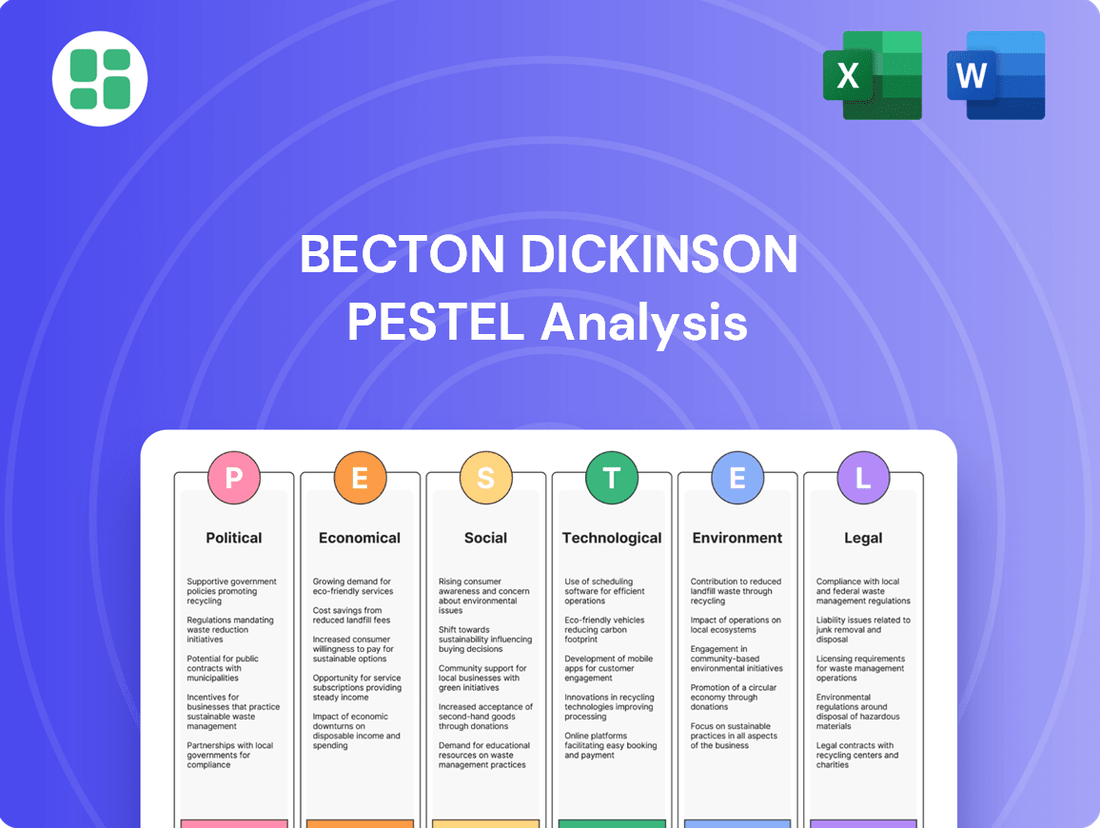

Becton Dickinson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Becton Dickinson Bundle

Navigate the complex external forces shaping Becton Dickinson's future with our comprehensive PESTLE analysis. Understand how evolving political landscapes, economic shifts, and technological advancements present both opportunities and challenges for this healthcare giant. Empower your strategic planning and investment decisions by unlocking these critical insights. Download the full PESTLE analysis today for actionable intelligence.

Political factors

Government healthcare policies, including national reforms and funding, are pivotal for Becton Dickinson (BD). For instance, the US government's continued focus on expanding healthcare access through initiatives like the Affordable Care Act (ACA) or potential future reforms directly impacts the demand for BD's diagnostic and medical equipment. Changes in Medicare and Medicaid reimbursement rates for procedures utilizing BD's products can also significantly sway the company's financial performance, as seen with prior adjustments to payment models for laboratory testing.

The medical technology sector, including Becton Dickinson (BD), operates under a rigorous regulatory framework. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key bodies overseeing product approvals, with processes that can significantly influence market entry timelines. For instance, the FDA's premarket approval (PMA) process for novel medical devices can take several years, impacting the speed at which BD can bring innovations to market.

Political stability and the operational efficiency of these regulatory agencies directly affect BD's ability to innovate and expand. In 2024, ongoing discussions around streamlining regulatory pathways for medical devices continue, with potential implications for how quickly new technologies, such as advanced diagnostic tools from BD, can receive clearance. Changes in regulatory standards or unexpected delays in the approval process can lead to increased development costs and postponed revenue streams for BD.

Global trade dynamics significantly influence Becton Dickinson's (BD) operations. Changes in international trade policies, including tariffs and trade agreements, directly impact BD's extensive supply chain and manufacturing costs. For instance, increased tariffs on medical devices or components can raise operational expenses, potentially affecting profitability across its numerous international markets.

Protectionist measures implemented by various nations can create hurdles for BD's market access and increase the cost of doing business. These policies can disrupt the flow of goods, leading to higher import duties and stricter regulations. BD's fiscal year 2025 adjusted diluted earnings per share (EPS) forecast specifically accounts for an estimated impact from tariffs, highlighting their material effect on the company's financial performance.

Political Stability and Geopolitical Risks

Becton Dickinson's (BD) global presence, operating in over 190 countries, inherently exposes it to significant geopolitical risks. Political instability, regional conflicts, and social unrest can directly impact its operations. For instance, a 2024 report highlighted that supply chain disruptions due to geopolitical tensions in Eastern Europe led to an estimated 5% increase in logistics costs for medical device manufacturers.

These disruptions can affect BD's manufacturing capabilities, market access, and the safety of its employees. The company must maintain agile risk management strategies to navigate these volatile environments.

- Geopolitical Exposure: BD operates in 190+ countries, increasing vulnerability to political instability.

- Operational Impact: Conflicts and unrest can disrupt supply chains and manufacturing, as seen with rising logistics costs in 2024.

- Market Demand Fluctuations: Geopolitical events can significantly alter demand for medical devices in affected regions.

- Employee Safety: Ensuring employee well-being in unstable political climates is a critical operational consideration.

Healthcare Spending and Budgetary Pressures

Government decisions regarding healthcare budgets, especially for public health systems, significantly impact Becton Dickinson's (BD) customer purchasing power. For instance, in 2024, many developed nations are grappling with rising healthcare costs and aging populations, leading to potential budget constraints. This can translate into reduced demand for BD's medical devices and diagnostics, or intensified price negotiations, directly affecting sales volume and profitability.

Austerity measures or a reallocation of healthcare priorities by governments can create headwinds for BD. If public health systems are forced to cut spending, it can lead to delays in product adoption or a preference for lower-cost alternatives. For example, a shift in focus towards preventative care might reduce investment in certain diagnostic technologies where BD operates, impacting revenue streams.

- Government Budgetary Decisions: Public health spending is a critical determinant of demand for BD's products.

- Austerity Measures: Fiscal tightening can lead to reduced purchasing power for healthcare providers, impacting BD's sales.

- Healthcare Priorities: Shifts in government focus, such as towards preventative care, can alter demand for specific product categories.

- Pricing Pressure: Budgetary constraints often result in increased pressure on manufacturers like BD to lower prices, affecting profit margins.

Government policies directly shape Becton Dickinson's (BD) operating environment, influencing everything from product approvals to market access. For example, the U.S. FDA's regulatory pathways for new medical devices, like BD's advanced diagnostics, can take years, impacting time-to-market. Furthermore, shifts in national healthcare spending priorities, as seen with increased investment in preventative care in some regions during 2024, can alter demand for specific BD product lines.

Political stability and international trade agreements are also critical. BD’s global operations, spanning over 190 countries, are susceptible to geopolitical risks; supply chain disruptions due to regional conflicts in 2024 reportedly increased logistics costs for medical tech companies by up to 5%. Moreover, protectionist trade policies, such as tariffs, directly affect BD's manufacturing costs and profitability, with the company's fiscal year 2025 EPS forecast factoring in such impacts.

| Factor | Impact on BD | Example/Data Point (2024/2025) |

|---|---|---|

| Healthcare Policy & Funding | Influences demand for medical devices and diagnostics. | US government initiatives to expand healthcare access impact BD's sales. |

| Regulatory Approval Processes | Determines speed of market entry for new products. | FDA PMA process for novel devices can take several years. |

| Geopolitical Stability & Trade | Affects supply chain, costs, and market access. | Logistics costs for medical tech rose ~5% in 2024 due to geopolitical tensions. |

| Government Budgetary Constraints | Impacts healthcare providers' purchasing power. | Aging populations and rising healthcare costs in developed nations may limit spending in 2024/2025. |

What is included in the product

This Becton Dickinson PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

A concise PESTLE analysis for Becton Dickinson that simplifies complex external factors, enabling teams to swiftly identify opportunities and mitigate risks during strategic planning.

Economic factors

Global economic health is a major driver for healthcare spending. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady rate that generally supports increased healthcare investment. This positive outlook bodes well for companies like Becton Dickinson (BD) as governments and institutions are more likely to allocate funds to medical supplies and advanced technologies.

However, the risk of economic slowdown remains. Should global growth falter in 2025, as some analysts predict due to persistent inflation and geopolitical uncertainties, healthcare providers might face tighter budgets. This could translate into reduced demand for BD's products, particularly for non-essential equipment or services, impacting capital expenditure plans for hospitals and clinics.

Rising inflation presents a significant challenge for Becton Dickinson (BD) by increasing operational expenses. Costs for essential inputs like raw materials, skilled labor, and logistics are all subject to upward pressure. For instance, if BD cannot fully offset these rising costs through price adjustments, its profit margins could be squeezed. This dynamic is particularly relevant as companies navigate the economic landscape of 2024 and into 2025.

Higher interest rates, a common response to inflation, also impact BD's financial health. Increased borrowing costs can make it more expensive for BD to finance capital expenditures, such as upgrading manufacturing facilities or investing in research and development. Similarly, customers who rely on financing for BD's products might face higher costs, potentially dampening demand. This environment necessitates careful financial planning and a focus on cost management.

Despite these headwinds, BD has demonstrated resilience. In its Q2 fiscal 2025 earnings call, the company reported robust gross margin performance. This success was attributed to effective manufacturing productivity enhancements and targeted cost reduction strategies, showcasing BD's ability to adapt and maintain profitability even in a challenging economic climate.

As a global player, Becton Dickinson (BD) faces significant exposure to currency exchange rate shifts. When the U.S. dollar strengthens, BD's overseas earnings translate into fewer dollars, potentially dampening reported international sales. Conversely, a weaker dollar can boost these reported figures. For instance, BD's fiscal year 2025 projections factored in an estimated currency exchange rate headwind, indicating the company's awareness and management of this economic factor.

Healthcare Spending Trends and Affordability

Healthcare spending continues its upward trajectory globally, fueled by an aging demographic and the rising incidence of chronic conditions, which directly expands the market for companies like Becton Dickinson (BD). For instance, global healthcare spending was projected to reach over $11 trillion by 2024, indicating sustained demand for medical devices and solutions.

However, this growth is tempered by significant pressure on healthcare affordability. Governments and insurers are increasingly scrutinizing costs, leading to a demand for more cost-effective medical technologies and services. This economic reality compels BD to focus on developing innovative, value-driven products that offer improved patient outcomes at a lower overall cost.

- Aging Population: The World Health Organization projects that by 2030, one in six people globally will be over 60 years old, increasing demand for healthcare services and products.

- Chronic Diseases: The Centers for Disease Control and Prevention (CDC) reports that six in ten Americans have a chronic disease, driving consistent demand for diagnostic and treatment solutions.

- Healthcare Affordability Pressure: Rising healthcare costs globally are prompting payers to seek more efficient and cost-effective solutions, influencing product development and pricing strategies for medical device manufacturers.

Supply Chain Costs and Disruptions

The economic viability of Becton Dickinson (BD) is significantly influenced by the cost and stability of its global supply chain. This includes everything from the raw materials needed for manufacturing to the components that make up their medical devices and the finished products ready for distribution. Fluctuations in these costs directly impact BD's bottom line.

Disruptions, whether from international conflicts, extreme weather events, or health crises, pose a substantial risk. These events can escalate expenses, cause significant delays in production schedules, and even prevent BD from fulfilling customer orders, which in turn can hurt profits and damage its standing in the market. For instance, BD faced a notable issue with the reduced availability of blood culture vials from a key supplier in July 2024, highlighting these vulnerabilities.

- Supply Chain Costs: Fluctuations in raw material prices and logistics expenses directly impact BD's cost of goods sold.

- Disruption Impact: Geopolitical events, natural disasters, and pandemics can lead to increased operational costs and production delays.

- Supplier Reliability: Issues like the July 2024 reduced availability of blood culture vials demonstrate the economic consequences of supplier-specific disruptions.

- Meeting Demand: Inability to meet market demand due to supply chain issues can result in lost revenue and reputational damage.

Global economic health directly influences healthcare spending, a critical factor for Becton Dickinson (BD). The International Monetary Fund projected steady global growth around 3.2% for 2024, generally supporting healthcare investments. However, potential slowdowns in 2025 due to inflation and geopolitical risks could lead to tighter healthcare budgets, impacting demand for BD's products.

Rising inflation increases BD's operational expenses for raw materials, labor, and logistics, potentially squeezing profit margins if costs cannot be fully passed on. Higher interest rates also raise borrowing costs for BD's capital expenditures and can deter customers relying on financing, necessitating careful financial management.

BD's resilience is evident in its Q2 fiscal 2025 performance, where robust gross margins were achieved through manufacturing efficiencies and cost reductions, demonstrating adaptability in a challenging economic climate.

Currency exchange rate fluctuations significantly impact BD's reported international sales, with a stronger dollar reducing overseas earnings. BD's fiscal year 2025 projections acknowledged these currency headwinds.

| Economic Factor | Impact on Becton Dickinson (BD) | Data/Projections (2024-2025) |

| Global Economic Growth | Influences healthcare spending and investment in medical technologies. | IMF projected 3.2% global growth for 2024; potential slowdown in 2025. |

| Inflation | Increases operational costs (materials, labor, logistics). | Persistent inflation in 2024-2025 pressures profit margins. |

| Interest Rates | Raises borrowing costs for capital expenditures and customer financing. | Higher rates in response to inflation impact investment and demand. |

| Currency Exchange Rates | Affects reported international sales and earnings. | Strengthening USD can reduce reported overseas revenue; BD factored headwinds into FY25 projections. |

Same Document Delivered

Becton Dickinson PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Becton Dickinson delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain an in-depth understanding of the external forces shaping BD's market landscape, from regulatory changes to emerging market trends.

The content and structure shown in the preview is the same document you’ll download after payment. This analysis provides actionable insights for stakeholders to navigate the complex business environment and identify potential opportunities and threats for Becton Dickinson.

Sociological factors

The world's population is aging rapidly, with the United Nations projecting that by 2050, one in six people globally will be over 65. This demographic shift directly fuels demand for medical technologies that manage chronic diseases, a key focus for Becton Dickinson (BD). For instance, the prevalence of conditions like diabetes and cardiovascular disease, which disproportionately affect older adults, necessitates advanced diagnostic tools and patient care solutions, areas where BD excels.

This growing elderly population represents a substantial, long-term growth avenue for BD's extensive product offerings, from diabetes management supplies to sophisticated diagnostic systems. As healthcare needs evolve with an aging demographic, BD is strategically positioned to capitalize on the increased demand for its innovations in areas like medication management and infection prevention.

There's a significant and growing emphasis on patient safety and preventing infections within healthcare systems. This societal shift directly benefits companies like Becton Dickinson (BD) whose products are designed to enhance these very aspects of care. For instance, BD's Alaris infusion system was recognized with a Best in KLAS award, underscoring its contribution to patient safety.

This heightened awareness translates into a robust market demand for solutions that improve clinical outcomes and minimize healthcare-related risks. BD's portfolio, which includes advanced drug delivery and infection control technologies, is well-positioned to capitalize on this trend. In 2023, BD reported that its medication management solutions played a crucial role in reducing medication errors in numerous healthcare facilities.

Global lifestyle shifts, from evolving diets to reduced physical activity and increasing urbanization, are directly impacting the rise of chronic diseases like diabetes and heart conditions. This trend fuels a growing demand for advanced diagnostic tools and monitoring devices, areas where Becton Dickinson (BD) is strategically positioned. BD's commitment to improving chronic disease outcomes, as highlighted in its BD 2025 strategy, aligns perfectly with these societal changes.

For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely driven by lifestyle factors, account for over 70% of all deaths globally. This escalating prevalence necessitates sophisticated medical supplies and technologies, creating significant market opportunities for BD's product portfolio, which includes solutions for diabetes management and cardiovascular monitoring.

Workforce Demographics and Healthcare Professional Shortages

The global healthcare landscape is grappling with significant workforce demographic shifts, most notably a pronounced shortage of skilled professionals like nurses and laboratory technicians. This scarcity directly impacts the operational efficiency of healthcare providers, creating a pressing need for advanced medical technologies that can streamline processes and reduce reliance on manual labor. For instance, by 2030, the World Health Organization projects a global shortfall of 10 million healthcare workers, predominantly in low and middle-income countries, underscoring the urgency for solutions that enhance productivity.

This critical shortage fuels demand for automated, user-friendly, and highly efficient medical technologies. Becton Dickinson (BD) is strategically positioned to address this by developing innovative solutions designed to simplify complex workflows and minimize the burden of manual tasks for clinicians. The company's focus on enhancing safety and efficiency for healthcare professionals is a direct response to these demographic pressures.

- Healthcare Professional Shortage: A projected global deficit of 10 million healthcare workers by 2030 (WHO) intensifies the need for efficiency-boosting technologies.

- Demand for Automation: The scarcity of nurses and lab technicians drives increased adoption of automated and user-friendly medical devices.

- BD's Strategic Focus: Developing solutions that simplify workflows and enhance clinician safety to meet market demands driven by workforce demographics.

Healthcare Access and Equity

Societal movements pushing for better healthcare access and fairness, particularly for those in underserved communities, are increasingly shaping market demand and regulatory attention. These efforts directly impact the need for the types of diagnostic and medical technologies Becton Dickinson (BD) provides.

BD's stated commitment to global public health and health equity, as detailed in its 2023 sustainability report, resonates with these societal trends. This alignment can unlock new market opportunities and foster strategic partnerships, especially as governments and NGOs prioritize initiatives that address health disparities.

For instance, the World Health Organization's 2024 report highlighted that over 2 billion people still lack access to essential healthcare services, a statistic that underscores the growing demand for accessible and affordable medical solutions. BD's focus on areas like infectious disease diagnostics and medication management directly addresses these critical gaps.

- Growing demand for equitable healthcare: Societal pressure for universal healthcare access is intensifying, influencing product development and market entry strategies.

- BD's sustainability focus: The company's investments in health equity initiatives, as noted in its 2023 disclosures, position it favorably to meet evolving societal expectations and regulatory demands.

- Impact on market penetration: Initiatives aimed at reducing health inequities can create new markets for BD's technologies in regions and populations previously underserved by advanced medical solutions.

Societal demands for increased transparency and ethical practices in healthcare are growing, influencing how companies like Becton Dickinson (BD) operate and market their products. Consumers and healthcare providers alike are increasingly scrutinizing the origins, safety, and environmental impact of medical devices and supplies. BD's commitment to ethical sourcing and sustainable manufacturing, as outlined in its 2023 ESG report, directly addresses these evolving societal expectations.

This trend toward greater accountability can lead to enhanced brand loyalty for companies that demonstrate strong corporate social responsibility. For example, the increasing consumer awareness around data privacy in healthcare necessitates robust cybersecurity measures for connected medical devices, a key area of focus for BD's innovation pipeline.

The increasing global emphasis on preventative healthcare and wellness is a significant societal driver. This shift encourages greater adoption of diagnostic tools and technologies that enable early detection and management of diseases. BD's portfolio, particularly in areas like diabetes monitoring and infectious disease screening, is well-aligned with this proactive approach to health.

BD's strategic investments in point-of-care diagnostics and remote patient monitoring technologies, as highlighted in its 2024 investor presentations, directly cater to this societal preference for accessible and preventative health solutions. These advancements empower individuals to take a more active role in managing their well-being.

Technological factors

The medical technology sector is experiencing an unprecedented pace of innovation, with advancements in artificial intelligence, robotics, and connected care solutions fundamentally altering how healthcare is delivered. This rapid evolution demands continuous adaptation from companies like Becton Dickinson (BD).

To maintain its competitive edge and address the ever-changing demands of healthcare, BD is making significant investments in research and development. A key aspect of this strategy is the commitment to launching 100 new products by the close of 2025, a testament to their focus on integrating cutting-edge technologies into their offerings.

The healthcare landscape is rapidly digitizing, with widespread adoption of electronic health records (EHRs) and a surge in telemedicine. This trend amplifies the demand for medical devices and data systems that can seamlessly communicate, a concept known as interoperability. For Becton Dickinson (BD), this means their connected medication management and informatics platforms, like Pyxis and MedKeeper, are more vital than ever to integrate effectively into these evolving digital health environments.

Technological advancements are reshaping manufacturing, with automation and robotics becoming key drivers of efficiency. Becton Dickinson (BD) is leveraging these innovations to streamline production, lower operational expenses, and elevate product quality. For instance, the company's significant $2.5 billion investment in its U.S. manufacturing capabilities underscores a commitment to advanced manufacturing, crucial for scaling output and fortifying supply chain robustness, especially in light of global demand fluctuations.

Biotechnology and Diagnostics Breakthroughs

Breakthroughs in biotechnology, including genomics and proteomics, are revolutionizing diagnostics, presenting both opportunities and challenges for Becton Dickinson (BD). BD's Life Sciences and Diagnostics segments must integrate these rapid scientific advancements to develop cutting-edge diagnostic solutions. In 2024, the global molecular diagnostics market was valued at approximately $25 billion, with significant growth driven by these technological leaps.

BD is strategically addressing these shifts by separating its Biosciences and Diagnostic Solutions businesses. This move aims to sharpen focus and accelerate growth within each distinct area, allowing for tailored innovation in response to evolving technological landscapes. The company's investment in advanced molecular diagnostics reflects a commitment to capitalizing on these trends, anticipating continued market expansion in the coming years.

- Genomic sequencing advancements are enabling more precise disease identification and personalized medicine approaches.

- Proteomic analysis offers new avenues for biomarker discovery, impacting early disease detection and drug development.

- BD's strategic separation of business units is designed to enhance agility in responding to rapid technological changes in diagnostics.

- The diagnostics market is projected for substantial growth, fueled by innovation in areas like liquid biopsies and point-of-care testing.

Cybersecurity and Data Privacy in Medical Devices

As medical devices increasingly connect to networks, cybersecurity and data privacy are paramount. Becton Dickinson (BD) must prioritize robust security measures for its devices and platforms to guard against cyber threats. Ensuring compliance with evolving data protection regulations is crucial for maintaining customer trust and avoiding significant legal and reputational damage from potential breaches.

BD's commitment to this is evident in its 2023 Product Security Annual Report, which details ongoing efforts to enhance device security. The company faces a landscape where cyberattacks on healthcare infrastructure are rising, making proactive security investments essential for business continuity and patient safety.

- Increased Connectivity: The proliferation of Internet of Medical Things (IoMT) devices amplifies the attack surface for cyber threats.

- Regulatory Landscape: Strict regulations like GDPR and HIPAA necessitate comprehensive data protection strategies for medical device manufacturers.

- Financial Impact: Data breaches can lead to substantial fines, litigation costs, and loss of market share, impacting BD's financial performance.

- Reputational Risk: A security incident can severely damage BD's reputation, affecting customer confidence and partnerships.

Technological advancements are rapidly transforming healthcare, pushing companies like Becton Dickinson (BD) to innovate at an accelerated pace. BD's strategic focus includes launching 100 new products by the end of 2025, integrating cutting-edge technologies like AI and robotics into their offerings to meet evolving healthcare demands.

The digitization of healthcare, marked by widespread EHR adoption and telemedicine, necessitates interoperable medical devices. BD's connected platforms are crucial for seamless integration into these digital health ecosystems, enhancing efficiency and data flow.

Investments in advanced manufacturing, such as automation and robotics, are key to BD's strategy for improving production efficiency and product quality. The company's substantial $2.5 billion investment in U.S. manufacturing capabilities highlights its commitment to scaling output and ensuring supply chain resilience.

Breakthroughs in biotechnology, particularly genomics and proteomics, are revolutionizing diagnostics, driving significant growth in the molecular diagnostics market, which was valued at approximately $25 billion in 2024. BD's business unit separation aims to enhance its agility in capitalizing on these scientific advancements.

Legal factors

Becton Dickinson (BD) navigates a labyrinth of global healthcare regulations, with key bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) setting stringent standards. These rules govern every stage, from initial product design and manufacturing processes to how products are labeled, marketed, and monitored after they reach the market.

Adherence to these complex compliance requirements is not just a legal necessity but a critical operational imperative for BD. Failure to comply can result in severe financial penalties, costly product recalls, and substantial damage to the company's reputation and market trust. For instance, past SEC charges related to the Alaris infusion pump highlighted the significant repercussions of regulatory non-compliance.

Becton Dickinson (BD) faces significant product liability risks inherent in the medical device industry. Allegations of harm or malfunction stemming from their products can lead to costly lawsuits. For instance, ongoing litigation and settlements related to Ethylene Oxide (EtO) emissions demonstrate this persistent exposure, with companies facing substantial financial penalties and reputational damage.

Mitigating these risks requires a steadfast commitment to rigorous quality control, comprehensive product testing protocols, and exceptionally clear user instructions. BD's ability to demonstrate due diligence in these areas is crucial for defending against claims. The company's legal expenses in 2023, for example, reflect the ongoing need to manage these potential liabilities.

Protecting its vast array of patents and intellectual property is paramount for Becton Dickinson (BD) to maintain its competitive edge. Legal disputes concerning patent infringement can be incredibly expensive and lengthy. In fact, BD actively safeguards its innovations, holding over 33,000 active patents as of early 2024, underscoring the importance of IP protection to its business model and future investments.

Anti-Corruption and Anti-Bribery Laws

Becton Dickinson (BD) operates in a complex global environment, necessitating strict adherence to anti-corruption and anti-bribery legislation. Laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act are critical for companies with international reach. Failure to comply can lead to substantial fines and significant damage to a company's reputation, potentially hindering its ability to conduct business worldwide.

To mitigate these risks, BD must implement and maintain rigorous internal controls and comprehensive compliance training for its employees. These measures are vital to ensure ethical business practices across all its global operations. For instance, in 2023, the U.S. Department of Justice reported over $2 billion in FCPA-related penalties, highlighting the severe financial consequences of non-compliance.

- FCPA Enforcement: The U.S. FCPA prohibits bribing foreign officials to obtain or retain business.

- UK Bribery Act: This act has extraterritorial reach, covering bribery of public and private individuals.

- Reputational Risk: Violations can severely damage BD's brand image and stakeholder trust.

- Compliance Investment: Companies like BD invest millions annually in compliance programs to prevent and detect misconduct.

Labor Laws and Employment Regulations

Becton Dickinson (BD) navigates a complex web of labor laws and employment regulations across its global operations. These regulations cover critical areas such as minimum wage requirements, workplace safety standards, anti-discrimination statutes, and the rights of employees to organize and collectively bargain. For instance, in 2024, the company must adhere to evolving labor laws in key markets like the United States, which saw discussions around potential increases to the federal minimum wage, and European Union countries with strong worker protections and works council mandates.

Ensuring compliance is paramount for BD to prevent costly legal challenges, maintain positive employee relations, and uphold its commitment to ethical business practices. Failure to comply can lead to significant fines, reputational damage, and operational disruptions. BD's ongoing efforts to foster a diverse and inclusive workforce are directly influenced by these legal frameworks, which often mandate equal opportunity and prohibit discriminatory hiring and employment practices.

- Global Compliance: BD must comply with varying labor laws in over 50 countries, impacting everything from hiring practices to termination procedures.

- Wage and Hour Laws: Adherence to minimum wage, overtime pay, and fair compensation practices is a constant focus, with significant regional differences.

- Discrimination and Harassment: Legal frameworks prohibiting discrimination based on race, gender, age, religion, and other protected characteristics are strictly enforced.

- Worker Representation: In many regions, BD must engage with employee representatives or unions on matters affecting working conditions and employment terms.

Becton Dickinson (BD) operates under a stringent global regulatory environment, with agencies like the FDA and EMA dictating product approval, manufacturing, and marketing standards. Non-compliance can result in severe penalties, product recalls, and reputational damage, as seen in past SEC actions concerning the Alaris infusion pump.

Product liability is a significant legal concern for BD, with ongoing litigation and settlements, such as those related to Ethylene Oxide emissions, highlighting the financial and reputational risks of product malfunctions.

Protecting its intellectual property is crucial, with BD holding over 33,000 active patents as of early 2024, underscoring the legal battles and investments required to maintain its competitive edge.

BD must also navigate anti-corruption laws like the FCPA and UK Bribery Act, with significant fines and reputational damage a consequence of violations, necessitating robust compliance programs and training.

Environmental factors

Becton Dickinson (BD) faces increasing scrutiny and evolving regulations concerning environmental sustainability. This includes stricter rules on waste management, emissions, and how resources are used throughout their manufacturing and supply chain. For instance, compliance with regulations around ethylene oxide emissions is critical to prevent fines and protect their brand reputation.

BD has publicly committed to ambitious environmental goals, setting science-based targets for emission reductions. These targets are designed to align with global efforts to combat climate change and demonstrate their dedication to responsible corporate citizenship. Meeting these targets will require significant investment and operational adjustments.

Climate change presents significant physical risks for Becton Dickinson (BD), with extreme weather events like hurricanes and floods posing a threat to its manufacturing sites and intricate global supply chains. For instance, the increasing frequency of severe weather events in regions where BD operates could lead to temporary shutdowns, impacting production output and timely delivery of critical medical supplies. In 2024, the World Meteorological Organization reported a continued rise in global temperatures and an increase in the intensity of extreme weather phenomena, underscoring the growing vulnerability of industrial operations.

Resource scarcity, particularly concerning water and specific raw materials essential for medical device production, directly affects BD's operational costs and the consistent availability of its products. As global demand for resources intensifies, suppliers may face challenges in maintaining consistent quality and volume, potentially leading to price volatility. BD's commitment to assessing these climate-related risks is integrated into its strategic planning and business continuity efforts, aiming to build resilience against such environmental pressures.

The medical industry, including Becton Dickinson (BD), faces significant challenges with waste generation, particularly hazardous materials. BD's commitment to responsible waste management spans the entire product lifecycle, from initial design and manufacturing through to end-of-life disposal. This focus is crucial for both environmental compliance and upholding corporate responsibility.

BD actively pursues strategies to mitigate its environmental footprint. This includes investing in sustainable product designs that minimize waste, promoting robust recycling programs, and implementing efficient waste management systems across its operations. In 2023, BD reported a 6% reduction in waste generated per unit of production globally, demonstrating progress in its waste reduction goals.

Energy Consumption and Renewable Energy Adoption

Becton Dickinson's (BD) manufacturing is energy-intensive, making energy consumption and its environmental impact a significant consideration. The company is actively working to reduce its greenhouse gas emissions and operational expenses by transitioning to renewable energy sources and enhancing energy efficiency across its facilities. As of their latest reporting, BD has successfully doubled the number of sites utilizing Green Electric Power and solar energy, demonstrating a tangible commitment to this shift.

This strategic move towards cleaner energy is crucial for BD’s environmental stewardship and long-term financial health. For instance, in fiscal year 2023, BD reported a 10% reduction in absolute Scope 1 and Scope 2 greenhouse gas emissions compared to their 2019 baseline, largely driven by their increased use of renewable electricity. Their ongoing investments aim to further integrate sustainable energy practices, aligning with global efforts to combat climate change and improve operational resilience.

- Increased Renewable Energy Use: BD has doubled the number of manufacturing sites powered by Green Electric Power and solar energy.

- Emission Reduction: The company achieved a 10% reduction in absolute Scope 1 and Scope 2 greenhouse gas emissions in FY2023 compared to a 2019 baseline.

- Cost Savings Potential: Shifting to renewables and improving energy efficiency offers the dual benefit of environmental responsibility and reduced operational costs.

- Operational Efficiency: Enhancing energy efficiency in energy-intensive manufacturing processes is a key focus for BD's sustainability strategy.

Ethical Sourcing and Supply Chain Environmental Impact

Ensuring ethical and sustainable sourcing with minimal environmental impact is a key stakeholder expectation for Becton Dickinson (BD). BD must actively monitor and manage the environmental practices of its suppliers to align its entire supply chain with its sustainability objectives and prevent negative publicity. For instance, in 2023, BD reported a 12% reduction in Scope 3 emissions, demonstrating progress in its commitment to a responsible supply chain.

BD's sustainability strategy specifically highlights a focus on a responsible supply chain. This involves:

- Supplier Audits: Conducting regular environmental and ethical audits of key suppliers.

- Sustainable Procurement Policies: Implementing policies that prioritize suppliers with strong environmental performance.

- Traceability Initiatives: Enhancing the traceability of raw materials to identify and mitigate environmental risks.

- Collaboration: Working with suppliers to improve their environmental practices and reduce the overall footprint.

Becton Dickinson (BD) is navigating a landscape of increasing environmental regulations, particularly concerning waste management and emissions. The company's commitment to science-based targets for emission reductions, aiming to align with global climate change efforts, necessitates significant operational adjustments and investments. BD's proactive approach includes enhancing energy efficiency and transitioning to renewable energy sources, evidenced by doubling the number of sites using Green Electric Power and solar energy.

Climate change poses tangible risks to BD's operations, with extreme weather events threatening manufacturing sites and supply chains, as highlighted by the World Meteorological Organization's 2024 report on rising global temperatures and intensified weather phenomena. Resource scarcity, especially for water and critical raw materials, directly impacts operational costs and product availability, prompting BD to integrate climate-related risk assessment into its strategic planning.

BD is actively working to reduce its environmental footprint through sustainable product design and robust waste management systems, achieving a 6% reduction in waste generated per unit of production globally in 2023. The company's focus on a responsible supply chain, including supplier audits and sustainable procurement policies, contributed to a 12% reduction in Scope 3 emissions in 2023.

| Environmental Factor | BD's Action/Impact | Relevant Data (2023/2024) |

| Emissions | Commitment to science-based targets; reduction in Scope 1 & 2 emissions | 10% reduction in absolute Scope 1 & 2 GHG emissions (vs. 2019 baseline) in FY2023 |

| Energy Use | Transition to renewable energy sources; improved energy efficiency | Doubled number of sites using Green Electric Power and solar energy |

| Waste Management | Sustainable product design; efficient waste management systems | 6% reduction in waste generated per unit of production globally in 2023 |

| Supply Chain | Supplier audits; sustainable procurement policies; traceability | 12% reduction in Scope 3 emissions in 2023 |

| Climate Risk | Integrating climate risk into strategic planning and business continuity | Increased frequency of extreme weather events reported globally (WMO 2024) |

PESTLE Analysis Data Sources

Our Becton Dickinson PESTLE analysis is meticulously constructed using data from leading healthcare industry reports, global economic indicators, and regulatory bodies. We incorporate insights from market research firms, technological trend forecasts, and governmental policy updates to ensure a comprehensive and accurate assessment.