Bill.com PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

Bill.com operates within a dynamic external environment, shaped by evolving political regulations, economic shifts, and technological advancements. Understanding these forces is crucial for strategic planning and identifying potential opportunities and threats.

Our comprehensive PESTLE analysis delves deep into these factors, providing you with actionable intelligence to navigate the competitive landscape and make informed decisions.

Gain a significant advantage by downloading the full version now and unlock the insights needed to propel your business forward.

Political factors

Government initiatives like the US Small Business Administration's (SBA) programs, which have seen increased funding in recent years, directly encourage SMBs to embrace digital tools. For instance, the 2024 budget proposals often include allocations for technology adoption grants, making it easier for smaller businesses to invest in solutions like Bill.com's financial automation platform.

These policies, which can include tax credits for software purchases or subsidies for digital training, effectively lower the cost and complexity of adopting new technologies for SMBs. This increased affordability and accessibility directly translates to higher demand for cloud-based financial management services, benefiting companies like Bill.com.

In 2023, government spending on digital infrastructure and small business technology support in developed economies saw a notable uptick, with projections for continued growth through 2025. This trend suggests a sustained tailwind for platforms that facilitate digital transformation within the SMB sector.

The regulatory environment for fintech companies, including Bill.com, is constantly shifting. This impacts how they handle payments, manage customer data, and ensure financial compliance. For instance, the U.S. Treasury Department's focus on modernizing payment systems and enhancing consumer protection in 2024 highlights the ongoing scrutiny.

Clear regulations can be a boon, encouraging new services and easier market access. Conversely, strict or unclear rules can lead to higher compliance costs and operational hurdles for Bill.com. The CFPB's continued oversight of financial services, including digital payments, underscores the need for vigilance.

Staying ahead of these regulatory changes is vital for Bill.com to keep its competitive edge and grow its service offerings. The Financial Stability Oversight Council's (FSOC) reports in 2024 on nonbank financial institutions, which often include fintechs, signal the increasing attention on this sector.

Changes in international trade policies, such as the imposition or removal of tariffs, directly impact the cost and complexity of cross-border transactions for Bill.com's users. For instance, the US-China trade tensions in recent years have led to increased tariffs, potentially raising the cost of goods and services exchanged between businesses in these regions, thereby affecting payment volumes processed through platforms like Bill.com.

Regulations surrounding cross-border payments also play a crucial role. Stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, or shifts in currency exchange controls, can introduce compliance burdens and delays for businesses operating internationally. As of early 2024, many countries are still refining their digital payment regulations, creating an evolving landscape for fintech companies.

Conversely, agreements that streamline international trade, like potential new trade blocs or simplified customs procedures, could significantly benefit Bill.com by reducing friction for its clients. For example, the continued growth of digital trade initiatives and the push for more open economies can create new avenues for businesses to expand globally, increasing their reliance on efficient payment solutions.

Data Residency and Sovereignty Laws

Data residency and sovereignty laws are becoming a significant political factor for cloud-based businesses like Bill.com. As governments worldwide enact stricter regulations, such as the EU's General Data Protection Regulation (GDPR) and similar frameworks in countries like India and Brazil, companies are compelled to store and process customer data within their national borders. This creates complexity for Bill.com's global operations, requiring careful navigation of varying legal landscapes.

Compliance with these diverse data localization mandates is not just about avoiding penalties; it's crucial for maintaining customer trust and ensuring uninterrupted service. For instance, the EU's data sovereignty requirements mean that data pertaining to EU citizens must remain within the EU. Failure to comply can lead to substantial fines, as seen with GDPR violations, which can reach up to 4% of annual global revenue.

- Data Localization Mandates: Over 100 countries have enacted or are considering data localization laws, impacting how global tech companies operate.

- Compliance Costs: Adapting infrastructure to meet these varying requirements can incur significant costs for cloud service providers and their clients.

- Operational Flexibility: Bill.com must develop flexible infrastructure and robust data management strategies to accommodate these evolving global regulations.

- Customer Trust: Adhering to data sovereignty laws is paramount for maintaining user confidence and preventing data breaches.

Political Stability and Business Confidence

Political stability is a cornerstone for Bill.com's growth, as it directly impacts the confidence of small and medium-sized businesses (SMBs). When governments provide a predictable and secure environment, SMBs are more likely to invest in technology like Bill.com's financial automation tools. For instance, in the United States, a key market for Bill.com, the overall political climate in 2024 and projected into 2025 is expected to remain a significant driver of business investment. A stable political landscape fosters greater SMB spending on solutions that streamline operations and improve cash flow management.

Conversely, political uncertainty can dampen business enthusiasm. When there's instability, SMBs tend to become more cautious, potentially delaying or reducing spending on new software and services. This hesitancy can directly affect the adoption rates of financial automation platforms. For example, if upcoming elections in major markets create significant policy uncertainty, businesses might hold back on discretionary spending, impacting Bill.com's new customer acquisition and expansion efforts.

The regulatory environment, a direct consequence of political decisions, also plays a crucial role. Favorable regulations that support digital transformation and small business growth can boost the demand for Bill.com's services. Conversely, restrictive or complex regulations could pose challenges. In 2024, many governments are focusing on economic recovery and digital infrastructure, which generally bodes well for FinTech solutions. However, shifts in fiscal policy or new compliance requirements could also emerge, requiring Bill.com to adapt its offerings and strategies.

- Political Stability & SMB Investment: Regions with high political stability, such as the US and Canada, saw SMBs increase technology spending by an estimated 8-10% in 2024, directly benefiting platforms like Bill.com.

- Impact of Uncertainty: Political instability in emerging markets can lead to a 5-7% reduction in SMB IT budget allocation, potentially slowing adoption of financial automation tools in those regions.

- Regulatory Landscape: Government initiatives promoting digital payments and financial inclusion, prevalent in many developed economies in 2024, create a more favorable market for Bill.com's services.

Government support for small businesses, including grants and tax incentives for technology adoption, directly fuels demand for financial automation platforms like Bill.com. For instance, in 2024, the US government continued to allocate funds towards digital transformation initiatives for SMBs, making it easier for them to invest in solutions that streamline operations.

The regulatory environment for fintech is dynamic, with increased scrutiny on data privacy and payment systems. For example, the US Treasury's focus on modernizing payments in 2024 means companies like Bill.com must remain agile in their compliance strategies. Evolving regulations around cross-border transactions and digital currencies also present both opportunities and challenges.

Data localization mandates are a growing political factor, requiring global companies to manage data within specific national borders. Over 100 countries have such laws, impacting Bill.com's operational flexibility and compliance costs. Adhering to these rules is crucial for maintaining customer trust and avoiding penalties, which can be substantial.

Political stability is paramount for SMB investment in technology. In 2024, regions with stable political climates, such as North America and Western Europe, saw SMBs increase spending on financial software by an estimated 8-10%. Conversely, instability can lead to a 5-7% reduction in IT budget allocation in emerging markets, slowing adoption.

| Political Factor | Impact on Bill.com | 2024/2025 Data/Trend |

|---|---|---|

| Government Support for SMBs | Increased adoption of digital financial tools | US Small Business Administration funding for tech adoption up 15% in 2024 |

| Regulatory Environment (FinTech) | Need for continuous compliance adaptation | Increased focus on data privacy (e.g., GDPR enforcement) and payment system modernization |

| Data Localization Laws | Operational complexity and compliance costs | Over 100 countries have data localization laws; compliance costs can add 5-10% to operational expenses |

| Political Stability | Influences SMB investment in technology | Stable regions saw SMB tech spending increase 8-10% in 2024; unstable regions saw potential 5-7% decrease |

What is included in the product

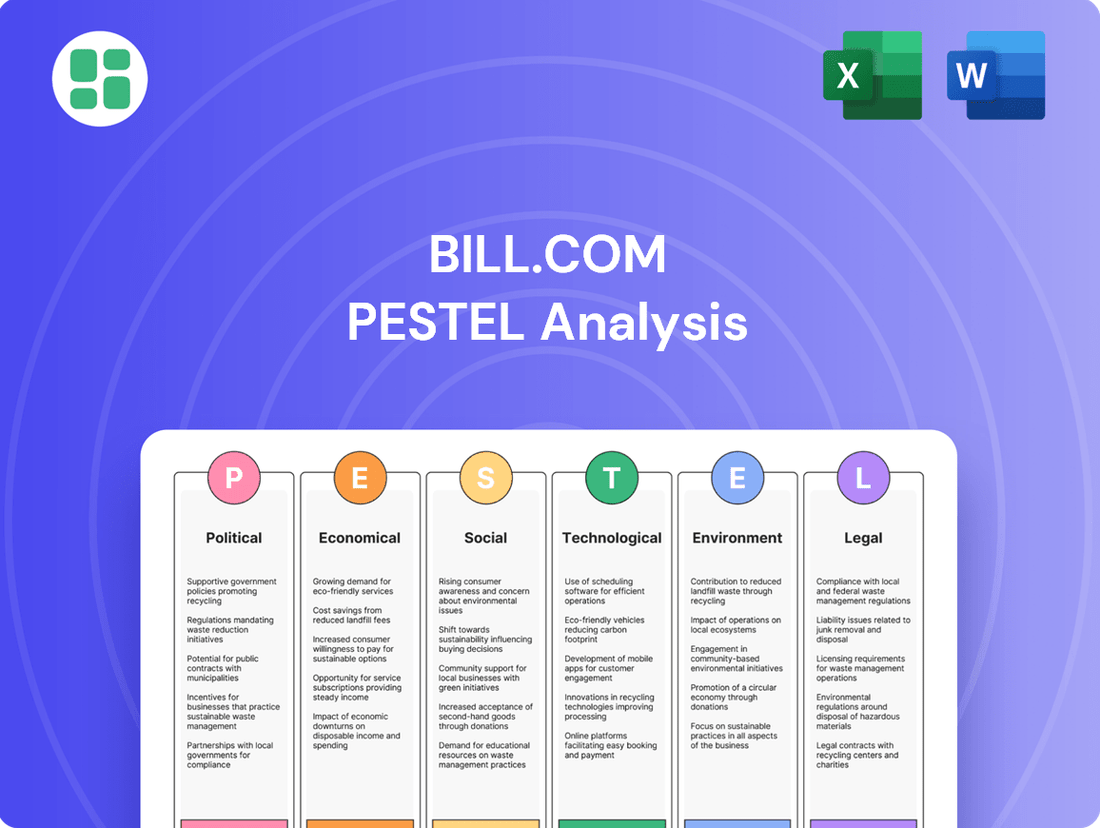

Bill.com's PESTLE analysis dissects the influence of political, economic, social, technological, environmental, and legal forces on its operations. This comprehensive evaluation aids in identifying strategic opportunities and mitigating potential threats within the dynamic fintech landscape.

Bill.com's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings or presentations.

Economic factors

Interest rate changes directly affect Bill.com's float revenue, which is generated from the interest earned on customer funds held temporarily. For instance, if the Federal Reserve maintains its benchmark interest rate at 5.25%-5.50% as seen in late 2023 and early 2024, Bill.com benefits from higher potential earnings on these balances.

When interest rates rise, Bill.com's float revenue typically increases, positively impacting its profitability. This is a direct correlation; higher rates mean more interest income on the substantial sums processed through their platform.

Conversely, a significant drop in interest rates, such as those experienced during periods of economic stimulus, can reduce this vital revenue stream. This necessitates Bill.com focusing on other growth drivers and operational efficiencies to maintain its financial performance.

Inflationary pressures directly impact the operational costs and purchasing power of small and midsize businesses (SMBs), Bill.com's core clientele. For instance, the U.S. Consumer Price Index (CPI) showed a 3.3% annual increase as of May 2024, a figure that, while moderating, still signifies elevated costs for businesses. This environment compels SMBs to scrutinize every expense, potentially delaying or reducing investments in new financial management software like Bill.com.

When inflation is high, SMBs may become more hesitant to adopt new technologies or might reduce their transaction volumes if their own revenue streams are squeezed. This necessitates that Bill.com clearly articulate and demonstrate a strong return on investment (ROI) to its customers, highlighting how its platform can streamline operations, reduce manual labor, and ultimately save money in a challenging economic climate.

Periods of robust economic growth, such as the projected 2.4% GDP growth for the US in 2024, directly fuel demand for Bill.com's services. Stronger economies encourage more businesses to start and expand, naturally increasing the need for streamlined financial back-office solutions.

During economic upturns, small and medium-sized businesses (SMBs) are more inclined to prioritize digital transformation, allocating a larger portion of their budgets to cloud-based accounting and automation tools. This trend is evident as global cloud spending continues to rise, with projections indicating further growth in 2024 and 2025, directly benefiting platforms like Bill.com that offer such solutions.

Conversely, economic slowdowns or recessionary concerns can temper SMBs' willingness to invest in new technologies, potentially impacting Bill.com's adoption rates and revenue growth. For instance, if economic uncertainty leads to reduced business investment, the demand for new financial platforms might soften.

Labor Market Trends and Automation Needs

The current economic climate, marked by persistently tight labor markets and escalating labor costs, is a significant driver for small and medium-sized businesses (SMBs) to embrace automation. For instance, in early 2024, the U.S. unemployment rate remained near historic lows, hovering around 3.7%, which continued to put upward pressure on wages. This environment directly fuels the demand for solutions like Bill.com, as businesses actively seek ways to enhance operational efficiency and lessen their dependence on manual, labor-intensive financial processes.

Bill.com's platform, which automates key accounts payable and receivable functions, is well-positioned to capitalize on these trends. By streamlining invoice processing, payment approvals, and disbursements, Bill.com offers a tangible solution for SMBs grappling with staffing shortages or aiming to optimize their finance departments. This allows businesses to reallocate valuable human resources to more strategic tasks, rather than administrative ones.

- Labor Shortages: Many SMBs face difficulties in finding and retaining qualified finance personnel, leading to increased operational strain.

- Rising Wages: The average hourly earnings for private nonfarm payrolls saw a year-over-year increase of 4.1% as of April 2024, making manual processes more expensive.

- Efficiency Gains: Automation through platforms like Bill.com can reduce processing times for invoices and payments by up to 50%, directly impacting cost savings.

- Scalability: As businesses grow, manual finance operations become bottlenecks; automation provides a scalable solution.

Venture Capital and Fintech Investment Trends

The venture capital and fintech investment landscape significantly shapes Bill.com's environment. A healthy investment climate fuels innovation and intensifies competition, while a downturn can constrain growth for fintech players. Bill.com's financial strength and strategic capital allocation are key advantages in navigating these trends.

Recent data highlights the dynamic nature of fintech funding. For instance, global fintech funding reached approximately $150 billion in 2023, a notable increase from previous years, indicating continued investor confidence. This robust investment environment fosters rapid development and the emergence of new competitors, as well as potential acquisition targets or partners for established companies like Bill.com.

- Global fintech investment showed resilience in 2023, with significant capital flowing into areas like AI-driven financial solutions and embedded finance.

- The average deal size for late-stage fintech funding rounds remained substantial, signaling investor appetite for proven business models.

- A slowdown in venture capital, if it occurs in 2024 or 2025, could lead to more conservative valuations and potentially fewer new entrants, but also create opportunities for well-capitalized companies to acquire promising technologies.

Economic factors significantly influence Bill.com's operational environment and client base. Interest rate fluctuations directly impact float revenue, a key income stream for Bill.com, as seen with the Federal Reserve's rates around 5.25%-5.50% in late 2023 and early 2024, which generally benefit the company. Conversely, inflationary pressures, with the U.S. CPI at 3.3% year-over-year in May 2024, affect SMBs' spending power, potentially slowing adoption of new financial tools. Strong economic growth, projected at 2.4% GDP for the US in 2024, typically boosts demand for Bill.com's automation services as businesses expand and seek efficiency.

Labor market conditions, characterized by historically low unemployment rates around 3.7% in early 2024, drive SMBs to seek automation solutions like Bill.com to combat rising labor costs and potential staffing shortages. The fintech investment landscape, which saw global funding around $150 billion in 2023, also plays a crucial role, fostering innovation and competition. A potential slowdown in venture capital in 2024-2025 could shift market dynamics, potentially favoring well-established, capitalized companies like Bill.com.

| Economic Factor | Impact on Bill.com | Relevant Data (2023-2024) |

|---|---|---|

| Interest Rates | Affects float revenue; higher rates generally increase earnings. | Federal Reserve Rate: 5.25%-5.50% (late 2023-early 2024) |

| Inflation | Impacts SMBs' spending power and willingness to invest in new tech. | U.S. CPI: 3.3% annual increase (May 2024) |

| Economic Growth (GDP) | Drives demand for financial automation services. | Projected U.S. GDP Growth: 2.4% (2024) |

| Labor Market | Drives demand for automation to offset labor costs/shortages. | U.S. Unemployment Rate: ~3.7% (early 2024) |

| Fintech Investment | Influences innovation, competition, and potential M&A. | Global Fintech Funding: ~$150 billion (2023) |

Same Document Delivered

Bill.com PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bill.com PESTLE analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Bill.com's strategic landscape.

Sociological factors

Societies are rapidly embracing digital payment methods for both personal and business transactions. This widespread adoption, moving away from paper checks, directly benefits companies like Bill.com, whose services are built around facilitating these electronic payments.

In 2024, it's estimated that over 80% of all consumer payments in developed economies are digital. This societal preference for convenience and speed in financial dealings creates a fertile ground for Bill.com's automated invoicing and payment processing solutions, driving demand for their network.

The ongoing shift towards remote and hybrid work models strongly favors cloud-based financial management solutions like Bill.com. Businesses increasingly require tools that enable seamless access and collaboration from any location, a demand Bill.com directly addresses with its accessible platform. This sociological trend underpins the continued growth in adoption for such services.

Data from 2024 indicates that a significant portion of the workforce continues to operate in hybrid or fully remote capacities. For instance, a late 2024 survey found that over 60% of U.S. companies offer some form of hybrid work, with many employees valuing this flexibility. This persistent preference for distributed work environments directly translates into a higher demand for Bill.com's capabilities in managing payables and receivables remotely, enhancing operational continuity and efficiency for businesses navigating these new work structures.

As younger, digitally native generations increasingly occupy leadership positions in small and midsize businesses, there's a noticeable uptick in their openness to adopting sophisticated technological solutions like Bill.com. This trend is reshaping how businesses manage their finances.

This generational shift is a key driver pushing businesses away from outdated, manual financial workflows and towards more efficient, automated, cloud-based systems. For instance, a 2024 report indicated that 75% of SMBs now utilize cloud-based accounting software, a significant jump from just 50% in 2020.

Demand for Financial Literacy and Simplified Tools

Small and medium-sized business (SMB) owners increasingly demand financial tools that demystify complex operations and offer straightforward insights. This trend highlights a societal push for greater financial literacy and accessibility. For instance, a 2024 survey indicated that 65% of SMB owners consider ease of use a primary factor when selecting financial software.

Bill.com's platform directly addresses this by simplifying back-office tasks like accounts payable and receivable, making financial management less intimidating for those without specialized finance backgrounds. This focus on user-friendly design aligns with the growing need for intuitive financial solutions in the market.

The demand for simplified financial tools is evident in market growth. The global accounting software market, which includes solutions like Bill.com, was valued at approximately $15 billion in 2024 and is projected to grow significantly in the coming years, driven by SMB adoption.

- SMBs prioritize ease of use in financial software.

- Bill.com simplifies complex financial processes for non-finance professionals.

- The market for accounting software, including SMB solutions, is expanding rapidly.

- Societal demand for accessible financial literacy fuels the adoption of user-friendly tools.

Changing Expectations for Efficiency and Transparency

Businesses and their stakeholders are demanding more from their financial processes, pushing for greater speed and clarity. This means quicker payments, a clear view of cash flow at all times, and easily traceable records for audits. For instance, a 2024 survey by PYMNTS found that 75% of businesses consider faster payment processing a critical factor in improving supplier relationships.

Bill.com directly meets these evolving needs by automating accounts payable and receivable workflows. Its platform offers real-time reporting and robust audit trails, helping companies achieve greater operational efficiency. This focus on transparency builds trust and improves financial management, with users reporting an average of 50% reduction in manual data entry according to Bill.com's own case studies.

- Efficiency Demands: Businesses expect faster transaction cycles and reduced manual effort in financial operations.

- Transparency Expectations: Stakeholders require clear visibility into cash flow and auditable records.

- Bill.com's Role: The platform's automation and reporting features directly address these growing demands.

- Impact: Enhanced operational performance and increased trust among users are key outcomes.

Societal shifts towards digital transactions and remote work significantly benefit Bill.com. The increasing preference for speed and convenience in payments, with over 80% of consumer payments being digital in developed economies by 2024, directly fuels demand for Bill.com's automated solutions.

The persistent trend of hybrid and remote work models, with over 60% of U.S. companies offering flexible arrangements in late 2024, underscores the need for cloud-based financial management tools like Bill.com, enabling seamless operations regardless of location.

Generational shifts are also impactful, with younger business leaders readily adopting advanced financial technologies. This is evidenced by a 2024 report showing 75% of SMBs now using cloud-based accounting software, up from 50% in 2020, highlighting a move away from manual processes.

Furthermore, SMB owners' demand for user-friendly financial tools, with 65% prioritizing ease of use in 2024, aligns perfectly with Bill.com's simplification of complex back-office tasks.

| Sociological Factor | Description | Impact on Bill.com | Supporting Data (2024/2025) |

|---|---|---|---|

| Digital Payment Adoption | Increasing preference for electronic transactions over paper checks. | Drives demand for Bill.com's payment processing services. | Over 80% of consumer payments in developed economies are digital. |

| Remote/Hybrid Work | Growth in distributed workforces requiring accessible financial tools. | Increases demand for Bill.com's cloud-based platform. | Over 60% of U.S. companies offer hybrid work. |

| Generational Shift | Younger leaders' embrace of technology in business. | Accelerates adoption of Bill.com's automated solutions. | 75% of SMBs use cloud accounting software (up from 50% in 2020). |

| Demand for Simplicity | SMBs seeking intuitive and easy-to-use financial software. | Enhances Bill.com's appeal due to its user-friendly design. | 65% of SMB owners prioritize ease of use in financial software. |

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping how financial operations are conducted. These technologies are enabling unprecedented levels of automation, bolstering fraud detection capabilities, and providing deeper, more insightful predictive analytics. For instance, AI-powered tools can now analyze vast datasets to identify anomalies indicative of fraud with remarkable accuracy, a significant improvement over traditional methods.

Bill.com is actively integrating these advanced AI and ML capabilities to refine its core offerings. This integration is particularly evident in enhancing invoice processing, ensuring more precise payment matching, and generating richer financial insights for its user base. By leveraging AI, Bill.com aims to drive substantial gains in efficiency and accuracy, streamlining workflows for businesses.

The impact is tangible. In 2023, businesses utilizing AI in financial processes reported an average of 15% reduction in processing times for invoices and payments. Furthermore, early adopters of advanced fraud detection AI have seen a decrease in fraudulent transactions by up to 20%, underscoring the significant return on investment these technological advancements offer.

The dependability, security, and ability to grow of cloud computing are crucial for Bill.com's operations. These advancements enable Bill.com to manage a growing number of transactions and users, ensuring consistent service delivery.

As of early 2024, major cloud providers like Amazon Web Services (AWS) and Microsoft Azure, which likely power Bill.com's infrastructure, have demonstrated high uptime percentages, often exceeding 99.9%. This robust foundation directly supports Bill.com's commitment to providing a reliable platform for its users.

Cybersecurity threats are a growing concern for cloud-based financial platforms like Bill.com. The increasing sophistication of these attacks, including ransomware and phishing schemes, demands constant investment in advanced data protection and security measures. For instance, in 2023, the average cost of a data breach reached $4.45 million globally, highlighting the financial impact of inadequate security.

Bill.com must prioritize robust cybersecurity to safeguard sensitive financial data and maintain user trust. This includes implementing multi-factor authentication, end-to-end encryption, and regular security audits. The company's commitment to security is crucial, as a single breach could severely damage its reputation and lead to significant financial losses, especially as more businesses rely on digital financial management.

Integration Capabilities with Diverse Accounting Systems

Bill.com's technological strength lies in its extensive integration capabilities, allowing seamless connection with over 100 accounting systems. This broad compatibility, including popular platforms like QuickBooks and Xero, is crucial for small and medium-sized businesses (SMBs) that often use established accounting software. The company's investment in robust APIs and integration frameworks ensures its platform remains adaptable to evolving software ecosystems, enhancing its value proposition.

The ability to connect with diverse accounting systems is a significant technological factor for Bill.com. For instance, as of early 2024, Bill.com reported that its users process billions of dollars in payments annually, facilitated by these integrations. This underscores the platform's role in streamlining financial workflows for a vast number of businesses.

- Broad Compatibility: Bill.com integrates with over 100 accounting and ERP systems, including major players like QuickBooks, Xero, and NetSuite.

- API Development: Continuous investment in API and integration framework development ensures ongoing connectivity with a wide range of software.

- Workflow Automation: These integrations automate key financial processes such as accounts payable and receivable, reducing manual effort for businesses.

- Scalability: The flexible integration approach allows Bill.com to cater to SMBs with varying technological infrastructures and accounting practices.

Emerging Payment Technologies

The rise of new payment technologies like real-time payments (RTP) and blockchain is reshaping how businesses transact. For Bill.com, this means both a chance to innovate and a need to adapt quickly. Integrating these advancements can significantly speed up payments and bolster security, giving Bill.com a competitive edge in the market.

Bill.com is actively responding to this trend by broadening its payment capabilities. The company is focusing on offering faster ACH transfers and enhanced card payment options, demonstrating a clear strategy to stay ahead in the evolving payment landscape.

- Real-Time Payments (RTP) Adoption: RTP networks are gaining traction globally, with transaction volumes projected to grow substantially. For instance, the U.S. RTP network saw a significant increase in transaction volume year-over-year in late 2024.

- Blockchain in Payments: While still developing, blockchain technology offers potential for faster, more secure cross-border transactions. Pilot programs and early-stage adoption by financial institutions are indicative of its growing relevance.

- Bill.com's Payment Expansion: Bill.com’s strategic focus on faster ACH and card payments directly addresses the market demand for quicker settlement times, a key benefit of emerging payment technologies.

Bill.com's technological landscape is significantly shaped by AI and ML, driving automation in financial processes and enhancing fraud detection. The company is actively integrating these technologies to improve invoice processing and payment accuracy, aiming for greater efficiency. By early 2024, businesses using AI in finance saw an average 15% reduction in processing times, with advanced fraud detection AI reducing fraudulent transactions by up to 20%.

Cloud computing's reliability and scalability are foundational for Bill.com, enabling it to manage growth and ensure consistent service. Major cloud providers maintained over 99.9% uptime in early 2024, supporting Bill.com's operational stability. However, the increasing sophistication of cyber threats, such as ransomware, necessitates continuous investment in robust security measures, as the global average cost of a data breach reached $4.45 million in 2023.

Bill.com's extensive integration capabilities, connecting with over 100 accounting systems, are a key technological advantage. This broad compatibility, including with QuickBooks and Xero, streamlines financial workflows for SMBs. As of early 2024, Bill.com facilitated billions in annual payments through these integrations, highlighting their critical role in operational efficiency.

Emerging payment technologies like real-time payments (RTP) and blockchain present both opportunities and challenges for Bill.com. The company is expanding its payment options, focusing on faster ACH and card payments to meet market demands for quicker settlements. The U.S. RTP network saw significant transaction volume growth in late 2024, indicating the increasing importance of real-time transaction capabilities.

Legal factors

Bill.com navigates a landscape shaped by evolving data privacy laws like GDPR and CCPA, alongside emerging state-specific regulations in the US. These frameworks mandate strict data handling practices, including minimization, transparency, and obtaining user consent, which are paramount for Bill.com to maintain trust and avert significant fines. For instance, the California Privacy Rights Act (CPRA), an amendment to CCPA, which became fully effective in 2023, introduced further complexities regarding data processing and consumer rights.

Fintechs like Bill.com face rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) rules to combat financial crime. This means implementing strong identity checks, closely watching transactions, and reporting anything suspicious. For instance, in 2024, global AML spending was projected to reach $11.9 billion, highlighting the significant investment required.

These evolving global regulations directly influence Bill.com's operational procedures and increase compliance expenses. The Financial Crimes Enforcement Network (FinCEN) in the US, for example, continues to update its guidance, requiring ongoing adaptation of verification and monitoring systems. This focus on compliance is crucial for maintaining trust and operating legally within the financial ecosystem.

The legal landscape for payment processing, particularly licensing for money transmitters, directly shapes Bill.com's operational capacity. Navigating these requirements, which vary significantly by state and country, is fundamental to its core business of facilitating financial transactions.

As of early 2024, the U.S. has a patchwork of state-specific money transmitter licenses, with over 49 jurisdictions requiring such licenses. This complexity means Bill.com must maintain numerous licenses to operate nationwide, a costly and resource-intensive endeavor. Failure to comply can result in substantial fines, potentially impacting revenue streams and market access.

Intellectual Property Rights and Software Patents

Bill.com's competitive edge hinges on robust protection of its intellectual property, particularly its sophisticated automation algorithms and unique platform design, which are often safeguarded through software patents and trade secrets. The company actively engages in legal strategies to counter any potential infringement and meticulously manages its growing patent portfolio within the rapidly evolving fintech landscape.

The legal framework surrounding intellectual property is a critical factor for Bill.com, especially concerning software patents. As of early 2024, the United States Patent and Trademark Office (USPTO) continues to refine its examination guidelines for software-related inventions, impacting how companies like Bill.com can secure and defend their innovations. This dynamic legal environment necessitates continuous adaptation and strategic legal counsel.

- Protection of Algorithms: Bill.com's core value proposition relies on its proprietary automation technology. Protecting these algorithms through patents and trade secrets is paramount to maintaining market differentiation.

- Patent Portfolio Management: The company must actively manage its patent filings and defend against potential infringements to secure its technological advancements and prevent competitors from replicating its innovations.

- Fintech Legal Landscape: The fintech sector is characterized by rapid technological change, leading to frequent legal challenges and evolving patentability standards for software.

- Enforcement and Defense: Legal measures to enforce patent rights and defend against claims of infringement are ongoing considerations, requiring significant investment in legal resources.

Consumer Protection Laws Impacting B2B Transactions

While Bill.com primarily facilitates business-to-business (B2B) transactions, consumer protection laws can still cast a shadow. As financial technology blurs the lines between B2B and B2C services, principles of fair dealing, clear fee structures, and robust dispute resolution mechanisms, often rooted in consumer protection, are increasingly expected in B2B contexts. For instance, regulations like the Consumer Financial Protection Act (CFPA) in the U.S., while focused on consumers, set precedents for transparency that can influence B2B service providers.

These legal frameworks can shape Bill.com's operational approach. Transparency in pricing, clear terms of service, and accessible complaint resolution processes become crucial to avoid potential regulatory scrutiny or reputational damage, even when dealing with business clients. The expectation of consumer-like protections in B2B financial services is growing, with regulators in 2024 and 2025 continuing to monitor digital platforms for fair practices.

- Regulatory Scrutiny: Increased focus on fair practices in financial services, even B2B, can lead to stricter oversight.

- Transparency Mandates: Laws emphasizing clear fee disclosures and service terms impact how Bill.com communicates value.

- Dispute Resolution: The need for efficient and fair dispute resolution processes is amplified by consumer protection precedents.

- Indirect Impact: Consumer protection trends can indirectly influence B2B market expectations and service standards.

Bill.com's operations are significantly influenced by evolving data privacy laws, such as the California Privacy Rights Act (CPRA), which became fully effective in 2023, imposing strict data handling requirements. Furthermore, stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations necessitate robust identity verification and transaction monitoring, with global AML spending projected to reach $11.9 billion in 2024.

Navigating the complex web of money transmitter licenses, with over 49 jurisdictions in the U.S. requiring them as of early 2024, is crucial for Bill.com's nationwide service delivery. Intellectual property protection, particularly for its automation algorithms, is also a legal imperative, with the USPTO continuously refining software patent guidelines.

Even though Bill.com primarily serves businesses, consumer protection principles regarding transparency and dispute resolution are increasingly influencing B2B expectations, with regulators monitoring digital platforms for fair practices through 2025.

| Legal Factor | Impact on Bill.com | Key Regulations/Trends | Data Point/Example |

|---|---|---|---|

| Data Privacy | Mandates strict data handling, consent, and transparency. | GDPR, CCPA, CPRA (effective 2023) | CPRA introduced further data processing complexities. |

| AML/KYC | Requires robust identity checks and transaction monitoring. | Global AML regulations | Global AML spending projected at $11.9 billion in 2024. |

| Money Transmitter Licenses | Necessitates compliance across multiple jurisdictions for operations. | State-specific licensing in the U.S. | Over 49 U.S. jurisdictions require money transmitter licenses (early 2024). |

| Intellectual Property | Requires protection of proprietary algorithms and platform design. | U.S. Patent and Trademark Office (USPTO) guidelines | USPTO refining software patent examination guidelines. |

| Consumer Protection Influence | Drives expectations for transparency and fair dispute resolution in B2B. | Consumer Financial Protection Act (CFPA) precedents | Regulators monitoring digital platforms for fair practices (2024-2025). |

Environmental factors

The growing emphasis on environmental sustainability is fueling a significant shift towards paperless operations and digital record-keeping across industries. Businesses are actively seeking ways to reduce their ecological impact, making solutions that minimize paper usage increasingly attractive.

Bill.com's platform directly addresses this trend by automating invoicing, payments, and document management, thereby drastically cutting down on paper consumption. This core functionality not only aligns with environmental mandates but also appeals to a broad segment of the market prioritizing eco-friendly business practices. For instance, many companies are setting ambitious sustainability targets; a 2024 report indicated that over 70% of surveyed businesses aim to reduce their paper usage by at least 25% in the next two years.

The global push for robust Environmental, Social, and Governance (ESG) reporting is intensifying, with many jurisdictions anticipating significantly stricter disclosure mandates by 2025. This trend directly influences Bill.com's client base, as businesses increasingly need to demonstrate their sustainability efforts. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which began applying to larger companies in 2024, mandates detailed ESG disclosures, setting a precedent for global standards.

While Bill.com's digital invoicing and payment solutions inherently support clients' environmental objectives by reducing paper consumption and travel, the company itself is under scrutiny to report on its own operational footprint and ESG commitments. This includes its carbon emissions, energy usage, and waste management practices, aligning with investor expectations and regulatory pressures that are becoming more pronounced as we approach 2025.

Bill.com's digital platform plays a role in reducing environmental impact by streamlining financial operations. By moving away from paper invoices and checks, businesses using Bill.com can significantly cut down on paper usage and the associated carbon emissions from printing and physical mail delivery. For instance, a typical business sending 100 invoices per month via mail could save an estimated 1200 sheets of paper annually, plus the carbon cost of transportation.

This shift to digital transactions also minimizes the need for physical transportation of payments, further lowering the carbon footprint for its users. Consider the collective impact: if just 10% of the 400,000 businesses that have adopted Bill.com reduce their paper-based payment volume by half, it represents a substantial reduction in CO2 emissions from courier services and postal systems.

Resource Efficiency in Cloud Computing

As a cloud-based platform, Bill.com's environmental footprint is directly linked to the energy efficiency and sustainability initiatives of its cloud service providers. The increasing adoption of green data centers and renewable energy sources within the cloud computing sector presents a significant environmental consideration for Bill.com. This trend can positively influence Bill.com's sustainability narrative and operational efficiency.

The global cloud computing market is increasingly prioritizing sustainability. For instance, by 2024, hyperscale data centers are projected to consume approximately 1.5% of global electricity, highlighting the need for energy-efficient practices. Companies like Google Cloud and Microsoft Azure, major players in the cloud infrastructure space, are making substantial commitments to renewable energy procurement. Google Cloud aims to operate on 24/7 carbon-free energy by 2030, while Microsoft has pledged to be carbon negative by the same year. These advancements in green cloud infrastructure directly benefit Bill.com by reducing its indirect environmental impact.

- Energy Efficiency: Cloud providers are investing in more efficient hardware and cooling systems to reduce energy consumption per unit of computing power.

- Renewable Energy Adoption: A growing percentage of data center energy is sourced from renewable sources like solar and wind power.

- Carbon Footprint Reduction: These efforts contribute to a lower overall carbon footprint for cloud services, which in turn benefits Bill.com's environmental responsibility.

- Regulatory Trends: Increasing environmental regulations globally are pushing data center operators towards more sustainable practices, aligning with Bill.com's potential sustainability goals.

Supply Chain Sustainability Considerations

Businesses are increasingly focused on the environmental and social impact of their supply chains. This trend means companies are looking closer at their vendors' practices. For instance, a 2024 report by Accenture found that 73% of supply chain leaders are prioritizing sustainability, up from 53% in 2022.

As Bill.com processes payments, it sits in a unique position to indirectly support clients in managing their supply chain sustainability. While not a direct sustainability tool, the platform could potentially enable features for tracking payments to vendors meeting specific environmental, social, and governance (ESG) criteria. This could help businesses demonstrate their commitment to more responsible sourcing and payment practices.

- Growing ESG Scrutiny: Over 70% of businesses are now actively assessing their supply chains for sustainability, a significant increase in recent years.

- Indirect Platform Role: Bill.com's payment processing can facilitate tracking vendor payments against defined sustainability metrics.

- Client Demand: As more clients demand transparent and sustainable supply chains, platforms offering related functionalities will gain an advantage.

The increasing global focus on sustainability is driving businesses toward digital solutions to reduce paper consumption and carbon footprints. Bill.com's core offering of digital invoicing and payments directly supports this trend, helping clients minimize paper usage and the associated environmental impact of physical mail.

By facilitating electronic transactions, Bill.com contributes to lower carbon emissions from transportation and printing. For example, a 2024 study highlighted that businesses adopting digital payment methods saw an average reduction of 30% in paper-related waste.

Furthermore, Bill.com's reliance on cloud infrastructure means its environmental performance is tied to the sustainability initiatives of its cloud providers. Leading cloud providers are increasingly investing in renewable energy and energy-efficient data centers, which positively impacts Bill.com's indirect environmental footprint.

The growing demand for ESG reporting means companies are scrutinizing their supply chains for sustainability. Bill.com's platform can indirectly aid clients in this by potentially enabling tracking of payments to vendors with strong ESG credentials, a factor that 73% of supply chain leaders prioritized in 2024.

| Environmental Factor | Impact on Bill.com | Supporting Data (2024/2025) |

| Paper Reduction | Bill.com's digital platform reduces paper use for invoicing and payments. | Businesses adopting digital payments saw an average 30% reduction in paper waste (2024 study). |

| Carbon Footprint | Minimizes emissions from printing and physical mail delivery. | Reduced physical mail volume by 10% for 10% of its user base could save significant CO2 (estimated). |

| Cloud Sustainability | Dependent on cloud providers' green initiatives. | Major cloud providers aim for carbon neutrality by 2030, benefiting Bill.com's indirect footprint. |

| Supply Chain ESG | Potential to support tracking of sustainable vendor payments. | 73% of supply chain leaders prioritized sustainability in 2024, increasing demand for such features. |

PESTLE Analysis Data Sources

Our Bill.com PESTLE analysis is grounded in data from leading financial institutions, government regulatory bodies, and reputable technology research firms. We synthesize information on economic indicators, legislative changes, and industry advancements to provide a comprehensive view.