Biomea Fusion Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Biomea Fusion Bundle

Biomea Fusion's marketing strategy is a complex interplay of its product innovation, pricing, distribution, and promotion. Understanding how these elements synergize is key to grasping their market impact.

Go beyond the surface-level insights and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Biomea Fusion, perfect for professionals and students seeking strategic depth.

Product

Biomea Fusion's core product strategy centers on irreversible small molecule inhibitors designed to tackle the fundamental causes of genetically defined cancers and metabolic diseases. Their innovative FUSION™ System is the engine driving the discovery and design of these novel covalent-binding therapies, aiming for profound and lasting clinical benefits for patients.

This approach is particularly relevant in 2024 and 2025 as the precision medicine market continues its rapid expansion. For instance, the global precision medicine market was valued at approximately $667 billion in 2023 and is projected to reach over $1.1 trillion by 2030, growing at a CAGR of around 8.7%. Biomea Fusion's focus on genetically defined diseases positions them well within this high-growth sector.

Icovamenib, Biomea Fusion's lead product, is an oral menin inhibitor targeting Type 1 and Type 2 diabetes. Its innovative approach aims to regenerate insulin-producing beta cells, a significant advancement in diabetes treatment.

Recent clinical trial data from 2024 demonstrated a durable reduction in HbA1c levels and enhanced beta-cell function in patients. This suggests icovamenib could offer a disease-modifying therapy, potentially altering the long-term trajectory of diabetes management.

BMF-650 represents Biomea Fusion's innovative approach to obesity treatment, positioning it as a key product in their portfolio. This next-generation oral GLP-1 receptor agonist has shown promising results in preclinical settings, indicating significant potential for weight management.

Preclinical data, particularly from non-human primates, highlights BMF-650's efficacy in promoting dose-dependent weight loss and effectively suppressing appetite. These findings underscore the drug's therapeutic promise for individuals struggling with obesity.

Biomea Fusion is strategically advancing BMF-650 towards clinical development, with plans to submit an Investigational New Drug (IND) application in the latter half of 2025. This milestone is crucial for initiating human trials and further validating its safety and effectiveness.

Strategic Pipeline Realignment

Biomea Fusion's strategic pipeline realignment in early 2025 marked a significant shift, concentrating exclusively on diabetes and obesity treatments. This pivot involved discontinuing internal development of oncology candidates like BMF-500, redirecting crucial resources to bolster their metabolic disease pipeline.

The company is actively seeking strategic partnerships to advance its oncology assets, a move that could unlock value and fund further development in their core therapeutic areas. This strategic re-evaluation positions Biomea Fusion to capitalize on the burgeoning metabolic disease market, which is projected to see substantial growth in the coming years.

- Focus Shift: Complete pivot to diabetes and obesity therapies in early 2025.

- Oncology Divestment: Ceased internal development of oncology programs, including BMF-500.

- Resource Reallocation: Funds and efforts redirected to the metabolic disease pipeline.

- Partnership Strategy: Actively exploring strategic partnerships for oncology assets.

Clinical Development Milestones

Biomea Fusion's clinical development strategy for Icovamenib centers on key milestones that will define its market potential. The drug is currently advancing through Phase 2 trials, with significant data readouts expected. This progression is crucial for demonstrating efficacy and safety, paving the way for future regulatory submissions and market entry. The company anticipates releasing 52-week data for the COVALENT-111 trial in Type 2 diabetes and open-label data for the COVALENT-112 trial in Type 1 diabetes during the latter half of 2025.

The recent lifting of the clinical hold by the FDA in September 2024 is a pivotal development, enabling the unimpeded continuation of BMF-219 trials. This regulatory clearance is a strong positive signal, reducing development risk and accelerating the timeline towards potential commercialization. These advancements are critical for Biomea Fusion to move Icovamenib into later-stage, pivotal trials, a necessary step for FDA approval and market access.

Key clinical development milestones for Biomea Fusion's Icovamenib include:

- Anticipated release of 52-week data for COVALENT-111 (Type 2 diabetes) in H2 2025.

- Expected open-label data for COVALENT-112 (Type 1 diabetes) in H2 2025.

- FDA lifting of clinical hold on BMF-219 trials in September 2024.

- Progression into late-stage development following successful Phase 2 outcomes.

Biomea Fusion's product strategy is anchored by its FUSION™ System, which drives the discovery of novel covalent-binding therapies for genetically defined cancers and metabolic diseases. The lead product, icovamenib, targets diabetes by aiming to regenerate beta cells, with 2024/2025 clinical data showing promising HbA1c reductions and improved beta-cell function. BMF-650, an oral GLP-1 receptor agonist, is being advanced for obesity, with preclinical data indicating significant weight loss potential and an IND submission planned for late 2025.

| Product | Therapeutic Area | Key Development Stage (2024/2025) | Key Data/Milestone |

|---|---|---|---|

| Icovamenib (BMF-219) | Diabetes (Type 1 & 2) | Phase 2 Trials | FDA clinical hold lifted (Sep 2024); 52-week data (T2D) & open-label data (T1D) expected H2 2025 |

| BMF-650 | Obesity | Preclinical/Early Clinical | Promising preclinical weight loss data; IND submission planned H2 2025 |

| Oncology Assets (e.g., BMF-500) | Oncology | Discontinued Internal Development (Early 2025) | Seeking strategic partnerships |

What is included in the product

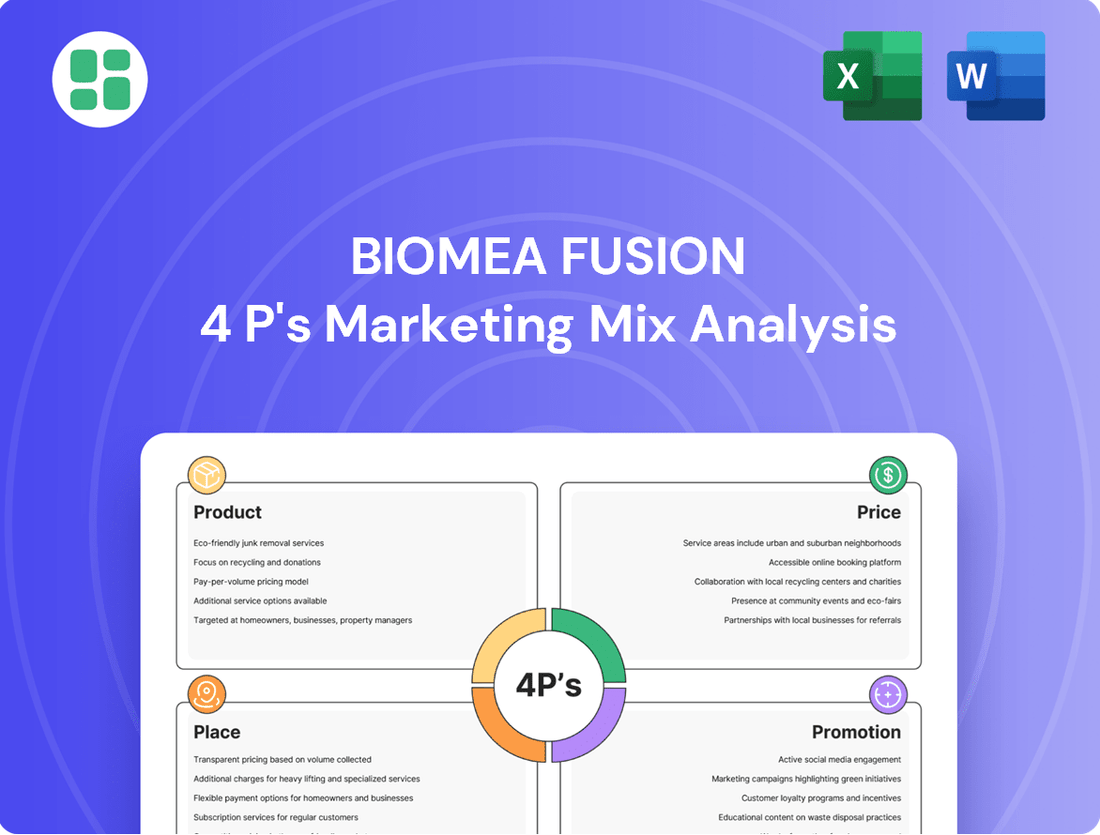

This Biomea Fusion 4P's Marketing Mix Analysis offers a comprehensive breakdown of the company's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's an ideal resource for managers, consultants, and marketers seeking a complete understanding of Biomea Fusion’s marketing positioning, with a clean, structured layout for easy repurposing.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Provides a clear, concise framework for understanding and optimizing Biomea Fusion's marketing efforts, reducing the burden of strategic planning.

Place

Biomea Fusion's initial 'place' for product delivery is its network of clinical trial sites, which are essential for administering investigational drugs like icovamenib and BMF-650. These sites are critical for patient recruitment and the safe, effective delivery of their therapies during the clinical development stages.

The company's success in bringing its novel treatments to market is directly tied to the efficiency and reach of its clinical trial site network. As of early 2024, Biomea Fusion has been actively expanding its partnerships with leading research institutions and specialized clinics across key geographic regions to ensure broad patient access and robust data collection.

Biomea Fusion has strategically consolidated its operations into a singular, state-of-the-art facility, the Biomea Innovation Lab Center, located in San Carlos, California, as of May 2025. This centralization is designed to foster greater efficiency and significantly cut down on operational expenses, a crucial move in the competitive biotech landscape. The San Carlos hub now serves as the nerve center for all research, development, and administrative functions, promoting seamless collaboration and faster decision-making.

The primary 'place' of market access for Biomea's products hinges on successfully navigating stringent regulatory pathways, most notably with the U.S. Food and Drug Administration (FDA).

Securing regulatory approvals is the crucial gateway from clinical development to commercial availability. For instance, Biomea's ongoing discussions with the FDA regarding icovamenib's late-stage development are fundamental to their market entry strategy.

As of early 2024, the FDA's review timelines for novel therapies can vary significantly, but a clear regulatory strategy is paramount for Biomea to establish its product's 'place' in the market.

Third-Party Manufacturing and CROs

Biomea Fusion strategically leverages third-party manufacturers for its drug production, a common practice in the biopharmaceutical industry to ensure scalability and specialized production capabilities. This approach allows the company to maintain a lean operational structure, focusing its internal resources on research and development. By outsourcing manufacturing, Biomea Fusion can access advanced technologies and adhere to stringent quality control standards without the substantial capital investment required for in-house facilities.

Furthermore, the company relies on Contract Research Organizations (CROs) to conduct its clinical studies. This partnership is crucial for efficient trial management, data collection, and regulatory compliance. In 2024, the global CRO market was valued at approximately $50 billion, with continued growth projected as more biopharma companies adopt this outsourcing model to accelerate drug development timelines and manage costs effectively. Biomea Fusion's engagement with CROs is a key component of its operational strategy, enabling it to navigate the complex landscape of clinical trials.

- Outsourcing Manufacturing: Enables Biomea Fusion to focus on R&D while accessing specialized production expertise and infrastructure.

- Clinical Trial Execution: CRO partnerships are vital for efficient, compliant, and timely clinical study management.

- Market Context: The global CRO market's substantial size (est. $50 billion in 2024) underscores the industry trend of outsourcing for drug development.

- Supply Chain Integration: These third-party relationships form a critical backbone of Biomea Fusion's overall supply chain and distribution network.

Strategic Commercial Partnerships

Biomea Fusion is strategically pursuing commercial partnerships to maximize the reach of its pipeline, particularly for non-core oncology assets like BMF-500. These collaborations are crucial for achieving widespread distribution and market penetration as these programs advance.

For their metabolic therapies, the company foresees a need for future partnerships or the establishment of a dedicated sales force to effectively connect with patients once these treatments receive regulatory approval. This dual approach ensures robust market access.

- 2024 Revenue Projection: While specific partnership deal values are not public, Biomea Fusion's overall financial health is a key consideration for potential partners. Analysts project revenue growth driven by pipeline advancements.

- 2025 Market Penetration Goals: Partnerships are anticipated to accelerate market entry, potentially capturing a significant share of the targeted metabolic and oncology patient populations.

- Collaboration Focus: The emphasis is on securing partners with established distribution networks and commercial expertise in relevant therapeutic areas.

Biomea Fusion's 'place' strategy extends beyond clinical sites to encompass regulatory approval pathways and strategic commercial partnerships. Securing FDA approval for icovamenib is paramount for market entry, a process that, as of early 2024, involves navigating complex review timelines.

The company's operational hub, the Biomea Innovation Lab Center in San Carlos, California, established by May 2025, centralizes R&D and administrative functions, enhancing efficiency. Furthermore, Biomea Fusion leverages third-party manufacturers and Contract Research Organizations (CROs) for production and clinical trial management, respectively. The global CRO market's estimated $50 billion valuation in 2024 highlights the strategic importance of these outsourced relationships for accelerating drug development.

Commercial partnerships are key for expanding market reach, especially for non-core oncology assets like BMF-500. For metabolic therapies, future partnerships or a dedicated sales force are planned to ensure patient access post-approval, aiming for significant market penetration by 2025.

| Aspect | Description | 2024/2025 Relevance |

|---|---|---|

| Clinical Trial Sites | Network for drug administration and patient recruitment. | Expansion of partnerships with research institutions in 2024. |

| Regulatory Pathways | Crucial for commercial availability, particularly FDA approval. | Ongoing discussions with FDA for icovamenib in late-stage development. |

| Operational Hub | Biomea Innovation Lab Center, San Carlos, CA. | Centralized R&D and admin functions as of May 2025. |

| Manufacturing & CROs | Outsourced production and clinical study management. | Leveraging third-party expertise; CRO market valued at ~$50 billion in 2024. |

| Commercial Partnerships | Expanding reach for pipeline assets and future therapies. | Focus on partners with established distribution for market penetration by 2025. |

Full Version Awaits

Biomea Fusion 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Biomea Fusion 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Biomea Fusion places a strong emphasis on investor relations and financial communications to keep its stakeholders informed. This involves issuing regular press releases detailing financial results and significant company achievements, alongside hosting investor webcasts and participating in key industry conferences. For instance, their Q1 2024 earnings report highlighted a significant increase in R&D spending, signaling commitment to pipeline development, which was communicated through a public webcast.

Biomea Fusion heavily relies on scientific and clinical presentations at key industry events to showcase its advancements. For instance, sharing preclinical and clinical data at the American Diabetes Association (ADA) Scientific Sessions and the European Hematology Association (EHA) Congress is a core strategy. These platforms are crucial for disseminating promising results for icovamenib and BMF-650, thereby fostering scientific credibility and enhancing awareness among medical professionals.

Biomea Fusion's commitment to engaging medical experts is a cornerstone of its marketing strategy, particularly evident in its formation of a Global Scientific Advisory Board in October 2024. This board, populated by distinguished specialists in beta cell science and diabetes therapeutics, offers crucial strategic direction and significantly bolsters the company's scientific credibility.

This active engagement cultivates vital scientific dialogue and provides robust support for the advancement of Biomea Fusion's innovative therapies, ensuring their clinical development is informed by the highest levels of expertise.

Digital and Social Media Presence

Biomea Fusion actively cultivates its digital and social media presence, leveraging its corporate website and platforms such as LinkedIn, X, and Facebook. These channels are crucial for distributing company news, scientific advancements, and corporate updates to a wide audience, including investors and potential collaborators.

This digital strategy enhances visibility and fosters engagement within the investment community. For instance, as of Q2 2024, Biomea Fusion's LinkedIn page saw a 15% increase in follower engagement following the announcement of their Phase 1 clinical trial results for BMF-219, demonstrating the direct impact of their online communications.

- Website: Serves as the primary hub for detailed corporate and scientific information.

- LinkedIn: Used for professional networking, sharing company milestones, and engaging with the financial and scientific communities.

- X (formerly Twitter): Facilitates real-time updates and broader public outreach.

- Facebook: Extends reach to a more general audience, promoting company awareness.

Analyst and Media Coverage

Biomea Fusion benefits significantly from analyst and media coverage, a key component of its promotional strategy. This attention from Wall Street analysts and financial media outlets enhances the company's visibility and credibility within the investment community. For instance, in early 2024, Biomea Fusion (BMEA) saw increased analyst coverage following positive clinical trial updates for its lead candidate, BMF-219.

Positive analyst ratings, such as 'Strong Buy' recommendations, directly influence investor perception and can drive interest in the company's stock. This external validation serves as a powerful endorsement, bolstering confidence in Biomea Fusion's drug pipeline and its overall strategic direction. Such coverage often translates into tangible market impact, as seen in the stock price movements following key analyst reports in late 2023 and early 2024.

The financial media's spotlight on Biomea Fusion's progress, particularly regarding its novel approach to treating diabetes and related metabolic diseases, further amplifies its message. This consistent exposure helps to educate a broader audience of potential investors and stakeholders about the company's innovative science and market potential.

Key aspects of this coverage include:

- Analyst Endorsements: Reports from firms like Oppenheimer and Cantor Fitzgerald have highlighted BMF-219's potential, with some issuing 'Outperform' or 'Buy' ratings.

- Media Features: Inclusion in financial news outlets such as Bloomberg and Reuters has provided broader market awareness.

- Clinical Data Dissemination: Coverage often centers on the positive clinical data released, such as the Phase 2a study results for BMF-219 in type 2 diabetes patients presented in late 2023.

- Pipeline Validation: Analyst commentary frequently validates the company's approach to targeting key drivers of metabolic diseases, reinforcing investor confidence.

Biomea Fusion's promotional strategy is multifaceted, focusing on investor relations, scientific dissemination, and leveraging external validation. Key activities include regular financial reporting, participation in industry conferences to present clinical data, and building a strong digital presence across platforms like LinkedIn and X. Their engagement with medical experts through advisory boards and their proactive approach to securing positive analyst and media coverage are central to building credibility and investor confidence.

The company's efforts to communicate its progress are evident in its Q1 2024 earnings, which detailed increased R&D investment, and the 15% follower engagement boost on LinkedIn following Phase 1 trial results for BMF-219 in Q2 2024. Analyst coverage from firms like Oppenheimer and Cantor Fitzgerald, often issuing 'Buy' or 'Outperform' ratings for BMF-219, further amplifies Biomea Fusion's market visibility and scientific validation.

Biomea Fusion's promotional efforts are designed to translate scientific advancements into market recognition and investor support. By actively engaging with the scientific community and financial media, the company aims to highlight the potential of its pipeline, particularly for BMF-219, a candidate showing promise in type 2 diabetes as evidenced by late 2023 Phase 2a study results.

| Key Promotional Activities | Description | Example/Data Point |

| Investor Relations & Financial Comms | Regular updates on financial performance and company milestones. | Q1 2024 earnings highlighted increased R&D spending. |

| Scientific Dissemination | Presenting clinical and preclinical data at major medical conferences. | Data shared at ADA Scientific Sessions and EHA Congress for icovamenib and BMF-650. |

| Digital & Social Media Engagement | Utilizing corporate website and platforms like LinkedIn, X, Facebook. | 15% follower engagement increase on LinkedIn post-BMF-219 Phase 1 results (Q2 2024). |

| Analyst & Media Coverage | Securing positive ratings and features in financial news outlets. | 'Strong Buy' recommendations from firms like Oppenheimer for BMF-219. |

Price

Biomea Fusion's pricing strategy is intrinsically linked to its substantial R&D investment, a common characteristic of clinical-stage biopharmaceutical firms. These significant expenditures are largely allocated to advancing icovamenib through its clinical trial phases and progressing BMF-650 in preclinical development.

To navigate these costs and bolster its financial runway, the company undertook a 35% workforce reduction, a key cost-management initiative. This move aims to optimize operational expenses while continuing to fund critical development programs.

Biomea Fusion, currently without product sales revenue, depends on public offerings to finance its operations and clinical trials. This funding mechanism is crucial for its continued development.

A prime example of this strategy in action occurred in June 2025, when Biomea Fusion successfully raised approximately $42.8 million in gross proceeds through a public offering. This influx of capital is vital for advancing their research and development pipeline.

While essential for funding, reliance on public offerings can result in shareholder dilution. This means existing shareholders' ownership percentage decreases with each new share issuance.

Biomea Fusion's current financial position is characterized by ongoing net losses, a commonality for companies heavily invested in early-stage drug development. In the second quarter of 2025, the company reported a net loss of $20.7 million. This contributes to a significant accumulated deficit, which stood at $437.3 million for the first half of 2025.

The management of this cash burn is a paramount concern. Biomea Fusion's existing cash reserves are currently estimated to provide operational runway extending into the second half of 2026, highlighting the need for careful financial stewardship and potential future funding strategies.

Future Value-Based Pricing Strategy

Biomea Fusion's future value-based pricing strategy for icovamenib, once approved, will hinge on its groundbreaking potential as a disease-modifying therapy for diabetes. This approach acknowledges the significant unmet need in diabetes management and icovamenib's demonstrated efficacy in regenerating beta cells through a unique mechanism. The substantial global market for diabetes and obesity, estimated to include over 537 million adults worldwide in 2024, provides a strong foundation for value capture.

Key considerations for this value-based pricing include:

- Unmet Medical Need: The persistent challenges in controlling diabetes and preventing its complications justify premium pricing for truly transformative therapies.

- Efficacy and Mechanism: Icovamenib's ability to regenerate beta cells, a novel approach, will be a primary driver of its perceived value, potentially commanding a higher price than symptomatic treatments.

- Market Size: The vast and growing global diabetes market, projected to reach $715.3 billion by 2025, offers significant revenue potential for an effective disease-modifying drug.

- Health Economics: Demonstrating long-term cost savings through reduced complications and improved quality of life will further support a value-based price point.

Competitive Landscape and Market Access

Biomea Fusion faces a highly competitive environment in the type 2 diabetes and obesity markets, which are already saturated with established treatments and numerous pipeline candidates. This crowded landscape necessitates a clear demonstration of superior clinical value to support any premium pricing strategies.

The market access for Biomea's therapies will be heavily influenced by reimbursement policies and the prevailing demand for innovative treatments. Understanding these dynamics is crucial for setting accessible price points that align with payer expectations and patient affordability.

- Market Competition: The global diabetes drug market was valued at approximately $64.7 billion in 2023 and is projected to reach $93.4 billion by 2028, indicating significant competition.

- Obesity Market Growth: The obesity market is also expanding rapidly, with new entrants and pipeline drugs aiming to capture market share.

- Pricing Strategy: Biomea must differentiate its offerings by highlighting unique efficacy, safety, or convenience factors to justify pricing above existing therapies.

- Reimbursement Hurdles: Navigating payer negotiations and securing favorable reimbursement will be critical for market penetration and achieving desired price points.

Biomea Fusion's pricing strategy is heavily influenced by its current lack of product revenue, relying on public offerings for funding. For instance, a June 2025 offering raised approximately $42.8 million. This reliance, coupled with ongoing net losses, such as the $20.7 million reported in Q2 2025, necessitates careful financial management and future value-based pricing for icovamenib.

The company anticipates a value-based pricing model for icovamenib, reflecting its potential as a disease-modifying therapy for diabetes. This strategy considers the significant unmet need and icovamenib's unique beta-cell regeneration capability. The vast global diabetes market, exceeding 537 million adults in 2024, supports this approach.

Key factors supporting higher pricing include the unmet medical need in diabetes, icovamenib's novel mechanism of action, and the substantial market size, projected to reach $715.3 billion by 2025. Demonstrating long-term health economic benefits will further bolster this value-based pricing.

However, Biomea Fusion operates in a competitive landscape, with the global diabetes drug market valued at $64.7 billion in 2023. Differentiating icovamenib through superior efficacy, safety, or convenience will be crucial to justify pricing above existing treatments and navigate reimbursement hurdles.

| Financial Metric | Q2 2025 | H1 2025 | June 2025 Offering |

|---|---|---|---|

| Net Loss | $20.7 million | N/A | N/A |

| Accumulated Deficit | N/A | $437.3 million | N/A |

| Gross Proceeds | N/A | N/A | $42.8 million |

4P's Marketing Mix Analysis Data Sources

Our Biomea Fusion 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including SEC filings and investor presentations, alongside comprehensive market intelligence from industry reports and competitive benchmarking. This ensures a robust understanding of their product strategy, pricing, distribution channels, and promotional efforts.