD) | Key Drivers |

|---|---|---|---|

| Research & Development | N/A (Detailed breakdown not provided for full year 2023) | $18.2 | Clinical trials, preclinical research, manufacturing for trials |

| General & Administrative | $41.7 | N/A (Detailed breakdown not provided for Q1 2024) | Personnel, professional services, legal, administrative operations |

| Intellectual Property & Legal | N/A (Integrated within G&A or specific project costs) | N/A | Patent filings, renewals, corporate governance, regulatory compliance |

Revenue Streams

Future product sales represent Biomea Fusion's primary revenue driver. This includes income generated from the commercialization of icovamenib, targeting diabetes, and BMF-650, for obesity, following successful clinical trials and regulatory approvals.

The company's strategy focuses on market penetration and sales of these innovative therapies. For instance, the diabetes market alone was valued at approximately $600 billion globally in 2023 and is projected to grow significantly.

Biomea Fusion plans to monetize its oncology pipeline and the FUSION™ System through licensing agreements. These partnerships are expected to provide upfront payments, alongside crucial development and regulatory milestone payments as partnered assets advance.

Biomea Fusion, as a clinical-stage biotechnology company, heavily relies on equity financing for its operations. This involves selling shares of its common stock to investors through various rounds of financing and public offerings.

These capital infusions are critical for funding its extensive research, development, and ongoing clinical trials. For instance, the company successfully raised $42.8 million in June/July 2025 through such equity transactions, demonstrating a key revenue stream.

Potential Grants and Research Collaborations

Biomea Fusion, like many biopharmaceutical innovators, can tap into a vital funding avenue through grants and research collaborations. These partnerships are crucial for advancing early-stage drug development and specific scientific inquiries. For instance, in 2024, the National Institutes of Health (NIH) continued to be a significant source of funding for biomedical research, awarding billions to promising projects across the United States.

Such collaborations can take various forms, offering financial support and access to specialized expertise. Companies might partner with academic institutions or other industry players on joint research projects, sharing both risks and potential rewards. These arrangements are often structured to fund specific milestones in a drug's development lifecycle.

- Government Grants: Agencies like the NIH or the Biomedical Advanced Research and Development Authority (BARDA) provide non-dilutive funding for research with public health impact.

- Non-Profit Funding: Disease-specific foundations often offer grants to accelerate research into particular conditions.

- Industry Collaborations: Partnerships with larger pharmaceutical companies can provide upfront payments, milestone payments, and royalties in exchange for access to novel technologies or drug candidates.

Future Royalty Payments from Licensed Assets

Biomea Fusion anticipates future royalty payments as a significant revenue stream stemming from the licensing of its intellectual property and drug candidates. Should their partnered companies successfully bring these assets to market, Biomea Fusion would receive a percentage of net sales. This model allows them to generate ongoing income without bearing the full cost and responsibility of commercialization for every licensed product.

This royalty-based approach diversifies Biomea Fusion's income beyond direct product sales or upfront licensing fees. For instance, if a licensed asset achieves substantial market penetration, these royalties could represent a consistent and growing revenue source. This strategy is particularly advantageous for biotech companies like Biomea Fusion, enabling them to leverage their research and development without needing to build extensive sales and marketing infrastructure for every pipeline candidate.

- Royalty Income: A percentage of net sales from commercialized products developed using Biomea Fusion's licensed technology.

- Long-Term Revenue: Provides a sustained income stream as licensed products achieve market success.

- Reduced Commercialization Burden: Allows Biomea Fusion to focus on R&D while partners handle market launch and sales.

- Diversified Income: Creates an additional revenue pillar independent of direct sales or milestone payments.

Biomea Fusion's revenue model is multi-faceted, encompassing direct product sales, licensing agreements, and royalties. Future product sales, particularly for icovamenib and BMF-650, are anticipated to be the primary income source once regulatory hurdles are cleared.

Licensing deals for its oncology pipeline and the FUSION™ System are designed to bring in upfront payments and milestone achievements as partnered assets progress through development and regulatory pathways.

Furthermore, Biomea Fusion expects to benefit from royalty payments on net sales of products commercialized by its partners, creating a diversified and sustained income stream.

| Revenue Stream | Description | Key Drivers | Example/Data Point |

| Product Sales | Revenue from commercialized therapies | Successful clinical trials, regulatory approval, market adoption | Global diabetes market valued at ~$600 billion in 2023 |

| Licensing Agreements | Upfront payments and milestone fees from partnerships | Advancement of pipeline assets, strategic collaborations | Partnerships with larger pharmaceutical companies |

| Royalties | Percentage of net sales from licensed products | Market success of partnered drugs | Ongoing income from successful commercialization |

Business Model Canvas Data Sources

The Biomea Fusion Business Model Canvas is informed by comprehensive market analysis, competitive intelligence, and internal strategic planning documents. These data sources provide a robust foundation for understanding customer needs, market opportunities, and operational efficiencies.