Becton Dickinson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Becton Dickinson Bundle

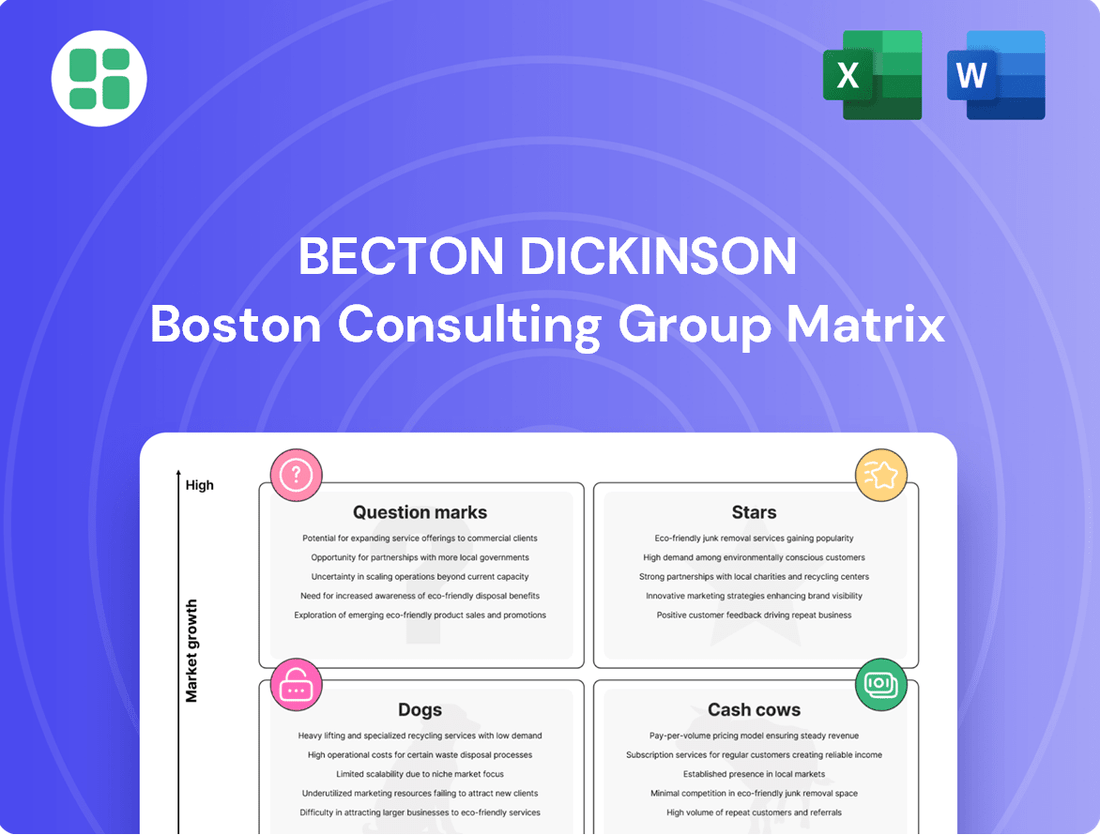

Curious about Becton Dickinson's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete report for actionable insights and a roadmap to optimize your own business strategy.

Stars

Becton Dickinson's (BD) Advanced Patient Monitoring (APM) with AI-driven solutions is a definite star in its portfolio. The strategic acquisition of Edwards Lifesciences' Critical Care product group in September 2024 significantly bolstered BD's presence in this rapidly expanding market. This move immediately established APM as a key player in a high-growth segment.

The introduction of the HemoSphere Alta™ Advanced Monitoring Platform, featuring AI-powered clinical decision support, underscores BD's commitment to innovation. This advanced platform is poised to capture substantial market share as AI integration becomes increasingly critical in patient care. BD anticipates this segment will be a strong driver of organic revenue growth.

The biologics market is a rapidly expanding sector, with projections indicating it will surpass $670 billion by 2030, signaling a substantial growth opportunity. Becton Dickinson's commitment to this area is evident in its development of advanced drug delivery systems.

BD's BD Libertas™ Wearable Injector is a prime example, having recently commenced its first pharma-sponsored clinical trial. This initiative positions BD to capture significant market share in the evolving landscape of biologic drug administration.

These cutting-edge delivery mechanisms are engineered to manage complex biologics and facilitate patient self-administration, anticipating robust market demand and widespread adoption by both pharmaceutical partners and patients.

Becton Dickinson's (BD) Alaris™ Infusion System is a cornerstone in hospital medication management, consistently earning industry accolades for its safety features and innovative design. The company's ongoing investment in this next-generation technology, coupled with recent FDA clearance to resume shipping, underscores its commitment to solidifying its leadership in this vital healthcare sector. This product line is currently experiencing robust double-digit growth within the infusion segment, reflecting a strong market presence in an expanding area of patient care.

Flow Cytometry and Single-Cell Multiomics Tools (Pre-Separation)

Flow cytometry and single-cell multiomics tools, particularly those used pre-separation, are crucial innovations within Becton Dickinson's Biosciences segment. These technologies are vital for advancing immunology and cancer research, representing significant growth areas in the life sciences. BD's robust portfolio in this space positions them as a market leader, necessitating ongoing investment to fuel innovation and sustain their competitive advantage.

BD's commitment to these high-growth areas is evident in their strategic focus. For instance, in fiscal year 2023, BD reported Biosciences revenue of approximately $2.1 billion, with a significant portion attributable to these advanced research tools. The company consistently invests a substantial percentage of its revenue back into research and development to maintain its leadership in cutting-edge single-cell analysis.

- Innovation Driver: Flow cytometry and single-cell multiomics tools are key drivers of innovation in immunology and cancer research.

- Market Leadership: BD holds a strong position in these high-growth life science research segments.

- Investment Focus: Significant R&D investment is required to maintain a competitive edge in these rapidly evolving fields.

- Revenue Contribution: Biosciences, including these tools, represented a substantial part of BD's fiscal year 2023 revenue.

Infection Prevention Solutions

Becton Dickinson's (BD) Infection Prevention Solutions are a cornerstone of its portfolio, demonstrating robust growth, particularly within its Surgery segment. This segment's strong performance highlights a dynamic market shaped by persistent healthcare demands and increasing regulatory scrutiny on patient safety.

BD's commitment to enhancing infection prevention is evident in its comprehensive offerings, which cater to a critical and ever-changing aspect of healthcare delivery. The company's established product range positions it to secure substantial market share in this vital sector.

- Market Growth: The global infection prevention market was valued at approximately USD 25 billion in 2023 and is projected to grow at a CAGR of around 7-8% through 2030, driven by rising hospital-acquired infections and increased healthcare spending.

- BD's Strategy: BD's focus on infection prevention aligns with its broader strategy to address unmet needs in healthcare, leveraging innovation to improve patient outcomes and reduce healthcare costs.

- Product Portfolio: Key offerings include sterilization products, disinfectants, and antimicrobial technologies, all designed to minimize the spread of infections in clinical settings.

Becton Dickinson's (BD) Advanced Patient Monitoring (APM) with AI-driven solutions is a definite star in its portfolio. The strategic acquisition of Edwards Lifesciences' Critical Care product group in September 2024 significantly bolstered BD's presence in this rapidly expanding market. This move immediately established APM as a key player in a high-growth segment.

The introduction of the HemoSphere Alta™ Advanced Monitoring Platform, featuring AI-powered clinical decision support, underscores BD's commitment to innovation. This advanced platform is poised to capture substantial market share as AI integration becomes increasingly critical in patient care. BD anticipates this segment will be a strong driver of organic revenue growth.

The biologics market is a rapidly expanding sector, with projections indicating it will surpass $670 billion by 2030, signaling a substantial growth opportunity. Becton Dickinson's commitment to this area is evident in its development of advanced drug delivery systems.

BD's BD Libertas™ Wearable Injector is a prime example, having recently commenced its first pharma-sponsored clinical trial. This initiative positions BD to capture significant market share in the evolving landscape of biologic drug administration.

These cutting-edge delivery mechanisms are engineered to manage complex biologics and facilitate patient self-administration, anticipating robust market demand and widespread adoption by both pharmaceutical partners and patients.

Becton Dickinson's (BD) Alaris™ Infusion System is a cornerstone in hospital medication management, consistently earning industry accolades for its safety features and innovative design. The company's ongoing investment in this next-generation technology, coupled with recent FDA clearance to resume shipping, underscores its commitment to solidifying its leadership in this vital healthcare sector. This product line is currently experiencing robust double-digit growth within the infusion segment, reflecting a strong market presence in an expanding area of patient care.

Flow cytometry and single-cell multiomics tools, particularly those used pre-separation, are crucial innovations within Becton Dickinson's Biosciences segment. These technologies are vital for advancing immunology and cancer research, representing significant growth areas in the life sciences. BD's robust portfolio in this space positions them as a market leader, necessitating ongoing investment to fuel innovation and sustain their competitive advantage.

BD's commitment to these high-growth areas is evident in their strategic focus. For instance, in fiscal year 2023, BD reported Biosciences revenue of approximately $2.1 billion, with a significant portion attributable to these advanced research tools. The company consistently invests a substantial percentage of its revenue back into research and development to maintain its leadership in cutting-edge single-cell analysis.

- Innovation Driver: Flow cytometry and single-cell multiomics tools are key drivers of innovation in immunology and cancer research.

- Market Leadership: BD holds a strong position in these high-growth life science research segments.

- Investment Focus: Significant R&D investment is required to maintain a competitive edge in these rapidly evolving fields.

- Revenue Contribution: Biosciences, including these tools, represented a substantial part of BD's fiscal year 2023 revenue.

Becton Dickinson's (BD) Infection Prevention Solutions are a cornerstone of its portfolio, demonstrating robust growth, particularly within its Surgery segment. This segment's strong performance highlights a dynamic market shaped by persistent healthcare demands and increasing regulatory scrutiny on patient safety.

BD's commitment to enhancing infection prevention is evident in its comprehensive offerings, which cater to a critical and ever-changing aspect of healthcare delivery. The company's established product range positions it to secure substantial market share in this vital sector.

- Market Growth: The global infection prevention market was valued at approximately USD 25 billion in 2023 and is projected to grow at a CAGR of around 7-8% through 2030, driven by rising hospital-acquired infections and increased healthcare spending.

- BD's Strategy: BD's focus on infection prevention aligns with its broader strategy to address unmet needs in healthcare, leveraging innovation to improve patient outcomes and reduce healthcare costs.

- Product Portfolio: Key offerings include sterilization products, disinfectants, and antimicrobial technologies, all designed to minimize the spread of infections in clinical settings.

BD's Advanced Patient Monitoring (APM) segment, bolstered by the 2024 acquisition of Edwards Lifesciences' Critical Care products, represents a significant star. This segment benefits from the growing demand for AI-driven healthcare solutions and is projected to drive substantial organic revenue growth for BD.

The biologics drug delivery market is another star, with BD's BD Libertas™ Wearable Injector progressing through clinical trials. This positions BD to capture a considerable share of a market expected to exceed $670 billion by 2030, driven by the increasing use of complex biologics.

BD's flow cytometry and single-cell multiomics tools are also stars within their Biosciences segment. These critical research tools are vital for advancements in immunology and cancer research, contributing to the segment's approximately $2.1 billion revenue in fiscal year 2023 and requiring continued R&D investment.

The Alaris™ Infusion System continues to shine, experiencing robust double-digit growth. Recent FDA clearance to resume shipping reinforces its position as a leader in medication management, a vital area in patient care.

| Product Category | BD's Role | Market Outlook | Key Growth Drivers | BD's Strategic Focus |

| Advanced Patient Monitoring (APM) | Key player with AI-driven solutions | High growth, increasing AI integration | Acquisition of Edwards Lifesciences' Critical Care products; HemoSphere Alta™ platform | Capturing market share in AI-driven patient care |

| Biologics Drug Delivery | Innovator in advanced delivery systems | Projected to exceed $670 billion by 2030 | Increasing use of complex biologics; BD Libertas™ Wearable Injector trials | Capturing market share in biologic drug administration |

| Flow Cytometry & Single-Cell Multiomics | Market leader in life sciences research tools | Significant growth in immunology and cancer research | Advancing research capabilities; BD's robust portfolio | Sustaining competitive advantage through R&D |

| Alaris™ Infusion System | Cornerstone in medication management | Robust double-digit growth in infusion segment | Safety features, innovative design, resumed shipping | Solidifying leadership in vital healthcare sector |

What is included in the product

The BCG Matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth, guiding strategic investment decisions.

The Becton Dickinson BCG Matrix provides a clear, visual overview, relieving the pain of complex portfolio analysis for strategic decision-making.

Cash Cows

Becton Dickinson's (BD) hypodermic products and vascular access solutions are classic Cash Cows. These are fundamental medical essentials with massive global demand, evidenced by BD delivering over 34 billion devices annually. Their widespread adoption and necessity in healthcare settings worldwide mean they command a significant market share and generate robust, consistent cash flow.

The mature nature of these markets, coupled with their essential status, means BD doesn't need to spend heavily on marketing or innovation to maintain sales. This low investment requirement, combined with high sales volume, translates directly into substantial profits and a strong cash-generating engine for the company.

Becton Dickinson's Specimen Management unit, exemplified by its iconic BD Vacutainer™ line, stands as a quintessential Cash Cow. This segment benefits from broad volume strength, underscored by consistent customer adoption and upgrades to more sophisticated, higher-value products within the portfolio.

The unit commands a substantial market share within a mature and stable market, a characteristic that translates directly into reliable and predictable cash flow for Becton Dickinson. These products are fundamental to the daily operations of clinical laboratories worldwide, ensuring a steady stream of revenue with relatively low reinvestment needs for growth.

Becton Dickinson's legacy dispensing and pharmacy automation solutions, while perhaps not experiencing rapid growth, are solid cash cows. These systems are deeply embedded in hospital operations, meaning they have a significant market share and generate consistent, recurring revenue. For instance, their established presence ensures continued demand for maintenance, consumables, and software updates.

These mature products benefit from high market penetration, making them reliable income streams for BD. While other areas like infusion solutions might be the growth engines, these established systems provide the financial stability needed to fund those expanding ventures. Their operational efficiencies for healthcare providers also solidify their position and ongoing use.

Traditional Surgical Devices (excluding high-growth innovations)

Becton Dickinson's traditional surgical devices, outside of their innovative segments, likely represent a significant portion of their mature market share. These established products, with their loyal customer base, generate predictable revenue streams. For instance, in fiscal year 2023, BD reported total revenue of $20.4 billion, with their Surgical Solutions segment contributing a substantial portion, reflecting the ongoing demand for these core offerings.

These offerings are characterized by their consistent profitability, requiring minimal incremental investment for sustained market presence. This stability allows BD to allocate resources to higher-growth areas while still benefiting from the reliable cash flow generated by these legacy products. They serve as the backbone of the company's surgical division.

- Established Market Presence: These devices often hold a dominant share in their respective mature surgical markets.

- Predictable Revenue: They provide a stable and consistent income stream due to established demand and customer loyalty.

- Low Investment Needs: Minimal capital expenditure is typically required to maintain their market position and profitability.

- Profitability Contribution: They are key contributors to overall company earnings without the high risk associated with new product development.

Pharmaceutical Systems (Prefillable Syringes for established drugs)

Becton Dickinson's (BD) Pharmaceutical Systems, specifically its prefillable syringes for established drugs, are classic cash cows. These products hold a significant market share within a mature industry, meaning growth is slow but steady. This stability is further bolstered by long-term supply agreements with pharmaceutical companies, ensuring a consistent revenue stream.

The essential nature of drug delivery for these established medications means demand remains robust, even in slower economic periods. BD's investment in this segment is focused on operational excellence and cost efficiency rather than groundbreaking innovation or market expansion. For example, BD announced a significant expansion of its prefillable syringe manufacturing capacity in 2022, investing $1.5 billion to support growing demand, particularly for biologics and vaccines, which includes capacity for established drug delivery systems.

- High Market Share: Dominant position in the mature prefillable syringe market for established drugs.

- Stable Cash Flows: Predictable revenue driven by long-term contracts and essential drug delivery.

- Low Investment Needs: Focus on maintaining efficiency rather than aggressive growth initiatives.

- Profitability: Generates substantial profits with minimal reinvestment required.

Becton Dickinson's (BD) legacy infusion pumps and related consumables represent strong cash cows. These devices, while perhaps not at the cutting edge of technological advancement, are widely adopted in healthcare settings and benefit from a sticky customer base that relies on them for critical patient care. The installed base ensures a steady demand for replacement parts, maintenance services, and the consumables that accompany their use.

The mature market for these infusion systems means that BD faces less intense competition from disruptive technologies, allowing for stable pricing and predictable sales volumes. The company's focus here is on optimizing manufacturing efficiency and supply chain reliability, which translates into high profit margins and consistent cash generation. For instance, BD's infusion systems are a cornerstone of hospital care, with millions of units in use globally, underscoring their market penetration and revenue stability.

BD's commitment to supporting these established products through ongoing service and supply, even as newer technologies emerge, solidifies their cash cow status. This strategy allows BD to leverage its existing infrastructure and brand reputation to extract maximum value from these mature product lines, providing a reliable financial foundation for investment in growth areas.

| Product Segment | BCG Category | Key Characteristics | Financial Impact |

| Infusion Pumps & Consumables | Cash Cow | High market share in mature segment, stable demand, low R&D needs | Consistent, strong cash flow generation, high profit margins |

What You See Is What You Get

Becton Dickinson BCG Matrix

The Becton Dickinson BCG Matrix preview you see is the exact, fully formatted report you will receive immediately after purchase. This comprehensive document, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional, ready-to-use analysis of Becton Dickinson's product portfolio. You can confidently download this file knowing it's the complete, editable version, perfect for immediate integration into your business planning and decision-making processes.

Dogs

Older diagnostic tests, especially in microbiology, often find themselves in a challenging spot within the BCG matrix. Think of them as the established, but perhaps less exciting, products. These might be facing what the industry calls a tough prior-year comparison, meaning their sales growth is slowing down, or they had a delayed start to their selling season, which also points to a stagnant or declining market share in areas that aren't growing much.

Products like these are vulnerable. New competitors can easily pop up, or newer, more advanced technologies can make them obsolete. This means they don't generate much cash to reinvest, and BD might even consider selling them off. In fact, BD’s own strategic moves away from certain diagnostic areas suggest these older tests are prime candidates for divestiture.

Becton Dickinson's (BD) divestiture of its Surgical Instrumentation platform exemplifies a classic 'Dog' in the BCG Matrix. This move signals that the platform operates in a low-growth market and has a poor strategic fit with BD's current focus, marking it as a product line managed for eventual sale to redeploy capital and resources towards more promising ventures.

Becton Dickinson's Life Sciences segment, particularly Biosciences, has faced headwinds from what they termed 'transitory market dynamics' and reduced demand for research instruments. A significant factor contributing to this was the impact of U.S. research grant cuts, which directly affected purchasing power for these critical tools.

While Becton Dickinson is in the process of separating this segment, certain legacy research instruments could be categorized as Dogs in the BCG Matrix. This classification would apply if these instruments hold a low market share and operate within sub-markets that are either in decline or facing significant challenges, making future growth prospects dim.

Non-Strategic or Underperforming Acquired Assets

Acquired assets that don't integrate smoothly or deliver on their projected growth can quickly fall into the 'dog' category. This often happens when they are in slow-growing sectors and struggle to capture a meaningful market share. For instance, if Becton Dickinson (BD) acquired a company in a mature medical device market that experienced minimal innovation, and that acquired entity failed to differentiate itself, it would likely become a dog.

BD's continuous portfolio assessment is designed to identify these underperforming assets. The company actively reviews its acquisitions to ensure they contribute positively to its overall strategic goals. In 2024, BD continued its focus on portfolio optimization, which includes scrutinizing the performance of its acquired businesses against predefined integration and growth milestones.

Such identified 'dogs' become prime candidates for strategic adjustments. These might involve streamlining operations to reduce costs, investing in revitalization efforts if a turnaround is feasible, or ultimately, divesting the asset to free up capital and management attention for more promising ventures. This proactive approach helps maintain a healthy and dynamic business portfolio.

- Underperforming Acquisitions: Assets that fail to integrate or meet growth targets in low-growth markets.

- Portfolio Review: BD's ongoing process to identify and address underperforming business units.

- Divestiture Potential: Identified 'dogs' are candidates for streamlining or sale to improve overall portfolio health.

Products Heavily Impacted by China's Volume-Based Procurement (VBP)

Products like certain Peripheral Intervention (PI) oncology devices and some MDS products have been significantly impacted by China's volume-based procurement (VBP) policies. This has led to intense pricing pressure, driving down revenue in these specific market segments. For Becton Dickinson, these represent challenging areas within their portfolio.

These VBP-affected product lines are characterized by low growth and low profitability. In 2024, the impact of these policies continued to reshape the market landscape for medical devices in China, forcing manufacturers to re-evaluate their strategies in these segments. The reduced margins make market share less attractive from a profitability perspective.

- Pricing Pressure: VBP policies in China directly target price reductions, impacting revenue streams for affected products.

- Low Growth/Low Profitability: Segments subject to VBP often become low-growth and low-profitability markets.

- Market Share Value Diminished: Reduced margins under VBP make gaining or holding market share less financially rewarding.

- Strategic Re-evaluation: Companies like Becton Dickinson must adapt their strategies for these challenged product categories.

Products categorized as Dogs in Becton Dickinson's BCG Matrix are those with low market share in low-growth markets. These are often legacy products or acquired businesses that haven't gained traction. BD's strategic focus involves identifying and managing these underperformers, potentially through divestiture, to reallocate resources effectively.

In 2024, Becton Dickinson continued its portfolio optimization efforts, which inherently involves evaluating assets that may fit the 'Dog' profile. This includes scrutinizing acquired businesses and legacy product lines for their growth potential and market position. For instance, certain older diagnostic tests or instruments in slow-growing segments might be candidates for divestment if they demonstrate stagnant or declining market share and low profitability.

The impact of external factors like China's volume-based procurement (VBP) policies in 2024 has also created 'Dog' like conditions for specific product lines, such as certain Peripheral Intervention oncology devices and MDS products. These policies impose significant pricing pressure, leading to low revenue growth and diminished profitability, making these segments less attractive and potentially candidates for strategic reassessment or divestiture.

BD's proactive portfolio management aims to identify these underperforming assets. The company's strategic reviews are designed to ensure that capital and management attention are directed towards higher-growth, higher-return opportunities, a process that naturally involves considering the future of 'Dog' category products.

Question Marks

Becton Dickinson (BD) is strategically positioning itself within the burgeoning field of Artificial Intelligence (AI) and digital health solutions. The company is making substantial investments, evidenced by the establishment of an AI incubator and the integration of AI into its core operational analytics and product platforms. This forward-looking approach aims to drive innovation and efficiency across its business.

While the broader AI in healthcare market is experiencing rapid growth, BD's specific market share in AI-driven products is still in its nascent stages. These ventures, therefore, are categorized as Question Marks in the BCG Matrix. They represent significant growth potential but also require substantial investment and strategic focus to capture market share and evolve into Stars.

Becton Dickinson's (BD) upcoming next-generation cell sorter research instruments are positioned as a significant investment within their BD 2025 strategy, targeting the burgeoning life sciences sector. This move signals BD's intent to capture market share in high-growth areas like cell and gene therapy, a market projected to reach substantial valuations in the coming years.

While the specific market share for these new instruments is still developing, the dynamic nature of the cell and gene therapy market suggests a need for considerable investment in research, development, and marketing. BD's commitment here reflects a strategic push to establish a stronger presence in a field with immense future potential.

Becton Dickinson's strategic emphasis on emerging biopharma systems, including GLP-1 drug delivery and patient-operated injectors, positions them within a high-growth trajectory, with projections indicating a billion-dollar revenue stream by 2030. This segment is characterized by rapid innovation and evolving market dynamics.

These biopharma systems are considered 'Stars' in the BCG Matrix framework. While the market potential is immense, BD's market share in these specific, nascent drug delivery technologies is still developing. Successful execution of their investment strategy in these areas could solidify their leadership position.

Connected Care Programs (post-Edwards Critical Care acquisition)

The Connected Care segment, bolstered by the Edwards Critical Care acquisition, positions Becton Dickinson (BD) within a high-growth area leveraging advanced analytics and AI with smart devices. This strategic focus for 'New BD' aims to capture a significant share in an evolving market. BD is actively investing in this segment to solidify its position and drive future growth.

While the market for integrated critical care solutions is expanding rapidly, BD's market share in this specific, technology-driven space is still developing. Significant investment is crucial to fully capitalize on the potential of these smart device integrations and data analytics. The objective is to transition these offerings from a question mark position towards a 'Star' in the BCG matrix.

- Market Growth: The global remote patient monitoring market, a key component of Connected Care, was projected to reach approximately $110 billion by 2024, indicating substantial expansion.

- BD's Investment: BD's strategic investments, including the reported $1.7 billion acquisition of Edwards Lifesciences' critical care business in 2020, underscore their commitment to this segment.

- Strategic Goal: The aim is to build market leadership by integrating advanced monitoring and data analytics, moving these solutions towards a 'Star' status by capturing increasing market share in a high-growth environment.

New Technologies for Chronic Disease Outcomes

Becton Dickinson's (BD) 2025 strategy heavily features advancements in chronic disease management, a critical area for future healthcare growth. New technologies targeting these conditions are often in their nascent stages, demanding significant investment in research and development alongside efforts to drive market acceptance. These innovations are positioned as potential future revenue streams, though their eventual market dominance remains to be seen in competitive landscapes.

BD's focus on chronic diseases aligns with a global demographic shift towards aging populations and the increasing prevalence of conditions like diabetes, cardiovascular disease, and respiratory illnesses. For instance, the global diabetes care market alone was projected to reach over $60 billion by 2025, highlighting the immense opportunity. BD's pipeline likely includes diagnostic tools, monitoring devices, and potentially therapeutic delivery systems designed to improve patient outcomes and reduce healthcare burdens associated with these long-term conditions.

- Focus on Early Detection: Innovations aimed at earlier and more accurate diagnosis of chronic diseases, potentially reducing long-term complications.

- Improved Patient Monitoring: Development of connected devices and platforms for continuous patient monitoring, enabling proactive intervention.

- Enhanced Treatment Delivery: Technologies that improve the efficacy and convenience of delivering treatments for chronic conditions, such as advanced drug delivery systems.

- Data Analytics for Personalized Care: Leveraging data from new technologies to offer more personalized treatment plans and predict disease progression.

Becton Dickinson's (BD) investments in emerging AI and digital health solutions, alongside next-generation cell sorters and new chronic disease management technologies, currently represent Question Marks in the BCG Matrix. These areas exhibit high market growth potential but require substantial ongoing investment to establish market share and transition into Stars.

BD's strategic focus on areas like AI-driven analytics, cell and gene therapy instruments, and advanced chronic disease management technologies places them in high-growth markets. However, their current market share in these nascent fields is still developing, necessitating significant capital allocation for research, development, and market penetration to achieve leadership.

The company's commitment to these segments reflects a deliberate strategy to capitalize on future healthcare trends, such as personalized medicine and remote patient monitoring, which are projected for significant expansion. For instance, the global AI in healthcare market was anticipated to grow substantially, with various estimates suggesting a compound annual growth rate (CAGR) well into the double digits leading up to 2025.

BD's objective is to transform these high-potential, but currently low-market-share, ventures into dominant market positions. This requires a careful balance of innovation, strategic partnerships, and aggressive market entry to outpace competitors and secure a leading role in these evolving healthcare sectors.

| BD Segment | BCG Category | Market Growth | BD's Current Share | Strategic Focus |

|---|---|---|---|---|

| AI & Digital Health | Question Mark | High | Nascent | Investment in R&D, AI Incubator |

| Next-Gen Cell Sorters | Question Mark | High (Life Sciences, Cell & Gene Therapy) | Developing | Targeting high-growth life sciences |

| Chronic Disease Management Tech | Question Mark | High (Aging Population, Diabetes Market >$60B by 2025) | Developing | Focus on early detection, monitoring, treatment delivery |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.