Bill.com Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

Bill.com masterfully leverages its product, offering a comprehensive suite of financial workflow automation to streamline accounts payable and receivable. Their pricing strategy often reflects a tiered subscription model, catering to businesses of varying sizes and needs. Discover how their strategic placement and promotional efforts create a powerful market presence.

Unlock the full potential of Bill.com's marketing strategy with our in-depth 4Ps analysis. This detailed report breaks down their product innovation, pricing tiers, distribution channels, and promotional campaigns, offering actionable insights for your own business. Get access to a professionally written, editable document that saves you hours of research and provides a clear roadmap to understanding market leadership.

Product

Bill.com's cloud-based financial operations platform is the core product, focusing on automating accounts payable and accounts receivable for SMBs. This allows businesses to manage their finances efficiently from any location, a critical feature for modern operations. As of early 2024, Bill.com served over 400,000 customers, demonstrating significant market penetration and adoption of its cloud solutions.

Bill.com's accounts payable automation is a core product offering, digitizing invoices and streamlining approvals. This feature allows for flexible payment methods including ACH, checks, and virtual cards, significantly cutting down on manual work and errors. For instance, businesses using Bill.com have reported reducing invoice processing time by an average of 50%.

For the Product aspect of Bill.com's 4P marketing mix, its Accounts Receivable (AR) management is a standout feature. The platform offers robust tools designed to accelerate customer payments. This includes features like streamlined invoicing, automated payment reminders, and a variety of payment acceptance methods, all contributing to a more efficient collection process.

By focusing on optimizing AR, Bill.com directly impacts a business's cash flow. For instance, studies in 2024 indicated that businesses using automated AR solutions saw an average reduction in their Days Sales Outstanding (DSO) by 15-20%. This improved cash conversion cycle is crucial for operational stability and growth, a key benefit for Bill.com's users.

Integration and Ecosystem

Bill.com's product strategy heavily emphasizes integration and its robust ecosystem, making it a cornerstone of its marketing mix. The platform is built for seamless connectivity with leading accounting software like QuickBooks, Xero, Sage Intacct, and NetSuite. This interoperability is crucial for businesses seeking a unified financial view, ensuring data consistency across their operational tools.

This interconnectedness not only streamlines workflows but also extends to Bill.com's vast network. The company boasts a proprietary network of millions of members, a key differentiator that accelerates payment processing within its ecosystem. This network effect is a significant value proposition, fostering efficiency and reducing friction in B2B transactions.

- Seamless Accounting Integration: Connects with QuickBooks, Xero, Sage Intacct, and NetSuite.

- Unified Financial View: Ensures synchronized financial data across multiple systems.

- Proprietary Network: Leverages millions of members for faster payments.

- Ecosystem Advantage: Facilitates efficient transactions within its user base.

Spend and Expense Management

Bill.com's Spend and Expense Management product, often provided at no cost to eligible businesses, extends beyond basic accounts payable and receivable. This offering is a key component of their marketing mix, emphasizing value and accessibility.

The product provides businesses with tools to manage company spending effectively. This includes issuing physical and virtual corporate cards, which is crucial for controlling employee expenditures. It also automates the often cumbersome process of expense reporting, saving time and reducing errors.

Furthermore, this feature allows for the setting and management of budgets, giving finance teams granular control over cash flow. Real-time insights into spending patterns are also a significant benefit, enabling proactive financial management. For instance, many businesses in 2024 are leveraging these tools to combat rising inflation by identifying areas for cost optimization.

- Corporate Cards: Facilitates the issuance of physical and virtual cards to employees, enabling better spending control.

- Budget Management: Allows businesses to set and monitor departmental or project-specific budgets.

- Expense Automation: Streamlines the submission, approval, and reimbursement of employee expenses.

- Real-time Insights: Provides dashboards and reports for immediate visibility into company-wide spending.

Bill.com's product suite is designed to be a comprehensive financial operations hub for SMBs, focusing on automating core back-office tasks like accounts payable (AP) and accounts receivable (AR). This automation extends to spend management, offering corporate cards and expense tracking. Crucially, the platform's value is amplified by its seamless integration with popular accounting software and a vast proprietary network of businesses, fostering efficient B2B transactions.

| Product Feature | Key Benefit | 2024/2025 Impact/Data |

|---|---|---|

| AP Automation | Streamlines invoice processing and payments | Reports indicate up to 50% reduction in invoice processing time for users. |

| AR Automation | Accelerates customer payments and improves cash flow | Users saw an average 15-20% reduction in Days Sales Outstanding (DSO) in 2024. |

| Spend & Expense Management | Enhances spending control and reduces errors | Enabled businesses to better manage budgets and identify cost optimization opportunities amidst inflation in 2024. |

| Integrations & Network | Provides a unified financial view and efficient transactions | Seamlessly connects with major accounting platforms; proprietary network facilitates faster payments. |

What is included in the product

This analysis provides a comprehensive breakdown of Bill.com's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It's designed for professionals seeking a detailed understanding of Bill.com's market positioning, grounded in real-world practices and competitive context.

Simplifies Bill.com's 4Ps marketing mix into a clear, actionable framework that directly addresses common business pain points in financial management.

Provides a concise overview of how Bill.com's product, price, place, and promotion strategies alleviate customer frustrations, making it ideal for quick understanding and communication.

Place

Bill.com's product strategy centers on its direct online sales and Software-as-a-Service (SaaS) model, making its financial management tools readily available to small and medium-sized businesses (SMBs). This digital-first approach empowers customers to self-serve, sign up, and manage their accounts directly through web and mobile platforms.

The company's website acts as the primary gateway, offering comprehensive product details, interactive demos, and a streamlined onboarding process. This direct channel fosters customer independence and reduces the need for traditional sales intermediaries, aligning with the digital expectations of its target market.

Bill.com leverages accounting firms as a crucial distribution channel, partnering with thousands nationwide. These firms, acting as trusted advisors to small and medium-sized businesses (SMBs), integrate Bill.com's platform to enhance their clients' financial operations. This strategy taps into existing professional networks, significantly expanding Bill.com's market penetration.

Bill.com's collaborations with major U.S. financial institutions are a key part of its Place strategy. By partnering with banks, Bill.com effectively embeds its payment and financial operations solutions directly into the platforms that businesses already use for their banking needs. This integration allows banks to offer enhanced services to their commercial clients, expanding Bill.com's reach and adoption through trusted financial channels.

App Marketplaces and Software Integrations

Bill.com's strategic placement within various app marketplaces acts as a powerful distribution channel. These marketplaces, often integrated with popular accounting software, allow businesses to discover and adopt Bill.com by connecting it directly to their existing financial workflows. This seamless integration simplifies onboarding and encourages wider platform usage.

The company's deep integrations with leading accounting software providers, such as QuickBooks, Xero, and NetSuite, are a cornerstone of its market penetration strategy. By enabling effortless data synchronization, Bill.com becomes an indispensable part of a business's financial technology stack. For instance, as of late 2024, Bill.com reported over 300 integrations, facilitating smoother operations for its user base.

- Marketplace Presence: Bill.com leverages app stores associated with major accounting platforms for visibility and customer acquisition.

- Deep Integrations: Over 300 integrations with accounting software enhance user experience and streamline financial processes.

- Distribution Advantage: Integrations serve as a primary discovery and adoption point for new business customers.

- Reduced Friction: Seamless connection to existing tools minimizes implementation hurdles and boosts user retention.

Scalable Cloud Infrastructure

Bill.com's scalable cloud infrastructure acts as its global distribution channel, ensuring broad accessibility. This robust platform allows businesses of all sizes, from small startups to large enterprises, to connect and transact seamlessly, irrespective of their physical location. As of early 2024, Bill.com serves over 400,000 small and midsize businesses, a testament to its efficient and widespread reach facilitated by this cloud foundation.

The underlying technology enables Bill.com to handle increasing transaction volumes and user growth without compromising performance. This scalability is crucial for a financial platform aiming to support a diverse and expanding customer base. For instance, the platform's ability to process millions of transactions monthly highlights the strength of its cloud architecture in managing peak loads and ensuring continuous service availability.

- Global Reach: Internet accessibility is the only requirement, making Bill.com available worldwide.

- Scalability: The infrastructure supports growth, accommodating more users and transactions effortlessly.

- Accessibility: Businesses of any size can leverage the platform, democratizing access to efficient financial operations.

- Distribution Mechanism: The cloud serves as the primary channel for delivering Bill.com's services to its market.

Bill.com's "Place" strategy is multifaceted, focusing on digital accessibility and strategic partnerships to reach its target audience. Its direct online sales model, coupled with a robust cloud infrastructure, ensures global availability. The company also strategically leverages app marketplaces and deep integrations with accounting software, making it readily discoverable and easily adoptable within existing business workflows.

| Distribution Channel | Key Feature | Reach/Impact (as of late 2024/early 2025) |

|---|---|---|

| Direct Online Sales (SaaS) | Self-service onboarding, web/mobile access | Serves over 400,000 SMBs |

| Accounting Firm Partnerships | Trusted advisor integration | Partnerships with thousands of firms nationwide |

| Financial Institution Integrations | Embedded solutions within banking platforms | Enables banks to offer enhanced services |

| App Marketplaces | Discovery and adoption via accounting software ecosystems | Facilitates connection to existing financial workflows |

| Cloud Infrastructure | Global accessibility, scalability | Supports millions of transactions monthly |

| Software Integrations | Data synchronization with leading platforms | Over 300 integrations, including QuickBooks, Xero |

What You Preview Is What You Download

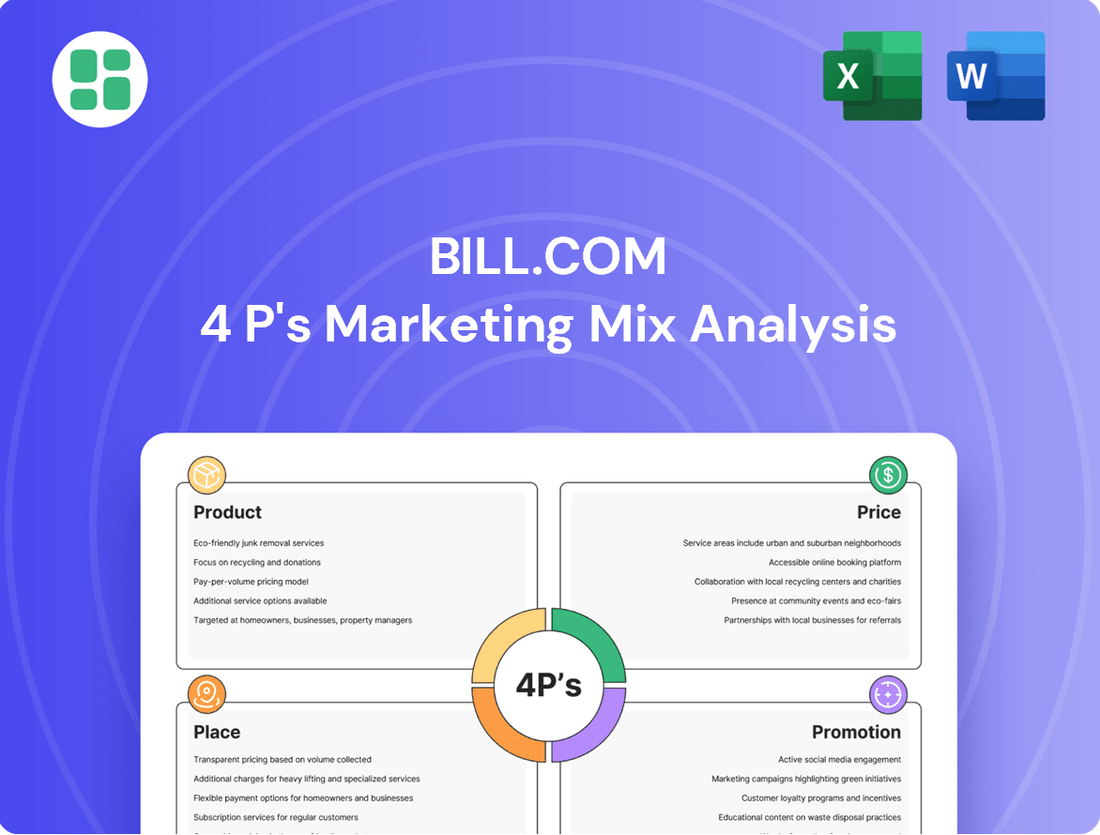

Bill.com 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the Bill.com 4P's Marketing Mix Analysis you'll receive, fully complete and ready to use. This isn’t a teaser or a sample; it’s the actual content you’ll receive when you complete your order.

Promotion

Bill.com leverages content marketing extensively, offering blogs, whitepapers, and case studies to educate businesses on financial automation. These resources highlight how Bill.com addresses key SMB challenges like cash flow and expense management, establishing credibility. In 2024, the company continued to emphasize educational content, with their blog seeing a 15% increase in traffic, demonstrating its effectiveness in attracting and informing potential customers.

Bill.com leverages digital advertising, including pay-per-click (PPC) and social media campaigns, to connect with its core audience of small and medium-sized businesses (SMBs), accountants, and financial professionals. These efforts are meticulously targeted, zeroing in on keywords and demographics that resonate with entities looking to streamline their financial processes. For instance, in 2023, Bill.com’s marketing spend was a significant factor in its customer acquisition, contributing to a 25% year-over-year increase in its customer base.

Bill.com actively uses webinars and product demonstrations as key promotional tools. These interactive sessions allow potential clients to see the platform in action, highlighting how it streamlines accounts payable and receivable processes. For instance, a typical demonstration might showcase how Bill.com can reduce invoice processing time by an average of 50%, a significant draw for busy businesses.

Public Relations and Industry Recognition

Bill.com actively cultivates its public relations by securing media coverage in prominent financial technology and business news outlets. This strategic approach aims to bolster its reputation and reach within the industry. For instance, in 2024, the company continued to be a subject of discussion in leading publications focusing on fintech innovation and business solutions.

Industry recognition plays a crucial role in Bill.com's marketing mix, significantly enhancing its credibility and visibility. Being named a 'Power Partner' by Inc. in recent years, including continued recognition through 2024, serves as a testament to the platform's value and effectiveness for businesses. Such accolades directly reinforce its position in the market.

These industry awards and positive media mentions act as powerful endorsements, validating Bill.com's platform for its target audience of small and medium-sized businesses. This validation is critical for building trust and encouraging adoption, especially in a competitive financial technology landscape. By highlighting these achievements, Bill.com effectively communicates its leadership and reliability.

- Media Coverage: Bill.com consistently seeks placement in top-tier financial technology and business news sources to amplify its message.

- Industry Awards: Accolades like Inc.'s 'Power Partner' designation, maintained through 2024, validate the platform's impact.

- Credibility Boost: Recognition enhances Bill.com's trustworthiness and visibility among its core customer base.

- Market Validation: These endorsements confirm the platform's value proposition and operational effectiveness.

Partner Marketing and Ecosystem Leverage

Bill.com actively leverages its ecosystem through partner marketing, engaging in co-marketing initiatives with its vast network of accounting firms and software integration partners. This strategy amplifies Bill.com's promotional reach by tapping into the established client bases and industry credibility of its partners.

These collaborative efforts often include joint webinars, shared content creation, and cross-promotional activities. For instance, in 2024, Bill.com continued to enhance its partner program, aiming to deepen integrations and co-marketing opportunities. This approach is crucial for expanding Bill.com's market presence through trusted channels, solidifying its role within the broader financial operations ecosystem.

- Co-Marketing Initiatives: Bill.com partners with accounting firms and software providers for joint promotional activities.

- Expanded Reach: This strategy leverages partners' existing client bases and industry influence to broaden Bill.com's exposure.

- Ecosystem Reinforcement: By working with partners, Bill.com strengthens its position as a central player in financial operations.

- Channel Trust: Promotions through trusted partners enhance Bill.com's credibility and market penetration.

Bill.com's promotional strategy is multifaceted, focusing on educating its target audience and building credibility through various channels. Digital marketing, content creation, and strategic partnerships are central to its approach, aiming to drive customer acquisition and market penetration.

The company's commitment to providing valuable content, such as blogs and whitepapers, saw a 15% increase in blog traffic in 2024, demonstrating its effectiveness in attracting and informing potential clients. Furthermore, Bill.com's targeted digital advertising campaigns contributed to a 25% year-over-year customer base increase in 2023.

| Promotional Tactic | Key Benefit | 2023/2024 Data Point |

|---|---|---|

| Content Marketing | Educates and attracts SMBs | 15% increase in blog traffic (2024) |

| Digital Advertising (PPC/Social) | Targeted customer acquisition | 25% YoY customer base growth (2023) |

| Webinars/Demos | Showcases platform value | Can reduce invoice processing time by 50% |

| Public Relations/Awards | Builds credibility and visibility | Continued 'Power Partner' recognition (2024) |

| Partner Marketing | Expands reach through ecosystem | Enhanced partner program (2024) |

Price

Bill.com primarily utilizes a subscription-based Software-as-a-Service (SaaS) pricing model. Customers are charged recurring fees for continuous access to the platform's comprehensive financial automation tools. This predictable revenue stream benefits Bill.com, while offering users consistent access to essential accounts payable and receivable functionalities.

Bill.com's pricing is designed with a tiered structure, offering plans like Essentials, Team, Corporate, and Enterprise. This allows businesses of all sizes, from small startups to large corporations, to find a plan that fits their specific needs and budget.

Each tier comes with a distinct set of features and user allowances. For instance, the Essentials plan might focus on core invoicing and payment processing, while the Enterprise plan could include advanced automation, custom workflows, and dedicated support, reflecting the varying complexities businesses face.

This tiered approach is crucial for scalability. As a business grows and its transaction volume or feature requirements increase, it can seamlessly upgrade to a higher tier, ensuring the software evolves with their operational demands without disruption.

Bill.com's transaction-based fees are a crucial element of its pricing strategy, directly impacting revenue and customer perception. These fees are applied on top of subscription costs, reflecting the actual cost of processing various payment types. For instance, when a business sends an ACH payment through Bill.com, a per-transaction fee is typically charged. This model aligns revenue with usage, making it a variable cost for users.

The company charges specific fees for different payment methods, including checks, ACH, and credit card transactions. These fees are designed to cover the expenses associated with payment processing and serve as a significant additional revenue stream for Bill.com. For example, processing a credit card payment often incurs a higher fee than an ACH transfer due to the associated interchange fees charged by card networks.

Furthermore, international wire transfers are subject to their own set of fees, which can fluctuate based on factors like the currency being transferred and the desired speed of delivery. This tiered fee structure allows Bill.com to monetize a wider range of its services and cater to businesses with diverse payment needs, from domestic check processing to global financial transactions.

Value-Based Pricing and ROI Focus

Bill.com's pricing strategy is deeply rooted in value-based principles, aligning costs with the tangible benefits customers receive. This approach highlights the platform's ability to deliver significant return on investment (ROI) by automating tedious financial tasks and improving cash flow management. For instance, businesses leveraging Bill.com often report substantial reductions in manual processing time, directly translating into cost savings and increased operational efficiency.

The company positions its subscription tiers not as mere expenses, but as strategic investments designed to yield measurable financial improvements. This resonates with financially savvy decision-makers who understand the quantifiable impact of streamlined accounts payable and receivable processes. Bill.com's focus on ROI is a key differentiator in the competitive fintech landscape, attracting clients who prioritize efficiency and profitability.

- Efficiency Gains: Bill.com users typically see a reduction in manual data entry and processing, freeing up valuable employee time.

- Improved Cash Flow: The platform's automation and payment features help accelerate payment cycles, positively impacting working capital.

- Cost Reduction: By minimizing errors and reducing the need for manual oversight, Bill.com helps lower operational costs associated with financial management.

- Scalable Value: Pricing tiers are designed to scale with business growth, ensuring that the value proposition remains compelling as a company expands.

Free Trials and Promotional Offers

Bill.com leverages free trials and promotional offers as key elements within its marketing mix to drive customer acquisition. By providing access to its platform, often for a limited time, the company allows potential users to directly experience its value proposition, such as streamlining accounts payable and receivable processes. This hands-on approach significantly reduces the perceived risk for new customers.

For instance, Bill Spend & Expense, a significant product offering, has been made available to qualified businesses at no cost. This strategy is designed to attract a broad user base, with revenue generation occurring through alternative channels like interchange fees associated with its corporate card services. Such promotions aim to lower the initial hurdle for adoption, encouraging businesses to integrate Bill.com into their financial operations.

These promotional tactics are crucial for market penetration, particularly in the competitive fintech landscape. By offering free access, Bill.com can gather valuable user feedback and demonstrate tangible benefits, such as reduced processing times and improved cash flow visibility, which are critical for small and medium-sized businesses. This approach aligns with the broader goal of making financial management more accessible and efficient.

- Customer Acquisition: Free trials and demos are primary tools to attract new users and showcase Bill.com's capabilities.

- Product Accessibility: Certain products, like Bill Spend & Expense, are offered free to qualified businesses to broaden market reach.

- Revenue Diversification: Revenue streams are diversified, with interchange fees on corporate cards supplementing free product offerings.

- Reduced Barriers: Promotional strategies are designed to minimize entry barriers, encouraging widespread platform adoption.

Bill.com's pricing strategy is fundamentally value-driven, aligning its subscription tiers and transaction fees with the tangible benefits customers gain. This approach emphasizes the platform's ability to deliver significant ROI through automation, improved cash flow, and reduced operational costs. For instance, businesses using Bill.com often report substantial savings in manual processing time, directly boosting efficiency.

The company's tiered subscription model, including options like Essentials, Team, and Corporate, caters to businesses of varying sizes and needs. This structure allows for scalability, ensuring that as a business grows, its Bill.com plan can adapt. Transaction fees, applied on top of subscriptions, reflect the cost of payment processing, with different rates for methods like ACH and credit cards, contributing to Bill.com's revenue while aligning costs with usage.

Promotional offers, such as free trials and the no-cost availability of Bill Spend & Expense for qualified businesses, serve as key customer acquisition tools. This strategy lowers adoption barriers and allows users to experience the platform's value firsthand, with revenue often generated through related services like interchange fees on corporate cards. These tactics are vital for market penetration in the competitive fintech sector.

| Pricing Element | Description | Impact on Customer | Bill.com Revenue Driver |

|---|---|---|---|

| Subscription Tiers | Monthly recurring fees for access to platform features (e.g., Essentials, Team, Corporate). | Scalable cost based on business size and feature needs. | Predictable recurring revenue. |

| Transaction Fees | Per-transaction charges for processing payments (ACH, credit card, checks, wire transfers). | Variable cost directly tied to payment volume and method. | Revenue linked to service usage. |

| Value-Based Pricing | Costs aligned with ROI from automation, efficiency gains, and cash flow improvements. | Perceived as an investment in operational improvement. | Justifies subscription value and encourages adoption. |

| Promotional Offers | Free trials and free access to certain products (e.g., Bill Spend & Expense). | Reduces initial adoption barriers and allows product experience. | Drives customer acquisition, with revenue from ancillary services. |

4P's Marketing Mix Analysis Data Sources

Our Bill.com 4P's Marketing Mix Analysis leverages a diverse set of data sources, including official company press releases, investor relations materials, and their corporate website for product and pricing insights. We also incorporate data from industry reports and competitive analysis platforms to understand distribution and promotional strategies.