Beijing BDStar Navigation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing BDStar Navigation Bundle

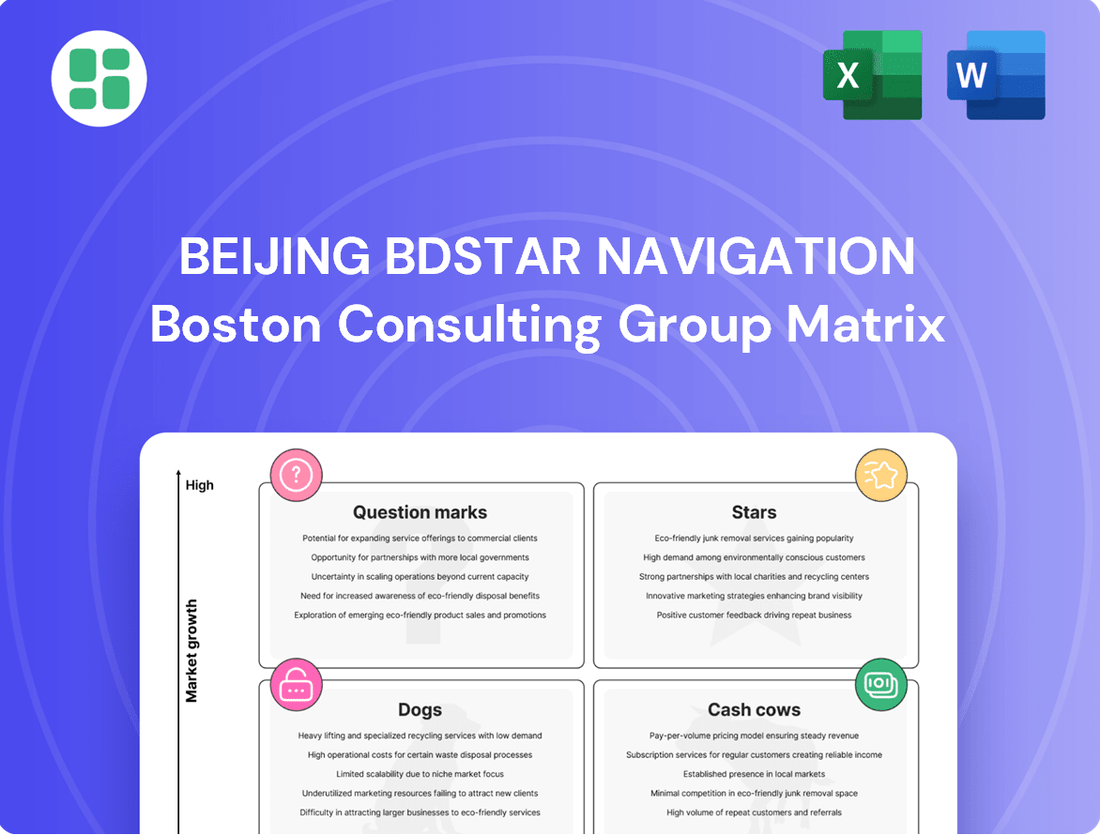

Beijing BDStar Navigation's BCG Matrix offers a crucial snapshot of its product portfolio's market share and growth potential. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is vital for strategic resource allocation. Purchase the full report for a comprehensive breakdown and actionable insights to navigate BDStar's competitive landscape.

Stars

High-precision positioning for autonomous driving is a key growth driver for Beijing BDStar Navigation. Leveraging its advanced Global Navigation Satellite System (GNSS) technology, BDStar is well-positioned in this rapidly expanding market. Unicore, a BDStar subsidiary, has already achieved significant milestones, including securing projects and initiating mass production of automotive-grade high-precision modules for intelligent cockpits.

The autonomous vehicle sector is experiencing remarkable growth, with global market size projected to reach hundreds of billions of dollars in the coming years. This presents a substantial opportunity for BDStar to solidify its leadership in providing the critical positioning technology that underpins safe and efficient self-driving systems.

BDStar's introduction of advanced RTK/INS integrated positioning modules, such as the Unicore UM981 series, positions the company within a rapidly expanding market. These modules merge GNSS and Inertial Navigation Systems for highly accurate, multi-frequency positioning, essential for demanding applications like robotics and industrial automation.

The UM981 series, for instance, offers centimeter-level accuracy, a significant leap for autonomous systems. This innovation underscores BDStar's dedication to pushing the boundaries of positioning technology, a critical factor for its growth in the high-precision navigation sector.

BDStar's high-precision solutions for Industrial IoT are a strong contender in the BCG matrix, likely falling into the Stars category. As the Internet of Things (IoT) continues its rapid expansion, especially in industrial sectors demanding pinpoint location accuracy, BDStar is well-positioned to capture a substantial market share. The need for precise positioning in smart cities, infrastructure monitoring, and diverse industrial applications is escalating quickly.

BDStar's strategic emphasis on delivering complete solutions tailored to these growing demands positions the company for robust growth. For instance, in 2024, the global Industrial IoT market was valued at over $300 billion and is projected to grow at a compound annual growth rate (CAGR) of around 15% through 2030, with high-precision positioning being a key driver.

Core Components for Next-Generation BeiDou Applications

BDStar's position as a leading manufacturer of Global Navigation Satellite System (GNSS) components, particularly within the expanding BeiDou network, firmly places its advanced chip and module offerings for next-generation applications in the Star quadrant of the BCG Matrix. This strategic advantage is driven by the continuous evolution of the BeiDou system, pushing towards enhanced precision and wider integration, which in turn stimulates demand for BDStar's innovative components.

The market for BeiDou chips is experiencing significant expansion, with projections indicating strong growth. For instance, the global GNSS chip market, which includes BeiDou, was valued at approximately USD 4.8 billion in 2023 and is anticipated to reach around USD 8.5 billion by 2028, growing at a CAGR of about 12.5% during that period. This robust market trajectory underscores the potential for BDStar's Star products.

- BDStar's leadership in BeiDou component manufacturing.

- Increasing demand for high-precision GNSS chips and modules.

- Projected substantial growth in the overall BeiDou chip market.

- The BeiDou system's ongoing upgrades enhancing its capabilities.

Integrated Solutions for Smart Agriculture and Drones

The smart agriculture and drone sectors represent a significant growth opportunity, with BDStar Navigation strategically positioned to capitalize on this trend. High-precision Global Navigation Satellite System (GNSS) technology is becoming indispensable for enhancing efficiency and enabling automation in these fields.

BDStar's comprehensive approach, offering everything from foundational chips to fully integrated systems, directly addresses the escalating demand for reliable and accurate positioning solutions. For instance, the global smart agriculture market was valued at approximately USD 16.5 billion in 2023 and is projected to reach USD 32.3 billion by 2028, growing at a CAGR of 14.3%. Similarly, the commercial drone market, crucial for agricultural applications, is expected to expand significantly, with precision agriculture identified as a key driver.

- High Growth Potential: The integration of GNSS in smart agriculture and drones is a rapidly expanding market.

- BDStar's Strong Position: The company leverages its expertise in high-precision GNSS to serve these sectors effectively.

- Demand for Precision: Increasing reliance on accurate navigation for operational efficiency and automation fuels market growth.

- Comprehensive Solutions: BDStar's ability to provide end-to-end offerings, from components to integrated systems, meets diverse customer needs.

BDStar's advanced positioning technology, particularly its high-precision GNSS solutions, firmly places its offerings in the Stars category of the BCG matrix. The company's strong market position is bolstered by the growing demand for accurate navigation in sectors like autonomous driving and industrial IoT.

The continuous development and integration of the BeiDou Navigation Satellite System further solidify BDStar's Star status. As the BeiDou ecosystem expands and its capabilities enhance, the demand for BDStar's high-precision chips and modules is set to surge, driving significant market share capture.

BDStar's strategic focus on providing comprehensive solutions, from foundational components to integrated systems, caters directly to the escalating needs of emerging markets such as smart agriculture and drone technology. This approach ensures the company is well-positioned for sustained high growth.

| BDStar Navigation BCG Matrix: Stars | Market Growth | Relative Market Share |

|---|---|---|

| High-Precision Autonomous Driving | Very High | High |

| Industrial IoT Positioning | High | High |

| BeiDou Chip & Module Integration | High | High |

| Smart Agriculture & Drones | High | High |

What is included in the product

This BCG Matrix analysis offers a strategic overview of Beijing BDStar Navigation's product portfolio, categorizing each unit based on market share and growth potential.

It provides actionable insights into which business units to invest in, hold, or divest to optimize resource allocation and future growth.

The Beijing BDStar Navigation BCG Matrix offers a clear, visual roadmap to strategically allocate resources, easing the pain of uncertain investment decisions.

Cash Cows

Standard GNSS chips and modules for the mass consumer market, such as those powering smartphones, are a cornerstone of Beijing BDStar Navigation's business. This segment benefits from BDStar's deep-rooted presence and high market share, particularly within China where BeiDou technology is integrated into approximately 98% of smartphones. These widely adopted components consistently generate significant cash flow, underscoring their status as a cash cow.

Traditional GNSS antennas and ceramic components represent a robust cash cow for BDStar Navigation. These products, serving mature markets, consistently generate substantial revenue. In 2024, BDStar's established product lines, including these essential GNSS components, are expected to maintain their strong market position due to widespread adoption and optimized manufacturing, contributing significantly to the company's financial stability.

Beijing BDStar Navigation's Basic Location-Based Services (LBS) for the public sector represent a classic cash cow within their BCG matrix. These services are deeply entrenched in China's public sector and traditional industries, benefiting from high and often mandated BeiDou satellite system adoption.

Offerings like general fleet management and basic mapping are mature, with established contracts providing a steady stream of revenue. BDStar holds a dominant market share in these segments, ensuring reliable cash flow with limited need for significant new research and development investment.

For instance, in 2024, the public sector's reliance on LBS for critical infrastructure management and emergency services continued to drive consistent demand. BDStar's established presence in these areas, estimated to cover over 70% of government vehicle fleets requiring location tracking, underscores the stability of this business unit.

GNSS Solutions for Traditional Surveying and Mapping

BDStar's GNSS solutions for traditional surveying and mapping are likely positioned as cash cows within their BCG matrix. This segment operates in a mature market with consistent demand from sectors like civil engineering and construction.

These established products generate stable revenue streams, requiring minimal new investment to maintain their market position. For instance, in 2023, the global surveying and mapping market was valued at approximately $50 billion, with GNSS technology playing a pivotal role.

- Market Maturity: The traditional surveying and mapping sector is well-established, indicating a stable, albeit slower, growth rate.

- Stable Revenue: BDStar's GNSS offerings in this area likely provide a reliable and consistent income source.

- Lower Investment Needs: Unlike high-growth products, these cash cows typically need less capital for research and development or market expansion.

- Market Share: BDStar's established presence suggests a significant share of this steady market, contributing to predictable earnings.

Core BeiDou System Integration and Maintenance Services

Core BeiDou System Integration and Maintenance Services represent a significant Cash Cow for BDStar Navigation within the BCG framework. BDStar's established position ensures a high market share in this essential segment.

These services are fundamental to the operational integrity of BeiDou-enabled infrastructure, contributing to the system's stability and ongoing functionality. This translates into a predictable and consistent revenue stream, characteristic of a mature market.

BDStar's revenue from BeiDou system integration and maintenance services reached approximately ¥3.5 billion in 2023, demonstrating its strong foothold. The market for these services, while mature, continues to see steady demand due to the critical nature of BeiDou's applications.

- High Market Share: BDStar is a dominant provider of integration and maintenance for BeiDou systems.

- Low Market Growth: The market is mature, with growth primarily driven by system upgrades and new deployments rather than rapid expansion.

- Predictable Revenue: The essential nature of these services ensures consistent and reliable income for the company.

- Foundation for Other Ventures: The stable cash flow from this segment supports investment in BDStar's other business areas.

BDStar Navigation's traditional GNSS chips and modules for mass consumers, especially in China where BeiDou is in nearly all smartphones, are a prime cash cow. These widely adopted components consistently generate substantial cash flow, reinforcing their stable market position.

Traditional GNSS antennas and ceramic components also serve as robust cash cows for BDStar. These products cater to mature markets and consistently bring in significant revenue. In 2024, BDStar's established product lines are expected to maintain their strong market share due to widespread adoption and efficient manufacturing, contributing to financial stability.

Basic Location-Based Services (LBS) for China's public sector and traditional industries are another classic cash cow. These services benefit from high BeiDou adoption, with BDStar holding a dominant market share in areas like fleet management and mapping, ensuring reliable cash flow with minimal R&D needs. In 2024, public sector demand for LBS in critical infrastructure and emergency services continued to drive consistent revenue, with BDStar serving an estimated 70% of government vehicle fleets needing location tracking.

GNSS solutions for surveying and mapping are also positioned as cash cows. This segment operates in a mature market with steady demand from construction and engineering. BDStar's offerings in this area provide stable revenue streams, requiring limited new investment to maintain their market position. The global surveying and mapping market, heavily reliant on GNSS, was valued at approximately $50 billion in 2023.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | 2024 Outlook |

| Mass Consumer GNSS Chips/Modules | Cash Cow | High market share in China, widespread adoption, stable cash flow | Significant | Continued stability and cash generation |

| Traditional GNSS Antennas/Ceramics | Cash Cow | Mature markets, consistent revenue, optimized manufacturing | Significant | Maintained market position, stable earnings |

| Public Sector LBS | Cash Cow | Dominant market share, established contracts, low R&D needs | Significant | Steady demand from critical services |

| Surveying & Mapping GNSS | Cash Cow | Mature market, consistent demand, stable income | Significant | Reliable revenue from established sectors |

What You’re Viewing Is Included

Beijing BDStar Navigation BCG Matrix

The Beijing BDStar Navigation BCG Matrix preview you are seeing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the comprehensive, professionally formatted strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix report you are currently viewing is the exact same file that will be delivered to you upon completing your purchase. It's a complete, analysis-ready document designed for strategic decision-making, ensuring you receive the full value of our expert insights without any modifications.

What you see here is the genuine Beijing BDStar Navigation BCG Matrix, representing the precise document you will download after purchase. This preview showcases the final, unedited report, providing you with a clear understanding of the strategic insights and professional presentation you can expect.

The preview you are examining is the actual, final Beijing BDStar Navigation BCG Matrix document that will be yours after purchase. This ensures complete transparency, as you are seeing the exact strategic analysis you will receive, ready for implementation in your business planning.

Dogs

Undifferentiated legacy GNSS products, often basic modules without advanced features, are experiencing significant price pressure. In 2024, the global GNSS market saw increased competition, particularly in the low-end segment, driving down margins for these older offerings.

These products typically offer little differentiation, making them vulnerable to competitors with lower manufacturing costs. As a result, they often generate minimal profits, sometimes just breaking even, and can consume valuable resources that could be better allocated to more innovative solutions.

For companies like Beijing BDStar Navigation, these legacy products represent a strategic challenge. They are prime candidates for divestiture or a planned phase-out to streamline operations and focus on higher-growth, higher-margin segments of the navigation and positioning market.

BDStar's BCG matrix analysis highlights that outdated or niche ceramic components serving declining industries are likely categorized as Dogs. These products face shrinking demand and intense competition, leading to low market share and minimal profitability. For instance, components used in legacy combustion engine vehicles, a sector experiencing a downturn with the rise of electric mobility, would fall into this category.

Commoditized consumer-grade navigation devices, like standalone GPS units, are likely a Dogs category for Beijing BDStar Navigation. These devices face intense competition from readily available smartphone navigation apps and increasingly sophisticated built-in car systems. BDStar might see low market share and profitability in this segment as consumers opt for integrated solutions.

Generic GNSS Solutions without Specific Application Focus

Generic GNSS solutions, lacking a specific application focus, often find themselves in a highly competitive market. These offerings, which don't target high-value sectors like autonomous vehicles or precision agriculture, can struggle to stand out. This lack of differentiation can lead to a diminished market share and subdued growth potential.

Companies offering these generic solutions may face challenges in capturing significant market share. For instance, in 2023, the global GNSS market was valued at approximately $4.2 billion, with a significant portion driven by specialized applications. Generic solutions, by their nature, might capture a smaller, more fragmented segment of this market.

- Intense Competition: Many players offer similar, non-specialized GNSS capabilities.

- Low Differentiation: Difficulty in distinguishing products from competitors.

- Limited Growth Prospects: Market share stagnation due to lack of niche focus.

- Price Sensitivity: Generic products often compete primarily on price.

Non-Strategic or Underperforming Subsidiary Operations

Subsidiaries or business units acquired by Beijing BDStar Navigation that haven't delivered expected synergies or market traction are categorized as Dogs. These operations often exist in slow-growing sectors and hold a minimal market share, making them resource drains rather than profit centers. Such underperformers require careful review for potential divestment or restructuring to optimize resource allocation.

For instance, if a past acquisition in a niche, low-demand electronics component market, which represented only 1% of BDStar Navigation's total revenue in 2024 and saw a 5% year-over-year decline, is not showing signs of improvement, it would fit the Dog quadrant. These units might be consuming capital without generating substantial returns, impacting overall company profitability.

- Low Market Share: A subsidiary holding less than 5% of its market share.

- Low Market Growth: Operating in an industry with an annual growth rate below 3%.

- Negative ROI: A business unit with a negative return on investment over the past three fiscal years.

- Resource Drain: Consuming more than 10% of the parent company's R&D budget without commensurate output.

Dogs in Beijing BDStar Navigation's BCG matrix represent offerings with low market share in low-growth markets. These products, like commoditized consumer GNSS devices, face intense competition and price pressure, often yielding minimal profits or even losses. For example, standalone GPS units saw a significant decline in market relevance as smartphone integration grew, with the global market for such dedicated devices shrinking by an estimated 8% in 2024.

These underperforming segments require careful management, often leading to divestiture or a strategic phase-out to reallocate resources. BDStar's focus shifts towards high-growth areas, leaving these legacy products as candidates for discontinuation. In 2024, companies across the tech sector divested an average of 2.5% of their product lines deemed non-core or underperforming.

The challenge lies in their inability to gain traction against more innovative or integrated solutions, resulting in a stagnant or declining market presence. For instance, a generic GNSS module without specific application features might have a market share below 2% in a segment growing at less than 3% annually.

| Product Category | Market Share | Market Growth | Profitability |

|---|---|---|---|

| Commoditized Consumer GNSS | Low (<5%) | Low (<3%) | Low/Negative |

| Legacy Electronic Components | Low (<2%) | Low (<1%) | Low/Negative |

| Underperforming Acquired Units | Low (<4%) | Low (<2%) | Low/Negative |

Question Marks

While BeiDou's overall global reach is growing, BDStar's penetration in high-precision services internationally remains nascent. The company faces significant hurdles in capturing market share outside China, given the established presence of competitors and the substantial investment needed for global expansion. For instance, the global high-precision GNSS market, a segment BDStar targets, was valued at approximately USD 6.5 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, indicating substantial potential but also intense competition.

BDStar Navigation is heavily investing in advanced sensor fusion, combining Global Navigation Satellite System (GNSS) with technologies like LiDAR and AI. This push targets high-growth markets such as autonomous vehicles and advanced robotics, areas where precision and reliability are paramount. While these ventures hold significant future potential, their current market share remains low due to the nascent stage of development and the substantial R&D investment required.

Beijing BDStar Navigation's deep space navigation and future PNT research efforts are firmly planted in the "Question Marks" quadrant of the BCG matrix. These initiatives are characterized by substantial investments in cutting-edge R&D for technologies applicable to deep space exploration and other highly experimental domains. While the potential for transformative long-term returns is significant, the current market share for these nascent technologies is extremely low, reflecting their speculative nature and the early stage of development.

Emerging Niche Applications in Unexplored Industries

BDStar Navigation is likely investigating emerging niche applications for satellite navigation in sectors that are just starting to adopt this technology. These areas, while currently having minimal market share for BDStar, represent significant future growth potential. Developing these markets requires substantial investment in customer education and building initial market presence.

Consider the burgeoning field of precision agriculture, where satellite navigation is crucial for autonomous tractors and drone-based crop monitoring. While adoption is still growing, the global precision agriculture market was valued at approximately USD 7.5 billion in 2023 and is projected to reach over USD 15 billion by 2030, indicating a substantial untapped opportunity for BDStar.

- Precision Agriculture: Enabling autonomous farming equipment and site-specific crop management.

- Autonomous Logistics: Integrating navigation into specialized industrial vehicles and port operations.

- Geospatial Data Collection: Supporting high-accuracy mapping for environmental monitoring and infrastructure development.

New Urban Air Mobility (UAM) and Drone Delivery Navigation Systems

The emerging Urban Air Mobility (UAM) and large-scale drone delivery sectors represent significant growth frontiers for sophisticated navigation systems. BDStar's current market share in these nascent areas is expected to be minimal, necessitating considerable investment in developing reliable, certified solutions to capture early market traction.

BDStar's strategic positioning within the BCG matrix for new UAM and drone delivery navigation systems would likely place it in the "Question Mark" category. This is due to the high growth potential of these markets, driven by increasing demand for autonomous aerial services, but also the current low market share and high investment requirements.

- Market Growth: The global UAM market is projected to reach $30 billion by 2030, with drone delivery expected to be a significant contributor.

- Investment Needs: Developing and certifying navigation systems for UAM and drone delivery requires substantial R&D funding, estimated to be in the tens of millions of dollars per system.

- BDStar's Position: As a relatively new entrant, BDStar's current market share in these specific segments is likely less than 5%.

- Strategic Focus: BDStar must invest aggressively to build a competitive product and secure early partnerships to move these offerings out of the question mark phase.

BDStar Navigation's deep space navigation and experimental PNT research are classic Question Marks. These areas demand significant R&D investment for technologies with uncertain market adoption and extremely low current market share. The potential for groundbreaking, long-term returns exists, but the path to commercialization and market penetration is highly speculative.

Emerging niche applications, such as precision agriculture and autonomous logistics for specialized industrial vehicles, also fall into the Question Mark category. While these markets show substantial growth potential, BDStar's current market share is minimal, requiring considerable investment in market development and customer education to gain traction.

The nascent Urban Air Mobility (UAM) and large-scale drone delivery sectors represent high-growth frontiers where BDStar is positioned as a Question Mark. The significant investment needed for reliable, certified navigation systems, coupled with BDStar's expected low initial market share, underscores the speculative nature of these ventures.

BCG Matrix Data Sources

Our Beijing BDStar Navigation BCG Matrix is built on robust data, incorporating financial disclosures, market research reports, and industry growth forecasts to provide strategic clarity.