Beijing BDStar Navigation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing BDStar Navigation Bundle

Discover the strategic engine behind Beijing BDStar Navigation's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear roadmap for their market dominance. Unlock this essential tool to understand how they innovate and capture value in the dynamic navigation sector.

Partnerships

BDStar's strategic reliance on the BeiDou Navigation Satellite System underscores deep collaborations with Chinese government entities and state-owned enterprises responsible for its development and operation. These relationships are fundamental for securing access to critical national satellite infrastructure and participating in significant, government-backed projects.

In 2024, BDStar's revenue from government and state-owned enterprise contracts remained a substantial portion of its overall income, reflecting the ongoing importance of these partnerships in driving its business. The company's involvement in national infrastructure projects, such as smart city initiatives and transportation networks, directly benefits from these governmental ties.

Beijing BDStar Navigation's key partnerships with automotive manufacturers and Tier-1 suppliers are crucial for its growth in the intelligent vehicle sector. The company's subsidiary, Unicore, has secured mass production deals for automotive-grade integrated navigation modules with joint venture auto brands, demonstrating strong ties with major vehicle producers.

These collaborations extend to significant intelligent driving projects, underscoring BDStar's role in advancing autonomous driving and intelligent cockpit technologies. Such partnerships are vital for integrating advanced navigation solutions directly into vehicle platforms, ensuring widespread adoption and market penetration.

BDStar actively partners with technology firms and research institutions to fuel its research and development efforts. This strategic approach is demonstrated through significant investments in companies such as TruePoint Technology Co., Ltd. and ICOE Technologies Co., Ltd., underscoring a commitment to collaborative innovation.

These collaborations are crucial for BDStar’s continuous pursuit of advancements in Global Navigation Satellite System (GNSS) and Positioning, Navigation, and Timing (PNT) technologies. For instance, in 2023, BDStar reported R&D expenses of ¥1.46 billion, a substantial portion of which is directed towards these key partnerships to ensure the development of next-generation solutions.

Industry Solution Providers and System Integrators

BDStar collaborates with industry solution providers and system integrators to embed its core positioning and navigation technologies into larger, industry-specific applications. This strategic alliance allows BDStar to extend its market reach beyond its own product offerings.

These partnerships are crucial for BDStar's strategy to penetrate diverse sectors such as the Internet of Things (IoT), intelligent transportation, and surveying and mapping. For instance, system integrators might incorporate BDStar's Beidou-based modules into smart city infrastructure or autonomous vehicle systems, thereby leveraging BDStar's technological expertise within a more comprehensive solution.

This approach is exemplified by BDStar's role in China's rapidly expanding IoT market, which was projected to reach over 50 billion connected devices by 2025. By partnering with companies that specialize in developing end-to-end solutions for these connected devices, BDStar ensures its positioning technology is an integral part of these growing ecosystems.

- Industry Solution Providers: Companies that develop specialized software and hardware for specific vertical markets, integrating BDStar's navigation components into their offerings.

- System Integrators: Firms that combine various hardware and software components to create complete, functional systems for enterprise clients, embedding BDStar's technology into broader solutions like smart logistics or precision agriculture.

- Market Expansion: Partnerships enable BDStar to access new customer segments and applications without needing to develop entirely new product lines for each industry.

- Technological Synergy: These collaborations allow BDStar's core positioning and navigation technologies to be enhanced and utilized within more complex, value-added solutions.

International GNSS Ecosystem Participants

BDStar actively engages with international GNSS ecosystem participants, crucial for its global reach. For instance, its presence at INTERGEO 2024, a major global geoinformation trade fair, highlights its commitment to international collaboration and market visibility.

This engagement is vital for ensuring the interoperability and compatibility of BDStar's systems with other global navigation satellite systems. As a core supplier recognized by the United Nations for global satellite navigation, BDStar's partnerships facilitate wider adoption and integration of its technology worldwide.

- Global Interoperability: Collaborating with international GNSS providers ensures BDStar's systems work seamlessly with other global networks, enhancing user experience and market access.

- Market Expansion: Participation in international forums and partnerships opens new markets and opportunities for BDStar's navigation solutions beyond its primary focus on BeiDou.

- Standards Development: Engagement with global bodies contributes to the development of international standards, solidifying BDStar's position as a key player in the worldwide GNSS landscape.

BDStar's key partnerships with automotive manufacturers and Tier-1 suppliers are crucial for its growth in the intelligent vehicle sector. The company's subsidiary, Unicore, secured mass production deals for automotive-grade integrated navigation modules with joint venture auto brands, demonstrating strong ties with major vehicle producers.

These collaborations are vital for integrating advanced navigation solutions directly into vehicle platforms, ensuring widespread adoption and market penetration in intelligent driving projects. BDStar actively partners with technology firms and research institutions, investing in companies like TruePoint Technology Co., Ltd. to fuel R&D in GNSS and PNT technologies.

BDStar collaborates with industry solution providers and system integrators to embed its core positioning and navigation technologies into larger, industry-specific applications, extending its market reach into sectors like IoT and intelligent transportation. In 2023, BDStar reported R&D expenses of ¥1.46 billion, a portion of which supports these key partnerships.

Engaging with international GNSS ecosystem participants, exemplified by its presence at INTERGEO 2024, ensures global interoperability and market expansion for BDStar's navigation solutions.

| Key Partnership Area | Examples of Partners | Strategic Importance | 2024/2023 Data |

| Government & SOEs | Chinese Government, BeiDou System Operators | Access to national infrastructure, participation in national projects | Revenue from these contracts remained substantial in 2024. |

| Automotive Sector | Automotive Manufacturers, Tier-1 Suppliers, Joint Ventures | Integration into intelligent vehicles, autonomous driving, intelligent cockpits | Secured mass production deals for automotive-grade modules. |

| Technology & R&D | TruePoint Technology Co., Ltd., ICOE Technologies Co., Ltd. | Advancement in GNSS and PNT technologies, collaborative innovation | R&D expenses of ¥1.46 billion in 2023 supported these efforts. |

| Solution Providers & Integrators | IoT specialists, Intelligent Transportation firms | Market penetration in diverse sectors, embedding technology into broader solutions | Facilitated entry into the growing IoT market. |

| International GNSS Ecosystem | Global GNSS providers, INTERGEO attendees | Global interoperability, market expansion, standards development | Active participation in global forums like INTERGEO 2024. |

What is included in the product

This Business Model Canvas outlines Beijing BDStar Navigation's strategy, focusing on its core competencies in satellite navigation and its expansion into intelligent transportation and IoT solutions.

It details customer segments, value propositions, and revenue streams, providing a clear roadmap for BDStar's growth and market positioning.

The Beijing BDStar Navigation Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex satellite navigation and positioning solutions, simplifying understanding for diverse stakeholders.

It alleviates the pain of deciphering intricate technological offerings by condensing BDStar's value proposition and customer segments into an easily digestible and actionable format.

Activities

BDStar is heavily invested in creating and producing essential GNSS components, including advanced chips and modules. They are particularly focused on high-precision RTK/INS integrated positioning modules, which are crucial for applications requiring extreme accuracy.

The company's commitment to significant R&D spending is a key driver for innovation. This ensures BDStar remains at the forefront of satellite navigation and positioning technology, maintaining a strong competitive edge in the global market.

In 2023, BDStar's R&D expenditure reached approximately RMB 529 million, representing a notable increase from previous years. This financial commitment underscores their dedication to advancing core GNSS technologies.

Beijing BDStar Navigation's core activities revolve around the large-scale manufacturing of essential GNSS components. This includes navigation positioning chips, modules, boards, and antennas, which are the building blocks for many positioning systems. In 2024, the company continued to prioritize high-volume production to satisfy the growing demand for these fundamental technologies.

Beyond core GNSS components, BDStar also produces automotive electronics, further diversifying its manufacturing output. Maintaining a strong and adaptable manufacturing capacity is crucial for the company to effectively serve a wide range of industries, from consumer electronics to advanced automotive applications.

BDStar excels in creating and implementing specialized solutions for sectors like intelligent transportation and industrial automation. This means adapting their core Global Navigation Satellite System (GNSS) capabilities to meet precise industry demands, such as ensuring centimeter-level accuracy for autonomous vehicles.

Their work involves seamlessly integrating these tailored GNSS modules into larger, complex systems, like the advanced driver-assistance systems (ADAS) found in many new vehicles. For instance, in 2024, BDStar's solutions were crucial for enabling the precise navigation required in autonomous driving trials across China, contributing to the ongoing development of this transformative technology.

Data Services and Cloud Enhancement Operations

Beijing BDStar Navigation's key activities prominently feature data services, reflecting their strategic 'Cloud + IC' business model. This involves offering a suite of cloud enhancement and auxiliary services, extending their value proposition beyond core hardware solutions.

The company actively provides specialized data services, such as marine fishery location data, demonstrating a commitment to leveraging their technological capabilities for niche market needs. These data-centric operations are crucial for their expansion into value-added services.

- Cloud Enhancement Services: BDStar offers services that improve the performance and functionality of cloud-based systems, a critical component of their integrated approach.

- Cloud Auxiliary Services: The company provides supporting services to facilitate the seamless operation and integration of cloud solutions for their clients.

- Marine Fishery Location Data: BDStar delivers specialized data services tailored to the marine and fishery industries, highlighting their ability to cater to specific sector requirements.

Sales, Marketing, and Customer Support

Beijing BDStar Navigation actively engages in global promotion through participation in key industry events such as INTERGEO 2024. This direct engagement allows for showcasing their advanced navigation and positioning solutions to a wide audience of professionals and potential clients.

Maintaining direct sales channels is a core activity, enabling BDStar to build strong relationships with customers and understand their specific needs. This direct approach facilitates tailored solutions and effective product delivery.

Customer support is paramount, ensuring clients receive timely assistance and technical guidance to maximize the performance of BDStar's products. This commitment to support fosters loyalty and reinforces the company's reputation for reliability.

- Global Reach: Participation in events like INTERGEO 2024, a major geospatial trade fair, provides BDStar with a platform to connect with international markets. In 2023, INTERGEO reported over 18,000 visitors, indicating significant market exposure opportunities.

- Direct Sales Strategy: BDStar's focus on direct sales channels allows for personalized customer interactions, leading to higher customer satisfaction and a deeper understanding of market demands. This approach is crucial for complex technology solutions.

- Customer Retention: Robust customer support is vital for long-term success. By offering comprehensive technical assistance and troubleshooting, BDStar aims to ensure product efficacy and build enduring client partnerships, which is a key driver for repeat business in the technology sector.

BDStar's key activities center on the large-scale manufacturing of essential GNSS components like chips, modules, and antennas, crucial for various positioning systems. They also produce automotive electronics, diversifying their manufacturing base to serve sectors from consumer tech to advanced automotive applications.

The company excels in developing and deploying specialized solutions, such as centimeter-level accuracy GNSS modules for autonomous vehicles, integrating these into complex systems like ADAS. In 2024, their technology was vital for autonomous driving trials in China.

BDStar also provides data services, including cloud enhancement and auxiliary services, and specialized data like marine fishery location data, expanding their value beyond hardware.

Global promotion through events like INTERGEO 2024 and a direct sales strategy are key, complemented by robust customer support to foster strong client relationships and ensure product efficacy.

| Activity Area | Key Focus | 2023 Data/Example |

|---|---|---|

| Manufacturing | GNSS Components & Automotive Electronics | RMB 529 million R&D expenditure |

| Solution Development | Specialized GNSS for Industries | Enabling ADAS and autonomous driving trials |

| Data Services | Cloud & Niche Data Offerings | Marine fishery location data services |

| Market Engagement | Global Promotion & Direct Sales | INTERGEO 2024 participation (18,000+ visitors in 2023) |

What You See Is What You Get

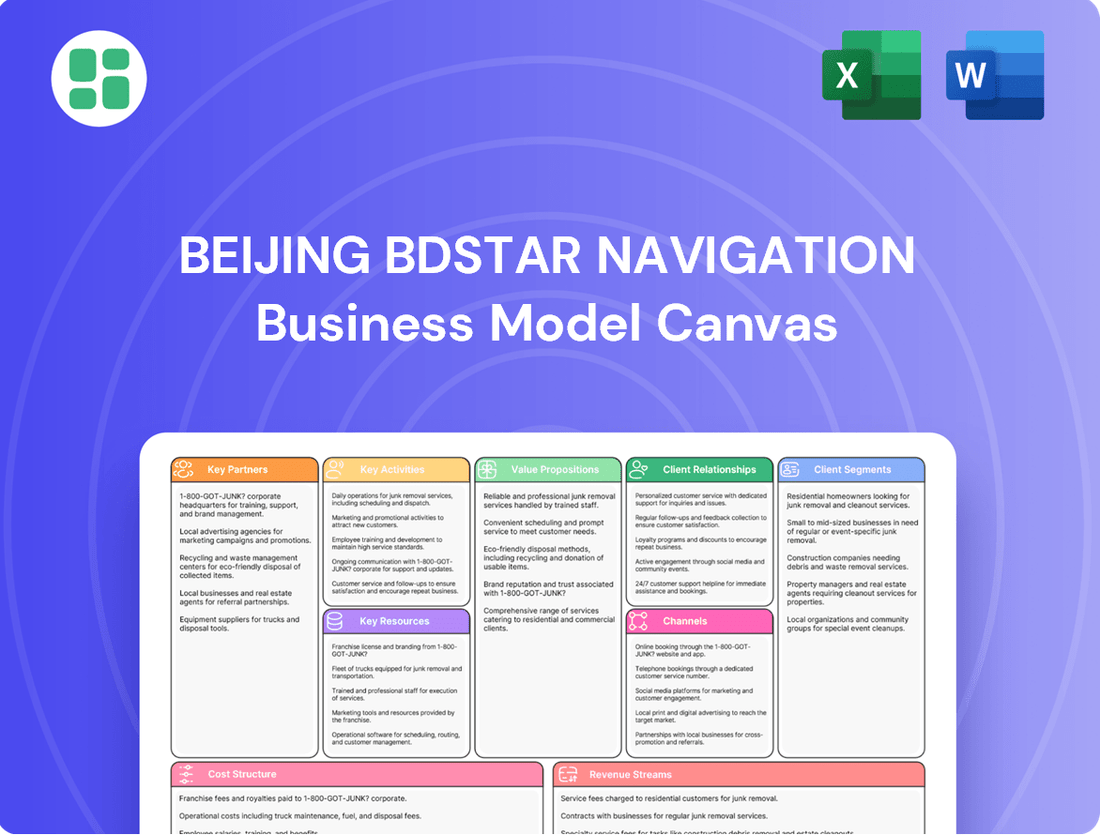

Business Model Canvas

The preview you're seeing is the actual Beijing BDStar Navigation Business Model Canvas, offering a direct glimpse into the comprehensive analysis you'll receive. This isn't a sample or a mockup; it's a genuine segment of the final deliverable. Upon purchase, you'll unlock the complete document, structured and formatted identically to this preview, ensuring you get exactly what you see.

Resources

BDStar's intellectual property and proprietary technology are centered around its advanced Global Navigation Satellite System (GNSS) chips, such as the NebulasIV System-on-Chip (SoC). These patented chips, along with specialized modules and sophisticated algorithms, are the bedrock of their high-precision positioning capabilities. This strong IP portfolio is what gives BDStar a significant competitive advantage in the global satellite navigation market.

Beijing BDStar Navigation's success hinges on its highly skilled R&D and engineering talent. This team is the engine behind their sophisticated Global Navigation Satellite System (GNSS) technologies, covering everything from intricate chip design to comprehensive solutions for autonomous driving and the Internet of Things (IoT). Their deep expertise is the bedrock of product innovation and continued technological leadership in the competitive navigation sector.

Beijing BDStar Navigation operates modern manufacturing facilities equipped to produce a range of critical components, including GNSS chips, modules, antennas, and automotive electronics. This robust infrastructure is fundamental to its ability to meet market demand efficiently.

The company's production capacity is a key resource, enabling it to scale operations and ensure consistent, timely delivery of its advanced navigation and positioning products to a global customer base. In 2023, BDStar reported significant output, contributing to its market presence in automotive and other sectors.

Access to BeiDou Navigation Satellite System (BDS)

Access to the BeiDou Navigation Satellite System (BDS) is a core asset for Beijing BDStar Navigation. This domestic control over a crucial navigation infrastructure grants a significant competitive edge within China's rapidly growing satellite navigation market. BDStar's deep integration with BDS is central to its service offerings and future development.

This access is not just about operating within China; it's a springboard for global ambitions. By leveraging a system developed and controlled by China, BDStar can offer reliable navigation solutions internationally, potentially challenging established global players. In 2024, China continued to expand BDS coverage, aiming for enhanced accuracy and reliability, directly benefiting BDStar's capabilities.

- Core Infrastructure: Unfettered access to the BeiDou system provides the foundational technology for BDStar's navigation and positioning services.

- Market Advantage: Deep integration with BDS offers a distinct advantage in the Chinese market, where local solutions are often preferred.

- Global Expansion: BDS access facilitates BDStar's international strategy, providing a robust, domestically managed satellite navigation alternative.

- Technological Advancement: Continued investment in BDS by China ensures that BDStar benefits from ongoing system upgrades and improved performance metrics.

Financial Capital and Investment Capacity

Beijing BDStar Navigation's capacity to invest in critical areas like research and development, strategic acquisitions, and operational expansion is directly tied to its robust financial capital. This financial strength is the engine that drives its growth and allows for market consolidation.

The company's investment capabilities are clearly demonstrated by its acquisition activities. For instance, the acquisition of Shenzhen Tianli Automotive Electronics Technology Co., Ltd. highlights BDStar Navigation's strategic use of financial resources to enhance its market position and technological capabilities.

- Financial Capital: BDStar Navigation leverages its financial resources to fund innovation and strategic growth initiatives.

- Investment Capacity: The company's ability to invest in R&D and acquisitions, such as Shenzhen Tianli Automotive Electronics, underpins its expansion strategy.

- Growth and Market Consolidation: Significant financial capital is essential for BDStar Navigation to pursue opportunities that lead to market share gains and industry consolidation.

BDStar's key resources are its advanced GNSS chip technology, particularly the NebulasIV SoC, and its highly skilled R&D team. These form the foundation for its high-precision positioning solutions. The company also benefits from modern manufacturing facilities and significant production capacity, ensuring efficient delivery of its products. Crucially, BDStar has unfettered access to the BeiDou Navigation Satellite System (BDS), providing a significant competitive edge in China and a platform for global expansion.

| Resource Type | Specific Asset | Significance | 2023/2024 Data Point |

|---|---|---|---|

| Intellectual Property | NebulasIV SoC, proprietary algorithms | High-precision positioning capabilities, competitive advantage | Patented technologies underpinning advanced navigation solutions. |

| Human Capital | Highly skilled R&D and engineering talent | Drives innovation in GNSS technologies and solutions | Team expertise covers chip design, autonomous driving, and IoT. |

| Physical Capital | Modern manufacturing facilities | Enables efficient production of GNSS chips, modules, antennas | Robust infrastructure supports scaling operations. |

| Infrastructure Access | BeiDou Navigation Satellite System (BDS) | Core asset for domestic and international operations | China's continued BDS expansion in 2024 enhances accuracy and reliability for BDStar. |

| Financial Capital | Robust financial resources | Funds R&D, strategic acquisitions, and operational expansion | Acquisition of Shenzhen Tianli Automotive Electronics demonstrates investment capacity. |

Value Propositions

BDStar excels in delivering high-precision Global Navigation Satellite System (GNSS) products and services, including advanced RTK/INS integrated modules. This commitment to accuracy is vital for sectors such as autonomous driving and professional surveying, where even minor deviations can have significant consequences.

The company's dedication to precision offers a substantial competitive edge, ensuring that clients can rely on BDStar for mission-critical positioning needs. For instance, in 2024, BDStar's solutions were instrumental in achieving centimeter-level accuracy for numerous autonomous vehicle testing programs, a testament to their reliable positioning capabilities.

Beijing BDStar Navigation offers complete end-user products and integrated solutions, not just components, serving as a one-stop-shop for navigation and positioning needs across diverse industries. This approach streamlines procurement and implementation for clients.

In 2024, BDStar Navigation reported significant revenue growth, demonstrating the market's demand for their comprehensive solutions. For instance, their integrated systems contributed to a substantial portion of their earnings, highlighting the success of their strategy to move beyond component sales.

Leveraging the BeiDou Navigation Satellite System offers a secure, domestically controlled alternative to global navigation systems, a significant value proposition within China. This strategic advantage directly supports national priorities for technological self-reliance and data security.

In 2023, China's Beidou system continued its expansion, with over 70% of smartphones sold in China featuring Beidou compatibility, demonstrating its growing domestic integration and user base.

Automotive-Grade and Industrial Reliability

BDStar's Unicore subsidiary is a key player in delivering automotive-grade and industrial reliability. Their success in achieving mass production for automotive-grade modules is a testament to their commitment to stringent quality and performance standards. This achievement directly supports critical applications within the demanding automotive and industrial sectors.

The company has secured significant intelligent driving projects, underscoring the trust placed in their robust and dependable navigation solutions. This track record highlights BDStar's capability to meet the high expectations for reliability and longevity required in these advanced fields.

- Mass Production of Automotive-Grade Modules: Unicore’s successful mass production signifies adherence to rigorous automotive quality standards, ensuring safety and performance in vehicles.

- Intelligent Driving Project Wins: BDStar's involvement in intelligent driving projects demonstrates their technology's reliability for advanced driver-assistance systems (ADAS) and autonomous driving.

- Industrial Sector Applications: The reliability of BDStar's modules extends to industrial environments, supporting critical operations where consistent performance is paramount.

'Cloud + IC' Business Model for Enhanced Services

BDStar's 'Cloud + IC' model elevates its offering by integrating hardware with sophisticated data services and cloud-based enhancements. This approach moves beyond simple product sales to provide a continuous stream of value.

This integrated strategy allows BDStar to deliver a more comprehensive solution, ensuring improved performance and ongoing service delivery to its customers. It creates a sticky ecosystem where hardware and software work in tandem.

- Hardware Integration: BDStar leverages its expertise in Integrated Circuits (IC) to build robust and reliable hardware solutions.

- Cloud-Based Services: The cloud component enables data analytics, remote management, and software updates, adding significant value post-purchase.

- Enhanced Performance: By combining hardware and cloud intelligence, BDStar can optimize performance and offer predictive maintenance, as seen in the advancements in smart transportation systems where real-time data processing is crucial. For instance, in 2024, the global IoT in transportation market was projected to reach over $100 billion, highlighting the demand for such integrated solutions.

BDStar's core value lies in its high-precision GNSS products and integrated RTK/INS modules, crucial for demanding applications like autonomous driving and surveying. Their commitment to accuracy ensures clients receive reliable positioning, as demonstrated by their role in achieving centimeter-level accuracy in autonomous vehicle tests during 2024.

The company provides complete end-user products and solutions, not just components, simplifying procurement and implementation for diverse industries. This comprehensive approach proved successful in 2024, contributing significantly to BDStar Navigation's reported revenue growth.

Leveraging the BeiDou Navigation Satellite System offers a secure, domestically controlled alternative, aligning with national priorities for technological self-reliance. This strategic advantage is amplified by BeiDou's increasing integration, with over 70% of smartphones sold in China featuring BeiDou compatibility in 2023.

| Value Proposition | Key Feature | Market Impact/Data |

|---|---|---|

| High-Precision Positioning | RTK/INS Integrated Modules | Centimeter-level accuracy achieved in 2024 autonomous vehicle tests. |

| Complete Solutions Provider | End-user products and integrated systems | Drove significant revenue growth in 2024 through comprehensive offerings. |

| BeiDou System Advantage | Domestic, secure navigation alternative | Over 70% of 2023 Chinese smartphone sales included BeiDou compatibility. |

Customer Relationships

BDStar Navigation likely cultivates direct sales channels, especially for its high-value industrial and government contracts. This approach allows for tailored solutions and deep engagement with clients requiring complex positioning and navigation systems.

Dedicated technical support teams are crucial for these direct relationships, ensuring seamless integration and ongoing operational efficiency for clients like automotive manufacturers. This hands-on approach fosters strong partnerships and problem-solving.

In 2023, BDStar reported a significant portion of its revenue derived from government and enterprise sectors, underscoring the importance of these direct customer relationships for its business model.

Beijing BDStar Navigation's B2B partnership management is built on fostering deep collaborations with system integrators and vehicle manufacturers. These relationships are key to embedding BDStar's core navigation and positioning components into larger systems. For instance, in 2024, BDStar secured significant supply agreements with several major automotive OEMs, underpinning their strategy of becoming an indispensable part of the automotive supply chain.

Nurturing these B2B relationships involves more than just transactional supply; it extends to joint development efforts. By working closely with partners on future product roadmaps, BDStar ensures its technology remains at the forefront of industry needs. This collaborative approach has led to the co-development of several advanced driver-assistance systems (ADAS) components, demonstrating the value of these long-term partnerships.

Beijing BDStar Navigation secures customer loyalty and predictable income through long-term service contracts for its data and integrated solutions. These agreements often incorporate recurring revenue from subscriptions and ongoing maintenance, fostering deep, enduring relationships.

For instance, BDStar's commitment to providing continuous value through these contracts helps ensure a stable financial foundation. In 2024, a significant portion of their revenue is expected to stem from these multi-year service agreements, demonstrating their strategic focus on customer retention and predictable cash flow.

Co-development and Customization

In high-value sectors such as autonomous driving, Beijing BDStar Navigation likely collaborates closely with major clients. This co-development approach ensures their Global Navigation Satellite System (GNSS) solutions are precisely adapted to the unique needs of each client's platform. For instance, in 2024, BDStar's partnerships in the automotive industry are expected to drive innovation in integrated navigation systems, moving beyond standard offerings to create highly specialized modules.

These collaborative efforts cultivate robust, long-term relationships built on shared development goals. BDStar's commitment to customization allows them to deliver bespoke product offerings that meet stringent performance and integration criteria, solidifying their position as a preferred technology partner.

- Tailored Solutions: BDStar's co-development model creates GNSS products specifically engineered for client platforms, particularly in demanding fields like autonomous vehicles.

- Enhanced Client Relationships: This collaborative process fosters deep partnerships, moving beyond transactional sales to strategic alliances.

- Bespoke Product Development: The focus is on creating customized, high-value offerings that precisely match the technical specifications and operational requirements of key customers.

Industry Event Engagement and Thought Leadership

BDStar actively participates in and sponsors key industry events such as the China International Navigation Satellite System Industry Conference (CPGNSS) and INTERGEO, a leading global trade fair for geodesy, geoinformation, and surveying. These engagements are crucial for connecting with a wide array of customers and partners. For instance, BDStar's presence at INTERGEO 2023 showcased its latest advancements in high-precision positioning solutions.

By demonstrating cutting-edge technologies at these forums, BDStar solidifies its position as a thought leader in the satellite navigation industry. This direct interaction allows for feedback and fosters deeper understanding of market needs. In 2024, BDStar continued its strategic event participation, aiming to highlight its commitment to innovation and industry advancement.

- Industry Event Participation: BDStar leverages events like CPGNSS and INTERGEO for direct customer engagement.

- Technology Showcase: These platforms are used to demonstrate new and existing satellite navigation technologies.

- Thought Leadership: Participation helps establish BDStar as a key influencer and expert in the sector.

- Market Insight: Events provide valuable opportunities to gather market intelligence and customer feedback.

BDStar Navigation fosters deep client relationships through direct sales and dedicated technical support, particularly for complex industrial and government projects. This direct engagement is vital for integrating their advanced positioning systems, as seen in their significant 2023 revenue from these sectors.

Long-term service contracts are a cornerstone of BDStar's customer strategy, providing recurring revenue from data and integrated solutions, ensuring customer loyalty and stable cash flow. In 2024, a substantial portion of their revenue is projected to come from these multi-year agreements.

BDStar's collaborative approach extends to co-developing solutions with key partners, such as automotive OEMs, to embed their GNSS technology into advanced systems. This strategy, reinforced by significant 2024 supply agreements, positions them as an integral part of the automotive supply chain.

Channels

BDStar's direct sales force is crucial for engaging with key accounts like large enterprises and government bodies. These teams are equipped to handle the complexities of integrated solutions, ensuring tailored discussions and negotiations for high-value projects.

In 2024, BDStar's direct sales efforts were instrumental in securing contracts within sectors demanding specialized positioning and navigation technologies. This direct approach fosters deeper client relationships and allows for precise understanding of unique customer needs.

BDStar heavily relies on strategic partnerships with automotive original equipment manufacturers (OEMs) and other major electronics producers. These collaborations are vital for embedding BDStar's advanced navigation and positioning components directly into vehicles and consumer devices, creating a significant distribution channel.

For instance, in 2024, BDStar announced a significant expansion of its automotive partnerships, aiming to supply its BeiDou-based high-precision modules for new energy vehicles produced by several leading Chinese automakers. This strategy directly taps into the rapidly growing EV market, projected to reach over 15 million units globally in 2024, providing BDStar with substantial market penetration.

These OEM agreements are not just about component supply; they often involve co-development and integration support, ensuring BDStar's technology is optimized for specific product lines. This deep integration fosters strong customer loyalty and provides a consistent revenue stream, as seen with BDStar's ongoing contracts with domestic automotive giants throughout 2023 and into 2024.

Beijing BDStar Navigation leverages industry exhibitions and conferences as a vital channel. Participation in major events like INTERGEO and CPGNSS offers a platform to unveil new product innovations and engage directly with potential clients and strategic partners. These gatherings are crucial for building brand presence and cultivating valuable business relationships.

These exhibitions are not just about showcasing technology; they are significant lead generation engines. In 2024, for instance, attendance at key geospatial events often exceeded tens of thousands of professionals, providing BDStar with unparalleled access to a concentrated audience of industry decision-makers actively seeking solutions. The direct interaction at these events translates into tangible business opportunities.

Online Platforms and Company Website

BDStar's official website functions as a crucial digital gateway, offering comprehensive company information, detailed product catalogs, and timely news updates. It also serves as a vital platform for investor relations, providing transparency and accessibility to stakeholders worldwide. In 2024, the company reported a significant increase in website traffic, indicating its growing importance as a primary channel for customer engagement and information dissemination.

This online presence acts as a virtual storefront, showcasing BDStar's technological advancements and solutions to a global audience. The website is meticulously designed to cater to diverse user needs, from potential clients seeking product details to investors monitoring company performance. Its role extends to facilitating direct inquiries and support, solidifying its position as a cornerstone of BDStar's customer outreach strategy.

- Primary Information Hub: BDStar's website is the go-to source for company news, product specifications, and financial reports.

- Global Reach: It provides 24/7 access to information for international clients and investors.

- Investor Relations: Key financial data and updates are readily available, enhancing transparency.

- Digital Storefront: The site effectively showcases BDStar's offerings and facilitates lead generation.

System Integrators and Value-Added Resellers (VARs)

BDStar likely leverages system integrators and value-added resellers (VARs) to extend its market reach across diverse industrial and IoT applications. These partners are crucial for bundling BDStar's core navigation and positioning technologies with complementary hardware and software, creating comprehensive end-to-end solutions for specific customer needs.

By partnering with these channel players, BDStar can effectively tap into niche markets and customer segments that might be difficult to access directly. VARs, in particular, add significant value by customizing solutions, providing integration services, and offering ongoing support, thereby enhancing the overall customer experience and driving adoption of BDStar's technology.

- Market Expansion: System integrators and VARs act as an extended sales and implementation arm, enabling BDStar to reach a broader customer base without direct investment in every vertical market.

- Solution Customization: Partners tailor BDStar's offerings, integrating them with other systems to meet unique industrial and IoT requirements, such as precision agriculture or smart logistics.

- Value Addition: VARs provide essential services like installation, configuration, training, and ongoing maintenance, increasing the perceived value of BDStar's products for end-users.

- Indirect Revenue Growth: BDStar's revenue is indirectly boosted as its components are embedded within the larger solutions delivered by its channel partners.

BDStar's direct sales force is crucial for engaging with key accounts like large enterprises and government bodies, ensuring tailored discussions for high-value projects. In 2024, these direct efforts were instrumental in securing contracts within sectors demanding specialized positioning and navigation technologies, fostering deeper client relationships.

Customer Segments

The automotive industry, particularly the segments focused on autonomous driving and intelligent cockpits, represents a key customer base for BDStar Navigation. This includes major car manufacturers and their critical Tier 1 suppliers who are actively integrating advanced driver-assistance systems (ADAS), sophisticated in-car digital experiences, and preparing for fully autonomous vehicle deployment. These players demand highly accurate and reliable positioning modules to ensure the safety and functionality of these cutting-edge automotive technologies.

Unicore, a significant player in the GNSS module market, has recently secured notable wins within this automotive sector, underscoring the growing demand for their high-precision positioning solutions. For instance, in 2024, Unicore announced collaborations with several leading automotive OEMs and Tier 1 suppliers for their next-generation vehicle platforms, indicating a strong market traction and a clear pathway for BDStar Navigation to leverage these trends.

BDStar Navigation's industrial segment caters to sectors requiring exceptionally precise positioning. This includes clients in precision agriculture, where guidance systems on machinery need centimeter-level accuracy to optimize planting and harvesting, and in surveying and mapping, where detailed and accurate geographical data is paramount.

The company's solutions are also crucial for establishing Continuously Operating Reference Stations (CORS), which form the backbone of national geodetic networks, and for advanced mechanical control systems in construction and mining. These applications demand reliability and sub-meter to centimeter accuracy, often in challenging environments.

In 2024, the global market for precision agriculture, a key area for BDStar, was projected to reach over $10 billion, highlighting the significant demand for high-accuracy GNSS technology. Similarly, the surveying and mapping equipment market continues to grow, driven by infrastructure development and urban planning initiatives worldwide.

BDStar Navigation's customer base includes IoT device manufacturers and solution providers who need precise positioning for their smart products. These companies are building everything from advanced logistics trackers to components for smart city initiatives.

For instance, in 2024, the global IoT market was projected to reach over $1.1 trillion, with a significant portion driven by hardware and connectivity solutions that rely on accurate location services. BDStar's technology directly supports these growth areas.

BDStar provides the foundational positioning technology that enables these manufacturers and providers to create more sophisticated and reliable IoT applications, enhancing the value proposition of their own offerings in a competitive landscape.

Government and Public Sector

The government and public sector are crucial customer segments for Beijing BDStar Navigation. These entities, including national defense, public safety, and critical infrastructure management, rely heavily on precise and secure positioning, navigation, and timing (PNT) services. In 2024, the global government satellite navigation market was valued at approximately $10.5 billion, with a significant portion driven by defense and public safety applications. BDStar's solutions are integral to these operations, ensuring national security and efficient public service delivery.

BDStar's offerings cater to specialized government needs, providing reliable navigation for military operations and emergency response systems. For instance, in 2023, China's Beidou Navigation Satellite System (BDS) played a vital role in various national projects, including disaster relief efforts and national infrastructure development, underscoring the system's importance to public sector operations. The demand for secure and high-accuracy PNT solutions continues to grow as governments worldwide enhance their capabilities.

- National Security and Defense: Providing secure and reliable PNT for military operations, intelligence gathering, and strategic defense planning.

- Public Safety and Emergency Services: Enabling efficient coordination for first responders, disaster management, and public safety communications.

- Infrastructure Management: Supporting the precise monitoring and management of critical infrastructure like transportation networks, energy grids, and water systems.

- Government Operations: Facilitating accurate data collection and management for various governmental functions, including surveying and mapping.

Consumer Electronics and Mass Market

BDStar actively targets the consumer electronics and mass market by supplying essential precision GNSS chips and modules. These components are crucial for a wide array of everyday devices, including vehicle navigation systems, smart wearables, and smartphones.

This strategy significantly broadens the adoption of BeiDou technology, integrating it seamlessly into daily life for millions of users. By making its technology accessible for these high-volume applications, BDStar aims to capture a substantial share of the consumer market.

- Market Reach: BDStar's GNSS solutions are integrated into devices used by a vast consumer base, extending BeiDou's presence beyond specialized applications.

- Product Integration: The company provides standard chips and modules for popular consumer electronics like smartphones and wearable tech.

- Everyday Utility: BDStar's technology enhances everyday experiences through reliable vehicle navigation and personal tracking devices.

BDStar Navigation serves a diverse customer base, from automotive giants integrating advanced driver-assistance systems to industrial sectors like precision agriculture and surveying that demand centimeter-level accuracy. The company's high-precision GNSS modules are critical for autonomous driving and intelligent cockpits, with significant OEM and Tier 1 supplier collaborations noted in 2024. In parallel, the industrial segment relies on BDStar for applications in agriculture, surveying, and critical infrastructure, areas experiencing robust market growth, with precision agriculture alone projected to exceed $10 billion in 2024.

| Customer Segment | Key Needs | 2024 Market Context/Data |

|---|---|---|

| Automotive | High-accuracy, reliable positioning for ADAS, autonomous driving, intelligent cockpits | Strong OEM/Tier 1 supplier wins; focus on next-gen platforms |

| Industrial (Agriculture, Surveying, Construction) | Centimeter-level accuracy, reliability in challenging environments | Precision Agriculture market > $10 billion; growth in surveying/mapping driven by infrastructure |

| IoT & Smart Devices | Precise location services for trackers, smart city components | Global IoT market > $1.1 trillion; hardware/connectivity reliant on location services |

| Government & Public Sector | Secure, precise PNT for defense, public safety, infrastructure management | Global government satellite navigation market ~$10.5 billion; Beidou vital for national projects |

| Consumer Electronics | Mass-market GNSS chips/modules for navigation, wearables, smartphones | Integrating BeiDou into daily life; high-volume applications |

Cost Structure

Beijing BDStar Navigation heavily invests in Research and Development (R&D), recognizing its critical role in maintaining a competitive edge. A substantial portion of their cost structure is dedicated to the innovation and refinement of Global Navigation Satellite System (GNSS) chips, modules, and sophisticated positioning algorithms. This commitment fuels the development of next-generation technologies and advanced positioning solutions.

The company's R&D expenses are primarily driven by the need to attract and retain top-tier engineering talent, essential for pushing the boundaries of GNSS technology. Significant capital is also channeled into establishing and upgrading state-of-the-art testing facilities. For instance, in 2023, BDStar Navigation reported R&D expenditures of approximately 320 million RMB, underscoring their strategic focus on technological advancement.

Manufacturing and production costs are a significant component for BDStar Navigation. These expenses cover the creation of their core products, which include Global Navigation Satellite System (GNSS) components, automotive electronics, and specialized ceramic components. For instance, the cost of raw materials like semiconductors and specialized alloys, alongside factory overheads and direct labor wages, directly impacts their profitability.

In 2024, the global semiconductor shortage continued to exert pressure on raw material costs for electronics manufacturers. BDStar, like many in the industry, likely faced increased procurement expenses for essential chips and electronic components. This, coupled with the operational costs of maintaining production facilities and employing a skilled manufacturing workforce, forms the backbone of their manufacturing expense base.

Beijing BDStar Navigation's cost structure heavily features expenses related to sales, marketing, and distribution. These are crucial for reaching its diverse customer base, which includes government entities and commercial clients. Costs encompass broad marketing campaigns, participation in key industry exhibitions like the China International High-Tech Expo, and maintaining a robust sales force.

The company invests significantly in promoting its advanced navigation and positioning technologies. This includes digital marketing efforts, content creation, and public relations to build brand awareness and generate leads. For example, in 2023, BDStar reported marketing and sales expenses of approximately RMB 311.5 million, reflecting a considerable commitment to market penetration and customer acquisition.

Furthermore, BDStar incurs substantial costs in establishing and maintaining its distribution channels, both domestically and internationally. This involves building relationships with partners, managing logistics for product delivery, and providing after-sales support. The global nature of its operations, serving sectors from automotive to aerospace, necessitates a well-funded and efficient distribution network, adding to the overall sales, marketing, and distribution expenditure.

Personnel and Talent Acquisition Costs

Personnel and talent acquisition costs are a substantial component of Beijing BDStar Navigation's operational expenses. This includes the salaries, comprehensive benefits packages, and the often-significant recruitment expenses associated with attracting and retaining a large workforce. The company relies heavily on specialized engineers, dedicated researchers, and skilled sales professionals, all of whom command competitive compensation.

In 2024, these costs are particularly pronounced due to the ongoing demand for highly skilled personnel in the rapidly evolving navigation and satellite technology sectors. BDStar Navigation's investment in human capital is crucial for its innovation and market competitiveness.

- Salaries and Wages: Covering the compensation for a diverse workforce, from R&D to sales.

- Employee Benefits: Including health insurance, retirement plans, and other welfare programs essential for talent retention.

- Recruitment and Training: Costs associated with sourcing, interviewing, hiring, and onboarding new employees, particularly specialized talent.

- Compensation for Specialized Roles: A significant portion allocated to engineers, researchers, and sales professionals with critical expertise in satellite navigation and related technologies.

Infrastructure and System Maintenance

Maintaining BDStar Navigation's 'Cloud + IC' infrastructure, encompassing servers, data centers, and network operations, is crucial for delivering robust data services and continuous cloud enhancements. These ongoing operational and maintenance expenses are a significant component of the cost structure.

In 2024, companies in the technology sector, particularly those with significant cloud infrastructure, often allocate a substantial portion of their budget to these areas. For instance, IT infrastructure spending globally was projected to reach over $1.3 trillion in 2024, with cloud services representing a major driver of this growth.

- Cloud Infrastructure: Costs associated with cloud hosting, server uptime, and data storage.

- System Maintenance: Expenses for software updates, security patches, and hardware upkeep.

- Network Operations: Investment in network bandwidth, connectivity, and operational support for data transmission.

- Data Center Management: Costs related to power, cooling, physical security, and staffing for data centers.

Beijing BDStar Navigation's cost structure is heavily influenced by its significant investment in Research and Development (R&D), focusing on GNSS chips, modules, and algorithms. Manufacturing and production expenses are also substantial, driven by raw material costs like semiconductors and factory overheads. Sales, marketing, and distribution activities, including promotional campaigns and maintaining distribution networks, represent another key cost area. Finally, personnel costs, particularly for specialized engineers and researchers, are critical for innovation and market competitiveness.

| Cost Category | 2023 (Approx. RMB million) | Key Drivers |

|---|---|---|

| Research & Development | 320 | Talent acquisition, testing facilities, technological innovation |

| Manufacturing & Production | N/A | Semiconductor costs, specialized alloys, labor, factory overheads |

| Sales, Marketing & Distribution | 311.5 | Marketing campaigns, exhibitions, sales force, logistics, after-sales support |

| Personnel & Talent Acquisition | N/A | Salaries, benefits, recruitment for specialized roles |

| Cloud & IT Infrastructure | N/A | Cloud hosting, data centers, network operations, system maintenance |

Revenue Streams

Beijing BDStar Navigation generates revenue by selling its core Global Navigation Satellite System (GNSS) chips and high-precision modules. These components are crucial for other manufacturers and system integrators building navigation and positioning devices.

This direct sales channel is a foundational element of their business model. For instance, in 2023, BDStar's revenue from integrated circuits and modules, which includes their GNSS chips, reached approximately 1.6 billion RMB, highlighting the significance of this revenue stream.

BDStar generates revenue by selling a range of finished products directly to consumers and businesses. This includes specialized navigation equipment, advanced automotive electronics such as infotainment systems and digital instrument clusters, and other integrated technology solutions tailored for various applications.

Beijing BDStar Navigation generates revenue through project-based solution and service fees, particularly for specialized industry applications. This includes delivering high-precision positioning services tailored for sectors like autonomous driving and the Internet of Things (IoT). For instance, in 2023, the company saw significant growth in its intelligent transportation segment, contributing to its overall revenue diversification.

Data Services and Software Licensing

Beijing BDStar Navigation generates revenue through its data services, offering specialized information like cloud enhancement and marine fishery location data for a fee. This taps into the growing demand for precise, actionable data in various sectors.

Furthermore, the company licenses its proprietary software and algorithms, providing clients with access to advanced navigation and positioning technologies. This recurring revenue stream supports ongoing development and market penetration.

- Value-added data services: Fees for specialized data like cloud enhancement and marine fishery location data.

- Software licensing: Revenue from licensing proprietary navigation and positioning algorithms.

Recurring Subscription Revenue

Beijing BDStar Navigation often secures recurring revenue by offering subscription-based access to its high-precision differential correction data. This model ensures a steady income stream for services critical to accurate positioning.

Cloud-based platforms and data services also fall under this recurring revenue strategy. BDStar leverages these subscriptions to provide ongoing value to its clients, fostering long-term relationships.

For instance, in 2023, BDStar's focus on enhancing its BeiDou-based high-precision positioning services aimed to bolster its subscription revenue. While specific figures for this segment are often embedded within broader reports, the company's strategic emphasis on these recurring models is a key indicator of their financial approach.

- Subscription Models: Essential for high-precision differential correction data.

- Cloud Services: Recurring revenue generation through ongoing access.

- Client Retention: Fosters long-term relationships and predictable income.

- Strategic Focus: BDStar prioritizes these models for financial stability.

BDStar Navigation's revenue streams are diverse, encompassing the sale of core GNSS chips and modules, finished navigation products, and project-based solutions. They also generate income through value-added data services and software licensing.

A significant portion of their revenue comes from recurring subscription models for high-precision differential correction data and cloud-based services, fostering client retention and predictable income.

In 2023, BDStar's integrated circuits and modules revenue reached approximately 1.6 billion RMB, underscoring the importance of their component sales.

| Revenue Stream | Description | 2023 Relevance (Approx.) |

|---|---|---|

| GNSS Chips & Modules | Core components for navigation devices. | 1.6 billion RMB (Integrated Circuits & Modules) |

| Finished Products | Specialized navigation equipment, automotive electronics. | Key segment for direct sales. |

| Project Solutions & Services | High-precision positioning for autonomous driving, IoT. | Growth in intelligent transportation. |

| Data Services | Cloud enhancement, marine fishery location data. | Taps into demand for precise data. |

| Software Licensing | Access to advanced navigation/positioning technologies. | Supports ongoing development. |

| Subscription Services | High-precision differential correction, cloud platforms. | Strategic focus for financial stability. |

Business Model Canvas Data Sources

The Beijing BDStar Navigation Business Model Canvas is built upon a foundation of market intelligence, financial reports, and competitive analysis. These sources provide the necessary data to accurately define customer segments, value propositions, and revenue streams.