W. R. Berkley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. R. Berkley Bundle

W. R. Berkley navigates a competitive insurance landscape where supplier power is moderate, primarily due to the availability of reinsurance. The threat of new entrants is tempered by significant capital requirements and regulatory hurdles, creating a barrier to entry. Understanding these dynamics is crucial for grasping Berkley's strategic positioning.

The complete report reveals the real forces shaping W. R. Berkley’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers, primarily reinsurers, significantly impacts W. R. Berkley's operational flexibility. While property reinsurance costs are stabilizing, casualty reinsurance is projected to experience substantial price hikes, with estimates pointing to double-digit increases for 2025. This trend is fueled by escalating concerns surrounding social inflation and increased litigation costs.

These divergent market dynamics mean that W. R. Berkley's ability to secure advantageous reinsurance terms is not uniform across all its business lines. The rising cost of casualty reinsurance, for instance, could constrain underwriting capacity or necessitate higher premiums for policyholders in those segments.

Insurers are heavily leaning on sophisticated data analytics, artificial intelligence, and the Internet of Things (IoT) to sharpen risk evaluation, pricing accuracy, and overall operational effectiveness. This escalating dependence on specialized technological solutions grants these providers a degree of bargaining power, as insurers must adopt these advancements to maintain a competitive edge and improve their underwriting processes.

Specialized actuarial and consulting services are indispensable for W. R. Berkley, particularly in navigating the intricacies of risk modeling, product innovation, and regulatory adherence within the commercial insurance sector. The deep knowledge these firms possess, especially concerning emerging or specialized risks, grants them a moderate degree of bargaining power.

These external insights are foundational to W. R. Berkley's commitment to disciplined underwriting. For instance, in 2024, the demand for sophisticated actuarial analysis to price cyber insurance and climate-related risks continued to escalate, underscoring the value and influence of these specialized consultants.

Legal and Claims Adjustment Services

The increasing prevalence of social inflation, leading to higher litigation expenses and jury awards, directly elevates the demand for adept legal and claims adjustment services. This heightened need grants established and efficient service providers a degree of bargaining power.

The quality and expense associated with these essential services have a tangible effect on an insurer's bottom line and combined ratio. For instance, in 2024, the average cost of settling a bodily injury claim in the US continued its upward trend, influenced by these inflationary pressures.

- Increased Demand: Social inflation is a significant driver, pushing up the need for specialized legal and claims handling.

- Impact on Profitability: The cost of these services directly affects an insurer's combined ratio.

- Provider Leverage: Reputable and efficient providers can leverage their value proposition to negotiate terms.

- Data Point: Reports in late 2023 and early 2024 indicated a notable rise in jury awards for liability cases, underscoring the financial impact on insurers.

Capital and Investment Markets

Capital and investment markets act as crucial suppliers for W. R. Berkley, providing the financial fuel for operations and expansion. Their bargaining power lies in their ability to dictate terms for capital raising and influence the cost of that capital. Favorable investment income and ready access to capital are paramount for W. R. Berkley's growth and maintaining solvency.

The overall health of financial markets, including prevailing interest rates, directly shapes W. R. Berkley's investment returns and the strength of its capital base. For instance, as of Q1 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25%-5.50%, impacting the yields on fixed-income securities held by insurers.

- Access to Capital: W. R. Berkley relies on these markets for issuing debt and equity, with market sentiment influencing the ease and cost of such transactions.

- Investment Income: The returns generated from invested assets, a key component of insurer profitability, are dictated by market performance and interest rate environments.

- Cost of Capital: Higher interest rates or volatile market conditions can increase the cost of borrowing and equity financing, thereby reducing W. R. Berkley's capacity for growth.

Suppliers, particularly reinsurers, wield significant influence over W. R. Berkley's profitability and operational capacity. The market for casualty reinsurance is expected to see substantial price increases, potentially in the double digits for 2025, driven by rising litigation costs and social inflation. This directly impacts underwriting flexibility and the cost of coverage for policyholders.

Insurers are increasingly reliant on specialized technology providers for advanced data analytics and AI solutions to enhance risk assessment and pricing. This dependence grants these tech firms a degree of bargaining power, as adopting these tools is crucial for maintaining a competitive edge.

Specialized actuarial and consulting services are vital for navigating complex risks and regulatory landscapes, especially in areas like cyber and climate insurance. In 2024, the demand for such expertise continued to grow, giving these providers leverage in negotiations.

The escalating costs of legal and claims adjustment services, influenced by social inflation, also empower specialized providers. For example, the average cost of settling bodily injury claims in the US saw an upward trend in 2024, reflecting these pressures.

Capital markets, as a source of funding, also exert bargaining power through their ability to set terms for capital raising and influence its cost. Prevailing interest rates, such as the Federal Reserve's maintained rate of 5.25%-5.50% as of Q1 2024, directly affect investment income for insurers like W. R. Berkley.

| Supplier Type | Impact on W. R. Berkley | Key Drivers | 2024/2025 Outlook |

|---|---|---|---|

| Reinsurers (Casualty) | Increased costs, reduced capacity | Social inflation, litigation costs | Projected double-digit price hikes for 2025 |

| Technology Providers (AI/Analytics) | Leverage due to reliance on specialized tools | Need for enhanced risk assessment, competitive edge | Growing dependence, potential for increased service costs |

| Actuarial/Consulting Firms | Negotiating power for specialized expertise | Complex risk modeling, regulatory compliance | Elevated demand for cyber and climate risk analysis |

| Capital Markets | Influence on cost of capital, investment returns | Interest rates, market sentiment | Federal Reserve rate at 5.25%-5.50% (Q1 2024) impacts investment yields |

What is included in the product

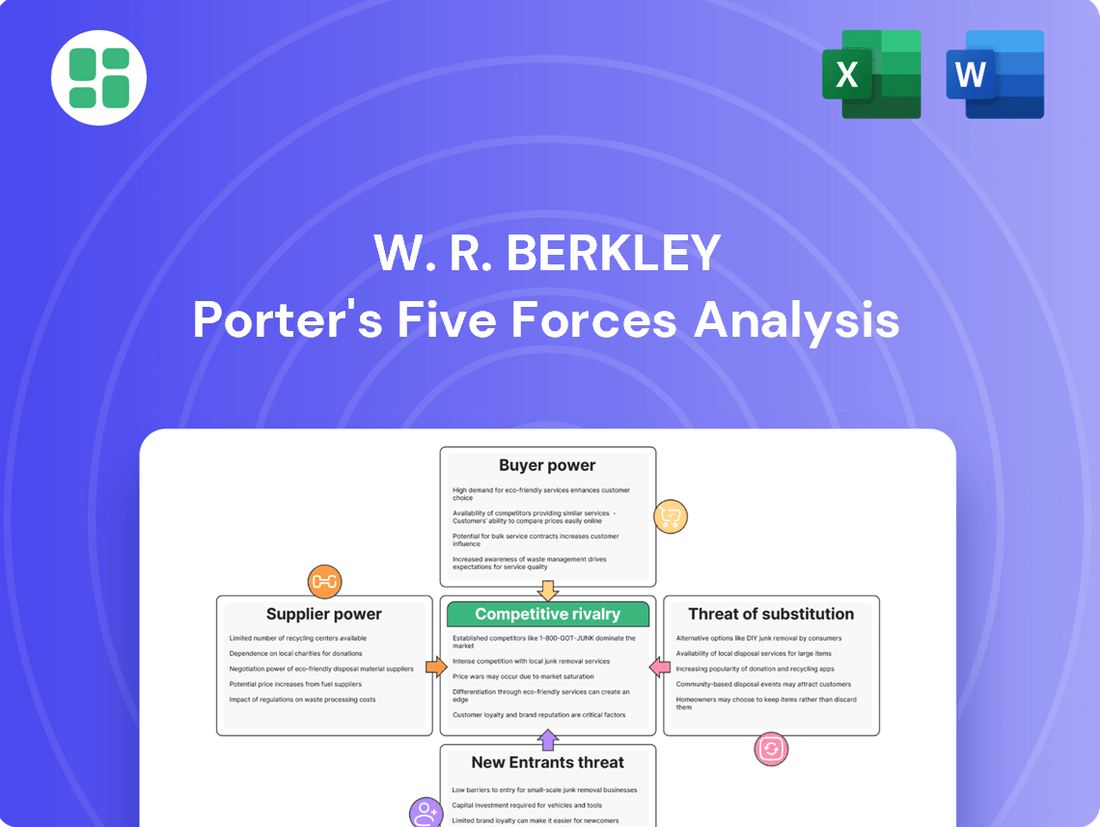

This analysis applies Porter's Five Forces framework to W. R. Berkley, evaluating the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes within the insurance industry.

Visualize competitive intensity with a dynamic Porter's Five Forces chart, instantly highlighting areas of strategic threat and opportunity for W. R. Berkley.

Customers Bargaining Power

The commercial insurance market anticipates a softening in specific sectors by 2025. This trend typically translates to more competitive pricing and improved coverage terms for policyholders, directly enhancing their leverage.

As the market transitions from a hard cycle, characterized by rising premiums and restrictive terms, insurers are likely to vie more intensely for market share. This increased competition naturally amplifies the bargaining power of customers.

For instance, during periods of market softening, businesses may find it easier to negotiate lower premiums or secure more favorable policy conditions. This shift empowers customers to demand better value and service from their insurance providers.

Customers, particularly businesses, show a strong sensitivity to increasing insurance premiums. They actively search for the most economical coverage options available, making price a significant factor in their purchasing decisions.

The proliferation of digital marketplaces and insurance aggregators has significantly amplified customer power. These platforms allow for effortless comparison of policies and prices from a multitude of insurers, fostering greater transparency.

This heightened transparency and ease of comparison directly translate into increased bargaining power for customers. For instance, in the commercial property insurance market, businesses are increasingly leveraging comparison tools to secure more competitive rates, a trend that was evident throughout 2024 as economic pressures influenced purchasing behavior.

The rise of Alternative Risk Transfer (ART) options significantly impacts the bargaining power of customers. Solutions like self-insurance, captives, structured programs, and parametric insurance are increasingly sought after, especially by businesses facing complex or unusual risks. This growing availability of substitutes directly challenges traditional insurers.

In 2024, the market for ART solutions continued its upward trajectory. For instance, the global captive insurance market was estimated to be worth tens of billions of dollars, with many companies leveraging these structures to manage their unique risk exposures more effectively. This trend empowers customers by giving them more choices and the ability to negotiate better terms or even bypass traditional insurance markets altogether.

Specialized Coverage Needs

W. R. Berkley's strategic focus on specialized property casualty insurance often means clients requiring unique or complex coverage have diminished bargaining power. This is because the pool of insurers capable of providing such niche solutions is typically smaller, limiting customer options. For instance, in 2024, the commercial insurance market saw continued specialization, with insurers like Berkley carving out profitable segments where tailored expertise is paramount.

Conversely, when W. R. Berkley offers more standardized or commoditized insurance products, the bargaining power of customers naturally escalates. In these instances, clients can more readily compare offerings and negotiate terms, as numerous competitors can fulfill their needs. This dynamic is a constant consideration in the insurance sector, influencing pricing and service delivery across different product lines.

- Niche Market Advantage: Berkley's specialization in complex risks reduces customer options, enhancing its pricing power in these segments.

- Commodity Market Pressure: For standard insurance products, increased competition among providers empowers customers to negotiate better terms.

- 2024 Market Trend: Continued demand for specialized insurance solutions in 2024 allowed insurers like Berkley to leverage their expertise and command premium pricing in specific areas.

Broker and Agent Influence

Brokers and agents significantly shape customer decisions by acting as trusted intermediaries and advisors. Their expertise in navigating the insurance landscape and presenting diverse policy options directly influences which insurer a customer ultimately chooses.

The capacity of brokers and agents to compare offerings from numerous insurance providers empowers customers. This access to a wide array of choices intensifies competition among insurers, thereby indirectly bolstering the bargaining power of the end customer.

- Intermediary Role: Brokers and agents serve as crucial links between insurance companies and policyholders, guiding customer selection.

- Information Asymmetry Reduction: By providing access to multiple carrier options, they help customers overcome information gaps and make more informed choices.

- Facilitating Competition: Their ability to shop around on behalf of clients directly encourages insurers to offer more competitive pricing and terms to secure business.

The bargaining power of customers in the commercial insurance market is influenced by several factors, including market conditions and the availability of alternative solutions. As the market moves towards softening, customers gain more leverage, particularly in 2024, where economic pressures encouraged businesses to seek more cost-effective coverage.

The increasing availability of digital comparison tools and Alternative Risk Transfer (ART) options, such as captives, further empowers customers. These trends allow businesses to more easily assess and negotiate terms, or even bypass traditional insurance providers, as seen with the significant growth in the captive insurance market throughout 2024.

W. R. Berkley's strategy of specializing in niche markets can reduce customer bargaining power for complex risks, as fewer insurers can offer tailored solutions. However, for more standardized products, increased competition among insurers, often facilitated by brokers, amplifies customer leverage, enabling them to negotiate better pricing and terms.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Market Softening | Increases power due to competition | Anticipated in specific sectors, driving price sensitivity |

| Digital Comparison Tools | Increases power through transparency | Widespread use for securing competitive rates |

| Alternative Risk Transfer (ART) | Increases power by offering substitutes | Growing market, e.g., global captive insurance market valued in tens of billions |

| Niche vs. Standard Products | Decreases power in niche, increases in standard | Specialization allows premium pricing for complex risks |

| Broker/Agent Influence | Increases power by facilitating choice | Key intermediaries in navigating options and driving competition |

Preview Before You Purchase

W. R. Berkley Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of W. R. Berkley Corporation meticulously dissects the competitive landscape, providing actionable insights into industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. This detailed report is professionally formatted and ready for your immediate use, offering a deep understanding of the strategic factors influencing W. R. Berkley's market position.

Rivalry Among Competitors

W. R. Berkley operates in a highly competitive commercial lines insurance market. The company faces rivalry from large national multi-line insurers, regional carriers, and other specialized insurance providers. Key competitors include well-established names such as Chubb, AIG, and Travelers, all vying for market share.

The commercial property and casualty (P&C) insurance sector is experiencing robust premium growth, with recent years seeing substantial increases. While this indicates a generally healthy market, it also signals intense competition among insurers vying for profitable business. For instance, W. R. Berkley highlighted this dynamic by reporting record net income and premium growth in 2024, demonstrating their success within this competitive landscape.

W. R. Berkley stands out by embracing a decentralized operational model and concentrating on specialized property casualty insurance offerings. This approach allows them to craft bespoke solutions and leverage local underwriting acumen, which effectively sidesteps intense price wars within their chosen niche markets.

While this specialization offers a competitive edge, achieving significant product differentiation across the entire insurance landscape remains a persistent challenge for W. R. Berkley. In 2024, the insurance industry continued to see a blend of commoditized offerings and highly specialized niches, with companies like Berkley navigating this dichotomy.

Technological Adoption and Innovation

Competitive rivalry in the insurance sector is intensifying, largely fueled by rapid technological adoption and innovation. Companies are increasingly leveraging advancements like artificial intelligence (AI) and sophisticated analytics to refine their operations.

These technologies are transforming how insurers assess risk, set prices, and manage their day-to-day activities. For instance, AI-powered underwriting can process vast datasets to identify patterns and predict potential losses with greater accuracy than traditional methods.

Insurers that successfully integrate these cutting-edge tools are positioning themselves for a significant competitive advantage. This edge is evident in their ability to offer more precise pricing, personalize customer experiences, and streamline claims processing.

Consider the impact of AI in claims: in 2024, many insurers are reporting faster claim settlements, with some AI systems handling initial assessments in minutes rather than days. This efficiency directly translates to improved customer satisfaction and reduced operational costs, a clear differentiator in a crowded market.

- AI-driven underwriting: Enables more accurate risk assessment and pricing.

- Advanced analytics: Improves operational efficiency and customer segmentation.

- Customer experience enhancement: Faster claims processing and personalized offerings.

- Competitive edge: Insurers leveraging technology gain an advantage in market share and profitability.

Underwriting Discipline and Risk Management

In today's unpredictable market, the intensity of competition among insurers significantly hinges on their underwriting discipline and the effectiveness of their risk management strategies. Companies that demonstrate robust underwriting performance and a keen ability to navigate market volatility are positioned to maintain profitability and gain a competitive edge.

W. R. Berkley's consistent focus on strong underwriting and proactive risk management serves as a critical differentiator. This approach allows them to better absorb the impact of market fluctuations and unexpected events, a crucial factor in the property and casualty insurance sector.

The insurance industry, particularly in 2024, continues to grapple with significant challenges. These include the increasing frequency and severity of catastrophic losses, such as major weather events, and the persistent impact of social inflation, which drives up claim costs. These pressures necessitate a continuous refinement of risk assessment and mitigation strategies.

- Underwriting Discipline: Insurers are sharpening their focus on selecting profitable risks and pricing them appropriately to counter adverse loss development.

- Risk Management Focus: Companies are investing in advanced analytics and data science to better predict and manage exposure to catastrophic events and emerging risks.

- Industry Challenges: The sector faces ongoing headwinds from climate change-related events and the sustained impact of social inflation on liability claims, demanding greater underwriting rigor.

- Competitive Advantage: Strong underwriting and risk management are becoming paramount for insurers seeking to deliver consistent profitability and maintain market share in a challenging environment.

The competitive rivalry within the commercial insurance market remains intense, with W. R. Berkley facing pressure from large national insurers, regional players, and specialized providers. This dynamic is amplified by a growing market, as evidenced by the robust premium growth seen across the sector, with W. R. Berkley itself reporting significant premium increases in 2024.

Technological advancements, particularly AI and advanced analytics, are reshaping competition by enabling more precise risk assessment and improved operational efficiency. Insurers leveraging these tools, like W. R. Berkley’s focus on AI-driven underwriting and claims processing, are gaining a distinct advantage in pricing and customer experience.

Underwriting discipline and effective risk management are critical differentiators for W. R. Berkley amidst industry challenges like increasing catastrophic losses and social inflation. These factors underscore the importance of rigorous risk assessment and mitigation strategies for maintaining profitability and market position.

| Competitor | Market Focus | Key Strengths |

|---|---|---|

| Chubb | Global Commercial & Personal Insurance | Strong brand, broad product offering, underwriting expertise |

| AIG | Global Insurance, Retirement, and Life | Extensive global reach, diverse business lines |

| Travelers | Property Casualty Insurance | Strong commercial lines presence, technological innovation |

| W. R. Berkley | Specialized Commercial Lines P&C | Decentralized model, niche market focus, underwriting acumen |

SSubstitutes Threaten

For large corporations, the option to self-insure or establish captive insurance companies presents a significant threat of substitution to traditional insurance providers. These alternatives allow businesses to retain risk internally, potentially cutting costs and gaining more control over their insurance programs.

Captive insurance companies, in particular, mimic the functions of traditional insurers but often operate with lower overhead and capital requirements for the policyholder. This can translate into cost savings and greater flexibility compared to purchasing coverage from external markets.

In 2024, the global captive insurance market continued its growth trajectory, with estimates suggesting the market size approached $100 billion in premiums written. This expansion underscores the increasing appeal of self-insurance and captive solutions as viable alternatives for risk management.

Alternative risk transfer (ART) mechanisms, beyond traditional captives, are increasingly becoming viable substitutes. Structured programs and parametric insurance, for instance, are gaining significant traction. These ART solutions are designed to cover specific or emerging risks that conventional insurance might not handle effectively, or they serve to bolster existing insurance portfolios. The global ART market saw substantial growth, with premiums for collateralized reinsurance and catastrophe bonds alone reaching billions in 2023, demonstrating a clear shift towards these alternatives.

The threat of substitutes for risk mitigation and loss prevention services is moderate. Businesses investing in robust internal risk management and loss prevention strategies can indeed reduce their reliance on certain insurance coverages. For instance, companies that enhance their building resilience against natural disasters or bolster their cybersecurity defenses might find they need lower insurance limits or can opt for different, potentially less comprehensive, coverage structures.

In 2024, the increasing adoption of advanced risk management technologies, such as AI-powered predictive analytics for operational risks, is a prime example of this substitution. Companies leveraging these tools may see a reduction in their need for traditional insurance products designed to cover those specific risks. This trend suggests that while insurance remains a crucial safety net, the proactive mitigation of risks can lessen the overall demand for certain types of coverage, impacting the market for these services.

Government Programs and Industry Funds

Government-backed programs and industry-specific funds can emerge as significant substitutes, especially for risks that private insurers find too substantial or uninsurable. These initiatives often function as a safety net, diminishing the necessity for businesses to rely solely on commercial insurance providers. For instance, in 2024, the U.S. federal government continued to offer flood insurance through the National Flood Insurance Program (NFIP), providing coverage where private options were scarce or prohibitively expensive.

These alternative structures can cap the potential losses for businesses, thereby lowering their perceived risk and reducing the demand for traditional insurance products. Consider the agricultural sector, where government programs often provide crop insurance against adverse weather events, acting as a direct substitute for private crop insurance policies. This can significantly impact the market share of commercial insurers in such segments.

- Government programs like the NFIP offer alternatives for specific high-risk perils.

- Industry funds can pool resources to cover risks beyond private market capacity.

- These substitutes reduce the overall reliance on commercial insurance for certain business needs.

Non-Insurance Risk Financing

Companies increasingly explore non-insurance risk financing, like self-funding through reserves or using financial derivatives, to manage specific exposures. This strategy is particularly prevalent for predictable, high-frequency, but low-severity losses, offering potential cost savings over traditional insurance premiums.

In 2024, the trend towards alternative risk transfer mechanisms continued. For instance, a significant portion of large corporations in the US reported utilizing captive insurance arrangements or dedicated risk retention groups, effectively acting as their own insurers for certain risks.

- Self-Insurance Reserves: Companies allocate funds to cover potential losses, often for predictable events.

- Financial Derivatives: Instruments like futures or options can hedge against specific financial risks, such as commodity price fluctuations or interest rate changes.

- Captive Insurers: Wholly-owned subsidiaries established by parent companies to insure their own risks, providing greater control and potential cost efficiencies.

- Risk Retention Groups: Groups of similar businesses that form an insurance company to cover their specific liability exposures.

The threat of substitutes for traditional insurance is significant and growing, driven by evolving risk management strategies and technological advancements. Businesses are increasingly looking beyond conventional policies to manage their exposures, leading to a diversification of risk financing options.

Self-insurance and captive insurance arrangements continue to gain traction, offering greater control and potential cost savings. In 2024, the global captive insurance market demonstrated robust growth, with premiums written estimated to be nearing $100 billion, indicating a strong preference for these alternatives.

Alternative risk transfer (ART) solutions, such as parametric insurance and structured programs, are also emerging as powerful substitutes. These mechanisms are adept at covering specific or complex risks that traditional insurance may not adequately address. The ART market, including instruments like catastrophe bonds, saw billions in premiums in 2023, highlighting a clear shift towards these innovative approaches.

| Substitute Type | Description | 2024 Market Trend/Data Point |

|---|---|---|

| Captive Insurance | Wholly-owned subsidiaries insuring parent company risks. | Global market size approaching $100 billion in premiums written. |

| Alternative Risk Transfer (ART) | Parametric insurance, structured programs, collateralized reinsurance. | Billions in premiums for catastrophe bonds and similar instruments in 2023. |

| Self-Insurance/Reserves | Internal funding for potential losses. | Increasing adoption by large corporations for predictable, low-severity risks. |

| Government Programs | Federally or state-backed insurance for specific perils. | Continued provision of flood insurance by the NFIP in the US. |

Entrants Threaten

The insurance sector, especially for commercial insurance, demands significant upfront capital. Insurers need substantial financial reserves to handle potential claims and adhere to strict regulatory solvency rules. For instance, in 2024, many commercial insurers maintained risk-based capital ratios well above regulatory minimums, often exceeding 300%, to ensure financial stability and market confidence.

These high capital requirements act as a formidable barrier to entry. New companies must secure vast sums to establish operations, build a reputable balance sheet, and underwrite policies effectively. This financial hurdle deters many aspiring players, limiting the threat of new entrants in the market.

The insurance industry's intricate web of regulations, including licensing, compliance, and operational mandates that differ across states and countries, acts as a substantial barrier. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize robust solvency requirements and consumer protection measures, making it challenging for newcomers to establish operations without significant upfront investment and expertise in legal and compliance frameworks.

Successful entry into the insurance market, particularly for complex lines of business, hinges on substantial underwriting expertise and robust data analytics. New entrants must possess sophisticated capabilities to accurately assess and price diverse risks, a skill honed over years of experience and investment. For instance, in 2024, the insurance industry continued to grapple with the increasing complexity of cyber risks, demanding specialized underwriting knowledge that is not easily replicated.

Building the necessary data infrastructure and cultivating the required expertise represents a significant capital and time investment, creating a formidable barrier for potential new competitors. Companies that have operated for decades have amassed invaluable historical loss data, which is crucial for actuarial modeling and pricing accuracy. This accumulated data advantage, combined with seasoned underwriting talent, makes it exceptionally difficult for newcomers to compete on a level playing field in 2024.

Brand Recognition and Trust

Established insurers like W. R. Berkley Corporation have cultivated significant brand recognition and trust over many years, a crucial advantage in the insurance sector. This long-standing reputation, built through consistent service and reliability, translates into deep-seated customer loyalty and strong relationships with insurance brokers, who are key distribution channels. For instance, in 2024, W. R. Berkley reported total revenue of $11.7 billion, demonstrating the scale and market penetration achievable through such established trust.

New entrants into the insurance market face a substantial hurdle in replicating this level of credibility and establishing a comparable distribution network. The insurance industry is inherently trust-based; clients entrust their financial security to providers. Building this trust from scratch requires considerable time, investment in marketing, and a proven track record, which new companies lack. Without this, attracting customers and securing partnerships with brokers becomes exceedingly difficult, thereby limiting the threat posed by new entrants.

The challenge for newcomers is amplified by the need to overcome established players' ingrained customer loyalty and broker relationships. This often necessitates offering significantly lower prices or highly innovative products to gain initial traction. However, even with competitive pricing, the inherent risk aversion of insurance consumers and the established reputations of companies like W. R. Berkley (which has operated since 1967) create a high barrier to entry.

Key challenges for new entrants include:

- Building Brand Credibility: New companies must invest heavily to establish a trustworthy brand image in a sector where reputation is paramount.

- Establishing Distribution Networks: Gaining access to and building relationships with insurance brokers is critical for reaching customers.

- Overcoming Customer Loyalty: Entrenched customer relationships with established insurers are difficult to disrupt.

- Regulatory Compliance Costs: Navigating and adhering to complex insurance regulations requires significant capital and expertise.

Insurtech Innovation and Niche Entry

While traditional insurance faces high entry barriers due to capital requirements and regulation, Insurtech firms are finding ways to enter specific market segments. By utilizing advanced technologies like artificial intelligence and the Internet of Things, these new entrants can create more efficient operations and offer a superior customer experience. For instance, in 2024, Insurtech funding reached over $10 billion globally, demonstrating significant investor confidence in this disruptive model.

These technology-driven innovations effectively lower some of the historical operational hurdles. Insurtechs can target underserved or specialized niches, such as parametric insurance for weather-related events or usage-based auto insurance, with a lean, tech-first approach. This allows them to compete effectively against established players by offering tailored products and streamlined digital interactions, potentially capturing market share in these focused areas.

- Insurtech Funding Growth: Global Insurtech funding exceeded $10 billion in 2024, highlighting significant capital inflow into the sector.

- Technology Adoption: AI, blockchain, and IoT are key enablers for Insurtechs to reduce operational costs and improve customer engagement.

- Niche Market Penetration: Insurtechs are successfully entering specialized insurance segments, challenging incumbents with innovative solutions.

- Lowered Entry Barriers: Technological advancements are creating new pathways for agile, digitally native companies to enter the insurance market.

The threat of new entrants in the commercial insurance sector, where W. R. Berkley operates, remains moderate due to significant capital requirements and extensive regulatory oversight. For instance, in 2024, maintaining solvency ratios well above 300% was common among insurers, a clear indicator of the substantial financial resources needed.

Established brand reputation and deep-rooted broker relationships also present formidable barriers. New players must invest heavily in building trust and distribution channels, a process that takes considerable time and capital, making it difficult to gain immediate traction against incumbents like W. R. Berkley.

However, the rise of Insurtech firms, fueled by over $10 billion in global funding in 2024, introduces a dynamic element. These tech-savvy entrants leverage AI and other advanced technologies to streamline operations and target niche markets, potentially lowering traditional entry barriers.

This technological disruption means that while the overall threat might be moderate, specific segments could see increased competition from agile, digitally native companies challenging established players.

Porter's Five Forces Analysis Data Sources

Our W. R. Berkley Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, SEC filings, and industry-specific market research from firms like AM Best and IBISWorld. We also incorporate insights from financial news outlets and expert commentary to provide a comprehensive view of the competitive landscape.