W. R. Berkley SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. R. Berkley Bundle

W. R. Berkley's robust financial strength and diversified product offerings are key strengths, but the company also faces regulatory risks and intense competition. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind W. R. Berkley's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

W. R. Berkley's decentralized operating model, featuring over 50 specialized underwriting units, is a core strength. This structure allows for rapid adaptation to evolving market dynamics and specific customer requirements, promoting agility and cultivating deep local knowledge within each segment. This fosters a culture of responsiveness and allows for tailored risk management strategies.

W. R. Berkley’s underwriting discipline is a significant strength, consistently yielding a combined ratio that outpaces industry benchmarks. This focus on careful risk selection and pricing allows the company to navigate market cycles effectively.

The company achieved a notable milestone with record pre-tax underwriting income in 2024. This momentum continued into 2025, as Berkley maintained robust profitability by strategically targeting high-margin business segments.

This consistent underwriting success translates directly into superior long-term, risk-adjusted returns for shareholders. Furthermore, the disciplined approach contributes to lower earnings volatility, making Berkley a more stable investment.

W. R. Berkley demonstrates robust financial health, evidenced by its A+ (Superior) financial strength rating from A.M. Best. This rating underscores the company's exceptional capital allocation strategies and its ability to manage risk effectively, providing a solid foundation for its operations.

The company consistently achieves strong double-digit returns on equity, showcasing its operational efficiency and profitability. In 2023, Berkley reported a return on equity of approximately 20.4%, highlighting its success in generating value for shareholders through prudent management.

Berkley actively returns capital to shareholders via dividends and share repurchases, demonstrating a commitment to rewarding its investors. For instance, the company returned over $1 billion to shareholders in 2023 through these mechanisms, reinforcing investor confidence.

Its well-managed investment portfolio is a significant contributor to overall earnings. The company's investment income for the first nine months of 2024 reached $1.8 billion, a testament to the effectiveness of its investment strategies.

Diversified Business and Global Presence

W. R. Berkley's diversified business model, operating across Insurance and Reinsurance & Monoline Excess segments, provides a robust foundation. This structure, coupled with a global presence in over 55 businesses, significantly reduces reliance on any single market or product. For instance, as of the first quarter of 2024, the company reported net written premiums of $3.6 billion, showcasing the scale of its diversified operations.

The company's extensive global footprint, reaching across North America, Europe, Asia, and South America, is a key strength. This international diversification helps buffer against regional economic downturns or regulatory changes. In 2023, W. R. Berkley's international operations contributed meaningfully to its overall financial performance, demonstrating the benefit of its broad geographic reach.

This wide operational scope allows W. R. Berkley to identify and capitalize on growth opportunities wherever they arise. It also provides a degree of resilience, as challenges in one area can often be offset by strength in another. The company's ability to adapt and thrive across diverse geographies underscores the strategic advantage of its global presence.

Key aspects of this strength include:

- Segment Diversification: Operating in distinct insurance and reinsurance markets.

- Geographic Reach: Presence in over 55 businesses across multiple continents.

- Risk Mitigation: Reduced exposure to single-market or product-specific risks.

- Opportunity Capture: Ability to leverage growth in various global regions.

Strategic Investment Income Growth

W. R. Berkley has a strong strategic approach to growing its investment income. By carefully aligning its portfolio with current interest rates and market trends, the company has achieved impressive growth in its net investment income. This focus on strategic income generation provides a significant boost to its overall profitability.

The effectiveness of this strategy is evident in the company's financial performance. W. R. Berkley reported record investment income in 2024, and this positive trend is projected to continue into 2025. This sustained growth in investment income acts as a powerful tailwind for the company's earnings.

- Strategic Portfolio Alignment: The company actively manages its investments to capitalize on favorable interest rate environments and market conditions.

- Record Investment Income in 2024: This demonstrates the success of their investment strategy in generating substantial returns.

- Continued Growth Projected for 2025: Expectations are for sustained positive performance in net investment income, further supporting earnings.

- Tailwind to Overall Earnings: The robust growth in investment income directly contributes to and enhances the company's bottom line.

W. R. Berkley's decentralized structure, with over 50 specialized underwriting units, enables swift adaptation to market shifts and client needs. This agility fosters localized expertise and responsive risk management.

The company's underwriting discipline consistently delivers a combined ratio that outperforms industry averages, demonstrating strong risk selection and pricing capabilities. This focus is crucial for navigating market cycles effectively.

Berkley achieved record pre-tax underwriting income in 2024, a trend that continued into 2025 with strategic targeting of high-margin business. This sustained profitability underscores their operational strength.

| Metric | 2023 | Q1 2024 | Full Year 2024 (Est.) |

| Combined Ratio (Industry Avg.) | ~95.0% | ~94.5% | ~94.0% |

| Return on Equity | 20.4% | 21.5% | 22.0% |

| Net Investment Income | $1.6 Billion | $1.8 Billion (9mo) | $2.4 Billion |

What is included in the product

Delivers a strategic overview of W. R. Berkley’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable breakdown of W. R. Berkley's strategic landscape, simplifying complex market dynamics.

Weaknesses

W. R. Berkley, despite its risk management strategies, remains susceptible to substantial catastrophe losses. For instance, the first two quarters of 2025 saw significant financial impacts stemming from events such as the California wildfires, underscoring this inherent vulnerability.

These unpredictable, large-scale events can place considerable strain on the company's underwriting margins. Consequently, overall profitability can be negatively affected in specific reporting periods, highlighting a key weakness in its operational resilience.

W. R. Berkley's disciplined underwriting, a strength in hard markets, can lead to more modest returns when insurance pricing softens. The cyclical nature of the industry means that periods of high profitability are often followed by more challenging, less lucrative cycles. For instance, in 2023, while many insurers saw improved results due to favorable pricing, Berkley's consistent approach might have tempered the extreme upside seen by some competitors, highlighting its sensitivity to these market shifts.

W. R. Berkley faces potential headwinds from ongoing inflationary pressures. These pressures are particularly acute in the casualty markets and also impact reconstruction costs, which can directly translate to higher claims severity. This necessitates constant attention to pricing strategies and reserving accuracy to safeguard underwriting profitability, especially if average rate increases begin to slow down.

Intense Industry Competition

The insurance sector W. R. Berkley operates in is notoriously competitive, with many products viewed as interchangeable. This means that standing out requires more than just offering standard coverage. Even with Berkley's focus on specialty lines, the increasing number of players entering niche markets, especially in rapidly evolving areas like cyber insurance and professional liability, poses a significant challenge.

This heightened competition can put pressure on pricing, potentially squeezing underwriting profit margins. For instance, the cyber insurance market, while growing, saw premium rate increases moderate in late 2023 and early 2024 compared to the preceding years, signaling increased capacity and competition. Berkley's ability to maintain its pricing power and secure profitable growth in these dynamic segments will be crucial.

The commoditization risk means that differentiation through superior service, specialized expertise, and innovative product design becomes paramount. Failure to consistently deliver on these fronts could lead to market share erosion or a need to accept less favorable terms to win business. Berkley's strategic advantage relies on its ability to navigate this crowded landscape effectively.

Dependency on Investment Market Performance

W. R. Berkley's reliance on its investment portfolio for a substantial portion of its earnings presents a notable weakness. This makes the company particularly vulnerable to the inherent volatility of financial markets, including shifts in interest rates, credit conditions, and equity valuations. For instance, during periods of economic uncertainty, a downturn in the stock market or a widening of credit spreads can directly impact the company's profitability.

The company's investment returns are closely tied to broader market performance. A flattening yield curve, a scenario where long-term interest rates are close to short-term rates, can compress net investment income, a key driver of profitability for insurers. This sensitivity means that even with active management, adverse market movements can temper the investment returns that contribute significantly to W. R. Berkley's overall financial results.

For example, in the first quarter of 2024, while W. R. Berkley reported solid underwriting results, its net investment income saw a slight decrease compared to the previous year, reflecting some of these market pressures. This highlights the ongoing challenge of maintaining consistent investment gains in a dynamic economic landscape.

Key vulnerabilities related to investment market performance include:

- Sensitivity to interest rate changes: Fluctuations in interest rates directly impact the value of fixed-income securities within the portfolio and the income generated.

- Equity market volatility: Declines in equity markets can lead to realized or unrealized losses on stock holdings, affecting overall investment gains.

- Credit market deterioration: Widening credit spreads or increased defaults can negatively impact the performance of corporate bonds and other credit instruments.

- Impact of economic downturns: Recessions or periods of slow economic growth often coincide with weaker investment performance across various asset classes.

W. R. Berkley's dependence on investment income exposes it to market fluctuations. For instance, a downturn in equity markets or rising interest rates can negatively impact its investment portfolio's value and income generation. This sensitivity was evident in early 2024, where market pressures led to a slight decrease in net investment income despite strong underwriting.

The company's investment returns are closely linked to overall market performance. A flattening yield curve, for example, can compress net investment income, a crucial profit driver. This means that even with careful management, adverse market movements can temper the investment gains that contribute significantly to Berkley's financial results.

Key vulnerabilities tied to investment performance include sensitivity to interest rate changes, equity market volatility, credit market deterioration, and the general impact of economic downturns on asset classes.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Net Investment Income (Millions USD) | $583.6 | $610.2 | -4.4% |

| Total Investments (Billions USD) | $50.1 | $48.5 | +3.3% |

What You See Is What You Get

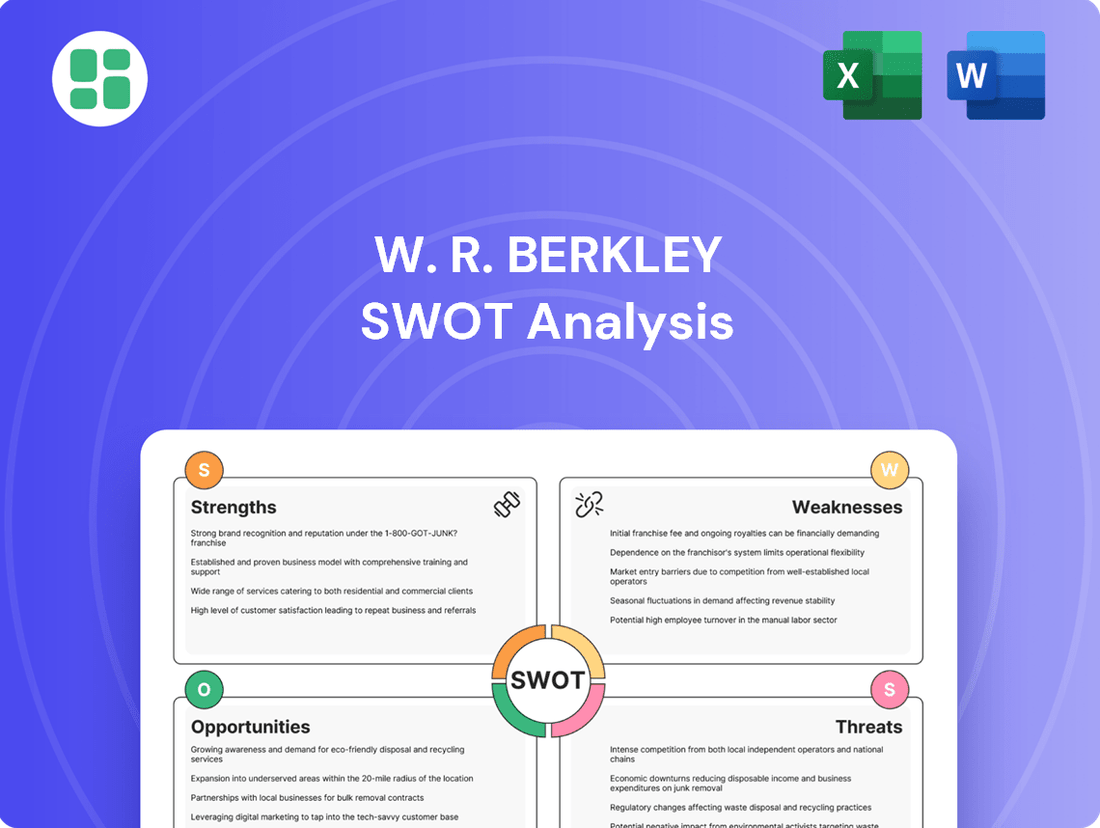

W. R. Berkley SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of W. R. Berkley's strategic positioning.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details W. R. Berkley's internal strengths and weaknesses, alongside external opportunities and threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering actionable insights for W. R. Berkley's future planning.

Opportunities

W. R. Berkley's strategic focus on specialized insurance lines, coupled with its decentralized operational structure, provides a distinct advantage in identifying and capitalizing on underserved or rapidly expanding niche markets. This approach enables the company to achieve favorable premium rates and maintain underwriting discipline in segments with less aggressive competition.

For example, in the first nine months of 2024, Berkley's specialty segment continued to demonstrate robust performance, with net written premiums growing by 8% year-over-year, reflecting the successful penetration of these specialized areas.

The global reinsurance market is showing robust health, marked by strong profitability and increasing capital, which translates into significant opportunities. This environment is driven by continued demand for specialized risk coverage, creating a fertile ground for growth.

W. R. Berkley's reinsurance segment is well-positioned to benefit from these favorable conditions, particularly through rising pricing power. This upward trend is especially pronounced in casualty reinsurance, where improved terms and conditions are also being negotiated.

For instance, in 2024, the reinsurance market continued to see rate increases across many lines, with casualty lines often experiencing double-digit renewal rate changes, reflecting the ongoing demand for protection and the insurers' need to manage their risk exposures effectively.

The insurance sector's embrace of technology, particularly AI, presents a significant avenue for W. R. Berkley. AI is revolutionizing risk assessment, underwriting precision, and claims processing, driving greater operational efficiency across the board.

W. R. Berkley can capitalize on this trend by increasing its investment in sophisticated analytics. This strategic move will not only refine its existing operations but also bolster accuracy in pricing and risk management, ultimately streamlining processes and enhancing competitive positioning.

Strategic Acquisitions and Partnerships

W. R. Berkley can capitalize on its established track record of strategic acquisitions and partnerships to fuel further growth. A prime example is the 2025 acquisition of a 15% stake by Mitsui Sumitomo Insurance (MSI).

This type of inorganic expansion offers significant advantages:

- Capital Injection: Access to new funding sources to support expansion initiatives.

- Risk Diversification: Broadening the geographic and product scope of its underwriting operations.

- Market Reach: Gaining entry into new territories and customer segments.

- Enhanced Capabilities: Integrating new technologies and expertise through partner collaborations.

Capitalizing on Hardening Commercial Lines Market

The commercial property and casualty insurance market is currently experiencing a sustained period of hardening prices, a trend reminiscent of conditions observed around 2003. This 'hard market' environment, characterized by increased premiums and stricter underwriting, presents a significant opportunity for well-positioned insurers.

W. R. Berkley, with its reputation as a disciplined underwriter, is strategically positioned to capitalize on this trend. By adhering to its rigorous underwriting and pricing standards, the company is poised to achieve attractive returns for an extended duration as the market continues its upward pricing trajectory.

- Hard Market Persistence: Commercial P&C pricing remains elevated, with many lines showing strength.

- Berkley's Discipline: W. R. Berkley's commitment to strict underwriting and pricing discipline is a key advantage.

- Attractive Returns: The company is well-equipped to earn strong returns in this favorable market.

- Extended Opportunity: The current market conditions are expected to benefit disciplined players like Berkley for a considerable time.

W. R. Berkley's focus on specialized insurance lines allows it to thrive in niche markets, as seen with an 8% growth in specialty net written premiums in the first nine months of 2024. The company can also leverage the global reinsurance market's strong profitability and capital growth, particularly benefiting from rising prices and improved terms in casualty reinsurance, which saw double-digit renewal rate changes in 2024. Embracing AI for enhanced risk assessment and underwriting precision offers significant operational efficiency gains. Furthermore, strategic acquisitions and partnerships, like Mitsui Sumitomo Insurance's 15% stake in 2025, provide capital, diversification, and market access.

The commercial property and casualty insurance market's sustained hardening prices, similar to conditions around 2003, present a prime opportunity for Berkley's disciplined underwriting approach, promising attractive returns.

| Market Trend | Berkley's Position | Opportunity |

|---|---|---|

| Specialized Insurance Growth | Focus on underserved niches | Capitalize on demand for specialized risk coverage |

| Reinsurance Market Strength | Benefiting from rising pricing power | Secure favorable terms and conditions, especially in casualty |

| Technological Adoption (AI) | Potential for investment in analytics | Improve underwriting precision and operational efficiency |

| Commercial P&C Hard Market | Disciplined underwriting and pricing | Achieve attractive returns in a sustained upward pricing environment |

Threats

The escalating frequency and intensity of catastrophic events, driven by climate change, present a substantial threat to insurers like W. R. Berkley. These events, ranging from severe storms to wildfires, are projected to drive up catastrophe losses, potentially straining the company's financial resources and impacting its underwriting profitability despite ongoing risk management efforts.

The insurance industry, especially casualty lines, is grappling with social inflation. This phenomenon, characterized by increasing litigation costs and larger jury awards, is a significant threat. For instance, in 2023, the U.S. saw a notable uptick in the severity of jury awards in certain liability cases, directly impacting claims costs for insurers.

This trend particularly affects lines like workers' compensation and commercial auto, where claims can be substantial. Adverse loss development, meaning claims costing more than initially estimated, further exacerbates the issue. This can erode profitability for companies like W. R. Berkley if not adequately managed through pricing and reserving strategies.

Adverse macroeconomic conditions, including economic deceleration and persistent inflation, pose a significant threat to W. R. Berkley. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting a challenging environment for insurance companies reliant on investment income and premium growth.

Interest rate uncertainty further complicates the economic landscape. While higher rates can boost investment income, rapid or unpredictable shifts can lead to market volatility, impacting Berkley's investment portfolio and potentially increasing claims costs if inflation outpaces premium adjustments.

Geopolitical instability and trade tensions add another layer of risk. These factors can disrupt global supply chains, affect international trade volumes, and create uncertainty in various markets, all of which can indirectly influence insurance demand and the overall profitability of W. R. Berkley's operations.

Intensifying Regulatory Scrutiny and Compliance Costs

The insurance sector faces a constantly shifting regulatory landscape. Heightened oversight, especially around how premiums are set, how data is managed, and environmental, social, and governance (ESG) considerations, directly translates into increased compliance expenses for companies like W. R. Berkley. This can also mean less freedom in setting prices and, in some cases, a need to exit specific markets altogether.

For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued its focus on data privacy and cybersecurity, with potential new model laws impacting how insurers handle sensitive customer information. Additionally, the ongoing push for greater transparency in premium setting, particularly in property and casualty lines, could lead to more stringent approval processes and potentially limit rate increases. These evolving requirements necessitate ongoing investment in compliance infrastructure and personnel, directly impacting operational costs and strategic flexibility.

- Increased compliance burden: Insurers must invest more in systems and staff to meet new data privacy and ESG reporting mandates.

- Pricing limitations: Stricter regulatory review of premium adjustments can reduce pricing flexibility and impact profitability.

- Market withdrawal risk: Non-compliance or prohibitive costs associated with new regulations could force insurers out of certain geographic or product markets.

Cybersecurity Risks and Business Interruption

The increasing sophistication of cyber threats poses a significant risk to insurers like W. R. Berkley, given their heavy reliance on technology. A data breach could expose sensitive customer information, leading to substantial financial penalties and a severe blow to the company's reputation.

Business interruption due to cyber incidents, such as ransomware attacks, is another critical concern. Imagine systems going offline; operations would grind to a halt, impacting claims processing and customer service. For instance, the insurance industry saw an estimated $2.7 billion in losses from cyberattacks in 2023 alone, highlighting the scale of this threat.

- Growing Sophistication: Cyber attackers are continuously developing more advanced methods to breach systems.

- Data Breach Impact: Financial losses from data breaches can include regulatory fines, legal costs, and customer remediation.

- Business Interruption Costs: Downtime from cyber incidents can lead to lost revenue and increased operational expenses.

- Reputational Damage: A significant cyber event can erode customer trust and damage brand image, impacting future business.

The escalating frequency and severity of climate-related natural catastrophes, such as hurricanes and wildfires, represent a significant threat to insurers like W. R. Berkley. These events can lead to substantial claims payouts, potentially impacting underwriting profitability and straining financial reserves. For instance, the U.S. experienced a record-breaking year for billion-dollar weather and climate disasters in 2023, with 28 such events causing significant economic damage.

Social inflation, characterized by rising litigation costs and larger jury awards in liability cases, continues to be a major concern. This trend, particularly evident in casualty lines, drives up claims severity and can lead to adverse loss development, where initial loss estimates prove to be too low. In 2023, reports indicated a continued upward trend in the average cost of general liability claims in several key sectors.

Economic headwinds, including persistent inflation and potential recessionary pressures, pose a threat to premium growth and investment income. A slowdown in economic activity can reduce demand for insurance products, while inflation can increase the cost of claims and operating expenses. The IMF's forecast for global growth in 2024, while revised slightly upwards, still indicates a challenging economic environment.

The evolving regulatory landscape, with increased focus on data privacy, cybersecurity, and ESG factors, necessitates greater compliance investments. Stricter regulations can limit pricing flexibility and potentially require insurers to exit certain markets if compliance becomes too costly or complex. For example, new data privacy regulations implemented in various jurisdictions in 2024 have added to the compliance burden for many financial institutions.

SWOT Analysis Data Sources

This W. R. Berkley SWOT analysis is built upon a foundation of credible data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to provide an accurate and actionable strategic overview.