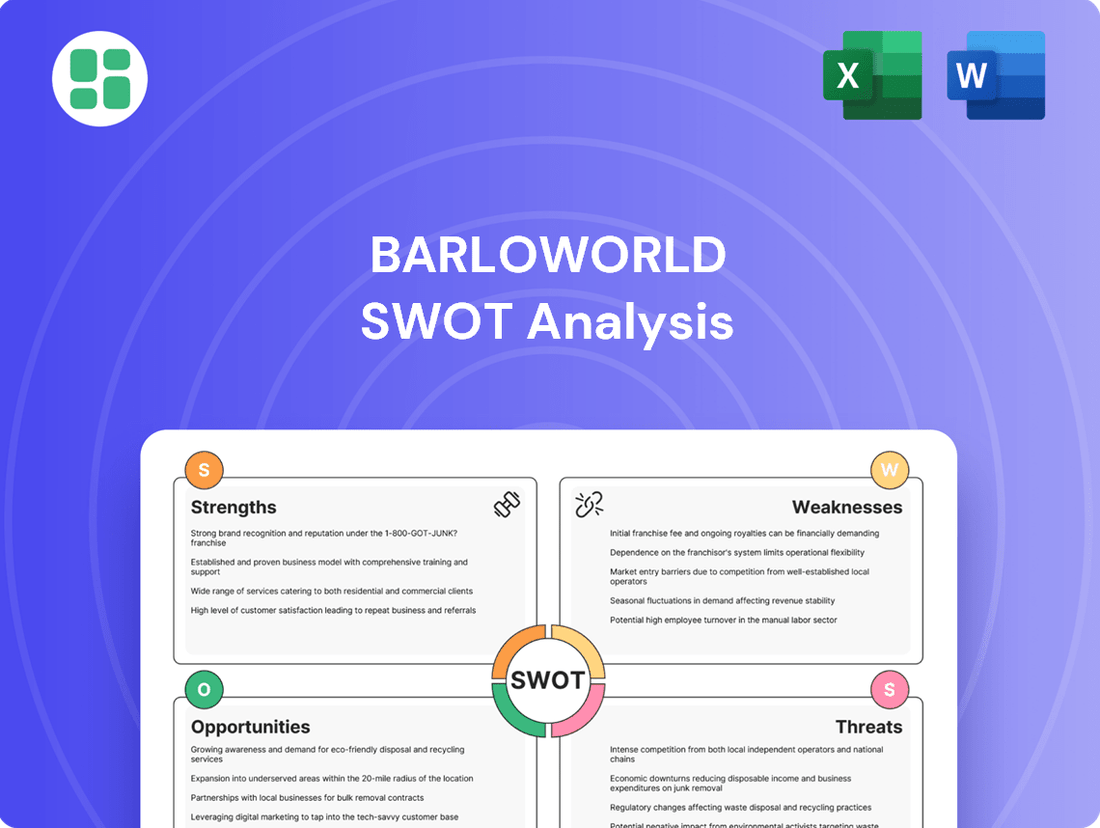

Barloworld SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

Barloworld's diversified business model presents significant strengths, but understanding its competitive landscape and potential threats is crucial for strategic decision-making.

Want the full story behind Barloworld's market position, potential risks, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Barloworld's strength lies in its diversified portfolio, spanning mining, construction, and industrial sectors. This broad operational base, offering integrated solutions from equipment sales to fleet management, significantly reduces reliance on any single market. For instance, in the fiscal year ending September 30, 2023, Barloworld reported revenue growth driven by strong performance in its Equipment Eurasia and Ingrain segments, showcasing the benefit of this diversification.

Barloworld's strength in brand partnerships is a significant advantage, particularly its long-standing ties with Caterpillar. This collaboration is foundational to its leadership in earthmoving and power systems equipment across Southern Africa and beyond. In 2023, Barloworld Equipment Southern Africa reported revenue of R28.8 billion, demonstrating the commercial success derived from this key partnership.

Barloworld showcased impressive financial resilience through fiscal year 2024, a period marked by economic headwinds. The company successfully maintained its EBITDA margins, a key indicator of operational profitability, even amidst challenging market conditions. This stability is a testament to its strategic approach.

A significant achievement was the strengthening of its balance sheet, primarily through a substantial reduction in gross debt. This deleveraging effort not only bolsters financial health but also provides greater flexibility for future investments and operations, reflecting prudent financial management.

The company's 'Fix, Optimise and Grow' strategy has been instrumental in navigating market volatility. This disciplined approach to capital allocation ensures that resources are deployed effectively, supporting both current stability and the capacity for future growth initiatives, a crucial element for long-term success.

Aftermarket Services and Recurring Revenue

Barloworld benefits significantly from its strong aftermarket services, which include parts and rental operations. These services are inherently more recurring and typically carry higher profit margins compared to the sale of new equipment. This strategic emphasis on the entire equipment lifecycle, from initial sale through ongoing maintenance and eventual replacement, helps to smooth out the inherent cyclicality often seen in new machinery markets. It creates a more predictable and stable revenue stream, especially when demand for new equipment dips.

For the fiscal year ending September 30, 2023, Barloworld reported that its Equipment business segment, which heavily relies on aftermarket services, demonstrated robust performance. While specific aftermarket revenue breakdowns are often embedded within segment reporting, the company’s overall strategy highlights the importance of these services for consistent financial results. For instance, in the first half of fiscal year 2024, Barloworld reported strong revenue growth, partly driven by the sustained demand for its aftermarket offerings.

- Recurring Revenue Base: Aftermarket services provide a consistent revenue stream, reducing reliance on the volatile new equipment sales cycle.

- Higher Profit Margins: Parts, service, and rental typically generate better margins than the sale of new machinery.

- Customer Retention: A strong aftermarket offering fosters customer loyalty and encourages repeat business throughout the equipment's life.

- Resilience in Downturns: This segment offers a buffer during economic downturns when new equipment purchases are often deferred.

Commitment to Sustainability and Innovation

Barloworld's dedication to sustainability is evident in its significant investments in renewable energy and its focus on offering eco-friendly solutions to clients. This forward-thinking approach not only addresses growing environmental concerns but also positions the company favorably in a market increasingly prioritizing green operations.

The company's commitment extends to practical applications like remanufacturing components, a strategy that directly contributes to reducing energy consumption and extending product lifecycles. This focus on circular economy principles enhances Barloworld's reputation and bolsters its long-term resilience.

- Renewable Energy Investment: Barloworld is increasing its capacity for renewable energy sources across its operations.

- Customer Solutions: Offering remanufacturing services reduces energy consumption for customers.

- Reputation Enhancement: Alignment with global sustainability trends strengthens brand image.

- Long-Term Viability: Proactive environmental strategies ensure future market relevance.

Barloworld's diversified business model, encompassing equipment, industrial, and infrastructure sectors, provides significant resilience. This broad reach mitigates risks associated with any single market, as demonstrated by its performance in fiscal year 2023, where growth in segments like Equipment Eurasia and Ingrain offset potential weaknesses elsewhere.

The company's strong brand partnerships, particularly its long-standing relationship with Caterpillar, are a cornerstone of its market leadership. This collaboration underpins its success in earthmoving and power systems equipment, with Barloworld Equipment Southern Africa generating R28.8 billion in revenue in 2023, highlighting the commercial value of these alliances.

Barloworld's robust aftermarket services, including parts and rentals, are a key strength, offering higher profit margins and more predictable revenue streams than new equipment sales. This focus on the entire equipment lifecycle provides a crucial buffer against the cyclicality of new machinery markets, contributing to financial stability.

The company's commitment to sustainability, evidenced by investments in renewable energy and eco-friendly solutions like remanufacturing, enhances its market position and long-term viability. This forward-thinking approach aligns with growing environmental consciousness among customers and stakeholders.

What is included in the product

Delivers a strategic overview of Barloworld’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Identifies key internal weaknesses and external threats to proactively address potential disruptions.

Weaknesses

Barloworld's Equipment division, a significant revenue driver, is deeply intertwined with the mining and construction sectors. These industries are inherently cyclical, meaning their performance is closely tied to global economic health and, crucially, commodity prices. When commodity prices fall or economic activity slows, demand for heavy machinery, Barloworld's core product, naturally declines.

This sensitivity was evident in Barloworld's 2024 financial performance, where revenue saw a reduction partly attributable to this cyclicality. For instance, a downturn in global mining activity can directly translate into fewer new equipment sales and reduced aftermarket service revenue for the company.

Barloworld's significant reliance on South Africa for revenue and cash flow ties its financial health directly to the nation's economic and political climate. For instance, in the fiscal year 2023, South Africa contributed a substantial portion of the group's revenue, making it vulnerable to local market downturns or policy changes.

Operations in regions like Eurasia, particularly its historical presence in Russia, present considerable geopolitical risks. These include potential sanctions, trade restrictions, and compliance challenges, which have historically necessitated significant financial provisions, as seen in past reporting periods, impacting overall profitability and operational continuity.

Barloworld's business model, heavily reliant on industrial distribution and heavy equipment, demands significant upfront investment. For instance, maintaining a robust rental fleet and extensive inventory of machinery, as seen in their Equipment division, ties up considerable capital. This can strain cash flow, particularly when economic conditions slow down or borrowing costs increase, as experienced with rising interest rates in 2023-2024.

Vulnerability to Currency Fluctuations

Barloworld's extensive global footprint means it's susceptible to currency exchange rate volatility. When earnings from foreign operations are converted back to its reporting currency, fluctuations can significantly impact reported revenues and profitability. For example, a stronger South African Rand in early 2025 presented a headwind, negatively affecting the company's top line.

- Exposure to Foreign Exchange: Barloworld operates in multiple countries, exposing it to the risk of adverse currency movements.

- Impact on Financials: Fluctuations can distort reported revenues and profits due to the translation of foreign currency earnings.

- Specific 2025 Impact: A strengthening Rand in early 2025 demonstrably reduced reported revenue.

Operational Complexities of Diverse Businesses

Barloworld's broad operational scope, encompassing heavy equipment, logistics, and consumer sectors like Ingrain, presents significant management challenges. Successfully integrating and optimizing these diverse business units requires advanced systems and considerable managerial expertise to unlock potential synergies.

The inherent complexities of managing such varied operations can strain resources and hinder the efficient flow of information and best practices across the group. This diversification, while a strategic advantage, necessitates a highly sophisticated operational framework.

For instance, in the fiscal year ending September 30, 2023, Barloworld reported revenue of R120.3 billion, demonstrating the scale of its diverse operations. However, achieving seamless integration and maximizing cross-segmental efficiencies across distinct industries remains a continuous operational hurdle.

- Diverse Business Portfolio: Managing distinct segments like Equipment (Southern Africa and Europe) and Consumer (Ingrain) creates inherent operational complexities.

- Synergy Challenges: Extracting meaningful operational synergies across vastly different business models is difficult and requires targeted strategies.

- Systemic Demands: The broad range of activities necessitates robust, adaptable internal systems capable of supporting varied operational needs efficiently.

- Management Overhead: Overseeing a diversified group inherently increases management complexity and the need for specialized expertise within each segment.

Barloworld's reliance on the cyclical mining and construction sectors makes it vulnerable to economic downturns and commodity price fluctuations, directly impacting equipment sales and aftermarket services. Its significant exposure to the South African economy also ties its performance to local political and economic stability. Furthermore, managing a diverse portfolio across different industries presents considerable operational and integration challenges, potentially hindering synergy realization.

| Weakness | Description | Impact/Example |

|---|---|---|

| Cyclical Industry Dependence | Heavy reliance on mining and construction sectors. | Revenue reduction in FY2024 due to slower global mining activity. |

| Geographic Concentration Risk | Significant revenue and cash flow from South Africa. | Vulnerability to local economic slowdowns and policy changes. |

| Operational Complexity | Managing diverse business units (Equipment, Consumer). | Challenges in achieving cross-segmental synergies and efficient information flow. |

| Capital Intensity | High investment required for industrial distribution and heavy equipment. | Strain on cash flow during economic slowdowns or rising interest rates. |

What You See Is What You Get

Barloworld SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Africa's infrastructure boom presents a substantial growth avenue for Barloworld. The continent's commitment to expanding transportation networks, energy grids, and urban centers is projected to fuel significant demand for heavy machinery and related services, directly benefiting Barloworld's core offerings.

For instance, the African Development Bank's (AfDB) Infrastructure Development Project pipeline for 2024-2025 includes billions in planned investments across key sectors like transport and energy, creating a fertile ground for Barloworld's equipment and solutions.

The increasing trend of businesses outsourcing non-core operations, particularly in fleet management and logistics, offers a significant avenue for growth for Barloworld's Automotive & Logistics segment. This strategic shift allows companies to focus on their primary competencies while leveraging external expertise for efficiency and cost reduction.

Companies are actively seeking ways to streamline operations and cut expenses, making comprehensive logistics and fleet management services highly appealing. Barloworld is well-positioned to capitalize on this demand by providing integrated solutions that enhance operational performance and deliver tangible cost savings for its clients.

For instance, the global fleet management market was valued at approximately USD 25.5 billion in 2023 and is projected to reach USD 43.1 billion by 2030, growing at a CAGR of 7.8% during the forecast period. This substantial market expansion underscores the opportunity for Barloworld to grow its market share.

Barloworld is actively leveraging technological advancements to boost its operational efficiency. For instance, the company's investment in telematics and advanced data analytics for its equipment and fleet management is designed to optimize performance and reduce downtime. This digital integration is not just about improving existing services but also about creating new revenue streams through enhanced customer insights and predictive maintenance offerings.

Expansion into New Markets or Adjacent Sectors

Barloworld has a significant opportunity to expand into new geographic markets exhibiting robust growth, particularly in regions where its expertise in equipment distribution and services can be leveraged. This strategic move could tap into unmet demand and diversify revenue streams. The company's successful expansion into Mongolia, as evidenced by its strong performance there, serves as a clear testament to its capability in executing such growth strategies.

Further opportunities lie in venturing into adjacent industrial sectors that complement Barloworld's existing core competencies. By identifying sectors with similar operational needs or customer bases, the company can build upon its established infrastructure and market knowledge. For instance, exploring opportunities in renewable energy equipment distribution or specialized logistics services could align well with its current business model.

- Geographic Expansion: Targeting high-growth emerging markets in Africa and Asia where infrastructure development is a priority.

- Adjacent Sector Entry: Leveraging distribution and service expertise into areas like mining technology solutions or sustainable infrastructure equipment.

- Mongolia Success: Barloworld Mongolia's reported strong performance in 2024 provides a blueprint for replicating market entry strategies.

Leveraging Sustainability Trends for New Offerings

The escalating global focus on sustainability and decarbonization presents a significant avenue for Barloworld to innovate and broaden its product and service portfolio. This includes developing and offering equipment powered by electric and hydrogen technologies, alongside solutions designed for enhanced energy efficiency.

Customer demand for environmentally conscious options is a key driver. Barloworld can capitalize on this by expanding its capabilities in advanced recycling and remanufacturing services, aligning its business model with the circular economy principles that are gaining traction across industries.

- Electric & Hydrogen Equipment: Barloworld is actively involved in exploring and offering zero-emission equipment solutions, aligning with global decarbonization targets.

- Energy-Efficient Solutions: The company can provide technologies and services that reduce energy consumption for its clients, contributing to their sustainability goals.

- Circular Economy Services: Expanding remanufacturing and recycling capabilities taps into the growing market for sustainable asset lifecycle management.

- Customer Demand: A significant portion of Barloworld's customer base, particularly in developed markets, is increasingly prioritizing suppliers with strong environmental, social, and governance (ESG) credentials.

Barloworld is strategically positioned to capitalize on the ongoing infrastructure development across Africa, with significant investment pipelines from institutions like the African Development Bank for 2024-2025 driving demand for heavy machinery and services.

The growing trend of businesses outsourcing fleet management and logistics presents a substantial growth opportunity, as evidenced by the global fleet management market's projected expansion to USD 43.1 billion by 2030.

Leveraging technological advancements, such as telematics and data analytics, allows Barloworld to optimize equipment performance and create new revenue streams through predictive maintenance.

Expansion into new, high-growth geographic markets, mirroring its success in Mongolia, offers a clear path to diversifying revenue and tapping into unmet demand.

Threats

A significant global economic downturn or recession would reduce demand across Barloworld's core mining, construction, and industrial sectors, leading to lower equipment sales, rental activity, and product support needs. This remains a primary external threat impacting revenue and profitability.

For instance, the International Monetary Fund (IMF) projected in April 2024 that global growth would slow to 2.8% in 2024, down from 3.2% in 2023, indicating a weakening economic environment. Such a slowdown directly translates to reduced capital expenditure by Barloworld's customers, impacting its top-line performance.

Barloworld faces significant threats from intensified competition across its diverse business segments. Established global players and nimble local competitors are constantly vying for market share, putting pressure on pricing and potentially squeezing profit margins. This is particularly true in areas where services are less distinct, making it harder to command premium pricing and protect market share.

Barloworld faces significant threats from evolving regulatory landscapes and persistent geopolitical instability. Changes in government policies, trade regulations, and environmental standards, particularly in its key operating regions like South Africa and Eurasia, can disrupt supply chains and impact profitability. For instance, the company's prior investigations into export control violations underscore the tangible risks associated with navigating complex international compliance requirements.

Supply Chain Disruptions and Input Cost Volatility

Disruptions in global supply chains for essential equipment, parts, and components pose a significant threat to Barloworld. These disruptions can lead to extended lead times and shortages, impacting the company's ability to service its customers effectively. For instance, the ongoing geopolitical tensions and lingering effects of the COVID-19 pandemic have continued to create bottlenecks in manufacturing and logistics throughout 2024 and into early 2025.

Furthermore, substantial volatility in input costs, such as fuel, steel, and energy, directly increases operational expenses. This cost pressure can erode profit margins if not effectively passed on to customers. Barloworld, like many in the heavy equipment sector, relies heavily on these commodities, making it vulnerable to price fluctuations. The International Monetary Fund (IMF) projected continued energy price volatility for 2024, a trend that directly impacts transportation and manufacturing costs.

- Increased Operational Expenses: Volatile input costs directly inflate the cost of doing business, from manufacturing to logistics.

- Impact on Equipment Availability: Supply chain disruptions can delay the delivery of critical machinery and spare parts, affecting Barloworld's inventory and customer service.

- Reduced Profitability: The combined effect of higher costs and potential delays in meeting demand can significantly squeeze profit margins.

- Customer Demand Uncertainty: Inability to meet customer demand due to supply chain issues can lead to lost sales and damage customer relationships.

Technological Disruption and Rapid Innovation by Competitors

Barloworld faces a significant threat from technological disruption, especially if it cannot match the pace of innovation set by competitors. For instance, the increasing adoption of autonomous mining and construction equipment by rivals could quickly diminish the market share of traditional offerings.

Competitors introducing disruptive technologies, such as advanced telematics or AI-driven fleet management solutions, pose a direct challenge. Barloworld's existing equipment and services might become less attractive if these innovations offer substantial efficiency gains or cost reductions to customers. For example, a competitor launching a fully electric, autonomous haul truck could disrupt the heavy machinery market, impacting Barloworld's traditional internal combustion engine sales.

- Technological Obsolescence: Failure to integrate new technologies like IoT and AI into equipment and services could make Barloworld's offerings outdated.

- Competitor Innovation: Rivals introducing disruptive solutions, such as advanced predictive maintenance software or fully electric fleets, could capture market share.

- Shifting Industry Standards: Rapid innovation can alter industry expectations, potentially leaving Barloworld behind if it doesn't adapt its product development and service models.

Barloworld faces a substantial threat from escalating operational expenses driven by volatile input costs. Fluctuations in fuel, steel, and energy prices directly impact its cost of doing business. For instance, the IMF projected continued energy price volatility for 2024, which directly affects transportation and manufacturing costs for Barloworld.

Supply chain disruptions remain a critical threat, leading to extended lead times for essential equipment and parts. This can hinder Barloworld's ability to meet customer demand promptly. Lingering effects from global events in 2024 and early 2025 have continued to create logistical bottlenecks.

Intensified competition across its segments poses a threat to pricing power and profit margins. Both established global players and agile local competitors are actively seeking market share, particularly in areas with less differentiated services.

Barloworld is also vulnerable to technological disruption, with competitors introducing advanced solutions like autonomous equipment and AI-driven fleet management. Failure to adapt could lead to obsolescence of existing offerings and a loss of competitive edge.

SWOT Analysis Data Sources

This Barloworld SWOT analysis is built upon a foundation of robust data, drawing from official company financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded strategic perspective.