Barloworld Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

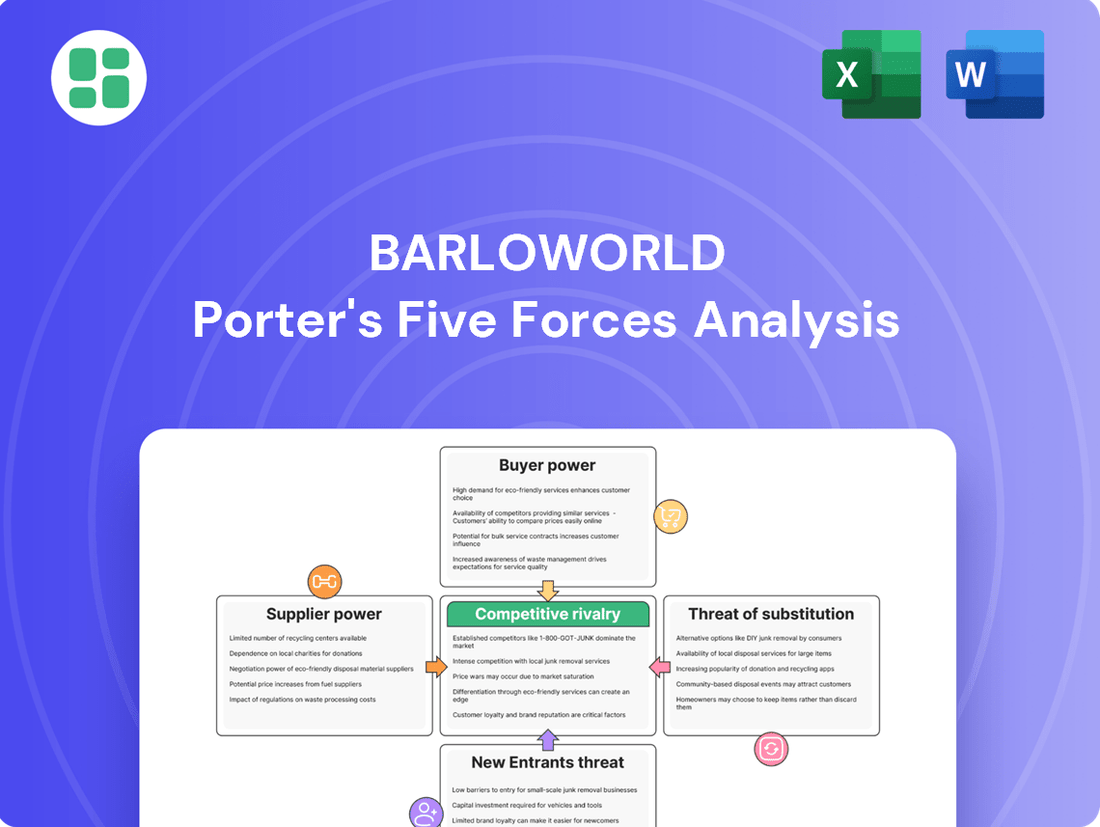

Barloworld operates within a dynamic industrial landscape, facing pressures from powerful suppliers and intense rivalry among existing competitors. The threat of new entrants is moderate, while the availability of substitute products presents a significant challenge to their market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Barloworld’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Barloworld's reliance on a concentrated group of Original Equipment Manufacturers (OEMs) like Caterpillar for its earthmoving and power systems equipment significantly amplifies supplier bargaining power. This limited supplier base, particularly for highly specialized machinery, means these manufacturers hold considerable sway over pricing and terms.

Caterpillar's position is further strengthened by Barloworld's exclusive dealership for Cat machines in Southern Africa. This exclusive arrangement entrenches Caterpillar's influence, as Barloworld has few viable alternatives for sourcing this critical equipment, directly impacting Barloworld's cost structure and operational flexibility.

The products Barloworld sources from its key Original Equipment Manufacturers (OEMs), such as Caterpillar, are highly specialized and technologically advanced. These are not off-the-shelf items; they are often proprietary and built with unique features that are critical to Barloworld's operations and customer offerings.

The reliability and strong brand reputation of equipment from suppliers like Caterpillar mean that readily available, comparable alternatives are scarce. This lack of easy substitutes significantly enhances the bargaining power of these suppliers.

For instance, Caterpillar's market share in heavy construction equipment globally remained robust, often exceeding 30% in key segments in 2024, underscoring its dominant position. Barloworld's inability to easily switch to other manufacturers without facing considerable operational disruptions and potentially losing its competitive edge further solidifies the suppliers' leverage.

Switching from a primary supplier like Caterpillar for Barloworld would incur significant expenses. These costs include retraining personnel on new equipment, reconfiguring existing service and maintenance infrastructure, and the potential erosion of customer confidence in brands that have become synonymous with reliability. In 2024, the heavy machinery sector continued to see high upfront investment in specialized tooling and diagnostic software, making supplier changes particularly costly.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Barloworld's distribution channels, while not a frequent occurrence, represents a significant latent power. Major global equipment manufacturers could, in theory, bypass existing distributors and sell directly to end-customers in Barloworld's operating regions.

However, the substantial investment and expertise required for local distribution, comprehensive after-sales support, and navigating diverse market-specific regulations often act as a deterrent for original equipment manufacturers (OEMs). Barloworld's established and extensive dealer network, therefore, serves as a crucial buffer against this potential threat.

Despite this, the OEMs retain this bargaining power, which could be leveraged if they perceive a significant opportunity or dissatisfaction with current distribution arrangements. For instance, if Barloworld's margins were perceived as excessively high, or if a competitor offered a more attractive partnership, OEMs might reconsider their distribution strategies.

The bargaining power of suppliers, specifically the threat of forward integration, is a critical consideration. For example, in 2024, the heavy equipment manufacturing sector saw continued consolidation, potentially empowering larger OEMs to explore direct sales models more aggressively.

- OEMs possess the technical expertise to replicate Barloworld's distribution functions.

- The complexity of after-sales service and local market knowledge can mitigate the threat of forward integration.

- Barloworld's established dealer network reduces the likelihood of OEMs pursuing direct sales.

- OEMs can leverage their bargaining power if Barloworld's distribution costs or margins are deemed unfavorable.

Importance of Supplier's Input to Barloworld's Business

The quality and availability of equipment from key suppliers are absolutely critical for Barloworld's diverse operations in mining, construction, and industrial sectors. Their ability to offer integrated solutions hinges directly on securing access to leading brands and their essential parts.

This significant dependence on supplier inputs for Barloworld's core business functions inherently bolsters the suppliers' bargaining power. For instance, in 2023, Barloworld reported capital expenditure of R12.4 billion, a substantial portion of which would be allocated to acquiring new equipment and parts from these critical suppliers.

- Key Equipment Dependency: Barloworld relies on a limited number of global manufacturers for specialized mining and construction machinery.

- Supply Chain Vulnerability: Disruptions in the supply of essential components or new equipment can directly impact Barloworld's service delivery and revenue streams.

- Brand Reputation: The association with reputable equipment brands enhances Barloworld's own market standing, giving suppliers leverage.

- High Switching Costs: Transitioning to alternative suppliers for specialized equipment can involve significant costs and operational disruptions.

Barloworld faces significant supplier bargaining power due to its reliance on a few key Original Equipment Manufacturers (OEMs) for highly specialized machinery. This concentration, coupled with the high switching costs associated with retraining and infrastructure changes, gives suppliers like Caterpillar considerable leverage over pricing and terms.

The specialized nature of the equipment, often proprietary and lacking readily available substitutes, further strengthens supplier influence. For example, Caterpillar's substantial global market share, often exceeding 30% in key segments during 2024, highlights its dominant position and Barloworld's limited alternatives.

While OEMs possess the technical capability to potentially integrate forward into Barloworld's distribution, the significant investment and local market expertise required often act as a deterrent. However, this threat remains a latent power, potentially leveraged if OEMs perceive unfavorable distribution costs or margins.

| Supplier Characteristic | Impact on Barloworld | Example Data (2024) |

|---|---|---|

| Supplier Concentration | High leverage for few OEMs | Limited number of global heavy machinery manufacturers |

| Product Uniqueness | Scarcity of substitutes | Proprietary technology in specialized equipment |

| Switching Costs | High costs for Barloworld | Significant investment in retraining and infrastructure |

| OEM Forward Integration Threat | Latent power over distribution | Potential for direct sales if margins are unfavorable |

What is included in the product

This analysis unpacks the competitive forces impacting Barloworld, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its operating industries.

Quickly identify and address competitive threats with a pre-built Barloworld Porter's Five Forces framework, saving valuable time and resources.

Customers Bargaining Power

Barloworld operates in sectors like mining and construction, where clients often require substantial equipment and services for large-scale projects. This means a few major clients can represent a significant portion of revenue.

For instance, in 2023, Barloworld's Equipment Southern Africa segment, which serves mining and construction, generated a substantial portion of the group's revenue. Large mining corporations, with their immense purchasing power, can negotiate favorable pricing and terms, directly impacting Barloworld's profitability.

The sheer volume these key customers commit to purchasing gives them considerable leverage. If a major mining company decides to switch suppliers or demand lower prices, it poses a significant threat to Barloworld's market position and margins.

Customers in the heavy equipment and logistics sectors possess significant leverage due to the availability of multiple distribution channels and rental solutions. Barloworld faces competition not only from other major distributors but also from smaller, localized rental providers and even the option of direct imports, which can bypass traditional distribution networks entirely.

The expanding market for heavy construction machinery rentals further amplifies customer bargaining power. In 2024, the global construction equipment rental market was valued at approximately $120 billion, offering businesses flexible and often more cost-effective alternatives to purchasing new equipment. This readily available rental pool provides customers with a strong negotiating position, as they can readily switch to a competitor if pricing or terms are unfavorable.

Customer switching costs are a crucial factor in assessing the bargaining power of customers. While acquiring a single piece of equipment from Barloworld might involve relatively low switching costs, the landscape changes significantly when considering integrated solutions. For instance, customers opting for Barloworld's comprehensive fleet management, product support, and logistics services often face substantial hurdles when attempting to switch to a competitor.

These high switching costs are often a result of long-term contracts, established maintenance agreements, and the integration of Barloworld's systems into a customer's operational framework. For example, Barloworld's customer value agreements and maintenance contracts are specifically designed to enhance customer stickiness, making it less appealing and more costly for clients to move their business elsewhere. This integration creates a dependency that strengthens Barloworld's position.

Price Sensitivity of Customers

Customers in industries where Barloworld operates, such as mining and construction, often exhibit high price sensitivity. This is particularly evident during periods of economic uncertainty, characterized by elevated interest rates and ongoing inflation, which can make customers more hesitant about large capital expenditures.

Barloworld's performance in 2024 reflected this sensitivity. The company reported a decrease in revenue, with subdued trading conditions contributing to the downturn. This suggests that customers were indeed exercising caution, potentially delaying purchases or seeking more favorable pricing terms.

- Price Sensitivity in Cyclical Industries: Mining and construction sectors are inherently cyclical, meaning customer demand and spending power can fluctuate significantly with broader economic trends.

- Impact of Economic Conditions: High interest rates increase the cost of financing equipment, while inflation erodes purchasing power, both driving customers to scrutinize prices more closely.

- Barloworld's 2024 Revenue Decline: The reported drop in revenue for Barloworld in 2024, attributed partly to subdued trading, serves as a direct indicator of customers' reduced spending and increased price consciousness.

Customer's Ability to Backward Integrate

Large customers, especially those in demanding sectors like mining and construction, often have the financial muscle and operational scale to consider acquiring their own equipment fleets. This means they could potentially set up their own maintenance and repair operations, effectively bringing those functions in-house.

This capability for backward integration, while requiring significant capital investment, grants these sophisticated customers considerable bargaining power. They can use the threat of developing these internal capabilities as leverage when negotiating terms with suppliers like Barloworld.

For instance, a major mining company might analyze the cost savings and control gained by owning and maintaining its own fleet versus leasing or purchasing from a third party. In 2024, companies are increasingly scrutinizing capital expenditure versus operational expenditure, making this decision more critical.

- Customer Integration Threat: Large clients can potentially bring key supplier functions in-house.

- Financial Capacity: Major players in mining and construction possess the capital for fleet acquisition and maintenance.

- Negotiating Leverage: The option to integrate backward strengthens customer bargaining power.

- Strategic Consideration: Customers weigh the cost-benefit of in-house operations versus external supply.

Barloworld's customers, particularly large entities in mining and construction, wield significant bargaining power. Their substantial order volumes allow them to negotiate favorable pricing and terms, directly impacting Barloworld's profitability. The availability of rental options and alternative suppliers further amplifies this leverage, as seen in the $120 billion global construction equipment rental market in 2024, which offers flexible alternatives to outright purchase.

While integrated solutions and long-term contracts can increase customer switching costs, the inherent cyclicality and price sensitivity of Barloworld's core markets, exacerbated by 2024's subdued trading conditions and economic pressures like high interest rates, mean customers remain keen negotiators. Furthermore, the potential for large clients to integrate backward by acquiring their own fleets and maintenance capabilities presents another avenue for them to exert influence.

| Customer Bargaining Power Factors | Impact on Barloworld | Supporting Data/Context |

| Concentration of Buyers | High leverage for major clients | Key clients in mining/construction represent significant revenue portions. |

| Availability of Substitutes/Rentals | Weakens Barloworld's pricing power | Global construction equipment rental market valued at ~$120 billion in 2024. |

| Customer Switching Costs | Mitigates power for integrated solutions | Long-term contracts, maintenance agreements create customer stickiness. |

| Price Sensitivity | Drives demand for lower prices | Subdued trading in 2024 and economic factors (interest rates, inflation) increase scrutiny. |

| Threat of Backward Integration | Potential for customers to bring services in-house | Large clients can invest in own fleets and maintenance operations. |

What You See Is What You Get

Barloworld Porter's Five Forces Analysis

This preview showcases the comprehensive Barloworld Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this in-depth analysis, ready for your strategic planning needs.

Rivalry Among Competitors

Barloworld navigates a competitive landscape shaped by its diverse business segments. In industrial equipment distribution and rental, the company contends with both global giants and a multitude of smaller, regional operators, leading to a fragmented market. This broad operational scope means Barloworld faces different sets of rivals depending on the specific industry it's competing in.

The heavy equipment rental sector, a significant area for Barloworld, is characterized by intense rivalry. Major multinational corporations with substantial resources and established brand recognition compete directly with numerous local and regional players who often possess deep market knowledge and customer relationships. This dynamic creates pressure on pricing and service offerings.

In South Africa, Barloworld's logistics and supply chain solutions also face a concentrated competitive environment. Several large, established companies dominate this market, offering integrated services that challenge Barloworld's market share. The presence of these major players underscores the need for efficiency and strategic differentiation.

The heavy construction machinery rental market is anticipated to expand, and the South African logistics sector is also poised for growth. This presents opportunities for companies like Barloworld, but it also means increased competition as businesses vie for a larger piece of the market.

Despite these positive market projections, Barloworld's Equipment Southern Africa segment saw a revenue decrease in 2024. This suggests that the trading conditions in some of their key operational areas were not as robust as the broader market growth might imply, highlighting a more challenging competitive landscape than initially suggested by industry growth rates alone.

Barloworld stands out by forging strong partnerships with premier global brands, notably Caterpillar, and offering a complete package of integrated solutions. This includes not just the machinery but also robust product support and streamlined logistics, setting them apart from competitors focused solely on equipment sales.

Their 'Barloworld Business System' is a cornerstone of their strategy, driving operational efficiencies across the board. This focus on internal improvement and optimized processes acts as a significant competitive edge, allowing them to deliver superior value and service.

These differentiation tactics are crucial in an industry often characterized by intense price competition. By providing added value through service, support, and operational excellence, Barloworld effectively lessens the direct impact of price wars on its market position.

Exit Barriers for Competitors

Competitors in Barloworld's operating sectors face substantial exit barriers, primarily due to the immense capital tied up in specialized equipment fleets and extensive logistical infrastructure. For instance, the upfront cost of acquiring and maintaining a large fleet of heavy machinery or sophisticated distribution vehicles can run into millions, making it economically unviable for many to simply walk away.

These high fixed costs, coupled with the need for specialized technical expertise and established supply chain networks, mean that companies are often compelled to continue operations even when market conditions are unfavorable. This persistence, driven by the difficulty of recouping initial investments, ensures a sustained level of competitive pressure within the industry.

The sheer scale of investment required to establish and maintain operations in industrial distribution and logistics creates a significant hurdle for any competitor looking to exit. Consider the capital expenditure involved: a single large-scale logistics operation might require hundreds of millions in investment for warehouses, fleet management systems, and a diverse range of vehicles. This financial commitment effectively locks businesses into the market, forcing them to weather economic storms rather than cease operations.

- High Capital Investment: The cost of industrial equipment, such as specialized trucks and machinery, can easily reach millions of dollars per unit, creating a significant barrier to entry and exit.

- Infrastructure Lock-in: Investments in dedicated warehouses, distribution centers, and maintenance facilities represent substantial sunk costs that are difficult to recover upon exiting the market.

- Specialized Human Capital: The reliance on skilled technicians, logistics planners, and experienced drivers means that a company's workforce is a valuable, yet difficult-to-transfer, asset, further increasing exit barriers.

- Operational Continuity: The necessity to maintain service levels and contractual obligations often prevents companies from simply shutting down operations, even in challenging economic periods, thus perpetuating competition.

Market Cyclicality and Economic Volatility

Barloworld's Equipment Southern Africa division is heavily influenced by the boom-and-bust cycles of the mining and construction industries. This means that when these sectors slow down, so does demand for Barloworld's equipment and services, increasing rivalry as companies scramble for a smaller pool of business.

Economic volatility and geopolitical uncertainties, as noted in Barloworld's 2024 performance and projections for 2025, exacerbate this competitive intensity. Companies are forced to compete more aggressively on price and terms to secure deals in a challenging economic climate.

- Exposure to Mining and Construction Cycles: Barloworld's Equipment Southern Africa is directly tied to the capital expenditure of mining and construction firms, which are inherently cyclical.

- Impact of Economic Downturns: Macroeconomic slowdowns reduce demand for heavy machinery, leading to greater competition among equipment suppliers.

- Geopolitical and Economic Volatility: Global events and economic instability increase uncertainty, intensifying the fight for market share and profit margins.

- 2024/2025 Outlook: Barloworld's own financial reporting for 2024 and its outlook for 2025 underscore the prevailing economic challenges that fuel competitive pressures.

Competitive rivalry at Barloworld is intense across its diverse segments, from industrial equipment to logistics. The company faces pressure from both global players and numerous regional competitors, particularly in sectors like heavy equipment rental where pricing and service offerings are key battlegrounds. Barloworld's strategic differentiation through strong brand partnerships like Caterpillar and its internal operational efficiencies, the Barloworld Business System, are crucial for managing this rivalry and mitigating price wars.

High capital investment in specialized fleets and infrastructure creates significant exit barriers, compelling companies to remain competitive even during downturns. This sustained competition, coupled with the cyclical nature of industries like mining and construction, intensifies rivalry, especially during economic volatility. Barloworld’s Equipment Southern Africa division experienced a revenue decrease in 2024, reflecting these challenging trading conditions and heightened competitive pressures.

| Segment | Key Competitors | Competitive Intensity |

|---|---|---|

| Industrial Equipment Distribution & Rental | Global giants (e.g., Komatsu, Hitachi), Regional/Local players | High |

| Heavy Equipment Rental | Multinational corporations, Local/Regional operators | Very High |

| Logistics & Supply Chain Solutions (South Africa) | Large, established integrated service providers | High |

| Heavy Construction Machinery Rental | Global manufacturers, Local rental companies | High and increasing |

SSubstitutes Threaten

The heavy equipment rental market presents a growing substitute threat for Barloworld. Companies increasingly opt to rent machinery for specific projects instead of making substantial capital investments in ownership. This shift is fueled by the cost-effectiveness and flexibility rentals offer, especially when interest rates make purchasing less appealing.

The robust used equipment market presents a significant threat by offering a lower-cost alternative to new machinery. This directly impacts Barloworld's new equipment sales, as customers may opt for pre-owned options to save capital. For instance, in 2023, the global used construction equipment market was valued at approximately $180 billion, highlighting the substantial scale of this alternative.

While Barloworld actively participates in the used equipment sector, a thriving independent used market can still dilute its market share. Customers gain more choices, potentially diverting business from Barloworld's new offerings if attractive used alternatives are readily available from other sources. This competitive landscape necessitates a strong value proposition for new equipment, emphasizing performance, reliability, and total cost of ownership.

Technological advancements present a significant threat of substitution for Barloworld. Innovations like advanced automation, sophisticated telematics, and highly efficient machinery mean customers might bypass traditional distributors like Barloworld in favor of newer, more productive solutions from emerging providers. For instance, the increasing adoption of AI-powered predictive maintenance in heavy equipment could reduce the need for traditional service contracts, a core revenue stream for some of Barloworld's divisions.

In-house Capabilities of Large Customers

Large industrial, mining, or construction companies, often Barloworld's key clients, possess the financial muscle and operational scale to develop their own fleet management and logistics solutions. This in-house capability acts as a direct substitute for Barloworld's offerings, especially for operations with high volume or specialized needs where direct control is paramount. For instance, a major mining operation might invest in its own telematics and maintenance systems, reducing reliance on third-party providers.

The threat is amplified when these large customers can achieve cost efficiencies or greater customization by bringing these functions in-house. Consider the 2024 trend of increased automation in heavy industries; companies are more likely to integrate proprietary fleet management software with their automated machinery, making external service providers less attractive. This internal development can lead to significant cost savings over the long term, further incentivizing the shift away from outsourcing.

Key considerations for Barloworld regarding this threat include:

- Customer Size and Financial Capacity: The ability of large customers to absorb the upfront investment in internal fleet management infrastructure.

- Operational Specialization: The degree to which a customer's operations require highly tailored fleet solutions that are difficult for external providers to match.

- Technological Integration: The potential for customers to integrate in-house fleet management with their existing or planned advanced operational technologies, such as IoT or AI-driven logistics.

- Cost-Benefit Analysis: The ongoing assessment by customers of whether internal management provides a superior cost-benefit ratio compared to Barloworld's services.

Alternative Logistics and Transport Methods

For Barloworld's logistics division, the threat of substitutes is significant. These substitutes include a wide array of third-party logistics (3PL) providers who offer flexible and specialized services, potentially undercutting Barloworld's integrated offerings. Furthermore, companies increasingly opt for direct shipping arrangements, bypassing intermediaries and gaining more control over their supply chains.

Alternative transport modes also pose a threat. For instance, the growing emphasis on sustainability is driving demand for greener shipping options, such as rail or electric vehicles for last-mile delivery, which can substitute traditional road freight. In 2024, the global logistics market saw a notable increase in the adoption of multimodal transport solutions, with companies actively seeking to optimize costs and environmental impact through these alternatives.

- Third-Party Logistics (3PL) Providers: Offer specialized and often more cost-effective solutions.

- Direct Shipping Arrangements: Companies bypass intermediaries for greater control.

- Alternative Transport Modes: Including rail, electric vehicles, and intermodal transport gaining traction in 2024.

- Sustainable Logistics Solutions: Driven by environmental concerns, offering greener alternatives to conventional methods.

The threat of substitutes for Barloworld is substantial, encompassing various alternatives that can diminish the need for its core offerings. These range from outright rental of equipment to the increasing in-house capabilities of large clients, alongside evolving logistics solutions.

The market for used equipment, valued at approximately $180 billion globally in 2023, presents a direct substitute for new machinery sales. Similarly, the logistics sector faces substitution from third-party providers and a shift towards alternative transport modes like rail and electric vehicles, a trend gaining momentum in 2024.

Technological advancements, such as AI-powered predictive maintenance, also introduce substitution risks by potentially reducing reliance on traditional service contracts. Companies developing their own fleet management systems further bypass Barloworld's integrated services.

| Substitute Category | Impact on Barloworld | Supporting Data/Trend |

|---|---|---|

| Equipment Rental | Reduces demand for new equipment sales. | Cost-effectiveness and flexibility are key drivers. |

| Used Equipment Market | Offers a lower-cost alternative to new purchases. | Global market valued at ~$180 billion in 2023. |

| In-house Fleet Management | Bypasses Barloworld's services for large clients. | Driven by control and potential cost efficiencies. |

| Alternative Logistics | Disrupts traditional logistics services. | Growth in rail, EVs, and multimodal transport noted in 2024. |

Entrants Threaten

The threat of new entrants for Barloworld, particularly in its industrial equipment distribution and heavy machinery rental sectors, is significantly mitigated by high capital requirements. Establishing a competitive presence necessitates massive upfront investments in acquiring a diverse fleet of heavy machinery, setting up extensive maintenance and repair facilities, and building robust distribution and logistics networks. For instance, a single large piece of mining or construction equipment can cost millions of dollars, and a comprehensive inventory requires hundreds or even thousands of such assets.

Barloworld enjoys a significant advantage due to its strong brand loyalty and deeply entrenched customer relationships, particularly with global giants like Caterpillar. These decades-old partnerships translate into a formidable barrier for any potential new entrant aiming to disrupt the market.

Newcomers would find it incredibly difficult to replicate the trust and recognition Barloworld has cultivated over many years. This established customer loyalty, coupled with extensive and reliable service networks, makes it a steep uphill battle for any new player to gain traction.

Barloworld's extensive distribution and service networks across Southern Africa and Eurasia represent a significant barrier to new entrants. Establishing a comparable infrastructure, which includes parts availability and skilled service technicians, demands substantial capital investment and years of operational experience. For instance, in 2023, Barloworld reported significant investments in its operational capabilities, underscoring the ongoing commitment to maintaining this advantage.

Regulatory Hurdles and Compliance

The threat of new entrants for Barloworld is significantly shaped by substantial regulatory hurdles and compliance demands. Operating in key sectors like mining, construction, and logistics requires adherence to intricate legal frameworks, specific licensing, and rigorous safety protocols, particularly across diverse African markets. These compliance landscapes act as a formidable barrier, making it challenging for newcomers to establish a foothold.

New entrants face considerable upfront investment in understanding and meeting these regulatory requirements. For instance, in South Africa, mining operations are governed by the Mineral and Petroleum Resources Development Act, which mandates specific ownership structures and environmental impact assessments. Similarly, logistics companies must navigate varying road transport regulations and customs procedures across different countries, adding layers of complexity.

- Regulatory Complexity: Barloworld operates in industries with high regulatory oversight, such as mining and construction, demanding significant compliance expertise.

- Licensing and Permits: Obtaining necessary licenses and permits in various African jurisdictions can be time-consuming and costly for new market entrants.

- Safety Standards: Stringent safety regulations in sectors like mining and equipment handling require substantial investment in training and infrastructure, deterring new players.

- Compliance Costs: The ongoing costs associated with maintaining compliance with evolving regulations present a continuous barrier to entry.

Economies of Scale and Experience Curve

Economies of scale significantly deter new entrants. Barloworld, a major player in equipment and industrial services, leverages its vast operational size to secure favorable pricing on bulk purchases of machinery, parts, and raw materials. For instance, in 2023, Barloworld's revenue reached R109.8 billion, underscoring its substantial purchasing power.

This scale translates directly into cost advantages in logistics and service delivery. New competitors would struggle to match Barloworld's efficiency in distribution networks and after-sales support without achieving a comparable volume of business. This initial cost disadvantage makes it challenging for newcomers to offer competitive pricing right from the outset.

- Economies of Scale: Barloworld's substantial revenue of R109.8 billion in 2023 grants it significant leverage in purchasing and operational efficiency.

- Cost Disadvantage for Newcomers: New entrants lack the established scale, leading to higher per-unit costs for equipment, parts, and logistics.

- Experience Curve Benefits: Incumbents like Barloworld also benefit from an experience curve, where accumulated knowledge leads to further cost reductions and process improvements over time, creating a knowledge barrier for new entrants.

The threat of new entrants for Barloworld is considerably low due to the substantial capital required to enter its core markets, particularly industrial equipment distribution and heavy machinery rental. The immense cost of acquiring and maintaining a diverse fleet, coupled with the necessity of building extensive service and logistics networks, acts as a significant deterrent.

Furthermore, Barloworld benefits from strong brand loyalty and long-standing relationships with key clients, such as Caterpillar, making it difficult for newcomers to gain market share. Established trust and extensive, reliable service networks present a steep uphill battle for any new player seeking to compete effectively.

Barloworld's established economies of scale, evidenced by its 2023 revenue of R109.8 billion, provide a distinct cost advantage in purchasing and operations. New entrants would struggle to match this efficiency and purchasing power, leading to higher per-unit costs and making competitive pricing a significant hurdle from the outset.

| Barrier Type | Description | Impact on New Entrants | Barloworld's Advantage |

|---|---|---|---|

| Capital Requirements | High investment needed for machinery, facilities, and networks. | Significant financial barrier. | Established infrastructure and fleet. |

| Brand Loyalty & Relationships | Decades-old partnerships and customer trust. | Difficulty in acquiring customers. | Strong ties with major clients like Caterpillar. |

| Economies of Scale | Leveraging large operational size for cost efficiencies. | Higher per-unit costs for newcomers. | Purchasing power and operational efficiency (2023 Revenue: R109.8 billion). |

| Regulatory Hurdles | Complex licensing, permits, and safety standards. | Time-consuming and costly compliance. | Expertise in navigating diverse regulatory environments. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Barloworld is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Frost & Sullivan, and regulatory filings from various jurisdictions where Barloworld operates.