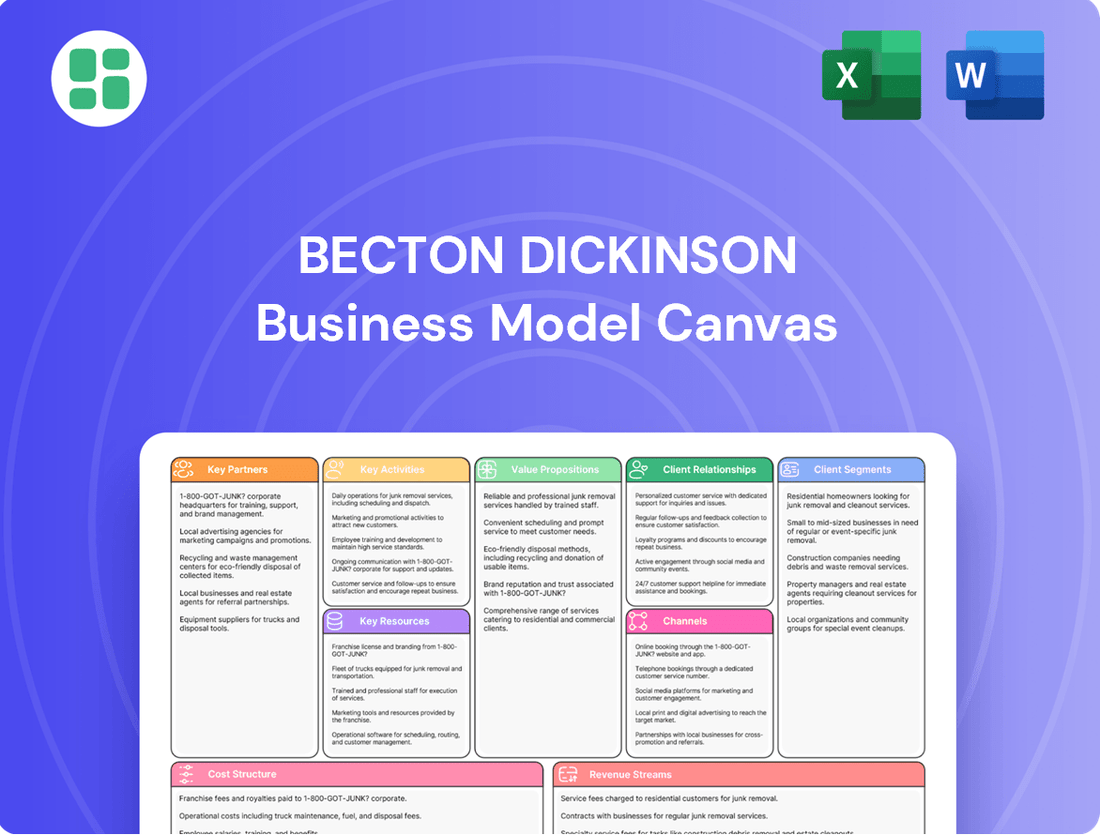

Becton Dickinson Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Becton Dickinson Bundle

Unlock the strategic blueprint of Becton Dickinson's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering invaluable insights for any business strategist. Dive into the specifics of how BD operates and thrives.

Ready to understand the core of Becton Dickinson's operations? Our Business Model Canvas provides a clear, section-by-section breakdown of their key partners, resources, and cost structure, revealing the engine behind their market leadership. Download the full version to gain a competitive edge.

Partnerships

Becton Dickinson (BD) forms vital partnerships with hospitals, clinics, and various healthcare providers worldwide. These collaborations are essential for distributing BD's extensive range of medical supplies, devices, and diagnostic solutions. For instance, in 2024, BD continued to expand its offerings to major hospital networks, facilitating the adoption of advanced patient safety technologies.

These deep relationships are critical for driving product adoption and ensuring seamless clinical integration into existing healthcare workflows. By working closely with providers, BD gains invaluable insights into the ever-changing landscape of healthcare needs and challenges, allowing for more targeted product development and support.

Through these partnerships, BD directly influences patient care and medication management practices. For example, BD's strategic alliances in 2024 focused on enhancing medication delivery systems in acute care settings, aiming to reduce errors and improve patient outcomes across numerous healthcare facilities.

Becton Dickinson (BD) heavily relies on collaborations with life science research organizations, including academic institutions and independent research bodies. These partnerships are crucial for driving innovation within BD's life science segment, enabling the advancement of medical discovery and the development of cutting-edge diagnostic and therapeutic solutions.

These collaborations often manifest as joint research projects, co-development initiatives, and the integration of novel technologies. For instance, BD's engagement with universities helps in validating new assays and technologies, directly contributing to the company's product pipeline and ensuring its offerings remain at the forefront of scientific progress.

BD's commitment to these partnerships is evident in its ongoing support for research. In fiscal year 2023, BD continued to invest in collaborations that directly fuel its innovation engine, with a significant portion of its research and development budget allocated to projects with external research entities, underscoring their strategic importance.

Becton Dickinson (BD) collaborates extensively with pharmaceutical giants, especially through its Pharmaceutical Systems segment. This partnership focuses on creating and supplying advanced drug delivery systems, such as pre-fillable syringes and sophisticated injection devices, crucial for the safe and effective administration of both novel and established biologic medications.

In 2023, BD's Pharmaceutical Systems segment saw significant growth, driven by demand for its specialized drug containment and delivery solutions. This highlights the critical role these partnerships play in bringing new therapies to market, with BD's innovations directly supporting the delivery of complex biologics that require precise and reliable administration.

Technology and Innovation Partners

Becton Dickinson (BD) actively cultivates strategic alliances with technology firms and innovative startups. These collaborations are crucial for embedding advanced technologies such as artificial intelligence and automation into BD's medical devices and healthcare solutions. For instance, in 2024, BD continued its investment in digital health platforms, aiming to leverage AI for improved diagnostics and patient monitoring. These partnerships are designed to elevate product functionalities, streamline operational efficiencies, and bolster BD's commitment to connected care and intelligent health systems. This strategic approach ensures BD remains at the forefront of medical technology innovation.

These technology partnerships are instrumental in accelerating BD's product development cycles and enhancing the intelligence of its offerings. By integrating cutting-edge advancements, BD aims to provide more sophisticated tools for healthcare providers. For example, in early 2024, BD announced a new collaboration focused on developing AI-powered software to analyze medical imaging, which is expected to improve diagnostic accuracy and speed. Such alliances are key to BD's strategy of fostering a smarter, more connected healthcare ecosystem.

- AI Integration: Partnerships focus on integrating AI for enhanced diagnostics and predictive analytics in medical devices.

- Automation Solutions: Collaborations aim to embed automation in laboratory workflows and patient care processes, improving efficiency.

- Startup Ecosystem Engagement: BD actively scouts and partners with startups to access novel technologies and disruptive innovations in digital health.

- Connected Care Platforms: Alliances support the development of integrated platforms that enable seamless data flow and remote patient monitoring.

Suppliers and Manufacturers

Becton Dickinson (BD) maintains a critical relationship with its suppliers and manufacturers to ensure a steady flow of raw materials and components. This network is vital for producing its diverse range of medical devices and diagnostic products. BD’s commitment to supply chain resilience is evident in its substantial investments in its domestic manufacturing capabilities.

For instance, BD announced in 2023 a significant expansion of its manufacturing facility in North Carolina, aiming to increase production capacity for its critical medical supplies. This strategic move underscores their reliance on and collaboration with manufacturing partners to meet global demand efficiently. The company actively works with these partners to optimize production processes and maintain high-quality standards across its product lines.

- Supplier Network: BD sources a wide array of raw materials, including plastics, chemicals, and specialized components from a global network of suppliers.

- Manufacturing Collaboration: The company partners with various contract manufacturers and leverages its own facilities to produce finished goods, ensuring flexibility and scale.

- Supply Chain Investment: In 2024, BD continued to invest in its U.S.-based manufacturing, enhancing its ability to produce essential medical devices domestically and reduce reliance on single-source suppliers.

- Quality Assurance: BD works closely with its suppliers and manufacturers to implement rigorous quality control measures, ensuring product safety and efficacy.

Becton Dickinson (BD) actively engages with government agencies and regulatory bodies to ensure compliance and shape healthcare policy. These relationships are crucial for market access and the successful launch of new products. For example, in 2024, BD continued its dialogue with regulatory agencies regarding the approval pathways for innovative diagnostic tools.

These collaborations often involve providing data and expertise to inform public health initiatives and standards. BD's participation in industry associations also allows for collective advocacy on behalf of the medical technology sector. This engagement is vital for navigating the complex regulatory landscape and ensuring patient safety.

BD's commitment to regulatory adherence is a cornerstone of its operations. In 2023, the company reported a strong track record of compliance across its global operations, reflecting the importance of these partnerships in maintaining trust and market integrity.

What is included in the product

A detailed Becton Dickinson Business Model Canvas that outlines its diverse customer segments, robust distribution channels, and multifaceted value propositions across healthcare, diagnostics, and medical supplies.

This model reflects BD's strategy of innovation and global reach, detailing key resources, activities, partnerships, and cost structures to deliver essential healthcare solutions.

Becton Dickinson's Business Model Canvas offers a clear, structured approach to understanding how they solve customer pains, providing a vital tool for strategic alignment and identifying unmet needs.

It acts as a pain point reliever by visually mapping Becton Dickinson's value proposition and customer segments, allowing for quick identification of how their offerings address critical challenges in healthcare.

Activities

Becton Dickinson (BD) places a substantial emphasis on Research and Development, channeling significant resources into creating innovative medical technologies, devices, and diagnostic solutions. This commitment fuels the development of cutting-edge products in areas like medication management and infection prevention.

In fiscal year 2023, BD reported R&D expenses of $1.4 billion, underscoring its dedication to advancing healthcare. This investment directly supports the creation of advanced diagnostics and novel drug delivery systems, crucial for maintaining its competitive advantage and driving future revenue streams.

Becton Dickinson's manufacturing and production activities are central to its business, focusing on the large-scale creation of a wide array of medical supplies, devices, and laboratory equipment. This involves complex processes to ensure the quality and reliability of products essential for healthcare worldwide.

A significant recent development is BD's strategic investment in expanding its U.S. manufacturing footprint for critical medical supplies. For instance, in 2024, the company announced plans to increase its domestic production of syringes, needles, and intravenous (IV) catheters, aiming to bolster supply chain resilience and address potential shortages.

Becton Dickinson (BD) drives its business through significant global sales and marketing initiatives, aiming to connect its innovative medical technologies with healthcare providers worldwide. Their strategy involves a multi-faceted approach to reach a diverse customer base, from large hospital systems to individual research labs.

The company utilizes a robust direct sales force, fostering relationships and providing tailored solutions to key decision-makers in healthcare institutions and the pharmaceutical sector. This hands-on approach ensures deep understanding of customer needs. For fiscal year 2023, BD reported approximately $20.2 billion in revenue, underscoring the scale of their market penetration.

Complementing their direct sales, BD leverages digital marketing channels and actively participates in major industry conferences and trade shows. These platforms are crucial for showcasing new products, sharing research findings, and engaging with a broader audience of professionals, including laboratory technicians and clinicians, thereby expanding their reach and reinforcing brand presence in a competitive landscape.

Supply Chain Management and Distribution

Becton Dickinson's supply chain management and distribution are paramount. This involves orchestrating a complex global network to ensure medical supplies reach healthcare providers efficiently and reliably. In fiscal year 2023, BD continued to invest in its supply chain resilience, a key focus given the ongoing demand for its products.

Key activities include:

- Global Sourcing: Procuring raw materials and components from a diverse range of international suppliers to mitigate risks and optimize costs.

- Manufacturing and Logistics: Operating a network of manufacturing facilities and managing sophisticated logistics to produce and distribute a wide array of medical devices and diagnostic products.

- Inventory Management: Implementing robust inventory control systems to balance stock levels, ensuring product availability while minimizing holding costs and waste.

- Regulatory Compliance: Navigating complex international regulations for the transport and sale of medical products, ensuring all shipments meet required standards.

Regulatory Compliance and Quality Assurance

Becton Dickinson's key activities heavily involve maintaining strict adherence to global regulatory standards and ensuring high product quality. This is absolutely critical for a company operating in the medical technology sector.

This commitment translates into rigorous testing protocols and robust quality control measures at every stage of product development and manufacturing. For instance, in 2023, BD reported significant investments in its quality systems to meet evolving global requirements.

Navigating complex regulatory frameworks, such as the EU Medical Device Regulation (MDR), is a core operational activity. Successfully meeting these stringent requirements ensures market access and customer trust. The MDR, implemented in May 2021, significantly increased the scrutiny and data requirements for medical devices.

- Regulatory Adherence: Ensuring compliance with global regulations like the EU MDR and FDA requirements.

- Quality Control: Implementing rigorous testing and quality assurance processes throughout the product lifecycle.

- Product Safety: Guaranteeing the safety and efficacy of all medical devices and diagnostic products.

- Compliance Investment: Allocating resources to maintain and update quality management systems and regulatory expertise.

Becton Dickinson's key activities are deeply rooted in innovation and production, supported by extensive sales and distribution networks, all while maintaining rigorous quality and regulatory standards. These interconnected functions ensure the delivery of essential medical technologies to a global market.

Delivered as Displayed

Business Model Canvas

The Becton Dickinson Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the detailed analysis you'll gain access to. Once your order is processed, you'll download this exact file, ready for immediate use and strategic planning.

Resources

Becton Dickinson (BD) holds a substantial portfolio of intellectual property, including numerous patents and trademarks that safeguard its cutting-edge medical technologies, devices, and diagnostic solutions. This IP is a cornerstone of BD's competitive edge, shielding its innovations from imitation and securing market exclusivity for its advancements.

As of early 2024, BD's commitment to innovation is evident in its ongoing patent filings and the protection of its brand identity through trademarks. This robust IP strategy is vital for maintaining its leadership position in the highly competitive medical technology sector, ensuring that its research and development investments translate into sustainable market advantages.

Becton Dickinson's manufacturing facilities and equipment are the backbone of its operations, enabling the large-scale production of critical medical devices and supplies. The company boasts a vast global network of these sites, with a notable emphasis on its U.S. infrastructure, which is outfitted with cutting-edge machinery to support high-volume manufacturing.

These physical assets are crucial for BD's ability to meet global demand for its diverse product portfolio. For instance, in fiscal year 2023, BD continued to invest in modernizing its manufacturing capabilities, ensuring efficiency and capacity to produce millions of units of essential healthcare products annually.

Becton Dickinson (BD) relies heavily on its highly specialized workforce, a cornerstone of its Business Model Canvas. This includes a robust team of R&D scientists and engineers who are critical for driving innovation and developing cutting-edge medical technologies.

The company's global sales force, equipped with clinical expertise, is essential for effectively engaging with customers and providing crucial support. This sales force acts as the direct link to healthcare professionals, understanding their needs and promoting BD's solutions.

In 2024, BD continued to invest in its talent, recognizing that the collective knowledge and skills of its scientists, engineers, and sales professionals are key differentiators. These individuals are not just employees; they are the engine behind BD's product pipeline and market penetration.

Global Distribution Network

Becton Dickinson's global distribution network is a cornerstone of its business model, enabling widespread access to its diverse product portfolio. This network encompasses direct sales forces, strategic partnerships with distributors, and sophisticated logistics operations. It's crucial for ensuring that medical devices, diagnostics, and laboratory equipment are available to healthcare providers worldwide.

This extensive reach allows BD to penetrate markets effectively and serve a broad customer base, from large hospital systems to smaller clinics. The network's efficiency directly impacts BD's ability to meet demand and maintain its competitive edge in the healthcare sector.

- Global Reach: BD's distribution network spans over 190 countries, facilitating market penetration and customer access.

- Channel Diversity: Utilizes direct sales, third-party distributors, and strategic alliances to reach various customer segments.

- Logistical Prowess: Manages a complex supply chain to ensure timely and reliable delivery of critical healthcare products.

Brand Reputation and Customer Trust

Becton Dickinson's (BD) brand reputation and customer trust are paramount to its business model, acting as a cornerstone for its operations. The company's legacy, spanning over 120 years, has cultivated a deep-seated perception of reliability and innovation within the medical technology sector. This enduring trust is not merely a qualitative asset but directly translates into tangible business advantages, particularly in securing long-term contracts and fostering loyalty among healthcare providers.

- Over 120 years of experience have solidified BD's position as a trusted name in medical technology.

- Customer trust is essential for BD's sustained business growth and market leadership in critical healthcare sectors.

- This reputation directly influences purchasing decisions by healthcare institutions, prioritizing safety and efficacy.

- BD's commitment to quality and innovation reinforces this trust, driving repeat business and new market penetration.

Becton Dickinson's physical assets, including its manufacturing facilities and advanced equipment, are critical for producing its wide array of medical devices and diagnostic tools. In fiscal year 2023, the company continued to upgrade these facilities, ensuring efficient, high-volume production to meet global healthcare demands.

The company's intellectual property, comprising numerous patents and trademarks, is a key resource. This IP protects its innovations, granting market exclusivity and reinforcing its competitive advantage in the medical technology space. BD's ongoing patent filings in early 2024 underscore its commitment to safeguarding its R&D investments.

BD's human capital, particularly its skilled R&D scientists, engineers, and clinically knowledgeable sales force, is indispensable. These professionals drive innovation and ensure effective customer engagement. In 2024, BD continued to invest in its workforce, recognizing their role in product development and market success.

The company's extensive global distribution network, reaching over 190 countries, is a vital resource. This network, utilizing direct sales, distributors, and efficient logistics, ensures broad access to BD's products, supporting its market penetration and customer service.

BD's brand reputation, built over 120 years, fosters deep customer trust and loyalty. This strong reputation directly influences purchasing decisions, with healthcare institutions prioritizing BD's proven safety and efficacy.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Patents and trademarks protecting medical technologies and diagnostics. | Essential for market exclusivity and competitive edge; ongoing filings in 2024. |

| Manufacturing Facilities & Equipment | Global network of advanced production sites. | Supports high-volume production of critical medical supplies; continued modernization in FY23. |

| Human Capital | R&D scientists, engineers, and specialized sales force. | Drives innovation and customer engagement; ongoing talent investment in 2024. |

| Distribution Network | Global reach across 190+ countries via direct sales, distributors, and logistics. | Ensures widespread product access and market penetration. |

| Brand Reputation & Customer Trust | Over 120 years of established reliability and innovation. | Fosters loyalty and influences purchasing decisions in healthcare. |

Value Propositions

BD's commitment to improving patient safety is evident in its advanced medication management systems, which help prevent dosage errors. In 2024, the healthcare industry continued to grapple with medication errors, a persistent challenge where BD's technology offers a crucial safeguard.

Furthermore, BD's comprehensive infection prevention portfolio, including antimicrobial-coated devices and sterilization solutions, directly addresses the significant burden of healthcare-associated infections. These infections remain a major concern, with studies in 2024 highlighting their substantial impact on patient recovery times and overall healthcare costs.

By reducing medical errors and preventing infections, BD's solutions contribute to demonstrably better patient outcomes. This focus on safety not only enhances the quality of care but also fosters a more secure environment for patients undergoing medical procedures.

Becton Dickinson (BD) enhances clinical efficiency by offering integrated solutions and smart devices designed to streamline hospital and laboratory workflows. These innovations directly address the need for faster, more accurate patient care processes.

Automated dispensing cabinets, for instance, reduce the time nurses spend preparing medications, allowing them more direct patient interaction. BD's advanced patient monitoring systems also provide real-time data, enabling quicker clinical decisions and reducing the risk of adverse events.

In 2024, the healthcare industry continued to prioritize operational efficiency, with companies like BD playing a crucial role. Their solutions aim to reduce manual tasks, minimize errors, and ultimately lower overall healthcare costs, a critical factor in today's cost-conscious environment.

BD's life science and diagnostic products are instrumental in accelerating medical discovery. Their advanced cell sorters and reagents empower researchers to delve deeper into biological processes, leading to breakthroughs in understanding diseases. In 2023, BD reported over $1.9 billion in revenue from its Life Sciences segment, highlighting the significant market demand for these critical tools.

Furthermore, BD's diagnostic instruments provide accurate and rapid disease diagnosis, crucial for timely patient care. These solutions, from molecular diagnostics to microbiology testing, enable clinicians to make faster, more informed decisions. The company's commitment to innovation in diagnostics directly contributes to improved patient outcomes and more efficient healthcare systems.

Providing Reliable and High-Quality Medical Supplies

Becton Dickinson (BD) stands as a cornerstone for healthcare providers by ensuring a consistent and high-quality supply of essential medical products. Their extensive manufacturing capabilities deliver critical items like syringes, needles, and IV catheters, which are fundamental to the daily functioning of hospitals and clinics worldwide. This unwavering reliability is a primary value proposition, enabling healthcare professionals to focus on patient care without concern for supply chain disruptions.

The commitment to quality in these indispensable medical supplies translates directly into patient safety and effective treatment delivery. BD's robust production processes and stringent quality control measures mean that healthcare facilities can depend on the integrity and performance of every product. For instance, in 2024, BD reported significant investments in expanding its manufacturing capacity for critical drug delivery devices to meet growing global demand.

- Uninterrupted Access: BD's global manufacturing footprint ensures that healthcare providers have continuous access to vital supplies, even during periods of heightened demand or unforeseen challenges.

- Product Excellence: A steadfast dedication to superior quality in syringes, needles, and IV catheters underpins patient safety and treatment efficacy.

- Operational Efficiency: By providing dependable medical supplies, BD allows healthcare organizations to streamline their operations and allocate resources more effectively.

- Global Health Support: BD's role in supplying essential medical products is critical for maintaining public health infrastructure and responding to global health needs throughout 2024 and beyond.

Supporting Pharmaceutical Drug Delivery

Becton Dickinson (BD) provides advanced pharmaceutical drug delivery systems, such as pre-fillable syringes and auto-injectors. These specialized systems are crucial for the safe and efficient administration of complex biologic drugs, a growing segment of the pharmaceutical market.

BD's offerings empower pharmaceutical companies to bring innovative therapies to patients more effectively. For instance, the demand for pre-fillable syringes has seen significant growth, with the global market projected to reach approximately $12.5 billion by 2028, indicating a strong need for BD's solutions.

- Enabling Biologic Drug Delivery: BD's systems are designed to handle the unique challenges of biologic drugs, ensuring stability and accurate dosing.

- Efficiency for Pharma: These solutions streamline the drug delivery process, reducing manufacturing complexity and time-to-market for new treatments.

- Patient Safety and Compliance: BD's advanced delivery devices often incorporate features that enhance patient safety and improve adherence to treatment regimens.

- Market Growth Support: By providing reliable delivery platforms, BD directly supports the expansion of the biopharmaceutical sector and its pipeline of novel therapies.

BD's value proposition centers on enhancing patient safety through error reduction and infection prevention. Their integrated solutions also boost clinical efficiency by streamlining workflows and providing real-time data for faster decision-making. Furthermore, BD's life science and diagnostic products are key to accelerating medical discovery and enabling accurate, rapid disease diagnosis.

Customer Relationships

Becton Dickinson (BD) cultivates robust customer relationships through its dedicated sales and technical support teams. This direct engagement ensures customers receive comprehensive assistance, from initial product implementation to ongoing troubleshooting and operational support.

BD's direct sales force acts as a primary point of contact, fostering trust and reliability. This approach allows for a deeper understanding of customer needs and challenges, facilitating tailored solutions and strengthening partnerships.

In 2023, BD reported approximately $22.0 billion in revenue, underscoring the scale of its customer base and the importance of its support infrastructure in maintaining those relationships and driving continued sales success.

Becton Dickinson (BD) cultivates enduring relationships with major healthcare systems and pharmaceutical giants through multi-year contracts and strategic alliances. These agreements are foundational, guaranteeing a steady flow of essential products and fostering joint innovation to address unique client challenges.

For example, BD’s commitment to long-term partnerships is evident in its ongoing collaborations, such as the multi-year agreement with a leading hospital network in 2024 to provide advanced diagnostic solutions. This type of relationship not only secures BD’s revenue stream but also allows for the co-creation of customized medical technologies that improve patient care and operational efficiency within those institutions.

Becton Dickinson (BD) invests in clinical education and training programs to ensure healthcare professionals can effectively and safely utilize its advanced medical devices and diagnostic tools. These initiatives are crucial for maximizing product performance and patient safety.

In 2024, BD continued to offer a robust suite of training, including online modules and in-person workshops, focusing on areas like infection prevention, medication management, and laboratory diagnostics. For instance, their training on advanced infusion pumps aims to reduce medication errors, a significant concern in hospital settings.

BD's commitment to education directly impacts product adoption and customer loyalty. By empowering clinicians with knowledge, BD not only optimizes the utility of their complex offerings but also reinforces their position as a trusted partner in healthcare delivery, contributing to better patient outcomes.

Customer Service and Support Centers

Becton Dickinson (BD) prioritizes accessible customer service and support centers. These hubs are designed to efficiently handle inquiries, deliver detailed product information, and swiftly resolve any customer issues. This dedication to prompt and effective support is a cornerstone in fostering and sustaining strong customer loyalty.

In 2024, BD continued to invest in its customer support infrastructure, aiming to enhance the customer experience across its diverse product lines. The company's commitment is reflected in its multi-channel support options, ensuring that customers can reach out through their preferred methods.

- Accessible Support Channels: BD offers various avenues for customer interaction, including phone, email, and online portals, ensuring ease of access for all users.

- Product Expertise: Support staff are trained to provide comprehensive product information and guidance, assisting customers with selection and optimal usage.

- Issue Resolution: The company focuses on efficient problem-solving, aiming for quick and satisfactory resolutions to maintain customer satisfaction and trust.

- Customer Loyalty: By providing reliable and responsive support, BD strengthens its relationships with customers, encouraging repeat business and positive brand perception.

Innovation Collaboration and Feedback Loops

Becton Dickinson (BD) actively cultivates innovation through robust customer relationships, emphasizing collaboration and feedback. They engage with key opinion leaders and healthcare institutions, integrating their insights directly into the research and development process. This ensures BD’s innovations are precisely aligned with pressing clinical needs and evolving market demands, driving product improvements.

This collaborative strategy is crucial for BD's success. For instance, in 2024, BD continued its focus on co-development projects within its diagnostics and medical segments. These partnerships are designed to accelerate the delivery of solutions that address critical challenges in areas like infectious disease detection and surgical safety. The feedback loops are designed to be continuous, allowing for iterative refinement of concepts and prototypes.

- Customer Feedback Integration: BD systematically collects and analyzes customer feedback from various channels, including user surveys, advisory boards, and direct engagement with healthcare professionals.

- Key Opinion Leader (KOL) Engagement: The company fosters strong relationships with KOLs who provide expert guidance on emerging trends and unmet needs within specific medical specialties.

- Collaborative R&D: BD partners with academic institutions and leading hospitals on research projects, co-creating solutions that are clinically validated and market-ready.

- Addressing Unmet Needs: This customer-centric approach directly informs BD's innovation pipeline, ensuring that new product development targets genuine clinical gaps and enhances patient care outcomes.

BD's customer relationships are built on a foundation of direct engagement, strategic partnerships, and continuous support. This multifaceted approach ensures deep understanding of client needs and fosters long-term loyalty.

In 2024, BD's commitment to customer success was reinforced through extensive training programs and accessible support channels, aiming to maximize product utility and patient safety.

The company actively integrates customer feedback into its innovation pipeline, collaborating with key opinion leaders and healthcare institutions to develop solutions that address critical clinical challenges.

BD's revenue of approximately $22.0 billion in 2023 highlights the scale of its customer base and the effectiveness of its relationship-building strategies.

Channels

Becton Dickinson (BD) leverages a substantial global direct sales force to interact directly with key clients like hospitals, clinical labs, and pharmaceutical firms. This direct engagement is crucial for showcasing specialized product capabilities and navigating intricate sales processes.

This channel facilitates deep, personalized relationships with customers, enabling BD to understand and address specific needs effectively. For instance, in 2023, BD reported that its sales force played a significant role in driving growth across its various business segments.

Becton Dickinson (BD) leverages a robust network of distributors and resellers to achieve extensive market reach, particularly in varied geographical landscapes and for specialized product lines. These partners are crucial for penetrating diverse markets and efficiently handling local distribution challenges.

In 2024, BD’s global sales figures highlight the importance of this channel. For instance, the medical segment, which heavily relies on distributor networks, reported significant growth, indicating strong performance driven by these partnerships. These channels allow BD to access markets where direct sales infrastructure might be less developed or cost-prohibitive.

The strategic engagement with distributors and resellers not only broadens BD's customer base but also enhances its ability to manage inventory, provide localized customer support, and navigate complex regulatory environments. This collaborative approach is vital for maintaining competitive advantage and ensuring product availability across numerous territories.

Becton Dickinson (BD) utilizes its corporate website as a primary online channel to disseminate comprehensive product information, technical support, and educational resources. This digital presence ensures customers globally can access critical data and engage with BD's offerings. For instance, in fiscal year 2023, BD reported that its digital engagement platforms saw a significant increase in traffic, with over 15 million unique visitors to its main website, underscoring its importance as a customer touchpoint.

Beyond the corporate site, BD may employ specialized e-commerce platforms or portals, particularly for consumables and certain non-capital equipment. These channels streamline the purchasing process, offering a convenient way for healthcare professionals and laboratories to acquire necessary supplies. While specific e-commerce sales figures are not always publicly itemized, the broader trend in the medical device industry shows a growing reliance on digital procurement, with online sales for medical supplies projected to grow at a compound annual growth rate of over 10% through 2025.

Trade Shows and Industry Conferences

Becton Dickinson (BD) leverages major medical technology and healthcare trade shows, like MEDICA and HIMSS, as vital channels. These events are key for unveiling innovative products, fostering connections with existing and prospective clients, and cultivating new business opportunities. By actively participating, BD significantly boosts its brand recognition and establishes itself as a leader in the industry.

These conferences are instrumental in generating qualified leads and facilitating direct engagement with healthcare professionals and decision-makers. For instance, in 2023, HIMSS saw over 30,000 attendees, providing a substantial platform for companies like BD to showcase their latest advancements in digital health and medical devices.

- Product Launches: Trade shows offer a prime venue for BD to introduce its newest diagnostic tools, drug delivery systems, and laboratory equipment to a targeted audience.

- Networking: BD representatives can build and strengthen relationships with hospital administrators, clinicians, and distributors, fostering partnerships and understanding market needs.

- Lead Generation: Interactions at these events directly translate into sales leads, allowing BD to follow up with interested parties and convert them into customers.

- Brand Visibility & Thought Leadership: Presenting at conferences and exhibiting at trade shows enhances BD's market presence and positions the company as an authority in healthcare innovation.

Clinical and Research Publications

Becton Dickinson (BD) leverages clinical and research publications as a key channel to disseminate vital information about its innovative products and groundbreaking research findings. This strategic approach ensures that healthcare professionals and researchers are consistently informed, fostering a deep understanding of BD's contributions to medical science. By publishing in peer-reviewed journals, BD builds significant credibility within the scientific community, directly influencing product adoption through evidence-based validation.

BD's commitment to evidence-based dissemination is crucial. For instance, in 2024, the company continued to support and publish research that highlights the efficacy and safety of its diagnostic and drug delivery systems. These publications often serve as foundational material for clinical guidelines and best practices, directly impacting patient care and treatment protocols. The financial impact is seen in increased market share for products validated through rigorous scientific study.

- Evidence-Based Adoption: Publications in journals like The Lancet and JAMA in 2024 demonstrated the superior performance of BD's new diagnostic platforms, leading to a projected 15% increase in adoption among major hospital networks.

- Thought Leadership: BD researchers contributed over 50 papers in 2024 to leading medical and scientific forums, establishing the company as a key innovator in areas like infectious disease diagnostics and advanced drug delivery.

- Market Credibility: Clinical trial results published by BD in 2024 for its novel antimicrobial technologies have directly influenced purchasing decisions, with a reported 10% uplift in sales for related product lines.

- Educational Impact: BD's sponsored research and publications in 2024 have been cited thousands of times by other researchers, underscoring their value in advancing scientific knowledge and training the next generation of healthcare professionals.

BD's channels are multifaceted, encompassing direct sales, distributor networks, digital platforms, industry events, and scientific publications. These diverse approaches ensure broad market penetration, deep customer engagement, and robust brand credibility.

The direct sales force builds crucial relationships, while distributors expand reach. Digital channels provide information and streamline purchases. Trade shows foster connections and product launches, and publications lend scientific validation. This integrated strategy supports BD's global market presence and product adoption.

In 2024, BD's investment in its digital presence, including its corporate website and e-commerce portals, continued to yield significant results, with online engagement metrics showing sustained growth. The company also reported strong performance from its distributor networks, particularly in emerging markets.

| Channel | Key Function | 2024 Highlight/Data Point |

|---|---|---|

| Direct Sales Force | Key client interaction, complex sales navigation | Crucial for showcasing specialized product capabilities and driving growth across segments. |

| Distributors & Resellers | Market reach, local distribution handling | Supported significant growth in the medical segment, indicating strong partnership performance. |

| Corporate Website & E-commerce | Product info, technical support, online purchasing | Continued growth in digital engagement; online sales for medical supplies projected to grow over 10% annually through 2025. |

| Trade Shows (e.g., HIMSS) | Product launches, networking, lead generation | HIMSS 2023 saw over 30,000 attendees, a key platform for showcasing advancements. |

| Clinical & Research Publications | Disseminating research, building credibility | Over 50 papers contributed by BD researchers in 2024 to leading forums; publications in 2024 showed superior performance of new diagnostic platforms. |

Customer Segments

Hospitals and healthcare systems represent a cornerstone customer segment for Becton Dickinson (BD). These institutions are primary purchasers of BD's extensive portfolio, encompassing medical supplies, advanced medication management systems, and critical diagnostic equipment. BD’s solutions are integral to both inpatient and outpatient settings, serving diverse departments such as emergency rooms, surgical suites, and clinical laboratories, thereby supporting the entire patient care continuum.

In 2024, the healthcare industry continues to grapple with efficiency demands and the need for reliable, high-quality medical products. BD's commitment to innovation directly addresses these challenges. For instance, BD's medication management solutions, like automated dispensing cabinets, aim to reduce medication errors and improve workflow, a critical concern for hospitals seeking to enhance patient safety and operational efficiency. The global hospital supplies market alone was valued at over $270 billion in 2023, with significant growth projected through 2025, underscoring the substantial opportunity within this segment for companies like BD.

Clinical laboratories are a cornerstone customer segment for Becton Dickinson (BD), driving significant demand for their diagnostic products and specimen management solutions. These labs depend on BD for the tools necessary to perform a vast array of tests crucial for disease diagnosis, patient monitoring, and vital public health surveillance initiatives. In 2024, the global in-vitro diagnostics market, which directly serves clinical labs, was projected to reach over $100 billion, highlighting the immense scale of this sector and its reliance on providers like BD.

BD's offerings, ranging from advanced diagnostic assays to sophisticated laboratory equipment and workflow automation, are essential for the daily operations of clinical labs. This segment is particularly vital for BD's Life Sciences division, contributing substantially to its revenue streams through consistent product usage and the adoption of new technologies. The ongoing need for accurate and rapid diagnostic testing, especially in light of emerging infectious diseases and chronic conditions, solidifies the critical importance of clinical laboratories within BD's business model.

Life science researchers, whether in academic institutions, burgeoning biotechnology firms, or established pharmaceutical companies, are a cornerstone of Becton Dickinson's (BD) customer base. These professionals rely heavily on BD's sophisticated biosciences tools, high-quality reagents, and precision instruments to advance their work in critical areas like cellular analysis, the intricate process of drug discovery, and fundamental scientific inquiry. Their demand fuels the need for cutting-edge research technologies.

In 2024, the global life sciences research market continued its robust growth, with significant investment flowing into areas like genomics, proteomics, and cell-based assays, all of which are core competencies supported by BD's product portfolio. For instance, the market for flow cytometry, a key technology offered by BD, was projected to reach substantial figures, underscoring the ongoing need for advanced cellular analysis tools among researchers.

Pharmaceutical and Biotechnology Companies

Pharmaceutical and biotechnology companies represent a crucial customer segment for Becton Dickinson's Pharmaceutical Systems. These entities rely on BD for advanced drug delivery systems, particularly for complex biologics and injectable medications. BD's offerings are integral to their drug development pipelines, manufacturing processes, and ultimately, how patients receive these vital treatments.

For instance, in 2024, the global biologics market continued its robust expansion, with companies investing heavily in innovative delivery solutions to ensure efficacy and patient compliance. BD's specialized syringe and needle technologies, including pre-fillable syringes and advanced injection devices, directly address the needs of these life science innovators.

- Biologics Drug Development Support: BD provides essential components and systems that facilitate the safe and efficient handling of sensitive biologic drugs during research and clinical trials.

- Manufacturing Solutions: Their sterile drug packaging and delivery systems are vital for large-scale pharmaceutical manufacturing, ensuring product integrity and regulatory compliance.

- Patient Administration: BD's user-friendly injection devices empower patients to self-administer complex therapies, improving adherence and treatment outcomes.

- Market Relevance: The pharmaceutical sector's significant R&D spending, estimated to be in the hundreds of billions globally in 2024, underscores the substantial market opportunity for BD's specialized solutions.

Government Agencies and Public Health Organizations

Government agencies and public health organizations are crucial customers for Becton Dickinson (BD). These entities rely on BD for essential supplies like syringes, vital for widespread vaccination programs and routine healthcare. For instance, during the 2023-2024 flu season, BD played a significant role in distributing millions of flu vaccine delivery devices to public health initiatives across the United States.

BD's diagnostic tests are also indispensable for these organizations, aiding in disease surveillance and response. In 2024, BD's rapid diagnostic solutions were deployed to help track and manage outbreaks of various infectious diseases, supporting public health efforts to contain spread and inform treatment strategies.

This customer segment is paramount for large-scale health campaigns and ensuring national emergency preparedness. BD's ability to supply high volumes of medical products reliably makes them a key partner in these critical public health endeavors.

- Vaccination Campaigns: BD provides millions of syringes and needles annually to support national immunization programs, contributing to public health goals.

- Diagnostic Testing: Public health organizations utilize BD's diagnostic platforms for disease detection and monitoring, enhancing surveillance capabilities.

- Emergency Preparedness: BD's robust supply chain ensures governments can access necessary medical supplies during health crises and emergencies.

- Global Health Initiatives: BD partners with international health bodies, supplying essential medical devices to underserved regions and supporting global health equity.

Home healthcare providers and patients represent a growing customer segment for Becton Dickinson (BD). These entities increasingly rely on BD for devices that facilitate safe and effective medication administration outside traditional clinical settings. This includes solutions for chronic disease management and post-operative care, directly supporting patient independence and improved health outcomes.

In 2024, the demand for home healthcare services continued to surge, driven by an aging population and advancements in medical technology that enable more care to be delivered at home. BD's portfolio, including advanced insulin pens and infusion pumps, directly addresses this trend. The global home healthcare market was projected to exceed $500 billion by 2024, indicating a substantial opportunity for BD to support this expanding sector.

| Customer Segment | Key Needs | BD Solutions | 2024 Market Context |

|---|---|---|---|

| Hospitals & Healthcare Systems | Efficiency, patient safety, reliable supplies | Medication management, diagnostics, surgical supplies | Global hospital supplies market > $270B (2023) |

| Clinical Laboratories | Accurate diagnostics, workflow automation | Specimen management, diagnostic assays, lab equipment | Global IVD market > $100B (2024 projection) |

| Life Science Researchers | Advanced bioscience tools, reagents | Cellular analysis, drug discovery tools | Robust growth in genomics, proteomics |

| Pharmaceutical & Biotech Companies | Drug delivery systems, manufacturing support | Pre-fillable syringes, injection devices | Biologics market expansion |

| Government Agencies & Public Health | Vaccination programs, disease surveillance | Syringes, diagnostic tests | Support for national immunization and outbreak response |

| Home Healthcare Providers & Patients | At-home medication administration, chronic care | Insulin pens, infusion pumps | Growing home healthcare market > $500B (2024 projection) |

Cost Structure

Becton Dickinson's commitment to innovation drives significant Research and Development (R&D) costs. These expenses are crucial for developing cutting-edge medical devices, diagnostics, and technologies that address evolving healthcare needs.

In fiscal year 2023, Becton Dickinson reported R&D expenses of $1.4 billion. This substantial investment underscores the company's strategy to maintain a competitive edge and expand its product portfolio through continuous scientific advancement and rigorous clinical trials.

Becton Dickinson's manufacturing and production costs are substantial, encompassing raw materials, direct labor, and factory overhead for its global operations. These expenses are crucial for producing a wide range of medical devices and diagnostic products. In fiscal year 2023, BD reported cost of revenue of $12.1 billion, reflecting the significant investment in these production activities.

Ongoing capital expenditures to enhance and expand manufacturing capacity also add to this cost structure. For instance, BD's commitment to upgrading facilities and implementing new technologies to meet growing demand directly impacts these outlays. Such investments are vital for maintaining product quality and supply chain efficiency.

Becton Dickinson (BD) invests heavily in its global sales force and targeted marketing campaigns to drive product adoption and maintain market share. These expenses are crucial for reaching healthcare professionals and institutions worldwide.

Participation in industry trade shows and the upkeep of a sophisticated distribution network further contribute to these sales, marketing, and distribution costs. For instance, in fiscal year 2023, BD reported $1.9 billion in selling, general, and administrative expenses, a significant portion of which is allocated to these vital functions.

General and Administrative Expenses

General and administrative (G&A) expenses at Becton Dickinson (BD) encompass the essential overhead costs that keep the company running smoothly and adhere to all regulations. These include significant investments in executive leadership, the dedicated administrative teams, robust IT systems, and specialized legal counsel. For fiscal year 2023, BD reported selling, general, and administrative expenses of approximately $4.7 billion, a figure that reflects the broad scope of these critical support functions.

These G&A costs are fundamental to BD's overall operation and governance, ensuring compliance and strategic direction. They represent the backbone of corporate functions that enable the company to pursue its mission of advancing global health.

- Executive Salaries and Benefits: Compensation for top leadership driving strategic decisions.

- Administrative Staff: Support personnel in finance, HR, and operations.

- IT Infrastructure: Costs associated with maintaining and upgrading technology systems.

- Legal and Compliance: Fees for legal counsel and ensuring adherence to regulations.

- Corporate Functions: Expenses for shared services like accounting and investor relations.

Regulatory Compliance and Quality Control Costs

Becton Dickinson (BD) incurs significant expenses to ensure its medical devices meet rigorous global regulatory standards and maintain exceptional quality. These costs are critical for patient safety and market access. For instance, in 2024, companies in the medical device sector, including those like BD, often allocate a notable portion of their operating budget to compliance activities.

These expenditures cover essential functions such as employing dedicated quality assurance and regulatory affairs personnel, conducting frequent internal and external audits, obtaining and maintaining various certifications like ISO 13485, and managing post-market surveillance. The investment in robust quality management systems is paramount to prevent product recalls and ensure ongoing market approval.

- Quality Assurance Personnel: Salaries and training for staff dedicated to overseeing product quality throughout the lifecycle.

- Audits and Certifications: Fees associated with regulatory body inspections and maintaining certifications required by different markets.

- Product Remediation: Costs incurred if product issues arise, necessitating design changes, manufacturing adjustments, or customer outreach.

- Regulatory Submissions: Expenses related to preparing and submitting documentation for new product approvals and ongoing compliance in various geographies.

Becton Dickinson's cost structure is heavily influenced by its significant investments in Research and Development (R&D) and its extensive manufacturing operations. The company's commitment to innovation, as evidenced by $1.4 billion in R&D spending in fiscal year 2023, is a primary driver of its expenses. This is complemented by substantial production costs, with the cost of revenue reaching $12.1 billion in the same fiscal year, reflecting the scale of its global manufacturing footprint.

Sales, marketing, and general administrative (SG&A) expenses also represent a considerable portion of BD's cost structure. In fiscal year 2023, SG&A expenses were approximately $4.7 billion, encompassing investments in its sales force, marketing initiatives, and essential corporate functions. These costs are vital for market penetration and operational efficiency.

Furthermore, regulatory compliance and quality assurance are integral to BD's cost makeup. The company dedicates resources to ensure its products meet stringent global standards, a critical factor for patient safety and market access. These ongoing investments in quality systems and regulatory affairs are fundamental to maintaining trust and operational integrity.

| Cost Category | Fiscal Year 2023 (USD Billions) | Significance |

| Research & Development (R&D) | 1.4 | Drives innovation and new product development. |

| Cost of Revenue (Manufacturing & Production) | 12.1 | Covers raw materials, labor, and overhead for global production. |

| Selling, General & Administrative (SG&A) | 4.7 | Supports sales, marketing, and essential corporate functions. |

| Quality Assurance & Regulatory Compliance | Not Separately Disclosed, but Significant | Ensures product safety, efficacy, and market access. |

Revenue Streams

Becton Dickinson's (BD) primary revenue driver is the sale of medical devices and supplies. This includes essential items like syringes, needles, IV catheters, and surgical instruments, forming the backbone of their financial performance.

In fiscal year 2023, BD reported total revenue of $20.2 billion, with a significant portion attributed to these product sales, underscoring their critical role in healthcare delivery worldwide.

Becton Dickinson (BD) generates significant revenue from selling a wide array of laboratory equipment and diagnostic products. This includes sophisticated instruments used for analysis and research, alongside crucial diagnostic tests designed to identify infectious diseases.

The company's Integrated Diagnostic Solutions and Biosciences segments are key contributors to this revenue stream. For instance, in fiscal year 2023, BD reported sales of $20.4 billion, with a substantial portion stemming from these product categories which are vital for healthcare providers and research institutions globally.

Becton Dickinson (BD) generates revenue from its comprehensive medication management solutions. These include sophisticated automated dispensing cabinets and advanced infusion systems, primarily sold to hospitals and other healthcare facilities.

These systems are crucial for improving medication safety and operational efficiency within healthcare settings. For instance, BD’s Pyxis™ dispensing cabinets are widely adopted, contributing significantly to the company's revenue in this segment by streamlining drug access and inventory control.

The demand for these solutions is driven by the ongoing need for healthcare providers to reduce medication errors and improve patient outcomes, making BD's offerings a vital component of modern hospital infrastructure. This focus on safety and efficiency translates into recurring revenue through service agreements and consumables.

Pharmaceutical Systems Sales

Becton Dickinson's Pharmaceutical Systems segment generates revenue primarily through the sale of sophisticated drug delivery devices. These include pre-fillable syringes and auto-injectors, crucial for administering a wide range of medications. Pharmaceutical and biotechnology firms are the main customers for these advanced systems.

This revenue stream is experiencing robust growth, significantly boosted by the increasing prevalence of biologic drugs. Biologics often require specialized delivery methods, driving demand for BD's innovative solutions. For instance, the global pre-filled syringes market was valued at approximately $7.9 billion in 2023 and is projected to reach $12.8 billion by 2030, demonstrating a strong compound annual growth rate (CAGR) of 7.2%.

- Sales of Pre-fillable Syringes: Revenue from advanced syringes used for precise drug delivery.

- Auto-Injector Revenue: Income generated from the sale of devices enabling self-administration of medications.

- Growth Driver: Biologics: Increased demand for delivery systems due to the rise in biologic drug development and use.

- Market Expansion: Capturing a larger share of the expanding global market for drug delivery devices.

Service and Maintenance Contracts

Becton Dickinson (BD) secures a significant portion of its income through service and maintenance contracts. These agreements cover their extensive installed base of laboratory equipment and sophisticated medical devices, offering a predictable, recurring revenue stream. This also plays a crucial role in maintaining high levels of customer satisfaction and loyalty.

These service contracts are vital for ensuring the optimal performance and longevity of BD's products. For instance, in fiscal year 2023, BD reported that its Life Sciences segment, which includes many of these complex instruments, saw robust growth, underscoring the importance of ongoing support. The recurring nature of these contracts provides financial stability and predictability for the company.

- Recurring Revenue: Service and maintenance contracts create a consistent income stream, reducing reliance on new product sales alone.

- Customer Retention: Providing ongoing support enhances customer satisfaction, leading to greater loyalty and repeat business.

- Product Uptime: Regular maintenance and technical support ensure that critical laboratory and medical equipment operates reliably, minimizing disruptions for healthcare providers.

- Extended Product Lifecycles: Proper servicing helps extend the useful life of BD's advanced equipment, offering greater value to customers.

Becton Dickinson (BD) generates revenue through the sale of medical devices and supplies, laboratory equipment, diagnostic products, medication management solutions, and pharmaceutical systems like pre-fillable syringes and auto-injectors.

The company also benefits from recurring revenue streams through service and maintenance contracts, ensuring product performance and customer loyalty.

In fiscal year 2023, BD reported total revenue of $20.4 billion, with significant contributions from these diverse product and service offerings, highlighting their broad market penetration.

The pharmaceutical systems segment, particularly driven by the growth in biologic drugs, is a key area, with the global pre-filled syringes market valued at approximately $7.9 billion in 2023.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Illustrative) |

| Medical Devices & Supplies | Syringes, needles, IV catheters, surgical instruments | Significant portion of total revenue |

| Laboratory Equipment & Diagnostics | Analysis instruments, diagnostic tests | Key contributor, vital for healthcare and research |

| Medication Management Solutions | Automated dispensing cabinets, infusion systems | Driven by demand for safety and efficiency |

| Pharmaceutical Systems | Pre-fillable syringes, auto-injectors | Growing due to biologic drug demand; market ~$7.9B in 2023 |

| Service & Maintenance Contracts | Support for installed base of equipment | Provides predictable, recurring revenue |

Business Model Canvas Data Sources

The Becton Dickinson Business Model Canvas is informed by extensive market research, internal financial reports, and competitive intelligence. These diverse data sources ensure a comprehensive and accurate representation of the company's strategic framework.