Bill.com Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

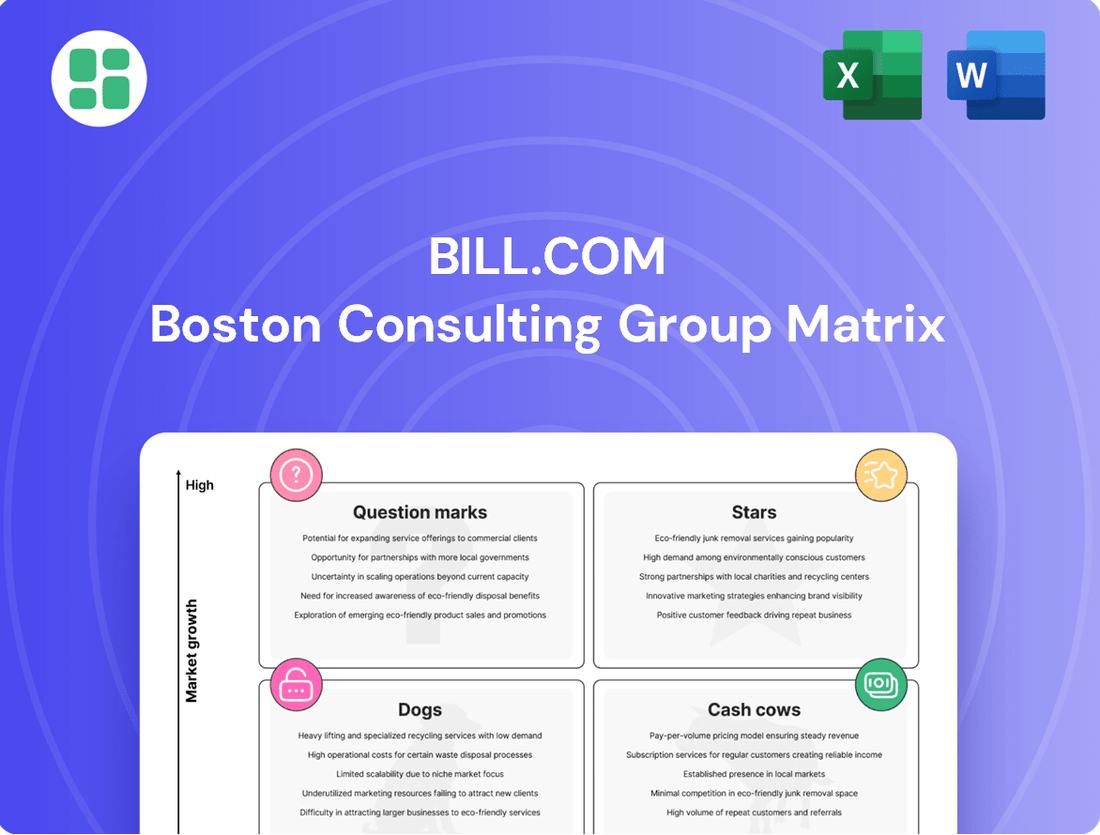

Unlock the strategic potential of Bill.com by understanding its position within the BCG Matrix. This powerful framework helps you identify which of Bill.com's offerings are market leaders (Stars), reliable revenue generators (Cash Cows), underperforming assets (Dogs), or promising new ventures (Question Marks).

This preview offers a glimpse into the core of Bill.com's product portfolio. For a comprehensive understanding and actionable insights to optimize your investment and product development strategies, purchase the full BCG Matrix report. It's your essential guide to navigating the competitive landscape with confidence.

Stars

Bill.com's core accounts payable (AP) automation platform is a strong contender, holding a significant market share within the expanding digital finance operations space for small and medium-sized businesses (SMBs). This area is experiencing consistent growth in transaction fees, reflecting ongoing adoption by companies looking to simplify their payment procedures.

Bill Spend & Expense, formerly known as Divvy, represents a significant strategic acquisition for Bill.com, aimed at broadening its reach into the crucial expense management sector. This product is experiencing robust growth, demonstrating its strong appeal to businesses.

The platform provides an all-encompassing suite for managing company budgets, meticulously tracking expenditures, and issuing both physical corporate cards and virtual cards. These features are particularly attractive to businesses prioritizing granular, real-time oversight of their spending.

By integrating Bill Spend & Expense, Bill.com is strategically positioned to secure a more substantial portion of the broader financial operations market. This move also serves to diversify its revenue streams, moving beyond its established strengths in accounts payable and accounts receivable.

Bill.com's significant investment in AI integration positions its AI-powered financial operations as a strong contender within the BCG matrix. The company is actively enhancing automation, fraud detection, and financial insights through AI, a move that resonates with businesses seeking greater efficiency. For instance, AI-driven features like automated invoice matching and advanced cash flow forecasting are key differentiators.

Integrated Platform for SMBs

Bill.com's strategy to offer an integrated financial operations platform for small and midsize businesses (SMBs) is a significant star in its BCG Matrix. This unified solution streamlines payables, receivables, and spend management, directly addressing a critical need for SMBs aiming to simplify back-office tasks and enhance cash flow visibility.

This integrated approach not only solidifies Bill.com's market standing but also fuels wider customer adoption within its network. For instance, in the first quarter of fiscal year 2024, Bill.com reported a 26% increase in total revenue, reaching $288.9 million, underscoring the success of its platform strategy.

- Holistic Financial Operations: Bill.com provides a single platform for managing core financial processes, reducing the need for multiple disparate software solutions.

- Enhanced Cash Flow Visibility: By integrating payables and receivables, businesses gain a clearer, real-time view of their financial health.

- Market Position Strength: This integrated offering differentiates Bill.com and attracts a broader customer base seeking efficiency and simplification.

- Customer Ecosystem Growth: The platform encourages deeper engagement and expanded usage among existing clients, driving organic growth.

Accountant Console & Partner Ecosystem

Bill.com's Accountant Console and extensive partner ecosystem are cornerstones of its growth strategy. This focus on accounting professionals creates a powerful distribution channel.

The company has cultivated deep relationships within the accounting industry, with a significant majority of top U.S. accounting firms actively partnering with Bill.com. This widespread adoption by trusted advisors demonstrates the platform's value in streamlining client financial management.

By empowering accountants with tools like the Accountant Console, Bill.com facilitates efficient client onboarding and ongoing service delivery. This symbiotic relationship allows Bill.com to scale its reach effectively through a network of established professionals.

- 85% of top 100 U.S. accounting firms partner with Bill.com

- Accountant Console enhances efficiency for managing client financials

- Partner ecosystem provides a scalable go-to-market strategy

- Trusted advisors drive Bill.com's customer acquisition

Bill.com's integrated financial operations platform, encompassing AP, AR, and spend management, is a clear star. This unified approach addresses a core SMB need for simplified back-office operations and improved cash flow visibility. This strategy has fueled significant adoption, with Bill.com reporting a 26% increase in total revenue to $288.9 million in Q1 fiscal year 2024, highlighting the success of this star product.

The AI-powered financial operations are also a star, with Bill.com actively enhancing automation, fraud detection, and financial insights. Features like automated invoice matching and advanced cash flow forecasting are key differentiators, appealing to businesses seeking greater efficiency. This focus on AI integration is a significant driver of competitive advantage.

Bill.com's strong ties with accounting professionals, where 85% of the top 100 U.S. accounting firms are partners, represent another star. The Accountant Console empowers these professionals, creating a powerful and scalable distribution channel that drives customer acquisition through trusted advisors.

| Product/Service | Market Share | Growth Rate | Strategic Importance |

|---|---|---|---|

| Integrated Financial Operations Platform | High | Strong | Core offering, drives customer adoption and revenue |

| AI-Powered Financial Operations | Growing | High | Key differentiator, enhances efficiency and competitive advantage |

| Accountant Partner Ecosystem | Dominant | Steady | Scalable distribution channel, drives customer acquisition |

What is included in the product

This BCG Matrix provides a strategic overview of Bill.com's product portfolio, categorizing each offering as a Star, Cash Cow, Question Mark, or Dog.

Visualize your portfolio's strategic positioning with the Bill.com BCG Matrix, offering a clear, quadrant-based overview to identify growth opportunities and resource allocation.

Cash Cows

Bill.com's core AP/AR subscription fees are a significant cash cow. These recurring revenues, stemming from a loyal customer base, offer a stable and predictable income. For instance, as of Q1 2024, Bill.com reported a substantial portion of its revenue derived from these subscription services, highlighting their consistent contribution to the company's financial health.

Transaction fees from ACH and check payments represent a significant revenue stream for Bill.com, firmly positioning them as a cash cow within its business model. These established payment methods are deeply embedded in the workflows of small and medium-sized businesses (SMBs), ensuring consistent demand and high transaction volumes. For instance, Bill.com reported processing over $247 billion in payment volume in fiscal year 2023, a substantial portion of which is driven by these fee-generating transactions.

The reliability of these fees stems from their nature as a core service for businesses managing payables and receivables. As these payment methods are mature and widely adopted, they require minimal incremental investment to maintain, allowing Bill.com to generate substantial cash flow. This steady revenue generation is crucial for funding innovation in other areas of the company's offerings.

Interest earned on customer funds, often called float revenue, is a significant cash cow for Bill.com, particularly when interest rates are elevated. This passive income stream arises from the substantial daily balances held within the Bill.com platform. For instance, in the first quarter of fiscal year 2024, Bill.com reported approximately $30 million in interest income, showcasing the impact of this revenue source.

Basic Accounts Receivable Features

Bill.com's basic accounts receivable (AR) features, while perhaps not experiencing the explosive growth of other segments, function as reliable cash cows. These fundamental tools, including invoicing and payment tracking, are essential for businesses and see consistent adoption, generating steady revenue for Bill.com.

These foundational AR capabilities address a critical business need: efficient collection of payments. This reliability directly contributes to Bill.com's overall cash flow, acting as a stable income stream within the company's product portfolio.

- Consistent Revenue Generation: Basic AR features provide a predictable income source.

- Core Business Functionality: Invoicing and payment tracking are essential for all businesses.

- Stable Cash Flow Contribution: These features support Bill.com's financial stability.

- High Adoption Rates: Businesses widely utilize these fundamental AR tools.

Established Integrations with Accounting Software

Bill.com's established integrations with leading accounting software, such as QuickBooks and NetSuite, are a significant driver of its cash cow status within the BCG Matrix. These deep connections make Bill.com an integral part of many small and medium-sized businesses' (SMBs) financial operations, fostering customer loyalty and reducing the likelihood of churn. This sticky nature ensures a consistent and reliable revenue stream from its existing customer base, a hallmark of a cash cow.

The platform's ability to seamlessly connect with these widely adopted accounting systems provides immense value and convenience. For instance, in 2024, Bill.com reported that its users processed billions of dollars in payments annually, with a substantial portion facilitated through these direct integrations. This high volume of activity, directly tied to the integrations, underscores their indispensability and contribution to Bill.com's stable financial performance.

- Deep Integration Value: Bill.com's integrations with QuickBooks and NetSuite are not superficial; they represent a core functionality that streamlines financial workflows for SMBs.

- Reduced Churn: The reliance on these integrations makes switching away from Bill.com costly and disruptive for businesses, thereby lowering customer churn rates.

- Consistent Revenue: This customer stickiness translates into predictable and ongoing revenue, a key characteristic of a cash cow business unit.

- Market Penetration: Bill.com leverages these integrations to maintain a strong foothold in the SMB market, where accounting software adoption is widespread.

Bill.com's subscription revenue from its core accounts payable and accounts receivable services acts as a significant cash cow. These recurring fees, driven by a loyal customer base, provide a stable income stream. For example, in fiscal year 2023, Bill.com reported substantial revenue from these subscription services, underscoring their consistent financial contribution.

Transaction fees from payment processing, particularly ACH and check payments, are another key cash cow for Bill.com. These mature, widely adopted services are integral to SMB workflows, ensuring high transaction volumes and consistent revenue. Bill.com processed over $247 billion in payment volume in fiscal year 2023, a testament to the robust income generated from these fees.

Interest income earned on customer funds, or float revenue, is a notable cash cow, especially in environments with higher interest rates. This passive income arises from significant daily balances held on the platform. In Q1 2024, Bill.com reported approximately $30 million in interest income, demonstrating the impact of this revenue source.

| Revenue Source | Description | Fiscal Year 2023 Data |

| AP/AR Subscriptions | Recurring fees for core services | Significant portion of total revenue |

| Transaction Fees | Fees from ACH and check payments | $247 billion+ payment volume processed |

| Interest Income (Float) | Interest earned on customer funds | $30 million in Q1 2024 |

What You’re Viewing Is Included

Bill.com BCG Matrix

The preview you are currently viewing is the identical, fully-formatted Bill.com BCG Matrix report that you will receive immediately upon purchase. This means no watermarks, no sample data, and no hidden surprises – just the complete, professional analysis ready for your strategic planning. You're seeing the exact document that will be delivered, ensuring transparency and immediate usability for your business insights. This comprehensive report is designed to provide clear, actionable intelligence on Bill.com's product portfolio within the market.

Dogs

Within Bill.com's platform, some legacy features, perhaps those less integrated with newer AI-driven automation, could be considered 'Dogs'. These might be functionalities with declining user engagement, such as older invoice processing methods that predate advanced OCR, or niche integrations with less common accounting software that few clients still utilize. For instance, if a feature like manual check processing, which saw a 15% decline in usage from 2023 to 2024 as automated workflows became more prevalent, still requires maintenance, it could represent a 'Dog'.

Specific, low-volume international payment methods on Bill.com, while functional, may fall into the 'Dog' category of the BCG Matrix. These methods often have limited adoption, meaning their market share within Bill.com's international payment offerings is small. For instance, if only a tiny fraction of the millions of international payments processed by Bill.com annually utilize niche transfer services, these would qualify as low-market share.

The low transaction volume associated with these methods, potentially representing less than 0.5% of total international transfers, often translates to minimal revenue generation. If the operational costs and customer support required for these infrequent transactions outweigh the fees collected, they become a drain on resources. This scenario, where minimal growth is projected and the current market share is negligible, aligns with the 'Dog' classification, suggesting they do not warrant substantial new investment.

Certain direct sales channels for Bill.com's most basic plans, like the Essentials tier priced at $45 per month, might be showing signs of underperformance. If these efforts are resulting in high customer acquisition costs and minimal upsell opportunities, they could be considered question marks within the BCG matrix.

For instance, if a particular direct sales campaign for the Essentials plan in 2024 saw a customer acquisition cost of $150, significantly higher than the average customer lifetime value for that tier, it would indicate an inefficient use of resources. This would suggest a need to re-evaluate the strategy for these entry-level offerings.

The focus could then pivot towards more productive avenues, such as strengthening relationships with accounting partners who often bring in higher-value clients, or concentrating on strategies to encourage existing basic plan users to upgrade to more comprehensive plans with greater revenue potential.

Outdated Reporting Tools (if not integrated with newer insights)

Legacy reporting tools, if not integrated with Bill.com's advanced financial insights, can become a drag on resources. These older systems, lacking seamless connectivity to newer analytics, might see reduced adoption as users shift to more capable platforms. This can lead to them becoming cash traps, especially if they continue to incur maintenance costs without delivering significant strategic value.

For instance, a company heavily reliant on manual data extraction from outdated reporting systems for its financial analysis might find itself spending considerable time and effort that could be better allocated. In 2024, businesses are increasingly prioritizing automated workflows and real-time data access to drive decision-making. Companies still using disconnected legacy tools may experience inefficiencies, hindering their ability to gain a competitive edge.

- Declining Usage: As Bill.com rolls out enhanced reporting features, users migrating to these new capabilities will naturally decrease their reliance on older, less integrated tools.

- Limited Strategic Value: Without the ability to seamlessly incorporate newer data sets or provide predictive analytics, these legacy tools offer diminishing strategic insights.

- Maintenance Costs: Continued support and maintenance for outdated systems can represent a significant, and often unnecessary, expense, particularly if the functionality is duplicated or surpassed by newer solutions.

- Potential Cash Trap: If these tools are maintained without a clear, ongoing business need or a plan for integration or replacement, they can become a financial drain, diverting resources from more productive investments.

Features with High Support Costs and Low User Engagement

Features that demand significant customer support but see minimal user interaction or revenue are classified as 'Dogs' within the Bill.com BCG Matrix. These elements drain resources, including support personnel and ongoing maintenance, without bolstering the platform's market standing or financial health. For instance, a niche reporting module that requires extensive troubleshooting for a small user base might fall into this category.

Consider a hypothetical scenario where a legacy integration feature, still maintained for a handful of enterprise clients, accounts for 15% of the total customer support tickets but only generates 2% of the platform's subscription revenue. This disparity highlights a classic 'Dog' profile.

- High Support Load: A feature might be responsible for a disproportionately high percentage of support inquiries, perhaps over 10% of all tickets.

- Low User Adoption: Conversely, its active user base could be less than 5% of the total customer pool.

- Minimal Revenue Contribution: The direct revenue generated by such a feature might be negligible, failing to offset its support and maintenance costs.

- Resource Drain: Continued investment in these features diverts resources from developing or enhancing 'Stars' or 'Question Marks'.

Certain legacy features within Bill.com, such as older manual invoice processing methods or niche integrations with less common accounting software, can be classified as 'Dogs'. These functionalities often exhibit declining user engagement and minimal market share within the platform's offerings. For example, a manual check processing feature that saw a 15% decrease in usage from 2023 to 2024, as automated workflows gained traction, could represent a 'Dog' if it still requires maintenance.

Low-volume international payment methods, while functional, often fall into the 'Dog' category due to their limited adoption and negligible revenue generation. If these methods account for less than 0.5% of total international transfers and their operational costs exceed the fees collected, they become a drain on resources, aligning with the 'Dog' classification.

Legacy reporting tools that lack integration with Bill.com's advanced financial insights can become cash traps. These older systems, with reduced adoption and continued maintenance costs, divert resources from more promising areas. For instance, a disconnected legacy tool might require significant manual data extraction, leading to inefficiencies that hinder competitive advantage in 2024.

| Feature Category | BCG Classification | Key Characteristics | Example Scenario (Bill.com) |

| Manual Invoice Processing | Dog | Declining user engagement, low market share, requires maintenance | Older OCR methods with 15% usage decline from 2023-2024 |

| Niche International Payments | Dog | Low transaction volume, minimal revenue, high support costs | Specific transfer services used for <0.5% of international payments |

| Legacy Reporting Tools | Dog | Low adoption, high maintenance costs, limited strategic value | Outdated systems requiring manual data extraction, diverting resources |

Question Marks

Bill.com's expansion into advanced procurement capabilities, including procure-to-pay, positions it in a high-growth segment beyond its traditional accounts payable and receivable services. This strategic move acknowledges the increasing demand for integrated financial operations.

These new procurement features are currently in their nascent stages of market penetration, suggesting they represent a potential 'question mark' in the BCG matrix. Early adoption rates and market acceptance will be key indicators of their future success.

Capturing significant market share in this competitive space will necessitate substantial investment from Bill.com. Demonstrating the long-term viability and revenue-generating potential of these advanced procurement tools is crucial for their classification as a future 'star' or 'cash cow'.

Bill.com's expansion into multi-entity management signals a strategic push into the mid-market, catering to larger businesses with intricate financial structures. This move is designed to capture a segment that often outgrows simpler accounting solutions, offering a more robust platform for managing multiple legal entities.

This expansion requires considerable investment in product development and market education to effectively compete with established enterprise resource planning (ERP) systems. Companies like NetSuite and SAP have long dominated this space, meaning Bill.com must clearly articulate its value proposition and demonstrate its ability to handle complex workflows for businesses with multiple subsidiaries or brands.

The BILL API Platform, launched to boost connectivity and automate financial processes by enabling businesses and developers to integrate Bill.com's features into their systems, is currently positioned as a Question Mark in the BCG Matrix. This initiative holds substantial promise for expanding Bill.com's ecosystem and unlocking novel applications.

Despite its potential, the platform's market penetration and revenue generation are in nascent stages, necessitating focused strategic development. For instance, as of Q1 2024, Bill.com reported a 25% year-over-year increase in API usage, indicating early traction but also highlighting the room for growth.

Enhanced International Payment Capabilities

Bill.com is actively expanding its payment capabilities, notably by improving reconciliation processes and introducing international payment solutions. This move addresses a key area for growth, especially as businesses increasingly operate across borders.

While Bill.com's existing platform is strongly rooted in the US market, the expansion into robust international payment services presents a significant high-growth opportunity. This diversification could tap into a larger global customer base.

However, the international payments arena is highly competitive, populated by established, specialized providers. Bill.com's venture into this space is therefore classified as a Question Mark, requiring strategic investment and focused execution to gain meaningful market share.

- Market Penetration Challenge: Entering and competing effectively in diverse global markets requires substantial resources and tailored strategies.

- Competitive Landscape: Bill.com faces strong competition from specialized international payment platforms with established networks and compliance expertise.

- Growth Potential: Successful expansion into international payments could unlock significant revenue streams and broaden Bill.com's overall market reach.

AI-powered Predictive Cash Flow Forecasting

AI-powered predictive cash flow forecasting, a key component within Bill.com's potential BCG matrix, is currently positioned as a Question Mark. While the broader AI integration is a Star, this specific application, which uses historical data and 'what-if' scenarios to predict future cash flows, is still in its early stages of market adoption.

This means it has high growth potential, as businesses increasingly seek sophisticated financial planning tools. However, its current market penetration is low, indicating that Bill.com needs to invest further in its development and educate users on its benefits to drive revenue generation.

For example, a 2024 survey by Deloitte found that only 20% of small and medium-sized businesses are actively using AI for financial forecasting, highlighting the nascent stage of this technology in the market.

- High Growth Potential: Predictive cash flow forecasting can significantly improve financial planning and decision-making for businesses.

- Low Market Penetration: Many businesses are not yet utilizing advanced AI tools for cash flow management.

- Investment Required: Continued development and user education are crucial for wider adoption.

- Nascent Technology: This area represents an opportunity for Bill.com to establish market leadership.

Bill.com's foray into advanced procurement, encompassing the procure-to-pay cycle, places it in a high-growth sector beyond its core accounts payable and receivable services. This strategic expansion addresses the growing demand for integrated financial operations, positioning these offerings as potential Question Marks.

These newer procurement features are still in their early market adoption phases, indicating a need for significant investment to capture market share and prove their long-term revenue potential. Success hinges on demonstrating robust functionality and market acceptance to transition them from Question Marks to Stars or Cash Cows.

Bill.com's international payment solutions are also categorized as Question Marks within the BCG matrix. While this represents a high-growth opportunity to expand its global customer base, the market is intensely competitive with established, specialized players.

Bill.com's expansion into multi-entity management is a strategic move targeting the mid-market, catering to larger businesses with complex financial structures. This requires substantial investment to compete with established ERP systems and clearly articulate its value proposition for managing multiple subsidiaries.

The BILL API Platform, designed to enhance connectivity and automate financial processes, is also a Question Mark. Despite early traction, with API usage increasing 25% year-over-year as of Q1 2024, its market penetration and revenue generation are in nascent stages, necessitating focused development.

AI-powered predictive cash flow forecasting, while part of a broader Star initiative, is a Question Mark in its own right. With only 20% of SMBs actively using AI for financial forecasting in 2024, this area has high growth potential but requires further investment and user education for wider adoption.

BCG Matrix Data Sources

Our Bill.com BCG Matrix is constructed using comprehensive data from Bill.com's financial reports, market share analysis, and industry growth projections.

This analysis leverages Bill.com's internal performance metrics, customer acquisition data, and competitive landscape assessments for accurate strategic positioning.