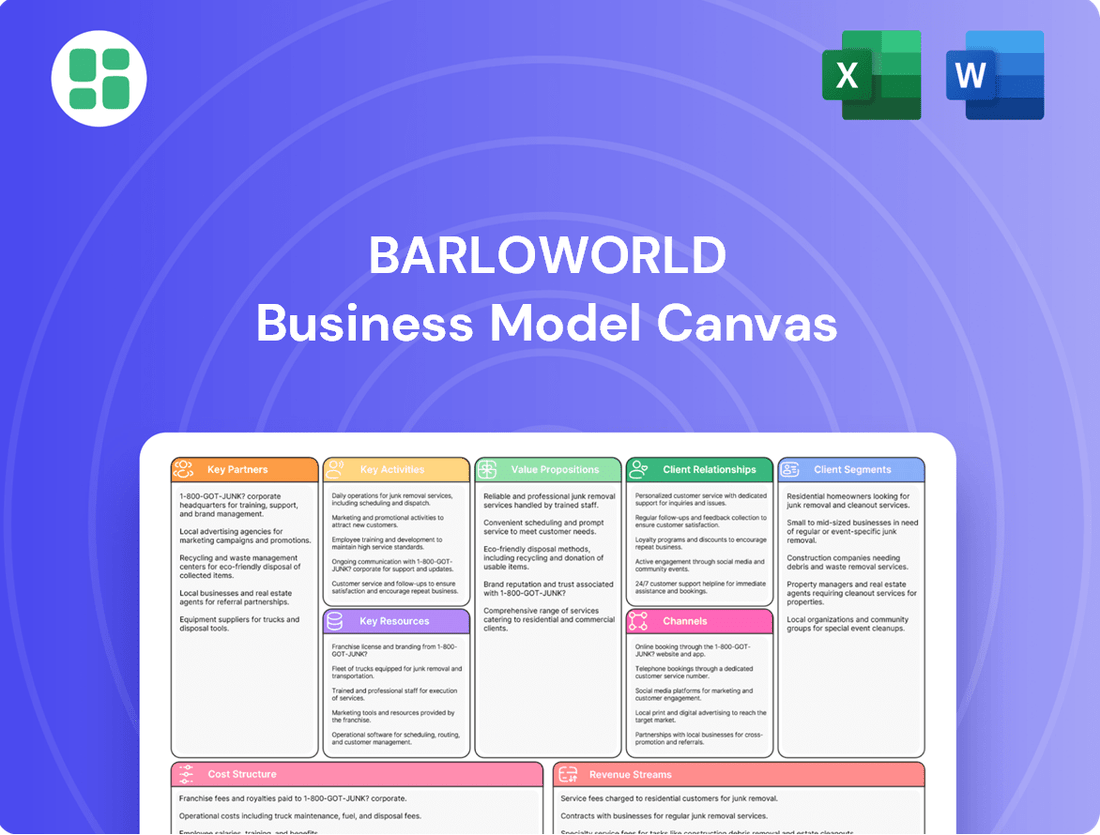

Barloworld Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

Unlock the strategic intricacies of Barloworld's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Ideal for anyone seeking to understand how a global industrial leader thrives.

Partnerships

Barloworld's strategic alliances with leading equipment manufacturers, particularly Caterpillar, form the bedrock of its business. These partnerships grant Barloworld exclusive distribution rights for earthmoving, power systems, and materials handling equipment across Southern Africa, ensuring a consistent supply of high-quality, technologically advanced products. In 2023, Caterpillar's sales, a significant portion of which flows through distributors like Barloworld, reached $67.1 billion, underscoring the scale and importance of these relationships.

Barloworld's collaborations with technology and software providers are crucial for delivering advanced integrated solutions. These partnerships allow for the seamless incorporation of cutting-edge analytics, telematics, and digital platforms into their offerings, particularly in areas like fleet management and predictive maintenance.

By integrating these technologies, Barloworld enhances operational efficiency for its clients. For instance, their digital solutions leverage data to provide predictive maintenance insights, aiming to reduce downtime. In 2023, Barloworld Equipment Southern Africa reported significant progress in digitalizing customer interactions and service delivery, a trend heavily reliant on these tech partnerships.

Barloworld's partnerships with banks and other financial institutions are absolutely crucial. These relationships enable vital services like equipment financing and leasing for their customers, often through specialized arms like CAT Finance. For instance, in the first half of fiscal year 2024, Barloworld Equipment Southern Africa reported strong performance, indicating the continued demand for these financing solutions.

These financial partnerships also play a significant role in supporting Barloworld's own operational needs and capital investments. The company's ongoing efforts to manage its debt, as highlighted in their financial reports, demonstrate the importance of these funding partners in maintaining financial flexibility. This financial strength allows Barloworld to continue offering competitive solutions and invest in its growth across various sectors.

Logistics and Supply Chain Collaborators

Barloworld relies heavily on third-party logistics (3PL) providers and specialized transport companies to manage its complex supply chain. These collaborations are crucial for ensuring the timely and cost-effective delivery of heavy machinery and spare parts across diverse and often challenging terrains. For instance, in 2024, Barloworld Equipment Southern Africa continued to leverage its partnerships with leading logistics firms to maintain efficient operations across South Africa, Namibia, Botswana, and Eswatini, territories where it distributes Caterpillar equipment.

These strategic alliances not only streamline Barloworld's internal distribution but also bolster its capacity to offer integrated supply chain solutions to its customer base. By outsourcing logistics, Barloworld can focus on its core competencies of equipment sales, rental, and aftermarket services, while ensuring that its clients receive their equipment and parts reliably. This approach is particularly vital in sectors like mining and construction, where downtime can be extremely costly.

- Efficiency Gains: Partnerships with 3PL providers help reduce transit times and optimize routes, contributing to lower operational costs.

- Geographical Reach: Specialized transport companies enable Barloworld to serve remote and challenging locations effectively.

- Service Enhancement: Collaborations allow Barloworld to offer end-to-end supply chain management services to its clients, adding significant value.

- Risk Mitigation: Outsourcing logistics to experts helps mitigate risks associated with transportation, such as damage or delays.

Government and Industry Associations

Barloworld actively engages with government bodies and regulatory authorities to navigate complex operating environments and shape policy, especially concerning geopolitical risks and trade tensions. This engagement is crucial for maintaining compliance and understanding evolving market dynamics.

Partnerships with industry associations keep Barloworld informed about the latest industry standards, compliance requirements, and emerging growth opportunities. For instance, in 2024, Barloworld's participation in key industry forums provided insights into sustainable mining practices, a critical area for its equipment and services divisions.

- Government Engagement: Barloworld collaborates with governments on infrastructure development projects and regulatory frameworks, ensuring alignment with national economic strategies.

- Industry Standards: Adherence to and influence on industry standards through associations helps maintain operational excellence and market access.

- Policy Influence: Proactive engagement allows Barloworld to contribute to policy discussions that impact its sectors, such as emissions regulations and trade agreements.

- Sustainability Initiatives: Partnerships support Barloworld's sustainability goals by aligning with governmental and industry-wide environmental targets.

Barloworld's key partnerships are primarily with global equipment manufacturers like Caterpillar, securing exclusive distribution rights and access to a vast product portfolio. These relationships are further strengthened by collaborations with technology providers, enabling the integration of advanced digital solutions for enhanced customer service and operational efficiency. Financial institutions are also vital partners, facilitating equipment financing and leasing options for customers, with Barloworld Equipment Southern Africa showing strong performance in H1 FY2024, indicative of this demand.

| Partner Type | Key Collaborations | Impact | 2023/2024 Data Point |

|---|---|---|---|

| Equipment Manufacturers | Caterpillar | Exclusive distribution rights, product access | Caterpillar sales: $67.1 billion (2023) |

| Technology Providers | Software & Analytics firms | Digital solutions, telematics, predictive maintenance | Digitalization progress in Barloworld Equipment Southern Africa (2023) |

| Financial Institutions | Banks, specialized finance arms (e.g., CAT Finance) | Equipment financing, leasing | Strong performance in H1 FY2024 for Barloworld Equipment Southern Africa |

What is included in the product

A structured overview of Barloworld's diversified industrial and financial services operations, detailing its key customer segments, value propositions, and revenue streams.

This model highlights Barloworld's strategic focus on equipment, industrial solutions, and consumer brands, supported by robust financial services and a commitment to sustainability.

Provides a clear, visual framework to diagnose and address operational inefficiencies, streamlining complex supply chains and mitigating risks.

Offers a structured approach to identify and resolve customer pain points by mapping value propositions to specific customer segments.

Activities

Barloworld Equipment's primary function is the distribution and sale of new and used earthmoving, power systems, and materials handling equipment. This involves a robust sales force and deep product expertise to connect customers with the right machinery.

The company manages a significant inventory, ensuring timely delivery to support client operations. For instance, in the first half of fiscal year 2024, Barloworld Equipment reported revenue growth, underscoring the demand for its distributed products.

This activity is crucial for maintaining Barloworld's market position and directly impacts customer productivity by providing essential operational tools.

Barloworld's integrated rental and fleet management services are central to its value proposition. These activities encompass providing a wide array of equipment for rent, coupled with advanced fleet management solutions. This includes proactive maintenance scheduling, continuous performance monitoring, and strategic optimization of customer-owned fleets.

The core objective is to ensure maximum equipment availability and operational efficiency for clients. For instance, in 2024, Barloworld Equipment's rental division continued to support major infrastructure projects, contributing to increased asset utilization. Their fleet management services aim to reduce downtime, thereby lowering the total cost of ownership for customers.

Barloworld's aftermarket product support and maintenance is a cornerstone of its business, ensuring customer equipment operates at peak performance. This involves a comprehensive network of service centers and highly trained technicians dedicated to keeping machinery running smoothly. For instance, Barloworld Equipment’s Reman Centre plays a vital role in this, offering specialized component rebuilding services.

The efficient distribution of genuine spare parts is another critical activity, minimizing downtime for customers. This robust supply chain is essential for maintaining customer satisfaction and fostering long-term loyalty. High-quality support directly contributes to extending the operational life of both sold and rented equipment, maximizing customer investment.

Logistics and Supply Chain Solutions

Barloworld's key activities in logistics and supply chain solutions involve designing, implementing, and managing intricate networks for clients. This includes everything from warehousing and transportation to precise inventory management.

They utilize cutting-edge logistics expertise and technology to streamline client operations, focusing on cost reduction and enhancing the efficiency of goods movement across diverse sectors. For instance, Barloworld Equipment Southern Africa, a significant part of the group, plays a crucial role in supporting mining and construction operations, indirectly impacting supply chain efficiency through equipment availability and maintenance.

- Designing and Implementing Supply Chain Solutions: Barloworld creates tailored logistics strategies for clients.

- Managing Warehousing and Transportation: They oversee the physical movement and storage of goods.

- Optimizing Inventory Management: Barloworld aims to reduce holding costs and improve stock availability.

- Leveraging Technology and Expertise: Advanced systems and skilled professionals drive operational efficiency.

Car Rental and Mobility Solutions

Barloworld's historical engagement in car rental and mobility solutions, primarily through brands like Avis and Budget under its Zeda subsidiary, represented a significant part of its Automotive & Logistics division. This segment was demerged and separately listed in late 2022, marking a strategic pivot.

The company's current focus has shifted towards industrial equipment rentals, a move that aligns with a broader strategy to emphasize asset-light operations. This evolution signifies a deliberate refinement of its business model to concentrate on areas offering greater flexibility and potentially higher returns on capital.

- Historical Operations: Barloworld previously managed car rental services, including Avis and Budget, through its Zeda unit.

- Strategic Demerger: Zeda was listed separately in late 2022, indicating a divestment from direct car rental operations.

- Current Focus: The company now prioritizes industrial equipment rentals as its core mobility-related activity.

- Strategic Shift: This change reflects Barloworld's move towards a more asset-light operational model.

Barloworld's key activities revolve around distributing and servicing heavy equipment, managing rentals, and providing aftermarket support. This includes selling new and used machinery, offering rental solutions with fleet management, and ensuring parts availability and maintenance services through a strong network. They also engage in logistics and supply chain management for clients.

In fiscal year 2024, Barloworld Equipment saw revenue growth, highlighting strong demand for its core offerings. For example, their rental division actively supports infrastructure projects, boosting asset utilization. The company's commitment to aftermarket support, including remanufacturing services, directly enhances equipment longevity and customer value.

| Key Activity Area | Description | Fiscal Year 2024 Impact/Focus |

|---|---|---|

| Equipment Distribution & Sales | Selling new and used earthmoving, power, and materials handling equipment. | Revenue growth reported, indicating strong market demand. |

| Rental & Fleet Management | Providing equipment rentals and managing client fleets for optimal performance. | Supports major infrastructure projects, increasing asset utilization. |

| Aftermarket Product Support | Offering maintenance, repairs, and spare parts to ensure peak equipment operation. | Reman Centre plays a vital role in component rebuilding; focus on minimizing customer downtime. |

| Logistics & Supply Chain Solutions | Designing and managing logistics networks, warehousing, and transportation for clients. | Streamlining operations for sectors like mining and construction, indirectly impacting efficiency. |

Delivered as Displayed

Business Model Canvas

The Barloworld Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a simplified sample or a mockup; it represents the full, professionally structured analysis that will be delivered to you. You can be assured that what you see here is precisely what you will get, ready for immediate use and customization.

Resources

Barloworld Equipment's extensive fleet and inventory are foundational, encompassing a wide array of earthmoving, power systems, materials handling, and automotive equipment. This vast physical asset base is critical for serving diverse customer needs across sectors like mining and construction.

The company's commitment to maintaining this resource is substantial, as evidenced by significant capital expenditure. For instance, in the first half of fiscal year 2024, Barloworld reported capital expenditure of R3.5 billion, a portion of which is directed towards bolstering its equipment fleet and inventory to ensure readiness and meet market demand.

This robust inventory includes both equipment available for outright purchase and a substantial rental fleet, providing flexible solutions for clients. Effective asset management is paramount, ensuring the fleet's availability and operational efficiency, which directly impacts customer satisfaction and revenue generation.

Barloworld's skilled technical and professional workforce is a cornerstone of its operations, with 6,234 employees as of late 2024. This human capital includes highly proficient technicians, engineers, sales professionals, and logistics experts.

The deep expertise of these individuals in equipment maintenance, providing operational support, and designing tailored solutions is crucial for delivering the high-quality services Barloworld is known for. Their knowledge directly impacts customer satisfaction and operational efficiency.

To maintain a competitive edge, Barloworld invests in continuous training and development programs. This ensures that its workforce's capabilities remain at the forefront of industry advancements and technological innovations.

Barloworld's advanced logistics and service infrastructure, a cornerstone of its business model, includes a vast network of over 100 service centers and workshops strategically positioned across Southern Africa and Eurasia. This extensive physical resource ensures efficient equipment distribution and maintenance.

These facilities are crucial for Barloworld's supply chain operations, enabling timely delivery and support for its diverse customer base. For instance, in 2024, the company continued to invest in upgrading its parts depots to enhance parts availability, a critical factor in minimizing customer downtime.

The modern nature and strategic placement of these hubs, such as the recently expanded logistics hub in Gauteng, South Africa, directly contribute to operational effectiveness. This infrastructure underpins Barloworld's ability to provide comprehensive after-sales support, a key differentiator in the heavy equipment sector.

Proprietary Technology and Digital Platforms

Barloworld's proprietary technology and digital platforms are a cornerstone of its business model, representing a significant intangible asset. The company has made substantial investments in areas like telematics and advanced fleet management software. These digital tools are crucial for optimizing supply chains and enhancing service delivery across its diverse operations.

These technological advancements allow for sophisticated data analysis, enabling remote monitoring of assets and providing deeper insights into operational efficiency. This capability is vital for delivering integrated solutions that cater to complex customer needs in sectors like equipment hire and logistics.

The strategic deployment of these digital platforms provides Barloworld with a distinct competitive advantage. By leveraging data analytics and digital services, the company can offer more tailored and efficient solutions, improving customer satisfaction and driving revenue growth.

For instance, in 2024, Barloworld continued to expand its digital capabilities, aiming to enhance customer experience and operational efficiency. Specific figures on R&D investment in digital platforms are often integrated into broader capital expenditure reports, but the trend clearly indicates a growing emphasis on these intangible resources as key value drivers.

- Telematics and Fleet Management: Barloworld utilizes advanced telematics to track and manage customer equipment fleets, providing real-time data on performance, location, and maintenance needs.

- Supply Chain Optimization: Digital platforms are employed to streamline logistics, inventory management, and the overall flow of goods and services, ensuring greater efficiency and cost savings.

- Data Analytics and Insights: The company leverages its digital infrastructure to gather and analyze operational data, offering customers valuable insights to improve their own business performance.

- Enhanced Service Delivery: These technologies underpin Barloworld's ability to offer predictive maintenance, remote diagnostics, and customized support, differentiating its service offerings in the market.

Strong Brand Reputation and Customer Trust

Barloworld's strong brand reputation, cultivated since its founding in 1902, is a cornerstone of its business model. This reputation for reliability and quality across its diverse sectors, including equipment and industrial, acts as a significant intangible asset.

Customer trust, earned through consistent service and enduring relationships, directly fuels new business acquisition and reinforces loyalty among its existing client base. This is particularly crucial in sectors where long-term partnerships are paramount.

- Brand Longevity: Founded in 1902, Barloworld boasts over a century of operational history, building a deep reservoir of trust.

- Reputation for Quality: The brand is synonymous with dependable equipment and integrated solutions, a key differentiator.

- Customer Loyalty: Consistent service delivery fosters strong, long-lasting relationships, reducing customer churn.

- New Business Facilitation: A positive brand image significantly lowers the barrier to entry for new clients and market penetration.

Barloworld's extensive equipment fleet and inventory represent a critical physical asset, encompassing a broad range of earthmoving and power systems. This vast resource is fundamental to serving diverse customer needs, particularly in mining and construction. The company's dedication to maintaining this asset base is substantial, with capital expenditure in the first half of fiscal year 2024 reaching R3.5 billion, partly to bolster its fleet and inventory for market readiness.

The company's skilled workforce, numbering 6,234 employees by late 2024, is a vital human resource. This includes expert technicians and engineers essential for equipment maintenance, operational support, and solution design. Continuous training ensures their capabilities align with industry advancements.

Barloworld's advanced logistics and service infrastructure, featuring over 100 strategically located service centers across Southern Africa and Eurasia, is a key operational asset. These facilities ensure efficient equipment distribution and maintenance, supported by ongoing investments in parts depots to minimize customer downtime, as seen in 2024 upgrades.

Proprietary technology and digital platforms, including telematics and fleet management software, form a significant intangible asset. These tools are crucial for optimizing supply chains and enhancing service delivery, with ongoing expansion in digital capabilities throughout 2024 to improve customer experience.

Barloworld's strong brand reputation, built over a century since 1902, is a core intangible asset. This reputation for reliability fosters customer trust and loyalty, significantly aiding new business acquisition and market penetration.

| Key Resource | Description | Relevance | Data Point (FY24 H1) |

| Equipment Fleet & Inventory | Vast range of earthmoving, power systems, etc. | Core offering for diverse customer needs | Capital Expenditure: R3.5 billion |

| Skilled Workforce | Technicians, engineers, sales professionals | Essential for maintenance, support, and solutions | Employees: 6,234 (late 2024) |

| Logistics & Service Infrastructure | Network of service centers and workshops | Ensures efficient distribution and after-sales support | Over 100 service centers |

| Proprietary Technology & Digital Platforms | Telematics, fleet management software | Optimizes operations and enhances service delivery | Ongoing investment in digital capabilities |

| Brand Reputation | Established over 100 years | Builds customer trust and loyalty | Founded: 1902 |

Value Propositions

Barloworld provides a powerful suite of integrated solutions, combining equipment supply with essential services like maintenance, fleet management, and logistics. This holistic approach is designed to significantly boost customer operational efficiency by simplifying complex processes.

By offering these end-to-end capabilities, Barloworld empowers clients to concentrate on their primary business objectives, reducing the burden of managing diverse operational aspects. This integration directly translates into streamlined workflows and improved productivity for their customers.

In 2024, Barloworld's focus on integrated solutions contributed to a strong performance, with the company reporting revenue growth driven by its equipment and services segments. This demonstrates the tangible benefits customers experience through enhanced operational efficiency.

Barloworld's customers gain a significant edge through access to dependable, top-tier equipment from renowned brands such as Caterpillar. This reliability is further bolstered by comprehensive support services, ensuring operations run smoothly and efficiently.

The company's commitment to proactive maintenance and ensuring the ready availability of spare parts directly translates into maximized uptime for clients. For sectors like mining and construction, where operational continuity is paramount, this minimizes costly disruptions and keeps projects on track.

In 2024, Barloworld's focus on equipment reliability and uptime is a cornerstone of its value proposition, directly addressing the core productivity needs of its diverse customer base, particularly in heavy-duty industries.

Barloworld empowers customers to optimize capital expenditure by offering flexible rental and leasing options, thereby minimizing the upfront investment in equipment. This approach directly addresses the need for financial agility, allowing businesses to scale their operations without the burden of large asset purchases.

Furthermore, Barloworld's integrated fleet management and logistics services are designed to drive significant operational cost savings. By streamlining these processes, they help clients reduce expenses related to maintenance, fuel, and inefficient routing. For instance, in 2024, Barloworld Equipment Southern Africa reported a strong focus on enhancing customer uptime and reducing total cost of ownership through advanced telematics and predictive maintenance, a key driver for cost optimization.

This combination of financial flexibility and demonstrable cost efficiency makes Barloworld's offerings particularly compelling for businesses aiming for robust budget management and improved profitability. The ability to access necessary equipment and services without tying up substantial capital is a critical value proposition in today's dynamic economic landscape.

Specialized Expertise and Technical Support

Barloworld's value proposition centers on delivering specialized expertise and robust technical support, ensuring clients receive unparalleled guidance. This deep industry knowledge, coupled with a highly skilled team of technicians and engineers, translates into practical, on-the-ground assistance. For instance, in 2024, Barloworld Equipment Southern Africa continued its commitment to skills development, with significant investment in training programs aimed at enhancing the technical proficiency of its workforce, directly benefiting customer operational efficiency.

Clients benefit from professional advice tailored to their unique challenges, leading to customized solutions that optimize performance. This proactive approach to problem-solving is crucial in demanding sectors like mining and construction. The company's rapid technical assistance ensures minimal downtime, a critical factor for businesses relying on heavy machinery. In the first half of fiscal year 2024, Barloworld reported a notable improvement in customer service response times across key markets, a direct result of enhanced technical support infrastructure.

- Deep Industry Knowledge: Access to Barloworld's extensive experience across various sectors.

- Skilled Workforce: Highly trained technicians and engineers providing expert service.

- Customized Solutions: Tailored advice and support for specific operational needs.

- Rapid Technical Assistance: Minimizing downtime through prompt and effective service delivery.

Enhanced Supply Chain Resilience and Agility

Barloworld enhances supply chain resilience and agility for its clients through advanced logistics and supply chain solutions. This includes specialized services like multi-temperature food logistics, ensuring product integrity and timely delivery across complex networks.

By optimizing inventory levels and streamlining transportation, Barloworld helps businesses mitigate risks and respond effectively to market shifts. This adaptability is crucial for maintaining a competitive edge in today's dynamic economic landscape.

- Optimized Inventory Management: Barloworld's solutions reduce holding costs and stockouts, ensuring products are available when and where needed.

- Efficient Transportation Networks: The company designs and manages transportation routes to minimize transit times and fuel consumption.

- Risk Mitigation Strategies: Barloworld implements proactive measures to address potential disruptions, from weather events to geopolitical issues, safeguarding client operations.

- Adaptability to Market Changes: Clients gain the flexibility to pivot quickly in response to evolving consumer demands and economic conditions.

Barloworld provides integrated solutions, combining equipment supply with essential services like maintenance and logistics, to boost customer operational efficiency. This holistic approach simplifies complex processes, allowing clients to focus on their core business objectives, which in 2024 contributed to revenue growth driven by equipment and services segments.

Customers gain access to reliable, top-tier equipment supported by comprehensive services that ensure smooth operations. Barloworld's commitment to proactive maintenance and spare parts availability maximizes client uptime, minimizing costly disruptions, a key factor in heavy-duty industries as highlighted in their 2024 focus.

Barloworld enables customers to optimize capital expenditure through flexible rental and leasing options, reducing upfront investment. This financial agility is complemented by operational cost savings from integrated fleet management and logistics. In the first half of fiscal year 2024, Barloworld Equipment Southern Africa emphasized reducing total cost of ownership through advanced telematics and predictive maintenance.

The company offers specialized expertise and robust technical support, ensuring clients receive tailored advice and rapid assistance to optimize performance and minimize downtime. In 2024, Barloworld continued investing in training to enhance workforce technical proficiency, directly benefiting customer operations.

Customer Relationships

Barloworld prioritizes building lasting connections with its major clients through dedicated account management. These specialists act as the main point of contact, deeply understanding each client's unique requirements.

These account managers are crucial for delivering customized solutions, significantly boosting customer satisfaction and loyalty, especially within their large corporate customer base. This focused, personalized service is a key element of their business-to-business strategy.

For instance, Barloworld Equipment, a significant segment, reported revenue growth in its fiscal year 2023, partly driven by strong customer retention facilitated by these dedicated relationships.

Barloworld prioritizes a service-oriented approach, focusing on proactive customer engagement. This includes offering timely maintenance, expert technical support, and swift resolutions to any operational disruptions, ensuring customers experience minimal downtime. For instance, in 2024, their commitment to uptime was reflected in their various service agreements, which are designed to keep essential equipment running smoothly, a critical factor for their diverse client base.

Barloworld cultivates customer relationships through a consultative, solution-driven approach. This involves deep dives into client operations to understand specific challenges in equipment, fleet, and logistics management. For instance, in 2024, Barloworld's focus on tailored solutions helped clients in the mining sector optimize fleet utilization, leading to an average 15% reduction in operational downtime.

By actively listening and co-creating customized strategies, Barloworld moves beyond a transactional vendor role. This partnership model, exemplified by their work with a major South African construction firm in early 2024, resulted in a more efficient project delivery schedule and a 10% cost saving on equipment maintenance.

This collaborative engagement fosters significant trust and positions Barloworld as an indispensable strategic ally. Their commitment to understanding business objectives and providing expert advice ensures that clients view them not just as a supplier, but as a key contributor to their success, a sentiment echoed in numerous client testimonials throughout 2024.

Digital Self-Service and Online Portals

Barloworld enhances customer engagement through digital self-service and online portals, offering convenient access to product information and service histories for specific customer segments. This digital approach complements personalized interactions, streamlining routine tasks and boosting overall accessibility. For instance, in 2024, the company continued to invest in its digital infrastructure, aiming to improve the user experience on these platforms.

- Digital Platforms: Barloworld provides online portals for customers to manage their accounts, access service records, and find product details.

- Self-Service Functionality: Customers can independently perform routine tasks, reducing the need for direct human interaction for basic queries.

- Efficiency and Convenience: These digital tools offer 24/7 access, allowing customers to engage with Barloworld on their own schedule.

- Complementary Service: Digital offerings support and enhance the personalized service provided to customers, particularly for straightforward requests.

Community Building and Industry Engagement

Barloworld cultivates strong customer relationships by actively participating in key industry events and forums. This engagement allows for direct interaction and understanding of evolving customer needs. In 2023, Barloworld Equipment Southern Africa, for instance, hosted several customer forums focusing on digital solutions and operational efficiency, directly addressing feedback from their client base.

The Barloworld Empowerment Foundation plays a crucial role in building community and fostering goodwill, which indirectly strengthens customer relationships. Through various initiatives, the foundation demonstrates Barloworld's commitment beyond its core business operations. For example, in the first half of fiscal year 2024, the foundation supported over 50 community projects across South Africa, impacting thousands of lives and enhancing Barloworld's brand reputation among its stakeholders.

Engaging with the broader industry reinforces Barloworld's leadership and creates a positive ecosystem for its customers. This includes collaborations and knowledge sharing that benefit the sectors in which Barloworld operates. Their participation in the 2024 Mining Indaba, for example, showcased their latest innovations and facilitated discussions on sustainable mining practices, aligning with customer priorities.

- Industry Event Participation: Barloworld actively engages in forums and conferences to connect with customers and understand market trends.

- Corporate Social Responsibility: The Barloworld Empowerment Foundation builds community and enhances brand reputation through impactful social initiatives.

- Sectoral Leadership: Broad industry engagement reinforces Barloworld's position and fosters a supportive environment for its customers.

Barloworld's customer relationships are built on a foundation of dedicated account management, offering personalized solutions and proactive support. This consultative approach, exemplified by a 15% reduction in operational downtime for mining clients in 2024, fosters deep trust and positions them as strategic allies. Digital platforms enhance this by providing convenient self-service options, complementing the personalized touch. Their commitment extends to industry engagement and social responsibility, solidifying their reputation and creating a positive ecosystem for clients.

Channels

Barloworld’s direct sales force is crucial for engaging with large corporate and industrial clients, building relationships, and understanding specific needs. This personal interaction is key in sectors like mining and construction where complex equipment is involved.

The network of regional branches and dealerships, particularly strong in Southern Africa and Eurasia, acts as vital touchpoints. These locations facilitate not only sales but also essential after-sales service and equipment demonstrations, reinforcing Barloworld’s commitment to customer support. For instance, in 2023, Barloworld Equipment Southern Africa reported revenue growth, partly driven by strong customer engagement through its extensive branch network.

Barloworld increasingly utilizes online platforms and digital portals to connect with its diverse customer base. These digital channels serve as crucial touchpoints for product information, service requests, and investor relations, streamlining communication and accessibility.

In 2024, Barloworld's focus on digital transformation continued, aiming to enhance customer experience through self-service options and readily available account management tools. This digital push is designed to improve operational efficiency and expand the company's reach across various markets.

Barloworld's service centers and workshops, including the Barloworld Equipment Reman Centre, are crucial for providing aftermarket support, maintenance, and repair services. These facilities are outfitted with specialized tools and employ certified technicians, ensuring equipment operates at peak performance and minimizing customer downtime. In 2024, Barloworld Equipment reported significant investment in its service capabilities, aiming to enhance customer uptime and satisfaction across its operational regions.

Strategic Partnerships and Dealer Networks

Barloworld's strategic partnerships, particularly with manufacturers like Caterpillar, are foundational to its business model, allowing it to act as a primary dealer and service provider for essential equipment. This relationship is key to its equipment segment's success, enabling broad market penetration and reliable product distribution.

While Barloworld divested its car rental operations, the equipment business continues to thrive by leveraging these crucial alliances with global brands. These networks are vital for both sales and after-sales support, ensuring customer satisfaction and brand loyalty.

- Dealer Agreements: Barloworld operates as an authorized dealer for major equipment manufacturers, securing exclusive or primary distribution rights in its operating regions.

- Brand Representation: The company represents and promotes leading global brands, benefiting from their reputation and product innovation.

- Service and Support Networks: These partnerships extend to comprehensive service, maintenance, and parts supply agreements, creating a robust customer support ecosystem.

Customer Relationship Management (CRM) Systems

Barloworld leverages robust internal Customer Relationship Management (CRM) systems as a crucial, albeit not directly outward-facing, component of its business model. These systems are vital for orchestrating customer interactions and ensuring a seamless, consistent experience across all engagement points. For instance, in 2024, Barloworld's investment in digital transformation included enhancing its CRM capabilities to better track customer lifecycles and service history, which is fundamental to their strategy of building long-term customer loyalty.

These internal CRM platforms enable coordinated communication between sales, service, and support teams, preventing fragmented customer experiences. They act as a central repository for all customer data, allowing for personalized service delivery and proactive issue resolution. This focus on data integration is exemplified by Barloworld’s reported progress in 2024 towards a unified customer view, aiming to improve response times and tailor offerings more effectively.

- Centralized Customer Data: CRM systems consolidate customer information, providing a single source of truth for all interactions.

- Enhanced Communication Coordination: Facilitates seamless information flow between internal departments to ensure consistent messaging.

- Personalized Service Delivery: Enables tailored interactions based on customer history and preferences, boosting satisfaction.

- Improved Customer Retention: By managing relationships effectively, CRM systems contribute to higher customer loyalty and repeat business.

Barloworld's channels are a multi-faceted approach, blending direct engagement with extensive physical and digital networks. This ensures comprehensive customer reach and support across its diverse equipment and services portfolio.

The company's direct sales force is vital for high-value client relationships, particularly in sectors like mining and construction. Complementing this, a broad network of regional branches and dealerships, especially prominent in Southern Africa and Eurasia, facilitates sales and critical after-sales services.

Digital platforms are increasingly leveraged for product information, service requests, and investor relations, enhancing accessibility. Furthermore, specialized service centers and workshops, including the Barloworld Equipment Reman Centre, are key for aftermarket support, ensuring equipment longevity and minimizing client downtime.

Barloworld's strategic partnerships, notably with Caterpillar, are fundamental to its channel strategy, enabling it to act as a primary dealer and service provider. These alliances underpin its market penetration and product distribution capabilities.

| Channel Type | Key Functions | 2024 Focus/Data Point |

|---|---|---|

| Direct Sales Force | Client relationship building, needs assessment | Crucial for large corporate/industrial clients |

| Regional Branches/Dealerships | Sales, after-sales service, equipment demos | Strong presence in Southern Africa and Eurasia; revenue growth driver in 2023 |

| Online Platforms/Digital Portals | Product info, service requests, investor relations | Enhanced self-service options and account management |

| Service Centers/Workshops | Aftermarket support, maintenance, repair | Investment in capabilities to improve customer uptime |

| Strategic Partnerships (e.g., Caterpillar) | Primary dealer rights, product distribution | Foundation for equipment segment success |

Customer Segments

Mining companies, from massive global enterprises to smaller, specialized operations, represent a core customer segment for Barloworld. These businesses rely heavily on robust heavy earthmoving equipment, reliable power systems, and intricate logistics to support their extraction and processing activities. In 2024, the global mining industry continued to invest in technology and equipment to enhance efficiency, with capital expenditures projected to remain strong, particularly in sectors like copper and lithium.

Key priorities for these mining clients include ensuring equipment dependability and maximizing operational uptime, as any downtime directly impacts production and profitability. They also place a high value on efficient supply chains to ensure timely delivery of parts and services, which is critical for maintaining continuous operations. Barloworld's ability to offer comprehensive service contracts and foster long-term partnerships is therefore paramount to meeting these demanding requirements.

Construction and infrastructure firms are a core customer segment, requiring earthmoving and materials handling equipment for projects like building construction and road development. These companies often opt for rental solutions, valuing prompt delivery and adaptable service offerings to meet the dynamic demands of their project-based work.

Industrial and manufacturing clients, a core segment for Barloworld, rely heavily on robust materials handling equipment, reliable power generation systems, and streamlined logistics to keep their operations running smoothly. Think of factories needing forklifts or warehouses requiring automated guided vehicles.

These businesses, from general manufacturing to specialized production, are primarily focused on boosting internal efficiency and cutting down on operational expenses. For instance, in 2024, many manufacturers were investing in energy-efficient equipment to combat rising utility costs, a key driver for Barloworld's power solutions.

The demand for tailored supply chain solutions is particularly strong. Clients seek integrated services that manage everything from equipment procurement and maintenance to the efficient movement of goods within their facilities, aiming for predictable production cycles and reduced downtime.

Logistics and Supply Chain Companies

Logistics and supply chain firms are key customers for Barloworld, needing specialized equipment like forklifts and trucks to optimize their operations. These businesses focus heavily on efficiency and cost reduction within their warehousing and transportation networks. In 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the significant demand for solutions that enhance fleet management and materials handling.

Barloworld serves this segment by providing not just equipment but also integrated support services designed to streamline operations. This includes maintenance, financing, and telematics for better fleet visibility. Companies in this sector are particularly sensitive to uptime and the total cost of ownership, making reliable equipment and support paramount for their success.

- Core Need: Efficient fleet management and robust materials handling equipment.

- Key Driver: Cost control and operational efficiency in logistics and warehousing.

- Market Context: The global logistics market reached an estimated $10.6 trillion in 2024.

- Barloworld's Offering: Specialized equipment, maintenance, financing, and telematics solutions.

Power and Energy Sector Clients

Barloworld's Power and Energy Sector Clients represent a crucial and expanding segment within their business model. This group encompasses entities involved in power generation, from traditional fossil fuels to burgeoning renewable sources, as well as those focused on energy infrastructure development. Their core requirement from Barloworld centers on reliable equipment and comprehensive services to maintain and enhance their operational capabilities.

The specific needs of this segment are diverse, including the provision of diesel and gas generators essential for consistent power output, alongside increasingly sought-after renewable energy solutions and advanced energy storage systems. Barloworld positions itself as a key partner, supplying the necessary machinery and expert support to ensure uninterrupted energy supply and to facilitate the transition towards more sustainable energy practices. This strategic focus not only addresses the immediate demands of the sector but also diversifies Barloworld's industrial customer base, reducing reliance on any single industry.

In 2024, the global power generation market saw continued investment, with renewable energy sources projected to account for a significant portion of new capacity. For instance, the International Energy Agency (IEA) reported in early 2024 that solar PV capacity additions alone were expected to break records again. This trend directly translates to increased demand for the types of equipment and services Barloworld offers within this sector, highlighting the segment's growth potential.

- Key Customer Needs: Diesel/gas generators, renewable energy equipment, energy storage systems, and associated maintenance and support services.

- Barloworld's Offering: Provision of reliable equipment and expert services to ensure consistent power supply and support sustainable energy solutions.

- Market Trend Impact: Growing demand driven by global investments in renewable energy and infrastructure upgrades, as evidenced by record solar PV capacity additions in 2024.

- Strategic Importance: Diversifies Barloworld's industrial customer base and aligns with the global shift towards sustainable energy.

Barloworld's customer base is diverse, spanning heavy industries that require specialized equipment and support. Key segments include mining, construction, industrial manufacturing, logistics, and the power and energy sectors.

These clients share a common need for reliable, high-performance machinery and integrated services that ensure operational efficiency and minimize downtime. Barloworld's strategy involves understanding the unique demands of each sector to provide tailored solutions.

In 2024, significant investment continued across these industries, driven by global demand for resources, infrastructure development, and the energy transition. Barloworld's ability to offer financing, maintenance, and parts support is crucial for these capital-intensive operations.

| Customer Segment | Key Needs | 2024 Market Context/Driver | Barloworld's Value Proposition |

|---|---|---|---|

| Mining | Heavy earthmoving equipment, power systems, logistics | Continued investment in technology, strong CAPEX in copper/lithium | Equipment dependability, uptime maximization, supply chain efficiency |

| Construction | Earthmoving, materials handling equipment | Infrastructure development, project-based demands | Rental solutions, prompt delivery, adaptable service |

| Industrial/Manufacturing | Materials handling, power generation, logistics | Focus on efficiency, cost reduction, energy-efficient equipment | Tailored supply chain solutions, predictable production cycles |

| Logistics | Forklifts, trucks, fleet management | $10.6 trillion global market value, focus on efficiency/cost reduction | Integrated support, telematics for fleet visibility, total cost of ownership |

| Power/Energy | Generators, renewable energy, storage systems | Global investment in renewables, record solar PV additions | Reliable equipment, expert support, facilitating energy transition |

Cost Structure

Barloworld's cost structure is heavily influenced by the acquisition and ongoing depreciation of its extensive equipment fleet, encompassing earthmoving machinery, power systems, and vehicles used for sales, rental, and operations. This capital investment is a core component of their business model.

For instance, in their 2023 financial year, Barloworld reported significant capital expenditure, with the group's investment in property, plant, and equipment totaling R14.3 billion, reflecting the ongoing need to maintain and expand their operational assets.

Barloworld's commitment to maintaining its vast equipment fleet, offering robust aftermarket support, and ensuring a ready supply of spare parts represents a significant component of its cost structure. These ongoing expenses are crucial for upholding equipment reliability and customer satisfaction.

In 2024, Barloworld likely continued to invest heavily in its service infrastructure. For instance, in fiscal year 2023, the company reported that its Equipment division’s revenue was driven by strong customer demand for parts and service, underscoring the importance of these cost centers.

The operational costs associated with skilled technicians, efficient inventory management systems for spare parts, and the upkeep of numerous service centers are substantial. These expenditures directly influence the company's ability to deliver on its promises of equipment uptime and performance.

Personnel salaries and benefits are a significant cost for Barloworld, reflecting the need for a large, skilled workforce. This includes sales teams driving revenue, engineers and technicians ensuring equipment functionality, logistics specialists managing complex supply chains, and administrative staff keeping operations smooth. In 2023, Barloworld reported employee-related costs, including salaries and benefits, as a substantial portion of its operating expenses, underscoring the value placed on human capital.

The investment in training and retaining this talent is also a major component of their cost structure. Developing the expertise of their personnel, especially in specialized fields like mining and construction equipment, is crucial for maintaining their competitive edge and delivering high-quality service. This ongoing commitment to human capital development directly supports their operational excellence and ability to meet customer demands effectively.

Logistics and Distribution Network Costs

Barloworld's logistics and distribution network incurs significant costs, encompassing warehousing, fuel, and sophisticated supply chain management systems. These expenses are vital for ensuring efficient and timely delivery of equipment and parts across its extensive operational footprint. For instance, in 2024, Barloworld continued to invest in optimizing its fleet and distribution routes to mitigate rising fuel costs and enhance delivery speed, a critical factor in customer satisfaction and operational uptime.

The company manages a complex web of warehouses and transportation assets to support its diverse business units, including equipment hire, earthmoving, and industrial machinery. These operational necessities directly impact the cost structure, requiring continuous investment in technology and infrastructure. Barloworld's commitment to streamlining these processes in 2024 aimed to achieve greater cost efficiencies while maintaining high service levels across its global operations.

- Warehousing Expenses: Costs associated with maintaining and operating storage facilities for equipment and spare parts.

- Transportation Costs: Expenditures on freight, fuel, vehicle maintenance, and driver salaries for moving goods.

- Supply Chain Technology: Investments in software and systems for managing inventory, tracking shipments, and optimizing routes.

- Fuel Price Volatility: The impact of fluctuating global fuel prices on transportation budgets, a key consideration in 2024 operational planning.

Technology and Digital Platform Investments

Barloworld's commitment to staying ahead in the digital age means significant ongoing investment in its technology and digital platforms. This includes everything from the underlying IT infrastructure that keeps operations running smoothly to the development of sophisticated software and the enhancement of their digital customer interfaces. These aren't one-off expenses; they represent a continuous cost as technology evolves and new capabilities are introduced.

These technology investments are crucial for several reasons. They directly contribute to improving how Barloworld operates, making processes more efficient and cost-effective. Furthermore, these platforms are key to delivering advanced solutions and services to customers, ensuring they receive the best possible experience. Maintaining a competitive edge in today's market absolutely requires this technological advancement.

Beyond development and infrastructure, data security and the ongoing maintenance of these complex systems are substantial cost drivers. Protecting sensitive information and ensuring the reliability and uptime of digital platforms are paramount, requiring dedicated resources and expertise. For instance, in 2024, many industrial companies reported increased spending on cybersecurity measures to combat evolving threats.

- IT Infrastructure: Continued upgrades and maintenance of servers, networks, and cloud services.

- Software Development: Investment in proprietary software, customer portals, and internal management systems.

- Digital Platforms: Development and enhancement of online sales channels, service booking systems, and data analytics tools.

- Telematics: Integration and maintenance of systems that track equipment performance and location for customers.

- Data Security & Maintenance: Costs associated with cybersecurity, software updates, bug fixes, and system support.

Barloworld's cost structure is fundamentally shaped by its significant capital investments in equipment, which are then subject to depreciation. This includes the acquisition and maintenance of a vast fleet for sales, rental, and operational use.

Operational costs are substantial, covering skilled labor for maintenance and repairs, inventory management for spare parts, and the upkeep of service centers. Personnel costs, including salaries and benefits for a large, skilled workforce across various functions, represent a major expenditure. Furthermore, investments in training and development are critical for maintaining expertise and competitive advantage.

Logistics and technology are also key cost drivers. This involves managing a complex distribution network with associated warehousing and transportation expenses, influenced by fuel price volatility. Continuous investment in IT infrastructure, software development, digital platforms, and data security is essential for operational efficiency and customer service enhancement.

| Cost Category | Description | Key Components | 2023 Financial Impact (Illustrative) |

| Equipment Acquisition & Depreciation | Capital expenditure on machinery and vehicles, with subsequent depreciation charges. | Earthmoving machinery, power systems, vehicles. | R14.3 billion (Capital Expenditure on PPE) |

| Aftermarket Support & Parts | Costs associated with maintaining equipment reliability and customer service. | Skilled technicians, spare parts inventory, service center operations. | Strong customer demand for parts and service drove Equipment division revenue. |

| Personnel Costs | Salaries, benefits, and training for the workforce. | Sales, engineering, logistics, administrative staff. | Substantial portion of operating expenses. |

| Logistics & Distribution | Expenses related to warehousing, transportation, and supply chain management. | Warehousing, fuel, fleet optimization, supply chain technology. | Ongoing investment in optimizing fleet and routes in 2024 to manage fuel costs. |

| Technology & Digital Platforms | Investment in IT infrastructure, software, and digital customer interfaces. | IT infrastructure upgrades, software development, cybersecurity. | Increased spending on cybersecurity measures reported by industrial companies in 2024. |

Revenue Streams

Barloworld’s Equipment Sales Revenue is primarily driven by the direct sale of new and used earthmoving, power systems, and materials handling equipment. This revenue stream caters to crucial sectors like mining, construction, and various industrial clients, often involving substantial, individual transactions.

The volume of sales and the pricing of this equipment significantly impact this revenue. Market demand, coupled with the natural fleet replacement cycles within these industries, directly influences Barloworld’s ability to generate income from equipment sales.

For instance, in the fiscal year 2023, Barloworld reported strong performance in its Equipment business, with revenue from equipment sales playing a significant role. The company's focus on key markets and strategic partnerships continues to bolster this vital revenue stream.

Barloworld generates income through equipment rental and leasing, offering both short-term and long-term agreements. This strategy provides customers with financial flexibility and avoids large upfront capital expenditures.

The company's revenue from these services is recurring, with pricing structures that adapt to the specific equipment, rental period, and expected usage levels. For instance, in the first half of fiscal year 2024, Barloworld's Equipment South Africa division reported a substantial contribution from rental and leasing activities, reflecting the ongoing demand for these flexible solutions.

Barloworld generates revenue by offering maintenance, repair services, and selling genuine spare parts for the equipment they sell and rent. This is a vital recurring revenue source that supports their core equipment business.

This aftermarket segment proved to be a resilient revenue stream, even when machine sales experienced a downturn. For instance, in the first half of fiscal year 2024, Barloworld's equipment division saw revenue increase by 11%, with aftermarket services playing a significant role in this growth.

The strength of this revenue stream underscores the importance of robust product support and nurturing strong relationships with customers. It demonstrates that ongoing service and parts availability are key to customer loyalty and sustained profitability.

Fleet Management and Logistics Service Fees

Barloworld generates revenue through fees for its comprehensive fleet management and logistics services. These services are designed to streamline operations and reduce costs for corporate clients.

The company offers integrated solutions that cover the entire lifecycle of a fleet, from acquisition and maintenance to disposal. Additionally, Barloworld provides specialized supply chain optimization and third-party logistics (3PL) services.

- Integrated Fleet Management: Fees are charged for managing and maintaining client fleets, ensuring optimal performance and uptime.

- Supply Chain Optimization: Revenue is generated by improving the efficiency and cost-effectiveness of clients' supply chains.

- Third-Party Logistics (3PL): Barloworld earns income by managing and executing logistics operations on behalf of its clients.

- Contract-Based Revenue: These services are typically secured through long-term contracts, providing a predictable revenue stream focused on delivering tangible value and cost savings to clients.

Car Rental and Mobility Service Income

Barloworld's historical car rental operations, primarily through its now demerged entity Zeda, generated revenue from providing vehicles for both short-term and long-term use. This income was derived from individual consumers and corporate clients, reflecting the demand for flexible transportation solutions.

The performance of this revenue stream was closely tied to factors such as rental volume and the efficient utilization of its vehicle fleet. Prior to the unbundling, these rentals were a significant contributor to the Automotive & Logistics division's overall financial performance.

- Historical Revenue Source: Income from short-term and long-term vehicle rentals to individuals and corporate customers.

- Previous Divisional Contribution: Contributed to Barloworld's Automotive & Logistics division's revenue.

- Key Performance Drivers: Rental volume and fleet utilization rates.

Barloworld's revenue is diversified across several key streams, including equipment sales, rental and leasing, aftermarket services, and fleet management. The company's strategic focus on these areas ensures multiple avenues for income generation, catering to a broad client base in essential industries.

Equipment sales form a foundational revenue pillar, driven by demand in mining and construction sectors. Complementing this, rental and leasing provide a recurring income stream, offering clients flexibility. Aftermarket services, encompassing repairs and parts, are crucial for sustained profitability and customer loyalty.

In the first half of fiscal year 2024, Barloworld's Equipment South Africa division saw revenue increase by 11%, with aftermarket services contributing significantly to this growth. This highlights the resilience and importance of these service-based revenue streams.

| Revenue Stream | Description | Key Drivers | FY23/H1 FY24 Relevance |

| Equipment Sales | Direct sale of new and used equipment. | Market demand, fleet replacement cycles. | Significant contributor to overall performance. |

| Rental & Leasing | Short-term and long-term equipment rental agreements. | Customer demand for flexibility, capital avoidance. | Substantial contribution, especially in South Africa. |

| Aftermarket Services | Maintenance, repair, and spare parts. | Product support, customer relationships. | Resilient, significant growth driver in H1 FY24. |

| Fleet Management & Logistics | Integrated fleet management, supply chain optimization, 3PL. | Operational efficiency, cost reduction for clients. | Contract-based, predictable revenue. |

Business Model Canvas Data Sources

The Barloworld Business Model Canvas is constructed using a blend of internal financial reports, operational data, and market intelligence. This comprehensive approach ensures all aspects, from customer segments to cost structures, are grounded in verifiable information.