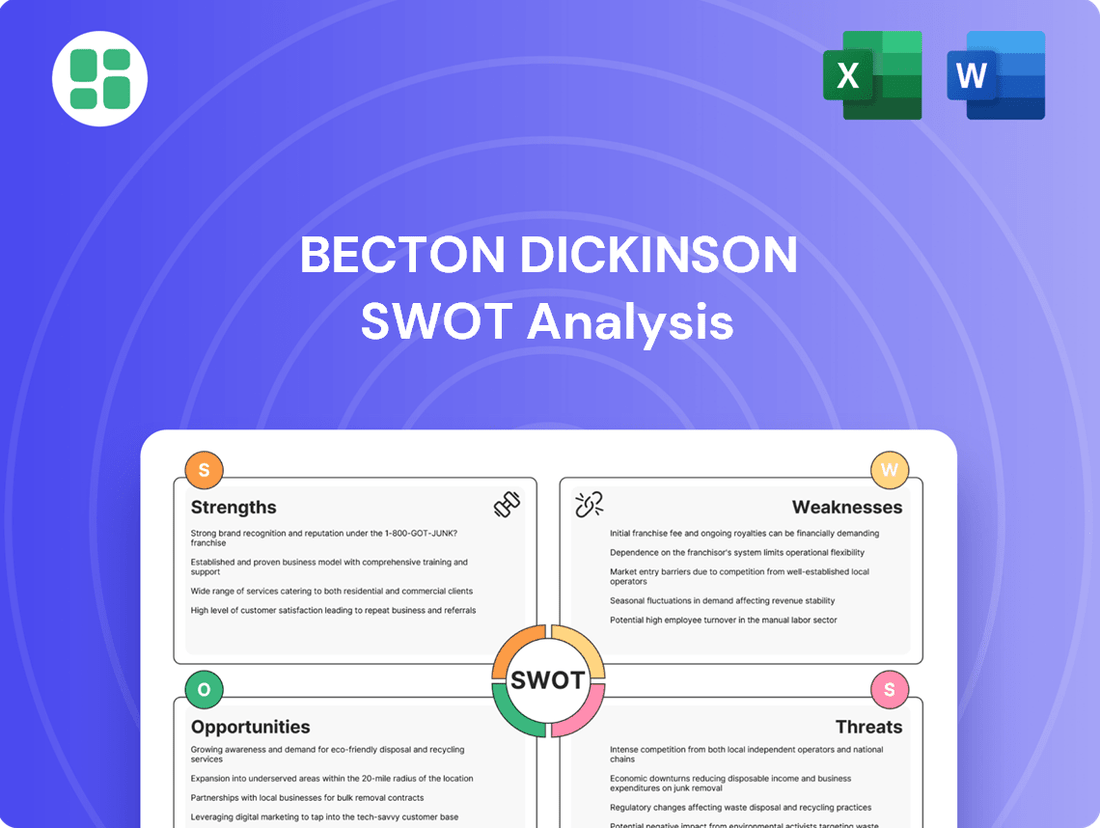

Becton Dickinson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Becton Dickinson Bundle

Becton Dickinson (BD) demonstrates robust strengths in its diversified product portfolio and strong brand recognition within the healthcare sector. However, potential challenges arise from intense competition and evolving regulatory landscapes.

Want the full story behind BD's market position, growth drivers, and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Becton Dickinson (BD) commands a formidable global market leadership position within the medical technology sector. Its extensive and diversified portfolio encompasses a wide range of medical supplies, devices, laboratory equipment, and diagnostic products, serving critical segments like healthcare institutions, life science research, and clinical laboratories.

This broad product offering insulates BD from downturns in any single market, contributing to its financial stability. As of early 2024, the company's market capitalization exceeded $51 billion, a testament to its significant scale and enduring presence in the healthcare industry.

Becton Dickinson (BD) consistently showcases impressive financial health, marked by robust revenue growth and a pattern of beating earnings expectations. This trend continued into Q1 of fiscal year 2025, where the company achieved $5.17 billion in revenue, exceeding analyst forecasts and representing a significant 9.8% increase compared to the previous year.

This strong financial trajectory is bolstered by strategic moves, including the acquisition of Edwards Lifesciences' Critical Care product group. Such acquisitions, combined with efficient operational strategies, directly contribute to enhanced profit margins and a healthier free cash flow for the company.

Becton Dickinson (BD) maintains a robust innovation pipeline, a core strength driven by its significant commitment to research and development as outlined in its BD 2025 strategy. This dedication is evidenced by dozens of new products currently in development, poised to address critical healthcare challenges.

Recent tangible successes include new FDA clearances for its Alaris infusion pump system, alongside the development of advanced technologies such as next-generation infusion pumps, sophisticated cell sorters, and innovative wearable injector systems designed for biologics administration. These advancements highlight BD's forward-looking approach to medical technology.

BD's strategic emphasis on integrating cutting-edge technologies like biologics, artificial intelligence (AI), and automation firmly positions the company as a leader in anticipating and meeting the evolving demands of modern healthcare. This focus ensures its offerings remain relevant and impactful.

Robust Manufacturing and Supply Chain Capabilities

Becton Dickinson (BD) boasts robust manufacturing and supply chain capabilities, underscored by significant investments in expanding U.S. production. The company is prioritizing critical medical devices such as syringes, needles, and IV catheters, with substantial capital expenditures slated for 2024 and 2025. This strategic move aims to bolster supply chain resilience and lessen dependence on international sources, thereby ensuring a consistent supply of vital healthcare products.

These investments highlight BD's commitment to operational excellence and its ability to adapt to evolving market demands. By reinforcing domestic manufacturing, BD is better positioned to navigate potential disruptions and maintain a reliable flow of essential medical supplies. This proactive strategy is crucial for meeting the ongoing needs of healthcare providers and patients.

- U.S. Manufacturing Expansion: BD is increasing its U.S. production capacity for key medical devices.

- Critical Product Focus: Investments target syringes, needles, and IV catheters.

- 2024-2025 Investment: Significant capital is allocated for these expansions in the coming years.

- Supply Chain Resilience: The goal is to reduce reliance on external factors and ensure product continuity.

Strategic Focus and Portfolio Optimization (BD 2025 Strategy)

Becton Dickinson's (BD) 2025 strategy is a significant move to sharpen its business focus and enhance profitability. By strategically shifting its portfolio towards higher-growth segments and streamlining operations, the company is positioning itself for accelerated expansion. This strategic pivot is designed to unlock greater value for all stakeholders involved.

A cornerstone of this transformation is the planned separation of its Biosciences and Diagnostic Solutions businesses. This separation is anticipated to create a more streamlined entity, the 'New BD,' with a concentrated emphasis on healthcare provider and patient end-markets. This focused approach is expected to foster increased innovation and drive robust growth within each distinct business segment.

The strategic realignment is projected to yield substantial benefits. For instance, BD announced in May 2024 that the separation of its Biosciences business was expected to be completed in the first half of fiscal year 2025. This move is anticipated to enhance operational efficiency and allow for more targeted capital allocation, ultimately driving improved financial performance and shareholder returns.

- Strategic Portfolio Shift: BD is concentrating on higher-growth areas within its business segments.

- Business Separation: The planned separation of Biosciences and Diagnostic Solutions aims to create a more focused 'New BD'.

- Targeted End-Markets: The 'New BD' will concentrate on healthcare provider and patient end-markets.

- Fiscal Year 2025 Impact: The separation of Biosciences was targeted for completion in H1 FY2025, enhancing operational focus.

BD's diversified product portfolio, spanning medical supplies, devices, and diagnostics, provides significant resilience against market fluctuations. This broad offering, coupled with a strong global market leadership, ensures a stable revenue base. The company's commitment to innovation, highlighted by its BD 2025 strategy and recent product clearances like the Alaris infusion pump system, fuels future growth and market relevance.

Strategic investments in U.S. manufacturing, particularly for critical items like syringes and needles, bolster supply chain resilience. Furthermore, the planned separation of its Biosciences business, targeted for completion in the first half of fiscal year 2025, aims to create a more focused entity, 'New BD,' poised for accelerated growth in its core healthcare provider and patient markets.

| Metric | Value (as of early 2024/Q1 FY2025) | Significance |

|---|---|---|

| Market Capitalization | >$51 billion | Demonstrates significant scale and market presence. |

| Q1 FY2025 Revenue | $5.17 billion | Exceeded analyst forecasts, showing robust financial health. |

| Year-over-Year Revenue Growth (Q1 FY2025) | 9.8% | Indicates strong top-line performance. |

| New Product Development | Dozens in pipeline | Supports long-term growth and market leadership. |

What is included in the product

Delivers a strategic overview of Becton Dickinson’s internal and external business factors, highlighting its market strengths and potential growth opportunities.

Offers a clear, actionable roadmap by highlighting Becton Dickinson's competitive advantages and areas for improvement, simplifying strategic decision-making.

Weaknesses

Becton Dickinson (BD) faces significant vulnerability due to its reliance on sole-sourced materials and components, a risk acknowledged even with ongoing efforts to bolster manufacturing resilience. This dependence on single suppliers for critical inputs, often tied to proprietary technology, directly impacts BD's capacity to produce and distribute key products, potentially leading to shortages or production halts.

While BD has implemented business continuity plans to mitigate such risks, the inherent nature of single-source dependencies presents a persistent operational challenge. For instance, disruptions in the supply of specialized plastics or electronic components from a single provider could directly affect the availability of diagnostic kits or medical devices, impacting sales and customer fulfillment.

Becton Dickinson (BD) has seen a notable drop in revenue from COVID-19 diagnostic tests, with sales falling significantly from their 2021 peak to 2023. For instance, COVID-19 related revenue declined from approximately $1.7 billion in fiscal year 2021 to around $500 million in fiscal year 2023.

While BD's core business segments have demonstrated resilience and growth, this substantial decrease in COVID-19 sales has impacted the overall performance of its Diagnostics segment. This trend underscores the need for strategic adjustments to address evolving market demands.

The erosion of COVID-19 related revenue highlights a weakness in BD's diagnostic portfolio's reliance on pandemic-specific products. Consequently, the company must focus on diversifying its diagnostic offerings to ensure sustained growth and mitigate risks associated with future public health shifts.

Becton Dickinson's (BD) reliance on reimbursement from public and private payers introduces significant uncertainty. For instance, shifts in Medicare reimbursement rates for diagnostic tests or medical devices can directly impact BD's revenue streams, as seen with potential adjustments to DRG (Diagnosis-Related Group) payments that affect hospital purchasing decisions for their equipment.

Changes in healthcare policy and reimbursement rates present a constant hurdle. For example, evolving payer policies regarding the coverage of specific diagnostic platforms or the pricing of consumables can create compliance costs and potentially limit market access for BD's innovative solutions. Navigating this intricate reimbursement landscape remains a critical challenge for sustained growth.

Potential Operational Disruptions from Strategic Restructuring

Becton Dickinson's (BD) strategic restructuring, specifically the planned separation of its Biosciences and Diagnostic Solutions businesses, introduces significant execution risks. This move, intended to unlock shareholder value, carries the inherent challenge of managing large-scale organizational changes. These changes can indeed lead to operational hiccups, potential cultural friction between teams, and unexpected expenses as the separation and integration processes unfold.

The complexity of disentangling these major business units could potentially slow down the achievement of anticipated synergies. Furthermore, these disruptions might negatively affect BD's financial performance in the near to medium term. For instance, during similar large-scale separations in the healthcare sector, companies have reported temporary dips in revenue growth, often in the range of 1-3%, due to the focus shifting to the restructuring itself.

- Execution Risk: The separation of Biosciences and Diagnostic Solutions is a complex undertaking with inherent execution challenges.

- Operational Impact: Large-scale organizational changes can cause disruptions, impacting day-to-day operations and efficiency.

- Financial Ramifications: Unforeseen costs and integration complexities may delay synergy realization and affect short-to-medium term financial results.

Exposure to Market Volatility and Macroeconomic Uncertainties

Becton Dickinson (BD) operates within the dynamic medical technology sector, which is inherently susceptible to market volatility and broader macroeconomic uncertainties. Factors like persistent inflation, fluctuating interest rates, and potential global economic slowdowns can significantly influence healthcare spending and capital investment decisions by hospitals and other healthcare providers. For instance, in 2024, many developed economies continued to grapple with inflation, impacting operational costs and potentially dampening demand for non-essential medical equipment.

These external economic pressures can directly affect BD's financial performance. Inflation can drive up the cost of raw materials and manufacturing, while economic downturns might lead to reduced purchasing power among BD's customer base, impacting sales volumes. Furthermore, evolving trade policies and geopolitical tensions can introduce uncertainties regarding tariffs and supply chain stability, adding another layer of complexity to BD's operational planning and cost management strategies.

- Market Volatility Impact: Economic downturns can reduce healthcare capital expenditure, affecting BD's sales cycles.

- Inflationary Pressures: Rising costs for materials and labor in 2024 and projected for 2025 can squeeze profit margins.

- Tariff Uncertainties: Shifting international trade policies create unpredictable cost structures for imported components and exported goods.

- Consumer Behavior Shifts: Economic uncertainty may lead to delayed elective procedures, indirectly impacting demand for certain BD products.

Becton Dickinson's (BD) reliance on sole-sourced components presents a significant operational vulnerability. This dependence can lead to production disruptions and shortages, directly impacting product availability. For example, a single supplier issue for critical plastics or electronics can halt the manufacturing of vital diagnostic kits and medical devices.

The substantial decline in COVID-19 diagnostic test revenue, dropping from approximately $1.7 billion in fiscal year 2021 to around $500 million in fiscal year 2023, highlights a weakness in the Diagnostics segment's reliance on pandemic-specific products. This necessitates diversification to ensure sustained growth amidst evolving public health landscapes.

BD is exposed to reimbursement risks from public and private payers, with shifts in rates impacting revenue. Changes in healthcare policies and payer coverage for specific platforms or consumables create compliance costs and potential market access limitations.

The planned separation of its Biosciences and Diagnostic Solutions businesses introduces execution risks, potentially leading to operational hiccups, cultural friction, and unforeseen costs. This complex restructuring could delay synergy realization and negatively impact short-to-medium term financial performance, with historical precedents showing temporary revenue growth dips of 1-3% during similar large-scale separations.

| Weakness Category | Specific Issue | Impact | Example/Data Point |

|---|---|---|---|

| Supply Chain Dependency | Sole-sourced components | Production disruptions, product shortages | Disruptions in specialized plastics or electronic components |

| Revenue Concentration | Decline in COVID-19 diagnostics | Reduced Diagnostics segment performance | Revenue drop from ~$1.7B (FY21) to ~$500M (FY23) |

| Reimbursement Uncertainty | Reliance on payer rates | Revenue stream volatility, market access limitations | Changes in Medicare reimbursement for diagnostic tests |

| Strategic Restructuring | Separation of business units | Execution risk, operational disruption, financial impact | Potential for 1-3% temporary revenue growth dips |

Same Document Delivered

Becton Dickinson SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Becton Dickinson's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering detailed insights into Becton Dickinson's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Becton Dickinson's (BD) strategic portfolio realignment, specifically the planned separation of its Biosciences and Diagnostic Solutions businesses, presents a significant opportunity to unlock shareholder value. This move allows each distinct entity to pursue tailored growth strategies and capital allocation, potentially leading to enhanced innovation and market responsiveness.

By enabling focused management and investor attention, the separation is expected to attract capital more efficiently. For instance, the life sciences sector, which BD's Biosciences division operates within, saw robust investment activity in 2024, with venture capital funding reaching billions for innovative biotech and diagnostics companies, suggesting a receptive market for a standalone, focused entity.

Becton Dickinson (BD) has a significant opportunity to grow by expanding into emerging markets. These regions often see increased healthcare spending and a rising need for advanced medical devices and diagnostic tools. For instance, in 2024, healthcare spending in many Asian emerging markets was projected to grow by over 7%, presenting a substantial market for BD's offerings.

This geographic expansion can lead to considerable revenue increases and a more balanced market presence for BD. By tapping into these developing economies, the company can address critical unmet healthcare needs, further solidifying its global reach and impact.

Becton Dickinson's growth hinges on embracing technological shifts like AI, biologics, and automation. This strategic focus allows BD to enhance its product portfolio and streamline operations, solidifying its position as a healthcare innovator.

By investing in these advanced technologies, BD aims to revolutionize patient care. For instance, AI-powered diagnostics can lead to earlier disease detection, while automation in labs can boost efficiency, ultimately improving patient outcomes and BD's market standing.

Strategic Acquisitions and Partnerships

Becton Dickinson (BD) has a proven track record of leveraging strategic acquisitions to fuel growth, exemplified by its acquisition of Edwards Lifesciences' Critical Care product group. This move not only bolstered its financial performance but also significantly enhanced its product offerings in a key segment.

Continuing this disciplined approach to capital deployment, with a focus on mergers and acquisitions that target growth opportunities, is crucial. Strategic partnerships can similarly fortify BD's market standing, broaden its product range, and expedite its expansion into emerging, high-potential markets.

- Acquisition of Edwards Lifesciences Critical Care: This acquisition, completed in 2020 for $1.05 billion, added a complementary portfolio of monitoring solutions.

- Focus on Growth-Oriented M&A: BD's strategy prioritizes acquisitions that align with its core businesses and offer substantial growth potential.

- Market Position Enhancement: Strategic deals strengthen BD's competitive edge and expand its reach in critical healthcare areas.

- Diversification and New Market Entry: Acquisitions and partnerships provide pathways to new product categories and geographic markets, mitigating risk and unlocking new revenue streams.

Growing Demand from Aging Population and Chronic Diseases

The world's population is getting older, and more people are dealing with long-term health issues. This means there's a constant and growing need for medical equipment and tests. For Becton Dickinson (BD), this is a significant opportunity because their main products, like those for managing medicines, keeping patients safe, preventing infections, and diagnosing illnesses, are exactly what this expanding group of patients requires.

Consider these key points:

- Demographic Shift: The number of individuals aged 65 and over is projected to reach 1.5 billion by 2050, a substantial increase from approximately 703 million in 2019.

- Chronic Disease Prevalence: Chronic diseases, such as diabetes, heart disease, and cancer, affect a significant portion of the global population, with estimates suggesting over 40% of adults in developed nations have at least one chronic condition.

- BD's Product Alignment: BD's portfolio, which includes infusion pumps, medication management systems, and diagnostic tools, directly addresses the increasing healthcare demands associated with an aging demographic and the management of chronic conditions.

- Market Growth Potential: This sustained demand translates into a robust and consistent growth opportunity for BD, as their solutions are critical for improving patient outcomes and healthcare efficiency in these growing segments.

Becton Dickinson's strategic portfolio realignment, including the planned separation of its Biosciences and Diagnostic Solutions businesses, offers a significant opportunity to unlock shareholder value by allowing each entity to pursue tailored growth strategies and attract capital more efficiently. The life sciences sector, where Biosciences operates, saw billions in venture capital funding in 2024, indicating a receptive market for a focused entity.

Expanding into emerging markets presents another growth avenue, with healthcare spending in many Asian emerging markets projected to grow by over 7% in 2024. This geographic expansion can drive revenue and solidify BD's global presence by addressing critical unmet healthcare needs.

Embracing technological shifts like AI, biologics, and automation allows BD to enhance its product portfolio and streamline operations, revolutionizing patient care through earlier disease detection and improved lab efficiency. The company's acquisition strategy, exemplified by the Edwards Lifesciences Critical Care purchase for $1.05 billion in 2020, continues to strengthen its market position and diversify its offerings.

The global demographic shift towards an older population, with the number of individuals aged 65+ projected to reach 1.5 billion by 2050, coupled with the rising prevalence of chronic diseases, creates sustained demand for BD's core products in medication management, patient safety, and diagnostics.

| Opportunity Area | Description | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Portfolio Realignment | Separation of businesses to unlock value and enable focused growth. | Life sciences sector attracted billions in VC funding in 2024. |

| Emerging Market Expansion | Addressing unmet healthcare needs in growing economies. | Projected 7%+ growth in healthcare spending in Asian emerging markets in 2024. |

| Technological Advancement | Integrating AI, biologics, and automation for enhanced products and operations. | AI in diagnostics can improve early disease detection rates. |

| Strategic Acquisitions & Partnerships | Strengthening market position and expanding product/geographic reach. | Acquisition of Edwards Lifesciences Critical Care (2020) for $1.05 billion. |

| Demographic & Health Trends | Meeting the needs of an aging global population and those with chronic diseases. | Global population aged 65+ to reach 1.5 billion by 2050; >40% adults in developed nations have chronic conditions. |

Threats

The medical technology landscape is fiercely competitive, with both seasoned giants and emerging innovators constantly battling for market dominance. Success hinges on a delicate balance of competitive pricing, superior product quality, groundbreaking innovation, and exceptional customer service.

Becton Dickinson (BD) contends with formidable rivals such as Medtronic and Johnson & Johnson. To preserve its prominent standing, BD must consistently allocate significant capital towards research and development and aggressive marketing initiatives, a necessity that can place considerable pressure on its financial reserves.

Becton Dickinson (BD) navigates a complex regulatory environment, where shifts in healthcare policies and enforcement practices can significantly impact operations. For instance, the U.S. Food and Drug Administration (FDA) approvals for new medical devices, a critical part of BD's business, can face delays or increased scrutiny. In 2024, the FDA continued to emphasize cybersecurity for medical devices, a trend expected to intensify, potentially requiring substantial investment in compliance and product redesign.

Changes in global regulations, like those concerning data privacy (e.g., GDPR) or product safety standards in emerging markets, also pose challenges. These evolving requirements can lead to increased compliance costs and potentially restrict market access if not addressed proactively. BD's ability to adapt swiftly to these policy changes is crucial for maintaining its competitive edge and avoiding costly penalties, with adaptation costs estimated to be in the tens of millions annually.

Global economic instability, marked by persistent high inflation and the looming threat of recession, presents a significant challenge for Becton Dickinson (BD). These macroeconomic headwinds can directly influence customer spending on medical devices and diagnostics, potentially slowing sales growth. For instance, in 2024, many developed economies are grappling with inflation rates that, while potentially moderating from 2023 peaks, remain above central bank targets, impacting discretionary spending by healthcare providers.

Rising inflation also translates to increased operating expenses for BD, affecting everything from raw material costs to labor and logistics. This puts pressure on BD's ability to maintain its profit margins without resorting to price increases that could further dampen demand. The company’s supply chain, already tested by recent global events, faces additional strain from inflationary pressures, potentially leading to disruptions and increased costs for essential components.

Cybersecurity Risks and Data Breaches

Becton Dickinson's (BD) increasing reliance on digital technologies and connected care solutions amplifies its vulnerability to cybersecurity risks and data breaches. The healthcare sector, in particular, is a prime target for cybercriminals. For instance, in 2023, the healthcare industry experienced a significant uptick in ransomware attacks, with reports indicating an average cost of $11 million per breach for healthcare organizations.

A successful cyberattack against BD could have severe repercussions. It could lead to the compromise of highly sensitive patient health information, proprietary intellectual property, or critical operational systems. The financial fallout from such an incident could be substantial, encompassing regulatory fines, legal settlements, and remediation costs. Beyond financial penalties, a data breach would undoubtedly inflict significant reputational damage, eroding trust among patients, healthcare providers, and partners.

- Increased Attack Surface: The proliferation of connected medical devices and digital platforms expands the potential entry points for cyber threats.

- Data Sensitivity: BD handles vast amounts of sensitive patient data, making it an attractive target for attackers seeking to exploit or ransom this information.

- Operational Disruption: Compromised operational systems could halt critical medical device functions, directly impacting patient care and BD's ability to deliver its products and services.

Integration and Execution Risks of Strategic Transactions

Strategic transactions, while promising growth, introduce significant integration and execution risks for Becton Dickinson. The company’s recent move to merge its Biosciences and Diagnostics businesses with Waters Corporation, a deal valued at approximately $1.3 billion, and the planned separation of its Life Sciences division are complex operations. These initiatives could face hurdles such as operational disruptions, cultural clashes between merging entities, and unexpected expenses. For instance, similar large-scale integrations in the healthcare sector have historically seen delays in synergy realization, with some studies indicating that up to 70% of mergers fail to achieve their intended financial goals within the projected timeframe.

These integration challenges can directly impact Becton Dickinson’s financial performance and strategic objectives. Operational disruptions might lead to decreased productivity or supply chain issues, while cultural integration problems can hinder collaboration and innovation. Furthermore, unforeseen costs associated with these complex transactions could strain financial resources, potentially diverting capital from other critical areas of the business. The successful navigation of these risks is crucial for Becton Dickinson to fully capitalize on the opportunities presented by these strategic realignments.

- Integration Complexity: Merging or separating business units involves intricate operational, IT, and personnel alignment, which can be a lengthy and costly process.

- Cultural Misfit: Differences in corporate cultures can impede effective collaboration and employee morale, potentially slowing down integration and synergy realization.

- Unforeseen Costs: Transaction costs, including advisory fees, restructuring charges, and potential regulatory compliance expenses, can exceed initial estimates.

- Synergy Delays: The anticipated benefits and cost savings from strategic transactions may take longer to materialize than planned, impacting near-term financial results.

Becton Dickinson faces intense competition from established players and nimble startups, demanding continuous innovation and cost management. Regulatory shifts, particularly concerning medical device cybersecurity and data privacy, require substantial ongoing investment. Global economic volatility, including inflation, directly impacts customer spending and increases operating costs, squeezing profit margins.

SWOT Analysis Data Sources

This Becton Dickinson SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.