Baytex Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baytex Energy Bundle

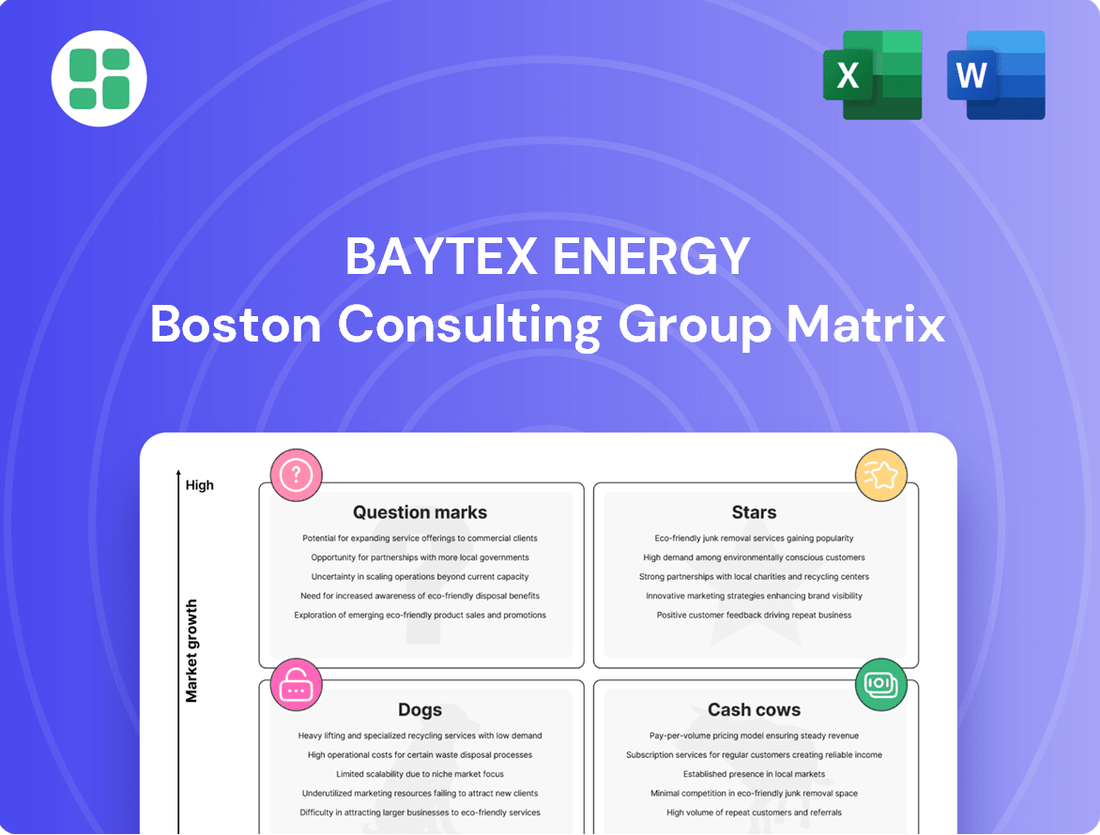

Curious about Baytex Energy's strategic positioning? This glimpse into their BCG Matrix reveals how their business units stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete picture; purchase the full report for actionable insights and a clear roadmap to optimizing their portfolio.

Stars

The Pembina Duvernay development by Baytex Energy is a prime example of a 'Star' in the BCG matrix. Recent well performance has been exceptional, with initial 30-day peak rates reaching 1,865 barrels of oil equivalent per day (boe/d) per well, primarily consisting of valuable oil and natural gas liquids (NGLs).

This strong operational success signifies a high-growth market where Baytex is solidifying its leadership. The asset is moving towards full commercialization, with ambitious production targets of 20,000 to 25,000 boe/d by 2029-2030, underscoring its significant growth potential.

Baytex Energy's Eagle Ford refrac program is a standout performer, with initial production rates from the Lower Eagle Ford rivaling new wells but at roughly half the capital cost. This efficiency is a key driver for their capital-efficient growth strategy.

With an impressive inventory of 300 identified refrac opportunities, Baytex is effectively extending the life of its assets in this mature basin. This focus on high-return projects is a strategic move to capture market share through operational excellence and cost savings.

Baytex's strategic production growth per share targets a 2% increase by 2025, building on Q2 2024 figures. This focus on per-share expansion, driven by operational efficiencies and high-return projects, positions it as a 'Star' within the BCG framework. It signifies a commitment to enhancing shareholder value in a dynamic market.

High-Return Capital Allocation

Baytex Energy exhibits disciplined capital allocation, prioritizing high-return opportunities. A substantial part of their investment is channeled into projects like the Pembina Duvernay and Eagle Ford refracs, targeting areas with strong market share and growth potential.

This strategic focus aims to boost returns and solidify Baytex's competitive position in its most lucrative plays. For instance, in the first quarter of 2024, Baytex reported strong operational performance, with production averaging 153,000 boe/d, showcasing the effectiveness of their capital deployment in key assets.

- Pembina Duvernay: Continued investment in this play is a cornerstone of their high-return strategy.

- Eagle Ford Refracs: Baytex is leveraging re-fracturing technology to unlock additional value from existing wells, demonstrating a commitment to maximizing asset potential.

- Capital Efficiency: The company's approach emphasizes capital efficiency, ensuring that investments generate the highest possible returns.

- 2024 Outlook: Baytex's 2024 capital budget, announced in late 2023, allocated a significant portion to these high-return programs, underscoring their strategic priorities.

Emerging High-Potential Plays

Beyond its core assets, Baytex Energy actively scouts for emerging high-potential plays, aiming to cultivate future stars within its portfolio. This strategic scouting is crucial for sustained growth in the ever-evolving energy landscape. For instance, in 2024, Baytex continued exploration and development activities in promising unconventional basins, seeking to replicate the success of its established plays.

These emerging opportunities represent Baytex's commitment to innovation and adaptability. The company's exploration budget for 2024 included dedicated funding for evaluating new geological plays, reflecting a forward-looking strategy. Success in these ventures could lead to significant reserve additions and production growth.

Baytex's proactive approach to identifying and nurturing these potential growth drivers is a key component of its long-term value creation strategy. By investing in the early stages of promising plays, the company positions itself to capitalize on future market shifts and technological advancements.

- Exploration Investment: Baytex allocated a portion of its 2024 capital expenditure to evaluate new exploration frontiers.

- Portfolio Diversification: The pursuit of emerging plays aims to diversify the company's asset base and mitigate risk.

- Future Growth Engines: Successful development of these plays is anticipated to contribute significantly to future production and cash flow.

- Market Adaptability: This strategy ensures Baytex remains agile and responsive to changing market dynamics and opportunities.

The Pembina Duvernay development and Eagle Ford refrac program are clear "Stars" for Baytex Energy, demonstrating high growth and strong market share. These assets are currently generating significant returns and are expected to drive future production increases. Baytex's strategic focus on these high-return projects, supported by impressive well performance and capital efficiency, solidifies their position as leaders in these key plays.

| Asset | 2024 Capital Allocation Focus | Key Performance Indicator | Market Position |

|---|---|---|---|

| Pembina Duvernay | Continued Development | Peak 30-day rates of 1,865 boe/d per well | High Growth, Solidifying Leadership |

| Eagle Ford Refracs | Maximizing Existing Wells | Production rivaling new wells at ~50% capital cost | High Growth, Capital Efficiency |

What is included in the product

The Baytex Energy BCG Matrix analyzes its business units based on market growth and share, guiding investment decisions.

Provides a clear, visual representation of Baytex's portfolio, simplifying complex strategic decisions.

This BCG Matrix analysis offers a streamlined approach to resource allocation, easing the burden of difficult choices.

Cash Cows

Baytex's operated Eagle Ford assets are clearly its cash cows, projected to contribute a substantial 56% of its 2025 production. These aren't just big contributors; they're highly efficient, with drilling and completion costs seeing an 11% reduction. This efficiency translates directly into strong, reliable cash flow with minimal need for reinvestment.

Baytex Energy's Canadian heavy oil assets, notably in Peace River and Lloydminster, are clear cash cows. These established operations are consistently strong performers, with production showing robust growth. In fact, production from these areas grew by 7% quarter-over-quarter in Q2 2025, underscoring their reliable output.

These assets are a cornerstone of Baytex's financial stability, characterized by capital-efficient development. They generate a stable, high-margin cash flow that fuels the company's broader strategy. Because they operate in a mature market, they require minimal promotional investment, allowing Baytex to allocate capital elsewhere.

Baytex's assets, characterized by their high market share, are projected to generate around $400 million in free cash flow for 2025. This strong cash generation, with a significant portion expected in the latter half of the year, is vital for the company's financial strategy.

This substantial free cash flow is earmarked for reducing debt and returning capital to shareholders, clearly positioning these operations as 'Cash Cows' within the BCG framework. They reliably produce more cash than is needed for their ongoing operations and maintenance.

Disciplined Debt Reduction & Shareholder Returns

Baytex Energy's strategy for its Cash Cows, exemplified by its disciplined debt reduction and shareholder returns, centers on robust free cash flow generation from mature assets. The company is committed to directing 100% of its free cash flow, after dividends, towards paying down debt. This focused approach aims to achieve a net debt target of roughly $2 billion by the end of 2025, reinforcing financial health and enhancing shareholder value.

This financial discipline is directly supported by the consistent and predictable cash flows generated by Baytex's established, mature production assets. These assets act as the engine for the company's deleveraging efforts and its ability to return capital to investors.

- Debt Reduction Target: Approximately $2 billion net debt by year-end 2025.

- Free Cash Flow Allocation: 100% after dividends directed to debt repayment.

- Asset Support: Cash generation from core, mature assets enables this strategy.

Low-Decline Production Base

Baytex Energy's portfolio, spanning both U.S. and Canadian operations, boasts a substantial liquids weighting. This diversification underpins a production base characterized by low decline rates, a hallmark of a robust Cash Cow. The company's mature fields in these regions generate consistent cash flow, minimizing the need for substantial capital reinvestment to maintain production levels.

This stability is a key differentiator for Baytex. For instance, in the first quarter of 2024, Baytex reported an average production of approximately 340,000 barrels of oil equivalent per day (boe/d). The significant contribution from their liquids-focused assets, particularly in the Eagle Ford and Permian Basin in the U.S., and Peace River in Canada, ensures a predictable revenue stream.

- Low Decline Production: Baytex's mature assets exhibit lower production decline rates compared to high-growth, high-cost areas.

- Liquids Weighted Portfolio: A substantial portion of their production comes from oil and natural gas liquids, which generally command higher prices and contribute to stable revenue.

- Consistent Cash Flow Generation: The low-decline, liquids-rich production base translates into reliable cash flow, supporting dividend payments and debt reduction.

- Reduced Reinvestment Needs: Unlike growth-oriented assets, these Cash Cow segments require less capital expenditure for maintenance, freeing up cash for other strategic initiatives.

Baytex's mature, liquids-weighted assets in the Eagle Ford and Canadian heavy oil regions are its primary cash cows. These operations are characterized by low decline rates and capital efficiency, generating substantial and predictable free cash flow. For 2025, these assets are projected to contribute significantly to the company's financial stability.

These cash cows are instrumental in Baytex's strategy of deleveraging and returning capital to shareholders. The company plans to allocate 100% of its free cash flow, after dividends, towards debt reduction, aiming for a net debt target of approximately $2 billion by the end of 2025.

The consistent cash generation from these mature fields, exemplified by a 7% quarter-over-quarter production growth in Canadian heavy oil during Q2 2025, allows for minimal reinvestment. This financial discipline is a direct result of the reliable output from these core assets.

Baytex's overall production in Q1 2024 averaged around 340,000 boe/d, with a significant portion coming from these liquids-rich, low-decline areas, ensuring a stable revenue stream.

| Asset Type | Key Characteristics | 2025 Production Projection (Est.) | Strategic Role |

|---|---|---|---|

| Eagle Ford (U.S.) | High efficiency, low D&C costs (-11%) | 56% of total production | Major Cash Cow, reliable cash flow |

| Canadian Heavy Oil (Peace River, Lloydminster) | Established, strong performers, low decline | Significant contributor | Consistent, high-margin cash flow |

What You See Is What You Get

Baytex Energy BCG Matrix

The Baytex Energy BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning. This comprehensive document, meticulously crafted with market data and expert analysis, is ready to be integrated into your business operations without any additional editing or watermarks. You can confidently use this preview as a direct representation of the high-quality, actionable insights you will gain for Baytex Energy's portfolio management and future growth strategies.

Dogs

Baytex Energy's renewable diesel segment is currently positioned as a 'Dog' in the BCG Matrix. This segment experienced an operating loss of $79 million in the second quarter of 2025, highlighting its status as a drain on company resources rather than a contributor to profitability.

Despite its role in the company's energy transition strategy, the renewable diesel operations are consuming cash without generating sufficient returns. This underperformance is a key indicator of its 'Dog' status, suggesting a need for strategic review or divestment.

Baytex Energy anticipates a decline in its non-operated Eagle Ford volumes for 2025. This forecast stems from anticipated lower activity levels in the latter half of 2024 and extending into early 2025.

Although Baytex's operated Eagle Ford assets are considered strong performers, the non-operated segment is viewed as a low-growth, low-market-share area. Consequently, it is not a priority for substantial capital allocation.

Marginal natural gas assets within Baytex Energy's portfolio, while not a primary focus, represent a segment that could be placed in the BCG Matrix's "dog" category. These are likely older, less productive wells where the cost of extraction outweighs the potential returns. In 2023, Baytex's production mix was heavily weighted towards oil and liquids, with natural gas accounting for only about 15% of their total output.

Older, High-Decline Wells

Older, high-decline wells in Baytex Energy's portfolio would likely be categorized as Dogs. These are mature assets that have passed their peak production and now require substantial operating costs to maintain minimal output. Such wells often struggle to generate positive cash flow, acting as a drain on resources rather than a contributor to growth.

These wells typically have high operating expenses per barrel of oil equivalent (BOE) compared to newer, more efficient wells. For instance, in the broader E&P industry, wells with decline rates exceeding 20-30% annually often fall into this category, especially if their lifting costs are near or above the prevailing commodity prices.

- High Operating Costs: These wells incur significant expenses for pumping, maintenance, and water handling relative to their declining production volumes.

- Low or Negative Cash Flow: The revenue generated often barely covers, or doesn't cover, the operating expenditures, leading to cash consumption.

- Limited Growth Potential: Without substantial reinvestment in enhanced oil recovery or workovers, these wells offer little to no prospect for increased production or profitability.

Assets Not Receiving Significant Capital

Baytex Energy's capital allocation strategy for 2024 highlights a clear focus, with 55-60% of expenditures directed towards the Eagle Ford and 40-45% towards Canadian light and heavy oil assets. This deliberate concentration means that any assets outside these core areas are likely receiving minimal capital investment.

These underfunded assets, if they also possess low market share within their respective segments and contribute negligibly to overall company performance, would align with the characteristics of 'Dogs' in a BCG matrix. Such assets represent areas where Baytex is not actively seeking growth or significant operational improvement.

- Low Capital Allocation: Assets not designated for the Eagle Ford or Canadian oil plays are likely to see reduced investment.

- Potential 'Dog' Status: If these assets also have low market share and minimal contribution, they fit the 'Dog' profile.

- Strategic Non-Focus: This indicates areas where Baytex is not prioritizing growth or substantial capital deployment.

Baytex Energy's renewable diesel segment, despite its strategic importance, is currently classified as a 'Dog' due to its underperformance. This segment incurred an operating loss of $79 million in Q2 2025, demonstrating its role as a cash drain rather than a profit generator.

Similarly, older, high-decline wells within Baytex's portfolio, characterized by high operating costs per barrel and limited growth potential, also fit the 'Dog' profile. These mature assets often struggle to generate positive cash flow, consuming resources without significant returns.

The company's capital allocation strategy for 2024, prioritizing Eagle Ford and Canadian oil assets, further suggests that any segments receiving minimal investment and possessing low market share would also be considered 'Dogs'. These are areas where Baytex is not actively pursuing growth.

| Segment | BCG Classification | Key Financial Indicator (2025) | Strategic Implication |

| Renewable Diesel | Dog | Operating Loss: $79 million (Q2 2025) | Requires strategic review or divestment |

| Older, High-Decline Wells | Dog | High operating costs per BOE, low/negative cash flow | Potential candidate for abandonment or optimization |

| Non-Operated Eagle Ford | Dog | Anticipated decline in volumes (2025) | Low priority for capital allocation |

Question Marks

Baytex Energy is actively exploring early-stage carbon capture initiatives, positioning these ventures as potential high-growth opportunities within the evolving energy transition landscape. These projects are characterized by their nascent development, demanding substantial capital investment and operating with unproven profitability and market traction, aligning them squarely within the Question Mark quadrant of the BCG Matrix.

The company's engagement in carbon capture technology, particularly in 2024, reflects a strategic move into a sector with significant long-term potential but also considerable upfront risk. For instance, the global carbon capture, utilization, and storage (CCUS) market was projected to reach USD 4.4 billion in 2024, with substantial growth anticipated, yet early-stage projects often face challenges in scaling and securing consistent revenue streams.

Baytex Energy's development of a distributed hydrogen model using renewable natural gas (RNG) as a feedstock positions it within the 'Question Mark' category of the BCG Matrix. This venture directly supports decarbonization objectives, a key strategic imperative in the current energy landscape.

While RNG-based hydrogen presents significant growth potential and aligns with evolving environmental regulations, its commercial viability and profitability for Baytex remain largely unproven at scale. This uncertainty, coupled with a currently low market share in this nascent sector, solidifies its 'Question Mark' status, requiring careful observation and strategic investment decisions.

Baytex Energy's strategic focus extends beyond its established Viking and Duvernay plays to include the exploration of novel unconventional resource targets. These emerging opportunities are characterized by their significant growth potential but currently possess low market share and demand substantial capital investment for reserve delineation, aligning with the characteristics of 'Question Marks' in the BCG matrix.

For instance, Baytex has been actively assessing the Montney formation in certain areas, which, while a proven play for others, represents a less developed unconventional target for Baytex itself. Successful exploration and development in these new areas would require significant upfront capital expenditure, mirroring the investment needed to transform a 'Question Mark' into a 'Star' within the BCG framework.

Potential Future Acquisitions

Baytex's strategic objective includes optimizing its portfolio through strategic acquisitions, which, depending on the nature and maturity of the acquired assets, could initially be question marks.

These would be high-growth opportunities where Baytex seeks to establish market share through significant investment and integration. For instance, if Baytex were to acquire a promising but undeveloped resource play in the Montney formation, it would likely represent a question mark initially, requiring substantial capital expenditure to prove reserves and develop production. As of late 2023 and early 2024, the energy sector has seen active consolidation, with companies like Baytex actively evaluating opportunities to expand their footprint in key producing basins.

- Acquisition of Undeveloped Reserves: Baytex might target acquisitions of companies holding significant proved undeveloped reserves (PUDs) that require substantial upfront investment for drilling and completion.

- Entry into New Basins: Acquiring assets in emerging or less mature unconventional plays would fit the question mark category, demanding exploration and development capital to determine economic viability and scale.

- Technological Advancement Integration: Purchases of companies with proprietary technologies that enhance recovery or reduce operating costs in challenging formations could also be categorized as question marks, requiring investment to scale and integrate these innovations.

Unproven Resource Expansion

Unproven Resource Expansion for Baytex Energy would fall into the Question Marks category of the BCG Matrix. This involves internal projects targeting the expansion of existing resource plays into less-proven or frontier areas within their acreage. The economic viability and full scale of these ventures are not yet definitively established, meaning they carry higher risk but also the potential for significant future growth.

These initiatives demand substantial capital investment to ascertain their feasibility and unlock their growth potential. For instance, if Baytex were to explore new, less-developed zones within the Viking or Peace River formations, these would be considered Question Marks. The success of such expansions hinges on extensive geological analysis, successful pilot projects, and favorable market conditions.

- Unproven Resource Expansion: Projects targeting less-explored acreage within existing plays.

- High Investment Requirement: Significant capital needed to de-risk and determine viability.

- Potential for High Growth: Offers substantial upside if successful in new areas.

- Risk Factor: Economics and scale are not yet fully proven, leading to inherent uncertainty.

Baytex Energy's ventures into early-stage carbon capture and new, less-explored resource plays are classified as Question Marks in the BCG Matrix. These initiatives require significant capital investment with uncertain profitability and market share, reflecting their high-risk, high-reward nature.

The company's strategic focus on carbon capture, particularly in 2024, aligns with a growing global market, projected to reach USD 4.4 billion, yet these early-stage projects face scaling and revenue generation hurdles. Similarly, exploring new unconventional targets like the Montney formation demands substantial upfront capital to delineate reserves and prove economic viability.

Baytex's potential acquisitions of undeveloped reserves or entry into new basins also fit the Question Mark profile, necessitating investment to establish market presence and prove the value of these assets. These strategic moves underscore Baytex's commitment to future growth, albeit with inherent uncertainties that characterize Question Mark investments.

| Initiative | BCG Category | Key Characteristics | Potential Upside | Associated Risks |

| Carbon Capture Ventures | Question Mark | Early-stage, high capital needs, unproven profitability | Long-term growth in energy transition | Scaling challenges, market acceptance |

| New Unconventional Resource Exploration (e.g., Montney) | Question Mark | Low market share, significant upfront investment | Discovery of substantial reserves | Geological uncertainty, development costs |

| Strategic Acquisitions (Undeveloped Assets) | Question Mark | Requires integration and development capital | Market share expansion, portfolio enhancement | Integration challenges, asset valuation |

BCG Matrix Data Sources

Our Baytex Energy BCG Matrix is constructed using robust data, including internal financial disclosures, industry-specific market research, and publicly available company performance metrics.