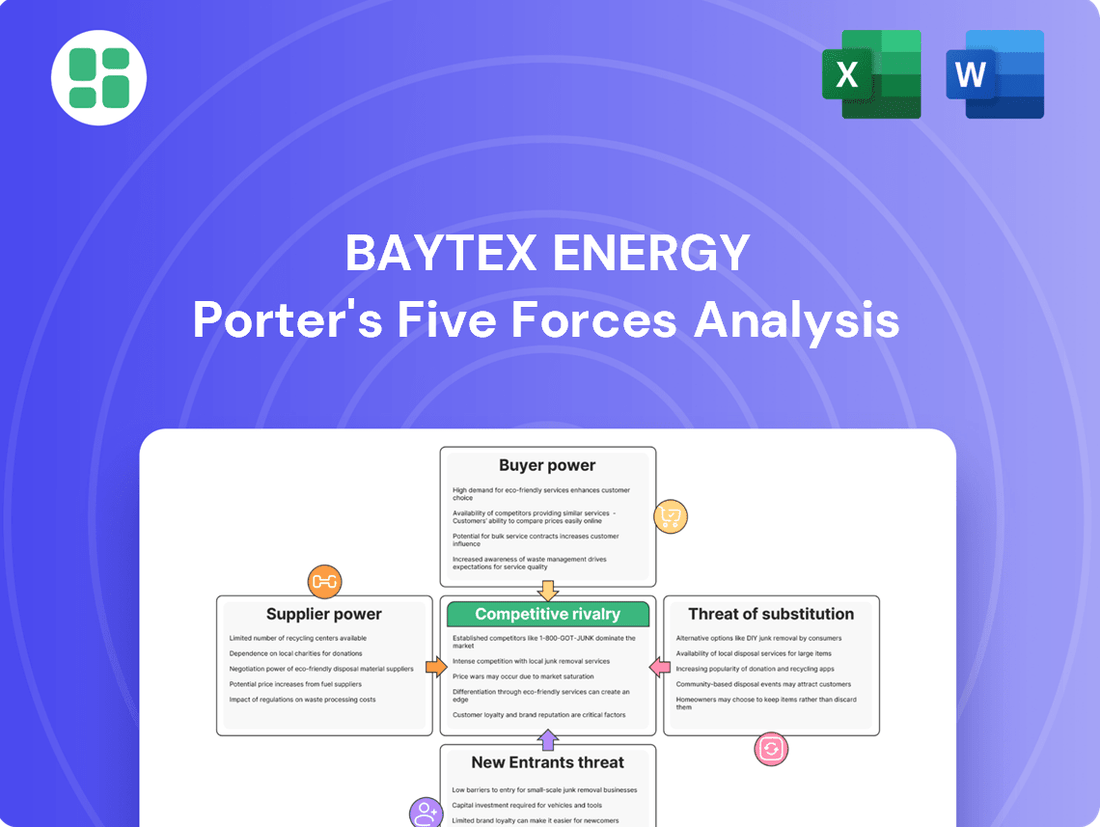

Baytex Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baytex Energy Bundle

Baytex Energy navigates a landscape shaped by intense rivalry and fluctuating commodity prices. Understanding the power of buyers and the threat of substitutes is crucial for any stakeholder. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Baytex Energy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The suppliers of specialized drilling equipment and oilfield services to Baytex Energy are generally fragmented, though some niche providers might exhibit higher concentration. This fragmentation means Baytex can often find alternative suppliers, which limits the bargaining power of any single provider. For instance, in 2024, the oilfield services sector saw numerous companies competing for contracts, with major players like Schlumberger and Halliburton holding significant market share but facing competition from smaller, specialized firms.

Baytex Energy's suppliers provide inputs that are largely commoditized, such as crude oil and natural gas. While some specialized equipment or services might be required for extraction and processing, these are generally available from multiple vendors, limiting the uniqueness of any single supplier's offering. For instance, in 2024, the energy sector saw continued investment in modular drilling technologies, making equipment more standardized.

The switching costs for Baytex Energy to change suppliers are typically moderate. While there can be initial setup or integration costs, they are usually not prohibitive given the availability of alternative providers for most essential inputs. For example, if a particular drilling fluid supplier is used, switching to another reputable provider would likely involve some logistical adjustments but not fundamental operational overhauls, keeping supplier bargaining power in check.

The threat of forward integration by suppliers in the oil and gas sector, while generally low for Baytex Energy, is a factor to monitor. Suppliers of specialized equipment or services might consider moving into exploration and production if the capital and expertise barriers were significantly lower, thereby increasing their bargaining power.

However, the substantial capital investment and deep technical expertise required for upstream oil and gas operations make this a difficult and unlikely move for most suppliers. For instance, a typical onshore drilling rig can cost millions, and operating wells requires extensive geological and engineering knowledge, which most service providers lack.

Importance of Supplier's Input to Baytex

The criticality of supplier inputs to Baytex's operations is a key factor in assessing supplier bargaining power. For instance, specialized services like environmental consulting or advanced drilling technologies are essential for maintaining operational efficiency and adhering to stringent regulatory standards. If Baytex relies heavily on a limited number of providers for these critical inputs, those suppliers gain significant leverage.

Baytex's operational efficiency and safety are directly tied to the quality and reliability of certain supplier inputs. For example, the supply of specialized chemicals for extraction processes or the maintenance services for complex drilling equipment are vital. Disruptions or quality issues with these inputs can lead to significant production downtime and increased costs. In 2023, Baytex reported capital expenditures of approximately $1.8 billion, a portion of which was allocated to maintaining and upgrading its operational infrastructure, highlighting its dependence on reliable suppliers.

- Critical Inputs: Specialized chemicals for enhanced oil recovery and advanced drilling fluids are essential for Baytex's production processes.

- Operational Impact: Reliance on a few key suppliers for environmental compliance services and specialized technical support can increase their bargaining power.

- Safety and Efficiency: The availability and quality of maintenance services for complex extraction machinery directly impact operational uptime and safety protocols.

- Cost Sensitivity: Fluctuations in the cost of essential raw materials or specialized equipment can significantly affect Baytex's profitability, giving suppliers of these items more influence.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Baytex Energy's bargaining power with its suppliers. If Baytex can easily find comparable alternatives for essential materials, equipment, or services, its leverage over current suppliers increases. For instance, if there are multiple providers of drilling fluids or specialized extraction machinery that perform similarly, Baytex can negotiate better terms or switch suppliers with minimal disruption.

Conversely, a lack of readily available substitutes for critical inputs strengthens the bargaining power of Baytex's suppliers. If a particular type of specialized pipe or a unique chemical compound is only offered by a few companies, those suppliers can command higher prices. In 2024, the energy sector continued to see fluctuations in the availability of certain specialized equipment and skilled labor, which can tilt the balance of power.

- Limited Substitutes for Specialized Equipment: Access to advanced hydraulic fracturing units or specific seismic surveying technology may be concentrated among a few manufacturers, giving them considerable pricing power.

- Availability of Raw Materials: While crude oil and natural gas are commodities, the availability of specific grades or the infrastructure to transport them can be limited, impacting Baytex's options.

- Service Provider Competition: The market for oilfield services, such as well completion and maintenance, often sees a mix of large, established players and smaller, specialized firms. The degree of competition among these service providers dictates Baytex's negotiating strength.

- Technological Dependence: If Baytex relies on proprietary technology or highly specialized expertise from a supplier, the absence of viable substitutes for that technology or expertise grants the supplier significant leverage.

The bargaining power of Baytex Energy's suppliers is generally moderate, influenced by the fragmentation of the oilfield services market and the commoditized nature of many inputs. While specialized equipment or services can offer some leverage to suppliers, the overall competitive landscape and Baytex's ability to switch providers keep this power in check.

In 2024, the energy sector saw continued competition among oilfield service providers, with companies like Schlumberger and Halliburton facing pressure from smaller, specialized firms. This dynamic limits the ability of any single supplier to dictate terms to Baytex. Furthermore, the availability of modular drilling technologies in 2024 contributed to a more standardized equipment market, reducing supplier uniqueness.

Switching costs for Baytex are typically manageable, preventing suppliers from exerting excessive influence. While initial integration costs exist, they are usually not prohibitive. For instance, replacing a drilling fluid supplier involves logistical adjustments but not fundamental operational overhauls, thereby capping supplier leverage.

| Factor | Impact on Supplier Bargaining Power | Baytex Energy Context (2024 Data) |

| Supplier Concentration | Low to Moderate | Fragmented oilfield services market with some niche specialists. |

| Input Commoditization | Low | Crude oil, natural gas, and increasingly standardized equipment. |

| Switching Costs | Moderate | Manageable logistical adjustments for most input changes. |

| Threat of Forward Integration | Low | High capital and expertise barriers for suppliers entering E&P. |

| Input Criticality | Moderate to High | Reliance on specialized chemicals and maintenance services for efficiency. |

| Availability of Substitutes | Moderate to High | Multiple providers for many essential inputs, though some specialization exists. |

What is included in the product

This Porter's Five Forces analysis for Baytex Energy dissects the competitive intensity within the oil and gas sector, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitute products.

Instantly identify and mitigate competitive threats with a comprehensive, actionable breakdown of Baytex Energy's industry landscape.

Customers Bargaining Power

The bargaining power of Baytex Energy's customers is influenced by their concentration. Baytex primarily sells to refiners and natural gas distributors. If a few major players dominate the customer base, they can exert significant pressure on Baytex for lower prices and more favorable contract terms. This is a common dynamic in the downstream oil and gas sector where large integrated companies often hold substantial purchasing power.

The volume of purchases by individual customers significantly impacts their bargaining power with Baytex Energy. Large-scale buyers, such as major refiners or industrial consumers, represent a substantial portion of Baytex's revenue. For instance, in 2023, Baytex's average daily production was approximately 83,000 barrels of oil equivalent (boe). Customers who commit to purchasing a considerable percentage of this output naturally wield more influence over pricing and contract terms, as their business is critical to Baytex's sales volume and operational stability.

Switching costs for Baytex Energy's customers are generally low in the commoditized oil and gas market. This means that if a customer wants to buy oil or gas from a different producer, the effort and expense involved are typically minimal. For instance, in 2024, the global crude oil market saw significant price volatility, making it easier for buyers to seek out the best available prices from various suppliers without incurring substantial penalties or setup fees.

While logistical hurdles like changing transportation arrangements might exist, they are often manageable for most industrial or commercial buyers. Contractual barriers, if present, are usually short-term or standard in nature, not creating a significant lock-in effect. This low switching cost environment directly enhances the bargaining power of Baytex's customers, as they have ample alternatives readily available.

Information Availability to Customers

Customers in the energy sector, particularly for oil and gas like that produced by Baytex Energy, often have access to a significant amount of information. This transparency regarding pricing, production levels, and market trends allows them to make well-informed decisions.

The widespread availability of data on commodity prices, such as West Texas Intermediate (WTI) and Western Canadian Select (WCS), directly impacts Baytex's bargaining power. For instance, as of early 2024, WTI crude oil prices have fluctuated, with benchmarks trading in the $70-$80 per barrel range, providing customers with clear reference points for negotiations.

- Price Transparency: Real-time commodity price feeds are readily accessible, enabling customers to understand the prevailing market value.

- Market Conditions: Information on global supply and demand dynamics, geopolitical events, and economic forecasts is widely published, influencing customer expectations.

- Alternative Suppliers: Customers can easily identify and compare offers from various oil and gas producers, both domestically and internationally.

- Industry Benchmarks: Data on production costs, reserve reports, and company financial performance are often publicly available, further empowering customer negotiation.

Threat of Backward Integration by Customers

The threat of backward integration by Baytex Energy's customers, particularly large refiners, poses a significant challenge. If these customers possess the financial muscle and technical know-how, they could potentially develop their own oil and natural gas production assets. This capability would allow them to bypass Baytex, directly controlling their supply and exerting downward pressure on Baytex's pricing and contract terms.

While less common in the energy sector compared to other industries, the possibility exists for major downstream players. For instance, a large integrated oil company with refining operations might consider developing its own upstream assets if it perceives significant cost advantages or supply chain security benefits. This strategic move could directly impact Baytex's market share and profitability.

- Customer Integration Risk: Large refiners, possessing substantial capital and operational expertise, could potentially invest in their own upstream oil and gas production.

- Impact on Pricing: Successful backward integration by customers would reduce their reliance on Baytex, potentially leading to lower prices demanded for crude oil and natural gas.

- Supply Chain Control: Customers integrating backward gain greater control over their raw material supply, diminishing their dependence on third-party producers like Baytex.

- Industry Example: While specific instances of major refiners backward integrating into Baytex's core production areas are not widely publicized, the strategic option remains a theoretical pressure point in contract negotiations.

The bargaining power of Baytex Energy's customers is moderate, driven by several factors. Their ability to switch suppliers is relatively easy due to low switching costs in the commoditized energy market, meaning buyers can readily find alternative sources for oil and gas. Furthermore, customers benefit from high price transparency, with readily available data on market benchmarks like WTI and WCS, such as WTI trading in the $70-$80 range in early 2024, empowering them in negotiations.

The volume of purchases by key customers significantly amplifies their influence. For instance, in 2023, Baytex's average daily production was around 83,000 boe, and large buyers of this output naturally command more favorable terms. While backward integration by major refiners is a potential threat, it's not a widespread current practice, limiting its immediate impact.

| Factor | Influence on Baytex | 2023/2024 Data/Context |

|---|---|---|

| Customer Concentration | Moderate to High (if few dominant buyers) | Baytex sells to refiners and distributors, concentration level varies. |

| Purchase Volume | High (for large buyers) | Average daily production ~83,000 boe in 2023. |

| Switching Costs | Low | Commoditized market, easy to find alternative suppliers. |

| Information Availability | High | WTI prices ~$70-$80/bbl in early 2024, market data readily accessible. |

| Threat of Backward Integration | Low to Moderate | Potential for large refiners, but not a dominant trend. |

Full Version Awaits

Baytex Energy Porter's Five Forces Analysis

This preview showcases the complete Baytex Energy Porter's Five Forces Analysis, offering a detailed examination of industry competitiveness. You'll receive this exact, professionally formatted document immediately upon purchase, providing actionable insights into the competitive landscape. Understand the forces shaping Baytex Energy's strategic environment with this comprehensive analysis.

Rivalry Among Competitors

The competitive landscape for Baytex Energy is characterized by a significant number of active oil and natural gas exploration and production companies operating across Western Canada and the United States. This includes both large, integrated energy giants and smaller, more specialized independent producers.

In 2024, the number of publicly traded E&P companies in North America remains substantial, with hundreds of entities actively seeking to extract hydrocarbon resources. Many of these competitors, particularly those focused on the same basins as Baytex, possess comparable operational scales and financial capacities, leading to direct competition for leases, talent, and capital.

For instance, in the key Permian Basin and Western Canadian Sedimentary Basin, Baytex contends with major players like ConocoPhillips, Pioneer Natural Resources, and Canadian Natural Resources Limited, alongside numerous mid-sized and smaller independents. This density of similarly sized competitors intensifies rivalry, as each seeks to optimize production, manage costs, and secure favorable market access.

The crude oil and natural gas industry, where Baytex Energy operates, has experienced fluctuating growth rates. While demand for hydrocarbons remains significant, the accelerating energy transition toward renewables is a key factor influencing long-term industry growth projections. This dynamic creates a challenging environment for established players.

In 2024, the International Energy Agency (IEA) projected that global oil demand would continue to rise, albeit at a more moderate pace than in previous years, with estimates suggesting an increase of around 1.2 million barrels per day. However, this growth is juxtaposed with substantial investments in renewable energy sources and evolving government policies aimed at decarbonization, which inherently dampen the long-term expansion prospects for traditional fossil fuels.

This scenario of moderate but potentially peaking growth intensifies competitive rivalry. Companies like Baytex must navigate a landscape where market share gains are harder to achieve, and efficiency improvements become paramount. The pressure to adapt to evolving energy demands and investor sentiment regarding environmental, social, and governance (ESG) factors further fuels this competitive intensity.

In the crude oil and natural gas sector, product differentiation is indeed minimal. Both commodities are largely interchangeable, meaning companies struggle to stand out based on unique product features.

This lack of differentiation forces competition to center heavily on price. For instance, in 2024, the price of West Texas Intermediate (WTI) crude oil fluctuated significantly, impacting profitability and making cost efficiency a primary competitive lever for producers like Baytex Energy.

Consequently, the intense price-based competition amplifies rivalry among players. Without distinct product offerings, companies must constantly focus on operational efficiency and cost management to maintain market share and attract buyers.

High Fixed Costs and Storage Costs

Baytex Energy faces intense competitive rivalry, partly due to the substantial fixed costs inherent in the oil and gas sector. These costs, spanning exploration, development, and production infrastructure, create pressure to maintain high operational levels. For instance, in 2024, the capital expenditure for the industry remained significant, with many companies investing heavily in maintaining or expanding their asset base.

The need to cover these considerable fixed costs often leads to aggressive pricing strategies, particularly when market demand softens. Companies may lower prices to keep production running and generate revenue, even if margins are thin, to avoid the full impact of unutilized capacity. This dynamic was evident in 2024, with fluctuating crude oil prices impacting producers' decisions on output levels.

Furthermore, storage costs can add another layer of expense and competitive pressure. Managing inventory, especially during periods of oversupply, incurs additional financial burdens. Companies must balance production decisions with the cost of storing excess product, influencing their willingness to compete on price to move inventory.

- High Fixed Costs: Exploration, development, and production infrastructure require significant upfront and ongoing investment.

- Price Competition: High fixed costs incentivize companies to maintain production, often leading to price wars during downturns.

- Storage Costs: Managing inventory adds to operational expenses, influencing production and pricing decisions.

- Industry Example: In 2024, continued investment in infrastructure underscored the high fixed cost environment for oil and gas producers.

Exit Barriers

Baytex Energy, like others in the oil and gas sector, faces significant exit barriers. Specialized assets, such as offshore platforms or unique extraction equipment, are difficult to repurpose or sell, locking companies into continued operations. Long-term contractual obligations, like supply agreements or lease agreements, also make exiting costly and complex. Social and environmental considerations, including decommissioning liabilities and regulatory requirements for site remediation, further increase the expense and difficulty of leaving the industry.

These high exit barriers can contribute to sustained competitive rivalry. When firms find it hard to leave, they may continue operating even when profitability is low, leading to overcapacity in the market. This can intensify price competition and reduce overall industry returns. For instance, in 2024, the global oil and gas industry continued to grapple with the challenges of stranded assets, where the economic viability of existing infrastructure is increasingly questioned due to the energy transition, highlighting the persistence of these exit barriers.

- Specialized Assets: Oil and gas infrastructure, like refineries and pipelines, has limited alternative uses, making them hard to divest.

- Contractual Obligations: Long-term supply contracts and leases can obligate companies to continued operations, even in unfavorable market conditions.

- Decommissioning Costs: The significant expense associated with safely shutting down and restoring oil and gas sites acts as a powerful deterrent to exiting.

- Regulatory Environment: Stringent environmental regulations and remediation requirements add further complexity and cost to any exit strategy.

The competitive rivalry for Baytex Energy is fierce, driven by a large number of players in the North American oil and gas sector. In 2024, the industry saw continued consolidation, but still maintained a robust number of independent producers, many with similar asset bases and operational scales to Baytex. This direct competition for resources and market share intensifies the pressure on all participants.

The lack of product differentiation in crude oil and natural gas means competition heavily relies on price and operational efficiency. For example, in 2024, fluctuating WTI prices directly impacted producers' margins, forcing a constant focus on cost management to remain competitive. Companies are pressured to optimize every aspect of their operations to secure favorable pricing and market access.

High fixed costs associated with exploration, development, and infrastructure in the oil and gas industry also fuel rivalry. In 2024, significant capital expenditures continued across the sector, compelling companies to maintain high production levels to cover these costs, even during periods of lower commodity prices. This often leads to aggressive pricing strategies to ensure capacity utilization.

Moreover, substantial exit barriers, including specialized assets and decommissioning liabilities, mean companies are often reluctant to leave the market, even when facing profitability challenges. This persistence of players, evident in 2024's ongoing discussions around stranded assets, contributes to sustained overcapacity and heightened competition.

SSubstitutes Threaten

The price-performance of substitutes for crude oil and natural gas presents a significant threat to Baytex Energy. Renewable energy sources like solar and wind power have seen dramatic cost reductions. For instance, the global weighted-average levelized cost of electricity for utility-scale solar PV fell by approximately 89% between 2010 and 2022, reaching $0.047 per kilowatt-hour in 2022. This makes them increasingly competitive with traditional fossil fuels, especially in regions with favorable resource availability.

Electric vehicles (EVs) also pose a growing threat, directly impacting gasoline demand. By the end of 2023, global EV sales were projected to reach 14 million units, a substantial increase from previous years, indicating a shift in consumer preference and a potential long-term decline in oil consumption for transportation. Furthermore, advancements in energy efficiency technologies across industrial, commercial, and residential sectors are reducing overall energy demand, thereby lessening the reliance on oil and gas.

Customer willingness to switch from fossil fuels to alternatives is a growing threat for Baytex Energy. Environmental concerns and government mandates are accelerating this shift, with global renewable energy capacity expected to grow significantly. For instance, the International Energy Agency reported that renewable energy sources accounted for over 80% of new global power capacity additions in 2023, highlighting a clear trend away from traditional fuels.

The threat of substitutes for Baytex Energy is moderate, primarily due to the energy-intensive nature of many industries and the current infrastructure favoring fossil fuels. While renewable energy sources like solar and wind are gaining traction, their intermittent nature and the need for significant grid upgrades limit their immediate ability to fully replace oil and gas in all applications. For instance, in 2024, global renewable energy capacity additions are projected to reach new heights, but the overall energy mix still heavily relies on hydrocarbons for baseload power and industrial processes.

Switching Costs for Customers to Substitutes

Customers face significant costs and inconveniences when switching from traditional crude oil and natural gas to alternative energy sources. These include substantial capital outlays for new infrastructure, such as electric vehicle charging stations or solar panel installations, which can run into thousands of dollars per household or business. Industrial processes often require extensive retooling and adaptation to accommodate new energy inputs, adding further expense and operational disruption.

Moreover, navigating regulatory landscapes and obtaining necessary permits for new energy systems can be time-consuming and complex, acting as a deterrent to rapid adoption. For instance, the average cost for a residential solar panel installation in 2024 can range from $15,000 to $25,000 before incentives, representing a considerable upfront investment. These high switching costs effectively dampen the threat of substitutes for Baytex Energy's core products.

- Infrastructure Investment: Significant capital required for new energy systems like EVs or solar panels.

- Industrial Process Adaptation: Costs associated with retooling operations for alternative energy sources.

- Regulatory Hurdles: Time and expense involved in compliance and permitting for new energy technologies.

- High Upfront Costs: For example, residential solar installations in 2024 can cost $15,000-$25,000.

Regulatory and Policy Environment

Government policies and regulations play a crucial role in shaping the competitive landscape for energy companies like Baytex. For instance, the Canadian government's carbon pricing mechanisms, such as the federal carbon tax, directly impact the cost of producing and consuming fossil fuels, making cleaner alternatives more economically attractive. This can accelerate the adoption of substitute energy sources, thereby increasing the threat they pose to Baytex's core business.

Incentives for renewable energy development, such as tax credits for solar and wind projects, further tilt the playing field. By 2024, Canada has seen significant growth in renewable energy capacity, with solar and wind power contributing an increasing share to the national grid. These policies can directly reduce demand for oil and gas, intensifying the threat of substitutes for Baytex.

Stricter emissions standards for vehicles and industrial processes also contribute to this trend. For example, proposed regulations aiming for zero-emission vehicle sales by 2035 in Canada will gradually decrease the demand for gasoline and diesel, key products for companies like Baytex. This regulatory push towards decarbonization directly elevates the threat of substitutes.

- Government policies directly influence the cost-competitiveness of substitute energy sources.

- Incentives for renewables can accelerate their market penetration, impacting demand for fossil fuels.

- Stricter emissions standards reduce the long-term viability of traditional energy consumption.

- By 2024, Canada's commitment to carbon pricing and renewable energy targets is reshaping the energy market.

The threat of substitutes for Baytex Energy is moderate, influenced by evolving technologies and customer preferences. While renewables like solar and wind are becoming more cost-effective, their integration challenges and the established infrastructure for fossil fuels create a gradual shift rather than an immediate disruption. For instance, in 2024, global renewable energy capacity additions are expected to reach record levels, but the overall energy mix still heavily relies on hydrocarbons for critical industrial applications and baseload power generation.

Customers face significant switching costs, including the capital investment for new energy infrastructure and potential operational disruptions when adopting alternatives. For example, residential solar panel installations in 2024 can range from $15,000 to $25,000 before incentives, a substantial upfront expense. These costs, coupled with regulatory complexities, help to moderate the immediate threat of substitutes for Baytex's products.

| Substitute Energy Source | Cost Competitiveness Factor | Switching Cost Factor | Market Penetration Trend (2024 Projection) |

|---|---|---|---|

| Solar Power | Decreasing LCOE (e.g., ~$0.047/kWh for utility-scale PV in 2022) | High upfront capital investment for installations | Significant growth, but grid integration challenges persist |

| Wind Power | Competitive pricing, especially offshore | High upfront capital investment for installations | Strong growth, but intermittent nature requires storage solutions |

| Electric Vehicles (EVs) | Lower running costs than gasoline cars | Higher initial purchase price of EVs, charging infrastructure development | Rapidly increasing sales (projected 14 million units globally by end of 2023) |

Entrants Threaten

Entering the oil and gas exploration and production sector, like the one Baytex Energy operates in, demands enormous upfront capital. Think about the costs involved: securing land rights, conducting detailed seismic studies to find promising reserves, the actual drilling operations, building pipelines and processing facilities, and navigating complex environmental and safety regulations. These expenses can easily run into hundreds of millions, if not billions, of dollars.

For instance, a single offshore oil platform can cost upwards of $1 billion to construct and commission. In 2024, the average cost to drill and complete a new oil well in the United States was estimated to be between $5 million and $10 million, depending on the depth and complexity. This sheer financial hurdle significantly discourages new players from challenging established companies like Baytex Energy.

New entrants to the oil and gas sector face significant hurdles in accessing established distribution channels. Baytex Energy, like many established players, benefits from existing infrastructure such as pipelines and processing facilities, often secured through long-term agreements or outright ownership. This preferential access creates a substantial barrier, as new companies must either negotiate costly access or invest heavily in building their own independent networks.

In 2024, the ongoing expansion and optimization of midstream infrastructure by major energy companies continue to solidify their control over these vital arteries. For instance, significant investments in new pipeline projects, such as those announced by TC Energy and Enbridge throughout late 2023 and into 2024, further concentrate control and increase the cost and complexity for any potential new entrant seeking to move their product to market.

The oil and gas sector faces a labyrinth of complex regulations, including rigorous environmental impact assessments and lengthy permitting procedures. For instance, in 2024, the average time to obtain federal permits for new oil and gas projects in the United States continued to be a significant deterrent, often spanning multiple years. These stringent requirements demand specialized knowledge and substantial upfront investment, acting as a formidable barrier for potential new entrants.

Economies of Scale and Experience Curve

Baytex Energy benefits significantly from economies of scale, giving it an edge over potential new entrants. Its large-scale operations in areas like the Eagle Ford and the Canadian heavy oil plays allow for more efficient procurement of materials and access to advanced technologies. For instance, in 2024, Baytex reported total production of approximately 330,000 barrels of oil equivalent per day (boe/d), a scale that smaller, newer companies would find difficult to match quickly.

The experience curve also plays a crucial role. Baytex has accumulated years of operational knowledge, leading to optimized drilling techniques, enhanced recovery methods, and improved cost management. This accumulated expertise translates into lower per-barrel costs compared to a new entrant that is still learning and refining its processes. In 2023, Baytex achieved a finding and development cost of $8.50 per boe, demonstrating the efficiency gained through experience.

- Economies of Scale: Baytex's substantial production volumes in 2024 (around 330,000 boe/d) enable cost advantages in purchasing, logistics, and technology adoption.

- Experience Curve Benefits: Accumulated operational knowledge allows Baytex to optimize drilling and production, as evidenced by its competitive finding and development costs of $8.50 per boe in 2023.

- Barriers to Entry: New entrants face challenges in replicating Baytex's scale and operational efficiencies, making it harder to achieve comparable cost structures and profitability.

Proprietary Technology and Expertise

The oil and gas industry, particularly in areas like the Permian Basin, showcases how proprietary technology acts as a significant barrier. Companies like Baytex Energy leverage specialized geological data and advanced drilling techniques, such as enhanced oil recovery (EOR) methods, which are costly and time-consuming for newcomers to replicate. For instance, the average drilling time for a horizontal well in the Permian has decreased significantly over the years due to technological advancements, but acquiring the expertise and data to achieve these efficiencies is a substantial hurdle.

Established players often possess vast libraries of proprietary seismic data and decades of operational experience, giving them a distinct advantage in identifying and extracting resources efficiently. New entrants would need to invest heavily in acquiring or developing comparable data sets and technical know-how, a process that can take years and significant capital. This deep well of accumulated knowledge and data is not easily transferable or replicable.

Consider the capital expenditure required. In 2024, major oil and gas companies continue to invest billions in R&D and technology upgrades. For example, some operators are investing in AI-driven reservoir analysis and automated drilling systems, which require not only significant financial outlay but also specialized engineering talent. Baytex Energy, like its peers, benefits from its established infrastructure and technological partnerships, making it difficult for smaller, less-resourced entities to compete on a similar technological footing.

- Proprietary Geological Data: Access to extensive, high-resolution seismic and well log data is crucial for accurate resource assessment, a resource typically built over many years by incumbents.

- Advanced Drilling Techniques: Expertise in complex horizontal drilling, hydraulic fracturing, and EOR methods requires substantial investment in specialized equipment and skilled personnel.

- Technological Innovation: Ongoing investment in areas like artificial intelligence for reservoir modeling and automation in operations creates a continuous technological advantage for established firms.

- Capital Intensity: The sheer cost of acquiring and developing these technological capabilities presents a formidable financial barrier for potential new entrants in the sector.

The threat of new entrants for Baytex Energy is generally low due to several substantial barriers. The immense capital required for exploration, drilling, and infrastructure development, often in the hundreds of millions or billions, is a primary deterrent. In 2024, the average cost to drill a new oil well in the US ranged from $5 million to $10 million, highlighting this financial hurdle.

Access to established distribution channels and midstream infrastructure, such as pipelines, is another significant obstacle. Companies like Baytex benefit from existing networks, while newcomers must either negotiate costly access or build their own, a process further complicated by ongoing infrastructure investments by major players in 2024, like those by TC Energy and Enbridge.

The industry's complex regulatory environment, involving lengthy permitting processes and environmental assessments, also acts as a barrier. In 2024, the time to secure federal permits for new oil and gas projects often spanned multiple years, demanding specialized knowledge and capital.

Economies of scale and the experience curve further solidify Baytex's position. With production around 330,000 boe/d in 2024 and finding and development costs of $8.50 per boe in 2023, Baytex demonstrates efficiencies difficult for new entrants to match.

| Barrier | Description | 2024 Data/Context |

|---|---|---|

| Capital Requirements | High upfront investment for exploration, drilling, and infrastructure. | Average US new oil well cost: $5M-$10M. |

| Access to Distribution | Control over pipelines and processing facilities. | Ongoing midstream expansion by major players (e.g., TC Energy, Enbridge). |

| Regulatory Hurdles | Complex environmental regulations and permitting processes. | Permitting times often span multiple years. |

| Economies of Scale | Cost advantages from large-scale production. | Baytex production: ~330,000 boe/d. |

| Experience Curve | Operational efficiencies gained through accumulated knowledge. | Baytex F&D costs: $8.50/boe (2023). |

Porter's Five Forces Analysis Data Sources

Our Baytex Energy Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Baytex's annual reports and SEC filings, alongside industry-specific market research from firms like Wood Mackenzie and Rystad Energy.

We also integrate data from financial news outlets and government energy databases to provide a robust assessment of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.