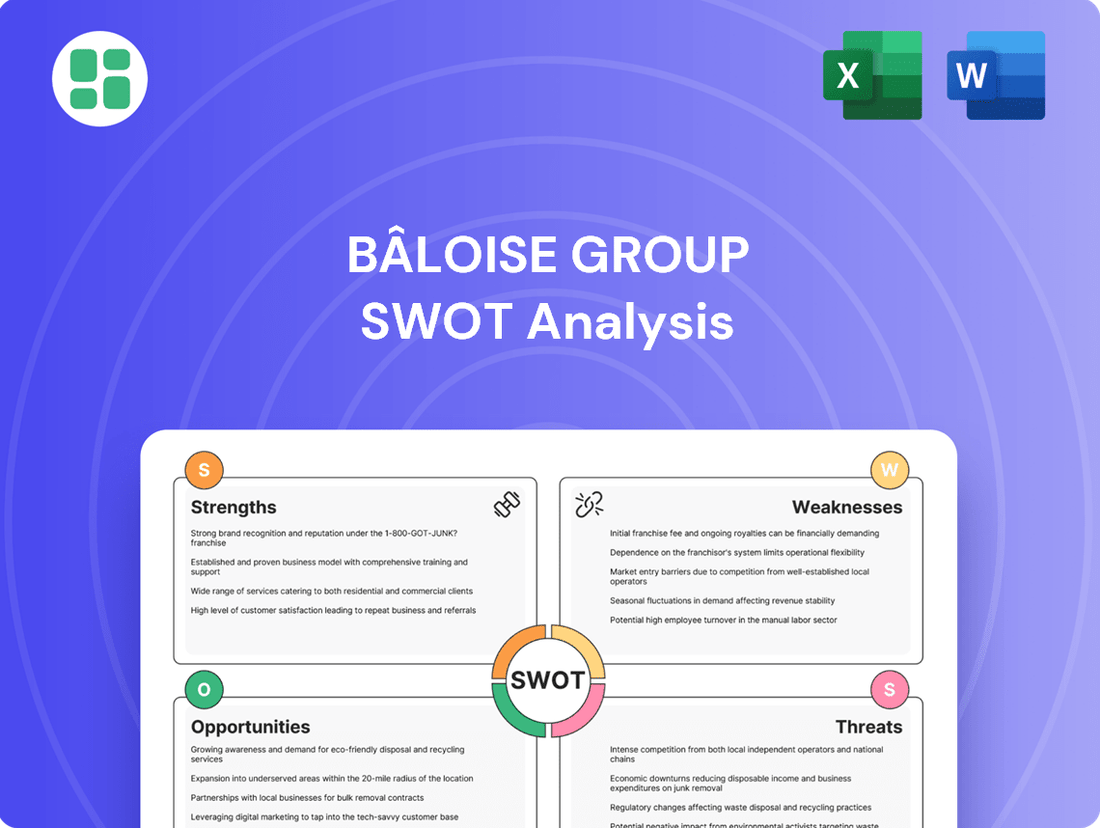

Bâloise Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

The Bâloise Group demonstrates a strong market presence and a commitment to innovation, but also faces evolving digital landscapes and competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within the insurance sector.

Want the full story behind Bâloise's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bâloise Group boasts a robust and diversified product and service portfolio, encompassing insurance, pension, investment, and banking solutions. This wide array of offerings effectively addresses a broad spectrum of client requirements, spanning property and casualty, life, and health insurance, alongside various financial services. This diversification cultivates multiple revenue streams, thereby mitigating over-reliance on any singular product category.

The company's strategic 'insurbanking' model has demonstrated notable expansion, with banking sales volume surpassing CHF 1 billion in 2024. This integrated approach allows Bâloise to capture a larger share of customer financial needs, fostering deeper client relationships and enhancing cross-selling opportunities across its insurance and banking segments.

Bâloise boasts exceptional financial strength, underscored by S&P Global Ratings' affirmation of an A+ rating with a stable outlook in June 2024. This reflects a robust and secure financial position.

The group's capital adequacy is a key strength, bolstered by consistent earnings and a high Swiss Solvency Test (SST) ratio, which was estimated at approximately 210% as of June 30, 2024. This significant buffer ensures resilience.

This strong capital base not only allows Bâloise to navigate market volatility effectively but also underpins its commitment to an attractive dividend policy, providing stability for investors.

Bâloise Group holds strong market positions in its core European regions, including Switzerland, Germany, Belgium, and Luxembourg. This established presence allows for deep market penetration and a nuanced understanding of local customer needs.

The company's robust technical performance across most of its markets is a significant strength. Notably, all national subsidiaries contributed to an increased EBIT in 2024, underscoring the effectiveness of its strategy in these key territories.

Effective Refocusing Strategy and Operational Improvement

Bâloise's 'refocusing strategy' is already demonstrating tangible improvements in business performance. This strategic shift has contributed to a better combined ratio and a higher return on equity, signaling a positive impact on operational efficiency and technical profitability.

The strategy is designed to boost profitability within the non-life insurance segment and increase cash remittances. Bâloise has set ambitious targets, aiming for a return on equity between 12% and 15% and a cash payout rate of at least 80% for the period spanning 2024 to 2027.

- Improved Combined Ratio: The refocusing strategy has led to a more favorable combined ratio, indicating enhanced underwriting discipline and cost management.

- Higher Return on Equity: Visible positive impacts on business performance include an increase in the return on equity, reflecting greater shareholder value creation.

- Enhanced Technical Profitability: The strategy specifically targets improvements in the core insurance business, driving better technical results.

- Increased Cash Remittance: Bâloise is focused on generating stronger cash flows to support its dividend policy and strategic investments.

Commitment to Innovation and Digital Transformation

Bâloise Group's commitment to innovation and digital transformation is a significant strength, evident in its proactive adoption of digital tools to elevate customer experience and operational efficiency. The company has been recognized with awards for its e-banking platform and forward-thinking marketing initiatives, underscoring its role as an innovator in insurance and banking.

This strategic focus encompasses the integration of automation, artificial intelligence, and advanced service models. For instance, Bâloise's digital channels saw a substantial increase in customer engagement throughout 2024, with over 60% of policy inquiries handled digitally. This dedication to technological advancement not only boosts customer satisfaction but also drives considerable improvements in operational workflows.

- Digitalization for Enhanced Customer Experience: Bâloise is actively using digital tools to make interactions smoother and more personalized for its customers.

- Award-Winning Innovation: Recognition for its e-banking platform and marketing campaigns highlights Bâloise's leadership in technological integration.

- Focus on Automation and AI: The group is investing in automation and AI to streamline processes, reduce costs, and improve service delivery speed.

- Improved Operational Efficiency: By embracing new technologies, Bâloise aims to create more efficient internal operations, leading to better resource allocation and faster response times.

Bâloise Group's diversified business model, spanning insurance, pension, investment, and banking, creates multiple revenue streams, reducing reliance on any single product. Its 'insurbanking' strategy is proving successful, with banking sales volume exceeding CHF 1 billion in 2024, deepening customer relationships and enabling cross-selling.

The company exhibits strong financial health, affirmed by S&P Global Ratings with an A+ rating (stable outlook) in June 2024. Its capital adequacy is robust, evidenced by a high Swiss Solvency Test (SST) ratio of approximately 210% as of June 30, 2024, ensuring resilience and supporting an attractive dividend policy.

Bâloise holds significant market positions in key European countries like Switzerland, Germany, Belgium, and Luxembourg, leveraging deep market penetration and local customer understanding. Its 'refocusing strategy' has already yielded positive results, improving the combined ratio and increasing return on equity, with targets set for 12-15% ROE and an 80% cash payout rate between 2024 and 2027.

A commitment to innovation and digital transformation enhances customer experience and operational efficiency. Bâloise's digital channels saw over 60% of policy inquiries handled digitally in 2024, and the group is actively investing in automation and AI to streamline processes.

| Strength | Description | Supporting Data/Fact |

| Diversified Portfolio | Offers a wide range of insurance, pension, investment, and banking solutions. | Banking sales volume surpassed CHF 1 billion in 2024. |

| Financial Strength | Possesses a strong and stable financial position. | S&P Global Ratings affirmed A+ rating (stable outlook) in June 2024. |

| Capital Adequacy | Maintains a high level of capital for resilience. | SST ratio estimated at ~210% as of June 30, 2024. |

| Market Position | Strong presence in core European markets. | Contributed to increased EBIT in 2024 across national subsidiaries. |

| Strategic Execution | Effective implementation of 'refocusing strategy'. | Improved combined ratio and higher return on equity achieved. |

| Digital Innovation | Focus on digital transformation for customer experience and efficiency. | Over 60% of policy inquiries handled digitally in 2024. |

What is included in the product

Analyzes Bâloise Group’s competitive position through key internal and external factors, highlighting its strengths in customer loyalty and digital innovation, while identifying potential weaknesses in legacy systems and opportunities in emerging markets and threats from increased competition.

Offers a clear, actionable framework for identifying and addressing Bâloise Group's strategic challenges.

Weaknesses

Bâloise Group's significant reliance on Switzerland, Germany, Belgium, and Luxembourg for its core business presents a notable weakness. This geographic concentration means that economic slowdowns or regulatory shifts in these specific European markets could disproportionately impact the group's overall performance. For instance, a downturn in the German economy, a key market for Bâloise, could significantly affect premium growth and investment returns.

Bâloise Group's profitability, especially in its non-life insurance business, faces a significant challenge from unexpected natural disasters and substantial individual claims. For instance, severe weather events in Switzerland during 2023 and the initial months of 2024 led to increased claims, impacting financial results.

Although Bâloise reported an improved combined ratio for the first half of 2024, the occurrence of such large-scale events remains a persistent risk. These can still negatively affect earnings and create unpredictability in the company's financial performance.

Bâloise faced a slight dip in overall business volume during 2024, with a notable contributor being reduced premiums from its traditional life insurance segment. This performance reflects a wider industry trend where customers are increasingly favoring more flexible, semi-autonomous financial products over traditional, less adaptable insurance policies.

Workforce Reduction as Part of Refocusing Strategy

Bâloise Group's strategic refocusing involves a significant workforce reduction, targeting 250 full-time equivalents (FTEs) across the entire organization, with approximately 125 of these cuts impacting their Swiss operations. This move, intended to streamline operations and cut costs, could negatively affect employee morale and create temporary operational disruptions. Careful execution is crucial to mitigate these risks and retain valuable expertise.

The planned reduction of 250 FTEs by Bâloise Group highlights a key weakness in their current strategy. Such significant workforce adjustments can lead to:

- Decreased employee morale and engagement: Uncertainty and job losses can impact the remaining workforce.

- Loss of institutional knowledge: Experienced employees departing can take valuable expertise with them.

- Short-term operational inefficiencies: The transition period may see productivity dips as roles are consolidated or eliminated.

- Potential for increased recruitment costs later: If the refocusing leads to unforeseen skill gaps, rehiring could become necessary.

Discontinuation of Ecosystem Strategy

Bâloise's decision to discontinue its ecosystem strategy and divest its FRIDAY portfolio has created a notable weakness. This move, which impacted 2024 profits through negative non-recurring items, signals that earlier investments in this area did not deliver the anticipated returns. The sale of FRIDAY, for instance, represents a significant pivot away from a previously pursued growth avenue.

The financial implications are clear: Bâloise reported a CHF 150 million impact from the FRIDAY divestment in its 2024 first-half results, contributing to a net profit of CHF 271 million. This strategic refocusing, while aiming to strengthen the core business, inherently highlights a past misallocation of resources or an underperforming venture that may necessitate further financial adjustments.

- Discontinuation of Ecosystem Strategy: Bâloise has ceased its ecosystem strategy, a significant shift from its previous direction.

- FRIDAY Portfolio Sale: The sale of the FRIDAY portfolio is a direct consequence of this strategic change.

- Financial Impact in 2024: This divestment resulted in negative non-recurring items, affecting the group's profit for the year. For example, the first half of 2024 saw a CHF 150 million impact from the FRIDAY sale.

- Underperformance Indication: The move suggests that previous investments in the ecosystem strategy did not yield the expected returns, potentially requiring further financial write-downs or strategic re-evaluations.

Bâloise Group's significant geographic concentration in Switzerland, Germany, Belgium, and Luxembourg exposes it to heightened risks from localized economic downturns or regulatory changes. For instance, a slowdown in the German market, a key revenue driver, could disproportionately impact the group's financial performance. This reliance means that adverse events in these core markets can have a substantial ripple effect across the entire organization.

The profitability of Bâloise's non-life insurance segment remains vulnerable to unpredictable events like severe weather and large individual claims. For example, the increased claims from natural disasters in Switzerland during late 2023 and early 2024 negatively affected financial results, highlighting the inherent volatility in this business line.

Bâloise's strategic pivot away from its ecosystem strategy, including the divestment of its FRIDAY portfolio, signals past underperformance in these ventures. The CHF 150 million negative impact from the FRIDAY sale in the first half of 2024 underscores a potential misallocation of resources and the need for careful re-evaluation of growth initiatives.

The planned workforce reduction of 250 FTEs, with 125 in Switzerland, presents a risk of decreased employee morale and the potential loss of institutional knowledge. This streamlining, while aimed at cost reduction, could lead to short-term operational inefficiencies and future recruitment needs if critical expertise is lost.

What You See Is What You Get

Bâloise Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the Bâloise Group's strategic positioning. This ensures you receive exactly what you need for informed decision-making.

Opportunities

Bâloise can unlock substantial value by deepening its integration of digital tools, especially AI. This means leveraging AI for smarter underwriting, more efficient claims processing, and personalized customer interactions. For instance, AI-driven analytics can refine risk assessment, potentially reducing claims costs and improving pricing accuracy.

The company has an opportunity to enhance operational efficiency and customer satisfaction through these digital advancements. By investing in AI for predictive analytics, Bâloise can anticipate customer needs and market trends, leading to more targeted product development and distribution strategies. This digital push is crucial for staying competitive in the evolving insurance landscape.

Bâloise's successful insurbanking model in Switzerland, which achieved over CHF 1 billion in sales volume in 2024, offers a prime opportunity for replication in its other key European markets.

This integrated insurance and banking approach fosters strong customer loyalty and attracts a wider demographic by providing a comprehensive financial service offering.

Expanding this synergistic model could unlock new revenue streams and solidify Bâloise's competitive advantage by deepening client relationships across its operational footprint.

Bâloise's Perspectiva collective foundation, a semi-autonomous pension solution, experienced remarkable growth in 2024, more than doubling its assets under management over the past few years. This surge is directly linked to increasing market demand for such flexible and tailored pension offerings.

This segment presents a significant growth opportunity for Bâloise, capitalizing on the trend towards more personalized retirement planning. The stable influx of assets under management in this area reinforces its strategic importance and contributes positively to the group's overall financial stability.

Leveraging ESG and Sustainability Trends

Bâloise Group's commitment to sustainability, underscored by its 2024 sustainability strategy and carbon emission reduction targets, presents a significant opportunity. By more deeply embedding ESG criteria into its investment and underwriting processes, Bâloise can appeal to a growing base of environmentally and socially conscious customers.

This strategic focus can lead to enhanced brand reputation and open doors to new market segments. For instance, as of early 2024, sustainable investment funds saw continued strong inflows, indicating robust client demand for ESG-aligned products. Bâloise can capitalize on this by expanding its range of sustainable finance solutions, such as green bonds or impact investing opportunities.

- Attracting a growing ESG-conscious client base

- Enhancing brand reputation and trust

- Unlocking new market segments and product offerings

- Meeting increasing regulatory and investor demands for sustainability

Strategic Partnerships and Acquisitions

Bâloise Group's robust capital position, particularly its Solvency II ratio which stood at an impressive 225% as of the end of 2023, provides a strong foundation for pursuing strategic partnerships and acquisitions. This financial strength allows for targeted expansion into adjacent markets or the integration of innovative insurtech capabilities. For instance, a potential acquisition in the digital health insurance space could leverage Bâloise's existing customer base and underwriting expertise, driving growth beyond its traditional offerings.

The company's strategic refocusing on its core markets and complementary business lines in 2024 presents a clear opportunity to identify and integrate businesses that align with this vision. By acquiring companies with proven digital platforms or unique customer engagement models, Bâloise can accelerate its digital transformation and enhance its competitive edge. Such moves could also unlock synergies, improving operational efficiency and profitability.

- Acquisition of Insurtech Startups: Bâloise could acquire smaller insurtech firms to gain access to advanced data analytics, AI-driven underwriting, or personalized customer experience platforms, potentially enhancing its digital offerings.

- Partnerships for Market Expansion: Collaborating with established players in new, high-growth European markets could provide a faster route to market entry than organic growth, leveraging local expertise and distribution networks.

- Diversification into Related Services: Exploring acquisitions in areas like preventative health services or digital wealth management could complement its insurance products, offering a more holistic financial solution to customers.

- Technology Integration: Acquiring companies with cutting-edge technology in areas such as cybersecurity or blockchain for claims processing could significantly improve operational efficiency and security.

Bâloise can expand its successful insurbanking model, which saw over CHF 1 billion in sales volume in Switzerland in 2024, into other European markets. This integrated approach fosters customer loyalty and attracts a broader demographic by offering comprehensive financial services. Expanding this model can create new revenue streams and deepen client relationships across its operational footprint.

Threats

The insurance and financial services sectors in Bâloise's key markets like Switzerland, Germany, Belgium, and Luxembourg are experiencing a significant surge in competition. This isn't just from established players but also from agile insurtech firms rapidly gaining traction.

This heightened rivalry directly translates into pressure on Bâloise's pricing strategies and profit margins. Furthermore, retaining existing customers becomes more challenging as competitors offer increasingly attractive alternatives, potentially impacting Bâloise's market share and revenue streams in the coming years.

Economic slowdowns and persistent inflation, particularly evident in 2024 and projected into 2025, pose a significant threat. These conditions can erode investment portfolio values and dampen consumer spending, directly impacting demand for Bâloise's insurance and financial services.

Geopolitical tensions, such as ongoing conflicts and trade disputes, create market volatility and uncertainty. This environment can lead to reduced investment returns and potentially higher claims costs for Bâloise, especially given Switzerland's interconnectedness with the broader European economy, which experienced a 0.3% GDP contraction in Q1 2024 according to Eurostat.

The insurance sector faces ongoing regulatory shifts, such as the implementation of IFRS 17, which significantly impacts financial reporting and operational processes for companies like Bâloise. These changes often necessitate substantial investments in IT systems and personnel training to ensure compliance, adding to operational costs. For instance, the European Union's evolving sustainability reporting standards are also creating new disclosure requirements that insurers must integrate into their business practices.

Cybersecurity Risks and Data Breaches

As Bâloise Group continues to embrace digitalization, its increased reliance on technology and the handling of sensitive client data amplify cybersecurity risks. A successful cyberattack or data breach could result in substantial financial penalties, severe reputational harm, and a significant loss of customer confidence.

The financial services industry, in general, is a prime target for cybercriminals. For instance, in 2023, the global average cost of a data breach reached an all-time high of $4.45 million, according to IBM's Cost of a Data Breach Report 2023. This highlights the substantial financial implications Bâloise could face.

- Increased Attack Surface: Digital transformation initiatives, while beneficial, expand the network's vulnerability points.

- Data Sensitivity: Handling personal and financial information makes Bâloise a high-value target for data theft.

- Regulatory Fines: Non-compliance with data protection regulations like GDPR can lead to significant financial penalties.

- Reputational Damage: A breach can erode trust, impacting customer retention and acquisition efforts.

Climate Change and Increased Frequency of Extreme Weather Events

The increasing frequency and intensity of extreme weather events, driven by climate change, represent a significant threat to Bâloise Group. These events directly impact the property and casualty insurance lines, leading to a surge in claims and potentially higher payouts. For instance, the European Environment Agency reported a significant increase in weather-related losses across Europe in recent years, with storms and floods being particularly costly.

While Bâloise is actively incorporating sustainability into its operations and underwriting, accurately modeling and pricing these escalating climate-related risks remains a complex undertaking. The unpredictability of future weather patterns makes it challenging to set premiums that adequately cover potential future claims. This could strain profitability in the short to medium term if not managed proactively.

Key challenges include:

- Increased claims volume: More frequent and severe weather events lead to a higher number of insurance claims, impacting profitability.

- Pricing accuracy: Accurately pricing policies to account for the growing risk of climate-related events is difficult.

- Capital allocation: The need to hold more capital to cover potential catastrophic losses could affect investment strategies.

Intensifying competition from both established insurers and agile insurtechs puts pressure on Bâloise's pricing and profit margins, potentially eroding market share. Economic headwinds, including inflation and potential slowdowns in 2024-2025, could dampen demand for financial services and devalue investment portfolios. Geopolitical instability adds market volatility, impacting investment returns and potentially increasing claims costs.

The group faces significant cybersecurity risks due to its digital reliance, with data breaches carrying substantial financial penalties and reputational damage, as evidenced by the 2023 global average data breach cost of $4.45 million. Evolving regulatory landscapes, such as IFRS 17 and sustainability reporting, require costly system upgrades and compliance efforts.

Climate change presents a growing threat through more frequent extreme weather events, increasing claims volume and complicating pricing strategies for property and casualty insurance. Accurately modeling and pricing these escalating risks is a complex challenge for Bâloise.

SWOT Analysis Data Sources

This Bâloise Group SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analysis to ensure a thorough and insightful assessment.