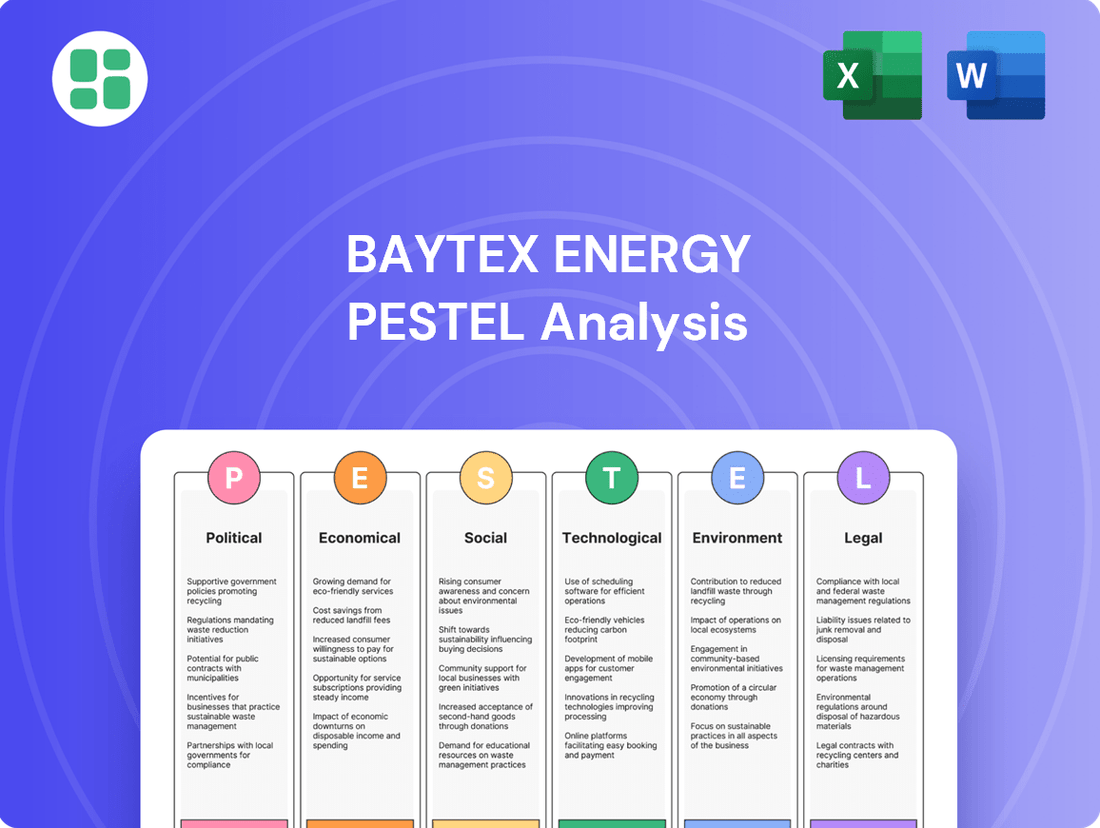

Baytex Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baytex Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Baytex Energy's trajectory. Our PESTLE analysis provides a comprehensive overview, equipping you with the foresight needed to navigate the evolving energy landscape. Don't be left behind – gain a competitive advantage by understanding these vital external forces. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies in Canada and the United States, where Baytex Energy primarily operates, significantly shape the oil and gas landscape. Canada's commitment to net-zero emissions by 2050 and a target of reducing greenhouse gas (GHG) emissions by 40-45% by 2030, including a proposed cap on oil and gas sector emissions, presents a complex regulatory environment.

These initiatives, such as the federal carbon pricing system and provincial regulations on methane emissions, can directly impact Baytex's operational costs and strategic planning. For example, the Canadian government's emissions reduction targets, if fully implemented, could necessitate substantial investments in emissions reduction technologies for Baytex's facilities.

Tensions between Canada's federal government and Alberta, particularly regarding the province's desire for more autonomy over its energy resources, can introduce significant policy uncertainty for companies like Baytex Energy. This dynamic can influence investment decisions and operational planning.

Furthermore, the specter of trade tariffs, such as those previously threatened by the United States on Canadian energy products, poses a direct risk to export markets. For instance, in 2023, the U.S. remained Canada's primary export destination for crude oil, making any disruption to this flow particularly impactful on revenue streams and the overall economic feasibility of Canadian oil and gas production.

Heightened geopolitical tensions globally, particularly in regions critical for oil and gas supply, directly impact energy security discussions. This focus often translates into increased demand for stable, reliable energy sources, potentially benefiting producers like Baytex Energy.

Nations are actively seeking to bolster their energy independence, leading to policies that might favor domestic production or strategic partnerships. This can create both opportunities and challenges for companies operating in the international energy landscape, influencing market access and investment decisions.

The observed 'return to upstream' trend among energy companies, including a renewed focus on exploration and production, is a clear strategic response to these global energy security imperatives. For instance, in 2024, many North American producers, including those in Canada where Baytex operates, saw increased investment in upstream activities driven by the need for secure energy supplies.

Regulatory Environment in the US

The regulatory environment in the United States significantly impacts oil and gas development, particularly on federal lands and offshore areas. These regulations are dynamic, often reflecting the priorities of the current administration. For instance, a shift in presidential administration could introduce policies designed to simplify permitting processes and accelerate environmental reviews, potentially benefiting companies like Baytex Energy with US-based operations.

Such policy shifts could lead to increased opportunities for oil and gas exploration and production. For example, in 2023, the Biden administration approved a record number of oil and gas drilling permits on federal lands, signaling a complex and evolving regulatory landscape. This demonstrates how administrative priorities can directly influence the pace and scope of development, affecting companies operating within these jurisdictions.

- Permitting Streamlining: Policies could reduce the time and complexity involved in obtaining permits for new drilling sites.

- Environmental Approvals: Faster environmental reviews might expedite project development, especially in sensitive areas.

- Federal Land Access: Expanded access to federal lands for oil and gas leasing could open new operational areas.

- Offshore Development: Changes in regulations for offshore leasing could unlock further production potential.

Government Incentives and Subsidies

Both Canadian and US governments are actively providing incentives and tax credits that can significantly impact energy companies like Baytex. For instance, Canada's Clean Economy Investment Tax Credits (ITCs) specifically target projects like carbon capture, utilization, and storage (CCUS). These credits are designed to encourage investment in decarbonization technologies, and Baytex can utilize them to reduce the financial burden of implementing emission reduction strategies.

These government programs are crucial for making large-scale decarbonization projects more economically viable. For example, the Canadian federal government has committed billions of dollars through various climate action plans and tax incentives to support the transition to a lower-carbon economy. Baytex's strategic decisions regarding emissions reduction will likely be influenced by the availability and structure of these financial supports, potentially making investments in CCUS or other green technologies more attractive in 2024 and 2025.

- Canada's Clean Economy Investment Tax Credits (ITCs) for CCUS: Aim to lower the cost of decarbonization technologies.

- US Tax Credits for Carbon Capture: The Inflation Reduction Act of 2022 enhanced Section 45Q tax credits, making CCUS projects more financially appealing in the United States.

- Impact on Investment Decisions: These incentives directly influence Baytex's capital allocation towards emission reduction projects.

- Potential Cost Offsets: Baytex can leverage these programs to offset significant upfront costs associated with environmental compliance and sustainability initiatives.

Government policies in Canada and the US significantly impact Baytex's operations, from emissions regulations like Canada's proposed oil and gas sector cap to US federal land access policies. Geopolitical events and the drive for energy independence also influence market demand and strategic partnerships for companies like Baytex.

Both nations offer incentives, such as Canada's Clean Economy Investment Tax Credits for CCUS and enhanced US Section 45Q tax credits, which can offset costs for emission reduction projects. These financial supports are critical in shaping Baytex's capital allocation towards sustainability initiatives and decarbonization in 2024 and 2025.

What is included in the product

This PESTLE analysis of Baytex Energy examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

A clear, concise PESTLE analysis for Baytex Energy, presented in an easily digestible format, removes the headache of sifting through complex data, enabling faster, more informed strategic decisions.

Economic factors

Global oil and gas prices are a critical factor for Baytex Energy. Fluctuations in benchmarks like WTI and Brent directly affect the company's revenue and bottom line. For instance, Baytex's 2025 budget is built assuming a WTI price of US$65 per barrel, highlighting its sensitivity to these market shifts.

Looking ahead, the U.S. Energy Information Administration (EIA) anticipates that Brent crude prices may see variability in 2025. This forecast is largely shaped by decisions from OPEC+ regarding production levels and the overall trajectory of global demand for energy.

Currency exchange rates are a critical factor for Baytex Energy, given its operations in both Canada and the United States. Fluctuations between the Canadian Dollar (CAD) and the U.S. Dollar (USD) directly influence the company's reported financial results and profitability. For instance, if the USD strengthens against the CAD, it can boost Baytex's free cash flow when U.S. dollar-denominated revenues are converted back into Canadian dollars.

The CAD/USD exchange rate impacts Baytex's cost structure as well. Many operating expenses, particularly those incurred in the U.S., become more or less expensive for the company depending on the prevailing exchange rate. As of early 2025, the CAD/USD hovered around the 0.73-0.75 mark, meaning a stronger U.S. dollar would translate to higher costs for Canadian dollar-based expenses when operating in the U.S., and vice versa.

Baytex's hedging strategies play a crucial role in mitigating the volatility associated with these currency movements. By employing financial instruments to lock in exchange rates for future transactions, the company aims to protect its earnings and cash flows from adverse currency swings. This proactive approach is essential for maintaining financial stability in a cross-border energy market.

Baytex's strategy hinges on careful management of capital expenditures to boost free cash flow and reward shareholders. For 2025, a significant $1.2 to $1.3 billion has been earmarked for exploration and development, a clear signal of their commitment to this disciplined approach.

This investment is designed to maintain steady production levels, which is crucial for generating the substantial free cash flow the company targets. The approved spending reflects a forward-looking view on how capital deployment directly impacts financial health and shareholder value.

Debt Management and Shareholder Returns

Baytex Energy actively manages its debt while focusing on rewarding shareholders. The company has set a clear objective to reduce its net debt to $1.5 billion. This target signifies a strong commitment to financial discipline, aiming for a total debt to EBITDA ratio of approximately 0.7x when WTI crude oil prices are around US$70 per barrel.

This strategic approach to debt reduction enhances the company's balance sheet strength, making it more resilient to market fluctuations. Simultaneously, Baytex prioritizes shareholder returns through various mechanisms.

- Debt Reduction Target: Aiming for $1.5 billion in net debt.

- Leverage Ratio Goal: Targeting a total debt to EBITDA of 0.7x at US$70 WTI.

- Shareholder Returns: Prioritizing dividends and share repurchases.

Market Demand and Supply Dynamics

Global oil demand is showing robust growth, but this is being met by significant increases in supply from non-OPEC countries, notably the United States, Canada, and Brazil. This creates a dynamic and often unpredictable balance in the market.

The U.S. Energy Information Administration (EIA) forecasts that global oil production growth will likely exceed demand growth from mid-2025 through 2026. This projected imbalance could put downward pressure on oil prices.

- Global Oil Demand Growth: Expected to continue, driven by economic activity.

- Non-OPEC Supply Increases: Significant contributions from the US, Canada, and Brazil are reshaping the supply landscape.

- EIA Projection (Mid-2025 to 2026): Production growth anticipated to outpace demand, suggesting potential price moderation.

Economic factors significantly influence Baytex Energy's performance, particularly global oil prices and currency exchange rates. The company's 2025 budget assumes a WTI price of US$65 per barrel, underscoring its sensitivity to market volatility. The EIA projects that production growth, especially from non-OPEC nations, may outpace demand in 2025-2026, potentially moderating prices.

Currency fluctuations between the CAD and USD directly impact Baytex's reported earnings and operational costs, as many expenses are incurred in the U.S. A strengthening USD can increase costs for Canadian dollar-based expenses when operating in the U.S. Baytex employs hedging strategies to mitigate these currency risks.

| Key Economic Factor | Baytex Energy's 2025 Outlook/Impact | Supporting Data/Projection |

| Global Oil Prices (WTI) | Crucial for revenue; budget assumes US$65/barrel. | EIA anticipates Brent price variability in 2025 due to OPEC+ and demand. |

| Currency Exchange Rates (CAD/USD) | Affects reported financials and operating costs. | Early 2025 CAD/USD around 0.73-0.75; stronger USD increases U.S. dollar costs for CAD-based expenses. |

| Global Oil Supply vs. Demand | Increased non-OPEC supply may pressure prices. | EIA forecasts production growth to exceed demand mid-2025 through 2026. |

Preview Before You Purchase

Baytex Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Baytex Energy covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external forces shaping Baytex Energy's future with this detailed report.

Sociological factors

Public perception of fossil fuels is increasingly negative, driven by widespread concern over climate change. This sentiment directly impacts policy, with many governments setting ambitious net-zero targets, which inherently restricts fossil fuel expansion. For instance, in 2023, renewable energy sources accounted for a significant portion of new global power capacity additions, reflecting this shift in public and governmental priorities.

Baytex Energy, like its peers, feels this pressure to adapt. Investors are scrutinizing environmental, social, and governance (ESG) performance more than ever. Companies that fail to demonstrate a commitment to decarbonization and responsible operations risk capital flight and reputational damage. Baytex's 2024 sustainability reports highlight investments in carbon capture technologies and emission reduction initiatives, aiming to address these public and investor concerns.

The global shift towards cleaner energy sources significantly influences how investors perceive and fund traditional oil and gas companies. This transition pressures firms like Baytex to demonstrate commitment to sustainability, affecting their ability to secure capital and maintain investor confidence.

Baytex is actively navigating this landscape by focusing on responsible energy development. The company is exploring opportunities in carbon-neutral hydrogen production and engaging in carbon capture partnerships, signaling a strategic move to align with the evolving energy transition and ESG (Environmental, Social, and Governance) expectations.

The oil and gas industry remains a cornerstone of employment in both Canada and the United States. For instance, in 2023, the Canadian oil and gas sector directly and indirectly supported over 577,000 jobs, underscoring its vital role in the national economy.

Looking ahead to 2025, projections indicate a notable uptick in drilling activity across Western Canada. This anticipated surge is expected to translate into significant job creation, further solidifying the industry's contribution to regional employment and economic stability.

Community Relations and Local Impact

Baytex Energy's operations in Western Canada and the United States directly influence the local communities where they operate, necessitating a strong focus on community relations. The company's commitment to addressing local concerns, such as environmental stewardship and economic contributions, is vital for maintaining its social license to operate. For instance, in 2023, Baytex reported significant capital expenditures in Alberta, contributing to local economies through employment and procurement. This direct local impact underscores the importance of proactive engagement.

Maintaining positive community relations is paramount for Baytex's long-term sustainability. This involves transparent communication, active listening to stakeholder feedback, and demonstrating a commitment to responsible resource development. In 2024, Baytex continued its community investment programs, focusing on areas like education and environmental initiatives in regions like the Peace River area of Alberta. These efforts aim to build trust and ensure that the company's activities are viewed as beneficial to the local populace.

- Community Engagement: Baytex actively participates in local events and supports community-based projects to foster positive relationships.

- Local Economic Impact: The company's operational presence generates employment opportunities and supports local businesses through its supply chain.

- Environmental Stewardship: Addressing local environmental concerns and implementing best practices are key to maintaining community trust.

- Stakeholder Dialogue: Regular consultations with Indigenous communities and local residents ensure that concerns are heard and addressed.

Consumer Behavior and Demand Shifts

Shifting consumer preferences toward sustainability are increasingly influencing energy demand. For instance, the International Energy Agency (IEA) projected in its 2024 Oil Market Report that while global oil demand is expected to see continued growth in the short term, it is anticipated to peak around 2030, with a subsequent gradual decline. This trajectory highlights the growing impact of energy efficiency measures and the adoption of alternative energy sources.

These long-term behavioral changes can gradually reduce the overall demand for traditional fossil fuels like crude oil and natural gas. Businesses in the energy sector, including Baytex Energy, must proactively adapt to these evolving consumption patterns to remain competitive and relevant in the coming years.

- Growing consumer preference for electric vehicles (EVs) is a key driver of reduced gasoline demand. By 2030, the IEA forecasts that EVs could account for nearly 15% of global car sales, up from around 10% in 2023.

- Increased adoption of renewable energy sources like solar and wind power for electricity generation directly displaces the need for natural gas in power plants.

- Corporate sustainability initiatives and government regulations are pushing for greater energy efficiency across industries and households, further impacting overall energy consumption.

- Consumer awareness campaigns promoting reduced energy usage and the benefits of conservation contribute to a gradual but significant shift in demand patterns.

Societal expectations are increasingly focused on corporate responsibility and ethical conduct, pushing companies like Baytex Energy to demonstrate strong ESG performance. This includes transparent reporting on emissions, community impact, and labor practices, with investors and the public scrutinizing these areas more closely. For example, in 2024, the Canadian oil and gas industry saw increased investor activism around climate-related disclosures and transition strategies.

Technological factors

Technological advancements in drilling and completion are key to boosting efficiency and cutting costs in the oil and gas sector. Baytex Energy has seen this firsthand, achieving impressive results. For instance, in their Pembina Duvernay operations, they've reported record well performance, indicating a significant improvement in how they extract resources.

These improved techniques have also led to substantial cost reductions. In the Eagle Ford play, Baytex has benefited from these innovations, further solidifying the financial advantages of adopting cutting-edge drilling and completion methods. This focus on technology directly impacts their bottom line and operational success.

Carbon Capture, Utilization, and Storage (CCUS) technologies are gaining significant traction within the oil and gas sector as companies strive to meet ambitious emission reduction goals. Baytex Energy is actively investigating potential carbon capture partnerships, reflecting a wider industry movement to integrate CCUS solutions for operational decarbonization. For instance, in 2024, the International Energy Agency reported that global CO2 emissions from energy combustion and industrial processes reached approximately 37.1 billion tonnes, highlighting the scale of the challenge CCUS aims to address.

Baytex Energy is increasingly leveraging digitalization and AI to enhance its upstream operations. This strategic adoption of advanced technologies, including machine learning, is crucial for optimizing exploration and production processes. For instance, the integration of AI-driven drilling systems can lead to more precise well placement and improved extraction rates, directly impacting operational efficiency and cost reduction.

The company is exploring the application of 'cognitive fields', a concept where AI continuously analyzes vast datasets in real-time to make predictive adjustments to operational parameters. This proactive approach, supported by advanced seismic algorithms, allows for better reservoir understanding and management. In 2024, the energy sector saw significant investment in digital transformation, with companies aiming to boost productivity by an average of 10-15% through AI implementation.

Methane Emission Reduction Technologies

Addressing methane emissions is a strategic imperative for Baytex Energy, driven by mounting environmental scrutiny and evolving regulations. Technologies focused on detecting and preventing these potent greenhouse gas releases are crucial for the oil and gas industry to maintain compliance and enhance its environmental stewardship.

The adoption of advanced methane detection technologies, such as infrared cameras and drone-based sensors, allows for more precise identification of leaks across Baytex's operations. These tools are vital for meeting stringent reporting requirements and demonstrating a commitment to reducing fugitive emissions, a key performance indicator for the sector.

Baytex Energy is actively investing in and implementing technologies designed for methane emission prevention. This includes upgrading equipment to minimize leaks and exploring innovative solutions for capturing or mitigating methane at various points in the production and processing chain.

Key technological advancements and their impact include:

- Advanced Leak Detection: Deployment of optical gas imaging (OGI) cameras and continuous monitoring systems to identify and quantify methane leaks more effectively.

- Vapor Recovery Units (VRUs): Installation of VRUs at well sites and processing facilities to capture methane that would otherwise be vented or released.

- Reduced Emission Completions (RECs): Utilizing technologies that capture methane during well completion and workover operations, significantly reducing flaring and venting.

- Digitalization and AI: Leveraging data analytics and artificial intelligence to optimize operations, predict potential leak points, and improve the efficiency of emission reduction efforts.

Renewable Energy Integration and Electrification

Baytex Energy, while rooted in oil and gas, is actively exploring avenues within the energy transition. This includes investigating distributed hydrogen models that utilize renewable natural gas, signaling a strategic move towards integrating cleaner energy solutions to reduce their carbon footprint.

This exploration aligns with broader industry trends. For instance, the global renewable energy sector saw significant investment in 2024, with projections indicating continued growth. Baytex's focus on renewable natural gas for hydrogen production could position them to capitalize on this evolving market, potentially lowering operational costs and meeting increasingly stringent environmental regulations.

- Hydrogen Market Growth: The global green hydrogen market is expected to reach $75.4 billion by 2030, presenting a substantial opportunity for companies like Baytex exploring this technology.

- Renewable Natural Gas (RNG) Potential: RNG offers a pathway to decarbonize natural gas operations, with North American RNG production projected to increase significantly in the coming years.

- Electrification Trends: The increasing electrification of transportation and industrial processes creates demand for cleaner energy sources, which Baytex's renewable initiatives could help meet.

Baytex Energy is significantly enhancing operational efficiency and cost-effectiveness through advanced drilling and completion technologies, as evidenced by record well performance in their Pembina Duvernay operations. These technological strides are directly translating into financial benefits, with notable cost reductions observed in their Eagle Ford operations, underscoring the competitive advantage derived from innovation.

The company is also strategically investing in digitalization and AI to optimize upstream processes, aiming to improve exploration and production through machine learning and AI-driven systems for more precise well placement and extraction. Furthermore, Baytex is actively exploring Carbon Capture, Utilization, and Storage (CCUS) technologies and investigating distributed hydrogen models utilizing renewable natural gas as part of its decarbonization strategy.

Baytex Energy is actively implementing technologies to combat methane emissions, including advanced leak detection systems and vapor recovery units, to meet regulatory demands and environmental stewardship goals. Their adoption of Reduced Emission Completions (RECs) further minimizes flaring and venting during critical operational phases.

The company's focus on renewable natural gas for hydrogen production aligns with significant market growth, with the global green hydrogen market projected to reach $75.4 billion by 2030, offering a pathway to capitalize on cleaner energy demands and meet evolving environmental standards.

| Technology Area | Baytex Energy Application | Industry Trend/Impact |

|---|---|---|

| Advanced Drilling & Completion | Record well performance (Pembina Duvernay), Cost reduction (Eagle Ford) | Boosts efficiency and lowers extraction costs. |

| Digitalization & AI | Optimizing upstream operations, Predictive maintenance | Aims for 10-15% productivity increase in energy sector (2024 estimates). |

| CCUS & Methane Reduction | Investigating CCUS partnerships, Advanced leak detection, VRUs, RECs | Addresses ~37.1 billion tonnes global CO2 emissions (2024 IEA data); crucial for regulatory compliance. |

| Hydrogen & RNG | Exploring distributed hydrogen models using RNG | Targets a green hydrogen market projected at $75.4 billion by 2030. |

Legal factors

Environmental regulations, particularly federal emissions caps in Canada, directly influence Baytex Energy's operational strategies. These rules necessitate careful management of greenhouse gas output, impacting production methods and investment in cleaner technologies.

Methane reduction targets in both Canada and the United States present another significant legal factor. Baytex must invest in technologies and practices to meet these evolving standards, potentially increasing operational costs but also driving innovation in emissions control.

Baytex Energy navigates a complex web of permitting and licensing requirements for its oil and gas operations across Canada and the United States. These frameworks are not uniform; they differ significantly based on jurisdiction, encompassing federal, provincial, state, and even tribal land regulations. This jurisdictional variation adds layers of complexity to securing the necessary approvals for exploration and development activities.

The timeline for obtaining these essential permits can be lengthy and subject to unforeseen delays. For instance, in 2024, the average time to secure an oil and gas drilling permit in Alberta, Canada, can range from several weeks to months, depending on the project's scope and environmental assessments. Similarly, in the US, the permitting process for federal lands can extend for over a year. Any shifts or new stipulations in these regulations can directly impact Baytex's project schedules and inflate operational costs, creating a dynamic challenge for strategic planning.

Laws dictating land use and access, especially concerning public and tribal territories in the United States, directly shape Baytex Energy's operational footprint and methodologies. These regulations are crucial for determining where and how the company can explore and extract resources.

Potential shifts in these legal frameworks, such as policy considerations emerging from initiatives like 'Project 2025' in the US, could significantly affect Baytex's ability to secure access to previously untapped oil and gas reserves. For instance, any changes that restrict drilling on federal lands could limit future growth opportunities.

Corporate Governance and Reporting Requirements

Baytex Energy operates under stringent corporate governance and reporting mandates from major stock exchanges like the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE), alongside securities regulators. These requirements are critical for maintaining investor trust and market integrity.

Key legal factors influencing Baytex include adherence to comprehensive financial reporting standards, such as International Financial Reporting Standards (IFRS), ensuring transparency in its financial performance. For instance, in Q1 2024, Baytex reported total revenue of $725 million, a significant figure subject to detailed disclosure.

Furthermore, the company must meticulously disclose its oil and gas activities, including production volumes, reserves, and environmental impact, aligning with regulatory expectations for the energy sector. Compliance with rules governing share repurchase programs, which can impact shareholder value and capital structure, is also a significant legal consideration.

- Financial Reporting: Adherence to IFRS and timely filing of financial statements (e.g., annual reports, quarterly filings) with TSX and NYSE.

- Disclosure of Operations: Detailed reporting on oil and gas reserves, production levels, and exploration activities as per securities regulations.

- Shareholder Rights: Compliance with rules governing share repurchases, dividend payments, and proxy solicitations.

- Regulatory Compliance: Meeting all legal and regulatory obligations set forth by securities commissions and stock exchange listing agreements.

International Trade and Investment Laws

International trade agreements and investment laws significantly shape Baytex Energy's operational landscape, influencing its capacity to export crude oil and natural gas, as well as its ability to attract capital from overseas. For instance, the United States' participation in trade pacts like the USMCA (United States-Mexico-Canada Agreement) can streamline cross-border energy flows, potentially reducing logistical hurdles and associated costs for Baytex. Conversely, shifts in these agreements or the imposition of new tariffs could introduce economic volatility and restrict access to key international markets, impacting revenue streams.

The global energy market is also susceptible to geopolitical tensions and trade disputes, which can directly affect Baytex's export potential and investment climate. For example, trade friction between major economic blocs could lead to retaliatory tariffs on energy products, creating uncertainty and potentially increasing the cost of doing business. As of late 2024, ongoing discussions around global energy security and trade policies continue to be a critical factor for companies like Baytex operating in international arenas.

- Trade Agreements: Baytex benefits from trade agreements that facilitate the movement of energy products across borders, such as those involving North America.

- Investment Laws: Foreign investment laws can impact Baytex's ability to secure capital for its projects, with varying regulations across different jurisdictions.

- Trade Disputes: Potential trade disputes or the imposition of tariffs by governments could create economic uncertainty and limit Baytex's market access.

- Market Access: Changes in international trade policies directly influence Baytex's ability to reach global customers and secure favorable pricing for its production.

Baytex Energy's legal obligations extend to robust financial reporting and operational disclosures, crucial for maintaining investor confidence and regulatory compliance. Adherence to standards like IFRS and timely filings with bodies such as the TSX and NYSE are paramount. For instance, in Q1 2024, Baytex reported substantial revenue, necessitating detailed transparency in its financial statements.

The company must also comply with specific rules governing share repurchases and shareholder rights, impacting its capital structure and investor relations. Furthermore, international trade agreements, like the USMCA, significantly influence Baytex's cross-border operations and market access, though trade disputes can introduce considerable economic uncertainty.

| Legal Factor | Description | Impact on Baytex Energy |

|---|---|---|

| Financial Reporting & Disclosure | Adherence to IFRS, timely filings with TSX/NYSE, disclosure of reserves and production. | Ensures investor trust, regulatory compliance, and transparency. Q1 2024 revenue of $725 million requires detailed reporting. |

| Shareholder Rights & Governance | Compliance with rules on share repurchases, dividend payments, proxy solicitations. | Affects capital structure, shareholder value, and corporate governance practices. |

| International Trade & Investment | Navigating trade agreements (e.g., USMCA) and foreign investment laws. | Facilitates cross-border energy flows and capital access but is vulnerable to trade disputes and tariffs, impacting market access and revenue. |

Environmental factors

The intensifying global commitment to climate action, including national net-zero emission targets, presents a significant operational context for Baytex Energy. These policies directly influence the demand for and production of fossil fuels.

Baytex must actively demonstrate its commitment to reducing its environmental impact. For instance, in 2023, the company reported its Scope 1 and Scope 2 greenhouse gas emissions intensity was 18.5 kg CO2e/boe, a figure it aims to further decrease.

Alignment with broader climate goals means adapting business strategies to incorporate lower-carbon solutions and transparently reporting on progress. This includes investments in technologies that can mitigate emissions from its operations.

Baytex Energy is actively working to reduce its greenhouse gas emissions intensity, a critical environmental performance indicator. This commitment is a direct response to increasing global pressure and regulatory frameworks aimed at mitigating climate change impacts.

The company's strategy involves significant investment in innovative technologies and operational efficiencies designed to lower emissions stemming from its crude oil and natural gas extraction processes. For instance, Baytex reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity by approximately 10% between 2019 and 2023, a tangible step towards its sustainability goals.

Baytex Energy's operations, particularly those involving hydraulic fracturing, face significant environmental scrutiny regarding water usage. Regulations around water sourcing, discharge, and disposal are becoming increasingly stringent, impacting operational costs and requiring robust management strategies. For instance, in 2023, the oil and gas industry in North America consumed billions of gallons of water for hydraulic fracturing, highlighting the scale of this environmental factor.

Land Reclamation and Biodiversity Protection

Environmental regulations are increasingly pushing companies like Baytex Energy to actively engage in land reclamation following resource extraction activities. This involves restoring disturbed land to a usable or natural state, often a legal requirement that impacts operational costs and timelines. For instance, in 2023, Baytex reported its ongoing commitment to reclamation efforts across its operating regions, with a focus on meeting or exceeding regulatory standards.

Protecting biodiversity in and around operational areas is another critical environmental factor. Baytex's responsible energy development strategy incorporates measures aimed at minimizing its ecological footprint, which can include habitat preservation and mitigation plans. The company actively monitors its impact on local ecosystems, striving to balance energy production with the conservation of wildlife and natural habitats.

- Land Reclamation Costs: Baytex's 2023 sustainability report detailed expenditures related to land reclamation, demonstrating a proactive approach to environmental stewardship.

- Biodiversity Impact Assessments: The company conducts regular assessments to understand and mitigate potential impacts on local biodiversity in its Canadian and U.S. operating areas.

- Regulatory Compliance: Adherence to stringent environmental regulations, including those for land reclamation and biodiversity protection, is a core component of Baytex's operational framework.

- Ecological Footprint Reduction: Baytex is invested in initiatives designed to reduce its overall ecological footprint, reflecting a commitment to sustainable energy practices.

Methane Leakage and Fugitive Emissions

Methane, a potent greenhouse gas, presents a significant environmental challenge for the oil and gas industry. Baytex Energy, like its peers, faces increasing regulatory pressure to curb these fugitive emissions.

New regulations, such as those implemented by the EPA in the United States and similar initiatives in Canada, mandate rigorous leak detection and repair (LDAR) programs for upstream operations. For instance, the U.S. EPA's proposed rules in 2024 aim to significantly reduce methane emissions from oil and gas facilities, requiring more frequent inspections and prompt repairs of identified leaks.

- Methane's Potency: Methane traps significantly more heat than carbon dioxide over a 20-year period, making its reduction a priority for climate action.

- Regulatory Focus: Governments globally are intensifying efforts to regulate methane emissions from oil and gas production, impacting operational costs and strategies.

- Industry Response: Companies are investing in advanced detection technologies and implementing comprehensive LDAR programs to comply with these evolving environmental standards.

Baytex Energy operates within an increasingly stringent environmental regulatory landscape, driven by global climate action. The company's commitment to reducing its greenhouse gas emissions intensity, which stood at 18.5 kg CO2e/boe in 2023, is a direct response to these pressures. This includes adapting to policies that influence fossil fuel demand and production.

Water usage in operations, particularly hydraulic fracturing, is under significant scrutiny. Baytex must navigate evolving regulations concerning water sourcing and disposal, which impact operational costs. The industry's substantial water consumption in 2023 underscores the importance of robust water management strategies.

Land reclamation and biodiversity protection are critical environmental considerations for Baytex. The company's 2023 sustainability report highlights expenditures on reclamation and ongoing biodiversity impact assessments, demonstrating a commitment to minimizing its ecological footprint and adhering to regulatory standards.

Methane emissions are a key focus, with new regulations in the U.S. and Canada mandating improved leak detection and repair (LDAR) programs. The U.S. EPA's proposed rules in 2024 aim to significantly curb these potent greenhouse gas emissions, requiring more frequent inspections and prompt repairs.

| Environmental Factor | Baytex's 2023 Data/Activity | Regulatory Context/Industry Trend |

| GHG Emissions Intensity | 18.5 kg CO2e/boe | Global net-zero targets, pressure to reduce emissions |

| Water Usage | Billions of gallons industry-wide for fracking | Increasingly stringent regulations on water sourcing and discharge |

| Land Reclamation | Ongoing commitment and reported expenditures | Legal requirements and focus on restoring disturbed land |

| Biodiversity Protection | Regular impact assessments conducted | Minimizing ecological footprint, habitat preservation efforts |

| Methane Emissions | Focus on LDAR programs | New EPA regulations (2024) targeting methane reduction |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Baytex Energy is built on a robust foundation of data from official government agencies, reputable financial institutions, and leading energy industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.