W. R. Berkley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. R. Berkley Bundle

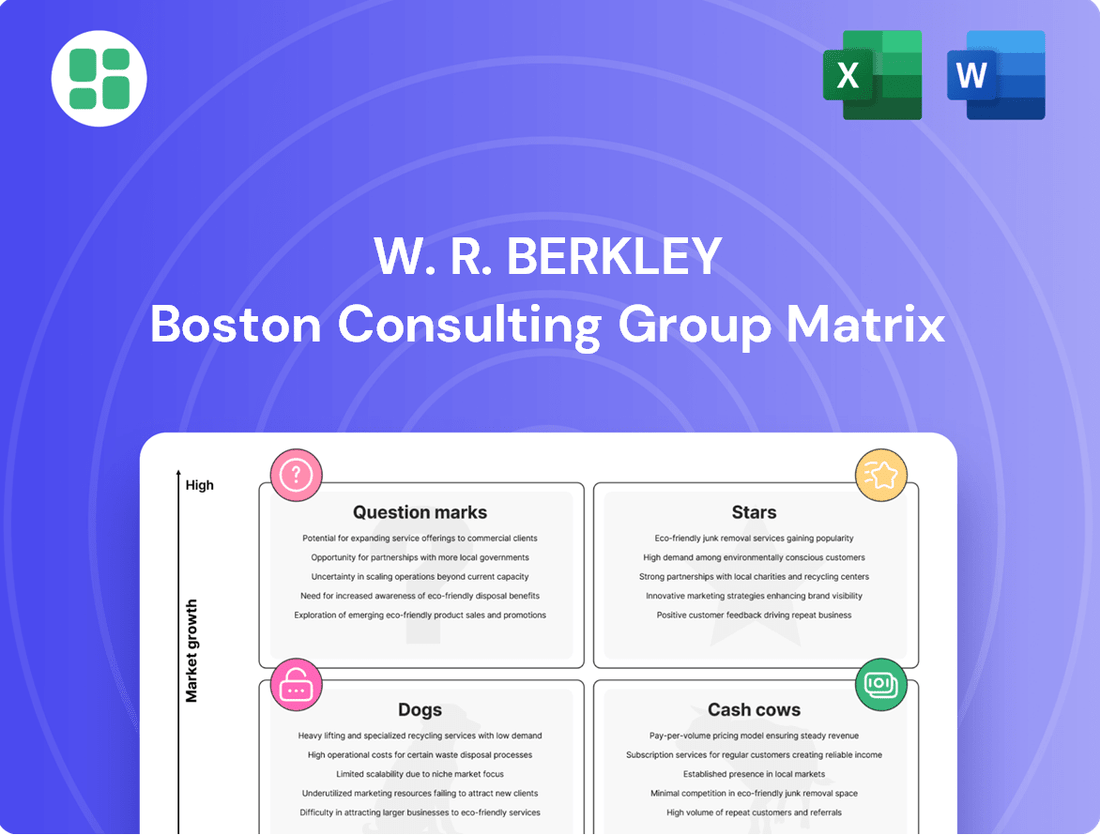

Curious about W. R. Berkley's strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their resources are best allocated and where future growth lies.

Don't settle for a partial view. Purchase the full BCG Matrix report for a comprehensive breakdown of each product's performance, complete with data-driven insights and actionable strategies to optimize W. R. Berkley's market approach.

Stars

W. R. Berkley's specialty commercial property lines are positioned as Stars within its BCG portfolio. This classification stems from the company's strategic emphasis on offering tailored property casualty insurance solutions in niche markets. These specialized segments are experiencing significant expansion, a trend expected to continue through 2029.

The global specialty insurance market is a key driver for this Star classification, with robust growth anticipated. Projections indicate a compound annual growth rate exceeding 10% from 2024 to 2029, significantly outperforming more generalized insurance offerings. This rapid market expansion provides fertile ground for Berkley's specialized products.

Berkley's success in these specialty commercial property lines is further bolstered by its disciplined underwriting approach. This focus allows the company to secure a substantial market share within these rapidly growing, high-potential niches. The ability to effectively underwrite risk in specialized areas is crucial for capitalizing on this market dynamism.

W. R. Berkley's Excess & Surplus (E&S) casualty business is a cornerstone of its commercial lines, designed to handle risks that standard insurers typically avoid due to their complexity or uniqueness. This segment is crucial for Berkley, allowing it to capitalize on specialized underwriting expertise and offer bespoke coverage solutions.

The E&S market, by its nature, is dynamic and often commands higher premiums, reflecting the specialized risk assessment and capacity provided. For Berkley, this segment is a significant growth engine, aligning perfectly with its decentralized operational model that fosters deep market knowledge and agility.

In 2024, the E&S market continued its robust expansion, with industry-wide direct written premiums projected to reach new highs, driven by increasing demand for specialized coverage. Berkley's strategic focus on this area positions it to benefit substantially from these market trends, reinforcing its status as a premier commercial lines writer.

W. R. Berkley's International Reinsurance operations, particularly Berkley Re UK Limited, are making significant strides in the UK and European markets. These regions are currently experiencing robust growth in the reinsurance sector, making them prime targets for expansion.

The company's commitment is underscored by recent leadership appointments, signaling a strategic push to increase its market share. This focus on international growth in a burgeoning market positions these reinsurance units as vital contributors to Berkley's overall portfolio.

Marine, Aviation & Transport (MAT) Insurance

Marine, Aviation & Transport (MAT) insurance is a substantial segment within specialty insurance, commanding 45.4% of the market's premiums in 2024. This sector is expected to maintain its rate firmness through 2025, indicating a robust and stable niche.

W. R. Berkley's strong presence in MAT insurance positions it favorably to capitalize on this segment's growth. Factors like strengthening global trade and supply chain adjustments are increasing insured values, further bolstering the market.

- Market Share: MAT policies accounted for 45.4% of specialty insurance premiums in 2024.

- Rate Firmness: The segment is projected to sustain rate increases into 2025.

- Growth Drivers: Expanding global trade and supply chain realignments are increasing insured values.

- Berkley's Position: A strong market position in MAT insurance offers significant growth potential.

Umbrella & Excess Liability

Umbrella and excess liability are seen as a prime growth area by industry strategists in the specialty insurance market. This surge is fueled by escalating litigation and a growing demand for higher coverage limits. W. R. Berkley's established expertise in commercial lines underwriting positions it favorably to capture a larger share of this expanding market.

The potential for this segment to become a future Cash Cow for W. R. Berkley is significant. In 2024, the commercial umbrella and excess liability market demonstrated robust growth, with premium volume increasing by an estimated 8-10% year-over-year, reflecting the increasing need for substantial protection against large claims.

- Growth Driver: Increasing frequency and severity of liability claims.

- Market Position: W. R. Berkley's underwriting acumen in commercial insurance.

- Financial Outlook: Potential to evolve into a Cash Cow.

- 2024 Data: Commercial umbrella and excess liability premiums saw an estimated 8-10% growth.

W. R. Berkley's specialty commercial property lines, including Marine, Aviation & Transport (MAT), are classified as Stars. The MAT segment alone represented 45.4% of specialty insurance premiums in 2024, with rates expected to remain firm into 2025. This growth is driven by factors like increased global trade, which boosts insured values.

The company's Excess & Surplus (E&S) casualty business also shines as a Star. The E&S market saw robust expansion in 2024, with industry-wide direct written premiums reaching new peaks due to demand for specialized coverage. Berkley's decentralized model and underwriting expertise allow it to capitalize on this dynamic market.

Umbrella and excess liability are also strong contenders, showing significant growth in 2024 with premium volume up an estimated 8-10%. This upward trend, fueled by increasing litigation and higher coverage demands, positions these lines for future Cash Cow status within Berkley's portfolio.

| Business Line | BCG Category | Key Growth Drivers | 2024 Data/Outlook |

|---|---|---|---|

| Specialty Commercial Property (MAT) | Star | Global trade, supply chain adjustments | 45.4% of specialty premiums in 2024; rate firmness into 2025 |

| Excess & Surplus (E&S) Casualty | Star | Demand for specialized coverage | Robust market expansion; record direct written premiums |

| Umbrella & Excess Liability | Star (potential Cash Cow) | Increasing litigation, higher coverage limits | 8-10% premium volume growth in 2024 |

What is included in the product

Highlights which units to invest in, hold, or divest.

Clear visualization of W. R. Berkley's business units, simplifying strategic resource allocation.

Cash Cows

Workers' compensation insurance typically operates as a mature and stable segment within the commercial insurance market, particularly for established insurers like W. R. Berkley. While overall commercial insurance rates have seen increases, workers' compensation itself often exhibits lower growth.

Despite slower rate growth, W. R. Berkley's extensive and long-standing presence in this line of business translates into a substantial and dependable stream of premium income. This segment is a reliable generator of cash flow, requiring minimal additional investment in marketing or distribution to maintain its position.

W. R. Berkley's traditional commercial property insurance lines operate as cash cows within their portfolio. Despite occasional market fluctuations, the company's rigorous underwriting standards and significant operational scale ensure these established portfolios consistently deliver robust cash flows. In 2024, this segment continued to be a bedrock of financial stability for the company.

W. R. Berkley's fixed-maturity portfolio is a powerhouse, generating substantial net investment income. This segment is a critical Cash Cow, consistently contributing to the company's profitability. In 2024, the net investment income saw robust growth, and this trend continued into Q1 2025, largely fueled by favorable new money rates, demonstrating the portfolio's strength.

Fidelity & Surety Bonds

Fidelity and surety bonds are considered established products for W. R. Berkley, functioning as cash cows within their business portfolio. These specialized insurance lines are characterized by predictable claims and consistent market demand, allowing for stable premium generation.

For W. R. Berkley, these mature segments contribute significantly to operating cash flow. This is largely due to their low need for growth-oriented investments, as the market for these products is relatively stable. For instance, in 2024, W. R. Berkley's surety segment demonstrated resilience, with gross written premiums in surety increasing by 10.1% to $1.07 billion in the first nine months of the year compared to the same period in 2023.

- Stable Premium Generation: Fidelity and surety bonds provide a reliable source of income.

- Predictable Loss Patterns: Experienced underwriting leads to manageable claims.

- Low Growth Investment Needs: Mature markets require less capital for expansion.

- Strong Cash Flow Contribution: These lines bolster overall financial stability.

Established Program Management Business

W. R. Berkley's reclassification of its program management business to the Reinsurance & Monoline Excess segment signals a mature and deeply integrated operation. This strategic move highlights the business's consistent performance and its established role within the company's broader structure.

These established programs are likely generating a predictable and consistent stream of premiums and fees. Their stable revenue generation contributes significantly to W. R. Berkley's overall financial health, positioning them as reliable cash cows.

- Mature Operations: The move to Reinsurance & Monoline Excess indicates a business that is no longer in a growth phase but is a stable contributor.

- Steady Revenue: Established programs typically benefit from long-term contracts and customer loyalty, ensuring consistent premium income.

- Fee Generation: Program managers often earn fees for underwriting, claims handling, and other administrative services, adding to the predictable revenue stream.

- Financial Stability: Their consistent contribution makes them a dependable source of cash flow, supporting other business initiatives or shareholder returns.

W. R. Berkley's traditional commercial property insurance lines are prime examples of cash cows. These segments, characterized by their maturity and stability, consistently generate substantial premium income with minimal need for reinvestment. In 2024, these established portfolios continued to be a bedrock of financial stability, demonstrating the company's strength in core insurance markets.

| Segment | BCG Category | 2024 Performance Indicator | Notes |

| Commercial Property Insurance | Cash Cow | Consistent Premium Income | Rigorous underwriting and operational scale ensure robust cash flows. |

| Fixed-Maturity Portfolio | Cash Cow | Strong Net Investment Income | Favorable new money rates fueled growth into Q1 2025. |

| Fidelity & Surety Bonds | Cash Cow | Stable Premium Generation | Predictable claims and consistent market demand support reliable income. |

What You’re Viewing Is Included

W. R. Berkley BCG Matrix

The W. R. Berkley BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means you get the full, unwatermarked analysis, ready for immediate strategic application. The preview accurately represents the polished, professional report designed to offer clear insights into W. R. Berkley's business portfolio. You can be confident that the downloaded file will be identical to this preview, providing you with the actionable data you need for informed decision-making.

Dogs

The commercial auto insurance sector is a challenging space, largely unprofitable for the industry. This is primarily due to high direct incurred loss ratios, meaning more money is paid out in claims than is brought in through premiums. For W. R. Berkley, if their presence in this segment doesn't show exceptional underwriting results, it could be classified as a Dog in the BCG Matrix.

A Dog in the BCG Matrix represents a business or product line with low market share and low growth potential. In the context of commercial auto insurance, this means it might be consuming cash without generating substantial returns for W. R. Berkley. The industry's ongoing struggles with profitability, as evidenced by persistent high loss ratios, underscore this risk.

Turning around an underperforming segment like commercial auto insurance often demands significant investment in expensive turnaround plans. These plans carry uncertain outcomes, making it a difficult area to manage. For instance, industry-wide loss ratios in commercial auto have been a persistent concern, with some reports indicating combined ratios exceeding 100% in recent years, signaling an unprofitable underwriting environment.

Highly commoditized general liability programs at W. R. Berkley would be categorized as Dogs. These are products that lack significant differentiation and face heavy price competition, making it hard to achieve healthy profit margins. For instance, in 2024, the general liability market saw an average rate increase of only 2.5%, indicating intense competition and limited pricing power for insurers offering undifferentiated products.

Certain legacy casualty reinsurance treaties within W. R. Berkley's Reinsurance & Monoline Excess segment are likely considered 'Dogs' in the BCG Matrix. This is due to a persistently competitive pricing environment in the casualty reinsurance market, which has historically pressured growth in this particular area of their operations.

These older, less advantageous treaty agreements are likely generating subdued returns and exhibiting limited potential for expansion. For instance, in 2024, the casualty reinsurance market continued to grapple with intense competition, impacting premium growth for many participants.

Consequently, these underperforming treaties might be candidates for strategic review, potentially leading to divestiture or a run-off strategy if they consistently fail to meet performance benchmarks.

Outdated Professional Liability Offerings

W. R. Berkley's professional liability offerings might be facing challenges in today's dynamic insurance landscape. The professional liability and cyber insurance markets are intensely competitive, with new threats emerging constantly. If Berkley's products haven't kept pace with evolving cyber risks or aren't priced competitively, they could be considered underperforming assets within their portfolio.

This stagnation can lead to a downward spiral. Offerings that fail to meet current market demands, particularly regarding robust cyber coverage and attractive pricing, risk losing market share. Consequently, profitability for these specific product lines could decline significantly. For instance, in 2024, the cyber insurance market saw a substantial increase in claims related to ransomware and data breaches, making outdated coverage inadequate.

- Competitive Pressure: The professional liability market is highly competitive, with insurers constantly innovating their products and pricing.

- Cyber Threat Evolution: Failure to adapt professional liability policies to cover new and emerging cyber threats, such as sophisticated phishing attacks and supply chain vulnerabilities, can render them obsolete.

- Pricing Disadvantage: If Berkley's professional liability products are not competitively priced against newer, more comprehensive offerings, they will naturally lose appeal to customers seeking better value.

- Market Share Erosion: In 2023, the global professional liability insurance market was valued at approximately $20 billion, a figure expected to grow. Companies with outdated offerings risk seeing their slice of this growing pie shrink.

Non-strategic, Geographically Limited Operations

W. R. Berkley's decentralized approach, while often a strength, can lead to non-strategic, geographically limited operations. These are units where the company doesn't possess substantial scale or a clear competitive edge, and the local market itself is experiencing very little growth. For instance, a small underwriting operation in a niche international market with limited potential for expansion might fall into this category.

These types of operations can be a drag on resources. They might hover around breaking even, or worse, consume cash without offering significant future growth potential. This situation is particularly concerning if the operational costs outweigh the revenue generated, especially in markets with little to no upward mobility.

- Limited Market Growth: Operations in regions with stagnant economic or insurance market growth are less likely to develop into Stars or Cash Cows.

- Lack of Scale: Small, isolated units may struggle to achieve the economies of scale necessary for strong profitability and competitive pricing.

- Potential Cash Consumption: These businesses might require ongoing investment to maintain operations without a clear path to generating substantial returns.

- Strategic Review Needed: Such units warrant careful evaluation to determine if divestiture, restructuring, or a significant strategic shift is necessary for W. R. Berkley's overall portfolio health.

Dogs in W. R. Berkley's portfolio represent business segments or products with low market share and low growth prospects. These are typically areas that consume resources without generating significant returns, often due to intense competition or a lack of competitive differentiation. For instance, highly commoditized general liability programs, where pricing power is limited, can be classified as Dogs. In 2024, the general liability market saw an average rate increase of only 2.5%, highlighting the competitive pressures that can relegate such offerings to Dog status.

Question Marks

Cyber insurance is a burgeoning sector, driven by a sharp increase in cyberattacks. For W. R. Berkley, their presence in this high-growth, yet highly competitive, market could classify their cyber insurance offerings as a Question Mark within the BCG Matrix if their current market share is relatively low.

The escalating frequency and sophistication of cyber threats, such as ransomware attacks and data breaches, have significantly boosted demand for cyber insurance. In 2023, the global cyber insurance market size was valued at approximately $10.4 billion, with projections indicating substantial growth, potentially reaching over $30 billion by 2030, according to various industry analyses.

To pivot from a Question Mark to a Star, W. R. Berkley would need to make substantial investments in product development, underwriting capabilities, and marketing efforts. This strategic focus is crucial to gain a stronger foothold and capture a larger share of the rapidly expanding cyber insurance market.

Parametric insurance, particularly for climate-related risks, is a burgeoning market. Submissions for these types of policies saw a remarkable 500% surge in 2024, highlighting significant investor interest in index-based settlements. This rapid growth suggests a high-potential, yet still developing, sector.

For W. R. Berkley, venturing into parametric insurance solutions would place them in a nascent but rapidly expanding category. These products offer a compelling upside due to their innovative payout structures, but they also necessitate substantial investment to build the necessary infrastructure and gain market traction.

The burgeoning renewable energy sector, fueled by global decarbonization efforts, presents a significant opportunity for insurers. As of 2024, the global renewable energy market is projected to reach trillions of dollars, with substantial investment flowing into solar, wind, and battery storage. This expansion necessitates tailored insurance solutions to mitigate risks inherent in these complex, capital-intensive projects.

W. R. Berkley, operating within the specialty insurance segment, is positioned to capitalize on this growth. While not yet a dominant player in renewable energy insurance, the company's strategic focus on niche markets suggests an avenue for development. Building robust underwriting expertise and establishing a strong market presence in this evolving landscape will require dedicated investment and strategic partnerships to effectively serve the growing demand for project-specific coverage.

ESG-Linked Liabilities Coverage

ESG-linked liabilities represent a burgeoning, unconventional risk demanding specialized insurance. W. R. Berkley, like many, faces a landscape where this high-growth sector currently holds a minimal market share.

Strategic investment in building ESG expertise and product offerings could position W. R. Berkley to capture significant future market share, potentially elevating this segment to a Star in its BCG matrix.

- Market Growth: The global ESG investing market reached an estimated $35.3 trillion in 2023, signaling substantial growth potential for related insurance products.

- Low Current Share: Insurers are still developing their capacity to underwrite complex ESG risks, meaning early movers can gain a competitive advantage.

- Strategic Investment: By focusing on underwriting innovation and claims management for ESG liabilities, W. R. Berkley can build a dominant position.

- Potential Transformation: Success in this area could transform a nascent market segment into a significant profit driver, akin to a Star performer in the BCG matrix.

New Geographic Market Entries (e.g., specific Asian-Pacific sub-markets)

W. R. Berkley's expansion into specific Asia-Pacific sub-markets, such as Vietnam or Indonesia, exemplifies a strategic move into potential "question mark" segments within the BCG matrix. These markets offer substantial growth prospects, with the Asia-Pacific region anticipated to lead specialty insurance growth globally. For instance, the Asia-Pacific insurance market is projected to see a compound annual growth rate (CAGR) of around 8% through 2027, according to industry analyses.

These new geographic entries require substantial capital investment to build brand recognition, develop distribution networks, and tailor products to local needs. Despite the high initial costs and the current low market share, the long-term potential for significant market share capture and profitability makes these ventures attractive. Companies like Berkley often face intense competition from established local players and other international insurers, making market penetration a challenging but potentially rewarding endeavor.

- High Growth Potential: Asia-Pacific is a key growth engine for the global insurance industry.

- Low Current Market Share: Berkley is establishing a presence in these markets, meaning its current share is minimal.

- Significant Investment Required: Entering these markets demands substantial upfront capital for operations and market development.

- Strategic Importance: Capturing early market share in these developing economies is crucial for long-term global positioning.

Cyber insurance, despite its rapid growth, can be a question mark for W. R. Berkley if their market share is currently low in this competitive space. The market is expanding quickly, with global valuations in the billions, but gaining significant traction requires substantial investment in underwriting and product innovation.

Parametric insurance, especially for climate risks, is another emerging area. Submissions surged 500% in 2024, indicating strong investor interest. W. R. Berkley's involvement here places them in a high-potential but undeveloped sector, demanding significant upfront investment.

The renewable energy sector's expansion, valued in trillions globally as of 2024, offers tailored insurance opportunities. W. R. Berkley's specialty focus positions them to enter, but building expertise and market presence necessitates dedicated investment and partnerships.

ESG-linked liabilities are a nascent, unconventional risk. While the ESG investing market reached $35.3 trillion in 2023, insurance capacity is still developing. Strategic investment in ESG underwriting could transform this segment into a Star performer for W. R. Berkley.

Entering specific Asia-Pacific markets like Vietnam or Indonesia represents question marks for W. R. Berkley. These regions show strong growth potential for specialty insurance, with an estimated CAGR of around 8% through 2027 in the broader Asia-Pacific market. However, significant capital is needed for market penetration.

| Segment | BCG Classification | Market Growth | W. R. Berkley's Position | Strategic Imperative |

| Cyber Insurance | Question Mark | High | Potentially Low Market Share | Increase Market Share |

| Parametric Insurance | Question Mark | Very High | Nascent | Build Infrastructure & Traction |

| Renewable Energy Insurance | Question Mark | High | Developing Niche Player | Enhance Expertise & Presence |

| ESG-Linked Liabilities | Question Mark | High | Minimal | Invest in ESG Underwriting |

| Asia-Pacific Expansion (e.g., Vietnam) | Question Mark | High | Establishing Presence | Capital Investment & Market Development |

BCG Matrix Data Sources

Our W. R. Berkley BCG Matrix is constructed using a blend of internal financial statements, industry-specific market research, and competitive benchmarking data to provide a comprehensive view of their business units.