Baytex Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baytex Energy Bundle

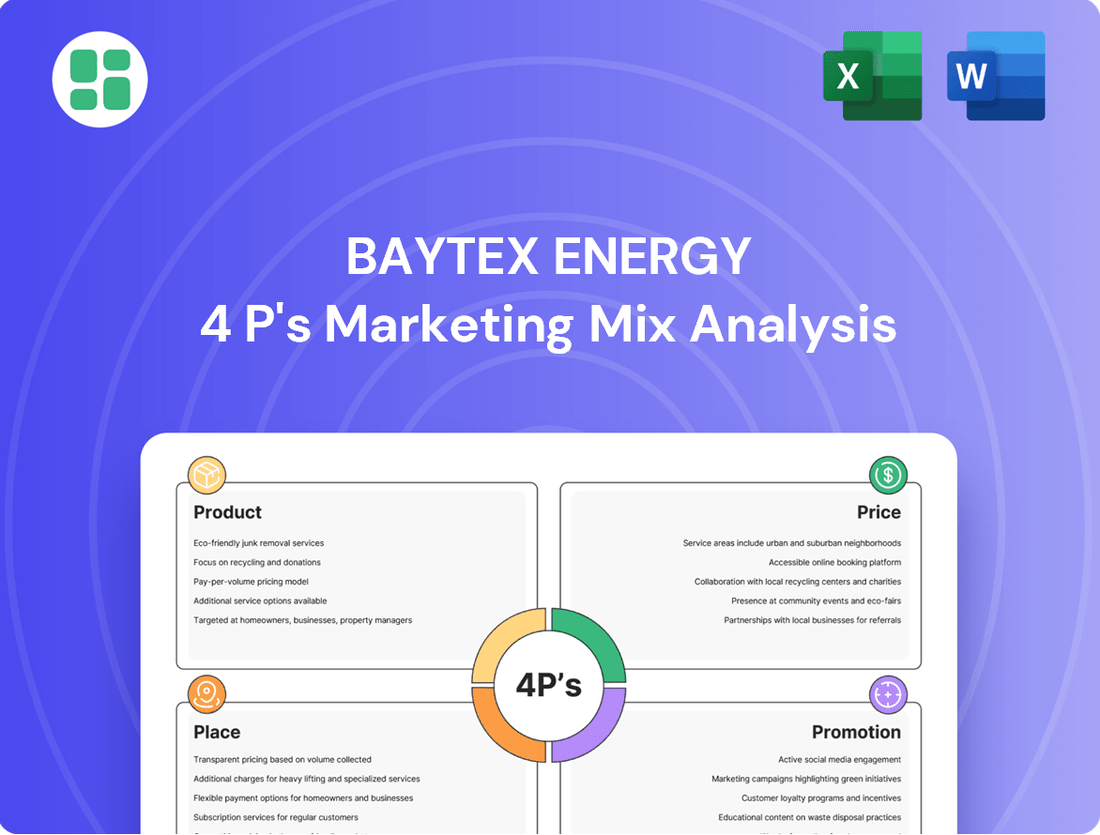

Discover the strategic brilliance behind Baytex Energy's market presence through a comprehensive 4Ps Marketing Mix Analysis. This report delves into their product offerings, pricing strategies, distribution channels, and promotional activities, revealing the cohesive approach that drives their success.

Unlock actionable insights into how Baytex Energy masterfully balances its product portfolio, pricing structures, market placement, and communication efforts. This detailed analysis is your key to understanding their competitive edge and applying similar strategies to your own business.

Ready to elevate your marketing understanding? Gain instant access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Baytex Energy, providing a robust framework for strategic planning and competitive benchmarking.

Product

Baytex Energy's core products are crude oil and natural gas, featuring a diverse range from light oil in the Eagle Ford (US) and Canadian assets like Pembina Duvernay and Viking, to heavy oil from Peace River and Lloydminster (Canada). This broad spectrum allows them to cater to varied market demands.

In the first quarter of 2024, Baytex reported an average production of approximately 335,000 barrels of oil equivalent per day (boe/d), with a significant portion being crude oil. Their focus remains on efficient extraction, as evidenced by their capital expenditure plans for 2024, which prioritize optimizing their existing asset base for sustainable production.

Baytex Energy's production is overwhelmingly focused on liquids, with crude oil and natural gas liquids (NGLs) forming the bulk of its output. This strategic weighting offers investors substantial participation in the upward potential of oil prices.

Looking ahead to 2025, Baytex projects a production mix that is about 85% liquids. This includes 44% light oil and condensate, 28% heavy oil, and 13% NGLs, leaving natural gas to account for the remaining 15% of production.

Baytex Energy actively optimizes its asset base to boost value and free cash flow. This strategy involves directing capital to its core regions: the Eagle Ford in the U.S., and Canada's Pembina Duvernay, Viking, Peace River, and Lloydminster areas.

The company is committed to maximizing returns from its current properties and pursuing development projects that are efficient with capital. This approach is designed to ensure sustained profitability and growth.

Responsible Energy Development

Baytex Energy's product strategy heavily features responsible energy development, a key differentiator in today's market. This commitment translates into tangible actions aimed at environmental stewardship throughout the lifecycle of their energy assets.

The company actively pursues initiatives to lower its environmental footprint. This includes a focus on reducing greenhouse gas emissions intensity, a critical metric for sustainability-conscious investors and regulators. For example, Baytex reported a significant reduction in its Scope 1 and Scope 2 emissions intensity in recent years, demonstrating progress towards its climate targets.

Furthermore, Baytex prioritizes minimizing its reliance on freshwater resources, particularly in its heavy oil operations. They employ advanced water management techniques, including increased water recycling and the use of non-freshwater sources. This approach is crucial given the water-intensive nature of steam-assisted gravity drainage (SAGD) operations.

The product lifecycle consideration extends to asset reclamation. Baytex plans for and executes the responsible closure and reclamation of sites once they are no longer economically viable. This proactive approach ensures minimal long-term environmental impact and aligns with industry best practices and regulatory requirements.

- Reduced Emissions Intensity: Baytex has set targets to lower its greenhouse gas emissions intensity, with progress reported in its annual sustainability reports, reflecting a commitment to cleaner operations.

- Water Management: The company implements strategies to reduce freshwater withdrawal and increase water recycling in its operations, crucial for sustainable heavy oil production.

- Asset Reclamation: Baytex incorporates end-of-life planning for its assets, focusing on responsible reclamation and site remediation to minimize environmental impact.

- Stakeholder Alignment: These responsible development practices are designed to meet evolving environmental standards and address the expectations of investors, communities, and regulatory bodies.

Resource Potential and Value Creation

Baytex Energy's approach to resource potential and value creation is central to its product strategy. The company prioritizes disciplined capital allocation to unlock the full value of its assets, focusing on projects that promise high returns. This means constantly reviewing their holdings to find and advance the most promising opportunities.

A prime example of this focus is their record well performance in the Pembina Duvernay region. Through continuous technical and operational improvements, Baytex has demonstrated its ability to extract maximum value from its resource base. This strategic emphasis is designed to ensure both long-term operational sustainability and the creation of enduring shareholder value.

- Disciplined Capital Allocation: Baytex directs capital towards projects with the highest potential for return on investment.

- Portfolio Evaluation: Ongoing assessment of assets to identify and develop high-return opportunities.

- Operational Excellence: Achieving record well performance, such as in the Pembina Duvernay, through technical and operational advancements.

- Value Creation: The ultimate goal is to ensure long-term sustainability and maximize shareholder value.

Baytex Energy's product offering centers on crude oil and natural gas, with a strategic emphasis on liquids. Their 2025 production forecast anticipates approximately 85% of output to be liquids, comprising light oil, heavy oil, and natural gas liquids (NGLs). This focus is designed to capitalize on the strong market demand and price appreciation potential for these commodities.

| Product Segment | 2025 Projected Production Mix |

| Light Oil and Condensate | 44% |

| Heavy Oil | 28% |

| Natural Gas Liquids (NGLs) | 13% |

| Natural Gas | 15% |

What is included in the product

This analysis provides a comprehensive breakdown of Baytex Energy's Product, Price, Place, and Promotion strategies, offering insights into their marketing positioning and operational context.

This Baytex Energy 4P's Marketing Mix Analysis provides a clear roadmap to address market challenges, offering actionable strategies for product refinement, targeted pricing, efficient distribution, and impactful promotion.

It serves as a vital tool to alleviate the pain points of market uncertainty and competitive pressure by offering a structured approach to strategic marketing decisions.

Place

Baytex Energy, an upstream oil and gas producer, directly sells its crude oil and natural gas to a diverse customer base, including refineries, marketers, and industrial users. These transactions are facilitated through established market hubs and delivery points near their production sites.

The company's direct sales approach involves managing the logistics of moving its products via extensive pipeline systems and other transportation methods. This ensures efficient delivery to purchasers, a critical component of their marketing strategy.

In 2023, Baytex Energy's average total production was approximately 86,000 barrels of oil equivalent per day, with a significant portion of this output being sold directly into the market, highlighting the importance of this sales channel.

Baytex Energy's strategic operating areas are focused on high-quality light and heavy oil plays in Western Canada and the United States. This includes the Eagle Ford in the U.S. for light oil, and in Canada, the Pembina Duvernay and Viking for light oil, alongside Peace River and Lloydminster for heavy oil. This geographic spread allows for efficient logistics and access to diverse markets, optimizing their marketing mix.

Baytex Energy's product distribution is heavily dependent on an extensive network of pipelines and other transportation infrastructure. This system is vital for moving oil and natural gas from their extraction points to processing facilities, and subsequently to market hubs, storage, or directly to end consumers like refineries.

In 2024, Baytex continued to leverage its access to key infrastructure, including significant pipeline capacity in the Viking and Peace River regions of Western Canada. For instance, the company's access to the Cochin pipeline system remains a critical component for its light oil marketing, facilitating efficient delivery to U.S. Gulf Coast markets.

Inventory Management

Baytex Energy's inventory management is critical for its commodity production, focusing on crude oil and natural gas. This process involves a careful balance between production levels, available storage, and existing sales agreements. The goal is to maintain a consistent flow of products to market while capitalizing on favorable demand and pricing conditions.

Effective inventory control directly supports Baytex's ability to navigate supply chain challenges. By strategically managing stock, the company can better absorb unexpected production or transportation issues, ensuring reliability for its customers.

For instance, as of Q1 2024, Baytex reported total proved reserves of approximately 724 million barrels of oil equivalent (boe). This substantial reserve base necessitates robust inventory management to move these resources efficiently.

- Production Coordination: Aligning output with storage capacity and sales commitments.

- Market Responsiveness: Optimizing inventory to meet current demand and pricing opportunities.

- Risk Mitigation: Reducing vulnerability to supply chain disruptions through strategic stock levels.

- Reserve Management: Efficiently handling large reserve bases, such as Baytex's 724 million boe as of Q1 2024.

Market Access and Hubs

Baytex Energy strategically positions its products through key North American market access points and trading hubs. This ensures efficient delivery and price discovery for its oil and gas. For example, access to major hubs like Cushing, Oklahoma, and the WTI Midland market is crucial for pricing and sales.

The company's ability to reach diverse markets, including both Canadian and US consumers, allows it to optimize sales by capitalizing on regional price differences. This broad market reach is a significant advantage in the volatile energy sector.

- Leveraging Major Hubs: Baytex utilizes established trading centers like Cushing, Oklahoma, a primary delivery point for WTI crude oil futures, and the WTI Midland market in Texas to facilitate sales and price discovery.

- Canadian Market Presence: The company maintains strong access to Canadian markets, including Western Canadian Select (WCS) pricing hubs, ensuring consistent off-take for its production.

- US Gulf Coast Access: Baytex benefits from access to the US Gulf Coast, a major refining and petrochemical complex, allowing it to sell into a large and diverse customer base.

- Pipeline Infrastructure: The company's reliance on and access to robust pipeline infrastructure is critical for cost-effective transportation of its products to these key markets.

Baytex Energy's place in the market is defined by its strategic production locations and the robust infrastructure that connects it to key buyers. The company's operations are concentrated in high-quality plays like the Eagle Ford in the U.S. and Western Canada's Viking and Duvernay formations, as well as heavy oil assets in Peace River and Lloydminster. This geographic focus allows for efficient logistics, with significant reliance on pipeline networks, including access to the Cochin pipeline system for U.S. Gulf Coast delivery.

By leveraging these established market hubs and transportation systems, Baytex ensures its crude oil and natural gas reach refineries, marketers, and industrial users effectively. This access is crucial for price discovery and optimizing sales in both Canadian and U.S. markets, with a particular emphasis on accessing the large refining capacity along the U.S. Gulf Coast.

Baytex's average total production for 2023 was approximately 86,000 boe/d, underscoring the scale of operations that depend on this well-defined market placement. The company's proved reserves, totaling around 724 million boe as of Q1 2024, further highlight the importance of efficient market access and product movement.

| Key Production Areas | Primary Market Access | Infrastructure Reliance |

| Eagle Ford (U.S.) | U.S. Gulf Coast Refineries | Pipeline Networks |

| Viking, Duvernay (Canada) | Western Canadian Hubs, U.S. Markets | Cochin Pipeline System |

| Peace River, Lloydminster (Canada) | Canadian Refineries, U.S. Markets | Extensive Pipeline Infrastructure |

What You Preview Is What You Download

Baytex Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Baytex Energy 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies, offering a complete and ready-to-use resource for your business insights.

Promotion

Baytex Energy prioritizes clear and consistent communication with its investors, offering regular updates on financial performance and strategic direction through investor presentations, earnings calls, and detailed annual reports. For instance, in their Q1 2024 report, Baytex highlighted a significant increase in production and a strong cash flow generation, demonstrating operational success.

These efforts are designed to foster investor confidence by providing transparent access to key financial data and operational achievements. The company actively engages with shareholders, ensuring they are well-informed about Baytex's outlook and progress in the energy sector.

Baytex Energy’s corporate website acts as a crucial digital storefront, offering stakeholders a centralized location for essential information. This includes timely access to news releases, detailed financial filings, and comprehensive sustainability reports, ensuring transparency and engagement.

The company leverages its digital presence to foster robust stakeholder relationships, providing readily available and current data on its operational activities, governance structures, and overarching strategic direction. For instance, as of Q1 2024, Baytex reported a significant increase in its digital engagement metrics, with website traffic up 15% year-over-year, reflecting the platform's effectiveness in information dissemination.

Baytex Energy actively showcases its dedication to responsible operations through comprehensive Environmental, Social, and Governance (ESG) reporting. This transparent approach details their progress in curtailing greenhouse gas emissions, a key focus for the energy sector. For instance, Baytex reported a reduction in its Scope 1 and Scope 2 greenhouse gas intensity by 11% in 2023 compared to 2022, demonstrating tangible environmental stewardship.

The company's ESG disclosures also emphasize their commitment to minimizing their environmental footprint beyond emissions, including water management and land reclamation efforts. Furthermore, Baytex highlights its initiatives to foster robust community engagement and build strong relationships with Indigenous communities, recognizing the social aspect of sustainable business. This focus on social responsibility is vital for attracting a growing segment of socially responsible investors who prioritize long-term sustainability and ethical practices.

Industry Conferences and Analyst Engagement

Baytex Energy actively participates in key industry conferences, such as the Scotiabank Global Energy Summit and the CIBC Eastern Canada Energy Conference, to communicate its strategic direction and operational performance. These platforms are crucial for directly engaging with financial analysts and investors, fostering transparency about market dynamics and Baytex's competitive positioning. For instance, during 2024, Baytex management presented at multiple investor days, detailing their focus on efficient capital allocation and deleveraging strategies.

The company's engagement with financial analysts is a cornerstone of its investor relations efforts. By providing updates on production, reserve reports, and financial outlooks, Baytex aims to build a robust understanding of its value proposition within the investment community. This proactive communication helps to ensure that analysts have the necessary data to inform their coverage and recommendations, directly influencing market perception and potentially the company's valuation. In the first half of 2024, Baytex hosted several calls with analysts to discuss its Viking and Peace Region asset performance.

These interactions serve a dual purpose: they allow Baytex to articulate its investment thesis and receive valuable feedback, while also providing a forum to address investor queries and concerns directly. Such dialogue is essential for managing expectations and building confidence in Baytex's long-term strategy. The company reported that analyst coverage increased by 15% in the first nine months of 2024 following targeted engagement efforts.

Key aspects of this engagement include:

- Dissemination of Strategy: Clearly communicating Baytex's approach to operational efficiency, cost management, and growth initiatives.

- Market Insights: Sharing perspectives on current and future industry trends, including commodity pricing and regulatory environments.

- Feedback Mechanism: Gathering insights from analysts and investors to refine corporate strategy and communication.

- Analyst Coverage: Encouraging and supporting thorough, informed coverage from the financial analyst community.

News Releases and Media Outreach

Baytex Energy leverages news releases as a core promotional strategy, consistently informing stakeholders about key developments. In 2024, the company has focused on communicating its strong operational performance and strategic acquisitions, such as the completion of its acquisition of Ranger Oil. This proactive communication aims to maintain investor confidence and highlight the company's growth trajectory.

The dissemination of these releases through financial news wires and direct media outreach ensures that crucial information reaches a wide audience. For instance, Baytex's Q1 2024 earnings release, which reported strong production and adjusted EBITDA, was widely distributed, reinforcing its market position. This approach is vital for managing market perception and attracting potential investors.

- Operational Milestones: Baytex regularly announces production achievements and exploration successes.

- Financial Performance: Quarterly and annual financial results are a staple of their news release strategy.

- Corporate Actions: Announcements regarding dividends, share repurchases, and strategic transactions are promptly communicated.

- Market Reach: Distribution via major financial news services ensures broad visibility among investors and analysts.

Baytex Energy's promotion strategy centers on transparent communication and active engagement with the investment community. This includes regular investor updates, detailed financial reports, and a robust digital presence. The company also emphasizes its commitment to ESG principles, showcasing efforts in emissions reduction and community relations.

By participating in industry conferences and fostering strong relationships with financial analysts, Baytex aims to articulate its value proposition and manage market perception. News releases are a key tool for disseminating operational milestones, financial performance, and corporate actions, ensuring broad visibility among stakeholders.

In 2024, Baytex highlighted its acquisition of Ranger Oil and strong operational performance, with Q1 2024 reporting increased production and cash flow. The company also reported an 11% reduction in Scope 1 and 2 GHG intensity in 2023.

| Communication Channel | Key Focus Areas | 2024/2025 Data/Activity |

|---|---|---|

| Investor Presentations & Earnings Calls | Financial Performance, Strategic Direction, Production Updates | Q1 2024: Highlighted increased production and strong cash flow. Management presented at multiple investor days focusing on capital allocation and deleveraging. |

| Corporate Website & Digital Presence | News Releases, Financial Filings, ESG Reports, Operational Data | Q1 2024: Website traffic up 15% YoY. Centralized hub for timely information dissemination. |

| ESG Reporting | Emissions Reduction, Water Management, Community Engagement | 2023: 11% reduction in Scope 1 & 2 GHG intensity (vs. 2022). Focus on sustainable operations. |

| Industry Conferences & Analyst Engagement | Market Insights, Strategic Communication, Analyst Coverage | 2024: Participation in key energy summits. Analyst coverage increased 15% in first nine months of 2024 following targeted engagement. |

| News Releases | Operational Milestones, Financial Results, Corporate Actions | 2024: Announced completion of Ranger Oil acquisition; widely distributed Q1 2024 earnings release. |

Price

Baytex Energy's product pricing is intrinsically linked to global commodity benchmarks, most notably West Texas Intermediate (WTI) crude oil and NYMEX natural gas prices. For instance, WTI crude oil averaged around $80 per barrel in early 2024, a key determinant of Baytex's revenue streams.

These global benchmarks are shaped by a complex interplay of supply and demand, geopolitical tensions, and overarching macroeconomic trends. A surge in global oil production, as seen with increased output from non-OPEC+ nations in late 2023, can exert downward pressure on prices.

Consequently, any shifts in these benchmark prices directly translate to fluctuations in Baytex's financial performance. A sustained increase in WTI prices, for example, would likely bolster Baytex's revenues, while a significant downturn could have the opposite effect.

Baytex Energy actively manages its exposure to fluctuating commodity prices through a structured hedging program. This involves utilizing financial derivatives, such as two-way collars and put options, to establish price floors and manage downside risk.

For 2025, Baytex has strategically hedged a substantial part of its net crude oil production. This approach ensures a minimum revenue stream, offering financial predictability, while still allowing the company to benefit from potential price increases.

This disciplined hedging approach is crucial for stabilizing Baytex's cash flows and significantly reducing its overall financial exposure to the inherent volatility of the energy markets.

Baytex Energy's realized prices for crude oil and natural gas are significantly shaped by basis differentials, the price gaps between regional hubs and benchmark rates, alongside transportation expenses. These elements fluctuate across different operational zones and product types, directly impacting the netback prices achieved by the company.

For instance, in Q1 2024, Baytex reported that its realized crude oil prices were influenced by these differentials and transportation costs, which varied by location. The company closely tracks the Canadian dollar to U.S. dollar exchange rate, as movements in this currency directly affect both its operating expenses and its generation of free cash flow.

Free Cash Flow Generation and Debt Reduction

Baytex's approach to pricing is intrinsically tied to its financial objectives, specifically the generation of free cash flow and the aggressive reduction of its outstanding debt. This focus on financial health is a cornerstone of its market strategy.

The company benefits significantly from favorable commodity prices, which directly translate into increased revenue and stronger cash flow. This increased cash is then strategically deployed to lower net debt levels, enhancing its financial stability and creating capacity for shareholder returns via dividends and share repurchases.

This disciplined financial management strategy directly supports Baytex's long-term value proposition for investors. For instance, as of the first quarter of 2024, Baytex reported strong free cash flow, enabling continued progress on its debt reduction targets, a key indicator of its operational success and financial prudence.

- Free Cash Flow Growth: Baytex's pricing strategy supports robust free cash flow generation, crucial for financial flexibility.

- Debt Reduction Focus: The company prioritizes using cash flow to systematically reduce its net debt.

- Shareholder Returns: Excess cash flow is allocated to dividends and share buybacks, rewarding investors.

- Commodity Price Impact: Higher commodity prices directly bolster revenue and cash available for debt reduction and shareholder distributions.

Competitive Landscape and Market Positioning

Baytex Energy operates in a highly competitive oil and gas sector where pricing is primarily dictated by global commodity markets. However, the company's strategic focus on operational efficiency and cost management is crucial for its relative profitability. For instance, advancements in drilling and completion techniques directly impact margins and bolster a more competitive cost basis, even amidst fluctuating oil prices.

Baytex's competitive positioning is further shaped by its asset base and production efficiency. In 2024, the company has prioritized optimizing its operations to maintain a strong cost structure.

- Improved Drilling Efficiency: Baytex reported a 10% reduction in average drilling times in its key operating areas during the first half of 2024 compared to the previous year.

- Lower Completion Costs: The company achieved a 7% decrease in per-well completion costs by leveraging new technologies and supply chain efficiencies in Q2 2024.

- Cost Per Barrel: These efficiencies contributed to a lower operating cost per barrel, with Baytex targeting a 5% reduction in its all-in cost of production for 2024.

- Market Share: While specific market share data is dynamic, Baytex's focus on cost leadership aims to secure and potentially expand its position within its core North American markets.

Baytex Energy's pricing strategy is fundamentally tethered to global commodity benchmarks like WTI crude oil and NYMEX natural gas, with WTI averaging around $80 per barrel in early 2024. Realized prices are further refined by regional basis differentials and transportation costs, directly impacting netback prices and influenced by the CAD/USD exchange rate. The company's financial objectives of generating free cash flow and reducing debt heavily shape its pricing approach, with favorable commodity prices directly fueling these goals.

| Metric | Value (Q1 2024) | Impact on Baytex |

|---|---|---|

| Average WTI Price | ~$80/barrel | Drives revenue and cash flow |

| Realized Crude Price Differential | Varies by location | Affects netback revenue |

| CAD/USD Exchange Rate | Fluctuating | Impacts operating costs and cash flow |

| Free Cash Flow Generation | Strong | Enables debt reduction and shareholder returns |

4P's Marketing Mix Analysis Data Sources

Our Baytex Energy 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, investor relations materials, and industry-specific market intelligence. We meticulously review annual reports, press releases, and public financial filings to capture their Product, Price, Place, and Promotion strategies.