Barloworld PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barloworld Bundle

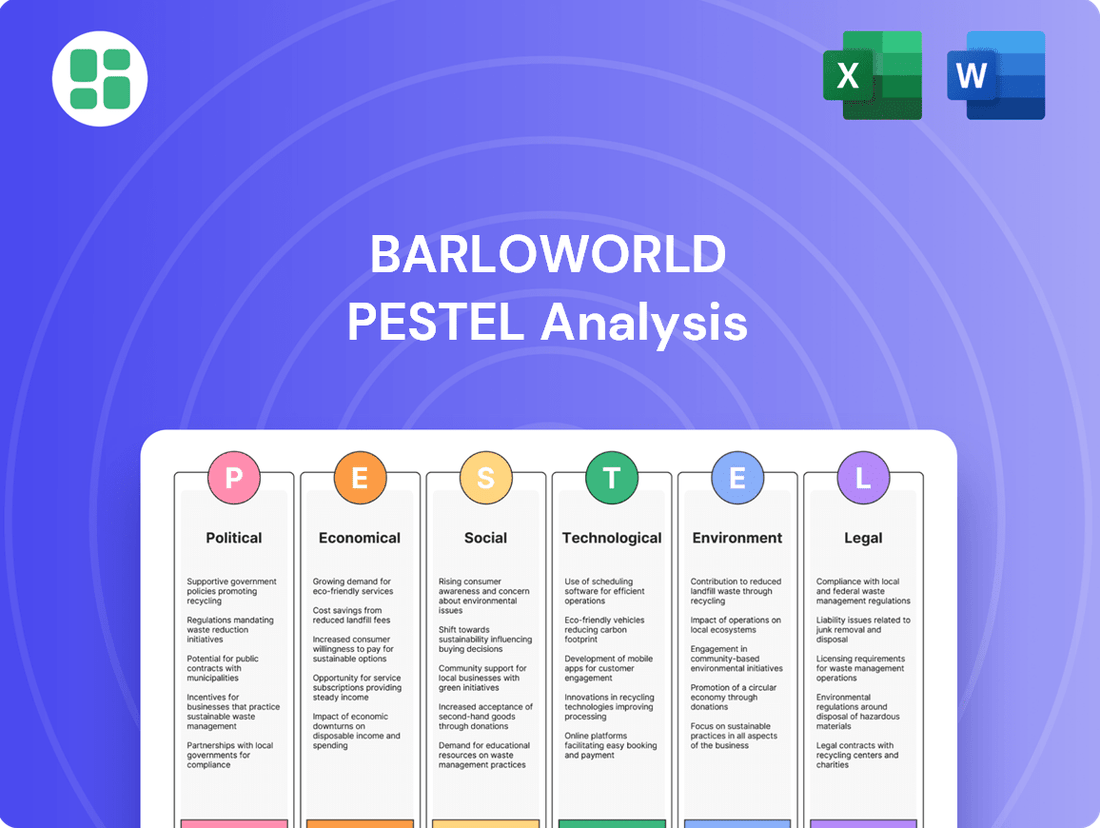

Barloworld operates within a dynamic global landscape. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors that are shaping its future. Understand the critical external forces influencing Barloworld's strategy and performance. Download the full PESTLE analysis to gain actionable intelligence and anticipate market shifts.

Political factors

Barloworld's significant presence in Southern Africa means its operations, especially in mining and construction, are directly influenced by government stability. Political shifts can introduce policy uncertainty, affecting investment decisions and long-term strategic planning. For instance, South Africa's recent history has seen periods of policy review impacting the mining sector, a key market for Barloworld.

Barloworld's international trade relations and the imposition of sanctions have a direct bearing on its global operations, influencing both its supply chain and its ability to access key markets. The company's experience in Russia, through its Vostochnaya Technica (VT) business, clearly illustrates this. Evolving sanction regimes have led to a noticeable reduction in VT's activities and a subsequent decline in its revenue, highlighting the tangible impact of geopolitical shifts.

Furthermore, broader geopolitical tensions can create significant economic headwinds for a globally diversified company like Barloworld. For instance, the prospect of potential levies by the US against China, a major global trading partner, could introduce inflationary pressures and disrupt established trade flows. Such disruptions can ripple through Barloworld's various business segments, affecting everything from raw material costs to the demand for its equipment and services.

Barloworld navigates a complex web of regulations across its global operations, impacting everything from equipment sales to logistics. Compliance with local laws, including stringent export controls, is non-negotiable for maintaining operational licenses and avoiding costly penalties. For instance, the ongoing investigation into potential export control violations by its Russian subsidiary underscores the critical need for robust compliance frameworks.

Infrastructure Development Policies

Government policies and investment in infrastructure development, particularly within the mining and construction sectors, directly shape the demand for Barloworld's equipment and services. For instance, South Africa's National Development Plan 2030 emphasizes infrastructure upgrades, which is a key driver for earthmoving and construction machinery sales.

Initiatives aimed at reforming South Africa's electricity and logistics sectors are anticipated to positively impact consumer and business sentiment, potentially translating into heightened activity for Barloworld Equipment Southern Africa. The country's energy transition plans, for example, will necessitate significant infrastructure investment, benefiting companies like Barloworld.

- Government investment in infrastructure projects directly supports Barloworld's revenue streams.

- Reforms in South Africa's energy and logistics sectors are expected to boost demand for equipment.

- Large-scale infrastructure projects, such as those outlined in the National Development Plan, ensure consistent demand for earthmoving and materials handling equipment.

Local Content and Empowerment Legislation

Legislation mandating local content and economic empowerment significantly shapes Barloworld's operational framework. For instance, South Africa's Broad-Based Black Economic Empowerment (B3) Act requires companies to demonstrate progress in ownership, management control, and skills development. Barloworld's 2023 Integrated Report highlighted its ongoing commitment to B3 compliance, with specific targets for black representation in management and procurement from black-owned enterprises. This focus influences their supplier selection and partnership strategies, ensuring alignment with national development objectives.

The evolving regulatory environment in key markets, such as South Africa and other African nations, often promotes indigenization and local ownership. These policies can necessitate adjustments to Barloworld's ownership structures and business models to comply with local participation requirements. For example, a proposed takeover bid involving a majority black-owned consortium underscores the strategic importance of aligning with these national empowerment goals. Compliance directly impacts Barloworld's ability to secure contracts, form strategic alliances, and maintain its market presence.

- South Africa's B3 Act: Barloworld's 2023 report detailed progress in achieving B3 targets, impacting procurement and employment practices.

- Procurement Policies: Legislation often mandates increased procurement from local and black-owned businesses, influencing Barloworld's supply chain decisions.

- Ownership Structures: Empowerment legislation can drive changes in company ownership to meet local participation thresholds.

- Market Access: Compliance with local content and empowerment laws is crucial for securing and maintaining market access in various African territories.

Government stability and policy continuity are paramount for Barloworld's significant operations in Southern Africa, particularly within the mining and construction sectors. Political shifts can introduce policy uncertainty, impacting investment and strategic planning, as seen with past policy reviews in South Africa's mining industry.

Global geopolitical tensions and trade relations directly affect Barloworld's international business, as demonstrated by sanctions impacting its Russian subsidiary, Vostochnaya Technica, leading to reduced revenue. Potential trade disputes, like US-China levies, could also introduce inflationary pressures and disrupt supply chains.

Barloworld must navigate a complex regulatory landscape globally, with compliance to local laws, including export controls, being critical for operational licenses. Investigations into potential export control violations by its Russian subsidiary highlight the importance of robust compliance frameworks.

Government investment in infrastructure, such as South Africa's National Development Plan 2030, directly drives demand for Barloworld's earthmoving and construction equipment. Reforms in South Africa's energy and logistics sectors are also expected to boost business sentiment and demand for equipment.

What is included in the product

The Barloworld PESTLE Analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This detailed evaluation offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within Barloworld's operating landscape.

Provides a concise version of Barloworld's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Barloworld's financial health is significantly influenced by global and regional economic expansion, particularly in its core operating areas such as Southern Africa, Eurasia, and Mongolia. A faltering global economic recovery or localized economic contractions, similar to what was observed in Equipment Southern Africa, can dampen trading performance and decrease demand for heavy machinery and equipment.

For instance, in the first half of fiscal year 2024, Barloworld noted that while Equipment Southern Africa faced subdued trading due to economic pressures, Equipment Eurasia and Russia demonstrated resilience, contributing positively to overall group performance. This highlights the uneven nature of economic recovery across different geographies.

Conversely, strong economic upturns in specific markets, such as the robust growth experienced in Mongolia, have demonstrably boosted Barloworld's revenue streams. This underscores the company's sensitivity to regional economic vitality and its ability to capitalize on growth opportunities.

Fluctuations in commodity prices, especially for minerals like iron ore and copper, directly influence the mining industry, a key market for Barloworld Equipment. For instance, the average iron ore price hovered around $100-$130 per tonne in early 2024, a significant factor for mining operations.

When commodity prices dip, mining companies often scale back operations, leading to reduced demand for heavy machinery and after-sales services. This cyclicality means Barloworld Equipment's sales volumes can be heavily impacted by these market downturns, as seen in periods of lower capital expenditure by mining firms.

Barloworld's significant exposure to the mining sector makes its financial performance susceptible to these commodity price volatilities and the resulting investment cycles within the industry.

High interest rates and persistent inflationary pressures significantly impact Barloworld by increasing its financing costs and dampening customer purchasing power, which directly affects equipment sales and rental demand. For instance, in early 2024, many central banks maintained elevated interest rates to combat inflation, with the US Federal Reserve holding its benchmark rate between 5.25%-5.50% for an extended period.

While Barloworld has demonstrated resilience by reducing its debt and associated finance costs, a future environment characterized by lower interest rates and easing global inflation is crucial. Such conditions are expected to bolster both consumer and business confidence, thereby creating more favorable trading conditions and stimulating demand for Barloworld's offerings.

Currency Fluctuations

Currency fluctuations significantly influence Barloworld's financial performance, particularly its international earnings. The strength of the South African Rand (ZAR) against major currencies like the US Dollar (USD) directly affects how revenue from its diverse global operations is reported. For instance, a strengthening Rand can diminish the reported Rand value of profits earned in USD, impacting overall profitability.

Conversely, favorable exchange rate movements can bolster earnings. In the first half of fiscal year 2024, Barloworld reported that a weaker Rand against key currencies provided a positive currency translation impact on its earnings, highlighting the dual nature of currency exposure. This underscores the critical need for robust currency risk management strategies to mitigate potential downsides and capitalize on favorable shifts.

Barloworld's exposure to currency volatility is evident in its reporting. For example, during the six months ended March 31, 2024, the Group's reported profit before tax was positively impacted by currency movements. Specific figures indicate that the average USD/ZAR exchange rate for the period was approximately 18.30, compared to 18.05 in the prior comparable period, demonstrating a slight weakening of the Rand which benefited translation of foreign earnings.

- Impact of Rand Strength: A stronger Rand reduces the Rand value of foreign earnings, potentially lowering reported revenue and profits from international segments.

- Impact of Rand Weakness: A weaker Rand increases the Rand value of foreign earnings, boosting reported revenue and profits from international operations.

- FY24 H1 Currency Impact: Barloworld experienced a positive currency translation impact on its earnings in the first half of fiscal year 2024 due to exchange rate movements.

- Strategic Importance: Effective currency risk management is a key strategic imperative for Barloworld to navigate global economic volatility and protect its financial results.

Availability of Credit and Capital Expenditure

The availability and cost of credit significantly shape Barloworld's operational landscape. When credit is readily accessible and affordable, both Barloworld and its clientele are more inclined to invest in new machinery, fleet upgrades, and expansion projects. This directly fuels demand for Barloworld's equipment and services.

Conversely, tighter credit markets or higher interest rates can lead customers to postpone significant capital expenditures. Instead of purchasing new equipment, they might opt for rental agreements or extend the lifespan of their existing machinery, which can dampen Barloworld's sales volumes. This dynamic underscores the importance of monitoring credit conditions for strategic planning.

Barloworld's own financial strategy, including its commitment to disciplined capital allocation and debt reduction, is a direct response to these market realities. For instance, in its fiscal year 2023, Barloworld reported a strong financial performance, with revenue increasing by 15% to R226.7 billion, demonstrating its ability to navigate various economic conditions. The company's focus on managing its debt levels ensures financial resilience, allowing it to weather periods of credit constraint more effectively.

Key considerations regarding credit and capital expenditure include:

- Impact on Customer Demand: Higher borrowing costs can reduce customer appetite for large equipment purchases, shifting preference towards rentals or leasing.

- Barloworld's Investment Capacity: The company's own access to capital influences its ability to invest in its own infrastructure, technology, and inventory.

- Financing Solutions: Offering flexible financing options to customers can mitigate the impact of tight credit markets and support sales.

- Economic Outlook: Broader economic forecasts, which often predict interest rate movements and credit availability, are crucial for anticipating shifts in capital expenditure trends.

Barloworld's performance is intrinsically linked to global and regional economic health, with expansions in Southern Africa, Eurasia, and Mongolia being key drivers. Economic slowdowns, as seen in Equipment Southern Africa during H1 FY24, can curb demand for heavy equipment, while growth in markets like Mongolia boosts revenue, demonstrating the company's sensitivity to localized economic vitality.

Commodity prices, particularly for iron ore and copper, directly impact Barloworld's mining sector clients. With iron ore prices fluctuating around $100-$130 per tonne in early 2024, downturns in these prices can lead mining firms to reduce capital expenditure, thus decreasing demand for machinery and services.

High interest rates and inflation, exemplified by the US Federal Reserve maintaining rates between 5.25%-5.50% in early 2024, increase Barloworld's financing costs and reduce customer purchasing power, affecting sales and rentals. Conversely, lower rates and easing inflation would likely improve business confidence and demand.

Currency fluctuations, such as the USD/ZAR rate averaging around 18.30 in H1 FY24, significantly impact reported earnings. A weaker Rand generally benefits Barloworld by increasing the Rand value of foreign profits, as observed in H1 FY24, highlighting the importance of currency risk management.

Credit availability and cost are crucial; easier credit fuels equipment purchases, while tighter markets encourage rentals or extended use of existing machinery. Barloworld's own financial strategy, including debt reduction, aims to build resilience against credit constraints, as evidenced by its 15% revenue increase to R226.7 billion in FY23.

| Economic Factor | Impact on Barloworld | Data/Example (Early 2024) |

|---|---|---|

| Global/Regional Economic Growth | Drives demand for equipment and services. | Subdued trading in Southern Africa vs. resilience in Eurasia/Russia. |

| Commodity Prices (e.g., Iron Ore) | Affects mining sector capex and machinery demand. | Iron ore prices around $100-$130/tonne. |

| Interest Rates & Inflation | Influences financing costs and customer purchasing power. | US Fed rate 5.25%-5.50%; persistent inflation. |

| Currency Exchange Rates (e.g., USD/ZAR) | Impacts reported value of international earnings. | USD/ZAR averaged ~18.30 in H1 FY24, benefiting foreign earnings translation. |

| Credit Availability & Cost | Shapes customer investment decisions and Barloworld's sales. | FY23 Revenue: R226.7 billion (+15%). |

Preview the Actual Deliverable

Barloworld PESTLE Analysis

The Barloworld PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of Barloworld's operating environment.

Sociological factors

Barloworld's operations heavily rely on a skilled workforce, with the availability of specialized talent for equipment maintenance and operation being a key concern. In 2024, the global shortage of skilled technicians, particularly in sectors like mining and construction, continues to impact operational efficiency. Attracting and retaining these individuals, especially for challenging remote locations, remains a significant hurdle for the company.

To counter skill gaps, Barloworld is actively investing in robust training and development programs. For instance, their apprenticeship initiatives aim to cultivate the next generation of technicians, ensuring a pipeline of qualified personnel. This focus on upskilling is vital for maintaining operational continuity and adapting to evolving technological demands within the equipment rental and industrial sectors.

Societal expectations and regulatory demands for workplace health and safety profoundly shape Barloworld's operational strategies. The company's dedication to achieving a zero-harm environment is crucial, particularly considering the inherent dangers associated with heavy equipment and industrial settings.

Barloworld's commitment to safety is not merely a compliance issue but a core value, reinforced by the stark reality of incidents. For instance, the tragic fatalities reported in 2024 highlight the absolute necessity for robust safety protocols and ongoing enhancements to prevent future harm.

Barloworld's commitment to Corporate Social Responsibility (CSR) is increasingly crucial as societal expectations for sustainable development and community well-being grow. The company's active engagement with local communities, support for social initiatives, and contributions to economic development in its operating regions are vital for maintaining its social license to operate. This focus directly supports Barloworld's vision of creating enduring economic and social value.

Customer Behavior and Preferences

Customer behavior is shifting, with a growing preference for rental solutions and aftermarket services over outright equipment purchases. This trend directly impacts Barloworld, necessitating an adaptation of its business model to capitalize on these evolving demands. For instance, the company has been actively strengthening its parts and rental businesses, particularly in Southern Africa, to align with these changing customer needs and maintain market relevance.

Barloworld's focus on these evolving customer preferences is evident in its strategic investments. In the fiscal year 2023, Barloworld Equipment Southern Africa saw its rental fleet utilization increase, reflecting a stronger demand for flexible equipment access. Furthermore, the aftermarket services division reported robust growth, driven by customers seeking to extend the life and optimize the performance of their existing machinery, underscoring the importance of these segments in the company's overall strategy.

- Shift to Rental: Growing demand for rental equipment offers Barloworld opportunities to expand its fleet services and generate recurring revenue.

- Aftermarket Importance: Increased focus on parts and service revenue streams provides a stable income base and strengthens customer loyalty.

- Sustainability Focus: Customers are increasingly inquiring about and opting for more fuel-efficient and environmentally friendly equipment options.

- Digital Engagement: Customers expect digital platforms for service requests, parts ordering, and equipment monitoring, pushing Barloworld to enhance its digital offerings.

Labor Relations and Unionization

Barloworld's operations are significantly influenced by labor relations and unionization, particularly in countries with strong trade union presence. These relationships directly affect operational costs and stability. For instance, successful wage negotiations in Namibia and Zambia in 2024 underscore the critical need for proactive and effective labor engagement to ensure smooth operations.

Restructuring initiatives, like the one undertaken at Ingrain, highlight the sensitivity of employee relations. Managing these processes with care is paramount to mitigating potential disruptions and maintaining productivity. The company's commitment to fair labor practices is a key factor in navigating these complexities and fostering a stable working environment.

- Impact of Unions: Strong unions in key operating regions can influence wage demands and working conditions, potentially increasing labor costs for Barloworld.

- Negotiation Successes: Positive outcomes from recent wage negotiations in Namibia and Zambia demonstrate Barloworld's capacity for constructive dialogue with labor unions.

- Restructuring Challenges: Managing employee relations during significant organizational changes, such as at Ingrain, requires careful planning to avoid operational disruptions.

Societal trends emphasize a growing demand for sustainable and ethically sourced products, influencing Barloworld's operational and sourcing decisions. This includes a greater emphasis on environmental responsibility and fair labor practices throughout its supply chain.

Barloworld's commitment to corporate social responsibility (CSR) is increasingly vital as public scrutiny on corporate impact intensifies. The company's investments in community development and environmental stewardship are crucial for maintaining its social license to operate and enhancing brand reputation. For example, Barloworld's focus on skills development in South Africa aims to address local unemployment challenges.

The increasing awareness and concern regarding climate change are driving consumer and regulatory pressure for greener business practices. Barloworld is responding by exploring more fuel-efficient equipment options and investing in technologies that reduce environmental impact, aligning with global sustainability goals.

Barloworld's engagement with stakeholders, including employees, customers, and communities, shapes its strategic direction. Positive labor relations, as seen in the successful 2024 wage negotiations in Namibia and Zambia, are critical for operational stability and employee morale. The company's proactive approach to these relationships is essential for long-term success.

Technological factors

Technological advancements are reshaping Barloworld's core sectors. In earthmoving, for instance, the trend towards autonomous haulage systems and advanced telematics is significantly boosting operational efficiency. Companies are seeing up to a 20% increase in productivity and a 15% reduction in operating costs with these technologies, according to industry reports from 2024.

Barloworld's power systems division also benefits from innovations in energy management and grid modernization. The increasing adoption of smart grid technologies and more efficient power generation equipment, like advanced gas turbines that achieve over 60% thermal efficiency, allows for better resource allocation and reduced environmental impact.

Furthermore, in materials handling, the deployment of automated warehouse systems and predictive maintenance powered by AI is a key differentiator. These systems can reduce errors by up to 90% and minimize equipment downtime, ensuring a smoother supply chain for Barloworld's clients.

The growing digital transformation in fleet management and logistics presents significant opportunities for Barloworld to boost efficiency. By adopting advanced digital solutions, the company can optimize delivery routes, reduce fuel consumption, and offer customers real-time shipment tracking, enhancing overall service quality and transparency.

Barloworld can leverage data analytics and integrated digital platforms to gain deeper operational insights. This enhanced visibility allows for better cost management, predictive maintenance for its fleet, and ultimately, improved service delivery, directly impacting customer satisfaction and operational profitability.

Barloworld is leveraging the Internet of Things (IoT) and predictive maintenance to revolutionize its customer service. By embedding sensors in equipment, the company can monitor asset health in real-time, anticipating potential failures before they occur. This proactive approach significantly reduces unexpected downtime for customers, a critical factor in industries like mining and construction where equipment availability directly impacts profitability.

This technological adoption directly translates into enhanced customer value. For instance, a mining operation can avoid costly production halts by addressing a component issue identified through predictive analytics, rather than reacting to a catastrophic breakdown. Barloworld’s investment in these capabilities strengthens its position as a service-driven partner, moving beyond simply selling equipment to providing comprehensive asset management solutions that boost operational efficiency and extend the useful life of machinery.

Renewable Energy and Power Systems

Technological advancements are significantly reshaping the energy landscape, directly influencing Barloworld's Power Systems division. The global shift towards renewable energy sources necessitates an evolution in product portfolios, pushing for the integration of sustainable solutions such as solar micro-grids and advanced hybrid power systems. This transition is driven by increasing environmental consciousness and regulatory pressures worldwide.

Industries are actively pursuing strategies to lower their carbon emissions, which in turn is fueling a growing demand for energy-efficient and low-emission equipment. This trend presents substantial new market opportunities for Barloworld to innovate and supply these critical technologies.

- Global Renewable Energy Capacity: As of early 2024, the International Energy Agency (IEA) reported that renewable energy sources accounted for over 80% of new global power capacity additions.

- Growth in Solar Power: Solar photovoltaic (PV) installations, a key area for micro-grids, saw a record expansion in 2023, with an estimated 400 GW added globally.

- Hybrid System Demand: The market for hybrid power systems, combining renewable sources with traditional or battery storage, is projected to grow significantly, with forecasts suggesting a compound annual growth rate (CAGR) of over 15% through 2028.

- Barloworld's Focus: Barloworld's strategy includes expanding its offerings in areas like Caterpillar's renewable energy solutions and battery storage, aligning with these market shifts.

Cybersecurity and Data Protection

As Barloworld's operations become more digitized, particularly in areas like fleet management and customer data handling, cybersecurity is a critical technological factor. Protecting sensitive information and maintaining the integrity of its digital systems are essential to prevent breaches and uphold customer trust.

The increasing sophistication of cyber threats means that robust data protection measures are not just a best practice but a necessity for business continuity and regulatory compliance. Barloworld's board actively addresses cybersecurity as a key strategic concern.

- Increased Investment: Global cybersecurity spending was projected to reach $1.75 trillion cumulatively from 2021 to 2025, highlighting the growing importance of this sector.

- Regulatory Landscape: Data protection regulations like GDPR and CCPA impose strict requirements, making compliance a significant operational consideration.

- Operational Resilience: A breach could disrupt Barloworld's extensive supply chain and customer service operations, underscoring the need for resilient digital infrastructure.

Barloworld is actively integrating advanced digital solutions to enhance operational efficiency and customer service across its sectors. The company's focus on IoT and predictive maintenance, exemplified by real-time asset health monitoring, aims to minimize equipment downtime, a critical factor for clients in mining and construction. This proactive approach, supported by data analytics, allows for better cost management and improved service delivery.

The company is also adapting to technological shifts in the energy sector, expanding its offerings in renewable energy solutions and battery storage to meet growing global demand for sustainable power. This strategic alignment with market trends, such as the significant expansion of solar PV capacity, positions Barloworld to capitalize on the transition to cleaner energy sources.

Cybersecurity remains a paramount technological consideration as Barloworld's operations become increasingly digitized. Protecting sensitive data and ensuring the integrity of digital systems are crucial for maintaining customer trust and operational continuity, especially given the escalating sophistication of cyber threats and stringent data protection regulations.

| Technology Area | Barloworld Impact | Industry Data/Trend (2024-2025) |

|---|---|---|

| Autonomous Systems & Telematics | Increased efficiency in earthmoving operations | Up to 20% productivity increase reported with autonomous haulage systems. |

| Energy Management & Renewables | Enhanced power systems, integration of sustainable solutions | Global renewable energy capacity additions exceeded 80% of new power capacity in early 2024. |

| Automation & Predictive Maintenance | Reduced errors and downtime in materials handling | AI-powered predictive maintenance can reduce equipment downtime by up to 15%. |

| Digitalization & Fleet Management | Optimized logistics, real-time tracking, reduced fuel consumption | Digital transformation in logistics is projected to grow by 10-12% annually. |

| Cybersecurity | Protection of sensitive data, ensuring business continuity | Global cybersecurity spending is expected to reach over $200 billion in 2024. |

Legal factors

Barloworld's global operations necessitate strict adherence to a complex web of international trade and export laws. This is particularly critical given its presence in diverse and sometimes politically volatile markets, requiring constant vigilance to avoid penalties and reputational damage.

The scrutiny faced by Barloworld, including investigations into its former Russian subsidiary for potential export control violations, underscores the substantial legal and financial ramifications of non-compliance. Such issues can lead to significant fines and operational disruptions, impacting overall profitability and market standing.

For Barloworld, robust compliance frameworks and diligent monitoring are paramount. In 2023, global trade compliance penalties reached billions of dollars, a figure expected to rise as regulatory enforcement intensifies, making proactive risk management a strategic imperative.

Competition and antitrust laws are crucial for Barloworld, as they dictate fair play in its operating markets, preventing monopolies and ensuring equitable trading. These regulations are particularly relevant when Barloworld considers expanding into new territories, forging strategic alliances, or pursuing acquisitions, as any action deemed anti-competitive can lead to severe penalties.

For instance, in 2023, the European Union continued its robust enforcement of competition laws, with fines levied against companies for cartel activities and abuse of dominant market positions reaching billions of euros. Barloworld's adherence to these stringent rules is paramount for maintaining market access and avoiding costly legal battles that could disrupt its global operations.

Barloworld must navigate a complex web of labor and employment laws across its global operations, impacting everything from minimum wages and working conditions to employee rights and collective bargaining agreements. For instance, in South Africa, the Basic Conditions of Employment Act sets standards for working hours and leave, while the Labour Relations Act governs union recognition and dispute resolution, crucial for Barloworld's significant presence there.

Compliance with these diverse legal frameworks is paramount to avoid costly disputes and ensure a stable workforce. Wage negotiations, a regular occurrence for a company of Barloworld's size, must strictly adhere to local legislative requirements to prevent strikes and maintain operational continuity. Similarly, any employee restructuring or retrenchment processes are subject to specific legal procedures, often requiring consultation with unions and adherence to notice periods, as mandated by laws like the Labour Relations Act in South Africa or similar legislation in other key markets.

Environmental Regulations and Standards

Barloworld's extensive operations, especially in equipment and industrial services, face rigorous environmental laws concerning emissions, waste disposal, and resource use. Adhering to these rules is a legal necessity and vital for maintaining its public image and operational permits. For instance, in 2023, Barloworld reported a 5% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2022 baseline, demonstrating a proactive approach to regulatory pressures.

The company's strategic focus on enhancing its environmental footprint is directly influenced by these evolving regulations. Barloworld's sustainability reports highlight investments in cleaner technologies and waste reduction programs, aiming to meet or exceed standards set by bodies like the European Environment Agency and national environmental protection agencies where it operates.

Key environmental compliance areas for Barloworld include:

- Emissions Control: Meeting air quality standards for industrial processes and vehicle fleets.

- Waste Management: Implementing responsible disposal and recycling practices for industrial byproducts and equipment.

- Resource Efficiency: Optimizing water and energy usage across its facilities and supply chain.

- Chemical Handling: Ensuring safe storage and use of chemicals in its service and manufacturing operations.

Corporate Governance and Reporting Standards

Barloworld, as a company listed on the Johannesburg Stock Exchange (JSE), is bound by stringent South African corporate governance codes, notably King IV. This mandates adherence to principles of ethical conduct, transparent financial reporting, and strong board oversight. For instance, King IV emphasizes the accountability of the board of directors and the importance of stakeholder engagement, which are crucial for maintaining investor confidence.

Compliance with international reporting standards, such as those set by the International Financial Reporting Standards (IFRS) foundation, is also a legal requirement. This ensures that financial statements are comparable and understandable across different jurisdictions. In 2023, Barloworld reported revenue of R253.8 billion, demonstrating the scale of its operations and the importance of accurate financial disclosures.

The potential delisting of Barloworld from the JSE would significantly alter its regulatory landscape. As a private entity, it would no longer be subject to the continuous disclosure requirements and governance scrutiny applicable to publicly traded companies. This shift could impact reporting frequencies and the specific information made available to the public, though certain reporting obligations might persist depending on the nature of the delisting and any new ownership structure.

- King IV Code: Mandates principles of responsible corporate citizenship, ethical leadership, and accountability for JSE-listed entities.

- IFRS Compliance: Ensures financial statements are prepared according to globally recognized accounting standards for comparability.

- 2023 Revenue: Barloworld reported R253.8 billion in revenue, highlighting the scale of its operations and reporting needs.

- Delisting Impact: Would change regulatory reporting obligations from public company standards to potentially private entity requirements.

Barloworld's global footprint exposes it to a myriad of legal and regulatory frameworks, from international trade laws to local labor statutes. Non-compliance can result in substantial fines, as seen in the billions levied globally for trade violations, and can disrupt operations. For instance, in 2023, the EU continued robust enforcement of competition laws, issuing billions in fines. Barloworld's adherence to these diverse legal requirements is critical for maintaining market access and operational continuity.

The company must also navigate stringent environmental regulations, which are increasingly influencing business practices. Barloworld's reported 5% reduction in Scope 1 and 2 emissions in 2023 highlights its efforts to align with these evolving standards. Key compliance areas include emissions control, responsible waste management, and resource efficiency, all vital for operational permits and public perception.

As a JSE-listed entity, Barloworld is bound by South African corporate governance codes like King IV, emphasizing ethical conduct and transparent reporting. In 2023, Barloworld reported R253.8 billion in revenue, underscoring the importance of accurate financial disclosures under IFRS standards. Any potential delisting would significantly alter these reporting obligations.

| Legal Area | Key Considerations for Barloworld | 2023/2024 Impact/Data |

|---|---|---|

| International Trade & Export Laws | Navigating diverse global regulations, potential for export control violations. | Global trade compliance penalties in billions; ongoing scrutiny of subsidiaries. |

| Competition & Antitrust Laws | Ensuring fair play, avoiding anti-competitive practices in market expansion and alliances. | EU fines for cartel activities and market abuse in billions of euros. |

| Labor & Employment Laws | Adherence to wage, working condition, and employee rights across different jurisdictions. | South African laws like the Basic Conditions of Employment Act and Labour Relations Act are critical. |

| Environmental Laws | Compliance with emissions, waste disposal, and resource efficiency standards. | Barloworld reported a 5% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2022 baseline). |

| Corporate Governance & Financial Reporting | Adherence to King IV and IFRS standards for public companies. | Barloworld's 2023 revenue was R253.8 billion; delisting would change reporting requirements. |

Environmental factors

Barloworld is actively responding to the growing global imperative to mitigate climate change and shrink its carbon footprint. This commitment extends across its diverse operations, encompassing everything from the energy efficiency of its machinery to the emissions generated by its extensive logistics network. For instance, in its 2023 financial year, Barloworld reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity by 7.5% compared to its 2020 baseline, demonstrating tangible progress in its sustainability targets.

The company's strategy hinges on enhancing energy efficiency and actively lowering greenhouse gas emissions. This involves a multi-pronged approach, including the integration of more fuel-efficient equipment in its rental fleet and exploring alternative energy sources for its operational sites. Barloworld's Equipment division, a significant part of its business, is investing in technologies that reduce fuel consumption and emissions for its customers, aligning with the broader industry shift towards greener solutions.

Barloworld's environmental strategy hinges on efficient resource use, particularly water and raw materials, alongside robust waste management. In 2023, the company reported a 10% reduction in water consumption across its operations, demonstrating a commitment to minimizing its footprint.

The company is actively pursuing circular economy principles, aiming to divert 85% of its operational waste from landfills by 2025. This focus not only reduces environmental impact but also enhances resource productivity, aligning with Barloworld's broader sustainability objectives.

Barloworld faces increasing scrutiny over environmental impact, with evolving regulations on emissions and waste management directly shaping its equipment and operational strategies. For instance, stricter emissions standards for heavy machinery necessitate investments in cleaner technologies and potentially affect the lifespan and resale value of existing fleets.

Compliance with these environmental mandates is not just about avoiding fines, which can be substantial, but also about safeguarding Barloworld's brand image and its social license to operate. The company's commitment to concluding its comprehensive environmental strategy in 2025 underscores its proactive approach to aligning business practices with global sustainability goals and anticipating future regulatory shifts.

Impact of Extreme Weather Events

Barloworld's extensive operations, particularly in regions susceptible to extreme weather, face significant disruption risks from climate change. For instance, severe droughts or floods can halt mining and construction activities, directly impacting the demand for Barloworld's equipment and services. This was evident in early 2024 when widespread flooding in parts of Southern Africa, a key market for Barloworld, led to temporary shutdowns in several mining operations.

These climate-related events also strain Barloworld's supply chains and logistics networks. Damaged infrastructure, such as roads and ports, can delay the delivery of essential parts and new equipment, increasing operational costs and potentially affecting customer service levels. The company's reliance on efficient transportation makes it vulnerable to these disruptions.

- Supply Chain Vulnerability: Extreme weather can disrupt the flow of goods and spare parts, impacting service delivery and project timelines.

- Demand Volatility: Sectors like mining and construction, crucial for Barloworld, are highly sensitive to weather conditions, leading to unpredictable demand fluctuations.

- Operational Resilience: Building robust contingency plans and investing in infrastructure that can withstand extreme weather is paramount for maintaining operational continuity.

- Climate Risk Assessment: A proactive approach to identifying and quantifying climate-related risks across its operating regions is essential for Barloworld's long-term strategy.

Sustainable Product and Service Offerings

Barloworld is responding to a significant increase in customer demand for environmentally friendly products and services. This shift is driving the company to focus on offering more sustainable equipment and solutions across its various divisions.

Key initiatives include promoting energy-efficient machinery, particularly in earthmoving and industrial sectors, and actively supporting the integration of renewable energy sources within its power systems business. Furthermore, Barloworld is highlighting its after-market services, which are crucial for extending the operational lifespan of equipment, thereby reducing waste and the need for new manufacturing.

This strategic alignment with sustainability trends presents substantial commercial opportunities. For instance, in 2023, Barloworld reported that approximately 60% of its revenue was generated from equipment and services that support customers’ sustainability objectives, demonstrating a tangible financial benefit from these environmental considerations.

- Growing Demand: Customers increasingly seek products and services that minimize environmental impact.

- Energy Efficiency: Barloworld is promoting machinery designed for lower energy consumption.

- Renewable Energy Support: The company is involved in facilitating the use of renewable energy solutions.

- Extended Equipment Life: Emphasis on after-market services contributes to a circular economy approach.

Barloworld is navigating a complex environmental landscape, driven by global climate change mitigation efforts and evolving regulatory frameworks. The company has set ambitious targets, aiming for an 85% diversion of operational waste from landfills by 2025, reflecting a commitment to circular economy principles. In its 2023 financial year, Barloworld achieved a notable 7.5% reduction in its Scope 1 and 2 greenhouse gas emissions intensity compared to a 2020 baseline.

The company's strategy actively addresses climate risks, recognizing that extreme weather events can disrupt its core operations in mining and construction. For example, supply chain vulnerabilities are heightened by the potential for damaged infrastructure due to severe weather, impacting timely delivery of equipment and parts. This necessitates robust contingency planning and investments in resilient infrastructure.

Customer demand for environmentally friendly products and services is a key driver for Barloworld's business. In 2023, approximately 60% of its revenue was linked to offerings that support customer sustainability objectives, underscoring the commercial viability of its green initiatives. This includes promoting energy-efficient machinery and supporting renewable energy integration.

| Environmental Factor | Barloworld's Response/Data (2023/2025 Targets) | Impact/Opportunity |

|---|---|---|

| Climate Change & Emissions | 7.5% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2020 baseline) | Mitigation of regulatory risk, enhanced brand reputation |

| Waste Management | Target: 85% waste diversion from landfills by 2025 | Resource efficiency, cost savings, circular economy integration |

| Water Consumption | 10% reduction in water consumption (2023) | Operational efficiency, reduced environmental footprint |

| Customer Demand for Green Products | 60% of revenue from sustainability-supporting offerings (2023) | Revenue growth, market leadership in sustainable solutions |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Barloworld is grounded in comprehensive data from international financial institutions, reputable market research firms, and official government publications. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends.