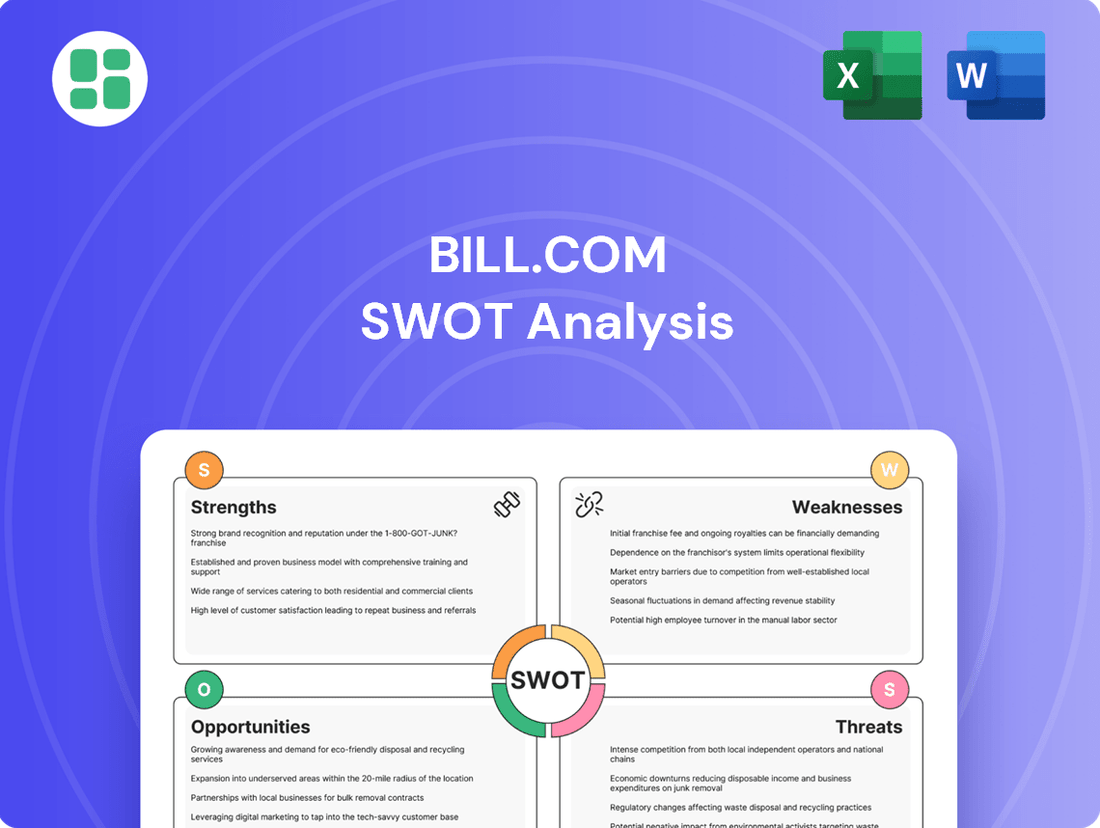

Bill.com SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

Bill.com boasts significant strengths in its robust platform and strong customer loyalty, positioning it well in the accounting software market. However, understanding the full scope of its competitive landscape, potential regulatory hurdles, and emerging technological threats requires a deeper dive.

Want the full story behind Bill.com’s market position, including its unique opportunities for expansion and potential weaknesses to mitigate? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bill.com has showcased impressive financial strength, with substantial year-over-year revenue growth reported in its Q1 and Q2 Fiscal Year 2025 earnings. This growth spans both its core operations and overall revenue streams, indicating a healthy and expanding business.

The company's profitability has also seen significant positive movement. Bill.com reported a notable improvement in non-GAAP operating income and net income, highlighting the effectiveness and resilience of its business model.

This consistent financial outperformance is largely driven by its successful monetization of subscription and transaction fees. Such a performance demonstrates Bill.com's capacity to thrive and generate consistent revenue, even amidst fluctuating economic conditions.

Bill.com holds a dominant position in the U.S. market for financial operations software catering to small and midsize businesses (SMBs). This leadership is underscored by its service to nearly half a million businesses, a testament to its effectiveness in simplifying complex financial workflows.

Bill.com's comprehensive cloud platform excels at automating accounts payable and receivable, along with expense management. This integrated approach simplifies financial operations for small and medium-sized businesses.

The platform's strength lies in its seamless integration with numerous accounting systems, offering digital payments, automated workflows, and valuable financial insights. This makes it a truly all-in-one solution for businesses seeking efficiency.

Recent enhancements, such as expanded procurement tools and multi-entity management capabilities, further solidify Bill.com's position as a robust and adaptable financial management solution, catering to evolving business needs.

Robust Partner Ecosystem

Bill.com's robust partner ecosystem is a significant strength, leveraging collaborations with major U.S. financial institutions, accounting firms, and accounting software providers. This network is vital for expanding its reach and integrating its services into the broader financial landscape.

A key example is the recently extended partnership with Bank of America, which facilitates customer acquisition and deepens market penetration. Such alliances are instrumental in embedding Bill.com's solutions within existing financial workflows, thereby enhancing its distribution channels and client support infrastructure.

- Strategic Alliances: Partnerships with over 200 accounting firms and software providers in 2024.

- Financial Institution Integration: Active integrations with major banks, including a renewed multi-year agreement with Bank of America in late 2023.

- Customer Acquisition: Over 60% of new customers in Q4 2024 were acquired through channel partners.

- Market Penetration: Increased market share by 5% in the SMB accounting software integration space due to partner referrals.

High Customer Retention and Engagement

Bill.com demonstrates impressive customer retention, a key strength that underpins its stable revenue. This loyalty is evident in their strong net revenue retention rates, signaling that existing customers find ongoing value and often expand their usage of the platform.

The sheer volume of business processed on Bill.com highlights deep customer engagement. In the fiscal year 2023, the company processed $246.9 billion in total payment volume and facilitated 178.5 million transactions. This substantial activity reflects a highly engaged user base that relies on the platform for critical financial operations.

This consistent and growing usage translates directly into a predictable and robust revenue stream for Bill.com. The ability to retain and deepen relationships with customers is a significant competitive advantage, providing a solid foundation for future growth and profitability.

- High Customer Retention: Bill.com consistently achieves strong net revenue retention, indicating customer satisfaction and increasing value perception.

- Significant Transaction Volume: In FY23, the platform processed $246.9 billion in total payment volume and 178.5 million transactions, showcasing deep user engagement.

- Predictable Revenue: Customer loyalty and high platform usage contribute to a stable and predictable revenue stream, a crucial strength for financial forecasting.

Bill.com's market leadership in the U.S. for SMB financial operations software is a significant strength. It serves nearly half a million businesses, simplifying complex financial workflows through its comprehensive cloud platform that automates accounts payable, receivable, and expense management.

The platform's seamless integration with numerous accounting systems, offering digital payments, automated workflows, and financial insights, makes it a truly all-in-one solution. Recent enhancements like expanded procurement tools and multi-entity management further solidify its adaptability.

Bill.com's robust partner ecosystem, including over 200 accounting firms and software providers in 2024, is crucial for market penetration. Strategic alliances, such as the renewed multi-year agreement with Bank of America in late 2023, drive customer acquisition, with over 60% of new customers in Q4 2024 coming through channel partners, increasing market share by 5%.

The company boasts impressive customer retention, evidenced by strong net revenue retention rates. In fiscal year 2023, Bill.com processed $246.9 billion in total payment volume and 178.5 million transactions, demonstrating deep user engagement and a predictable revenue stream.

| Metric | FY23 Value | Significance |

| Businesses Served | ~500,000 | Market leadership and broad adoption |

| Total Payment Volume (FY23) | $246.9 billion | High customer engagement and platform reliance |

| Transactions Processed (FY23) | 178.5 million | Demonstrates deep user engagement |

| Partner Firms (2024) | 200+ | Expands reach and drives customer acquisition |

| New Customers via Partners (Q4 FY24) | 60%+ | Effectiveness of strategic alliances |

What is included in the product

Offers a full breakdown of Bill.com’s strategic business environment by examining its internal strengths and weaknesses alongside external market opportunities and threats.

Simplifies complex financial workflows by automating accounts payable and receivable, reducing manual errors and freeing up valuable time.

Weaknesses

Bill.com's significant reliance on the United States market, where it generated over 95% of its revenue in 2024, presents a notable weakness. This concentrated geographical focus contrasts with competitors who have established a more substantial international presence.

This limited global footprint means Bill.com is more susceptible to economic downturns or regulatory changes within a single country. It also highlights a missed opportunity for international expansion and diversification of its revenue streams.

Bill.com's reliance on small and medium-sized businesses (SMBs) makes it highly sensitive to broader economic shifts. When inflation rises or recession fears loom, SMBs often tighten their belts, directly impacting their ability to spend on services like Bill.com. This can lead to slower growth in Total Payment Volume (TPV), a key metric for the company.

For instance, during periods of economic uncertainty, SMBs might delay payments or reduce their transaction volumes, directly affecting Bill.com's revenue streams. This vulnerability was evident in early 2023 reports, where some analysts noted a slowdown in SMB spending, a trend that could continue if macroeconomic headwinds persist through 2024 and into 2025.

While Bill.com's revenue growth has been robust, there's a notable concern about a potential slowdown in its core revenue expansion. This deceleration is partly attributed to softer monetization rates, with some analysts observing a deterioration in the company's take rate.

For instance, in fiscal year 2024, while total revenue saw significant increases, the pace of growth in certain segments has shown signs of moderating compared to previous periods. Revenue guidance has also occasionally fallen short of analyst expectations, signaling potential headwinds.

Maintaining the high growth rates seen in earlier stages becomes increasingly difficult as the company operates within a more mature market segment. This presents a challenge for Bill.com to sustain its previous growth trajectory.

Intense Competitive Landscape

Bill.com operates within a fiercely competitive financial technology space, contending with both legacy providers and agile newcomers. Companies such as Tipalti, Stampli, Concur, Airbase, and Melio present viable alternatives, often carving out specific market segments or targeting distinct business scales. This crowded environment demands constant investment in innovation and unique value propositions to secure and grow market share.

The competitive pressure is evident in market dynamics. For instance, the broader Accounts Payable (AP) automation market, which Bill.com significantly participates in, is projected to grow substantially. Mordor Intelligence forecasts the global AP automation market to reach USD 10.64 billion by 2024 and expand to USD 18.59 billion by 2029, growing at a CAGR of 11.64% during the forecast period (2024-2029). This growth attracts numerous players, intensifying the rivalry for Bill.com.

- Intense Rivalry: Bill.com faces direct competition from established players and emerging fintechs in the AP and B2B payments space.

- Niche Competitors: Solutions like Tipalti and Stampli often cater to specific business needs or sizes, offering specialized features that could draw customers away.

- Innovation Imperative: To stay ahead, Bill.com must continuously enhance its platform and services, a costly endeavor in a rapidly evolving technological landscape.

- Market Saturation: As the fintech sector matures, the sheer number of available solutions means businesses have more choices, potentially fragmenting market share.

Valuation Concerns

Despite Bill.com's solid financial footing and promising growth trajectory, its stock valuation has raised eyebrows among certain investors. The company's valuation multiples, while reflecting its strong performance, might be a deterrent for some considering an investment, especially given the current market sentiment which can be cautious regarding valuation floors.

For instance, as of mid-2024, Bill.com's Price-to-Sales (P/S) ratio has often traded at a premium compared to its peers in the financial technology sector, a common observation for high-growth companies. While this premium is often justified by its rapid revenue expansion and market share gains, it can introduce uncertainty about the sustainability of its current market price.

- Premium Valuation: Bill.com's stock often trades at higher valuation multiples, such as a P/S ratio that can exceed 10x, compared to the industry average.

- Investor Caution: This premium can lead to investor caution, as they assess the potential for future growth to justify the current price, creating an uncertain valuation floor.

- Profitability vs. Multiples: Although the company demonstrates robust cash profitability, the elevated valuation multiples might still deter some potential investors seeking more conservative entry points.

Bill.com's reliance on a single geographic market, with over 95% of its 2024 revenue originating from the United States, exposes it to significant country-specific risks. This lack of international diversification makes the company vulnerable to economic downturns or regulatory shifts within the US, while also representing a missed opportunity for global expansion.

The company's customer base, primarily small and medium-sized businesses (SMBs), renders Bill.com highly susceptible to economic fluctuations. During periods of inflation or recessionary concerns, SMBs tend to reduce spending, directly impacting Bill.com's Total Payment Volume (TPV) and overall revenue growth. This sensitivity was noted in early 2023, with potential for continued impact through 2024 and 2025.

A potential slowdown in Bill.com's core revenue expansion is a concern, partly due to moderating monetization rates and a softening take rate observed in fiscal year 2024. While revenue growth remains strong, the pace has shown signs of deceleration compared to prior periods, with occasional revenue guidance falling short of analyst expectations.

The competitive landscape in financial technology is intensely crowded, with Bill.com facing pressure from both established players and agile fintech startups. Companies like Tipalti, Stampli, and Melio offer specialized solutions, intensifying rivalry and requiring continuous investment in innovation to maintain market share. The broader AP automation market, projected to reach USD 10.64 billion by 2024 and USD 18.59 billion by 2029, further fuels this competition.

What You See Is What You Get

Bill.com SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The escalating integration of artificial intelligence and machine learning within the fintech sector offers a prime avenue for Bill.com's growth. As small and medium-sized businesses increasingly turn to AI for streamlining operations, from robust fraud detection to more accurate financial forecasting, Bill.com is well-positioned to capitalize on this trend.

By embedding sophisticated AI-driven functionalities, Bill.com can further automate routine processes, thereby boosting operational efficiency and delivering more profound financial intelligence to its clientele. For instance, AI-powered invoice processing can reduce manual data entry by up to 80%, a significant time-saver for SMBs.

Bill.com can significantly broaden its reach by embedding its solutions within the offerings of financial institutions and other software providers. This strategic move allows businesses to access Bill.com's capabilities directly through their existing banking portals or accounting software, creating a more seamless experience.

For instance, a partnership with a major bank could see Bill.com's accounts payable and receivable features integrated into the bank's business online platform. This would expose Bill.com to millions of the bank's business customers, potentially driving substantial user acquisition. As of Q1 2024, Bill.com reported a 27% year-over-year increase in total payment volume, highlighting the growing demand for efficient payment solutions that such embedded strategies can further fuel.

Bill.com has a significant opportunity to broaden its platform beyond accounts payable and receivable, moving into more comprehensive financial operations. This expansion could include enhanced procurement tools, more sophisticated multi-entity management features, and the development of mass payment solutions for businesses.

By integrating these additional functionalities, Bill.com can significantly increase its value proposition. For instance, by offering advanced procurement, it can streamline the entire purchasing process for clients. This move aims to make the platform more indispensable, capturing a larger portion of a client's overall financial workflow and increasing customer retention.

In 2024, the market for integrated financial management solutions is growing rapidly, with businesses increasingly seeking platforms that can handle multiple financial tasks. Bill.com's expansion into areas like procurement and mass payments aligns with this trend, potentially capturing a larger market share as companies look to consolidate their financial software needs.

Targeting Larger Enterprises

Bill.com's expansion into serving larger enterprises presents a significant growth opportunity. By offering advanced product suites, such as multi-entity management and robust procurement capabilities, the company is well-positioned to attract businesses with more complex financial workflows and higher transaction volumes than its traditional small and medium-sized business (SMB) customer base.

This strategic move upmarket allows Bill.com to capitalize on the increasing demand for sophisticated financial automation solutions among mid-market and enterprise-level companies. For instance, the company's acquisition of Divvy in 2021, which brought expense management and corporate card solutions, further bolstered its ability to cater to larger organizations' needs. This expansion taps into a market segment that typically generates higher average revenue per user (ARPU) and offers greater potential for sustained growth.

- Market Expansion: Targeting larger enterprises allows Bill.com to access a segment with higher spending power and more complex needs, moving beyond its historical SMB focus.

- Revenue Growth Potential: Larger clients often have greater transaction volumes and require more advanced features, leading to higher ARPU and increased overall revenue.

- Product Diversification: The development of advanced product suites, like multi-entity management and enhanced procurement, directly addresses the sophisticated requirements of enterprise clients, broadening Bill.com's appeal.

Leveraging Data for Enhanced Financial Insights

Bill.com's platform processes a massive volume of financial transactions, a rich source for sophisticated analytics. This data can be leveraged to provide customers with deeper insights into their financial health, moving beyond basic record-keeping to strategic advisory services. For instance, by analyzing trends in payment cycles and vendor spending, Bill.com could offer predictive cash flow forecasts, a critical need for businesses navigating economic uncertainties. In 2024, businesses are increasingly prioritizing data-driven decision-making, making advanced analytics a key differentiator.

This presents a significant opportunity to enhance customer value by transforming raw transaction data into actionable intelligence. Imagine offering clients personalized reports highlighting cost-saving opportunities or identifying potential payment bottlenecks before they impact cash flow. Such capabilities would solidify Bill.com's position as an indispensable partner, not just a payment processor. The ability to provide these strategic insights could directly contribute to improved financial planning and more robust business decision-making for their user base.

- Enhanced Cash Flow Management: Providing predictive analytics on incoming and outgoing payments.

- Strategic Financial Planning: Offering insights into spending patterns and potential cost optimizations.

- Informed Business Decisions: Delivering data-backed recommendations for operational improvements.

- Competitive Advantage: Differentiating through advanced reporting that aids customer growth and stability.

Bill.com can leverage the growing demand for AI-powered financial solutions by integrating advanced machine learning into its platform, enhancing automation and providing deeper financial insights. For example, AI can improve invoice processing, potentially reducing manual data entry by as much as 80%. Furthermore, strategic partnerships with financial institutions and software providers offer a significant opportunity to embed Bill.com's services directly into existing business workflows, thereby expanding its reach and customer acquisition. This embedded approach, seen in Q1 2024's 27% year-over-year increase in total payment volume, highlights the market's appetite for seamless financial solutions.

Threats

The financial operations software market is increasingly crowded, with numerous fintech firms providing specialized or all-encompassing solutions. This intense competition can put pressure on pricing and market share, forcing companies like Bill.com to continually innovate and differentiate their offerings to maintain a competitive edge.

Bill.com faces direct threats from established competitors such as Tipalti, Stampli, and Melio, all of whom offer similar accounts payable and receivable automation services. Furthermore, larger technology corporations and traditional financial institutions are expanding their digital payment and financial management capabilities, presenting a broader competitive landscape.

As a cloud-based platform managing sensitive financial information, Bill.com faces significant cybersecurity risks. A data breach could severely damage its reputation and customer trust, leading to substantial financial and legal penalties. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, a figure that highlights the potential financial fallout for companies like Bill.com.

A prolonged economic downturn, marked by persistent inflation and increasing interest rates, presents a considerable threat to Bill.com. Many small and midsize businesses, the platform's primary users, are particularly vulnerable to these economic shifts. This vulnerability can translate into reduced spending on financial software and services, directly impacting Bill.com's revenue streams.

During economic slowdowns, SMBs often tighten their budgets, leading to decreased transaction volumes processed through platforms like Bill.com. This reduction in activity directly affects transaction-based fees. Furthermore, a challenging economic climate can dampen demand for new subscriptions and increase the risk of existing customers downgrading or churning. For instance, during periods of economic contraction, businesses may postpone investments in new technologies or seek out lower-cost alternatives.

Regulatory Changes in Fintech and Payments

The fintech and payments sector faces a constantly shifting regulatory environment. For Bill.com, this means adapting to new rules concerning data privacy, anti-money laundering (AML), and consumer protection, which could require significant investment in compliance infrastructure. For instance, the European Union's Digital Operational Resilience Act (DORA), fully applicable from January 2025, imposes stringent ICT risk management requirements on financial entities, which could impact service providers like Bill.com if they operate within or serve clients in the EU.

These evolving regulations, both in the US and potentially abroad, could lead to increased operational costs and may necessitate modifications to Bill.com's existing service offerings or business model. Failure to comply with new mandates, such as stricter Know Your Customer (KYC) or data localization laws, could result in penalties or limitations on market access.

- Increased Compliance Costs: New regulations may require substantial IT and personnel investments for adherence.

- Operational Model Adjustments: Changes in payment processing or data handling rules could force service modifications.

- Market Access Restrictions: Non-compliance with international regulations could limit Bill.com's global expansion opportunities.

- Potential for Fines: Regulatory breaches can lead to significant financial penalties, impacting profitability.

Customer Concentration Risk

Bill.com's reliance on strategic partnerships with major financial institutions, while beneficial for customer acquisition, introduces a significant customer concentration risk. The termination or adverse alteration of a contract with a key banking partner could severely disrupt a substantial portion of its revenue streams and customer onboarding processes. For instance, if a single large bank partner accounted for over 15% of Bill.com's new customer acquisition in 2024, a disruption would have a material impact.

To mitigate this, Bill.com needs to actively pursue diversification of its key relationships. Expanding its network of financial institution partners and reducing dependence on any single entity is crucial for long-term stability and resilience. This strategy would spread the risk and ensure that the business is not overly vulnerable to the decisions or performance of one or two major collaborators.

- Customer Concentration: Dependence on a few large financial institution partners creates a vulnerability.

- Revenue Impact: Loss of a major partner could significantly affect revenue and customer acquisition.

- Diversification Need: Expanding relationships with multiple financial institutions is key to stability.

- Mitigation Strategy: Proactive efforts to broaden the partner ecosystem are essential for long-term growth.

Bill.com operates in a highly competitive market, facing pressure from established players like Tipalti and Melio, as well as broader tech and financial institutions expanding their digital offerings. Cybersecurity remains a critical threat, with the average cost of a data breach in 2024 reaching $4.73 million globally. Economic downturns, characterized by inflation and rising interest rates, disproportionately affect Bill.com's small and midsize business customer base, potentially reducing transaction volumes and subscription demand. The evolving regulatory landscape, including measures like the EU's DORA, necessitates ongoing investment in compliance, with potential penalties for non-adherence. Furthermore, reliance on a few key financial institution partners presents a customer concentration risk, where the loss of a major partner could materially impact revenue and customer acquisition.

| Threat Category | Specific Threat | Potential Impact | Mitigation Focus |

|---|---|---|---|

| Competition | Intense market competition from fintechs and traditional players | Pressure on pricing, market share erosion | Continuous innovation, differentiation |

| Cybersecurity | Data breaches and cyberattacks | Reputational damage, financial and legal penalties (Avg. data breach cost 2024: $4.73M) | Robust security infrastructure, continuous monitoring |

| Economic Conditions | Economic downturns, inflation, rising interest rates | Reduced SMB spending, lower transaction volumes, increased churn | Diversified customer base, value-added services |

| Regulatory Environment | Evolving data privacy, AML, consumer protection laws (e.g., EU's DORA from Jan 2025) | Increased compliance costs, operational adjustments, potential fines | Proactive compliance strategy, legal counsel engagement |

| Partnership Dependence | Customer concentration risk with key financial institutions | Significant revenue disruption if a major partner is lost | Diversification of financial institution partnerships |

SWOT Analysis Data Sources

This Bill.com SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and valuable insights from industry experts.