Becton Dickinson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Becton Dickinson Bundle

Becton Dickinson navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder in the medical technology sector.

The complete report reveals the real forces shaping Becton Dickinson’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Becton Dickinson (BD) sources specialized components and raw materials from a global network, with some suppliers holding significant sway due to their unique or patented offerings. For instance, the medical device industry often relies on highly specific biological reagents or intricate micro-electronic parts, where few alternatives exist. This concentration means suppliers of these critical inputs can command higher prices and more favorable terms.

The specialized nature of these inputs, coupled with the rigorous qualification and regulatory processes required to switch suppliers, further amplifies supplier bargaining power. In 2024, the lead times for certain advanced medical-grade plastics and specialized semiconductor components used in diagnostic equipment saw an average increase of 15-20%, reflecting the tight supply and supplier leverage in these niche markets.

Suppliers who provide unique or patented technologies and materials are a significant factor for Becton Dickinson (BD). These specialized inputs are crucial for BD's ability to innovate and develop new products, giving these suppliers considerable influence over pricing and contract terms.

BD's ongoing commitment to research and development, evidenced by its consistent new product introductions, means it relies heavily on these advanced components. For example, the integration of artificial intelligence and novel materials in the medical technology sector further amplifies the bargaining power of suppliers offering these differentiated inputs.

Becton Dickinson (BD) faces significant switching costs when changing suppliers, which directly impacts its bargaining power. These costs involve the substantial financial and temporal investments required to identify, thoroughly vet, and integrate new suppliers into its complex manufacturing and supply chain operations. For instance, the regulatory requalification process for materials and components used in medical devices can be lengthy and expensive, often taking months or even years and involving extensive testing and documentation.

Furthermore, switching suppliers often necessitates redesigning existing products to accommodate new materials or components, a process that incurs considerable research and development expenses. BD’s reliance on specialized, high-quality inputs for its life-saving medical products means that even minor changes can trigger extensive revalidation protocols. This inherent difficulty in shifting its supply base grants existing suppliers a stronger position in price negotiations and contract terms.

In 2023, the medical device industry, where BD operates, saw continued supply chain volatility. Companies reported an average of 10% increase in input costs, partly due to these supplier dependencies and the rigorous validation processes involved. This underscores the financial implications for BD when it cannot easily switch suppliers due to the high switching costs.

Threat of Forward Integration by Suppliers

While typically less common for suppliers of basic components, there's a credible threat that a key technology or raw material provider could integrate forward into manufacturing medical devices or sub-assemblies. This scenario becomes more potent if the supplier holds proprietary intellectual property or possesses intimate knowledge of how their materials are used in the final product. Such a move would allow them to directly compete with Becton Dickinson (BD).

For instance, a supplier of a critical, patented polymer used in a specific BD diagnostic kit might leverage their material science expertise to develop and market their own version of the kit. This could disrupt BD's market share by offering a vertically integrated solution. In 2024, the medical device supply chain saw increased consolidation, with some component manufacturers exploring broader product offerings.

- Supplier Integration Risk: Key technology or raw material suppliers may integrate forward into manufacturing medical devices or sub-assemblies.

- Leveraging Expertise: Suppliers with unique intellectual property or deep product application knowledge are best positioned for this threat.

- Competitive Impact: Forward integration allows suppliers to directly compete with established players like BD, potentially eroding market share.

Impact of Supplier's Input on Product Quality and Safety

The critical nature of a supplier's input for Becton Dickinson's (BD) medical products significantly boosts supplier bargaining power. When a supplier's materials are essential for the performance, safety, and regulatory adherence of BD's devices, BD becomes highly reliant on their consistent quality. This dependence is particularly acute in the medical field, where any lapse in input quality can lead to dire patient outcomes, costly product recalls, and severe regulatory penalties.

For instance, a supplier of specialized polymers for a BD infusion pump must meet exceptionally high standards. A failure in this material could compromise the pump's accuracy, leading to incorrect medication delivery. In 2024, the medical device industry saw increased scrutiny on supply chain integrity, with reports indicating that over 60% of medical device manufacturers cited supply chain disruptions as a major concern, underscoring the leverage held by reliable, high-quality suppliers.

- Input Criticality: Suppliers providing components vital to patient safety and product efficacy hold considerable sway.

- Regulatory Dependence: Adherence to stringent FDA and international regulations means BD cannot afford input failures from its suppliers.

- Consequence of Failure: Product recalls, patient harm, and reputational damage grant suppliers significant leverage if they maintain quality.

- Industry Trends: In 2024, supply chain resilience and quality assurance became paramount, strengthening the position of dependable suppliers in the medical sector.

Suppliers of specialized components and raw materials for Becton Dickinson (BD) wield significant bargaining power, particularly when their offerings are unique, patented, or critical for product performance and regulatory compliance. The high switching costs associated with qualifying new suppliers in the medical device industry further solidify this power. In 2024, lead times for certain advanced medical-grade plastics and specialized semiconductor components increased by 15-20%, indicating supplier leverage in these niche markets.

The critical nature of inputs for patient safety and product efficacy means BD cannot easily substitute suppliers. A failure in a critical component, such as a specialized polymer for an infusion pump, could lead to incorrect medication delivery. In 2024, over 60% of medical device manufacturers cited supply chain disruptions as a major concern, highlighting the importance of reliable, high-quality suppliers and their resulting influence.

| Factor | Impact on BD | 2024 Data/Observation |

|---|---|---|

| Uniqueness/Patents | Limits alternatives, increases supplier pricing power. | Suppliers of patented bio-reagents or micro-electronics hold sway. |

| Switching Costs | High financial and time investment to change suppliers. | Regulatory requalification can take months/years; redesigns are costly. |

| Input Criticality | Essential for safety, efficacy, and regulatory adherence. | Component failure can lead to recalls and patient harm. |

| Supplier Integration Risk | Potential for suppliers to become direct competitors. | Consolidation in 2024 saw some component manufacturers explore broader offerings. |

What is included in the product

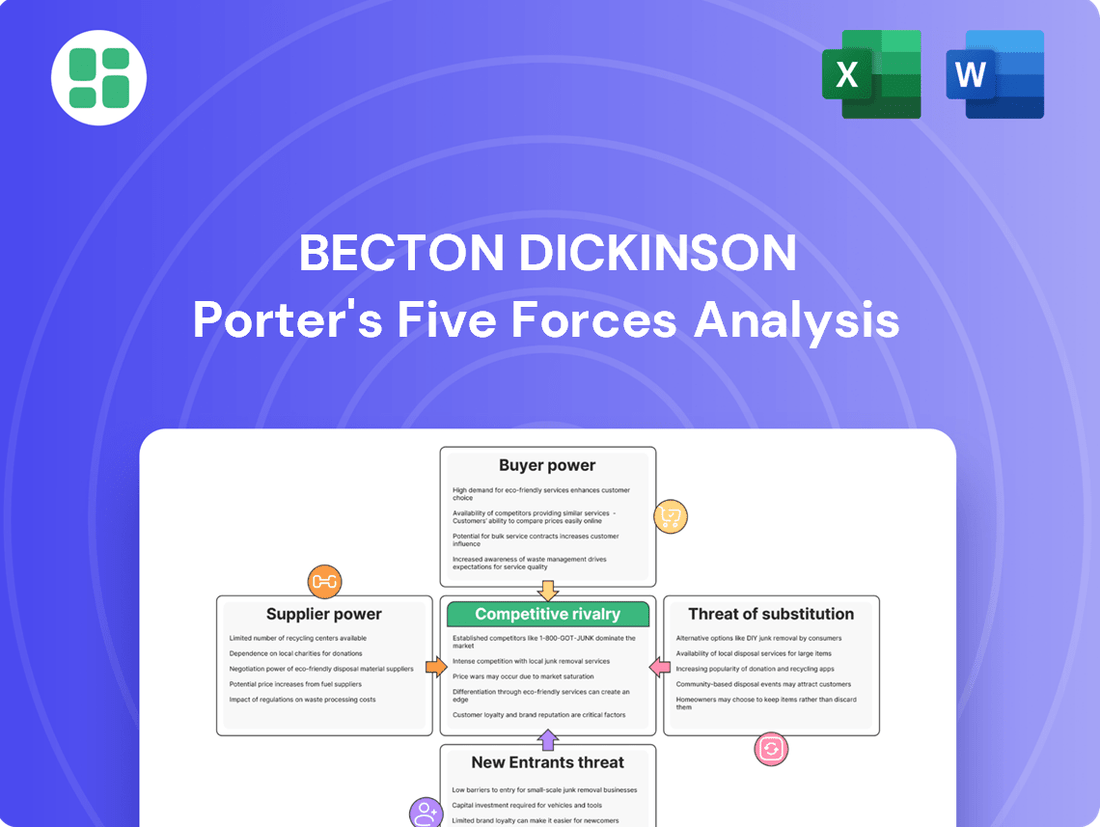

This analysis meticulously examines the five competitive forces impacting Becton Dickinson, providing insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Becton Dickinson's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and identifying potential threats.

Customers Bargaining Power

Becton Dickinson's (BD) customer base is heavily concentrated, with major hospital systems, integrated delivery networks, and large pharmaceutical companies representing significant buyers. These entities often procure supplies in substantial volumes, granting them considerable leverage in negotiations.

This purchasing power translates into the ability for these customers to influence pricing and contract terms, particularly for essential, high-volume medical products. For instance, in 2024, large hospital groups continued to consolidate, with some systems managing hundreds of facilities, amplifying their collective bargaining strength against suppliers like BD.

Becton Dickinson (BD) navigates varying customer bargaining power based on product standardization. For commoditized items like basic surgical gloves or syringes, customers can easily switch suppliers and compare prices, increasing their leverage. This is a common dynamic in the medical supply industry where many manufacturers exist.

However, BD's highly differentiated products, such as advanced diagnostic platforms or integrated medication management systems, significantly reduce customer bargaining power. These complex solutions often involve substantial investment, training, and integration into existing healthcare workflows, creating high switching costs and locking customers into BD's ecosystem.

For instance, in 2024, the market for highly specialized diagnostic equipment, where BD holds a strong position, saw continued demand driven by advancements in personalized medicine, giving BD more pricing power. Conversely, the market for more standardized consumables remained competitive, with buyers leveraging multiple supplier options.

Customers face significant hurdles when considering a switch from Becton Dickinson's (BD) integrated systems, like their Alaris infusion pumps or BD MAX molecular diagnostic platforms. These switching costs are substantial, encompassing expenses for retraining staff on new equipment, reconfiguring existing IT infrastructure to accommodate different systems, and the rigorous validation of new processes to ensure patient safety and regulatory compliance.

The financial implications of these switching costs can be considerable. For instance, retraining a hospital's nursing staff on a new infusion pump system could cost tens of thousands of dollars, depending on the size of the facility. Furthermore, integrating a new diagnostic platform often requires significant IT investment, potentially running into hundreds of thousands of dollars for hardware, software, and specialized personnel.

Beyond direct financial outlays, the potential disruption to clinical workflows presents another major deterrent. Implementing new medical devices or diagnostic tools can temporarily impact patient care delivery, a risk healthcare providers are extremely reluctant to take. This inherent inertia, driven by high switching costs and the critical nature of healthcare operations, significantly limits customers' ability to easily transition to competing offerings, thereby strengthening BD's bargaining power.

Customer Price Sensitivity and Healthcare Cost Pressures

Healthcare institutions worldwide are grappling with significant cost management pressures, largely stemming from reimbursement complexities and tight budget allocations. This environment inherently makes them highly sensitive to pricing, directly impacting their purchasing decisions for medical technologies.

This pronounced price sensitivity compels customers to actively seek competitive pricing, enhanced value-added services, and demonstrably cost-effective solutions. Consequently, their ability to negotiate favorable terms and influence pricing increases substantially when dealing with medical technology suppliers such as Becton Dickinson (BD).

- Global Healthcare Spending Growth: In 2024, global healthcare spending is projected to continue its upward trajectory, with estimates suggesting a growth rate that necessitates stringent cost control measures by providers.

- Reimbursement Rate Stagnation: Many healthcare systems are experiencing stagnant or declining reimbursement rates for procedures, pushing institutions to scrutinize every expenditure, including medical devices.

- Demand for Value-Based Purchasing: A growing trend in 2024 is the shift towards value-based purchasing, where healthcare providers prioritize solutions that offer proven clinical outcomes and long-term cost savings, further empowering their bargaining position.

Customer Information and Transparency

The growing accessibility of information about product performance, pricing, and competing suppliers significantly bolsters customer bargaining power. In 2024, healthcare providers increasingly utilize data analytics to compare device efficacy and cost-effectiveness, a trend that puts pressure on manufacturers like Becton Dickinson (BD) to justify their value propositions.

Sophisticated healthcare procurement groups, armed with extensive market data and benchmarking studies, are adept at negotiating more favorable terms. This informed approach compels BD to consistently demonstrate superior clinical outcomes and economic advantages to secure and retain business.

- Increased Information Access: Customers can easily compare BD's product pricing and performance against competitors.

- Sophisticated Buyers: Healthcare procurement groups leverage data to demand better terms.

- Value Demonstration: BD must prove superior clinical outcomes and cost-effectiveness.

Becton Dickinson (BD) faces significant customer bargaining power, particularly from large, consolidated healthcare systems that purchase in high volumes. This leverage allows these buyers to negotiate pricing and terms, especially for commoditized products where switching suppliers is easy. However, BD's advanced, specialized solutions with high switching costs mitigate this power, as seen in the 2024 demand for personalized medicine diagnostics.

The bargaining power of customers is amplified by increasing price sensitivity due to healthcare cost pressures and stagnant reimbursement rates, as observed in 2024. Customers are actively seeking value-based purchasing, demanding proven clinical outcomes and cost savings. This, combined with greater access to comparative product data, forces BD to continually justify its value proposition to secure contracts.

| Factor | Impact on BD | 2024 Trend/Data |

|---|---|---|

| Customer Concentration | High Leverage for Large Buyers | Continued consolidation of hospital systems amplified purchasing power. |

| Product Standardization | Increases Bargaining Power | Commoditized items (e.g., gloves) face intense price competition. |

| Product Differentiation | Reduces Bargaining Power | Advanced diagnostics and integrated systems create high switching costs. |

| Price Sensitivity | Increases Bargaining Power | Cost pressures and stagnant reimbursement rates make buyers price-focused. |

| Information Accessibility | Increases Bargaining Power | Data analytics enable better comparison and negotiation by buyers. |

Preview the Actual Deliverable

Becton Dickinson Porter's Five Forces Analysis

This preview shows the exact Becton Dickinson Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Becton Dickinson, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This in-depth analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The medical technology sector is a crowded arena, featuring a wide array of global competitors. Becton Dickinson (BD) faces rivals from giants like Medtronic and Johnson & Johnson, as well as smaller, specialized firms and innovative startups.

BD's strategic decision in 2024 to spin off its Biosciences and Diagnostic Solutions segments into a new, independent company could reshape the competitive landscape, particularly in the in-vitro diagnostics (IVD) market. This move might open doors for rivals to capture greater market share.

Competitive rivalry in the medical technology sector, particularly for companies like Becton Dickinson (BD), is intensely fueled by the relentless pace of product differentiation and innovation. Companies are constantly striving to introduce cutting-edge technologies that offer improved patient outcomes and operational efficiencies. This drive necessitates substantial investment in research and development.

BD's strategic focus on accelerating innovation, as outlined in its BD 2025 plan, highlights this competitive dynamic. The company has set an ambitious target of launching 100 new products by the close of 2025. This aggressive product development pipeline demonstrates a clear commitment to maintaining a competitive edge through technological advancements and superior product offerings in a crowded marketplace.

The medical technology sector presents a mixed picture regarding growth. While some established segments are quite mature, leading to intensified competition for existing market share, newer areas like AI-driven diagnostics and personalized medicine are experiencing robust expansion. This dynamic fuels rivalry as companies vie for dominance in these high-growth frontiers.

Becton Dickinson (BD) itself is navigating this landscape, reporting 3.9% organic revenue growth in its first quarter of fiscal year 2025. The company is actively pursuing strategic initiatives aimed at accelerating this growth. This focus on expansion in a sector with both mature and rapidly developing segments naturally intensifies competitive pressures.

High Fixed Costs and Exit Barriers

The medical technology sector, where Becton Dickinson operates, is characterized by significant fixed costs. These include substantial investments in research and development, sophisticated manufacturing facilities, stringent regulatory compliance, and the establishment of broad sales and distribution channels. For instance, the development of a new medical device can cost hundreds of millions of dollars and take many years.

These high initial and ongoing costs, along with considerable investments in intellectual property and specialized, often non-transferable assets, erect substantial exit barriers. Companies find it difficult and financially punishing to leave the market. This situation intensifies competitive rivalry, as firms are compelled to fight for market share and profitability rather than cutting their losses and exiting.

- High R&D Spending: Companies like Becton Dickinson often spend 5-10% of their revenue on R&D to stay competitive.

- Capital Intensive Manufacturing: Building and maintaining state-of-the-art medical device manufacturing plants requires billions in investment.

- Regulatory Hurdles: Navigating FDA or EMA approval processes involves significant legal and compliance costs, estimated in the tens of millions for complex devices.

- Intellectual Property: Patents and proprietary technologies represent substantial, illiquid assets that tie companies to the market.

Marketing and Sales Intensity

Becton Dickinson (BD) faces intense rivalry in its markets, particularly driven by aggressive marketing and sales efforts targeting healthcare providers. Companies actively engage in direct sales, offer substantial clinical support, and run educational programs to sway purchasing decisions.

This competition extends to securing long-term contracts, a critical factor in the highly regulated and trust-dependent healthcare sector. BD and its competitors invest heavily in building brand loyalty and demonstrating value to clinicians and administrators.

- Sales Force Investment: Companies like BD often maintain large, specialized sales forces to directly engage with hospitals, clinics, and laboratories. For instance, in fiscal year 2023, BD reported significant investments in its commercial operations to support product launches and market penetration.

- Clinical Education and Support: Providing extensive clinical education and ongoing support is a key differentiator. This includes training on new devices, data interpretation, and best practices, fostering deeper relationships with healthcare professionals.

- Promotional Activities: Marketing intensity is also seen in participation at major medical conferences, digital marketing campaigns, and the development of thought leadership content to influence market perception and product adoption.

- Partnership Strategies: Strategic alliances with Group Purchasing Organizations (GPOs) and integrated delivery networks (IDNs) are crucial for gaining market access and securing large-scale contracts, further intensifying the competitive landscape.

The competitive rivalry within the medical technology sector, where Becton Dickinson (BD) operates, is fierce. Companies are locked in a continuous battle for market share, driven by innovation and aggressive commercial strategies. BD's own performance, with 3.9% organic revenue growth in Q1 FY2025, underscores the dynamic nature of this competition.

The intense rivalry stems from high fixed costs and significant R&D investments, making market exit difficult. This forces established players like BD to constantly innovate and differentiate their offerings to maintain profitability and market position.

BD's strategic move to spin off certain divisions in 2024 could further intensify competition, potentially allowing rivals to gain ground in specific market segments.

The medical technology market is a mix of mature segments with established competition and high-growth areas like AI diagnostics, where companies are actively vying for early dominance.

| Key Competitor | Approximate FY2023 Revenue (USD Billions) | Key Product Areas |

| Medtronic | $23.5 | Cardiovascular, Medical Surgical, Neuroscience, Diabetes |

| Johnson & Johnson (MedTech) | $27.0 | Surgical Technologies, MedSurg Devices, Vision |

| Abbott Laboratories | $23.6 | Diagnostics, Medical Devices, Nutrition, Pharmaceuticals |

| Siemens Healthineers | $21.7 | Diagnostic Imaging, Laboratory Diagnostics, Advanced Therapies |

SSubstitutes Threaten

The threat of substitutes for Becton Dickinson (BD) is significant due to the swift evolution of medical technologies and therapies. Innovations in areas like non-invasive diagnostics, precision gene therapies, and regenerative medicine could diminish the demand for BD's established devices and in-vitro diagnostic solutions.

For example, the increasing adoption of liquid biopsy techniques, which analyze blood for cancer markers, poses a substitute threat to traditional tissue-based diagnostic methods that BD supports. In 2024, the global liquid biopsy market was projected to reach over $10 billion, demonstrating a clear shift towards less invasive diagnostic pathways.

The increasing adoption of telemedicine, remote patient monitoring, and hospital-at-home programs presents a significant threat of substitutes for traditional healthcare settings where Becton Dickinson's (BD) diagnostic and treatment equipment is typically utilized. These evolving care models allow for many procedures and monitoring to occur outside of hospitals or clinics, potentially reducing the reliance on BD's established product lines.

For instance, the global telemedicine market was valued at approximately $117.3 billion in 2023 and is projected to grow substantially, indicating a clear shift in how healthcare is delivered. This trend directly impacts the demand for in-facility medical devices, as more patients receive care in decentralized or home-based environments.

While BD is actively developing Internet of Medical Things (IoMT) devices to align with these trends, the fundamental shift towards home-based care can still diminish the volume of certain conventional institutional products, acting as a powerful substitute for their traditional market.

The growing emphasis on preventative healthcare and lifestyle changes presents a significant threat of substitutes for Becton Dickinson (BD). As individuals and public health bodies prioritize wellness and early intervention, the demand for certain diagnostic and treatment products could diminish.

For instance, successful public health initiatives focused on infection prevention, such as improved sanitation and vaccination programs, could reduce the need for BD's infection control solutions and diagnostic tests. In 2024, global spending on preventative healthcare continued to rise, reflecting a broader societal shift towards proactive health management.

Generic or Biosimilar Diagnostic Reagents and Devices

The threat of generic or biosimilar diagnostic reagents and simpler medical devices is a notable concern for Becton Dickinson (BD). When other companies introduce products that perform similarly but at a lower price point, it directly impacts BD's market share and pricing power in those specific segments. This is particularly relevant in areas where the technology is more established and less complex.

For instance, in the diagnostics market, the availability of lower-cost alternatives can erode the premium BD might command for its branded products. This competitive pressure is amplified as regulatory pathways for biosimilars and generics become more streamlined, allowing for quicker market entry.

- Lower Pricing Pressure: Generic and biosimilar diagnostics can force BD to reduce prices to remain competitive, impacting profit margins.

- Market Share Erosion: Competitors offering comparable products at lower costs can capture a portion of BD's existing customer base.

- Increased R&D Focus: To counter this, BD may need to invest more in innovation and differentiation for its core product lines.

In-house Development and Custom Solutions by Customers

Large healthcare systems and research institutions increasingly possess the capability to develop their own proprietary diagnostic tests and laboratory protocols. This in-house development can serve as a direct substitute for some of Becton Dickinson's (BD) standard offerings, especially when customers prioritize enhanced control over their processes or seek to optimize costs. For instance, major hospital networks might invest in building internal capacity for specific molecular diagnostics, bypassing the need to purchase BD's ready-made kits for those assays.

The trend towards greater customization and cost-consciousness among sophisticated buyers fuels this threat. While developing highly complex solutions in-house remains challenging, the feasibility for less intricate but still significant product categories is rising. This can impact BD's market share in areas where off-the-shelf products are perceived as less efficient or adaptable to unique institutional workflows. As of late 2024, the global market for in-vitro diagnostics (IVD) is projected to reach over $100 billion, with a growing segment driven by customized solutions and internal laboratory capabilities.

- In-house Development: Healthcare systems may create their own diagnostic tests and lab protocols.

- Custom Solutions: Customers can develop tailored solutions to meet specific needs.

- Cost Efficiency: In-house development can offer cost savings compared to purchasing off-the-shelf products.

- Control and Flexibility: Institutions can gain greater control over their testing processes and workflows.

The threat of substitutes for Becton Dickinson (BD) is amplified by the rise of alternative care delivery models and the increasing focus on preventative health. Innovations like telemedicine and personalized wellness programs offer less reliance on traditional medical devices and diagnostics, impacting BD's established markets.

For example, the growing adoption of home-based care, supported by a telemedicine market valued at over $117 billion in 2023, directly substitutes for in-hospital procedures. Similarly, preventative health initiatives, with global spending on the rise in 2024, can reduce the demand for certain diagnostic tests.

Furthermore, the availability of lower-cost generic diagnostic reagents and the increasing capacity of large healthcare systems to develop in-house testing solutions present significant substitute threats. These trends pressure BD's pricing and market share, particularly for less complex or more established product lines.

| Substitute Area | Example | Market Trend (2023-2024) | Impact on BD |

|---|---|---|---|

| Alternative Care Models | Telemedicine, Home-based care | Telemedicine market > $117B (2023) | Reduced demand for in-facility devices |

| Preventative Health | Lifestyle changes, Public health initiatives | Increased global spending on preventative health (2024) | Lower demand for certain diagnostic tests |

| Low-Cost Alternatives | Generic reagents, Biosimilars | Growing market for generics/biosimilars | Pricing pressure, Market share erosion |

| In-house Development | Proprietary diagnostic tests by healthcare systems | Increasing internal lab capabilities | Bypassing BD's standard offerings |

Entrants Threaten

The medical technology sector, where Becton Dickinson operates, presents a significant threat of new entrants due to stringent regulatory hurdles and substantial compliance costs. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate rigorous approval processes, including extensive clinical trials and the establishment of robust quality management systems.

These regulatory requirements translate into considerable financial outlays and extended timelines for any new company seeking to enter the market. For instance, the cost of bringing a new medical device to market can range from hundreds of thousands to millions of dollars, a substantial barrier for smaller, less-capitalized firms. In 2024, the complexity of navigating these global regulations continues to be a major deterrent.

Entering the medical device and diagnostics arena, where Becton Dickinson operates, necessitates significant upfront capital. Companies need to invest heavily in research and development to innovate, build state-of-the-art manufacturing plants, and establish broad sales and distribution channels worldwide. For example, in 2023, the global medical device market was valued at approximately $578 billion, with significant portions of that attributed to R&D and capital expenditures.

These substantial financial requirements act as a formidable barrier, discouraging many aspiring competitors, particularly smaller firms looking to challenge established players like BD. The sheer scale of investment needed to match the capabilities of a diversified global leader deters a significant number of potential new entrants from even attempting to enter the market.

Becton Dickinson (BD) and similar established players in the medical technology sector benefit from extensive intellectual property (IP) portfolios. These include thousands of patents covering everything from diagnostic assays to drug delivery systems. For instance, as of early 2024, BD held over 13,000 active patents globally, protecting key product lines and manufacturing processes.

New entrants must navigate this dense IP landscape. Developing groundbreaking products that bypass existing patents is a significant hurdle, often requiring substantial R&D investment. Alternatively, licensing BD's patented technologies can be prohibitively expensive, creating a substantial barrier to entry and limiting the ability of newcomers to compete effectively in the market.

Brand Reputation and Customer Loyalty

In the healthcare industry, brand reputation is a significant barrier to entry. Becton Dickinson (BD) has cultivated decades of trust and reliability with healthcare professionals and institutions, a difficult asset for newcomers to replicate. This deep-seated loyalty means that even with innovative products, new entrants face an uphill battle in displacing established relationships and ingrained purchasing habits.

Consider the impact of consistent performance; BD's long history of delivering dependable medical devices and diagnostic tools has solidified its market position. For instance, in 2023, BD reported revenue of $20.3 billion, demonstrating its substantial market presence built on this very reputation. New companies must not only match product quality but also overcome the years of trust BD has earned.

- Brand reputation in healthcare is built on trust and proven clinical efficacy.

- BD's long-standing commitment to reliability fosters strong customer loyalty among healthcare providers.

- New entrants struggle to quickly establish the credibility and trust that BD possesses.

- BD's 2023 revenue of $20.3 billion underscores the strength of its established market position.

Access to Distribution Channels and Supply Chains

Securing access to established global distribution channels and building relationships with key opinion leaders and purchasing organizations presents a significant hurdle for newcomers. Becton Dickinson (BD) leverages its extensive, long-standing relationships and a presence in over 190 countries, making it incredibly difficult for new entrants to effectively reach and serve its diverse customer base without substantial investment and considerable time.

BD's established supply chain infrastructure, built over decades, provides a distinct advantage. For instance, in 2024, BD's global reach allowed it to efficiently distribute critical medical supplies, including diagnostic kits and laboratory equipment, to healthcare providers worldwide, a feat that would require immense capital and logistical expertise for a new player to replicate.

- Global Reach: BD operates in over 190 countries, a testament to its established distribution network.

- Key Relationships: Long-standing ties with purchasing organizations and key opinion leaders are difficult for new entrants to forge.

- Logistical Complexity: Replicating BD's intricate global supply chain requires significant capital and time investment.

- Market Penetration: New entrants face challenges in gaining widespread market penetration against established distribution agreements.

The threat of new entrants in the medical technology sector, where Becton Dickinson (BD) operates, is moderated by substantial barriers. These include significant capital requirements for R&D and manufacturing, as well as extensive intellectual property portfolios held by established players like BD. Navigating complex global regulations, building brand reputation, and establishing robust distribution channels further deter new competition.

| Barrier to Entry | Description | Impact on New Entrants | BD's Position (as of 2024) |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Deters smaller, less-capitalized firms. | BD invests billions annually in R&D and has extensive manufacturing facilities. |

| Intellectual Property | Thousands of patents protecting products and processes. | Requires costly licensing or development of non-infringing technologies. | BD held over 13,000 active patents globally in early 2024. |

| Regulatory Hurdles | Stringent FDA and EMA approval processes. | Increases time-to-market and compliance costs. | BD has established expertise in navigating global regulatory landscapes. |

| Brand Reputation | Decades of trust and reliability with healthcare providers. | Difficult for newcomers to replicate established customer loyalty. | BD's 2023 revenue of $20.3 billion reflects its strong market standing. |

| Distribution Channels | Extensive global networks and key relationships. | Challenging for new entrants to achieve broad market access. | BD operates in over 190 countries with established supply chains. |

Porter's Five Forces Analysis Data Sources

Our Becton Dickinson Porter's Five Forces analysis is built upon a foundation of comprehensive data, including BD's annual reports and SEC filings, alongside industry-specific market research reports from firms like IBISWorld and Statista.