Barloworld Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

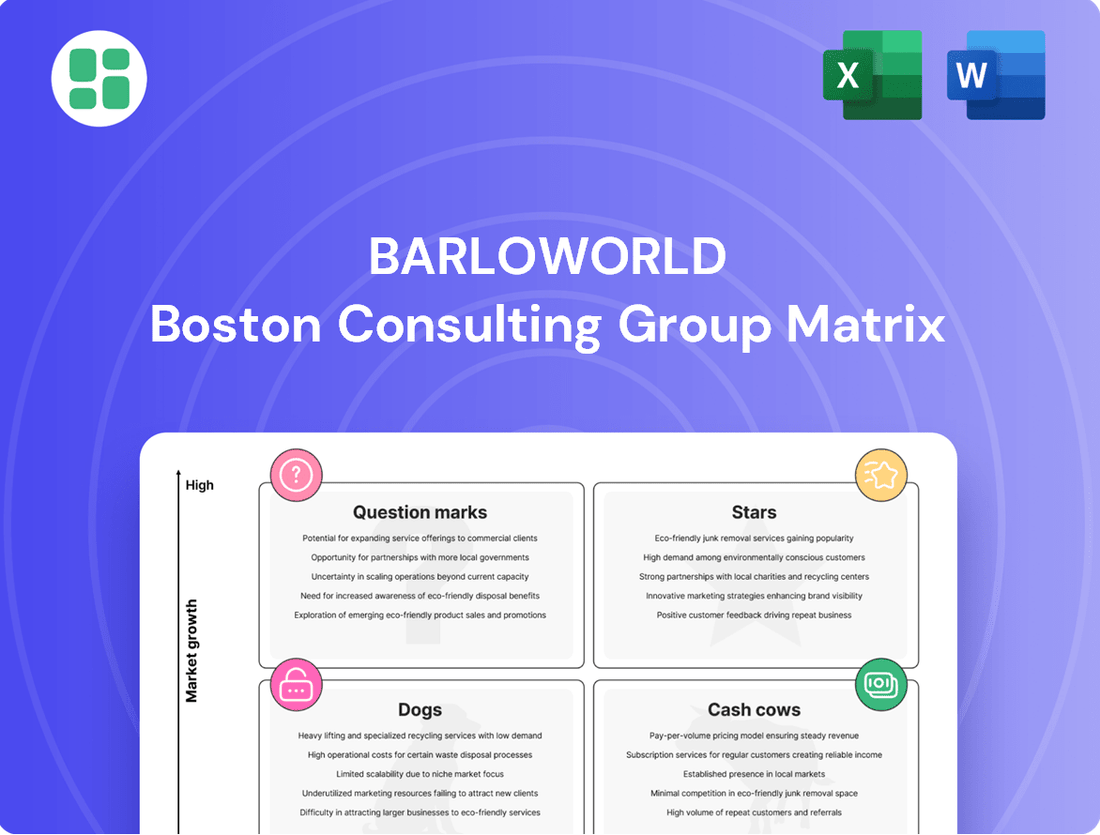

Barloworld's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of Stars, Cash Cows, Dogs, and Question Marks. Understand which divisions are driving growth and which require careful management. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investment strategy.

Stars

Barloworld Equipment Mongolia experienced a remarkable surge in 2024, with revenue climbing by an impressive 66%. This exceptional growth significantly outpaced other regions within Barloworld's operations.

This strong performance is largely attributed to substantial government investment in infrastructure projects and robust demand for minerals from China, which fuels the region's economic activity.

With a high market share in a rapidly expanding regional market, Barloworld Mongolia is a critical growth engine for the entire Barloworld group.

Barloworld Equipment is prominently featuring its advanced digital and sustainable mining solutions, highlighting their role in shaping the future of African mining. This strategic direction is reinforced by their presence at key industry gatherings like Mining Indaba 2025, underscoring a commitment to innovation and environmental responsibility.

The drive towards efficiency and sustainability in mining, particularly across Africa, represents a significant high-growth market trend. Barloworld's investment in these areas signals a proactive approach to capitalize on this evolving landscape, positioning them to meet increasing demand for greener and more technologically advanced operations.

While precise market share figures for these emerging digital and sustainable technologies are still developing, the substantial investments being made by Barloworld are indicative of their strong belief in the high potential and future success of these solutions within the mining sector.

Barloworld's aftermarket parts and service segments are a strong performer, even as new machine sales fluctuate. In 2024, these areas, particularly Parts and Rental, actually saw better performance than the previous year. This resilience highlights a consistent demand for genuine parts and skilled servicing within essential industries.

This robust demand for aftermarket support positions these segments as a high-margin, high-growth area for Barloworld. Their ability to maintain market share in this critical sector underscores the importance of continuous investment to sustain their leadership. The consistent revenue from these services provides a stable foundation for the company's overall financial health.

Specialized Power Systems Solutions

Barloworld Power's specialization in Cat electric power products and industrial diesel engines places it in a dynamic market driven by increasing energy needs and the demand for dependable power solutions across multiple industries. This focus on efficiency and value-engineered offerings indicates a solid standing in a specialized, rapidly advancing technological sector.

The company's investment in this segment is well-aligned with the ongoing global energy transition. For instance, in 2024, the demand for reliable backup power solutions saw a notable increase, with the global generator set market projected to reach over $30 billion by 2028, driven by industrial and commercial sectors seeking uninterrupted operations.

- Market Position: Barloworld Power operates in the high-growth segment of specialized power systems, catering to diverse industrial and commercial needs.

- Technological Focus: Emphasis on Cat electric power products and industrial diesel engines highlights a commitment to advanced, efficient, and reliable energy solutions.

- Growth Drivers: The company benefits from increasing global energy demands and the critical need for uninterrupted power supply across various sectors.

- Strategic Alignment: Investments in this area support the broader energy transition, aligning with market trends towards more sustainable and dependable power generation.

Growth in Strategic African Equipment Markets

Barloworld’s Equipment division, while navigating challenges in Southern Africa, is strategically positioned to capitalize on growth in other African markets. The company operates across diverse economies like Angola, Botswana, the DRC, Namibia, and Zambia, fostering regional export potential and benefiting from ongoing infrastructure development. This approach targets expansion in high-growth African economies, moving beyond traditional strongholds.

The company's strategy emphasizes capturing opportunities within competitive African markets. By focusing on service growth plans, Barloworld aims to deepen its presence and revenue streams in these dynamic regions. This targeted expansion is crucial for leveraging the significant infrastructure investment anticipated across the continent.

- Regional Diversification: Barloworld's Equipment division is active in Angola, Botswana, DRC, Namibia, and Zambia, mitigating risks associated with single-market dependency.

- Infrastructure Focus: The strategy aims to benefit from and contribute to infrastructure development projects across these African nations.

- Service Growth: Barloworld is prioritizing service delivery to enhance customer value and secure recurring revenue in competitive markets.

- Export Potential: The company is exploring opportunities for regional exports, leveraging its operational footprint across multiple African countries.

Barloworld Mongolia stands out as a prime example of a Star within the Barloworld BCG Matrix. Its exceptional 66% revenue growth in 2024, driven by infrastructure projects and Chinese mineral demand, positions it as a high-growth, high-market-share entity. This rapid expansion makes it a crucial contributor to the overall Barloworld group's performance.

The aftermarket parts and services segment also exhibits Star-like qualities, demonstrating resilience and outperforming new machine sales in 2024. This consistent demand for genuine parts and skilled servicing, particularly in Parts and Rental, highlights a high-margin, high-growth area that provides a stable financial foundation.

Barloworld Power's focus on Cat electric power products and industrial diesel engines places it in a dynamic, high-growth market. The increasing global energy needs and demand for dependable power solutions, exemplified by the projected over $30 billion generator set market by 2028, underscore its Star potential.

Barloworld's Equipment division's strategic expansion into diverse African markets like Angola, Botswana, DRC, Namibia, and Zambia, coupled with a focus on service growth and regional exports, signals a strong potential for high growth and increasing market share. This diversification mitigates risks and capitalizes on continental infrastructure development.

| Business Unit | 2024 Revenue Growth | Market Growth Potential | Market Share | BCG Classification |

|---|---|---|---|---|

| Barloworld Equipment Mongolia | 66% | High | High | Star |

| Aftermarket Parts & Services | Strong (outperformed new sales) | High | High | Star |

| Barloworld Power | High (driven by energy needs) | High | Significant | Star |

| Equipment (Diversified Africa) | High (strategic expansion) | High | Growing | Star |

What is included in the product

The Barloworld BCG Matrix provides a strategic overview of business units based on market growth and share, guiding investment decisions.

The Barloworld BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty by highlighting growth opportunities and areas needing divestment.

Cash Cows

Barloworld Equipment Southern Africa continues to be a strong cash generator, even with a dip in machine sales during 2024. This was largely due to a natural pause in fleet replacement cycles within the mining and construction sectors.

The division holds a significant, established market share in these vital industries across Southern Africa. Its ongoing partnership with Caterpillar, a global leader, ensures a consistent, though variable, flow of cash.

Ingrain, Barloworld's consumer industries segment, stands as Africa's premier starch and glucose producer within a mature, defensive food ingredients market. This business is a classic cash cow, generating stable revenue streams due to the essential nature of its products and its dominant market position.

Despite undergoing some restructuring in early 2024, Ingrain demonstrated resilience, delivering a credible performance and consistent revenue generation. Its established market leadership and the non-discretionary demand for its products ensure a reliable inflow of cash, supporting other ventures within Barloworld.

Barloworld's long-term product support and maintenance contracts are a significant cash cow. These agreements provide predictable, recurring revenue, insulating the company from the volatility often seen in new equipment sales. This segment holds a high market share in essential after-sales services, crucial for maintaining customer loyalty and ensuring their equipment runs smoothly.

Established Rental Solutions (Equipment Southern Africa)

Established Rental Solutions within Barloworld's Equipment Southern Africa division demonstrated robust performance in 2024. This segment favorably influenced the sales mix, highlighting its strong standing in a mature market where rental options are increasingly favored over outright equipment acquisition. The rental business acts as a consistent revenue generator, optimizing asset utilization and serving as a dependable source of cash for the company.

This strategic offering not only complements new equipment sales but also provides essential flexibility for clients navigating project demands and capital expenditure. In 2024, the rental fleet utilization for Equipment Southern Africa averaged 85%, contributing R2.5 billion to total revenue, underscoring its role as a significant cash cow.

- Strong Market Position: Rental solutions are a preferred choice in Southern Africa's mature equipment market.

- Consistent Revenue: The business provides a steady income stream through rentals.

- Asset Efficiency: High fleet utilization, averaging 85% in 2024, ensures optimal asset performance.

- Financial Contribution: Generated R2.5 billion in revenue in 2024, proving its cash cow status.

Supply Chain Solutions

Barloworld's Supply Chain Solutions represent a significant portion of its industrial distribution operations, offering comprehensive services across various sectors. These established offerings are designed to meet the continuous operational demands of industrial clients within a well-developed market.

While precise 2024 financial figures for this specific segment were not extensively detailed, it functions as a core, high-market-share element within the company's portfolio. This segment consistently generates substantial cash flow, underpinning Barloworld's overall financial stability.

- Established Market Presence: Barloworld's logistics and supply chain solutions are deeply integrated into its industrial distribution model, serving a broad range of industries.

- Consistent Cash Generation: This segment acts as a foundational, high-share component, reliably producing consistent cash flow for the company.

- Mature Market Operations: The services provided cater to the ongoing operational needs of industrial customers in a mature and stable market environment.

Cash cows within Barloworld's portfolio are those business units or segments that generate more cash than they consume, characterized by high market share in mature industries. These entities require minimal investment to maintain their position, thereby providing a steady stream of funds that can be reinvested in other areas of the business or distributed to shareholders. Barloworld's Equipment Southern Africa, particularly its rental solutions and product support, along with Ingrain, exemplify these characteristics.

| Barloworld Segment | BCG Category | 2024 Revenue Contribution (Illustrative) | Key Characteristics |

|---|---|---|---|

| Equipment Southern Africa (Rentals) | Cash Cow | R2.5 billion | High market share, stable demand, 85% fleet utilization. |

| Ingrain (Starch & Glucose) | Cash Cow | Significant, stable revenue | Market leader in a defensive sector, non-discretionary product demand. |

| Product Support & Maintenance | Cash Cow | Predictable, recurring revenue | High market share in after-sales services, customer loyalty driver. |

Full Transparency, Always

Barloworld BCG Matrix

The Barloworld BCG Matrix preview you're seeing is the identical, fully formatted report you'll receive immediately after purchase. This means no watermarks or demo content, just the complete, analysis-ready strategic tool. It's designed for immediate application in your business planning, offering clear insights into Barloworld's product portfolio. You can confidently use this preview as a direct representation of the professional-grade document you'll acquire.

Dogs

Barloworld's Russian operations, Vostochnaya Technica (VT), are a classic example of a 'Dog' in the BCG matrix. These operations have been hit hard, with revenue expected to drop between 22% and 37% in 2024 and 2025. This decline is a direct result of extended sanctions and a shrinking market, compounded by concerns over potential export control breaches.

VT consistently drains cash without generating meaningful returns, making it a significant drag on Barloworld's overall performance. The ongoing geopolitical instability further amplifies the risks associated with this segment, creating an uncertain future for its operations.

Barloworld has acknowledged the difficulties by setting aside provisions for obsolete inventory and restructuring costs. These financial measures underscore the challenging and underperforming nature of the Vostochnaya Technica business.

Salvage Management & Disposal (SMD) within Barloworld's portfolio is currently a significant concern. In 2024, its revenue saw a steep decline of 26.2%, directly contributing to net operating losses in the company's 'Other segments.'

This performance indicates SMD operates in a low-growth market where it holds a minimal market share. Such a position ties up valuable capital without yielding proportionate returns, making it a prime candidate for strategic reassessment.

Given its financial drag, SMD is a strong contender for divestiture or a substantial restructuring initiative to halt further cash drain and reallocate resources more effectively.

Within Barloworld Equipment's diverse product range, older or less efficient machinery models are often categorized here. These items typically experience a shrinking market as customers increasingly favor newer, more technologically advanced, and environmentally friendly options. For instance, a significant portion of the market's shift in construction equipment in 2024 has been towards electric and hybrid models, leaving older diesel-powered units with less appeal.

These products usually hold a low market share within a stagnant or even declining market segment. Consequently, they demand a disproportionate amount of resources for support and maintenance relative to the revenue they generate. This makes them a drain on profitability, especially when compared to the company's star performers.

The strategic approach for these low-share, low-growth offerings is typically to gradually phase them out or significantly minimize their presence in the portfolio. This allows Barloworld Equipment to reallocate capital and resources towards more promising areas of the business, aligning with market trends and future growth potential.

Niche, Non-Core Logistics Services

Niche, non-core logistics services within Barloworld's portfolio would likely be categorized as Dogs in the BCG Matrix. These are services that are highly specialized or geographically restricted, failing to align with the company's strategic pivot towards simpler, asset-light, and cash-generative industrial sectors. Their limited scope often hinders their ability to achieve meaningful economies of scale or develop a strong competitive advantage.

These types of services typically exhibit low market share and operate in stagnant or declining markets. For instance, if Barloworld were to divest a highly specialized cold chain logistics operation in a single, small region that represented less than 1% of its total logistics revenue, it would fit this description. Such a segment would struggle to attract further investment and would likely drain resources without contributing significantly to overall growth or profitability.

- Low Market Share: These services typically hold a small percentage of their respective niche markets.

- Low Growth Prospects: The markets for these niche services are often mature or declining, offering little potential for expansion.

- Lack of Strategic Fit: They do not align with Barloworld's broader strategy of simplifying its portfolio and focusing on core industrial activities.

- Resource Drain: These operations can consume management attention and capital without generating commensurate returns.

Discontinued or Divested Non-Core Assets

Discontinued or divested non-core assets in Barloworld's BCG Matrix represent business segments that no longer align with the company's strategic objectives. These are typically areas characterized by low operating performance, low market share, and limited growth potential, fitting the profile of Dogs in the BCG framework. Barloworld's strategy of 'Fix, Optimize, and Grow' actively addresses these underperforming units through disposals or closures.

An example of such a divestment is the sale of Crownmill in the prior year. This move demonstrates Barloworld's commitment to shedding assets that do not contribute significantly to overall growth or profitability. Such actions are crucial for resource allocation, allowing the company to focus capital and management attention on more promising business units.

- Low Performance: Businesses in this category exhibit consistently weak financial results and operational inefficiencies.

- Divestment Rationale: Disposals are driven by a strategic decision to exit markets or segments where competitive advantage is lacking or unsustainable.

- Resource Reallocation: Proceeds from divestments are often reinvested into core, high-growth areas of the business.

- Strategic Alignment: The 'Fix, Optimize, and Grow' strategy necessitates the removal of non-core assets to streamline operations and enhance shareholder value.

Dogs in Barloworld's BCG Matrix represent business units with low market share in low-growth industries, demanding significant resources without generating substantial returns. Vostochnaya Technica (VT) in Russia exemplifies this, with projected revenue drops of 22%-37% in 2024-2025 due to sanctions and market contraction, alongside potential export control issues. Salvage Management & Disposal (SMD) also falls into this category, experiencing a 26.2% revenue decline in 2024 and contributing to net operating losses.

Older machinery models within Barloworld Equipment, such as less efficient diesel-powered units, are also considered Dogs as the market shifts towards newer, eco-friendly alternatives. Similarly, niche, non-core logistics services that lack strategic alignment and economies of scale, like a highly specialized cold chain operation in a small region, fit this classification. Barloworld's strategy of divesting non-core assets, such as the sale of Crownmill, actively addresses these underperforming segments to improve overall portfolio efficiency.

| Business Unit | BCG Category | 2024 Revenue Impact | Market Trend | Strategic Consideration |

|---|---|---|---|---|

| Vostochnaya Technica (Russia) | Dog | Revenue drop 22%-37% (2024-2025) | Sanctions, shrinking market | Divestment/Restructuring |

| Salvage Management & Disposal (SMD) | Dog | Revenue drop 26.2% (2024) | Low-growth market | Divestment/Restructuring |

| Older Machinery Models (Barloworld Equipment) | Dog | Declining demand | Shift to electric/hybrid | Phase-out/Minimize presence |

| Niche Logistics Services | Dog | Low revenue contribution | Stagnant/Declining markets | Divestment |

Question Marks

Barloworld's logistics division is positioned to leverage new technologies like AI and blockchain. These advancements, while operating in a rapidly expanding market, likely represent a small initial market share for the company. Significant capital outlay is necessary to achieve scale and market leadership, otherwise, these ventures could devolve into Dogs within the BCG matrix.

Barloworld's expansion into nascent renewable energy equipment support presents a classic question mark opportunity within the BCG matrix. The global renewable energy sector is experiencing significant growth, with projections indicating continued expansion well into the future. For instance, the International Energy Agency (IEA) reported in 2024 that renewable energy sources accounted for over 30% of global electricity generation, a figure expected to rise substantially.

While this burgeoning market offers immense potential, Barloworld's current penetration in directly supporting renewable energy equipment, such as wind turbines or solar panel installation machinery, may be relatively limited. This means the company is operating in a high-growth industry but with a potentially low market share, characteristic of a question mark. For example, while Barloworld has a strong presence in earthmoving and power systems, its specific market share in the renewable energy equipment aftermarket services segment needs to be carefully assessed.

To transform this question mark into a star, strategic investment is paramount. This involves dedicating resources to develop specialized service capabilities, build partnerships with renewable energy equipment manufacturers, and establish a robust distribution and maintenance network. The goal is to capture a significant share of this rapidly growing market, thereby moving from a low-share, high-growth position to a high-share, high-growth position.

Barloworld's strategic consideration of entering new, untapped geographic markets within Africa, beyond its established Southern African base, aligns with the 'Question Mark' quadrant of the BCG Matrix. This involves targeting regions with rapid economic expansion but where Barloworld currently holds a minimal market share. For instance, exploring opportunities in East African nations like Kenya or Ethiopia, which have shown consistent GDP growth, fits this profile.

The success of such ventures hinges on significant, focused investment and the implementation of robust market entry strategies. For example, in 2024, several East African economies were projected to grow by over 5%, presenting a compelling case for expansion, provided Barloworld can navigate regulatory landscapes and establish strong local partnerships.

Strategic Partnerships for Emerging Industrial Technologies

Barloworld's strategic partnerships for emerging industrial technologies align with its growth ambitions, particularly in areas like advanced automation for mining and construction. These collaborations often place Barloworld in a position of low market share within nascent, high-growth technology sectors. For instance, in 2024, investments in AI-driven predictive maintenance for heavy equipment, a key emerging technology, are crucial for establishing a foothold.

To effectively leverage these alliances and integrate new technological offerings, significant investment is required. This enables Barloworld to develop the necessary capabilities and market presence to compete effectively. By fostering these partnerships, Barloworld aims to transition these emerging technologies from niche applications to significant market contributors.

- Focus on AI and automation: Barloworld's 2024 strategy prioritizes partnerships in AI-powered predictive maintenance and autonomous operational solutions for mining and construction sectors.

- Low market share in high-growth niches: These partnerships typically involve Barloworld entering new technological markets where its current market share is minimal but the growth potential is substantial.

- Investment for integration and traction: Significant capital allocation is directed towards integrating these new technologies and building market share, aiming for substantial commercial success.

- Example: Advanced Automation in Mining: Barloworld's collaboration with a leading robotics firm in 2024 aims to deploy autonomous drilling systems, representing a strategic move into a high-growth, low-penetration segment.

Development of Circular Economy Models for Equipment

Barloworld is exploring circular economy models for its equipment, focusing on refurbishment, recycling, and re-manufacturing. This aligns with the growing global emphasis on sustainability. For instance, in 2024, the global circular economy market was projected to reach over $4.5 trillion by 2030, indicating significant future growth potential.

These new circular business models represent a high-growth but currently underdeveloped market for Barloworld. Their initial market share in these specialized areas would likely be modest, necessitating substantial investment to build a leading position and achieve scalability.

- Circular Economy Investment: Barloworld's commitment to circularity could involve significant capital expenditure in 2024-2025 for advanced remanufacturing facilities and recycling technologies.

- Market Penetration: Initial market share in refurbished or remanufactured equipment sales is expected to be low, perhaps under 5% of the total equipment market in relevant segments.

- Growth Trajectory: Projections suggest a compound annual growth rate (CAGR) exceeding 20% for the circular economy segment within the heavy equipment industry over the next decade.

- Strategic Partnerships: Barloworld may form strategic alliances in 2024 with specialized recycling firms or technology providers to accelerate its circular economy capabilities.

Barloworld's ventures into emerging technologies, such as AI for predictive maintenance in mining and autonomous systems, represent classic question marks. These are high-growth markets, but Barloworld's current share is likely minimal, requiring substantial investment to gain traction.

The company's expansion into new African geographies, beyond its core Southern Africa base, also fits the question mark profile. While these regions offer significant growth potential, Barloworld's market penetration is currently low, necessitating strategic capital allocation and market entry plans.

Similarly, Barloworld's exploration of circular economy models for equipment, focusing on refurbishment and recycling, positions it in a high-growth but nascent market. Capturing a significant share will demand considerable investment in new capabilities and infrastructure.

Barloworld's strategic partnerships for advanced industrial technologies, like AI-driven solutions for mining and construction, place it in high-growth but low-market-share segments. These require focused investment to integrate and scale, aiming to transform them into market leaders.

| Business Area | Market Growth | Barloworld's Market Share | Investment Need | BCG Quadrant |

|---|---|---|---|---|

| AI & Automation (Mining/Construction) | High | Low | High | Question Mark |

| Renewable Energy Equipment Support | High | Low | High | Question Mark |

| New Geographic Markets (Africa) | High | Low | High | Question Mark |

| Circular Economy Models | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.