Beijing BDStar Navigation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing BDStar Navigation Bundle

Beijing BDStar Navigation boasts significant strengths in its technological innovation and established market presence within the satellite navigation sector. However, understanding the full scope of its competitive landscape, potential threats, and untapped opportunities is crucial for strategic decision-making.

Want the full story behind BDStar Navigation's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Beijing BDStar Navigation Co., Ltd. enjoys a leading position in China's burgeoning satellite navigation sector. This strength is underscored by the remarkable expansion of the domestic market, with the total output value of China's satellite navigation and positioning service industry reaching an impressive 575.8 billion yuan in 2024, reflecting significant year-on-year growth.

Beijing BDStar Navigation excels in developing and manufacturing essential core components like GNSS chips and modules. This deep expertise in foundational technology is a significant strength, providing a solid base for its product offerings.

The company's subsidiary, Unicore, launched new all-constellation, multi-frequency, high-precision RTK/INS integrated positioning modules in March 2025, showcasing its commitment to cutting-edge innovation. Furthermore, the successful commencement of mass production for automotive-grade integrated navigation modules for intelligent cockpits in January 2025 highlights BDStar's ability to translate advanced development into market-ready products.

This dedication to proprietary technology development not only secures a competitive advantage but also significantly mitigates risks associated with dependence on external suppliers, ensuring greater control over its supply chain and product quality.

BDStar excels by offering comprehensive solutions for burgeoning sectors like high-precision positioning, autonomous driving, and the Internet of Things. These markets are experiencing significant global growth, and BDStar's expertise directly addresses their needs.

The company's commitment to quality is evident as its automotive-grade high-precision modules secured a key intelligent driving project in November 2024. This achievement underscores BDStar's strong foothold in the rapidly evolving automotive technology landscape.

BDStar's strategic alignment with the increasing global demand for precise navigation in these expanding industries positions it favorably for continued success and market penetration.

Strategic Leverage of BeiDou System

BDStar's strategic advantage is deeply intertwined with the BeiDou Navigation Satellite System (BDS). As a leading entity in China's satellite navigation sector, BDStar leverages the ongoing enhancements and expanding use of BDS. This national infrastructure offers high-precision, lane-level navigation capabilities across more than 99% of China's urban and rural road networks, providing a solid foundation for BDStar's offerings.

The global reach of BeiDou further bolsters BDStar's market potential. With BeiDou products and services now available in over 140 countries and regions, BDStar is positioned to tap into a significant international customer base, extending its growth opportunities beyond domestic borders.

- Leveraging national infrastructure: BDStar benefits from BeiDou's extensive coverage and precision, particularly in China.

- Expanding international presence: The global adoption of BeiDou opens new markets for BDStar's satellite navigation solutions.

- Technological synergy: BDStar's development is closely aligned with the continuous advancements of the BeiDou system.

Active Strategic Investments and Acquisitions

BDStar Navigation actively pursues growth through strategic investments and acquisitions, bolstering its market presence and technological capabilities. A prime example is its May 2025 acquisition of a 51% stake in Shenzhen Tianli Automotive Electronics Technology Co., Ltd. This move significantly enhances BDStar's automotive sector operations.

These strategic initiatives allow BDStar to:

- Integrate advanced technologies: The acquisition of Tianli Automotive Electronics brings new automotive electronics expertise into BDStar's fold.

- Expand market access: Gaining a majority stake in Tianli opens up new avenues within the automotive market for BDStar's products and services.

- Strengthen product portfolio: By incorporating Tianli's offerings, BDStar diversifies and deepens its overall product and service range.

- Enhance competitive positioning: These proactive investments solidify BDStar's standing in key technology sectors.

BDStar Navigation's robust R&D, particularly through its subsidiary Unicore, has yielded advanced products like all-constellation, multi-frequency RTK/INS modules launched in March 2025. The company's ability to secure key automotive projects, such as an intelligent driving project in November 2024, demonstrates its strong market penetration and technological relevance.

BDStar's strategic acquisition of a 51% stake in Shenzhen Tianli Automotive Electronics in May 2025 significantly bolsters its automotive sector capabilities and market access.

The company's deep integration with and leverage of the BeiDou Navigation Satellite System (BDS) provides a significant competitive edge, benefiting from its extensive coverage and precision across China and its growing global adoption.

BDStar's comprehensive solutions cater to high-growth sectors like autonomous driving and IoT, aligning with substantial market demand and positioning it for sustained expansion.

| Area of Strength | Description | Supporting Data/Event |

|---|---|---|

| Technological Innovation | Development of core GNSS components and advanced positioning modules. | Unicore launched new RTK/INS modules (March 2025); Mass production of automotive-grade modules for intelligent cockpits (January 2025). |

| Market Position & Alignment | Leading player in China's satellite navigation sector, aligned with national infrastructure. | China's satellite navigation industry output value reached 575.8 billion yuan in 2024; BeiDou available in over 140 countries. |

| Strategic Growth Initiatives | Expansion through acquisitions and partnerships to enhance capabilities. | Acquisition of 51% stake in Shenzhen Tianli Automotive Electronics (May 2025). |

| Automotive Sector Penetration | Securing significant projects in the intelligent driving space. | Won a key intelligent driving project for automotive-grade high-precision modules (November 2024). |

What is included in the product

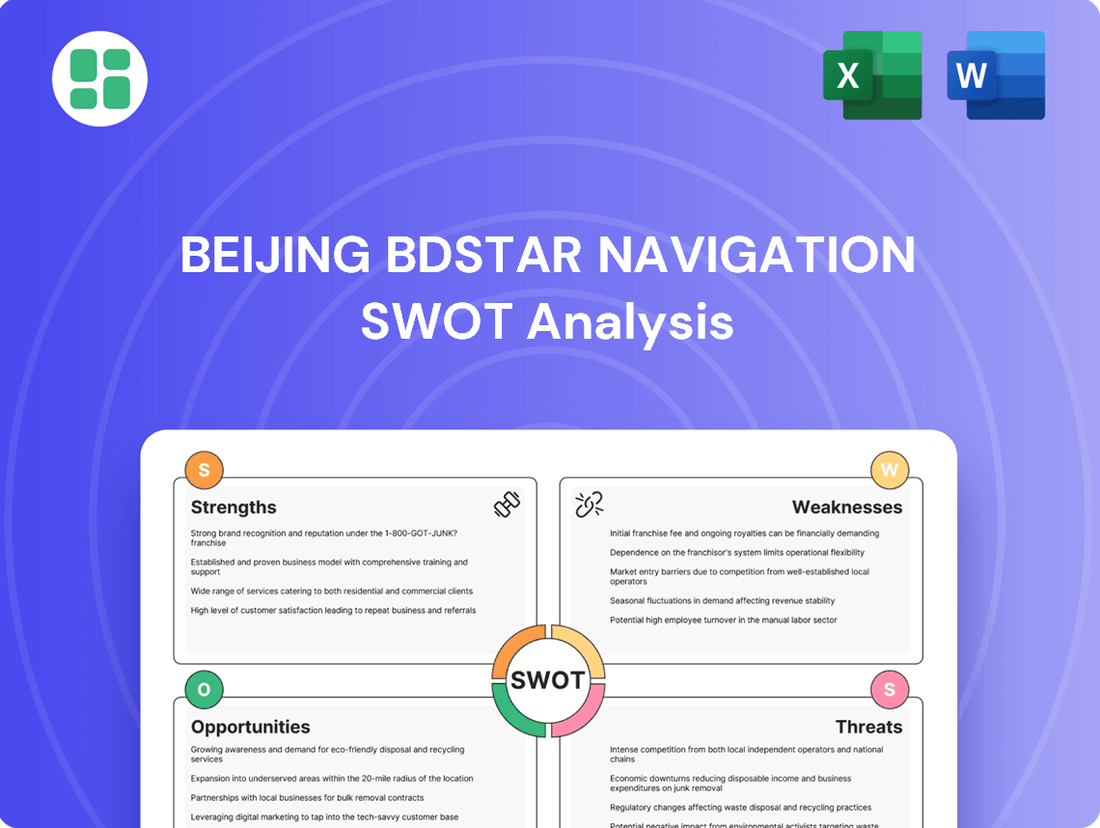

Analyzes Beijing BDStar Navigation’s competitive position through key internal and external factors, detailing its strengths in technology and market access, weaknesses in brand recognition, opportunities in emerging markets, and threats from intense competition.

Offers a clear breakdown of Beijing BDStar Navigation's competitive landscape, directly addressing the pain of uncertainty in strategic decision-making.

Weaknesses

Beijing BDStar Navigation's significant reliance on the Chinese domestic market presents a key weakness. While China's market is substantial, this concentration exposes BDStar to heightened risks from domestic economic downturns or sudden policy changes. For example, a slowdown in China's infrastructure spending or defense budget could directly impact BDStar's revenue streams, as a large portion of its business is tied to these sectors.

Beijing BDStar Navigation operates in a fiercely competitive arena, grappling with formidable rivals both on the global stage and within China's burgeoning domestic market. Major international entities such as Qualcomm, Trimble, and Hexagon, along with a growing number of Chinese firms focused on autonomous driving and navigation solutions, exert constant pressure. This crowded field demands relentless innovation and substantial capital outlay to secure and advance market standing and technological leadership.

Maintaining a technological edge in the rapidly evolving GNSS and autonomous driving sectors requires substantial and ongoing investment in research and development. BDStar Navigation's commitment to innovation, while crucial for future growth, directly translates into significant R&D expenditures. For instance, the company reported a net loss for the full year 2024, with preliminary Q1 2025 results also indicating continued financial pressure, suggesting that these high R&D costs are a key factor impacting short-term profitability.

Vulnerability to Global Supply Chain Disruptions

As a key player in developing and manufacturing essential components like GNSS chips and modules, Beijing BDStar Navigation faces significant vulnerability to disruptions within the global supply chain. This reliance on intricate international networks means that events like widespread chip shortages, as seen impacting the automotive and electronics sectors throughout 2021-2024, can directly impede BDStar's production capabilities. Such disruptions can lead to increased manufacturing costs and significant delays in getting their products to market, a persistent hurdle for high-tech manufacturers worldwide.

The company's dependence on a stable flow of critical raw materials and specialized semiconductors makes it susceptible to geopolitical events and trade restrictions. For instance, the ongoing global semiconductor supply chain challenges, which saw lead times for certain advanced chips extend to over a year in 2023, highlight the potential for production bottlenecks and cost escalations for BDStar. This inherent weakness requires robust risk management strategies to mitigate the impact of external shocks on their operations and delivery schedules.

- Supply Chain Bottlenecks: Vulnerability to global chip shortages and raw material availability issues.

- Increased Costs: Disruptions can lead to higher component acquisition and manufacturing expenses.

- Delivery Delays: Production interruptions can significantly impact product delivery timelines.

- Geopolitical Risks: Susceptibility to trade restrictions and international political instability affecting component sourcing.

Potential Impact from Geopolitical Tensions

Increasing geopolitical tensions, especially between China and Western nations, present a significant risk. These disputes could indirectly impact BDStar Navigation. For instance, trade tariffs or barriers could affect the business of its Canadian subsidiary, which serves the US market. This necessitates ongoing vigilance and strategic adjustments to mitigate potential disruptions.

The company's reliance on international markets makes it susceptible to shifts in global trade policies. As of early 2024, ongoing trade discussions between the US and China, alongside broader global economic uncertainties, highlight the dynamic nature of these risks. BDStar must remain agile to navigate these complex international relationships and their potential financial implications.

- Trade Policy Impact: Tariffs or trade restrictions could increase costs for BDStar's Canadian operations or reduce demand from US clients.

- Supply Chain Vulnerability: Geopolitical friction might disrupt the supply chains for components crucial to BDStar's satellite navigation products.

- Market Access Restrictions: Certain political climates could lead to limitations on market access for Chinese technology companies in Western countries.

BDStar Navigation's substantial reliance on the Chinese domestic market, while offering scale, creates a significant vulnerability to internal economic shifts or policy changes. This concentration means that a slowdown in key sectors like infrastructure or defense spending, which are major drivers for BDStar, could directly impact its revenue. For example, if China's national development priorities shift away from areas where BDStar's navigation solutions are critical, the company could face reduced demand.

The company operates in a highly competitive landscape, facing pressure from both established global players and a growing number of domestic Chinese firms. This requires continuous innovation and significant investment to maintain market share and technological leadership. For instance, the autonomous driving sector, a key growth area, is populated by tech giants and specialized startups, all vying for market dominance.

High research and development (R&D) expenditures are a necessity for BDStar to stay competitive in the rapidly evolving GNSS and autonomous systems markets. These ongoing investments, while crucial for future growth, directly impact short-term profitability. The company's financial performance, including reported net losses for the full year 2024 and continued financial pressures in early 2025, underscores the cost of maintaining this technological edge.

BDStar Navigation's dependence on global supply chains for critical components, such as advanced semiconductors, exposes it to disruptions. Events like the widespread chip shortages experienced between 2021 and 2024 highlight the potential for production delays and increased manufacturing costs. This vulnerability necessitates robust supply chain management and diversification strategies to ensure consistent production and timely delivery of its navigation products.

| Weakness Category | Specific Concern | Potential Impact | Example/Context |

|---|---|---|---|

| Market Concentration | Heavy reliance on the Chinese domestic market | Vulnerability to domestic economic downturns and policy shifts | Slowdown in Chinese infrastructure or defense spending |

| Competition | Intense rivalry from global and domestic players | Pressure on market share and profitability, requiring high R&D investment | Competition from Qualcomm, Trimble, Hexagon, and Chinese autonomous driving firms |

| R&D Investment | Significant ongoing expenditure for technological advancement | Impact on short-term profitability and financial performance | Net loss reported for FY2024, continued financial pressure in Q1 2025 |

| Supply Chain Dependency | Reliance on global supply chains for critical components | Risk of production delays and increased manufacturing costs due to shortages | Impact of global chip shortages seen in 2021-2024 |

Preview Before You Purchase

Beijing BDStar Navigation SWOT Analysis

This is the actual Beijing BDStar Navigation SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can trust that the insights and strategic considerations presented here are representative of the full, detailed report. Purchase unlocks the complete, in-depth version for your strategic planning needs.

Opportunities

The global GNSS market is expected to reach USD 703.21 billion by 2032, growing at an 11.17% CAGR, presenting a significant opportunity for BDStar's high-precision positioning technologies.

The expanding IoT market, a key area for BDStar's integrated solutions, offers further avenues for international growth and adoption of its navigation and connectivity services.

This dual market expansion provides BDStar with a substantial and growing international customer base eager for advanced positioning and IoT capabilities.

The global autonomous driving sector is experiencing a significant upswing, with projections indicating a market value of approximately $200 billion by 2025, driven by increasing consumer adoption and technological breakthroughs. BDStar's established proficiency in high-precision positioning systems, coupled with its strategic acquisition of automotive electronics capabilities in early 2024, directly addresses the core needs of this rapidly evolving industry. This dual focus allows BDStar to offer integrated, reliable navigation solutions crucial for the safe and efficient operation of autonomous vehicles, positioning the company for substantial market share capture.

China's dedication to advancing its BeiDou Navigation Satellite System offers a significant avenue for BDStar. The system's planned technological upgrades by 2025 and full realization by 2035 will create a robust environment for new applications and continuous innovation in satellite navigation.

As a prominent domestic provider, BDStar is strategically positioned to leverage these forthcoming BeiDou enhancements, integrating them into its product and service portfolio. This development aligns with the broader national strategy, potentially leading to increased government contracts and market share for BDStar in the evolving satellite navigation landscape.

Strong Government Support and Policy Initiatives

The Chinese government's unwavering commitment to the satellite navigation sector, particularly the BeiDou system, provides a significant tailwind for Beijing BDStar Navigation. Policy initiatives aimed at accelerating BeiDou's integration across various industries, from transportation to agriculture, directly translate into expanded market opportunities for BDStar's solutions. This strategic focus is expected to drive substantial government procurement and incentivize private sector adoption.

Further bolstering BDStar's prospects, broader national strategies emphasizing high-end manufacturing and the digital economy create a fertile ground for innovation and growth. For instance, the Digital China initiative, with its focus on smart infrastructure and data-driven services, inherently supports the deployment of advanced positioning and navigation technologies. These overarching policies foster an environment conducive to research and development, market penetration, and the overall technological advancement of companies like BDStar.

Key government support mechanisms include:

- Increased R&D Funding: Allocations for satellite navigation research are projected to rise, supporting BDStar's technological advancements.

- Preferential Procurement Policies: Government agencies are increasingly mandated to utilize BeiDou-based systems, creating a guaranteed customer base.

- Industry Standards Development: Government involvement in setting BeiDou standards ensures interoperability and facilitates market entry for compliant solutions.

- Subsidies and Tax Incentives: Financial incentives are available for companies contributing to the national satellite navigation ecosystem, reducing operational costs for BDStar.

International Expansion of BeiDou Ecosystem

BeiDou's established presence, with products and services reaching over 140 countries and embedded in international standards, presents a significant opportunity for BDStar to broaden its global reach. This existing penetration provides a strong foundation for further international expansion.

The United Nations' recognition of the BeiDou Navigation Satellite System (BDS) and its integration into various international organizations' standards are key enablers for BDStar. These endorsements facilitate market entry, especially in regions actively adopting BeiDou for a wide array of applications, from precision agriculture to smart transportation.

- Global Reach: BeiDou products exported to over 140 countries.

- Standard Integration: BeiDou integrated into international standards.

- Market Penetration: Opportunity to enter new markets adopting BeiDou technology.

- UN Recognition: United Nations endorsement aids global adoption efforts.

The burgeoning global autonomous driving sector, projected to exceed $200 billion by 2025, presents a prime opportunity for BDStar. The company's expertise in high-precision positioning, bolstered by its early 2024 acquisition of automotive electronics capabilities, directly addresses the critical navigation needs of this rapidly expanding market.

China's ongoing development and technological upgrades to its BeiDou Navigation Satellite System, with full realization targeted by 2035, create a fertile ground for BDStar's innovation and application development.

The global GNSS market's significant growth, anticipated to reach USD 703.21 billion by 2032 with an 11.17% CAGR, offers BDStar substantial opportunities for its high-precision positioning technologies and integrated IoT solutions.

BeiDou's established international presence, with products in over 140 countries and integration into international standards, provides BDStar a solid platform for further global market penetration and expansion.

Threats

The satellite navigation and high-precision positioning landscape is becoming increasingly crowded. Established global entities and burgeoning domestic rivals are all vying for a piece of this growing market. This intensified competition, particularly within China where BDStar holds a strong position, attracts new players and fuels aggressive pricing strategies, raising concerns about potential market saturation in specific areas.

This heightened competitive pressure could directly impact BDStar's profitability by squeezing profit margins. Furthermore, it presents a significant challenge to maintaining and expanding its existing market share as more companies enter the fray, all seeking to capture a larger portion of the demand.

The rapid evolution of technologies like AI, 5G, and advanced sensors in GNSS, autonomous driving, and IoT presents a significant threat of obsolescence for BDStar's current offerings. Competitors are constantly innovating, potentially introducing superior or more affordable solutions that could quickly diminish the value of BDStar's existing products.

To counter this, BDStar's commitment to research and development is crucial. For instance, in 2023, the company allocated approximately 15% of its revenue to R&D, a figure that needs to remain robust to stay competitive in these fast-moving sectors.

Escalating geopolitical tensions, particularly between China and Western nations, present a significant threat to BDStar Navigation. The imposition of trade barriers and tariffs by major economies like the United States and the European Union on Chinese technology products could directly impact BDStar's international sales, potentially reducing revenue streams from key global markets.

These trade policies can also disrupt BDStar's supply chain by increasing the cost of essential imported components or even restricting access to critical technologies needed for product development and manufacturing. For instance, in 2023, the US continued to place restrictions on certain Chinese tech firms, impacting their ability to acquire advanced semiconductors, a component vital for navigation systems.

Such measures could significantly hinder BDStar's global expansion efforts and compromise the stability of its international supply chain. The company's reliance on a global network for both sales and component sourcing makes it particularly vulnerable to these evolving trade dynamics.

Economic Slowdown Impact on Industrial Investment

An economic slowdown presents a significant threat to Beijing BDStar Navigation. A general downturn, whether in China or globally, could lead to reduced capital expenditure across key sectors that rely on BDStar's high-precision positioning and navigation solutions. Industries like automotive, construction, and agriculture, which are major consumers of these technologies, might scale back investments in new projects and upgrades.

This decreased industrial investment directly impacts BDStar's revenue streams. A slowdown in the adoption of autonomous driving systems, advanced IoT applications, and infrastructure development projects could dampen demand for BDStar's core offerings. For instance, if China's GDP growth moderates, as projected by many economists for 2024-2025, this could translate into lower sales volumes for BDStar.

- Reduced Capital Expenditure: Industries may cut back on investments in new equipment and technology due to economic uncertainty.

- Lower Demand for Navigation Solutions: A slowdown in automotive production or construction projects directly curbs the need for BDStar's advanced positioning systems.

- Impact on IoT and Autonomous Driving: Investment in these forward-looking sectors is often sensitive to broader economic conditions, potentially delaying adoption and revenue generation.

- Global Economic Headwinds: International market downturns can also affect BDStar's sales if it has significant export markets.

Cybersecurity Risks and Data Privacy Concerns

As satellite navigation and IoT systems become more interconnected, cybersecurity risks and data privacy concerns are escalating. A significant breach could severely damage BDStar's reputation and user trust. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved.

Stricter data protection regulations, such as GDPR and similar frameworks being adopted globally, could impose substantial compliance costs on BDStar. Failure to adhere to these evolving mandates may result in hefty fines and operational disruptions, impacting profitability and market access. The average cost of a data breach in 2024 was reported to be $4.73 million globally.

- Increased attack surface: The growing integration of BDStar's navigation and IoT solutions into critical infrastructure, like transportation and energy grids, presents more potential entry points for malicious actors.

- Data privacy liabilities: Handling sensitive location and user data necessitates robust privacy protocols; non-compliance can lead to significant legal penalties and reputational damage.

- Erosion of trust: A major cybersecurity incident could undermine customer confidence in the reliability and security of BDStar's services, leading to customer attrition.

- Regulatory scrutiny: Governments worldwide are intensifying their focus on data security and privacy, potentially leading to more stringent oversight and enforcement actions against companies like BDStar.

The increasing complexity and interconnectedness of satellite navigation and IoT systems amplify cybersecurity threats. A substantial data breach could severely damage BDStar's reputation and user trust, especially as the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025. Furthermore, stricter data protection regulations worldwide could impose significant compliance costs, with the average cost of a data breach in 2024 reported at $4.73 million globally.

| Threat Category | Description | Potential Impact | Mitigation Focus |

|---|---|---|---|

| Cybersecurity & Data Privacy | Growing interconnectedness of navigation and IoT systems increases attack vectors. Handling sensitive location data poses privacy risks. | Reputational damage, loss of user trust, hefty fines for non-compliance (e.g., GDPR). | Robust security protocols, data encryption, adherence to privacy regulations, regular security audits. |

| Geopolitical Tensions & Trade Policies | Trade barriers, tariffs, and restrictions imposed by major economies on Chinese technology. | Reduced international sales, supply chain disruptions, increased component costs, limited access to critical technologies. | Supply chain diversification, exploring alternative markets, lobbying for favorable trade policies. |

| Intensified Competition | Increased number of global and domestic players in the satellite navigation market. | Erosion of market share, pressure on profit margins, aggressive pricing strategies. | Continuous innovation, R&D investment (e.g., 15% of revenue in 2023), strategic partnerships. |

| Technological Obsolescence | Rapid advancements in AI, 5G, and sensors could render current offerings outdated. | Loss of competitive edge, decreased product relevance, need for significant R&D investment. | Proactive R&D, agile product development, adoption of emerging technologies. |

SWOT Analysis Data Sources

This analysis draws from a comprehensive blend of official company filings, market research reports, and expert industry commentary to provide a robust understanding of Beijing BDStar Navigation's strategic position.