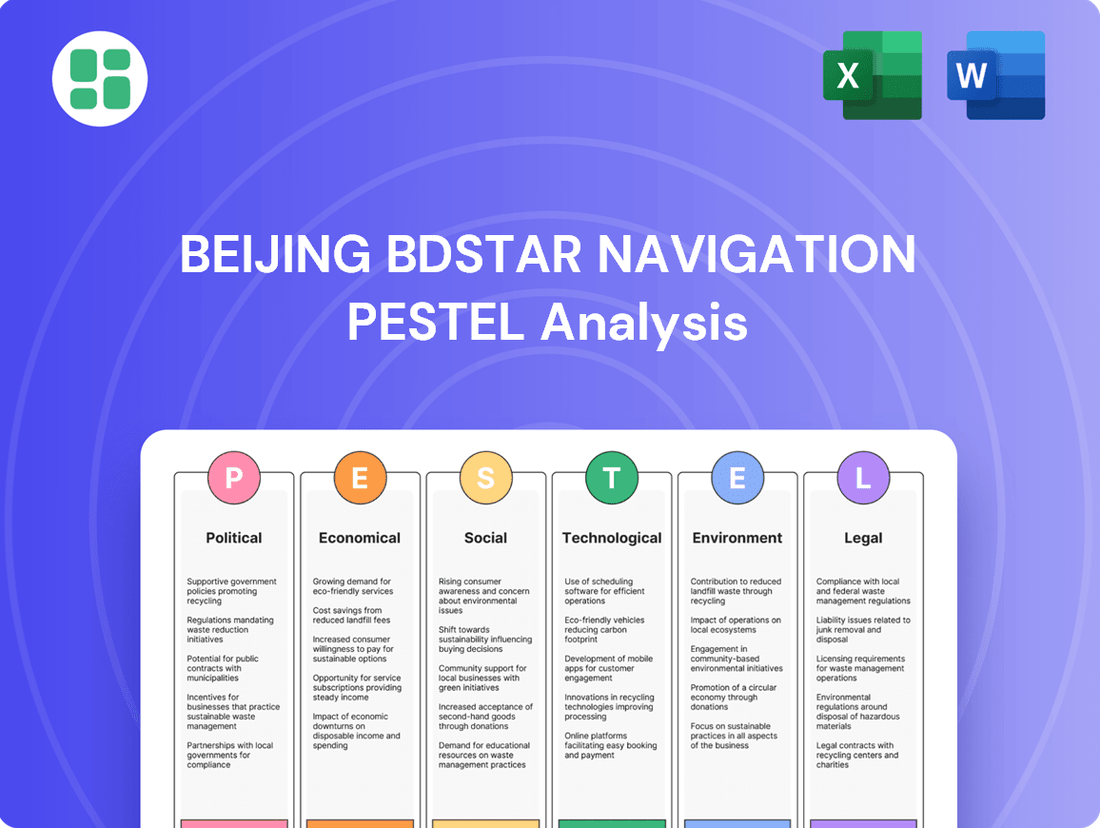

Beijing BDStar Navigation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing BDStar Navigation Bundle

Unlock the strategic landscape of Beijing BDStar Navigation with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Gain the foresight needed to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now to arm yourself with actionable intelligence.

Political factors

The Chinese government's unwavering commitment to the BeiDou Navigation Satellite System (BDS) as a cornerstone of national strategy creates a highly supportive policy landscape for BDStar Navigation. This strategic imperative, focused on achieving technological self-reliance and expanding global reach, translates into consistent government backing and investment for BDS development and application, directly benefiting BDStar as a primary implementer.

Official government documents, including development plans and white papers, consistently signal ongoing and future investment in enhancing BeiDou's capabilities and broadening its application scope. For instance, the 14th Five-Year Plan (2021-2025) emphasizes the integration of BeiDou with other emerging technologies, indicating a sustained commitment to its growth and integration into various sectors.

China's National Digital Economy Strategy, often referred to as 'Digital China,' is a significant political driver for companies like BDStar Navigation. This strategy involves substantial government investment in digital infrastructure, artificial intelligence, and the data industry. These investments directly support BDStar's core business in areas like the Internet of Things (IoT) and autonomous driving, which are fundamental to the nation's digital transformation goals.

The government's ambition is for the core digital economy industries to contribute more than 10% to China's Gross Domestic Product (GDP) by the end of 2025. This aggressive target signals a strong commitment to fostering growth in sectors where BDStar operates, creating a favorable policy environment for its technological advancements and market expansion.

Beijing and other major Chinese cities are actively crafting clearer legal and regulatory frameworks to facilitate the testing, demonstration, and eventual commercial deployment of autonomous vehicles. These advancements are crucial for the industry's growth.

Regulations like those enacted in Beijing in late 2024, which became effective in April 2025, are particularly significant. They offer a defined path for companies like BDStar to integrate their high-precision positioning solutions into the rapidly expanding autonomous driving sector, reducing market entry barriers.

Geopolitical Competition and Self-Reliance

Heightened geopolitical competition, especially between the US and China in advanced technologies, is a significant driver for China's push towards self-reliance in crucial areas like satellite navigation. This strategic imperative directly benefits companies like BDStar, which are central to China's domestic Global Navigation Satellite System (GNSS) capabilities.

BDStar's focus on developing domestic GNSS chips and modules is strategically vital for reducing China's reliance on foreign systems such as GPS. This national objective fosters a protected and prioritized domestic market, creating a favorable environment for BDStar's growth and innovation in the navigation sector.

- Technological Decoupling: The ongoing US-China tech rivalry accelerates China's drive for indigenous solutions, bolstering demand for BDStar's BeiDou-centric products.

- Market Protection: Government policies favoring domestic GNSS providers create a secure market for BDStar, shielding it from direct foreign competition.

- Strategic Importance: BeiDou's role in national security and economic development elevates BDStar's status, likely leading to continued state support and investment.

International Expansion of BeiDou

China's concerted effort to expand BeiDou's global footprint is a significant political factor for BDStar. The system's export to over 140 countries and integration into 11 international organizations' standards highlight a deliberate push for international adoption. This diplomatic drive, supported by government initiatives and strategic alliances, directly translates into expanded market access for BDStar's navigation and positioning solutions on a global scale.

BeiDou's increasing role as a tool of Chinese foreign policy further amplifies its significance. By fostering international reliance on its satellite navigation system, China aims to bolster its geopolitical influence and technological standing. This strategic positioning can create both opportunities and potential challenges for BDStar as it navigates international markets shaped by geopolitical considerations.

- Global Reach: BeiDou products and services exported to over 140 countries and regions.

- Standard Integration: Incorporated into the standards of 11 international organizations.

- Diplomatic Driver: International adoption driven by government diplomacy and strategic partnerships.

China's national strategy prioritizes technological self-reliance, heavily supporting BDStar Navigation's role in the BeiDou system. This focus is evident in the 14th Five-Year Plan, which targets the integration of BeiDou with emerging technologies, ensuring sustained government investment and development. The 'Digital China' strategy further bolsters BDStar, with significant government investment in digital infrastructure and AI, aiming for digital economy industries to contribute over 10% to GDP by 2025.

Regulatory advancements, particularly in autonomous driving, are crucial. Beijing's regulations, effective April 2025, provide a clear framework for integrating high-precision positioning solutions like BDStar's into this growing sector. Geopolitical competition with the US accelerates China's drive for indigenous solutions, creating a protected domestic market for BDStar's BeiDou-centric products and reducing reliance on foreign systems like GPS.

BeiDou's global expansion is a key political objective, with its products and services reaching over 140 countries and integrated into 11 international organizations' standards. This diplomatic push, supported by government initiatives, expands market access for BDStar, while BeiDou's role in foreign policy enhances China's geopolitical influence and technological standing.

| Factor | Description | Impact on BDStar Navigation |

|---|---|---|

| National Strategy & Investment | Government commitment to BeiDou as a strategic asset, with continued investment outlined in development plans like the 14th Five-Year Plan. | Directly benefits BDStar through funding and prioritization of BeiDou development and applications. |

| Digital Economy Push | China's 'Digital China' strategy and ambitious GDP targets for digital economy industries by 2025. | Creates a favorable environment for BDStar's IoT and autonomous driving solutions, aligning with national digital transformation goals. |

| Autonomous Driving Regulations | Evolving legal and regulatory frameworks for autonomous vehicles, such as Beijing's April 2025 regulations. | Reduces market entry barriers for BDStar's high-precision positioning solutions in the autonomous driving sector. |

| Geopolitical Competition | US-China tech rivalry driving China's pursuit of technological self-reliance. | Fosters a protected domestic market for BDStar's BeiDou-based products and reduces reliance on foreign GNSS. |

| Global BeiDou Expansion | Government-led efforts to expand BeiDou's international adoption and integration into global standards. | Opens up expanded market access for BDStar's navigation and positioning solutions globally. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Beijing BDStar Navigation, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive overview designed to equip stakeholders with insights into market dynamics and strategic opportunities.

This PESTLE analysis for Beijing BDStar Navigation acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing during meetings and streamlining strategic decision-making.

Economic factors

The satellite navigation market in China is expanding rapidly, reaching an output value of 575.8 billion yuan in 2024, a 7.39% increase from the previous year. This growth is fueled by broad adoption and rising demand for navigation services across various sectors.

BDStar's core business, particularly in satellite navigation chips and algorithms, benefits directly from this expansion, with its segment alone generating 169.9 billion yuan in output value in 2024. This strong market foundation supports BDStar's strategic positioning and revenue potential.

The autonomous vehicle market in China is on a significant growth trajectory, with projections indicating a leap from US$17.23 billion in 2024 to US$170.57 billion by 2033. This substantial expansion, driven by innovation and supportive government initiatives, presents a vast opportunity for BDStar's high-precision positioning and navigation technologies, which are critical components for self-driving vehicles.

The increasing adoption of advanced autonomous driving features in China's passenger car market is a key indicator of this trend. In 2024, the penetration rate for these advanced systems stood at 11.4%, with expectations that this figure will climb to 31.6% by 2030, underscoring the growing demand for the underlying navigation and positioning infrastructure that BDStar provides.

China's aggressive push for mobile Internet of Things (IoT) development, targeting over 3.6 billion mobile IoT terminal connections by 2027, signals a massive economic tailwind. This expansion, supported by substantial investments in 5G infrastructure, directly benefits BDStar's IoT business by creating a vast market for its solutions.

Further bolstering this growth, the satellite IoT sector, while niche, offers significant revenue potential. This segment is expected to more than double, growing from an estimated $2.24 billion in 2025 to $5.52 billion by 2030, presenting BDStar with opportunities in high-value markets.

Increased R&D Investment and Patent Growth

China's satellite navigation sector has experienced a surge in innovation, with patent applications surpassing 129,000 by the close of 2024. This robust growth underscores a significant commitment to research and development within the industry.

The substantial investment in R&D, especially in critical areas such as satellite navigation chips and sophisticated algorithms, creates a fertile environment for companies like BDStar to maintain and enhance their technological edge. This focus directly translates into improved product differentiation and strengthens market competitiveness.

- Patent Growth: Over 129,000 patent applications in China's satellite navigation sector by end of 2024.

- R&D Focus: Investment concentrated on core components like chips and algorithms.

- Market Impact: Drives product differentiation and competitiveness for leading firms.

Government Subsidies and Incentives

Government support for strategic industries, such as satellite navigation and the digital economy, directly benefits companies like BDStar Navigation. While specific subsidies for BDStar aren't explicitly stated, broader policy initiatives create a favorable operating environment. This includes potential tax breaks, research grants, and preferential government procurement, all of which can lower costs and spur innovation.

China's commitment to developing its high-tech sector is evident in plans like Made in China 2025, aiming for self-sufficiency in critical areas like industrial design and production. This national focus translates into tangible advantages for domestic players in advanced technologies. For example, the digital economy sector in China saw significant growth, with its scale reaching an estimated 50.2 trillion yuan in 2023, indicating substantial government investment and policy backing.

- Favorable Policies: Expect continued government backing through tax incentives and R&D funding for companies in the satellite navigation sector.

- Preferential Procurement: Government entities are likely to prioritize domestic suppliers for navigation and related technologies.

- Innovation Support: Grants and funding are available to encourage technological advancements and self-sufficiency in high-tech industries.

- Market Growth: The digital economy's expansion, projected to continue its robust growth trajectory, creates a larger market for BDStar's navigation solutions.

China's economic landscape presents a robust environment for BDStar Navigation, driven by significant growth in its core markets. The satellite navigation sector's output value reached 575.8 billion yuan in 2024, a 7.39% increase, directly benefiting BDStar's chip and algorithm segments which generated 169.9 billion yuan in output value that same year. Furthermore, the burgeoning autonomous vehicle market, projected to expand from US$17.23 billion in 2024 to US$170.57 billion by 2033, offers substantial opportunities for BDStar's high-precision positioning technologies. The expanding mobile IoT sector, targeting over 3.6 billion connections by 2027, also provides a strong economic tailwind for BDStar's solutions.

| Economic Factor | 2024 Data/Projection | Impact on BDStar |

|---|---|---|

| Satellite Navigation Market Output Value | 575.8 billion yuan (7.39% increase) | Direct revenue growth for BDStar's core business. |

| Autonomous Vehicle Market Size | US$17.23 billion (2024) to US$170.57 billion (2033) | Significant demand for BDStar's high-precision navigation. |

| Mobile IoT Terminal Connections | Over 3.6 billion by 2027 | Expands market for BDStar's IoT navigation solutions. |

Full Version Awaits

Beijing BDStar Navigation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Beijing BDStar Navigation's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting BDStar Navigation.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the external environment of this leading navigation technology company.

Sociological factors

The increasing adoption of smart devices is a significant sociological factor for BDStar Navigation. By the end of 2024, an estimated 288 million mobile phones in China were equipped with BeiDou Navigation Satellite System (BDS) positioning capabilities. This widespread integration demonstrates a growing societal reliance on and acceptance of advanced navigation technologies.

This trend translates into a substantial user base for BDStar's products and services. By the close of 2024, over 2 billion devices in China possessed the capability to utilize BeiDou. This high level of adoption underscores the societal shift towards smart, connected devices that increasingly depend on precise location services.

There's a growing societal desire for safer and more efficient travel, especially as self-driving technology advances. This directly fuels the demand for precise location services, which is a core area for BDStar Navigation.

With more smart, connected cars hitting the road, people expect navigation systems to be both dependable and spot-on. This societal shift plays right into BDStar's strengths, particularly in the automotive sector.

The strong emphasis on making transportation safer is a major catalyst for the growth of autonomous vehicles. This trend is a significant tailwind for companies like BDStar that provide the foundational technology for these systems.

China's rapid urbanization continues to accelerate, with projections indicating that by 2025, over 65% of its population will reside in urban areas. This demographic shift is a primary driver for smart city initiatives, creating a substantial market for technologies like the Internet of Things (IoT) and high-precision positioning systems. BDStar's expertise in these areas directly addresses the growing need for efficient infrastructure management, enhanced public services, and sophisticated intelligent transportation networks within these expanding urban centers.

The societal embrace of smarter, more connected urban living environments translates into increased demand for BDStar's integrated solutions. For instance, smart traffic management systems, a key component of smart cities, saw significant investment in 2024. This trend is expected to continue into 2025, as cities aim to reduce congestion and improve safety, directly benefiting companies like BDStar that provide the foundational navigation and positioning technologies.

Aging Population and Accessibility Needs

China's rapidly aging population presents a significant sociological shift, with projections indicating that by 2035, over 30% of the population will be 60 years or older. This demographic trend directly influences demand for technologies that enhance mobility and independence for older adults. BDStar's expertise in navigation and positioning systems is well-suited to address these evolving needs.

The increasing number of elderly individuals, coupled with a desire for greater autonomy, fuels the market for assisted living solutions and accessible transportation. BDStar's positioning and navigation technologies can be integrated into autonomous vehicles and advanced mobility aids, offering safer and more convenient travel options for seniors and those with disabilities. This could unlock new revenue streams for the company by catering to a growing and underserved market segment.

- Demographic Shift: China's elderly population is projected to reach 400 million by 2035, impacting consumer demand and service needs.

- Market Opportunity: Demand for assistive technologies in transportation is expected to rise significantly, creating a new market for BDStar.

- Technological Integration: BDStar's core competencies in navigation can be applied to develop solutions for autonomous driving and enhanced mobility for the elderly.

Data Privacy Concerns and Public Trust

Growing public awareness regarding data privacy, particularly with the proliferation of satellite navigation and IoT devices, poses a significant challenge. As BDStar's technologies collect extensive personal and location data, maintaining public trust becomes paramount. This necessitates transparent data handling and strong security measures to prevent potential backlash and ensure continued market adoption.

China's issuance of ethical guidelines for autonomous driving, including limitations on data collection, underscores the regulatory focus on privacy. For instance, by mid-2024, regulations were being finalized to govern the cross-border transfer of data generated by connected vehicles, impacting companies like BDStar operating in this space.

- Data Collection Scrutiny: Increased public and governmental scrutiny on how location and personal data are collected, stored, and utilized by navigation and IoT systems.

- Trust as a Differentiator: Companies demonstrating robust data protection and transparent practices, like BDStar, can build significant public trust, which is crucial for user adoption.

- Regulatory Landscape: Evolving regulations in China and globally are shaping data privacy expectations, requiring companies to adapt their operations to comply with new standards.

Societal acceptance of advanced navigation is growing, with over 2 billion devices in China capable of using BeiDou by the end of 2024. This widespread adoption, driven by a desire for safer and more efficient travel, particularly with autonomous vehicle advancements, directly benefits BDStar Navigation.

China's rapid urbanization, projected to have over 65% of its population in urban areas by 2025, fuels smart city initiatives. This creates a significant market for BDStar's IoT and high-precision positioning technologies, essential for smart traffic management and intelligent transportation networks.

The aging demographic in China, with over 30% of the population expected to be 60+ by 2035, presents an opportunity for BDStar. Demand for assistive technologies, including navigation for autonomous vehicles and mobility aids, is rising, offering new avenues for the company.

Public concern over data privacy, amplified by the proliferation of navigation and IoT devices, necessitates transparency and robust security from companies like BDStar. Evolving regulations, such as those governing data transfer by mid-2024, further shape these expectations.

Technological factors

China's ambitious push to upgrade the BeiDou Navigation Satellite System is a significant technological factor for Beijing BDStar Navigation. The next-generation system aims for critical advancements by 2025, with full completion slated for 2035. This evolution promises real-time, highly accurate navigation, achieving precision levels from meters down to decimeters, alongside an optimized satellite constellation structure.

These ongoing enhancements to BeiDou's core capabilities directly benefit BDStar by providing a more robust and dependable platform for its diverse range of navigation and positioning products and services. The system’s growing precision and reliability are crucial for applications in sectors like autonomous driving and high-precision surveying, areas where BDStar is actively engaged.

Beijing BDStar Navigation's expertise in high-precision positioning is a significant technological enabler. This technology is vital for emerging sectors such as autonomous vehicles and the industrial Internet of Things (IoT), where exact location data is paramount for safe and efficient operation.

The market, particularly for urban autonomous driving, increasingly requires centimeter-level accuracy. BDStar's subsidiary, Unicore, is at the forefront of this, developing sophisticated Real-Time Kinematic (RTK) and Inertial Navigation System (INS) integrated positioning modules to meet these stringent demands.

This ongoing commitment to advancing positioning precision serves as a crucial competitive differentiator for BDStar. For instance, in 2023, Unicore's GNSS modules achieved a market share of over 30% in China's high-precision GNSS receiver market, highlighting their technological leadership and market penetration.

The integration of Global Navigation Satellite System (GNSS) chips and modules is a foundational technological factor for Beijing BDStar Navigation. In 2024, China's satellite navigation industry saw its core output value, encompassing chips, algorithms, and terminal devices, reach 169.9 billion yuan. This substantial figure underscores the critical importance of advanced component-level technology within the sector.

BDStar's proficiency in designing and manufacturing these essential GNSS chips and modules directly addresses this significant market demand. By focusing on technological self-sufficiency at the component level, BDStar is well-positioned to capture and maintain a strong market share. For instance, the company's Unicore UM62X series of automotive-grade modules has already entered mass production, specifically targeting the burgeoning intelligent cockpit segment.

AI and IoT Integration

The convergence of Artificial Intelligence (AI) with the Internet of Things (IoT) and satellite navigation is a significant technological driver, fueling innovation across sectors like smart connected vehicles, smart cities, and industrial automation. Beijing BDStar Navigation's strategic focus on IoT applications positions it to capitalize on this trend, facilitating enhanced intelligent decision-making and increased automation in its offerings.

China's national digital economy strategy actively promotes 'AI Plus' applications and the further optimization of IoT networks and industrial internet infrastructure. This governmental push creates a favorable environment for companies like BDStar that are deeply involved in these interconnected technologies. For instance, the development of autonomous driving systems, a key area for BDStar, relies heavily on the seamless integration of AI, IoT sensors, and precise satellite positioning.

BDStar's investment in AI and IoT integration is expected to yield tangible benefits. By 2025, the global IoT market is projected to reach over $1.5 trillion, with a significant portion driven by industrial and automotive applications. BDStar's ability to leverage AI for data analysis from its IoT-enabled navigation systems can unlock new revenue streams and improve operational efficiency.

- AI-powered data analytics for optimizing navigation routes and traffic flow in smart city initiatives.

- IoT sensor integration in connected vehicles to provide real-time diagnostics and predictive maintenance.

- Enhanced industrial automation through AI-driven insights from IoT devices in manufacturing and logistics.

- Support for China's 'AI Plus' initiative by developing advanced AI algorithms for satellite navigation and positioning services.

Development of Autonomous Driving Solutions

The development of autonomous driving solutions is a significant technological factor for Beijing BDStar Navigation. BDStar is a key player in providing high-precision positioning, which is crucial for the rapidly evolving autonomous driving sector in China. This evolution includes advancements from L2.5 to L4 systems, demanding complex positioning and sensor fusion capabilities.

BDStar's subsidiary, Unicore, has been actively involved in securing major projects within the intelligent driving space. For instance, in 2023, Unicore announced several new orders for its automotive-grade chips, contributing to the growing Chinese intelligent vehicle market, which is projected to reach over 60% of new vehicle sales by 2030 according to industry forecasts.

- High-Precision Positioning: Essential for L2.5 to L4 autonomous driving systems.

- Sensor Fusion: BDStar's technology integrates multiple sensors for enhanced accuracy.

- Market Growth: China's intelligent vehicle market is expanding rapidly, driving demand for BDStar's solutions.

- Unicore's Role: Securing significant projects in intelligent driving, highlighting technological adoption.

The continuous advancement of China's BeiDou Navigation Satellite System is a primary technological driver for Beijing BDStar Navigation. By 2025, BeiDou's next-generation system aims for decimeter-level accuracy, enhancing the platform for BDStar's high-precision positioning products and services, particularly for autonomous driving and surveying applications.

BDStar's expertise in high-precision positioning, especially through its subsidiary Unicore, is crucial for emerging technologies like autonomous vehicles and the industrial Internet of Things (IoT). Unicore's RTK and INS integrated modules are designed to meet the centimeter-level accuracy demands of the urban autonomous driving market. In 2023, Unicore secured over 30% of China's high-precision GNSS receiver market, underscoring its technological leadership.

The integration of AI with IoT and satellite navigation is a key trend, powering smart connected vehicles and smart cities. BDStar's focus on IoT applications allows it to leverage AI for improved decision-making and automation. The global IoT market is projected to exceed $1.5 trillion by 2025, with significant growth in industrial and automotive sectors, presenting a substantial opportunity for BDStar.

| Technology Area | BDStar's Role/Capability | Market Impact/Data |

|---|---|---|

| BeiDou System Evolution | Leveraging enhanced accuracy (decimeter-level by 2025) | Supports high-precision navigation for autonomous driving. |

| High-Precision Positioning | RTK & INS integration (Unicore) | Unicore held >30% of China's high-precision GNSS receiver market in 2023. |

| AI & IoT Convergence | AI-driven insights for IoT navigation systems | Global IoT market projected >$1.5 trillion by 2025. |

Legal factors

China's commitment to robust data security and privacy is intensifying, particularly with the surge in location data usage via satellite navigation and IoT devices. BDStar must navigate these evolving regulations, which include specific limitations on data collection for autonomous driving systems, ensuring full compliance.

Failure to adhere to China's stringent data protection laws, such as the Personal Information Protection Law (PIPL), can result in significant penalties and damage user trust. For instance, PIPL imposes strict requirements on consent, data minimization, and cross-border data transfer, impacting how BDStar can collect and utilize location data.

Beijing, like other major Chinese cities, is actively developing and implementing specific regulations for autonomous vehicles (AVs). These rules govern everything from road testing and public demonstrations to eventual commercial deployment, creating a framework for how AV technology can be integrated into urban environments.

These evolving regulations clearly define legal liabilities for accidents and establish technical standards for various levels of autonomous driving, from driver assistance to fully driverless systems. For instance, by early 2024, several Chinese cities had issued permits for over 1,000 autonomous vehicles to conduct road tests, indicating a tangible push towards AV integration.

BDStar Navigation must remain agile, continuously updating its products and solutions to align with these dynamic national and local legal mandates. This proactive adaptation is crucial for BDStar to successfully navigate the complex regulatory landscape and ensure its autonomous driving technologies meet all necessary compliance requirements for market entry and sustained operation.

Beijing BDStar Navigation's reliance on its technological innovations, especially in satellite navigation chips and modules, makes robust intellectual property rights protection a critical legal factor. China's legal framework for safeguarding these innovations is vital for maintaining BDStar's competitive edge in the market. By the end of 2024, China had seen an impressive surge in satellite navigation patent applications, with over 129,000 submissions, underscoring the growing importance of IP in this sector.

International Standards and Compliance

The BeiDou Navigation Satellite System's integration into the standards of 11 international organizations, including those governing civil aviation, maritime affairs, and mobile communications, mandates that BDStar's products meet these global norms. This compliance is crucial for ensuring interoperability and facilitating market access in international arenas.

Adherence to these diverse legal and technical requirements across various jurisdictions presents both opportunities and challenges for BDStar. For instance, by meeting the International Civil Aviation Organization (ICAO) standards, BDStar products can be certified for use in global aviation, opening up significant revenue streams. As of late 2024, over 100 countries have adopted BeiDou services, underscoring the growing importance of international standardization.

- Global Integration: BeiDou's standards are now part of 11 international bodies, enhancing global compatibility.

- Market Access: Compliance ensures BDStar products can be sold and utilized worldwide.

- Regulatory Landscape: Navigating diverse legal frameworks in each country is essential for BDStar's international operations.

Product Liability and Safety Regulations

BDStar Navigation faces stringent product liability and safety regulations, particularly for its hardware and software used in end-user products like autonomous vehicles and high-precision navigation systems. Compliance with rigorous safety standards is paramount to mitigate risks and adhere to consumer protection laws.

Recent regulatory developments are clarifying liability in autonomous driving incidents, a critical area for BDStar. For instance, China's evolving legal framework for intelligent connected vehicles (ICVs) is increasingly defining responsibilities in scenarios where autonomous systems are involved in accidents. This necessitates robust validation and testing of BDStar's technologies to ensure they meet the highest safety benchmarks.

- Product Safety Standards: BDStar must ensure its navigation hardware and software meet stringent safety standards, such as those outlined by China's national standards for automotive products, to minimize liability risks.

- Autonomous Driving Liability: New regulations are assigning liability in autonomous vehicle accidents, placing a greater onus on manufacturers and technology providers like BDStar to guarantee system safety and reliability.

- Consumer Protection: Adherence to consumer protection laws is vital, requiring transparency in product performance and safety features, especially for high-stakes applications like autonomous driving.

- Regulatory Compliance Costs: Meeting these evolving safety and liability regulations may incur significant research, development, and testing costs for BDStar, impacting its operational budget.

China's legal framework is increasingly focused on data privacy and security, directly impacting how BDStar handles location data, especially for autonomous driving systems. Strict adherence to laws like the Personal Information Protection Law (PIPL) is essential, as non-compliance can lead to substantial fines and reputational damage. By early 2024, China had over 1,000 permits issued for autonomous vehicle road tests, highlighting the rapid development and regulatory oversight in this sector.

Environmental factors

Beijing BDStar Navigation, as a developer and manufacturer of critical electronic components like GNSS chips and modules, is increasingly feeling the pressure to embrace sustainable manufacturing. This involves actively managing electronic waste, a growing concern in the tech sector, and significantly reducing energy consumption throughout its production processes. For instance, the global electronics industry is projected to generate over 74 million metric tons of e-waste annually by 2030, highlighting the urgency for companies like BDStar to implement robust recycling and disposal programs.

Furthermore, responsible sourcing of materials is becoming paramount. This means ensuring that the raw materials used in BDStar's chips and modules are obtained in an environmentally conscious manner, minimizing depletion of natural resources and reducing pollution associated with extraction. While specific figures for BDStar's material sourcing are not publicly available, the broader electronics manufacturing sector in China is navigating stricter environmental regulations, with many companies investing in greener supply chains to meet both consumer and governmental expectations.

The burgeoning demand for data processing, fueled by advancements in IoT, high-precision positioning, and autonomous driving technologies, places a significant strain on energy resources. These data-intensive applications require substantial computing power, directly impacting the energy consumption of data centers. For instance, by 2025, global data center energy consumption is projected to reach approximately 1.5% of total global electricity demand, a figure that underscores the environmental implications.

BDStar Navigation's strategic direction will be increasingly shaped by the imperative for energy-efficient data solutions. Participation in national initiatives like China's 'East Data, West Computing' project is crucial. This ambitious plan aims to rebalance computing power, directing data processing to less energy-intensive regions and thereby reducing the overall carbon footprint of China's digital infrastructure, which is expected to see substantial growth in the coming years.

Climate change poses a significant risk to BDStar Navigation's infrastructure, with extreme weather events potentially disrupting satellite navigation systems and ground operations. For instance, increased frequency of heavy rainfall or extreme heatwaves in China, as observed in recent years, could impact the reliability of outdoor IoT devices and autonomous driving components that rely on precise positioning.

BDStar must assess and enhance the resilience of its deployed solutions against these environmental stressors. This involves ensuring that components can withstand varying climatic conditions, a crucial factor for widespread outdoor technology deployment, especially in sectors like smart agriculture or logistics where consistent connectivity is paramount.

Resource Scarcity and Supply Chain Resilience

The production of crucial components for BDStar, such as advanced chips and navigation modules, relies heavily on access to a range of raw materials. Some of these materials face potential scarcity or are vulnerable to disruptions in global supply chains, which can be influenced by geopolitical events. For instance, the International Energy Agency reported in early 2024 that demand for critical minerals essential for advanced technologies, including those used in navigation systems, is projected to surge significantly in the coming decade.

To navigate these challenges, BDStar must prioritize building robust supply chain resilience. This involves diversifying suppliers, increasing inventory levels for critical components, and exploring alternative material sources. Furthermore, adopting more sustainable practices, such as implementing circular economy principles for material use and recycling, can mitigate long-term risks associated with resource depletion and volatile commodity prices.

- Critical Minerals Demand: Projections indicate a substantial increase in demand for minerals like rare earths and cobalt, vital for electronics, by 2030.

- Supply Chain Vulnerabilities: Geopolitical tensions and trade policies can directly impact the availability and cost of essential raw materials.

- Resilience Strategies: BDStar's proactive approach to supply chain diversification and inventory management is key to mitigating disruptions.

- Sustainability Focus: Embracing circular economy models can reduce reliance on primary resource extraction and enhance long-term material security.

Environmental Regulations for Electronics Disposal

Beijing BDStar Navigation faces increasing environmental regulations concerning electronic waste (e-waste) disposal and recycling, impacting its product lifecycle. For instance, China's revised Law on the Prevention and Control of Environmental Pollution by Solid Waste, effective from March 1, 2020, emphasizes extended producer responsibility, requiring manufacturers like BDStar to manage their products post-consumer use. This necessitates proactive strategies such as implementing take-back programs or designing products for enhanced recyclability, adding to operational complexities and costs.

These evolving legal and environmental mandates are a general consideration for all electronics manufacturers operating globally. BDStar must ensure its product designs and end-of-life management processes align with these standards to avoid penalties and maintain market access. For example, the European Union's Restriction of Hazardous Substances (RoHS) directive, which China often mirrors, restricts certain hazardous materials in electrical and electronic equipment.

The financial implications of these regulations can be significant. Companies might incur costs for establishing recycling infrastructure, managing hazardous materials, and developing more sustainable product designs. A report by the UN University in 2020 estimated that global e-waste generation reached 53.6 million metric tons annually, highlighting the scale of the challenge and the growing regulatory pressure to address it effectively.

- Evolving E-waste Regulations: China's strengthened solid waste law places greater emphasis on producer responsibility for product disposal.

- Compliance Strategies: BDStar must consider take-back programs and design for recyclability to meet regulatory requirements.

- Global Alignment: Adherence to international standards like RoHS is crucial for market access and brand reputation.

- Financial Impact: Costs associated with compliance can include infrastructure development and material management, reflecting the growing global e-waste challenge.

Environmental concerns are increasingly shaping BDStar Navigation's operational landscape, particularly regarding e-waste and energy efficiency. The global push for sustainability means BDStar must actively manage its electronic waste streams, a challenge amplified by the projected 74 million metric tons of e-waste annually by 2030. Furthermore, the company's energy-intensive data solutions, supporting IoT and autonomous driving, contribute to a growing demand on global electricity, with data centers alone expected to consume 1.5% of global electricity by 2025.

Climate change also presents tangible risks, potentially disrupting satellite navigation and ground operations through extreme weather events. Ensuring the resilience of BDStar's deployed technologies against these climatic shifts, especially for outdoor applications, is becoming a critical factor for reliable service delivery in sectors like smart agriculture.

The company's reliance on raw materials for its advanced chips and modules exposes it to supply chain vulnerabilities and potential scarcity, with demand for critical minerals projected to surge. BDStar's strategic response involves enhancing supply chain resilience through diversification and exploring circular economy principles to mitigate long-term resource risks.

Regulatory pressures are intensifying, especially concerning e-waste management and the use of hazardous substances, mirroring global trends like the EU's RoHS directive. BDStar must adapt by implementing take-back programs and designing for recyclability, which may involve significant compliance costs but are essential for market access and brand reputation.

| Environmental Factor | Impact on BDStar Navigation | Key Data/Projection (2024-2025) | Mitigation/Strategy |

|---|---|---|---|

| E-waste Management | Increased regulatory scrutiny and operational costs for disposal and recycling. | Global e-waste projected to reach 74 million metric tons annually by 2030. China's solid waste law emphasizes producer responsibility. | Implement take-back programs, design for recyclability, invest in recycling infrastructure. |

| Energy Consumption | Strain on resources due to data-intensive applications; need for energy-efficient solutions. | Data centers to consume ~1.5% of global electricity by 2025. China's 'East Data, West Computing' project aims to reduce carbon footprint. | Develop energy-efficient data solutions, participate in national energy-saving initiatives. |

| Climate Change Resilience | Risk of disruption to navigation systems and ground operations from extreme weather. | Increased frequency of extreme weather events observed globally and in China. | Enhance resilience of deployed components against varying climatic conditions. |

| Resource Scarcity & Supply Chain | Vulnerability to raw material availability and price volatility. | Demand for critical minerals essential for advanced technologies projected to surge significantly. | Diversify suppliers, increase inventory, explore alternative materials, adopt circular economy principles. |

PESTLE Analysis Data Sources

Our Beijing BDStar Navigation PESTLE Analysis utilizes a robust blend of official Chinese government reports, international economic data from institutions like the IMF, and leading industry publications focused on geospatial technology and navigation systems.