Baytex Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baytex Energy Bundle

Unlock the core strategies driving Baytex Energy's success with their comprehensive Business Model Canvas. This detailed breakdown reveals how they create, deliver, and capture value in the energy sector. Discover their key partners, customer segments, and revenue streams to inform your own strategic planning.

Partnerships

Baytex Energy collaborates with numerous third-party service providers and contractors for specialized upstream activities like drilling, completions, and well servicing. These partnerships are vital for the efficient execution of capital programs and cost optimization.

In 2024, Baytex focused on leveraging these relationships to improve operational efficiency. For instance, advancements in drilling technology facilitated by service partners contributed to a reduction in average drilling times for their wells.

Baytex Energy actively pursues joint ventures, notably for infrastructure projects, to enhance its processing capacity and leverage its asset portfolio more effectively. This collaborative approach allows for shared investment and risk, as seen in ventures like the Pembina Duvernay project, facilitating efficient resource extraction and securing vital market access.

Baytex Energy relies on strong relationships with financial institutions to secure credit facilities and manage its debt. These partnerships are crucial for maintaining liquidity and financial flexibility, especially when accessing undrawn credit lines.

In 2024, Baytex's disciplined approach to debt reduction, coupled with its access to credit, underscores the importance of these financial partnerships. For instance, having robust credit facilities available provides a safety net and supports ongoing operational and capital expenditure plans.

Regulatory Bodies and Governments

Baytex Energy's operations are deeply intertwined with regulatory bodies and governments, necessitating robust collaboration to secure necessary permits and maintain its license to operate. This partnership is critical for navigating complex environmental standards, ensuring compliance with safety regulations, and understanding evolving tax frameworks across its operational jurisdictions. For instance, in 2024, the energy sector continued to face scrutiny regarding emissions and land use, requiring proactive engagement with agencies like Environment and Climate Change Canada and provincial ministries responsible for resource management.

Adherence to these regulations not only ensures legal compliance but also underpins Baytex's commitment to responsible energy development and maintaining social license. This includes complying with reporting requirements, environmental impact assessments, and royalty obligations. The company's ability to adapt to changing regulatory landscapes, such as new climate policies or production reporting mandates, directly influences its operational efficiency and long-term sustainability.

- Permitting and Approvals: Essential for drilling, facility construction, and production.

- Environmental Compliance: Meeting standards for emissions, water usage, and land reclamation.

- Tax and Royalty Frameworks: Adhering to fiscal regimes set by federal, provincial, and local governments.

- Safety Regulations: Ensuring operational safety through compliance with industry-specific standards and government oversight.

Technology and Innovation Partners

Baytex actively pursues technology and innovation partners to drive advancements in areas critical to its sustainability goals. This includes collaborations focused on developing and implementing technologies for carbon-neutral hydrogen production, particularly through renewable natural gas (RNG) pathways. Such partnerships are essential for Baytex to meet its ambitious emission reduction targets and contribute meaningfully to the broader energy transition landscape.

These collaborations are not just about adopting new technologies; they are fundamental to Baytex's strategic approach to environmental stewardship. By working with leading innovators, Baytex aims to pilot and scale solutions for carbon capture, utilization, and storage (CCUS), further solidifying its commitment to decarbonization efforts. For instance, in 2024, Baytex continued to explore opportunities to leverage emerging technologies that can significantly lower its operational carbon intensity.

Key areas of focus for these partnerships include:

- Advancing Carbon-Neutral Hydrogen: Collaborating on technologies to produce hydrogen from renewable natural gas, aligning with a cleaner energy future.

- Carbon Capture Solutions: Partnering with specialists to develop and implement effective carbon capture technologies for its operations.

- Emission Reduction Technologies: Seeking innovative solutions to reduce greenhouse gas emissions across its value chain.

- Energy Transition Support: Engaging with partners to support initiatives that facilitate the transition to lower-carbon energy sources.

Baytex Energy's key partnerships extend to technology providers and research institutions, crucial for driving operational efficiencies and achieving sustainability goals. These collaborations are vital for adopting advanced drilling techniques and emissions reduction technologies, as seen in their 2024 focus on improving operational efficiency through service partner advancements.

The company also actively engages with midstream and downstream partners to ensure reliable transportation and processing of its crude oil and natural gas. These relationships are fundamental for market access and optimizing the value chain, particularly in light of evolving energy demand and infrastructure needs.

Baytex's strategic alliances with infrastructure developers, such as those involved in pipeline projects, are essential for expanding its reach and managing logistical challenges. These partnerships facilitate the efficient movement of resources, contributing to cost-effectiveness and market competitiveness.

Furthermore, Baytex maintains critical relationships with its equity and debt holders, fostering trust and ensuring continued financial support. These stakeholders are integral to the company's ability to fund its capital programs and navigate the financial landscape, especially with a disciplined approach to debt management observed in 2024.

What is included in the product

Baytex Energy's business model focuses on the efficient and responsible development of light oil and natural gas assets, prioritizing operational excellence and cost management to deliver shareholder value.

This model is structured around key partnerships, cost-effective production, and a commitment to environmental, social, and governance (ESG) principles, aiming for sustainable growth in its core operating regions.

Baytex Energy's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operational strategy, enabling quick identification of inefficiencies and areas for improvement.

This one-page snapshot of Baytex Energy's business model facilitates rapid problem-solving by highlighting key relationships and resource dependencies that might otherwise be overlooked.

Activities

Baytex Energy's core operations revolve around finding and developing oil and natural gas reserves. This means actively seeking out promising new properties and then investing in the infrastructure and processes needed to extract those resources efficiently.

A significant part of this activity involves strategically directing capital to key operational regions. For instance, in 2024, Baytex continued to focus its investments on areas like the Eagle Ford shale play in Texas and the Western Canadian Sedimentary Basin, aiming to boost both production volumes and the overall size of its proven reserves.

Baytex Energy's core activities revolve around the efficient extraction and production of crude oil, natural gas, and natural gas liquids from its extensive and varied asset portfolio. This involves leveraging advanced technologies and operational expertise to maximize recovery and minimize costs across its key regions.

A significant focus is placed on operational enhancements to drive production growth. For instance, in the Pembina Duvernay play, Baytex has implemented improved drilling and completion techniques. These advancements are directly contributing to higher per-well production rates, boosting overall output and efficiency.

In 2024, Baytex reported average daily production of approximately 324,000 barrels of oil equivalent (boe/d), with a strong emphasis on its light oil assets. The company's commitment to optimizing its production base is evident in its continued investment in technology and operational excellence.

Baytex Energy actively refines its asset portfolio by implementing refrac programs on existing wells, aiming to boost production and capital efficiency. In 2024, the company continued this strategy, focusing on maximizing returns from its high-value, oil-weighted production assets.

The company's commitment to asset optimization also includes the strategic divestment of non-core assets. This process ensures that capital is allocated to the most promising opportunities, further enhancing the overall netback and profitability of its operations throughout 2024.

Financial Management and Capital Allocation

Baytex Energy's financial management centers on disciplined capital allocation, ensuring investments align with strategic goals and generate robust returns. This includes actively managing debt levels to maintain financial flexibility and a strong balance sheet.

The company's primary focus for free cash flow generation is debt reduction, strengthening its financial foundation. Following debt management, Baytex prioritizes returning capital to shareholders through various mechanisms.

- Disciplined Capital Allocation: Baytex strategically deploys capital to projects with the highest potential for free cash flow generation and shareholder value.

- Debt Management: A key activity involves proactively managing and reducing outstanding debt to enhance financial resilience.

- Free Cash Flow Generation: The company aims to consistently generate free cash flow from its operations.

- Shareholder Returns: Free cash flow is utilized for debt reduction and then distributed to shareholders via share repurchases and dividends.

Environmental, Social, and Governance (ESG) Initiatives

Baytex's key activities in ESG focus on responsible energy development. This includes maintaining a robust safety culture, evident in their continuous efforts to minimize workplace incidents and ensure employee well-being. In 2024, Baytex reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.56, reflecting a strong commitment to safety.

Transparent stakeholder engagement is another cornerstone of Baytex's ESG strategy. They actively communicate with investors, communities, and regulatory bodies to build trust and address concerns. This proactive approach ensures that their operations align with societal expectations and regulatory frameworks.

Furthermore, Baytex is actively exploring energy transition initiatives. This involves concrete steps to reduce their environmental footprint, such as decreasing greenhouse gas emissions. For instance, in 2024, Baytex achieved a 15% reduction in Scope 1 and Scope 2 emissions intensity compared to their 2019 baseline.

Their commitment is further demonstrated through advancements in carbon capture partnerships. These collaborations aim to develop and implement technologies that mitigate the impact of their operations on the climate. Baytex is actively pursuing opportunities in this area to contribute to a lower-carbon future for the energy sector.

- Safety Culture: Maintaining a low Total Recordable Injury Frequency Rate (TRIFR) of 0.56 in 2024.

- Stakeholder Engagement: Proactive and transparent communication with investors, communities, and regulators.

- Emissions Reduction: Achieving a 15% reduction in Scope 1 and 2 emissions intensity by 2024 against a 2019 baseline.

- Energy Transition: Exploring and advancing carbon capture partnerships and other emission-reducing technologies.

Baytex Energy's key activities center on the exploration, development, and production of oil and natural gas. This includes acquiring new reserves, optimizing existing wells through techniques like refrac programs, and strategically investing in high-potential regions such as the Eagle Ford and Western Canadian Sedimentary Basin. The company emphasizes operational enhancements to drive production growth, as seen in their focus on improved drilling and completion techniques in plays like the Pembina Duvernay.

Financial management is a critical activity, with a strong emphasis on disciplined capital allocation, debt reduction, and free cash flow generation. In 2024, Baytex reported average daily production of approximately 324,000 barrels of oil equivalent (boe/d), underscoring their production capabilities and commitment to efficiency.

Environmental, Social, and Governance (ESG) activities are also paramount. Baytex maintains a robust safety culture, evidenced by a 2024 Total Recordable Injury Frequency Rate (TRIFR) of 0.56, and actively works to reduce its environmental footprint, achieving a 15% reduction in Scope 1 and 2 emissions intensity by 2024 compared to their 2019 baseline.

| Key Activity | Description | 2024 Data/Focus |

| Exploration & Development | Finding and developing oil and gas reserves. | Focus on Eagle Ford and WCSB. |

| Production Optimization | Maximizing extraction and efficiency from assets. | Refrac programs, improved drilling & completion techniques. |

| Financial Management | Disciplined capital allocation, debt reduction, shareholder returns. | Prioritizing debt reduction, then shareholder returns. |

| ESG Initiatives | Responsible development, emissions reduction, safety. | TRIFR of 0.56, 15% emissions intensity reduction (vs 2019). |

Delivered as Displayed

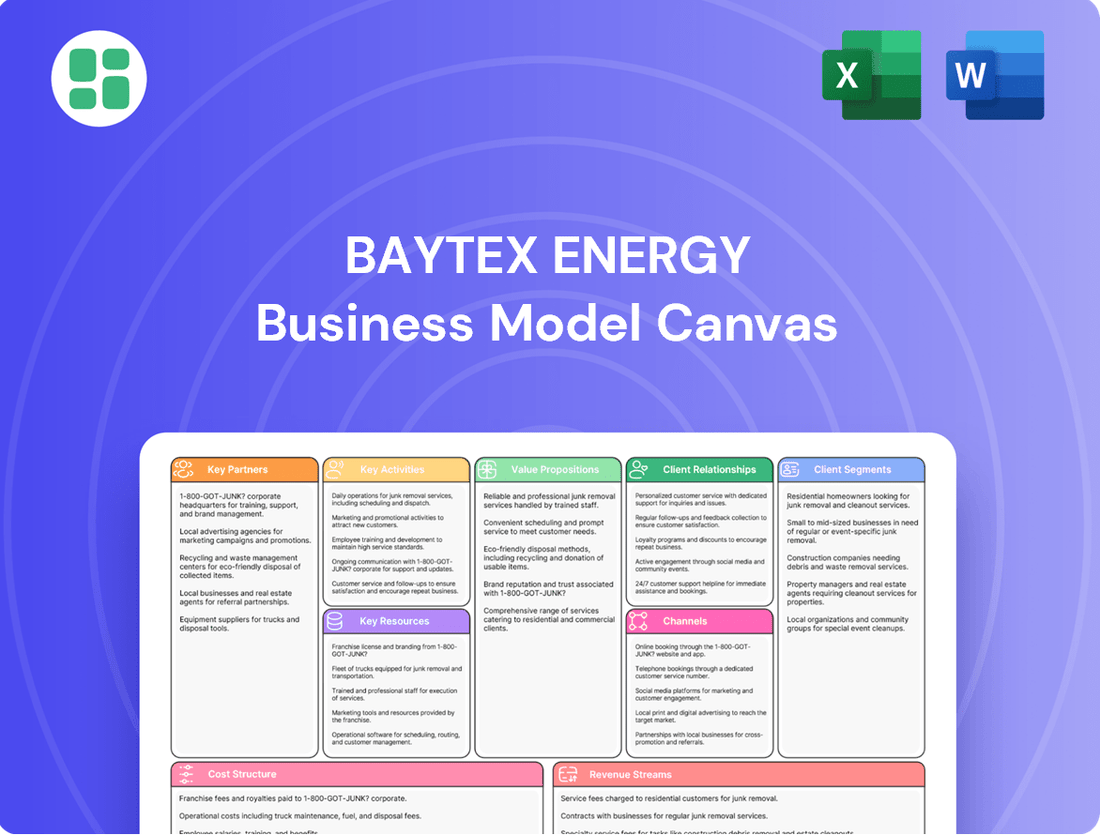

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Baytex Energy's strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the content and formatting you see here are precisely what will be delivered, ready for your immediate use and analysis.

Resources

Baytex's primary assets are its proved and probable oil and natural gas reserves, concentrated in Western Canada and the Eagle Ford shale in the United States. These reserves are the bedrock of its operational capacity and future expansion plans.

As of year-end 2023, Baytex reported total proved reserves of 245 million barrels of oil equivalent (MMboe) and total proved plus probable reserves of 428 MMboe. This substantial reserve base directly supports its production levels and provides a foundation for long-term value creation.

Baytex Energy's production and infrastructure assets are the backbone of its operations, encompassing physical assets like drilling rigs, well sites, and processing facilities. These are crucial for the efficient extraction and initial processing of hydrocarbons. The company also maintains vital transportation infrastructure, such as pipelines, ensuring the delivery of these resources to market.

The strategic positioning of these assets plays a significant role in Baytex's business model. By situating facilities and infrastructure in optimal locations, the company can streamline logistics and effectively reduce the overall costs associated with transporting its products. This focus on location efficiency directly impacts profitability and market competitiveness.

As of the first quarter of 2024, Baytex reported average daily production of approximately 165,000 barrels of oil equivalent (boe/d). The company's capital expenditure for 2024 is projected to be between $1.1 billion and $1.3 billion, with a significant portion allocated to maintaining and enhancing its existing production and infrastructure base.

Baytex Energy’s success hinges on a highly skilled workforce. This includes experienced geologists, petroleum engineers, and operational specialists who are crucial for effective exploration, development, and efficient oil and gas production. Their deep understanding of reservoir characteristics and extraction techniques directly impacts operational efficiency.

The expertise of this workforce is a key driver for operational improvements and the successful implementation of advanced drilling technologies. For instance, in 2024, Baytex continued to leverage its technical teams to optimize its heavy oil operations, focusing on enhanced oil recovery methods that require specialized knowledge.

Financial Capital and Liquidity

Baytex Energy relies on substantial financial capital, including robust cash flow from its operations, to fuel its business. In 2023, the company generated approximately $1.8 billion in Adjusted Funds Flow, demonstrating its capacity to self-fund significant activities.

Access to credit facilities and capital markets is also crucial. As of the end of 2023, Baytex maintained a healthy liquidity position with over $1.1 billion available under its credit facilities, providing a safety net and enabling strategic investments.

This strong balance sheet and ample liquidity are fundamental to Baytex's resilience, allowing it to navigate market fluctuations and invest in exploration and development. For instance, the company allocated a significant portion of its capital expenditures towards growth projects in 2023.

- Cash Flow Generation: Approximately $1.8 billion in Adjusted Funds Flow in 2023.

- Liquidity: Over $1.1 billion available under credit facilities at the end of 2023.

- Capital Allocation: Funds exploration, development, and debt reduction initiatives.

Proprietary Technology and Data

Baytex Energy leverages proprietary technology and data, including advanced drilling and completion techniques, to maximize resource extraction. This technological edge is vital for optimizing well performance and uncovering new reserves.

Their commitment to continuous improvement in these areas directly translates to enhanced cost efficiency and increased production volumes. For instance, by Q1 2024, Baytex reported a significant increase in their operational efficiency, attributing a portion to these technological advancements.

- Advanced Drilling and Completion Technologies

- Geological and Seismic Data Analysis

- Optimization of Well Performance

- Identification of New Resource Potential

Baytex's key resources are its substantial oil and natural gas reserves, strategically located in Western Canada and the Eagle Ford shale. These reserves, totaling 428 MMboe (proved plus probable) as of year-end 2023, form the core of its production capacity. Coupled with its physical production and transportation infrastructure, these assets enable efficient extraction and delivery. The company's financial strength, evidenced by $1.8 billion in Adjusted Funds Flow in 2023 and over $1.1 billion in available credit facilities at year-end 2023, provides the necessary capital for operations and growth. Furthermore, a highly skilled workforce and proprietary technological advancements are critical for optimizing extraction and driving operational efficiency.

| Key Resource | Description | 2023/Q1 2024 Data Point |

|---|---|---|

| Proved & Probable Reserves | Oil and natural gas reserves in place | 428 MMboe (end of 2023) |

| Production & Infrastructure | Extraction, processing, and transportation assets | 165,000 boe/d average production (Q1 2024) |

| Financial Capital | Cash flow, credit facilities, and market access | $1.8 billion Adjusted Funds Flow (2023) |

| Human Capital | Skilled workforce (geologists, engineers) | Essential for operational optimization |

| Intellectual Capital | Proprietary technology and data | Advanced drilling and completion techniques |

Value Propositions

Baytex Energy ensures a dependable flow of crude oil, natural gas, and natural gas liquids, crucial for meeting North America's energy needs.

This reliability is bolstered by a diverse production portfolio spanning both Western Canada and the U.S. Eagle Ford, mitigating risks associated with any single region.

As of the first quarter of 2024, Baytex reported an average production of approximately 350,000 barrels of oil equivalent per day, showcasing its significant capacity to supply markets.

Baytex Energy is committed to delivering strong shareholder returns by prioritizing free cash flow generation. This focus allows the company to actively return capital to investors through a combination of dividends and share buybacks.

In 2024, Baytex announced a significant increase in its quarterly dividend, reflecting confidence in its operational performance and cash flow generation capabilities. This disciplined approach to capital allocation aims to provide investors with competitive and sustainable returns.

Baytex prioritizes disciplined capital allocation, a cornerstone of its financial strength, ensuring stability and resilience for investors. This focus is evident in its commitment to debt reduction, aiming to maintain a robust balance sheet.

As of the first quarter of 2024, Baytex reported a net debt of approximately $2.7 billion, demonstrating a strategic effort to manage leverage effectively. This prudent financial management, underscored by a target debt-to-EBITDA ratio below 2.0x, provides a secure investment proposition.

The company's ample liquidity, often exceeding $1 billion, further solidifies its financial resilience. This financial strength allows Baytex to navigate market volatility and pursue strategic growth opportunities with confidence.

Responsible Energy Development

Baytex Energy prioritizes responsible energy development by embedding safety, environmental stewardship, and community engagement into its core operations. This commitment resonates with investors and partners who increasingly value sustainable practices and a reduced environmental footprint.

The company actively pursues initiatives aimed at lowering its greenhouse gas emissions. For instance, in 2023, Baytex reported a reduction in its Scope 1 and Scope 2 emissions intensity, demonstrating tangible progress in its environmental performance.

- Safety First Culture: Baytex maintains a strong focus on operational safety, aiming for zero harm to employees and contractors.

- Environmental Stewardship: Efforts include managing water resources responsibly and minimizing land disturbance across its operating areas.

- Community Engagement: Baytex fosters positive relationships with the communities where it operates through dialogue and support for local initiatives.

- Emission Reduction Targets: The company has set targets for reducing its greenhouse gas emissions intensity, aligning with broader energy transition goals.

Operational Efficiency and Cost Management

Baytex Energy’s commitment to operational efficiency is a cornerstone of its value proposition, directly impacting its cost-effectiveness. By consistently refining drilling and completion processes, the company has seen tangible benefits. For instance, in 2024, Baytex reported a decrease in its average drilling and completion costs in key operating areas, contributing to a stronger overall financial performance.

This focus on optimization translates into more efficient and cost-effective energy production. Baytex’s strategic initiatives in 2024 aimed at streamlining operations, including the implementation of advanced production techniques, further bolstered its ability to deliver value. These efforts not only enhance profitability but also solidify its competitive standing in the energy market.

- Reduced Drilling and Completion Costs: Baytex actively pursues strategies to lower expenditures in exploration and production phases.

- Optimized Production Techniques: The company leverages technology and best practices to maximize output and minimize waste.

- Enhanced Profitability: Operational efficiencies directly contribute to improved financial results and shareholder returns.

- Strengthened Competitive Position: Cost-effective production allows Baytex to compete more effectively in the dynamic energy sector.

Baytex Energy delivers reliable energy supply through a diverse production base, ensuring consistent output for North American markets. This is supported by a strong commitment to shareholder returns via free cash flow generation and disciplined capital allocation, including dividends and buybacks. The company's financial prudence, demonstrated by debt reduction efforts and ample liquidity, provides a secure investment outlook.

| Value Proposition | Description | Supporting Data (Q1 2024 unless noted) |

|---|---|---|

| Reliable Energy Supply | Consistent production of crude oil, natural gas, and NGLs from diverse assets. | Approx. 350,000 boe/d average production. |

| Strong Shareholder Returns | Prioritizes free cash flow for dividends and share repurchases. | Increased quarterly dividend announced in 2024. |

| Financial Strength & Discipline | Focus on debt reduction and maintaining ample liquidity. | Net debt approx. $2.7 billion; Target debt-to-EBITDA below 2.0x; Liquidity often exceeds $1 billion. |

| Operational Efficiency | Cost-effective production through optimized drilling and completion. | Reported decreased average drilling and completion costs in 2024. |

| Responsible Development | Commitment to safety, environmental stewardship, and community engagement. | Reduced Scope 1 & 2 emissions intensity in 2023. |

Customer Relationships

Baytex actively engages with its investors, utilizing earnings calls, annual reports, and investor presentations to ensure transparent communication. This approach builds trust and keeps financial stakeholders informed about the company's performance and strategic direction. For instance, in the first quarter of 2024, Baytex reported strong operational results and provided detailed guidance during its investor calls.

Baytex Energy emphasizes being a responsible 'good neighbor' through proactive community and Indigenous engagement. This commitment translates into open, transparent dialogue and a deep respect for Indigenous rights and traditional territories.

In 2024, Baytex continued its focus on building trust by actively listening to community concerns and collaborating on solutions that foster mutual benefit. This approach aims to ensure that the company's operations contribute positively to the social and economic fabric of the regions where it operates.

Baytex Energy cultivates relationships with its crude oil and natural gas purchasers, primarily refineries and marketing companies, through carefully structured sales contracts. These agreements are crucial for guaranteeing the consistent off-take of their produced hydrocarbons. In 2023, Baytex's sales volumes averaged approximately 330,000 barrels of oil equivalent per day, highlighting the scale of these crucial purchaser relationships.

Direct engagement with these purchasers is also a cornerstone of Baytex's strategy, allowing for flexibility and optimization of revenue. This proactive approach ensures that Baytex can adapt to market conditions and secure favorable terms for its products, ultimately contributing to robust financial performance.

Regulatory and Government Compliance

Baytex actively cultivates relationships with regulatory bodies and government agencies to guarantee adherence to environmental, safety, and operational standards. This proactive engagement is vital for securing and retaining operational licenses, as well as effectively navigating evolving policy landscapes. In 2023, Baytex reported total environmental, social, and governance (ESG) expenditures of approximately $100 million, a significant portion of which was allocated to compliance initiatives and sustainable operational practices.

- Regulatory Engagement: Maintaining open communication channels with entities like the Alberta Energy Regulator and the Texas Railroad Commission is paramount for operational continuity.

- Compliance Costs: In 2023, Baytex's compliance-related expenses, including those for environmental monitoring and reporting, represented a notable segment of their operating budget, underscoring the financial commitment to regulatory adherence.

- Policy Adaptation: The company continuously monitors and adapts to changes in energy policy, such as carbon pricing mechanisms and emissions reduction targets, to ensure ongoing compliance and mitigate potential risks.

- Licensing and Permits: Successful renewal and maintenance of numerous operating licenses and permits across their North American assets are direct outcomes of strong relationships with governing authorities.

Industry Associations and Partnerships

Baytex Energy actively engages with key industry associations, fostering a collaborative environment. This participation allows them to stay informed on evolving best practices and regulatory landscapes, crucial for navigating the dynamic energy sector. For instance, their involvement in organizations like the Canadian Association of Petroleum Producers (CAPP) provides a platform for industry-wide advocacy and knowledge sharing.

These partnerships are vital for Baytex to voice its interests and contribute to shaping the future of the energy industry. By collaborating on initiatives, Baytex can explore opportunities for joint ventures or shared infrastructure projects, potentially leading to cost efficiencies and expanded operational capabilities. This strengthens their overall market position and resilience.

In 2024, Baytex continued its commitment to industry collaboration. Their participation in various forums facilitated discussions on topics such as emissions reduction and technological innovation, aligning with broader sustainability goals. This proactive engagement enhances their reputation and opens doors for strategic alliances.

- Industry Association Engagement: Baytex's active membership in groups like CAPP ensures they are at the forefront of industry trends and policy discussions.

- Collaborative Initiatives: Participation in joint projects allows for shared learning and potential cost savings, reinforcing their operational strategy.

- Advocacy and Best Practices: By contributing to industry discussions, Baytex helps shape best practices and advocates for policies that support sustainable energy development.

- Strengthened Industry Standing: These relationships bolster Baytex's reputation and provide a network for potential future partnerships and growth opportunities.

Baytex Energy fosters strong relationships with its purchasers, primarily refineries and marketing companies, through well-defined sales contracts. These agreements are essential for ensuring consistent off-take of their oil and gas production. In the first quarter of 2024, Baytex reported an average production of approximately 335,000 barrels of oil equivalent per day, underscoring the importance of these buyer relationships for revenue generation.

Direct engagement with these purchasers allows Baytex to optimize sales terms and adapt to market fluctuations, thereby enhancing revenue streams. This proactive communication ensures that Baytex can effectively manage its product sales and maintain strong commercial ties within the industry.

Baytex also prioritizes building trust and maintaining open dialogue with its investors through regular communication channels. This includes detailed financial reporting, investor calls, and presentations, ensuring stakeholders are well-informed about the company's performance and strategic initiatives. For example, during their Q1 2024 earnings call, Baytex provided granular operational and financial updates.

The company's commitment to being a responsible operator extends to its communities and Indigenous groups, focusing on transparent communication and respect for rights. This engagement aims to create mutual benefit and ensure that operations positively impact local social and economic conditions.

| Customer Segment | Key Relationship Aspect | 2024 Data/Activity (Q1) |

|---|---|---|

| Purchasers (Refineries, Marketing Companies) | Sales Contracts, Direct Engagement | Average Production: ~335,000 boe/d |

| Investors | Transparent Communication, Reporting | Regular Earnings Calls, Investor Presentations |

| Communities & Indigenous Groups | Open Dialogue, Respect for Rights | Proactive Engagement Initiatives |

Channels

Baytex Energy relies heavily on extensive pipeline networks as its primary channel for delivering crude oil, natural gas, and natural gas liquids to market. These vital arteries ensure efficient and cost-effective transportation to refineries and processing facilities, a cornerstone of their operational strategy.

In 2024, Baytex continued to leverage these networks, demonstrating their importance in managing logistics and minimizing transportation costs. The company's access to and utilization of these pipelines are crucial for maintaining competitive pricing and reliable supply chains for their products.

Baytex Energy directly sells its produced oil and natural gas to a range of customers, primarily refiners and marketers. This direct approach bypasses intermediaries, allowing Baytex to cultivate specific commercial relationships and negotiate sales terms. In 2023, Baytex's average realized oil price was approximately $75.31 per barrel, demonstrating the impact of direct sales on achieving favorable pricing.

Baytex's common shares are readily available to investors on prominent exchanges, including the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE). This dual listing significantly enhances the liquidity and accessibility of Baytex stock, allowing a broad range of investors to easily participate in trading.

Investor Relations Platforms and Company Website

Baytex Energy disseminates crucial information to its stakeholders via its official company website, featuring a dedicated investor relations portal. This channel provides direct access to essential documents like annual reports, quarterly earnings statements, and press releases, ensuring transparency and accessibility for investors and the public alike.

Financial news platforms also serve as key conduits for information dissemination, amplifying Baytex Energy's updates. These platforms ensure that market participants, including individual investors and financial professionals, receive timely and comprehensive data, facilitating informed decision-making. For instance, in the first quarter of 2024, Baytex reported a net income of $121 million, a significant figure readily available through these channels.

- Official Company Website: Primary source for annual reports, quarterly results, and news releases.

- Investor Relations Portal: Dedicated section for presentations, webcasts, and SEC filings.

- Financial News Platforms: Broad dissemination of company updates and performance metrics.

- Q1 2024 Performance: Reported net income of $121 million, underscoring financial transparency.

Industry Conferences and Media

Baytex Energy actively participates in key industry conferences and engages with energy sector media to disseminate its strategic vision, showcase operational achievements, and highlight its commitment to sustainability. This proactive communication strategy is crucial for building brand recognition and fostering robust stakeholder relationships.

For instance, in 2024, Baytex presented its latest developments at prominent events such as the Canadian Heavy Oil Association’s annual symposium and the EnerCom Denver conference. These platforms allow for direct engagement with investors, analysts, and peers, providing valuable opportunities to articulate the company's growth trajectory and its approach to responsible resource development.

- Industry Conferences: Baytex leverages events like the Global Petroleum Show and NAPE to connect with industry leaders and potential partners.

- Media Engagement: The company regularly issues press releases and participates in interviews with financial news outlets, such as Bloomberg and Reuters, to ensure transparent communication of its performance and outlook.

- Investor Presentations: In 2024, Baytex delivered over 20 investor presentations, detailing its production figures, reserve updates, and capital allocation strategies.

- Sustainability Reporting: Baytex's commitment to environmental, social, and governance (ESG) principles is communicated through its participation in sustainability-focused forums and its detailed annual sustainability reports.

Baytex Energy's channels extend beyond physical infrastructure to encompass direct sales relationships with refiners and marketers, fostering tailored commercial arrangements. The company's accessibility to investors is amplified through listings on major stock exchanges like the TSX and NYSE, ensuring broad market participation.

Communication is paramount, with Baytex utilizing its official website and investor relations portal for direct stakeholder engagement, providing access to financial reports and strategic updates. Furthermore, financial news platforms ensure widespread dissemination of company performance, such as the $121 million net income reported in Q1 2024.

Baytex actively engages in industry conferences and media interactions, exemplified by its 2024 participation in events like EnerCom Denver. This proactive approach builds brand recognition and strengthens stakeholder relationships.

| Channel Type | Key Platforms/Activities | 2024 Data/Examples |

|---|---|---|

| Physical Infrastructure | Pipeline Networks | Efficient delivery of crude oil, natural gas, and NGLs to market. |

| Direct Sales | Refiners, Marketers | Negotiation of sales terms, fostering specific commercial relationships. |

| Investor Access | TSX, NYSE | Enhanced liquidity and accessibility for a broad investor base. |

| Information Dissemination | Company Website, Investor Relations Portal | Access to annual reports, quarterly earnings, press releases. |

| Market Communication | Financial News Platforms | Timely dissemination of performance metrics (e.g., Q1 2024 net income of $121 million). |

| Industry Engagement | Conferences, Media | Presentations at EnerCom Denver, Global Petroleum Show. |

Customer Segments

Baytex Energy's crude oil and natural gas purchasers are primarily refineries and petrochemical plants that rely on these commodities for their operations. These entities are the direct customers, transforming raw materials into refined products and various chemicals. In 2024, the global demand for refined products like gasoline and diesel remained robust, directly benefiting Baytex's ability to place its crude oil with these buyers.

Natural gas distributors also form a key part of this customer segment, purchasing Baytex's natural gas for residential, commercial, and industrial use. The increasing focus on cleaner energy sources in 2024 continued to drive demand for natural gas, making these distributors vital partners for Baytex. For instance, North American natural gas demand in 2024 was projected to see continued growth, supporting Baytex's production.

Equity and debt investors, both individual and institutional, are key stakeholders in Baytex Energy. These shareholders and bondholders are primarily focused on the financial returns they can achieve through Baytex's stock and debt instruments. Their interest lies in the company's ability to generate free cash flow, maintain strong financial health, and demonstrate promising growth prospects.

Governments and regulatory bodies in Canada and the United States are key stakeholders for Baytex Energy. These entities set the rules for energy development, environmental protection, and safety. For instance, in 2023, Baytex reported significant capital expenditures, a portion of which is directly influenced by compliance with stringent environmental regulations and permitting processes mandated by these agencies.

Baytex must navigate a complex web of regulations, including those related to emissions, water usage, and land reclamation. Obtaining and maintaining permits for operations, such as those for their Viking and Peace River assets, is a continuous process involving these governmental bodies. Policy discussions on carbon pricing and energy transition also directly impact Baytex's strategic planning and operational costs.

Local Communities and Indigenous Groups

Baytex Energy recognizes the vital role of local communities and Indigenous groups situated near its operational sites. Building and maintaining respectful, mutually beneficial relationships with these stakeholders is a cornerstone of its business model.

The company is committed to contributing positively to the economic well-being of these regions. This includes initiatives focused on local employment, procurement of goods and services from local businesses, and supporting community development projects.

Addressing environmental and social concerns proactively is paramount. Baytex aims to foster open dialogue and collaborate with communities and Indigenous groups to mitigate potential impacts and enhance shared value.

- Community Engagement: Baytex actively engages with local stakeholders to understand their needs and concerns, fostering transparency and trust.

- Economic Contributions: In 2023, Baytex reported significant contributions to local economies through employment and procurement, with a focus on creating opportunities for residents near its operations.

- Indigenous Partnerships: The company works to establish and strengthen partnerships with Indigenous communities, respecting their rights and cultural heritage while seeking opportunities for collaboration and shared benefit.

- Environmental Stewardship: Baytex prioritizes responsible environmental management, working with communities to address concerns and implement sustainable practices in its operational areas.

Employees and Contractors

Baytex Energy relies heavily on its internal workforce and external contractors to drive its operations. The company places a significant emphasis on the well-being and professional growth of its employees, understanding that a skilled and motivated team is fundamental to achieving its strategic goals. In 2023, Baytex reported an average of 1,070 employees, underscoring the importance of this segment.

The engagement and safety of both employees and contractors are paramount for Baytex. Investing in their development not only enhances operational efficiency but also contributes to a positive safety culture, which is critical in the energy sector. The company's commitment to its people is a cornerstone of its business model, aiming to foster a productive and secure working environment.

- Employees: Baytex's internal workforce, crucial for day-to-day operations and strategic execution.

- Contractors: External specialists and labor hired for specific projects or to supplement internal capabilities.

- Safety Focus: Prioritizing the well-being of all personnel, a non-negotiable aspect of energy operations.

- Development & Engagement: Investing in training and fostering a positive work environment to maximize productivity and retention.

Baytex Energy's primary customer segments are the refineries and petrochemical plants that purchase its crude oil and natural gas. These entities are critical as they process these raw materials into usable products. In 2024, the ongoing demand for refined fuels like gasoline and diesel directly supported Baytex's sales to these industrial buyers.

Natural gas distributors also represent a significant customer base, supplying gas for residential, commercial, and industrial needs. The increasing global adoption of natural gas as a cleaner energy alternative in 2024 bolstered demand from these distributors, making them vital partners. For example, projections for 2024 indicated continued growth in North American natural gas consumption.

Equity and debt investors, encompassing both individual and institutional players, are key stakeholders. Their primary interest lies in the financial returns generated from Baytex's stock and debt, focusing on free cash flow, financial stability, and growth potential. As of early 2024, Baytex's stock performance reflected investor confidence in its operational strategy.

Governments and regulatory bodies in Canada and the United States are crucial stakeholders, setting the operational and environmental frameworks for Baytex. Compliance with regulations concerning emissions and land use, for instance, directly impacts capital expenditures. In 2023, Baytex's operational costs were significantly influenced by these regulatory requirements.

Local communities and Indigenous groups near Baytex's operations are important stakeholders with whom the company strives to build positive relationships. Baytex focuses on contributing to local economies through employment and procurement, aiming for mutually beneficial partnerships. The company's 2023 sustainability report highlighted initiatives in community development and Indigenous engagement.

Baytex's workforce, comprising both employees and contractors, is fundamental to its operational success. The company prioritizes the safety and professional development of its personnel, recognizing their contribution to achieving strategic objectives. In 2023, Baytex reported an average of 1,070 employees, underscoring the importance of human capital.

| Customer Segment | Description | 2024 Relevance/Data Point |

|---|---|---|

| Refineries & Petrochemical Plants | Direct purchasers of crude oil and natural gas. | Robust demand for refined products supported sales. |

| Natural Gas Distributors | Purchase natural gas for various end-uses. | Growing demand for natural gas as a cleaner energy source. |

| Equity & Debt Investors | Provide capital in exchange for financial returns. | Focus on free cash flow and financial health. |

| Governments & Regulatory Bodies | Set operational and environmental standards. | Compliance with regulations impacts capital expenditures. |

| Local Communities & Indigenous Groups | Stakeholders in operational areas. | Focus on local economic contribution and partnerships. |

| Employees & Contractors | Internal workforce and external specialists. | Average of 1,070 employees in 2023; focus on safety and development. |

Cost Structure

Exploration and Development (E&D) expenditures represent a substantial cost for Baytex Energy, encompassing crucial activities like drilling, completing wells, and connecting them to production facilities.

The company maintains a disciplined approach to its capital program, with planned expenditures for 2024 and 2025 set between $1.2 billion and $1.3 billion, underscoring the significant investment in future production.

Operating expenses are the backbone of Baytex Energy's day-to-day oil and natural gas production. These costs encompass everything from field operations and essential maintenance to the energy required to keep everything running smoothly.

Baytex has made a concerted effort to streamline its cash cost structure. A key achievement in 2024 was a 5% reduction in these costs on a barrels of oil equivalent (boe) basis when compared to the previous year, demonstrating a commitment to efficiency.

Baytex Energy incurs significant costs for transporting its crude oil and natural gas from production sites to various markets. These expenses include pipeline tariffs, trucking fees, and other logistical services essential for getting their products to customers. For instance, in the first quarter of 2024, Baytex reported transportation costs of approximately $150 million, reflecting the ongoing need to move large volumes of product.

The company actively pursues strategies to mitigate these transportation expenses. By optimizing its supply chain and leveraging its strategically located assets, Baytex aims to reduce the per-barrel cost of moving its oil and gas. This focus on efficiency is crucial for maintaining profitability, especially in fluctuating commodity price environments.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Baytex Energy encompass the essential overhead costs supporting its corporate management, administrative functions, and various support departments. These are the behind-the-scenes costs that keep the company running smoothly, from executive salaries to legal and accounting services. Baytex actively seeks to optimize these expenses as a key component of its broader cost management strategy, aiming for greater operational efficiency and improved profitability.

For instance, in 2023, Baytex reported G&A expenses of approximately $234 million. This figure reflects the ongoing investment in the infrastructure and personnel necessary for the effective oversight and operation of its oil and gas assets. The company's commitment to cost reduction is evident in its continuous efforts to streamline these expenditures without compromising essential corporate functions.

- Corporate Management Salaries and Benefits: Compensation for executives and senior leadership.

- Administrative Support Staff: Wages for personnel in HR, finance, legal, and IT.

- Office Rent and Utilities: Costs associated with corporate office space.

- Professional Fees: Expenses for external legal, accounting, and consulting services.

Debt Servicing Costs

Debt servicing costs are a significant component of Baytex Energy's operational expenses, encompassing all interest payments and associated fees on their outstanding borrowings. These costs directly impact profitability and cash flow available for reinvestment or distribution.

Baytex has made debt reduction a strategic priority, recognizing its importance in strengthening the balance sheet and reducing financial risk. This focus is expected to continue, with the company targeting substantial debt reduction throughout 2025.

- Interest Expense: In the first quarter of 2024, Baytex reported interest expense of approximately $108 million.

- Debt Reduction Strategy: The company aims to achieve a net debt to EBITDA ratio below 1.0x by the end of 2025, a key metric for financial health.

- Impact on Cash Flow: Lowering debt servicing costs frees up capital that can be allocated to growth initiatives or returned to shareholders.

Baytex Energy's cost structure is heavily influenced by its exploration and development (E&D) activities, with a planned capital program between $1.2 billion and $1.3 billion for 2024 and 2025. Operating expenses, covering field operations and maintenance, are also a significant outlay, though Baytex achieved a 5% reduction in these costs on a boe basis in 2024 compared to the prior year.

Transportation costs, including pipeline tariffs and trucking, are substantial, with Q1 2024 figures around $150 million. General and Administrative (G&A) expenses, which were approximately $234 million in 2023, are continuously being optimized. Debt servicing is another key cost, with Q1 2024 interest expenses at about $108 million, as Baytex prioritizes debt reduction to achieve a net debt to EBITDA below 1.0x by the end of 2025.

| Cost Category | 2023 Actual (Approx.) | Q1 2024 Actual (Approx.) | 2024-2025 Planned Capital |

|---|---|---|---|

| Exploration & Development (E&D) | N/A | N/A | $1.2 - $1.3 billion |

| Operating Expenses | N/A | N/A | Focus on 5% reduction (boe basis) vs 2023 |

| Transportation | N/A | $150 million | N/A |

| General & Administrative (G&A) | $234 million | N/A | Ongoing optimization |

| Debt Servicing (Interest Expense) | N/A | $108 million | Targeting Net Debt/EBITDA < 1.0x by end of 2025 |

Revenue Streams

Baytex's core revenue generation hinges on selling the crude oil it extracts, encompassing both light and heavy varieties from its operations in Canada and the United States. This segment is the backbone of its financial performance.

In 2024, Baytex's production profile showed a strong reliance on oil, with approximately 85% of its output consisting of crude oil and natural gas liquids, underscoring the significance of these sales to its overall revenue.

Baytex Energy also generates revenue from selling natural gas liquids (NGLs), which are valuable by-products recovered during natural gas processing. These NGLs, including ethane, propane, and butane, are crucial components of the company's overall production mix.

The sale of NGLs significantly bolsters Baytex Energy's liquids-weighted production strategy, contributing to a more diversified revenue stream. For instance, in the first quarter of 2024, Baytex reported NGL sales volumes averaging 26,100 barrels per day, underscoring their importance to the company's financial performance.

While crude oil and natural gas liquids are Baytex Energy's primary revenue drivers, the sale of natural gas still plays a role, contributing to the company's overall financial performance. In 2023, Baytex reported an average natural gas production of 185 million cubic feet per day, which, though less than its liquids production, still generated significant income.

Baytex extracts natural gas from its operational areas in both Western Canada, particularly in the Viking light oil play, and the Eagle Ford shale region in Texas. This dual-region presence allows the company to diversify its natural gas output and tap into different market dynamics.

Commodity Hedging Gains

Baytex Energy utilizes a structured commodity hedging strategy to shield its revenue from the unpredictable swings in crude oil prices. This program primarily involves two-way collars, a financial instrument that sets a floor and a ceiling for oil prices, thereby managing risk.

These hedging activities can directly impact reported revenues. For instance, in the first quarter of 2024, Baytex reported gains on its commodity derivative financial instruments, contributing positively to its overall financial performance. The company's approach aims to create a more predictable revenue stream, even amidst market volatility.

- Disciplined Hedging Program: Baytex actively manages commodity price risk through a structured hedging program.

- Two-Way Collars: The primary hedging instrument used is the two-way collar on crude oil exposure.

- Revenue Contribution: Positive outcomes from these hedges can directly increase reported revenues.

- Q1 2024 Performance: Baytex experienced gains from commodity derivative financial instruments in early 2024, highlighting the revenue impact.

Asset Divestments

Asset divestments represent a crucial, albeit non-recurring, revenue stream for Baytex Energy. These strategic sales of non-core assets are designed to unlock capital and enhance the company's overall financial health. For instance, in 2023, Baytex completed the divestment of its U.S. light oil business for approximately $500 million, a move aimed at focusing on its core Canadian operations.

This strategy allows Baytex to streamline its operations and reallocate resources to more profitable ventures. By shedding underperforming or non-strategic assets, the company can improve its debt-to-equity ratio and bolster its liquidity. Such transactions are vital for maintaining financial flexibility, especially in a volatile energy market.

- Strategic Portfolio Optimization: Divestments allow Baytex to concentrate on its core, higher-margin assets, thereby improving operational efficiency.

- Capital Generation: The sale of assets provides significant one-time cash inflows, which can be used for debt reduction, share buybacks, or reinvestment in core growth areas.

- Financial Strengthening: By reducing its asset base in non-strategic areas, Baytex can improve key financial metrics and enhance its balance sheet.

- Market Responsiveness: Divestment strategies enable the company to adapt to changing market conditions and investor preferences by shedding less attractive business segments.

Baytex Energy's primary revenue comes from selling crude oil and natural gas liquids (NGLs) extracted from its Canadian and U.S. operations. In 2024, approximately 85% of its production comprised crude oil and NGLs, highlighting the dominance of these products in its revenue mix.

The company also generates income from natural gas sales, though it represents a smaller portion of its overall output. For instance, in 2023, Baytex reported an average natural gas production of 185 million cubic feet per day.

Baytex employs a disciplined hedging program, primarily using two-way collars on crude oil, to stabilize revenue against price volatility. This strategy can lead to direct revenue gains, as seen with positive outcomes from commodity derivative financial instruments in Q1 2024.

Asset divestments, such as the 2023 sale of its U.S. light oil business for around $500 million, provide significant, albeit non-recurring, revenue streams that help optimize its portfolio and financial health.

| Revenue Source | Description | 2023/2024 Relevance |

| Crude Oil Sales | Sale of light and heavy crude oil | Backbone of revenue; ~85% of 2024 production |

| Natural Gas Liquids (NGLs) Sales | Sale of ethane, propane, butane | Bolsters liquids-weighted strategy; 26,100 bbls/day in Q1 2024 |

| Natural Gas Sales | Sale of natural gas | Contributes to overall performance; 185 MMcf/day average in 2023 |

| Commodity Hedging | Gains from financial instruments | Stabilizes revenue, can add positively to reported income (e.g., Q1 2024) |

| Asset Divestments | Sale of non-core assets | Non-recurring but significant capital generation (e.g., $500M U.S. light oil sale in 2023) |

Business Model Canvas Data Sources

The Baytex Energy Business Model Canvas is informed by a combination of internal financial data, including historical performance and cost structures, alongside external market research and industry analysis. This ensures a robust and data-driven approach to understanding their strategic positioning and operational effectiveness.