W. R. Berkley PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. R. Berkley Bundle

Discover the critical political, economic, social, technological, environmental, and legal factors impacting W. R. Berkley's strategic landscape. This comprehensive PESTLE analysis provides actionable intelligence to help you anticipate market shifts and identify growth opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Government regulation significantly shapes W. R. Berkley's operating landscape. State-based insurance departments, overseen by the National Association of Insurance Commissioners (NAIC), set solvency standards, licensing, and consumer protection rules. For instance, the NAIC's Risk-Based Capital (RBC) requirements, continually updated, directly influence capital management strategies for insurers like Berkley. Federal oversight, while less direct, can impact areas like cybersecurity and data privacy, with evolving frameworks such as those proposed by the Treasury Department potentially adding compliance layers.

W. R. Berkley's global reinsurance and specialized insurance operations are significantly influenced by international trade policies and geopolitical stability. For instance, the ongoing trade disputes between major economies in 2024 could introduce new tariffs or regulatory hurdles, impacting the cost of doing business and the ease of cross-border transactions. Changes in trade agreements, like potential renegotiations of existing pacts, can alter market access and profitability for insurers operating internationally.

Geopolitical tensions and shifts in international relations directly affect W. R. Berkley's ability to operate and repatriate profits. In 2024, continued geopolitical fragmentation could lead to increased uncertainty in key markets, potentially impacting investment income and the overall risk landscape. Furthermore, the imposition of sanctions or embargoes on certain countries could restrict W. R. Berkley's access to those markets or complicate its financial dealings, as seen in past instances where sanctions disrupted global financial flows.

Political stability is a cornerstone for W. R. Berkley's operations, especially in property and casualty insurance where geopolitical events can directly impact underwriting risk. Regions experiencing political unrest or significant governmental shifts often see a rise in claims related to civil disturbances or economic disruption, which can affect policy demand and claim frequency.

For instance, in 2024, the global political landscape continued to present a mixed picture, with ongoing conflicts in Eastern Europe and the Middle East posing challenges for insurers operating in or exposed to those areas. W. R. Berkley's diversified geographic footprint helps mitigate some of this risk, but a stable political climate across its key markets remains crucial for predictable long-term underwriting performance.

Fiscal and Monetary Policy

Government fiscal policies, including tax rates and public spending initiatives, directly affect economic expansion, which in turn shapes the demand for insurance. For instance, a robust economy fueled by government investment might see increased demand for commercial property and casualty insurance. Conversely, higher corporate taxes could dampen business investment and thus insurance needs.

Monetary policies, particularly interest rate decisions by central banks like the Federal Reserve, significantly influence W. R. Berkley's investment income. As of Q1 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range. This environment impacts the returns Berkley generates on its substantial premium float, a critical driver of insurer profitability, necessitating strategic adjustments in investment portfolios to adapt to evolving yield landscapes.

- Fiscal Policy Impact: Government spending on infrastructure projects can boost economic activity, increasing demand for construction-related insurance.

- Monetary Policy Impact: Higher interest rates generally benefit insurers by increasing investment income on their float, but can also slow economic growth, potentially reducing premium volume.

- 2024 Interest Rate Environment: The Federal Reserve's target range for the federal funds rate remained elevated through early 2024, providing a favorable backdrop for investment income for insurers like W. R. Berkley.

- Strategic Adjustments: Insurers must continually reassess their asset allocation strategies to optimize returns in response to shifts in monetary policy and interest rate movements.

Public Policy on Risk Management

Government initiatives focused on disaster preparedness and infrastructure development directly shape the insurance landscape. For instance, federal funding for climate resilience projects, such as the Infrastructure Investment and Jobs Act of 2021, which allocated billions to infrastructure upgrades, can reduce the frequency and severity of natural catastrophe claims, thereby influencing demand for related insurance products.

Public-private partnerships for managing large-scale risks like cyberattacks or terrorism create new avenues for insurers. The Cybersecurity and Infrastructure Security Agency (CISA) actively promotes collaboration to enhance national cyber defenses, potentially leading to increased demand for specialized cyber insurance policies. These partnerships can either mitigate risks for insurers through shared mitigation efforts or generate new revenue streams.

- Federal investment in infrastructure: The U.S. government's commitment to infrastructure resilience, exemplified by the over $1 trillion allocated through the Infrastructure Investment and Jobs Act, aims to reduce the impact of natural disasters.

- Cybersecurity initiatives: Government programs fostering public-private partnerships in cybersecurity, such as those led by CISA, are driving the need for advanced cyber risk coverage.

- Risk mitigation and opportunity creation: Policies designed to mitigate systemic risks can lower insurers' exposure, while simultaneously opening up markets for innovative insurance solutions.

Government regulation remains a significant factor, with state insurance departments and the NAIC setting solvency and consumer protection standards. Evolving federal cybersecurity frameworks also necessitate compliance adjustments.

Geopolitical instability and trade policy shifts in 2024 continue to influence W. R. Berkley's international operations, potentially impacting cross-border transactions and market access. Political unrest in key regions can directly affect underwriting risk and investment income.

Fiscal and monetary policies play a crucial role; for instance, the Federal Reserve's interest rate policy in early 2024, with rates around 5.25%-5.50%, directly impacts Berkley's investment income from its premium float.

Government initiatives like infrastructure spending, as seen in the Infrastructure Investment and Jobs Act, can influence demand for construction insurance and reduce catastrophe claims, while public-private cybersecurity partnerships drive demand for cyber coverage.

What is included in the product

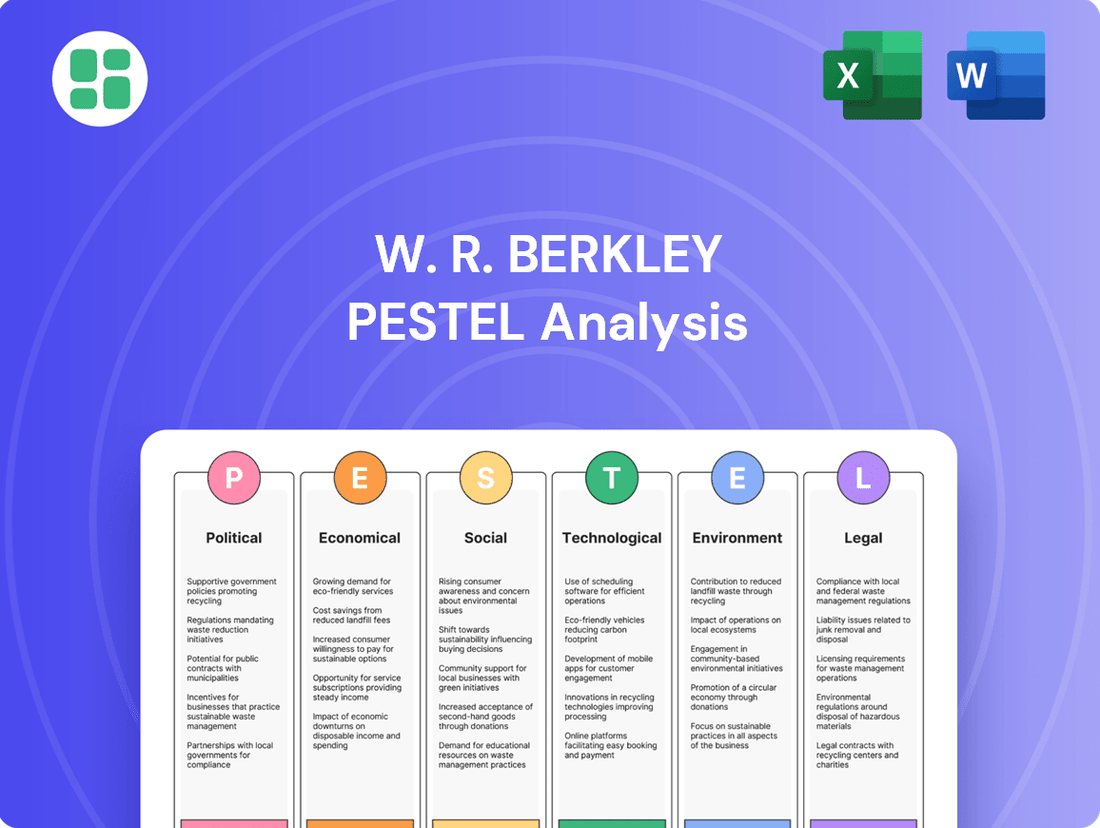

This W. R. Berkley PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

It provides actionable insights for stakeholders to navigate the complex external landscape and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal influences on W. R. Berkley.

Economic factors

The prevailing interest rate environment significantly impacts W. R. Berkley's financial performance. As an insurance holding company, Berkley manages substantial investment portfolios funded by premiums. Higher interest rates, like those seen with the Federal Reserve's benchmark rate hovering around 5.25%-5.50% in early 2024, generally boost investment income, enhancing profitability, particularly for lines with longer payout periods.

Conversely, a sustained period of low interest rates, such as those experienced in the past decade, can compress investment yields. This compression puts additional pressure on underwriting margins, as insurers may need to rely more heavily on underwriting profit to offset lower investment returns. The ability to achieve profitable underwriting becomes even more crucial when investment income is subdued.

The overall health of the U.S. economy significantly influences demand for W. R. Berkley's commercial insurance. In 2024, while growth projections remain somewhat cautious, a slowdown in GDP growth could temper business expansion, directly impacting the need for new or expanded insurance coverage. For instance, if U.S. GDP growth moderates to around 1.5% in late 2024, as some forecasts suggest, this could translate to slower growth in commercial property and casualty insurance premiums.

Conversely, a recessionary environment poses a considerable risk. Reduced business activity means fewer insurable assets and operations, leading to lower demand for insurance products. Furthermore, during economic downturns, businesses often scrutinize expenses more closely, potentially leading to increased pressure on insurance premium rates, impacting Berkley's profitability and market share.

Inflationary pressures significantly impact property and casualty insurers like W. R. Berkley by increasing the cost of claims. For instance, rising material and labor costs for repairs and rebuilding, coupled with escalating medical expenses, directly translate to higher payouts. This trend was evident in 2023, where supply chain disruptions and strong consumer demand contributed to elevated inflation rates, impacting the insurance sector's operational costs.

Higher inflation can also squeeze underwriting margins if premiums aren't adjusted quickly enough to offset these rising claim costs. Furthermore, it erodes the real value of investment returns, a critical component of an insurer's profitability. As of early 2024, while inflation has shown signs of moderating in some economies, persistent underlying pressures remain a key concern for insurers in their pricing and reserving strategies.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant factor for W. R. Berkley, given its global footprint, especially within the reinsurance sector. Changes in currency values directly affect the translation of foreign earnings and the valuation of international assets and liabilities on its financial statements. For instance, a strengthening U.S. dollar can diminish the reported value of premiums and investment income earned in other currencies.

These movements can impact W. R. Berkley's reported profitability. For example, if the U.S. dollar strengthens against the Euro, European premiums collected in Euros will translate into fewer dollars, potentially lowering reported revenue and earnings. This is a recurring challenge for multinational insurers.

To manage this exposure, W. R. Berkley, like many global financial institutions, likely employs various hedging strategies. These can include forward contracts or currency options designed to lock in exchange rates for future transactions, thereby reducing the volatility of its financial results stemming from currency movements.

- Impact on Reported Earnings: A stronger USD can reduce the value of foreign-denominated premiums and investment income when translated into U.S. dollars, affecting reported profitability.

- Asset and Liability Valuation: Fluctuations also alter the reported value of international assets and liabilities, impacting the company's balance sheet.

- Hedging as a Mitigation Strategy: W. R. Berkley likely utilizes financial instruments to hedge against adverse currency movements and stabilize its financial performance.

- Global Operations Exposure: The company's extensive international operations, particularly in reinsurance, inherently expose it to a variety of currency exchange rate risks.

Investment Market Volatility

Investment market volatility directly impacts W. R. Berkley's financial performance. For instance, in the first quarter of 2024, global equity markets experienced fluctuations, with the S&P 500 seeing a notable increase of over 10% while bond yields also adjusted. This environment can lead to unpredictable swings in the company's investment income and the valuation of its holdings.

High volatility, characterized by rapid price changes, can create challenges for maintaining stable investment returns. For example, the VIX index, a common measure of market volatility, averaged around 15-20 during early 2024, indicating periods of elevated uncertainty. Such conditions necessitate robust diversification strategies and active risk management within W. R. Berkley's investment portfolio to mitigate potential negative impacts on financial stability and profitability.

W. R. Berkley's investment portfolio is designed to generate income and capital appreciation, but market swings can affect these objectives. The company's ability to navigate these conditions is crucial for its overall financial health. Key considerations include:

- Diversification: Spreading investments across various asset classes, geographies, and industries to reduce concentration risk.

- Risk Management: Employing hedging strategies and actively monitoring market trends to protect against adverse movements.

- Asset Allocation: Adjusting the mix of investments based on prevailing economic conditions and risk tolerance.

- Long-Term Perspective: Maintaining a focus on long-term investment goals rather than reacting to short-term market noise.

Economic factors significantly shape W. R. Berkley's operational landscape. Interest rates, inflation, and overall economic growth directly influence investment income, claim costs, and premium demand. For instance, the Federal Reserve's benchmark rate, maintained around 5.25%-5.50% in early 2024, impacts Berkley's investment yields. Economic slowdowns, potentially seeing U.S. GDP growth moderate to 1.5% in late 2024, can temper demand for commercial insurance, while persistent inflation increases claim expenses.

Currency fluctuations and investment market volatility also play crucial roles. A strengthening U.S. dollar can reduce the value of foreign earnings, while market swings affect investment portfolio performance. For example, the VIX index, averaging 15-20 in early 2024, signals periods of elevated market uncertainty, necessitating robust risk management strategies for Berkley.

| Economic Factor | Impact on W. R. Berkley | Relevant Data/Trend (Early 2024) |

|---|---|---|

| Interest Rates | Boosts investment income; higher rates generally favorable. | Federal Reserve Rate: 5.25%-5.50% |

| Economic Growth (GDP) | Influences demand for commercial insurance. | Projected U.S. GDP growth moderating to ~1.5% |

| Inflation | Increases claim costs and erodes real investment returns. | Inflation showing signs of moderation but persistent underlying pressures. |

| Currency Exchange Rates | Affects translation of foreign earnings and asset valuations. | Strengthening USD can diminish foreign-denominated income. |

| Investment Market Volatility | Impacts investment income and portfolio valuation. | VIX Index averaging 15-20, indicating elevated uncertainty. |

Full Version Awaits

W. R. Berkley PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive W. R. Berkley PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping W. R. Berkley's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis provides actionable insights into the opportunities and threats facing W. R. Berkley in its industry.

Sociological factors

The insurance industry, including W. R. Berkley, is significantly impacted by shifting demographics. For instance, the aging population in many developed nations, including the United States, means a greater demand for health, long-term care, and retirement-related insurance products. Conversely, a shrinking younger workforce could strain the availability of skilled talent for roles like actuaries and claims adjusters.

Workforce trends also play a crucial role. As of early 2024, the U.S. labor force participation rate hovered around 62.5%, indicating a substantial portion of the adult population is either employed or actively seeking employment. However, the composition of this workforce is changing, with an increasing number of individuals seeking flexible work arrangements and specialized skills, which affects how insurance companies recruit and retain talent, and potentially influences demand for gig economy-related insurance.

Societal attitudes towards risk are shifting, with a growing emphasis on corporate accountability. This evolving perception directly influences litigation trends and the expectations placed on businesses for their actions and potential oversights.

In 2024, the United States continued to see robust activity in class-action lawsuits, particularly concerning data breaches and environmental, social, and governance (ESG) disclosures. For instance, the number of securities class actions filed in 2023 remained elevated compared to pre-2020 levels, indicating persistent shareholder scrutiny.

Heightened awareness of emerging risks, such as cyber threats and the financial implications of climate change, is also reshaping the insurance landscape. This drives demand for specialized coverages like cyber insurance and parametric insurance for climate events, but simultaneously adds layers of complexity to underwriting for insurers like W. R. Berkley.

Consumers increasingly expect digital-first interactions, demanding personalized insurance solutions and seamless online experiences. This shift, accelerated by the pandemic, means insurers must adapt their distribution and engagement strategies. For instance, in 2024, digital channels are projected to account for a significant portion of new insurance policy sales, forcing companies like W. R. Berkley to enhance their online presence and self-service capabilities.

The demand for tailored products and proactive customer service is reshaping expectations. Clients now favor providers who can offer customized coverage and readily available support, moving away from one-size-fits-all approaches. This trend highlights the need for insurers to leverage data analytics to understand individual needs and deliver responsive, value-added services, impacting how W. R. Berkley's underwriting expertise is communicated and applied.

Public Trust and Reputation

The insurance sector is fundamentally built on public trust, and W. R. Berkley is no exception. Major events, from severe weather events to economic downturns, can significantly shape how the public views the reliability and fairness of insurance providers. Maintaining a strong reputation for efficient claims processing, ethical operations, and robust financial stability is paramount for W. R. Berkley to retain existing clients and attract new ones.

In 2024, the insurance industry faced scrutiny following a year of significant natural disaster losses, which tested public perception of insurer solvency and responsiveness. For instance, the cumulative insured losses from natural catastrophes globally were estimated to be in the tens of billions of dollars in 2023, a figure expected to remain high in 2024, putting pressure on insurer reputations.

- Claims Handling Efficiency: A swift and fair claims process is a key driver of customer satisfaction and trust in the insurance industry.

- Ethical Business Practices: Transparency and integrity in all dealings are crucial for maintaining a positive public image.

- Financial Strength: Demonstrating a solid financial foundation reassures policyholders of an insurer's ability to meet its obligations, especially during times of crisis.

- Brand Perception: W. R. Berkley's commitment to its core values directly influences its standing and ability to compete in the market.

Urbanization and Population Density

Increasing urbanization and population density, particularly in coastal and disaster-prone regions, concentrates insurable assets. This concentration means that a single event, such as a hurricane or a major fire, can result in significantly larger claims for property and casualty insurers. For instance, the US saw a 1.3% population increase in urban areas between 2020 and 2023, according to Census Bureau estimates, highlighting this ongoing trend.

These demographic shifts demand enhanced capabilities in catastrophe modeling and risk accumulation management. Insurers like W. R. Berkley must accurately assess potential losses from events that impact densely populated areas. The economic impact of such events is substantial; for example, insured losses from natural catastrophes globally reached an estimated $135 billion in 2023, a figure heavily influenced by the concentration of value in urban centers.

- Urban Growth: Continued migration to cities increases the density of insured property and the potential for larger, aggregated losses.

- Risk Concentration: Densely populated areas amplify the financial impact of localized catastrophic events for insurers.

- Modeling Needs: Sophisticated catastrophe modeling is crucial for insurers to understand and manage exposure in these high-density environments.

- Economic Impact: The financial fallout from events in urban areas can be severe, affecting insurer solvency and pricing strategies.

Societal attitudes are evolving, with a growing emphasis on corporate accountability and a heightened awareness of emerging risks like cyber threats and climate change. This drives demand for specialized insurance products and influences litigation trends, as seen in the elevated number of securities class actions filed in 2023. Consumers increasingly expect digital-first, personalized experiences, pushing insurers to enhance online capabilities and customer service.

| Societal Factor | Impact on Insurance (e.g., W. R. Berkley) | 2023/2024 Data/Trend |

| Corporate Accountability & Litigation | Increased demand for D&O, E&O, cyber liability; higher litigation costs. | Securities class actions remained elevated in 2023 compared to pre-2020 levels. |

| Risk Awareness (Cyber, Climate) | Growth in demand for cyber, parametric, and climate-related insurance; complex underwriting. | Global insured losses from natural catastrophes estimated at $135 billion in 2023. |

| Consumer Expectations (Digital, Personalization) | Need for enhanced digital platforms, personalized products, and proactive service. | Digital channels projected to account for a significant portion of new policy sales in 2024. |

| Public Trust & Reputation | Emphasis on efficient claims handling, ethical practices, and financial strength. | Industry scrutiny following significant natural disaster losses in 2023 tested public perception. |

Technological factors

The insurance industry, including W. R. Berkley, is increasingly adopting advanced data analytics and AI. These technologies are revolutionizing core functions like underwriting, claims processing, and risk assessment. For instance, by 2024, the global AI in insurance market was projected to reach over $15 billion, highlighting the significant investment and expected impact.

W. R. Berkley can harness these tools to gain granular insights into diverse risk profiles, leading to more precise pricing and better fraud detection. This technological integration is vital for enhancing operational efficiencies across its specialized insurance segments and maintaining a competitive advantage in a rapidly evolving market.

W. R. Berkley's increasing reliance on digital platforms for operations, data storage, and client interactions makes cybersecurity a critical factor. The threat of data breaches and cyberattacks could compromise data integrity, erode customer trust, and lead to regulatory non-compliance. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

To mitigate these risks, Berkley must invest in robust cybersecurity measures. This includes advanced threat detection, data encryption, and employee training. Concurrently, as a major insurer, Berkley is also positioned to offer cyber insurance solutions, a growing market driven by these very risks. The cyber insurance market is projected to reach $20.5 billion by 2025, according to various industry analyses.

W. R. Berkley is actively embracing digitalization across its operations, from online policy issuance to digital customer portals. This strategic move is designed to boost efficiency and elevate the customer experience. For instance, in 2023, the insurance industry saw a significant increase in digital adoption, with many insurers reporting higher volumes of online policy applications and claims submissions compared to previous years, reflecting a broader industry trend that Berkley is leveraging.

The company aims to optimize its decentralized operational model by integrating digital tools, ensuring that local expertise and personalized service remain central. This approach allows for the automation of routine tasks, freeing up resources to focus on more complex client needs and strategic growth initiatives. The ongoing investment in digital transformation is a key factor in maintaining competitive advantage in the evolving insurance landscape.

Emerging Technologies for Risk Mitigation

New technologies are revolutionizing risk mitigation in the insurance sector. Telematics, for instance, in auto and commercial trucking insurance, provides real-time data on driving behavior, enabling proactive risk management and potentially lowering premiums. The global telematics market, valued at approximately $35 billion in 2023, is projected to grow significantly, indicating strong adoption trends.

Internet of Things (IoT) devices offer enhanced property monitoring capabilities, detecting potential hazards like water leaks or fires before they escalate into major claims. This proactive approach can lead to substantial cost savings for insurers. Similarly, drone technology is transforming claims assessment, allowing for faster, safer, and more accurate inspections of damaged properties, especially in hard-to-reach areas.

W. R. Berkley can leverage these advancements by integrating them into its insurance products or utilizing them to sharpen its underwriting accuracy and claims processing efficiency. For example, adopting drone-based claims assessment could reduce average claim handling times by up to 20% in certain scenarios.

- Telematics: Enhances driver safety and reduces accident frequency through data-driven insights.

- IoT Devices: Enables proactive property protection and early detection of potential damage.

- Drone Technology: Streamlines claims assessment, improving speed and accuracy while reducing adjuster exposure.

- Market Growth: The insurance technology market is expanding rapidly, with significant investment in AI, IoT, and telematics solutions.

InsurTech Innovation and Competition

The insurance industry is experiencing a significant shift driven by InsurTech innovation. Startups are introducing novel business models, direct-to-consumer distribution channels, and advanced technological solutions like AI-powered underwriting and personalized pricing. This surge in InsurTech activity, with venture capital funding for InsurTech reaching an estimated $10.5 billion globally in 2023, presents both challenges and opportunities for established players like W. R. Berkley. To maintain its competitive edge, W. R. Berkley must actively monitor these advancements, potentially engaging in strategic partnerships or acquisitions with promising InsurTech firms to integrate new capabilities and adapt to evolving customer expectations and industry standards.

These technological advancements are also fostering the development of highly specialized insurance products, catering to niche markets and emerging risks that traditional insurers may overlook. For instance, parametric insurance, triggered by specific data events rather than traditional claims processes, is gaining traction. W. R. Berkley's strategic response to these InsurTech trends will be crucial in shaping its future market position and ability to offer innovative, customer-centric solutions in an increasingly dynamic landscape.

- InsurTech Funding: Global venture capital investment in InsurTech was approximately $10.5 billion in 2023, highlighting rapid innovation.

- Disruptive Technologies: AI, blockchain, and IoT are enabling new underwriting, claims processing, and customer engagement models.

- New Distribution Channels: InsurTechs are leveraging digital platforms and partnerships to reach customers more directly and efficiently.

- Specialized Products: The rise of InsurTech facilitates the creation of niche products like cyber insurance and parametric coverage.

W. R. Berkley's technological trajectory is marked by significant investment in AI and data analytics to refine underwriting and claims processing, with the global AI in insurance market projected to exceed $15 billion by 2024. This focus on advanced analytics allows for more precise risk assessment and fraud detection, crucial for its specialized insurance segments.

Cybersecurity is paramount given the increasing reliance on digital platforms; the global average cost of a data breach reached $4.45 million in 2024, underscoring the need for robust protective measures and highlighting the growth potential of cyber insurance, which is expected to reach $20.5 billion by 2025.

Digitalization efforts, including online policy issuance and customer portals, are enhancing operational efficiency and customer experience, with industry-wide digital adoption seeing notable increases in 2023 for policy applications and claims. Furthermore, technologies like telematics, with a global market valued around $35 billion in 2023, and IoT devices are revolutionizing risk mitigation and claims assessment.

| Technology | Impact on W. R. Berkley | Market/Growth Data |

|---|---|---|

| AI & Data Analytics | Enhanced underwriting, claims processing, risk assessment, fraud detection | Global AI in insurance market projected >$15 billion (2024) |

| Cybersecurity | Protecting data integrity, customer trust, regulatory compliance | Average cost of data breach: $4.45 million (2024); Cyber insurance market projected $20.5 billion (2025) |

| Digitalization | Improved operational efficiency, customer experience, online services | Increased digital adoption in insurance sector (2023) |

| Telematics & IoT | Proactive risk management, property monitoring, efficient claims assessment | Global telematics market ~$35 billion (2023) |

Legal factors

W. R. Berkley navigates a dense regulatory landscape, encompassing state-specific insurance laws, federal oversight, and international compliance standards. These regulations dictate everything from capital adequacy and claims handling to marketing practices and product filings, ensuring consumer protection and market stability.

Failure to comply can result in significant penalties, including fines, license suspension, and reputational damage. For instance, in 2024, state insurance departments continued to focus on cybersecurity preparedness and data privacy, with some imposing substantial fines for breaches. Berkley's commitment to robust compliance programs is therefore critical for maintaining its operational licenses and financial health across all its operating jurisdictions.

Data privacy laws like GDPR and CCPA, along with evolving state regulations in 2024 and 2025, directly influence W. R. Berkley's handling of customer information. This necessitates strong data governance, consent mechanisms, and cybersecurity measures, impacting how they use data for underwriting and marketing efforts.

Non-compliance with these stringent privacy regulations, which are becoming increasingly complex, can result in significant financial penalties. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, a risk W. R. Berkley must actively mitigate through robust compliance programs.

Changes in tort law, such as potential caps on non-economic damages or modifications to punitive damage standards, directly influence the potential payouts W. R. Berkley might face. For instance, a shift towards more restrictive damage caps could reduce the severity of liability claims, positively impacting the insurer's financial performance.

Evolving litigation trends, including the frequency of class-action lawsuits and judicial interpretations of liability, are critical for W. R. Berkley's risk assessment. In 2024, the U.S. saw continued activity in areas like product liability and professional negligence claims, necessitating ongoing adaptation in reserving and pricing strategies to reflect these dynamics.

Antitrust and Competition Law

W. R. Berkley, as a significant entity in commercial insurance and reinsurance, navigates a landscape where antitrust and competition laws are paramount. These regulations are designed to prevent any single company from dominating the market, ensuring a level playing field for all participants. For Berkley, this means scrutinizing every merger, acquisition, and business practice to guarantee compliance, particularly as the insurance sector sees ongoing consolidation. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor the insurance industry for potential anticompetitive behavior, impacting strategic growth decisions.

Adherence to these laws directly shapes Berkley's approach to expanding its market share and entering new territories. The potential for regulatory scrutiny can influence the structure and feasibility of proposed acquisitions, as authorities assess whether such moves would substantially lessen competition. In 2024, the focus on market concentration in various industries, including financial services, means Berkley must be particularly diligent in demonstrating that its growth strategies do not stifle competition or create undue market power. This legal framework is a critical consideration in all of Berkley's strategic planning.

Key considerations for W. R. Berkley regarding antitrust and competition law include:

- Merger Review: Ensuring all proposed acquisitions are reviewed for potential anticompetitive effects, aligning with guidelines from regulatory bodies like the FTC and DOJ.

- Market Conduct: Maintaining business practices that do not involve price-fixing, bid-rigging, or other collusive activities that could harm consumers or competitors.

- Regulatory Scrutiny: Staying abreast of evolving antitrust enforcement priorities, especially concerning market consolidation within the insurance sector.

- Global Compliance: Managing compliance with diverse antitrust regulations across the various international markets where Berkley operates.

Contract Law and Policy Interpretation

Insurance policies are fundamentally legal contracts. How courts interpret the specific wording of these contracts can dramatically alter how claims are handled and what risks are actually covered. This means W. R. Berkley needs to draft its policies with extreme precision to avoid unintended liabilities.

Legal decisions set precedents that ripple through the industry. These rulings can shape how policies are written in the future, influence how insurers underwrite new business, and ultimately determine the company's exposure to various types of risk. For instance, a significant 2024 court ruling on business interruption coverage could impact Berkley's future claims reserves.

W. R. Berkley's commitment to clear, legally robust policy language is paramount. This diligence helps protect the company from costly disputes and ensures a predictable claims environment. In 2024, the company reported a slight increase in litigation expenses, underscoring the ongoing importance of precise contract drafting.

- Contractual Clarity: Ensuring policy language is unambiguous to minimize legal interpretation disputes.

- Precedent Impact: Monitoring and adapting to court decisions that set new legal standards for insurance contracts.

- Underwriting Alignment: Adjusting underwriting practices based on evolving legal interpretations of coverage scope.

- Risk Management: Proactively managing legal exposure by ensuring policy terms align with current legal understanding.

W. R. Berkley operates within a complex web of legal and regulatory frameworks that directly impact its business operations and strategic decisions. These include insurance-specific regulations, data privacy laws, antitrust statutes, and contract law, all of which are subject to ongoing changes and enforcement actions. For instance, in 2024, regulatory bodies continued to emphasize cybersecurity and data protection, imposing significant penalties for non-compliance, which Berkley actively mitigates through robust programs.

The company must also navigate evolving tort law and litigation trends, which influence claims payouts and risk assessment. For example, shifts in damage caps or increased class-action filings, as seen in product liability in 2024, necessitate adaptive reserving and pricing strategies. Furthermore, antitrust laws shape Berkley's growth strategies, particularly concerning mergers and acquisitions, requiring diligent adherence to prevent anticompetitive practices, with regulatory bodies like the FTC closely monitoring market concentration.

The interpretation of insurance policy language by courts is a critical legal factor, directly affecting claim handling and coverage. Precise contract drafting is essential to avoid unintended liabilities and costly disputes, a challenge underscored by a slight increase in litigation expenses reported by Berkley in 2024. Key legal considerations include ensuring contractual clarity, adapting to legal precedents, aligning underwriting with evolving interpretations, and proactively managing overall legal exposure.

Environmental factors

Climate change is making natural disasters like hurricanes, wildfires, and floods more frequent and intense. This directly affects W. R. Berkley's property and casualty insurance business, as these events lead to more claims. For instance, the economic losses from natural catastrophes globally were estimated to be around $275 billion in 2023, with insured losses reaching approximately $100 billion, according to Swiss Re.

To manage this growing risk, W. R. Berkley must rely on sophisticated catastrophe modeling to predict potential losses. They also need to adapt their underwriting practices, potentially charging higher premiums in areas more vulnerable to these events. The cost of reinsurance, which insurers use to protect themselves from large losses, is also likely to increase due to these escalating risks.

W. R. Berkley, like many in the insurance sector, faces increasing pressure from investors, regulators, and the public to integrate Environmental, Social, and Governance (ESG) factors into its operations. This scrutiny is driving a demand for greater transparency regarding climate-related financial risks and a shift towards sustainable investments.

For instance, by the end of 2024, a significant portion of institutional investors are expected to have ESG mandates in place, influencing capital allocation. W. R. Berkley's approach to underwriting, especially for industries with substantial environmental footprints, is being closely examined, impacting its access to capital and overall market reputation.

W. R. Berkley's insured industries face growing risks from resource scarcity, such as water shortages impacting agriculture or manufacturing. For example, in 2024, several regions experienced severe drought conditions, leading to crop failures and increased demand for business interruption insurance.

Climate change-induced supply chain disruptions are also a significant concern. Extreme weather events in 2024, like widespread flooding, disrupted global logistics, increasing the cost of materials for repairs and potentially inflating claims payouts for property damage.

Pollution and Environmental Liability

As environmental regulations around pollution and waste management continue to evolve, businesses face increasing liability. This trend directly fuels the demand for specialized environmental impairment liability insurance, a sector W. R. Berkley actively participates in. Staying ahead of these regulatory shifts is crucial for Berkley to maintain its product relevance and accurately underwrite associated risks.

The increasing focus on climate change and sustainability is a significant driver for these regulatory changes. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stricter standards on industrial emissions and wastewater discharge. Companies that fail to comply can face substantial fines and remediation costs, thereby increasing their need for robust environmental insurance coverage.

- Increased Regulatory Scrutiny: Expect continued tightening of regulations concerning greenhouse gas emissions, plastic waste, and water pollution in major global markets through 2025.

- Growing Remediation Costs: The cost of cleaning up contaminated sites is on the rise, with estimates suggesting remediation expenses could reach tens of billions annually globally by 2025.

- Demand for ESG-Linked Insurance: Insurers like W. R. Berkley may see growing demand for products that incentivize or cover environmental, social, and governance (ESG) compliance.

- Litigation Risk: Businesses face an elevated risk of litigation related to environmental damage, making comprehensive environmental liability coverage more critical than ever.

Sustainability Initiatives and Green Economy

The global push for sustainability, particularly evident in the growing green economy, presents a dynamic landscape for insurers like W. R. Berkley. This transition means some traditional, carbon-heavy sectors might see reduced demand for coverage, as they face increasing regulatory scrutiny and investor pressure. For instance, the International Energy Agency reported in 2024 that investments in clean energy technologies surpassed $1.7 trillion globally in 2023, a clear indicator of this economic shift.

Conversely, this green transformation is simultaneously unlocking significant new opportunities. The expansion of renewable energy projects, the development of eco-friendly buildings, and the proliferation of sustainable technologies are creating fresh markets that require specialized insurance products. W. R. Berkley can strategically position itself to underwrite risks associated with these burgeoning sectors, offering tailored coverage for everything from solar farm construction to electric vehicle infrastructure development.

To capitalize on these shifts, W. R. Berkley can proactively adapt its product portfolio. This involves developing and refining insurance solutions that specifically address the unique risks and opportunities within the green economy.

- Renewable Energy Insurance: Coverage for solar, wind, and other renewable energy installations, including construction, operation, and business interruption.

- Green Building Insurance: Policies designed for sustainable construction projects, covering materials, design, and performance guarantees.

- Sustainable Technology Insurance: Protection for emerging green technologies, such as carbon capture, battery storage, and electric mobility solutions.

- Climate Risk Management: Services and insurance products to help businesses manage and mitigate physical and transitional climate-related risks.

The increasing frequency and intensity of climate-related natural disasters, such as hurricanes and wildfires, directly impact W. R. Berkley's property and casualty insurance lines, leading to higher claims. For instance, global insured losses from natural catastrophes were approximately $100 billion in 2023, according to Swiss Re, highlighting the growing risk exposure.

W. R. Berkley faces mounting pressure to integrate ESG principles, with a significant portion of institutional investors expected to have ESG mandates by the end of 2024, influencing capital allocation and scrutinizing environmental risk management.

The growing green economy presents both challenges and opportunities, as traditional sectors face scrutiny while renewable energy and sustainable technologies create new markets for specialized insurance products.

Environmental regulations are tightening, with the EPA continuing stricter enforcement on emissions and wastewater discharge in 2024, increasing liability risks and the demand for environmental impairment insurance.

| Environmental Factor | Impact on W. R. Berkley | 2023/2024 Data/Trend |

|---|---|---|

| Climate Change & Natural Disasters | Increased claims in P&C insurance | Global insured losses from natural catastrophes ~$100 billion (2023) |

| ESG Pressure | Demand for transparency, ESG mandates influencing investment | Majority of institutional investors expected to have ESG mandates by end of 2024 |

| Green Economy Transition | Reduced demand for traditional sectors, growth in renewables/sustainable tech | Global clean energy investment surpassed $1.7 trillion in 2023 |

| Environmental Regulations | Increased demand for environmental liability insurance | Stricter EPA enforcement on industrial emissions and wastewater discharge (2024) |

PESTLE Analysis Data Sources

Our W. R. Berkley PESTLE analysis is informed by a robust blend of public and proprietary data. We draw from official government publications, leading financial news outlets, and specialized insurance industry reports to ensure comprehensive and accurate insights.