Bill.com Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

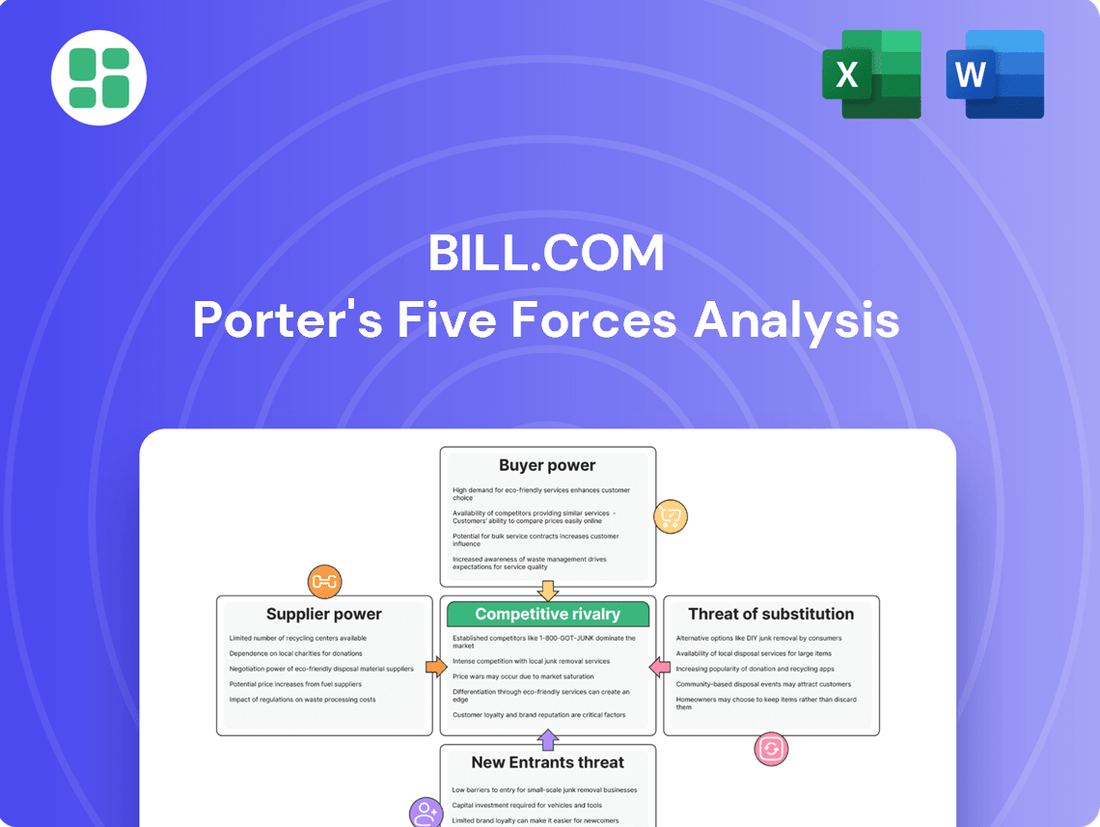

Bill.com operates in a dynamic market where buyer power is moderate due to readily available alternatives, while the threat of new entrants is tempered by high switching costs and established network effects. Understanding these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Bill.com’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in Bill.com's bargaining power. The company relies on a diverse set of technology and service providers, ranging from cloud infrastructure to payment networks and integration partners. When these suppliers are few in number or offer highly specialized, hard-to-replace services, their ability to dictate terms to Bill.com intensifies.

However, the landscape for Bill.com's suppliers is generally competitive. The widespread availability of major cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, and the existence of multiple payment networks limit the individual leverage any single provider can exert. This broad availability suggests that Bill.com can often find alternative suppliers if one attempts to increase prices or impose unfavorable terms.

Furthermore, Bill.com's strategic partnerships with leading U.S. financial institutions, accounting firms, and accounting software providers often create a dynamic of mutual dependency. These relationships are typically built on collaboration and shared benefits, rather than a situation where suppliers hold significant one-sided power. For instance, Bill.com's integration with popular accounting software like QuickBooks and Xero demonstrates a symbiotic relationship where both parties benefit from the connection.

The bargaining power of suppliers for Bill.com is influenced by the ease with which Bill.com can switch between its critical suppliers. If Bill.com faces significant hurdles in changing providers, such as the complex process of re-integrating payment gateways or transferring vast amounts of data to a new cloud infrastructure, its existing suppliers would hold more sway.

Bill.com's deep integrations with popular accounting software like QuickBooks and NetSuite can foster a degree of reliance on these platforms. However, the company also provides APIs, enabling custom integrations and offering some flexibility in managing these relationships.

If Bill.com's suppliers offer highly specialized or proprietary technology essential for its platform and difficult to replicate, their bargaining power increases. However, the cloud infrastructure and payment processing sectors often feature multiple capable providers, lessening the impact of uniqueness for many fundamental services.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Bill.com's core market can significantly amplify their bargaining power. If a key software provider, for instance, were to develop its own robust accounts payable and accounts receivable automation features, it would create direct competition for Bill.com.

This is a tangible concern within the financial automation sector. Major players like Intuit, the company behind QuickBooks, and Xero are actively expanding their service offerings, either by enhancing their existing functionalities or through strategic acquisitions. For example, Intuit's continued investment in QuickBooks Online and its associated ecosystem aims to capture more of the workflow automation needs of small and medium-sized businesses, potentially encroaching on Bill.com's territory.

- Supplier Forward Integration Risk: Suppliers developing competing AP/AR automation solutions directly challenges Bill.com's market position.

- Competitive Landscape: Intuit and Xero are key examples of upstream players enhancing their own automation capabilities, increasing this threat.

- Market Dynamics: The trend of software providers offering more integrated financial management tools underscores the potential for increased supplier bargaining power.

Importance of Volume to Suppliers

Bill.com's substantial payment processing volume significantly influences its suppliers' bargaining power. With hundreds of thousands of businesses utilizing its platform, Bill.com represents a critical revenue stream for its payment network and cloud infrastructure providers.

This reliance on Bill.com's business can diminish the suppliers' ability to dictate terms. For instance, the company processed an impressive $84 billion in total payment volume in the second quarter of fiscal year 2025. Such a large client is unlikely to risk disruption by imposing unfavorable conditions.

- High Transaction Volume: Bill.com handles a vast number of transactions, making it a key customer for its suppliers.

- Supplier Dependence: Suppliers are incentivized to maintain favorable terms to retain Bill.com as a major client.

- Reduced Supplier Leverage: The sheer scale of Bill.com's operations limits the individual bargaining power of its suppliers.

Bill.com's bargaining power with suppliers is moderate, influenced by the competitive nature of cloud infrastructure and payment processing. While Bill.com's significant transaction volume, reaching $84 billion in Q2 FY2025, makes it a valuable client, suppliers like Intuit and Xero are also expanding into automation, posing a forward integration risk.

| Factor | Impact on Bill.com | Key Considerations |

|---|---|---|

| Supplier Concentration | Low to Moderate | Multiple cloud providers (AWS, Azure) and payment networks limit individual supplier leverage. |

| Switching Costs | Moderate | Complex integrations and data migration can make switching costly, increasing supplier influence. |

| Supplier Forward Integration | Moderate to High | Companies like Intuit and Xero are enhancing their own automation features, creating potential competition. |

| Bill.com's Volume | Lowers Supplier Power | Bill.com's $84 billion Q2 FY2025 payment volume makes it a crucial client, reducing supplier leverage. |

What is included in the product

This analysis unpacks the competitive forces impacting Bill.com, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the B2B payments and financial operations software market.

Bill.com's Porter's Five Forces Analysis simplifies complex competitive landscapes, offering clear insights to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Bill.com's core customer base consists of small and midsize businesses (SMBs), a segment known for its keenness on cost-effective solutions. These businesses are often highly sensitive to pricing, actively seeking tools that offer clear value and demonstrable savings for their financial operations.

While Bill.com's automation promises long-term efficiency and cost reductions, the upfront subscription fees and per-transaction charges can be a significant consideration for budget-conscious SMBs. For instance, in 2024, many SMBs reported that while the platform's features were attractive, the cumulative cost of higher-tier plans or substantial transaction volumes could present a barrier, prompting a search for more budget-friendly alternatives.

The bargaining power of customers is significantly amplified by the sheer abundance of substitutes and alternatives available in the market. Competitors like Tipalti, AvidXchange, Stampli, and Melio offer similar accounts payable automation solutions. Even more broadly, generic accounting software such as QuickBooks provides basic functionalities that some businesses might leverage, reducing their reliance on specialized platforms.

This competitive environment empowers customers, as they can readily compare features, pricing structures, and integration capabilities across various providers before making a commitment. This ease of comparison puts pressure on Bill.com to consistently innovate and deliver compelling value propositions to retain its customer base.

Customer switching costs play a crucial role in shaping the bargaining power of customers for financial automation platforms like Bill.com. While these platforms are designed for efficiency, moving from one system to another presents tangible hurdles for small and medium-sized businesses (SMBs). These include the often-complex process of data migration, the necessity of re-training employees on a new interface, and the significant effort required to adapt existing workflows. These embedded costs can lock customers into Bill.com's ecosystem, reducing their inclination to switch even if they encounter minor issues, thereby diminishing their bargaining leverage.

Customer Concentration

Bill.com's customer base is exceptionally fragmented, serving nearly 500,000 small and medium-sized businesses (SMBs). This wide distribution means that no single customer, or even a small group of customers, wields substantial power over the company.

The lack of customer concentration significantly diminishes the bargaining power of individual clients. Bill.com's revenue is not disproportionately dependent on any one or a few clients, which insulates it from demands for lower prices or customized terms from specific customers.

- Customer Base Size: Nearly 500,000 SMBs.

- Impact of Fragmentation: Reduces individual customer leverage.

- Revenue Diversification: Bill.com is not reliant on a few large clients.

Customer's Ability to Integrate Backward

The bargaining power of customers, specifically their ability to integrate backward, is quite limited for Bill.com. Small and medium-sized businesses (SMBs), the primary customer base for Bill.com, generally do not possess the substantial resources or the specialized technical knowledge required to build their own advanced financial automation systems. This makes the threat of them developing a competing service themselves practically nonexistent.

While some SMBs might employ basic, less integrated software or rely on manual methods, they are typically unable to replicate the comprehensive, cloud-based functionalities that Bill.com provides. This inability to bring the service in-house significantly curtails their leverage to dictate terms by threatening self-production.

- Limited SMB Resources: The average SMB in 2024 often operates with leaner IT budgets and fewer in-house technical specialists compared to larger enterprises, hindering their capacity for complex software development.

- Complexity of Bill.com's Platform: Bill.com's offering involves sophisticated cloud infrastructure, data security protocols, and integrations with various financial institutions, making it a high barrier for SMBs to replicate.

- Negligible Threat of Self-Production: Consequently, the risk of customers choosing to develop their own financial automation solutions instead of using Bill.com is minimal, thus reducing their bargaining power.

The bargaining power of customers for Bill.com is moderate, primarily due to the fragmented nature of its nearly 500,000 small and medium-sized business (SMB) clients. This wide customer base means no single client has significant leverage to demand lower prices or customized terms.

While Bill.com's platform offers significant value, the availability of numerous competitors like Tipalti and AvidXchange, along with more basic accounting software, provides customers with viable alternatives. This creates pressure on Bill.com to maintain competitive pricing and demonstrate clear value, especially as many SMBs in 2024 remained highly cost-sensitive.

Switching costs, such as data migration and employee retraining, do offer some stickiness, somewhat mitigating customer power. However, the ease with which customers can compare offerings across providers means Bill.com must continually innovate to retain its market position.

Preview the Actual Deliverable

Bill.com Porter's Five Forces Analysis

This preview showcases the complete Bill.com Porter's Five Forces Analysis, providing a detailed examination of competitive forces within its industry. The document you are viewing is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring clarity and immediate usability for your strategic planning.

Rivalry Among Competitors

Bill.com operates within a crowded financial operations automation market, facing a wide array of competitors. These range from niche providers focusing on specific areas like accounts payable (AP) or accounts receivable (AR) to broader platforms offering comprehensive spend management. This means Bill.com is up against specialized solutions and larger, more integrated systems alike.

Key players vying for market share include Tipalti, AvidXchange, Stampli, MineralTree, Melio, and Routable, each offering distinct functionalities. Furthermore, established giants such as SAP Concur and Oracle NetSuite also present significant competition, especially for larger enterprises seeking all-encompassing financial suites. This sheer number and variety of competitors significantly escalates the rivalry for capturing and retaining customers.

The financial automation market, especially for small and medium-sized businesses (SMBs), is booming. In 2024, this sector is projected to see substantial expansion, fueled by the growing integration of AI and automation technologies designed to boost efficiency and precision in financial operations.

While robust market growth generally tempers intense competition by creating ample room for all participants, the swift pace of technological advancement and shifting customer expectations necessitate continuous adaptation and clear differentiation. Companies must actively innovate to secure their share of this expanding market.

Competitive rivalry within the accounts payable and receivable automation space is intensifying. While Bill.com offers a robust platform, rivals are actively differentiating by introducing features such as real-time payment processing, sophisticated AI-driven analytics, expanded global payment functionalities, and more profound integrations with other business software. This constant innovation forces Bill.com to continuously enhance its own offerings to maintain its market position.

Despite Bill.com's established integrations and extensive user network, some customers express concerns regarding workflow efficiency and cost scalability as their businesses grow. While the existing customer base benefits from high switching costs, which typically dampen rivalry, competitors are actively developing strategies to make it easier for businesses to transition away from incumbent solutions. This includes offering more competitive pricing and smoother onboarding processes, thereby chipping away at Bill.com's customer lock-in.

Strategic Partnerships and Ecosystem

Bill.com’s competitive rivalry is intensified by its reliance on strategic partnerships. The company has forged alliances with major accounting firms, financial institutions such as Bank of America, JPMorgan, and Wells Fargo, and accounting software providers including Xero and Intuit. These collaborations are crucial for expanding Bill.com's market presence and integrating its services into existing financial workflows.

These partnerships create powerful network effects, bolstering Bill.com's competitive standing. However, they also introduce a significant risk: partners might develop or acquire competing solutions. A prime example is Xero's acquisition of Melio, which directly challenges Bill.com’s offerings in the accounts payable and receivable automation space.

- Key Partners: Major accounting firms, Bank of America, JPMorgan, Wells Fargo, Xero, Intuit.

- Partnership Benefits: Expanded reach, service integration, network effects.

- Competitive Risk: Partners developing or acquiring competing solutions (e.g., Xero acquiring Melio).

Market Concentration and Acquisitions

The competitive rivalry in the AP/AR automation space is intensifying as the market experiences significant consolidation. This dynamic is driven by larger accounting software and ERP providers actively acquiring or integrating capabilities that directly challenge standalone platforms. For instance, Xero's acquisition of Melio in 2024 underscores this trend, bringing enhanced AP/AR automation directly into a major accounting ecosystem. This integration creates a more bundled offering, potentially drawing users away from solutions that don't offer a similar all-in-one experience.

While Bill.com has also pursued strategic acquisitions, such as its purchase of Finmark, to bolster its product suite, the overall landscape is shifting. The increasing prevalence of bundled solutions means that Bill.com faces pressure not just from other dedicated AP/AR automation providers but also from established players embedding these functionalities. This strategic move by competitors aims to capture more of the workflow, making it harder for specialized, unbundled solutions to compete on convenience and integration alone.

- Market Consolidation: The accounting software and ERP market is seeing a surge in mergers and acquisitions, with larger players absorbing specialized fintech solutions.

- Strategic Acquisitions: Xero's acquisition of Melio in 2024 is a prime example, integrating advanced AP/AR automation into a broader accounting platform.

- Bundled Solutions: Competitors are increasingly offering integrated AP/AR automation as part of their core accounting or ERP services, creating a more comprehensive user experience.

- Bill.com's Response: Bill.com has also engaged in acquisitions, like Finmark, to enhance its own offerings and remain competitive in this evolving market.

Competitive rivalry for Bill.com is fierce, with numerous players offering similar AP/AR automation solutions. This intense competition is further amplified by market consolidation, where larger entities are acquiring specialized capabilities. For instance, Xero's 2024 acquisition of Melio highlights the trend of integrated offerings, presenting a significant challenge to standalone platforms like Bill.com.

Bill.com must continually innovate and leverage its strategic partnerships, which include major banks and accounting software providers, to maintain its market position. However, these very partnerships carry the risk of partners developing or acquiring competing technologies, as seen with Xero and Melio.

The market is seeing a rise in bundled solutions that integrate AP/AR automation into broader financial suites. This forces Bill.com to not only compete with direct rivals but also with larger, more comprehensive platforms that offer convenience and seamless integration, making differentiation and customer retention critical.

| Competitor | Key Offerings | Differentiation Strategy |

|---|---|---|

| Tipalti | Global AP automation, mass payments | Focus on large enterprises, global compliance |

| AvidXchange | AP and payment automation for mid-market | Industry-specific solutions, end-to-end automation |

| Stample | AP automation with AI and workflow | Emphasis on AI for invoice processing, workflow customization |

| Melio (Acquired by Xero) | AP and payments for small businesses | Seamless integration with accounting software, user-friendly interface |

| SAP Concur | Spend management, travel and expense | Integrated suite for large enterprises, global reach |

SSubstitutes Threaten

Manual processes and traditional methods like spreadsheets and paper-based systems remain a basic substitute for businesses, especially very small ones with low transaction volumes. While Bill.com offers automation, the inherent option to continue with these less efficient methods persists. However, the demonstrable gains in efficiency, accuracy, and cost savings offered by platforms like Bill.com significantly diminish the attractiveness of these manual substitutes for most growing businesses.

Generic accounting software like QuickBooks, Zoho Books, and FreshBooks presents a viable threat of substitutes for Bill.com. These platforms often include basic invoicing and payment tracking, capabilities that can fulfill the needs of smaller businesses or those not yet requiring advanced financial automation. For instance, QuickBooks Online had over 3.4 million subscribers as of early 2024, demonstrating its widespread adoption for core accounting tasks.

For larger small and medium-sized businesses (SMBs) or those with very particular, intricate requirements, building their own financial management systems in-house can present a substitute threat. This approach grants them complete control over customization and functionality.

However, the significant upfront investment in development, coupled with the continuous expenses for maintenance and the inherent limitations in scaling these custom solutions, often render them less appealing than a comprehensive, cloud-based platform like Bill.com. This is particularly true when considering the swift evolution of financial automation technology.

For instance, while a custom-built solution might offer niche features, the average cost to develop and maintain enterprise-level financial software can easily run into hundreds of thousands, if not millions, of dollars annually, a substantial barrier for many businesses compared to Bill.com's subscription model.

Direct Bank Payment Services

Banks provide direct payment services like wire transfers and ACH, acting as a substitute for certain functionalities offered by Bill.com. These bank-native options are suitable for straightforward payments but often miss the sophisticated invoice management, automated approval processes, and seamless reconciliation that Bill.com integrates for comprehensive financial operations.

While banks offer basic payment rails, they typically lack the specialized features that businesses need to manage their entire accounts payable and receivable lifecycle efficiently. For instance, in 2024, many small to medium-sized businesses still rely on manual processes for bill payment, highlighting a gap that specialized platforms like Bill.com fill.

- Bank Payment Services: Wire transfers, ACH, and online bill pay are direct alternatives for moving funds.

- Feature Gap: These services often lack integrated invoice tracking, multi-level approval workflows, and automated reconciliation.

- Business Needs: Companies require end-to-end financial process automation beyond simple fund transfers.

Outsourced Financial Services

The threat of substitutes for outsourced financial services is significant, as businesses can opt to handle accounts payable and receivable functions internally or through specialized accounting firms and Business Process Outsourcing (BPO) providers. These alternatives offer a different approach to financial management.

These substitute services often involve manual processing or the use of proprietary internal systems, which can be less efficient than a dedicated platform like Bill.com. For example, a 2024 survey indicated that 35% of small businesses still rely heavily on manual invoice processing, highlighting a direct substitute behavior.

- Manual Processing: Many businesses still manage AP/AR manually, a direct substitute for automated platforms.

- Accounting Firms/BPO: Outsourcing to traditional firms or BPO providers offers an alternative to in-house software solutions.

- Cost vs. Control: While substitutes can offload tasks, they may incur higher costs and reduce real-time visibility compared to integrated platforms.

- Market Share: The BPO market for finance and accounting services was valued at over $50 billion globally in 2023, demonstrating the scale of these substitutes.

The threat of substitutes for Bill.com is multifaceted, ranging from basic manual methods to more sophisticated accounting software and even in-house solutions. While manual processes remain an option, their inefficiency makes them less attractive for growing businesses. Generic accounting software, widely adopted by small businesses, offers core functionalities that can serve as substitutes for certain Bill.com features.

For instance, QuickBooks Online, with over 3.4 million subscribers in early 2024, demonstrates the significant market penetration of these alternative platforms. Furthermore, businesses with highly specific needs might consider custom-built systems, though the substantial costs and maintenance challenges often make this impractical compared to cloud-based solutions.

| Substitute Type | Description | Key Considerations | Example/Data Point (2024) |

|---|---|---|---|

| Manual Processes | Spreadsheets, paper-based systems | Low efficiency, prone to errors, suitable for very small businesses | 35% of small businesses still rely heavily on manual invoice processing. |

| Generic Accounting Software | QuickBooks, Zoho Books, FreshBooks | Core accounting features, widely adopted, varying levels of automation | QuickBooks Online had over 3.4 million subscribers in early 2024. |

| Custom-Built Systems | In-house developed financial management software | High customization, significant upfront and ongoing costs, scalability challenges | Annual costs for enterprise-level custom financial software can range from hundreds of thousands to millions of dollars. |

| Bank Payment Services | Wire transfers, ACH, online bill pay | Basic fund transfer, lack integrated AP/AR lifecycle management | Many SMBs still use manual processes for bill payment, indicating a gap filled by specialized platforms. |

| Outsourced Financial Services | Accounting firms, BPO providers | Task delegation, potential for higher costs and less real-time visibility | The BPO market for finance and accounting services was valued at over $50 billion globally in 2023. |

Entrants Threaten

Entering the financial operations automation market demands substantial capital. Companies need to invest heavily in developing sophisticated platforms, robust security, and ensuring compliance with financial regulations. For instance, Bill.com itself has made considerable investments in technology and strategic acquisitions to build its scalable cloud-based infrastructure, a clear indicator of the financial commitment required.

The financial services sector, including payment processing and data security, is intensely regulated. Newcomers must surmount significant compliance challenges, secure licenses, and build trust concerning sensitive financial information, areas where Bill.com has a long-standing advantage.

Bill.com has cultivated significant brand loyalty and a robust network of millions of users, encompassing small and medium-sized businesses (SMBs), suppliers, and accounting firms. This extensive reach is a formidable barrier to entry.

The platform benefits from powerful network effects; as more users join, the platform's value grows, making it increasingly difficult for new competitors to attract and retain customers. This established ecosystem and the inherent trust it fosters create a significant hurdle for any potential new entrants.

Technological Complexity and AI Integration

The threat of new entrants in the financial automation space, particularly concerning technological complexity and AI integration, is moderately high. Developing a platform comparable to Bill.com requires substantial upfront investment in research and development to achieve comparable feature sets, including AI-driven automation and secure integrations with diverse accounting software. For instance, the global AI in fintech market was valued at USD 10.7 billion in 2023 and is projected to grow significantly, indicating the high stakes and investment required for new players to compete effectively.

New entrants must not only replicate existing functionalities but also innovate with cutting-edge technologies. The increasing reliance on AI for tasks like fraud detection, predictive analytics, and personalized financial advice means that platforms lacking advanced AI capabilities will struggle to gain traction. Companies entering this market need to demonstrate a clear technological advantage, often requiring specialized talent and significant capital to develop and maintain these sophisticated systems.

- Significant R&D Investment: New entrants must allocate substantial resources to R&D to match the technological sophistication of established players like Bill.com.

- AI Integration is Crucial: The ability to offer AI-driven automation is no longer a differentiator but a necessity for efficiency and competitive advantage in financial services.

- High Barrier to Entry: The technical expertise and capital required to develop and deploy advanced financial automation platforms create a considerable barrier for potential new entrants.

- Security and Integration Demands: Meeting stringent security standards and ensuring seamless integration with a wide array of accounting systems adds further complexity and cost for newcomers.

Access to Distribution Channels and Partnerships

Bill.com's advantage lies in its deeply entrenched partnerships with banks and accounting firms. These alliances act as vital conduits for reaching small and medium-sized businesses (SMBs), driving customer acquisition and referrals. For instance, in 2024, a significant portion of Bill.com's new customer growth was attributed to these strategic relationships.

Newcomers face a substantial hurdle in replicating these established networks. Building comparable trust and integration with financial institutions and accounting professionals takes considerable time and investment, thereby restricting their ability to efficiently access the target SMB market and hindering their initial growth trajectory.

- Established Partnerships: Bill.com leverages existing relationships with financial institutions and accounting firms as key distribution channels.

- Referral Networks: These partnerships provide a consistent stream of referrals, boosting customer acquisition.

- Barriers to Entry: New entrants find it difficult to quickly establish similar deep-rooted relationships, limiting their market access.

- Slower Adoption: The inability to replicate these channels impedes new entrants' ability to gain traction and achieve rapid adoption rates within the SMB segment.

The threat of new entrants for Bill.com is moderate due to high capital requirements and regulatory hurdles. Developing a robust, secure, and compliant financial automation platform demands significant investment in technology and talent. For instance, the global fintech market continues to see substantial venture capital funding, with billions invested annually, underscoring the capital intensity required to compete.

Established brand loyalty and network effects also present a considerable barrier. Bill.com's extensive user base and integrated ecosystem, where more users increase the platform's value, make it difficult for newcomers to gain traction. Building trust and replicating these network effects takes considerable time and resources, further deterring potential entrants.

Furthermore, Bill.com's deep-rooted partnerships with banks and accounting firms act as a critical distribution channel, driving customer acquisition through referrals. New entrants struggle to quickly establish similar trusted relationships, limiting their market access and growth potential.

| Factor | Bill.com's Position | Impact on New Entrants |

| Capital Requirements | High (Platform Development, Security) | Significant barrier; requires substantial upfront investment. |

| Regulatory Compliance | Established and Robust | Demands significant expertise and resources to navigate. |

| Brand Loyalty & Network Effects | Strong, Millions of Users | Difficult for new players to replicate; creates customer stickiness. |

| Partnerships & Referrals | Deeply Entrenched (Banks, Accountants) | Provides a competitive advantage in customer acquisition. |

Porter's Five Forces Analysis Data Sources

Our Bill.com Porter's Five Forces analysis is built upon a foundation of credible data, including financial reports from publicly traded companies, industry-specific market research reports, and government economic data. This comprehensive approach allows us to accurately assess competitive pressures within the accounts payable and receivable automation sector.