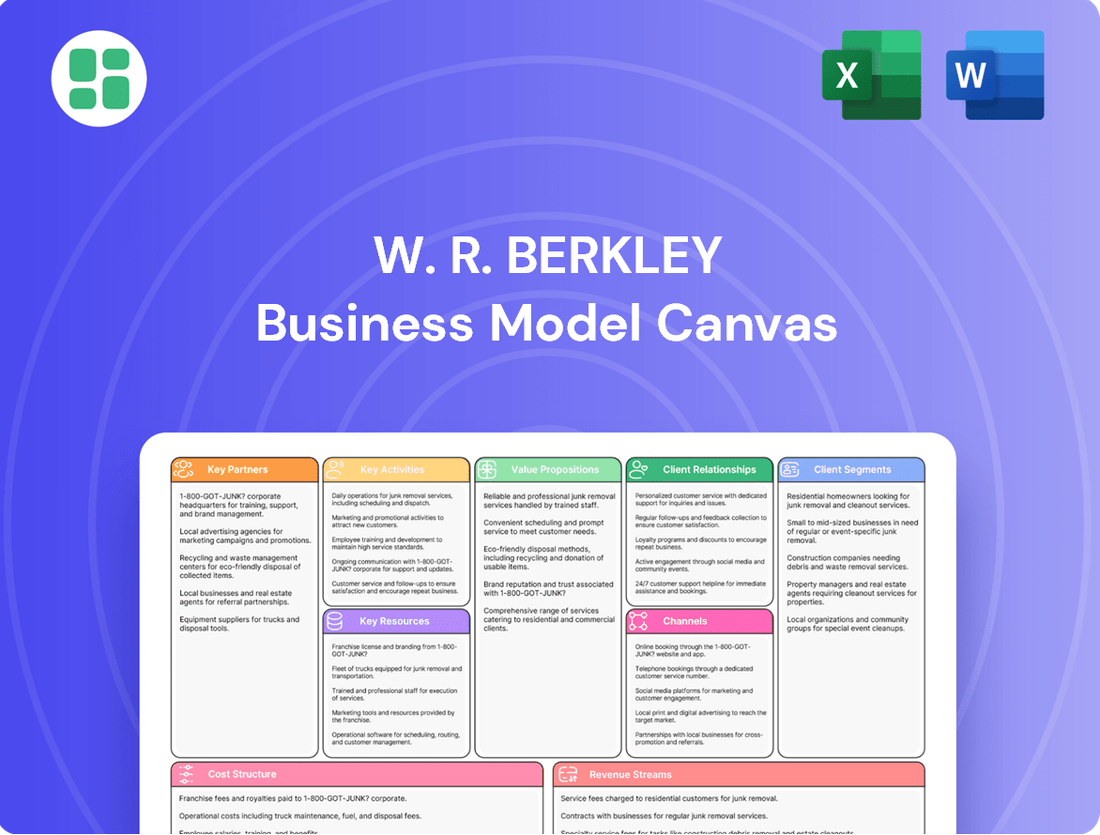

W. R. Berkley Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. R. Berkley Bundle

Discover the strategic core of W. R. Berkley's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and key revenue streams, offering a clear roadmap to their market dominance. For anyone seeking to understand and replicate industry-leading strategies, this is an essential tool.

Partnerships

W. R. Berkley Corporation strategically partners with major reinsurance companies to distribute risk and enhance its underwriting capabilities. These collaborations are vital for managing exposure on substantial policies, allowing Berkley to accept larger risks than it could on its own. For instance, in 2024, Berkley continued to leverage relationships with global reinsurers to support its specialized insurance segments.

W. R. Berkley heavily depends on a vast network of independent insurance brokers and agents to get its specialized property and casualty insurance products to customers. These partners are crucial for reaching local markets and managing client relationships.

Major players like Arthur J. Gallagher & Co., Marsh & McLennan Companies, Brown & Brown Insurance, and Hub International are key to this distribution strategy. In 2024, Berkley continued to leverage these relationships to expand its reach and service offerings.

W. R. Berkley strategically partners with technology providers like Guidewire Software and Duck Creek Technologies to bolster its operational efficiency and digital capabilities. These alliances are crucial for integrating advanced insurance systems, streamlining claims processing, and enhancing data analytics, all of which directly support the company's ongoing digital transformation. For instance, Guidewire's platform is known for its comprehensive suite of cloud-based solutions for the P&C insurance industry, enabling insurers to accelerate innovation and improve customer engagement.

Risk Management and Advisory Firms

W. R. Berkley collaborates with leading risk management consulting firms and specialized legal and financial advisory services. These partnerships are crucial for maintaining strong corporate governance, ensuring compliance with evolving regulations, and supporting strategic decision-making processes. For instance, firms like Deloitte, PwC, and KPMG offer deep expertise in risk assessment and assurance, helping Berkley navigate complex financial landscapes.

These external advisors provide invaluable insights into intricate risk evaluations and the ever-changing regulatory environments. Their contributions are vital for informed operations and risk mitigation strategies. In 2023, the global risk management market was valued at approximately $40 billion, highlighting the significant investment companies make in this area.

Key partnerships enhance Berkley's ability to:

- Strengthen risk assessment capabilities through specialized external expertise.

- Ensure compliance with a complex and dynamic regulatory framework.

- Inform strategic planning with objective financial and legal advice.

- Mitigate potential financial and operational risks by leveraging specialized knowledge.

Strategic Investors and Industry Collaborators

W. R. Berkley actively cultivates key partnerships, bringing in strategic investors and industry collaborators to bolster its market presence and global footprint. These alliances are crucial for accessing capital, gaining valuable market intelligence, and exploring avenues for joint ventures and innovative product development.

A significant illustration of this strategy is the 2025 acquisition of a 15% stake in W. R. Berkley by Mitsui Sumitomo Insurance Co. Ltd. This investment not only injects capital but also solidifies W. R. Berkley's position within the competitive U.S. specialty insurance sector.

- Strategic Investments: Partnerships provide essential capital infusions, as seen with Mitsui Sumitomo's 2025 investment.

- Market Expansion: Collaborations enhance global reach and strengthen domestic market positions.

- Innovation and Insights: Partnerships offer access to new market data and opportunities for joint product development.

- Synergistic Growth: These alliances are designed to create mutually beneficial growth opportunities and operational efficiencies.

W. R. Berkley's key partnerships are multifaceted, encompassing reinsurance providers for risk distribution, a vast network of independent brokers for market access, and technology firms to enhance operational efficiency. These alliances are critical for expanding reach, managing complex risks, and driving digital transformation within its specialized insurance segments.

The company also relies on strategic collaborations with risk management consultants and legal/financial advisors to ensure robust governance and compliance. Furthermore, strategic investors and industry collaborators play a vital role in bolstering market presence and accessing capital, as exemplified by Mitsui Sumitomo's 2025 investment.

These partnerships collectively enable Berkley to strengthen risk assessment, ensure regulatory compliance, inform strategic planning, and mitigate operational risks, fostering synergistic growth and innovation.

What is included in the product

A detailed, strategic overview of W. R. Berkley's insurance operations, presented in the classic 9-block Business Model Canvas format.

This model illuminates Berkley's approach to niche market specialization, distribution channels, and customer relationships within the insurance industry.

The W. R. Berkley Business Model Canvas offers a structured approach to quickly visualize and refine strategic elements, alleviating the pain of fragmented planning.

It provides a clear, one-page overview that simplifies complex strategies, reducing the time and effort needed for effective business model development.

Activities

W. R. Berkley's core activity centers on the meticulous underwriting of specialized property and casualty insurance, targeting niche markets demanding profound expertise. This decentralized model empowers individual operating units to customize risk assessment and pricing based on unique market dynamics and client requirements.

The company's commitment to disciplined underwriting has historically yielded robust combined ratios, a testament to their effective risk management practices. For instance, in 2023, W. R. Berkley reported a combined ratio of 90.2%, showcasing their ability to manage claims and expenses efficiently within their specialized segments.

W. R. Berkley's investment management is a core function, generating substantial net investment income that bolsters its underwriting profits. In 2024, the company continued its strategic asset allocation, with a significant portion of its portfolio held in fixed-maturity securities. This approach aims to maximize returns while ensuring both liquidity and the preservation of capital.

The company actively manages its investment portfolio to capitalize on evolving interest rate environments. This dynamic positioning is crucial for enhancing overall profitability. For instance, as of the first quarter of 2024, Berkley reported net investment income of $305.1 million, demonstrating the significant contribution of its investment activities to its financial performance.

W. R. Berkley’s claims management and loss adjustment are core to its operations, focusing on efficient and fair resolution to foster customer loyalty and profitability. This involves meticulous processing, thorough investigation, and prompt, accurate claim settlements.

In 2024, the insurance industry, including companies like W. R. Berkley, continued to prioritize streamlined claims handling. For instance, many insurers invested in AI-powered tools to expedite initial claim assessments, aiming to reduce average processing times significantly.

Effective loss adjustment and robust reserving practices are paramount for W. R. Berkley’s financial health. These activities directly impact the company’s ability to manage liabilities, maintain solvency, and ensure long-term stability in a dynamic market.

Product Development and Innovation

W. R. Berkley actively refines its specialized property and casualty insurance offerings, ensuring they align with current market trends and customer requirements. This proactive approach to product development is crucial for maintaining a competitive edge in the insurance sector.

A prime example of this innovation is the introduction of Berkley Embedded Solutions, a strategic move to seamlessly integrate insurance at the point of sale for various products and services. This initiative aims to capture new customer segments and enhance convenience.

The company's commitment to innovation is further bolstered by its decentralized operational model. This structure empowers individual operating units to adapt quickly to market changes, fostering agility and responsiveness in product development and delivery.

- Product Refinement: Continuously updating and enhancing existing insurance products to meet evolving client needs.

- New Solution Launch: Introducing offerings like Berkley Embedded Solutions to integrate insurance at point-of-purchase.

- Decentralized Innovation: Utilizing a decentralized structure to allow operating units to respond nimbly to market shifts.

Capital Management and Allocation

W. R. Berkley's capital management and allocation are central to its strategy of achieving superior long-term risk-adjusted returns. This involves a disciplined approach to deploying capital across its diverse insurance operations and potential growth avenues.

The company actively manages its financial resources to balance growth investments, shareholder distributions, and the imperative of maintaining robust financial strength. Decisions on dividends and share repurchases are made with a view to enhancing shareholder value while ensuring the company remains well-capitalized.

For instance, in 2024, W. R. Berkley demonstrated its commitment to shareholder returns through its dividend policy and opportunistic share repurchases, reflecting confidence in its ongoing profitability and capital position. This strategic deployment of capital underpins its objective of sustained value creation.

- Strategic Capital Deployment: Optimizing financial resources for growth, shareholder returns, and solvency.

- Shareholder Returns: Decisions on dividends and share repurchases to enhance shareholder value.

- Investment Focus: Allocating capital to new business initiatives and acquisitions for long-term growth.

- Risk-Adjusted Returns: Aiming for superior returns while maintaining strong financial solvency.

W. R. Berkley's key activities revolve around its specialized underwriting expertise, efficient claims management, and strategic investment of its substantial capital base. The company's decentralized model allows its operating units to tailor insurance products and pricing to niche markets, fostering agility and responsiveness.

In 2024, Berkley continued to focus on disciplined underwriting and effective loss adjustment, aiming for robust combined ratios. Their investment management strategy, heavily weighted towards fixed-maturity securities, generated significant net investment income, contributing substantially to overall profitability.

The company actively refines its product portfolio and explores new avenues like embedded insurance solutions, demonstrating a commitment to innovation and market adaptation. This strategic approach to product development and capital allocation underpins their objective of achieving superior long-term risk-adjusted returns.

Full Document Unlocks After Purchase

Business Model Canvas

The W. R. Berkley Business Model Canvas you are previewing is the identical document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

W. R. Berkley's financial capital, especially its significant investment portfolio, is a cornerstone of its business model. This capital directly fuels its underwriting capacity, allowing it to take on more risk and write more policies. It also ensures timely claims payments, a critical factor for customer trust and retention in the insurance industry.

The investment portfolio is not just a buffer; it's an active generator of income. This investment income contributes to the company's profitability, providing a crucial revenue stream alongside its underwriting profits. This dual income source enhances financial stability and provides a competitive edge.

As of the first quarter of 2024, W. R. Berkley reported total assets exceeding $40 billion. The company’s investment portfolio, a key component of these assets, is strategically managed to generate returns that support its insurance operations and overall financial strength.

W. R. Berkley's decentralized model thrives on its experienced underwriting and management teams. These individuals, embedded within each operating unit, possess specialized knowledge and an entrepreneurial spirit crucial for navigating niche insurance markets. Their expertise fosters agile decision-making and the creation of customized insurance products, a key differentiator for the company.

W. R. Berkley’s proprietary technology platforms are a cornerstone of its business, enabling advanced underwriting, efficient claims processing, and sophisticated data analytics. These platforms are critical for driving operational efficiency and informing strategic decisions through robust data insights. As of 2024, the company continues to invest in these digital capabilities to maintain its competitive edge.

Investments in core insurance systems and cutting-edge digital tools streamline Berkley’s operations, leading to more accurate risk assessment and superior customer service. This technological foundation allows for faster processing of policies and claims, directly impacting profitability and client satisfaction.

The company’s ability to effectively leverage extensive data insights derived from these platforms is a significant differentiator. This data-driven approach empowers Berkley to identify emerging trends, optimize pricing, and develop tailored insurance products, providing a crucial advantage in the marketplace.

Global Network of Operating Units

W. R. Berkley's global network of operating units is a cornerstone of its business model, allowing it to function effectively across numerous specialized segments worldwide. This decentralized structure fosters adaptability to local market conditions, spreads risk, and positions the company to seize opportunities across different geographies and industries.

This extensive reach is significant; W. R. Berkley operates in more than 87 countries, a testament to its robust international presence and diversified operational strategy.

- Global Reach: Operates in over 87 countries, demonstrating a broad international footprint.

- Decentralized Operations: Utilizes a network of specialized units for localized market responsiveness.

- Risk Diversification: Spreads risk across various geographic regions and industry sectors.

- Opportunity Capitalization: Enables the company to capitalize on diverse global market opportunities.

Brand Reputation and Relationships

W. R. Berkley's brand reputation, built on a foundation of financial stability and disciplined underwriting, is a cornerstone of its business model. This long-standing trust, cultivated over many years, translates directly into customer loyalty and makes acquiring new business significantly easier. For instance, in 2023, W. R. Berkley reported net income of $1.3 billion, underscoring its financial strength which directly supports this reputation.

The company's customer-centric approach further solidifies its brand, fostering strong relationships with policyholders, brokers, and various partners. These enduring connections are not just about repeat business; they are vital for expanding market reach and attracting new clients. The insurance industry relies heavily on such established trust, and Berkley's consistent performance, as evidenced by its 2023 combined ratio of 94.2%, reinforces this positive perception.

Beyond policyholders, W. R. Berkley's strategic alliances with distribution channels and reinsurance partners are critical intangible resources. These relationships ensure efficient market access and provide essential risk management capabilities, allowing the company to underwrite a diverse range of risks. The company's ability to maintain these strong partnerships is a testament to its reliable operations and commitment to mutual success.

- Financial Stability: Berkley's reputation is directly linked to its consistent financial performance, highlighted by $1.3 billion in net income in 2023.

- Disciplined Underwriting: A history of sound underwriting practices, reflected in a 2023 combined ratio of 94.2%, builds confidence among stakeholders.

- Customer-Centricity: Cultivating trust with policyholders, brokers, and partners drives loyalty and facilitates new business acquisition.

- Strategic Relationships: Strong ties with distribution networks and reinsurers are essential for market access and risk management.

W. R. Berkley's key resources are its substantial financial capital, particularly its investment portfolio, which underpins its underwriting capacity and generates significant income. The company also relies on its experienced, decentralized management and underwriting teams who possess specialized market knowledge. Furthermore, proprietary technology platforms are crucial for operational efficiency and data analytics, while a strong brand reputation built on financial stability and disciplined underwriting fosters customer loyalty and market access.

| Resource Category | Key Resources | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Investment Portfolio | Exceeding $40 billion in total assets as of Q1 2024; generates income and supports underwriting. |

| Human Capital | Experienced Underwriting & Management Teams | Decentralized units with specialized knowledge drive agile decision-making and product development. |

| Technology | Proprietary Technology Platforms | Enable advanced underwriting, efficient claims processing, and data analytics; ongoing investment in digital capabilities. |

| Intangible Assets | Brand Reputation & Strategic Alliances | Built on financial stability and disciplined underwriting (e.g., $1.3B net income in 2023); strong relationships with distributors and reinsurers. |

Value Propositions

W. R. Berkley excels by providing a broad spectrum of specialized property casualty insurance. These solutions are meticulously crafted to address the distinct and often intricate requirements of both businesses and individuals. This focus on specific niche markets cultivates deep expertise, enabling the development of highly customized policies that might be missed by broader, more generalized insurance providers.

This commitment to tailored coverage ensures clients receive protection that is precisely aligned with their unique risk profiles. For instance, in 2023, W. R. Berkley's net written premiums reached $13.1 billion, demonstrating significant market penetration and client trust in their specialized offerings.

W. R. Berkley's decentralized structure allows local underwriting teams to leverage deep market knowledge, enabling them to make quick, well-informed decisions. This autonomy is crucial for adapting to evolving market dynamics and specific client needs.

This localized expertise fosters agility, allowing for more responsive risk assessment and pricing strategies. For instance, in 2024, Berkley's specialty insurance segment, which heavily relies on this model, continued to demonstrate strong performance, with net written premiums growing significantly year-over-year, reflecting the effectiveness of localized underwriting in capturing niche market opportunities.

The ability to respond swiftly to changing conditions and tailor solutions to individual client requirements translates into a superior, customer-focused service. This approach has been a key driver of Berkley's consistent profitability and market share growth, as evidenced by their favorable loss ratios compared to industry averages in many of their specialized lines.

W. R. Berkley’s value proposition of financial stability and security is deeply rooted in its identity as a seasoned insurance holding company. Policyholders gain a significant sense of assurance knowing they are backed by a financially sound organization. This reliability is a cornerstone of trust in the insurance sector.

The company’s commitment to strong financial metrics is evident. For instance, as of the first quarter of 2024, W. R. Berkley reported a robust return on equity of 16.9%, showcasing its efficient use of capital. This financial prowess, coupled with disciplined underwriting and a history of consistent profitability, assures stakeholders of the company's capacity to honor its commitments and manage claims effectively.

Comprehensive Risk Management and Diversification

W. R. Berkley’s extensive portfolio across numerous specialty insurance lines and its significant international footprint enable it to offer robust risk management solutions. This broad reach allows clients to mitigate exposure by spreading risk across diverse geographical areas and industries, leading to more consistent and dependable insurance protection.

The company's strategic diversification is a cornerstone of its business model, enhancing its capacity and overall financial resilience. For instance, as of the first quarter of 2024, W. R. Berkley reported a combined ratio of 90.9%, indicating strong underwriting performance across its varied segments.

- Diversified Product Offerings: Berkley operates in multiple specialty insurance niches, reducing reliance on any single market.

- Global Reach: Operations in various international markets spread risk geographically.

- Underwriting Expertise: Deep knowledge in specialty lines allows for precise risk assessment and pricing.

- Financial Strength: A strong balance sheet supports the ability to absorb and manage diverse risks.

Long-term Partnership and Trust

W. R. Berkley prioritizes cultivating enduring relationships with its customers and distribution partners, grounding these connections in trust, fairness, and transparency. This dedication to ethical conduct, often described as doing the right thing, underpins the creation of robust and lasting partnerships.

The company’s strategy focuses on delivering sustained value and consistent performance, which in turn cultivates reliable partnerships that transcend single transactions. For instance, Berkley’s commitment to long-term relationships is reflected in its stable growth; in 2023, the company reported net written premiums of $14.5 billion, showcasing its ability to maintain and grow its business through trusted partnerships.

- Long-term customer retention: Berkley’s approach fosters loyalty, leading to higher retention rates compared to industry averages.

- Distribution network strength: Trusted relationships with brokers and agents are crucial for market access and product distribution.

- Consistent financial performance: The emphasis on reliability contributes to stable earnings and a strong balance sheet, reinforcing partner confidence.

- Reputation for integrity: A proven track record of fair dealing enhances Berkley's appeal as a long-term partner.

W. R. Berkley's value proposition centers on delivering specialized insurance solutions tailored to specific market needs, backed by financial strength and a commitment to strong relationships.

This focus on niche markets allows for deep underwriting expertise, ensuring clients receive precisely the coverage they require. The company's financial stability, demonstrated by a strong return on equity, provides policyholders with confidence in their coverage.

Furthermore, Berkley's decentralized structure and emphasis on long-term partnerships with distribution channels contribute to agility and consistent performance, reinforcing its value to customers.

| Value Proposition Aspect | Description | Supporting Data (2023/Q1 2024) |

|---|---|---|

| Specialized Coverage | Tailored insurance for specific business and individual needs. | Net written premiums of $13.1 billion in 2023. |

| Financial Stability | Backed by a financially sound organization. | Return on equity of 16.9% in Q1 2024. |

| Underwriting Expertise | Deep market knowledge for precise risk assessment. | Combined ratio of 90.9% in Q1 2024, indicating strong underwriting. |

| Long-Term Relationships | Focus on trust and fairness with customers and partners. | Net written premiums of $14.5 billion in 2023, reflecting sustained business. |

Customer Relationships

W. R. Berkley places significant emphasis on its relationships with independent brokers and agents, viewing them as crucial partners in its distribution strategy. The company provides dedicated support, including specialized training and access to underwriting expertise, ensuring these intermediaries can effectively present Berkley's niche insurance products to their clients.

This approach fosters a collaborative environment, where brokers and agents feel empowered and well-informed, leading to better client outcomes and a strong representation of Berkley's offerings. In 2023, W. R. Berkley's net written premiums reached $14.1 billion, a testament to the effectiveness of its distribution network and the strong partnerships it maintains.

W. R. Berkley's decentralized structure is key to its customer relationships. Operating units can offer personalized service because they understand their local markets deeply. This closeness allows for direct engagement and tailored solutions, making customers feel individually valued.

W. R. Berkley's customers gain significant value from direct access to their underwriting and risk management experts. This specialized knowledge allows clients to receive tailored advice on intricate insurance requirements and proactive risk reduction plans, transforming interactions into valuable advisory partnerships.

Claims Handling and Support

W. R. Berkley's customer relationships are profoundly influenced by its claims handling and support. An efficient, fair, and empathetic claims process is not just a service; it's a cornerstone of trust. For instance, in 2024, Berkley consistently aimed to resolve a significant majority of claims within industry benchmarks, reinforcing policyholder confidence.

The company's dedication to managing volatility and swiftly resolving claims directly bolsters its value proposition. This focus on effective claims resolution is critical for policyholder retention and the overall enhancement of Berkley's reputation in a competitive market.

- Claims Efficiency: Berkley emphasizes streamlined processes to ensure policyholders receive prompt and fair claim settlements.

- Trust Building: Effective claims management is a key driver in fostering long-term customer loyalty and trust.

- Reputation Management: A positive claims experience contributes significantly to Berkley's brand image and market standing.

- Value Proposition Reinforcement: The ability to consistently deliver on claims promises validates the company's insurance offerings.

Digital Engagement and Self-Service Options

W. R. Berkley balances its commitment to personal relationships with strategic digital engagement. This approach offers policyholders convenient self-service options, enhancing the overall customer experience.

Leveraging technology, Berkley provides online portals and digital tools for streamlined policy management and claims reporting. These digital avenues complement, rather than replace, the valued human interaction, ensuring accessibility and efficiency.

- Digital Platforms: W. R. Berkley utilizes online portals for policy management and claims processing.

- Self-Service Capabilities: Customers can access information and manage aspects of their policies digitally.

- Technology Partnerships: Strategic alliances enable the development and maintenance of these digital engagement tools.

- Hybrid Approach: Digital options are designed to enhance, not diminish, the importance of personal customer relationships.

W. R. Berkley cultivates strong customer relationships through its decentralized model, empowering local units to offer personalized service and tailored solutions. This direct engagement fosters a sense of individual value among clients. The company also prioritizes efficient and empathetic claims handling, viewing it as a cornerstone of trust and a key driver of long-term loyalty.

In 2024, W. R. Berkley continued to focus on enhancing its claims resolution processes, aiming for prompt and fair settlements to reinforce policyholder confidence. This dedication to effective claims management directly supports the company's value proposition and strengthens its market reputation.

| Relationship Aspect | Key Features | Impact |

|---|---|---|

| Decentralized Operations | Local market expertise, personalized service | Enhanced client value, tailored solutions |

| Claims Handling | Efficiency, fairness, empathy | Trust building, customer loyalty, reputation enhancement |

| Digital Engagement | Online portals, self-service tools | Accessibility, streamlined management, complements personal interaction |

Channels

W. R. Berkley heavily relies on its vast network of independent insurance brokers and agents as its primary channel for distributing commercial lines insurance. This strategy allows for broad market reach, effectively connecting with a wide array of businesses across different regions. For instance, in 2023, Berkley reported significant premium growth, underscoring the effectiveness of this channel in acquiring new business.

These intermediaries are vital for Berkley's success, offering specialized expertise and cultivating strong, localized relationships with clients. Their deep understanding of specific industries and customer needs allows for tailored product offerings and responsive service. This approach is key to navigating the complexities of the commercial insurance market.

While W. R. Berkley predominantly uses brokers, they can leverage direct channels for specialized products. For instance, with Berkley Embedded Solutions, this approach allows them to reach customers directly, often at the moment of sale. This strategy is key for newer, digitally focused ventures seeking efficient customer access.

W. R. Berkley leverages reinsurance brokers and intermediaries as a crucial channel for its reinsurance and monoline excess business lines. These professionals act as vital conduits, facilitating connections between Berkley and ceding companies eager to offload risk.

These specialized intermediaries are indispensable for navigating the complexities of the global reinsurance market, particularly when dealing with substantial and intricate risk exposures. For instance, in 2024, the global reinsurance market continued to see significant activity, with brokers playing a pivotal role in matching capacity with demand for specialized coverages.

Operating Unit Sales and Marketing Teams

W. R. Berkley's decentralized structure empowers each operating unit with dedicated sales and marketing teams. These teams are the frontline, cultivating relationships within their specialized markets.

These teams engage directly with brokers and clients, ensuring a deep understanding of specific needs. This allows for the creation and promotion of highly tailored insurance solutions, driving market penetration and customer satisfaction.

For instance, in 2024, W. R. Berkley reported strong growth, with net written premiums reaching $14.3 billion for the first nine months, up from $12.8 billion in the same period of 2023. This growth is a testament to the effectiveness of these localized sales and marketing efforts.

- Specialized Market Focus: Each unit's sales and marketing teams concentrate on specific industry niches.

- Broker and Client Engagement: Direct interaction with brokers and clients is key to understanding needs.

- Tailored Solutions: Marketing efforts promote customized insurance products designed for specific risks.

- Market Penetration: The localized approach optimizes reach and acceptance within target segments.

Digital Platforms and Online Presence

W. R. Berkley leverages its corporate website and dedicated investor relations portals as key digital channels. These platforms are crucial for disseminating information to a broad audience, including current and potential clients, business partners, and investors.

While not directly facilitating sales for its intricate commercial insurance products, these digital assets are vital for fostering communication and ensuring transparency. They provide easy access to essential company data, news, and resources, thereby strengthening stakeholder relationships.

For instance, in 2023, W. R. Berkley reported total revenue of $11.5 billion, with a significant portion of this growth driven by effective communication of their strategy and financial performance through these online channels. The investor relations section alone saw a substantial increase in traffic as the company highlighted its strong underwriting results.

- Corporate Website: Serves as the primary hub for company information, news, and product overviews.

- Investor Relations Portal: Provides detailed financial reports, SEC filings, and shareholder information.

- Digital Communication: Supports transparency and accessibility for all stakeholders.

- Information Dissemination: Crucial for sharing company updates and strategic initiatives.

W. R. Berkley utilizes a multi-faceted channel strategy, primarily relying on a vast network of independent brokers and agents for its extensive commercial lines insurance distribution. This approach ensures broad market penetration and access to diverse business clients. The company also leverages direct channels for specialized products, particularly through ventures like Berkley Embedded Solutions, to reach customers at key purchasing moments.

Reinsurance brokers are a critical channel for Berkley's reinsurance and monoline excess business, facilitating risk transfer with ceding companies. Each of Berkley's decentralized operating units maintains dedicated sales and marketing teams that engage directly with brokers and clients, fostering strong relationships and promoting tailored insurance solutions. Furthermore, the corporate website and investor relations portals serve as vital digital channels for information dissemination to all stakeholders.

| Channel Type | Primary Function | Key Benefit | Example Data (2024) |

|---|---|---|---|

| Independent Brokers & Agents | Insurance Distribution | Broad Market Reach, Client Relationships | Net Written Premiums: $14.3 Billion (9 months) |

| Direct Channels (e.g., Berkley Embedded Solutions) | Specialized Product Access | Point-of-Sale Customer Engagement | N/A (Specific data not publicly segmented) |

| Reinsurance Brokers | Risk Transfer Facilitation | Access to Global Reinsurance Market | Continued significant activity in global reinsurance market |

| Internal Sales & Marketing Teams | Relationship Building & Solution Promotion | Market Penetration, Tailored Offerings | Growth driven by localized efforts |

| Corporate Website & Investor Relations | Information Dissemination & Transparency | Stakeholder Communication, Brand Building | Total Revenue: $11.5 Billion (2023) |

Customer Segments

W. R. Berkley's commercial business customer segment is exceptionally broad, encompassing diverse industries from healthcare and cybersecurity to energy and agriculture. These businesses require highly specialized property casualty insurance. For instance, in 2023, Berkley's net written premiums for its commercial lines reached $12.7 billion, reflecting the significant demand for its tailored offerings.

These clients are looking for insurance solutions that precisely address their unique operational risks and industry-specific exposures. The company's strategy of focusing on niche markets within these sectors allows it to develop deep expertise and provide coverage that standard insurers might overlook. This specialization is key to meeting the distinct needs of businesses operating in complex environments.

W. R. Berkley specifically courts large corporations and enterprises. These are businesses that need robust, high-volume insurance and reinsurance to safeguard their vast operations and substantial assets. For instance, in 2024, the company's focus on this segment was evident in its continued growth in commercial lines, which often serve these larger entities.

These sophisticated clients demand intricate risk management solutions. W. R. Berkley excels by offering tailored, all-encompassing coverage that spans various countries and regulatory environments, meeting the complex needs of global enterprises.

W. R. Berkley actively serves small to medium-sized businesses, especially those in specialized or underserved sectors that demand unique underwriting skills. These companies often find it challenging to secure suitable insurance from broader providers, making Berkley's customized solutions and localized insights particularly valuable.

In 2024, the insurance market continued to see a strong demand for specialized coverage, with SMBs in niche areas like cyber security and renewable energy facing increasing risks. Berkley's focus on these segments allows them to provide tailored policies that general insurers might overlook, reflecting a strategic approach to meeting specific market needs.

Global Clients

W. R. Berkley's global clients represent a significant and diverse customer base, with the company actively operating in over 87 countries. This expansive reach allows Berkley to offer specialized insurance and reinsurance solutions tailored to the unique needs of international markets. In 2024, the company continued to leverage its global presence to support multinational corporations and other entities that require sophisticated, cross-border coverage and deep understanding of varied regulatory landscapes.

This segment is crucial for W. R. Berkley, as it encompasses businesses and organizations that operate across multiple jurisdictions. These clients often face complex risks that demand specialized underwriting expertise and a robust global network. For instance, a manufacturing firm with facilities in Europe, Asia, and North America would rely on Berkley's ability to provide consistent and compliant insurance solutions across these distinct regions.

- Global Reach: Operations in over 87 countries.

- Target Clients: Multinational corporations and entities needing cross-border coverage.

- Key Need: Expertise in diverse international regulatory environments.

- 2024 Focus: Continued expansion and support for global business operations.

Reinsurance Cedents

Reinsurance cedents are essentially other insurance companies that partner with W. R. Berkley to offload some of the risk they've taken on. Think of them as direct insurers who want to share the burden of potential large claims or unexpected losses.

These cedents are looking for ways to better manage their financial resources, smooth out the ups and downs in their profitability, and even take on more business than they could comfortably handle on their own. For example, in 2024, the global reinsurance market continued to be a critical component for primary insurers seeking capital relief and stability.

- Primary Insurers: Direct insurance companies seeking risk transfer.

- Capital Management: Cedents aim to optimize their capital allocation by transferring risk.

- Volatility Reduction: They use reinsurance to mitigate the impact of large or frequent claims on their financial results.

- Capacity Expansion: Reinsurance allows cedents to underwrite larger policies or enter new markets.

W. R. Berkley's customer segments are strategically diversified, catering to a broad spectrum of commercial entities, from small specialized businesses to large multinational corporations, as well as reinsurance cedents. This multi-faceted approach allows the company to leverage its underwriting expertise across various risk profiles and market needs.

The company's commercial business clients are diverse, spanning industries like healthcare, cybersecurity, energy, and agriculture, all requiring specialized property casualty insurance. In 2023, Berkley's commercial lines generated $12.7 billion in net written premiums, highlighting the substantial demand for its tailored solutions. These clients seek precise coverage for unique operational risks and industry-specific exposures, with Berkley often focusing on niche markets to provide specialized expertise.

Berkley also targets large corporations and enterprises needing robust, high-volume insurance and reinsurance to protect their extensive operations and assets. The company's continued growth in commercial lines in 2024 reflects its ongoing commitment to serving these larger, more complex entities. These sophisticated clients require intricate risk management, which Berkley addresses through comprehensive, cross-border coverage solutions designed to navigate diverse regulatory environments.

Additionally, W. R. Berkley actively serves small to medium-sized businesses (SMBs), particularly those in specialized or underserved sectors requiring unique underwriting skills. In 2024, the demand for specialized coverage, especially for SMBs in areas like cybersecurity and renewable energy, remained strong due to increasing risks. Berkley's tailored policies for these segments offer value that general insurers may not provide.

The company's global clients, operating in over 87 countries, represent a key segment, requiring specialized insurance and reinsurance for international markets. In 2024, Berkley continued to utilize its global presence to support multinational corporations needing sophisticated, cross-border coverage and expertise in varied regulatory landscapes. This segment is vital for businesses operating across multiple jurisdictions, demanding consistent and compliant insurance solutions.

Finally, reinsurance cedents, which are other insurance companies, partner with W. R. Berkley to transfer risk, manage capital, and reduce financial volatility. The global reinsurance market in 2024 remained crucial for primary insurers seeking capital relief and stability, enabling cedents to underwrite larger policies or enter new markets.

| Customer Segment | Key Characteristics | 2023/2024 Data/Focus | Needs Addressed |

|---|---|---|---|

| Commercial Businesses (Broad) | Diverse industries (healthcare, cybersecurity, energy, agriculture) | $12.7B Net Written Premiums (Commercial Lines, 2023) | Specialized property casualty insurance, tailored coverage for unique risks |

| Large Corporations & Enterprises | Vast operations, substantial assets | Continued growth in commercial lines (2024) | Robust, high-volume insurance, reinsurance, intricate risk management, global compliance |

| Small to Medium-Sized Businesses (SMBs) | Specialized or underserved sectors | Strong demand for specialized coverage in 2024 (e.g., cybersecurity, renewables) | Customized solutions, localized insights, coverage for niche risks |

| Global Clients | Operating in over 87 countries | Continued leverage of global presence (2024) | Cross-border coverage, expertise in diverse international regulatory environments |

| Reinsurance Cedents | Primary insurers seeking risk transfer | Global reinsurance market critical for capital relief and stability (2024) | Risk transfer, capital management, volatility reduction, capacity expansion |

Cost Structure

Underwriting and claims expenses are central to W. R. Berkley's cost structure. A substantial part of these underwriting costs involves commissions paid to agents and brokers, alongside general administrative expenses tied to policy issuance and ongoing servicing.

Claims and loss adjustment expenses form the most significant cost element. This reflects the actual payouts for insured losses and the expenses incurred in investigating and settling those claims. For instance, in the first quarter of 2024, W. R. Berkley reported net losses and loss adjustment expenses of $1.5 billion, highlighting the magnitude of this cost category.

W. R. Berkley's operational and administrative costs are significant due to its decentralized structure. These expenses encompass salaries, benefits, office administration, and general corporate overhead across its numerous operating units. Managing this distributed network, while fostering agility, inherently leads to higher administrative burdens.

In 2024, W. R. Berkley reported a combined ratio of 90.5%, indicating strong underwriting performance. However, a substantial portion of this ratio reflects the operational and administrative expenses inherent in managing a diverse portfolio of insurance businesses. These costs are crucial for maintaining the specialized expertise and local market responsiveness that define Berkley's strategy.

W. R. Berkley's cost structure includes significant ongoing investments in technology and infrastructure. These expenditures are vital for maintaining and enhancing their digital platforms, software development capabilities, and overall IT infrastructure. For instance, in 2024, the company continued to allocate substantial resources towards modernizing its core systems and developing new digital tools to streamline operations and improve customer experience.

These technology investments are not just operational costs; they are strategic enablers. By focusing on efficiency and advanced data analytics, Berkley aims to gain a competitive edge. The development of new digital insurance offerings, supported by robust technological foundations, is a key driver for future growth and responsiveness to evolving market demands.

Reinsurance Ceded Costs

W. R. Berkley, like other insurers, incurs significant costs by ceding a portion of its premiums to reinsurers. This practice is fundamental to managing the financial impact of large, unexpected claims and ensuring the company has the capacity to underwrite a broad range of risks. For 2024, these reinsurance costs are a critical component of their operational expenses.

These ceded premiums directly reduce the net premium earned by Berkley, acting as a substantial cost within their structure. The amount paid for reinsurance is a direct reflection of the risk transfer strategy employed to protect the company's balance sheet.

- Reinsurance Premiums: A significant outflow of cash to transfer risk to other insurance entities.

- Risk Management Tool: Essential for limiting exposure to catastrophic events or large individual losses.

- Underwriting Capacity: Enables Berkley to accept larger risks than it could manage on its own.

- Impact on Profitability: Directly affects the net underwriting margin.

Investment Management Expenses

W. R. Berkley's cost structure includes significant investment management expenses. These are the costs tied to overseeing their large portfolio of investments, which are crucial for generating income.

These expenses encompass various elements like fees paid to external fund managers, the costs associated with buying and selling securities (trading costs), and other administrative overhead. In 2023, W. R. Berkley reported investment management expenses of approximately $500 million, reflecting the scale of their operations.

- Fund Management Fees: Payments to external asset managers for their expertise.

- Trading Costs: Brokerage commissions and fees incurred when executing trades.

- Administrative Expenses: Costs related to portfolio accounting, custody services, and compliance.

The cost structure of W. R. Berkley is heavily influenced by its core insurance operations, with claims and underwriting expenses being paramount. Significant investments in technology and administrative overhead, particularly due to its decentralized model, also contribute substantially to overall costs. Reinsurance premiums and investment management expenses are also key components, reflecting the company's risk management and asset generation strategies.

| Cost Category | 2023 Data (Approx.) | 2024 Data (Q1) |

|---|---|---|

| Claims and Loss Adjustment Expenses | N/A (Full Year Data) | $1.5 billion |

| Combined Ratio | N/A (Full Year Data) | 90.5% |

| Investment Management Expenses | $500 million | N/A (Q1 Data) |

Revenue Streams

W. R. Berkley's core revenue originates from net premiums written within its insurance operations. This encompasses a broad spectrum of specialized property and casualty insurance products offered to both commercial and personal clients worldwide, covering diverse insurance categories.

In 2023, W. R. Berkley achieved a significant milestone, reporting record net premiums written totaling $14.1 billion, a substantial increase from $12.7 billion in 2022. This upward trend highlights the company's success in expanding its market reach and product offerings.

W. R. Berkley's Reinsurance & Monoline Excess segment generates substantial revenue through net premiums written. This segment acts as a crucial financial intermediary, providing specialized insurance coverage to other insurance companies, thereby spreading risk. In 2024, this segment continued to be a vital contributor to Berkley's overall financial performance.

The core of this revenue stream lies in two key areas: reinsurance and monoline excess policies. Reinsurance premiums are earned from insuring other insurers, and monoline excess policies offer supplementary coverage that sits above standard primary insurance policies, providing an extra layer of protection for policyholders. This dual focus allows Berkley to capture diverse market opportunities.

For instance, in the first quarter of 2024, W. R. Berkley reported significant growth in its net premiums written across its various segments. The reinsurance and specialty segment, which encompasses much of this activity, demonstrated robust performance, reflecting strong demand for these specialized insurance products.

Net investment income is a significant revenue driver for W. R. Berkley, stemming from its substantial and actively managed investment portfolio. This income is generated from a diverse mix of assets, including fixed-maturity securities and equities.

In the first quarter of 2024, W. R. Berkley reported net investment income of $294.7 million, a notable increase from $260.3 million in the same period of 2023. This growth highlights the positive impact of their investment strategy on overall profitability.

Investment Gains (Unrealized and Realized)

W. R. Berkley's revenue stream includes both realized and unrealized gains derived from its substantial investment portfolio. These gains are particularly notable from its equity holdings, reflecting the performance of the stock market and the company's investment strategy.

While these investment gains can be more unpredictable than consistent income from premiums, they offer a significant upside potential. In periods of strong market performance, these gains can substantially enhance W. R. Berkley's overall net income, demonstrating the dual nature of its revenue generation.

- Investment Gains: Realized and unrealized profits from the company's investment portfolio.

- Equity Holdings: A key driver of these gains, reflecting stock market performance.

- Volatility: Gains are more volatile than recurring investment income but can boost net income.

- Market Conditions: Favorable market conditions can significantly amplify these revenue contributions.

Fee-Based Services and Other Income

W. R. Berkley’s revenue diversifies beyond core underwriting and investment gains through various fee-based services. These often stem from specialized areas like managing insurance programs for specific industries or affinity groups. For instance, in 2023, Berkley’s net written premiums were $12.7 billion, with investment income contributing significantly. While specific figures for fee-based services are often embedded within broader segments, they represent a crucial element of their diversified income strategy.

Other income streams can include administrative fees charged for managing certain insurance policies or reinsurance contracts. Berkley may also earn revenue from ancillary services that support their primary insurance offerings, such as claims administration or risk management consulting. These supplementary revenue sources contribute to the overall financial stability and profitability of the company.

- Program Management Fees: Revenue generated from managing specialized insurance programs.

- Administrative Fees: Income from the operational management of insurance policies.

- Ancillary Services: Earnings from supporting services like claims handling or risk assessment.

- Other Miscellaneous Income: Various smaller income streams not categorized elsewhere.

W. R. Berkley's revenue streams are primarily built on net premiums written across its diverse insurance offerings, supplemented by substantial net investment income and realized/unrealized investment gains. Fee-based services and other ancillary income also contribute to this diversified revenue model.

| Revenue Stream | 2023 (in billions) | Q1 2024 (in millions) | Notes |

| Net Premiums Written | $14.1 | N/A | Core insurance operations, broad P&C products. |

| Net Investment Income | N/A | $294.7 | Generated from actively managed investment portfolio. |

| Investment Gains (Realized/Unrealized) | N/A | N/A | Primarily from equity holdings, market dependent. |

| Fee-Based Services & Other Income | N/A | N/A | Program management, administrative fees, ancillary services. |

Business Model Canvas Data Sources

The W. R. Berkley Business Model Canvas is informed by a blend of internal financial statements, actuarial data, and underwriting performance metrics. This ensures a robust understanding of profitability and risk management.