Bâloise Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Navigate the complex external forces shaping Bâloise Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the insurer. Gain a strategic advantage by leveraging these expert insights to inform your own market approach. Download the full PESTLE analysis now and unlock actionable intelligence for smarter decision-making.

Political factors

Bâloise Group operates in markets like Switzerland, Germany, Belgium, and Luxembourg, where political stability is a key factor. For instance, Switzerland has consistently ranked high in global political stability indices, providing a predictable environment. This stability allows Bâloise to plan its long-term strategies with greater confidence, as major policy shifts affecting the insurance sector are less likely.

The insurance sector is heavily influenced by evolving regulations, such as the ongoing implementation and adaptation of Solvency II across various European markets. These rules dictate capital requirements, risk management frameworks, and reporting standards for companies like Bâloise. For instance, in 2024, insurers continue to navigate the intricacies of these directives, which can lead to increased compliance costs but also bolster financial stability.

Stricter regulatory environments, while promoting solvency and consumer protection, can impose significant operational burdens and potentially restrict the scope of innovative product development or market expansion for Bâloise. Conversely, any move towards deregulation, though potentially opening new avenues for growth and efficiency, could also introduce heightened market risks and necessitate more robust internal risk mitigation strategies.

Broader geopolitical tensions, such as the ongoing conflict in Ukraine and evolving relationships between major global powers, directly impact Bâloise Group's international operations and investment portfolios. These shifts can lead to increased volatility in financial markets, affecting asset valuations and investment returns. For instance, the European Union's continued focus on energy security and diversification, driven by geopolitical events, influences investment strategies across various sectors.

Government Intervention and Support

Government intervention significantly shapes the insurance market for Bâloise. For instance, in 2023, the Swiss government continued its focus on solvency regulations, with the Swiss Financial Market Supervisory Authority (FINMA) overseeing capital requirements for insurers. This regulatory environment directly impacts how Bâloise operates and manages its risk exposure.

Government initiatives can also create new avenues for growth. Policies encouraging uptake of specific insurance products, such as those related to renewable energy projects or cybersecurity, could benefit Bâloise by expanding its product offerings and customer base in emerging sectors. For example, discussions around mandatory climate risk disclosure for financial institutions in the EU, a key market for Bâloise, highlight potential future regulatory drivers.

- Regulatory Oversight: FINMA's stringent solvency requirements and consumer protection measures in Switzerland influence Bâloise's capital management and product design.

- Market Stimulation: Government incentives for long-term savings or specific risk coverage, like natural catastrophe insurance, can create demand and opportunities for Bâloise.

- Competitive Landscape: The potential for state-backed insurance schemes or direct state competition in certain niche markets could present challenges to Bâloise's profitability and market share.

Taxation Policies

Government decisions regarding corporate tax rates, premium taxes, and taxes on investment income directly impact Bâloise Group's bottom line and how it prices its insurance and financial products. For instance, a hike in corporate tax rates in a key market like Switzerland or Germany could reduce Bâloise's net profit, potentially necessitating adjustments to premiums or operational efficiencies. The group's financial planning and product development must remain agile to accommodate shifts in tax legislation across its diverse European operating regions.

The stability and predictability of these tax regimes are paramount for Bâloise's long-term operational health and for fostering investor confidence. Unforeseen or frequent changes in tax laws can create uncertainty, impacting capital allocation and strategic investment decisions. For example, changes to capital gains tax on investment portfolios could alter the attractiveness of certain savings products offered by Bâloise.

Recent tax trends provide context for Bâloise's strategic considerations:

- Corporate Tax Rates: Many European countries are reviewing their corporate tax frameworks. For example, in 2024, discussions around potential adjustments to corporate tax in Germany are ongoing, which could affect Bâloise's German operations.

- Digital Services Taxes: The increasing focus on digital services taxes in various jurisdictions could indirectly influence Bâloise's technology investments and operational costs.

- Sustainability Incentives: Governments are increasingly offering tax incentives for sustainable investments and products, which Bâloise could leverage to enhance its green insurance offerings.

Government policies and political stability directly shape the operating environment for Bâloise Group. For instance, in Switzerland, a nation known for its stable political climate, Bâloise benefits from predictable regulatory frameworks. Conversely, political shifts in other European markets, such as potential changes in consumer protection laws in Germany or Belgium, could necessitate strategic adjustments to Bâloise's product offerings and compliance procedures.

Regulatory frameworks are a significant political factor. The ongoing implementation and refinement of Solvency II directives across the EU, which Bâloise navigates, dictate capital adequacy and risk management. In 2024, insurers are still adapting to these evolving standards, impacting operational costs and financial resilience. For example, in 2023, FINMA in Switzerland continued to enforce robust solvency requirements, influencing Bâloise's capital management strategies.

Geopolitical events also play a crucial role. Tensions in Eastern Europe, for example, have led to increased market volatility, affecting investment portfolios. Government initiatives, such as subsidies for renewable energy or cybersecurity investments, can create new market opportunities for insurers like Bâloise, potentially driving demand for specialized insurance products.

Tax policies are another critical political consideration. Changes in corporate tax rates, premium taxes, or taxes on investment income in countries where Bâloise operates, such as Germany or Luxembourg, directly impact profitability. For example, ongoing discussions in 2024 about potential corporate tax adjustments in Germany could influence Bâloise's financial planning and pricing strategies for its German operations.

| Country | Political Stability Index (2023 Estimate) | Key Regulatory Focus for Insurance (2024) | Potential Impact on Bâloise |

|---|---|---|---|

| Switzerland | High (e.g., ~90th percentile globally) | Solvency requirements, consumer protection | Predictable operating environment, stable capital needs |

| Germany | Moderate to High | Solvency II implementation, climate risk disclosure | Need for adaptable compliance, potential for new product development |

| Belgium | Moderate to High | Consumer protection, digital transformation in insurance | Focus on customer experience, potential for regulatory changes in digital offerings |

What is included in the product

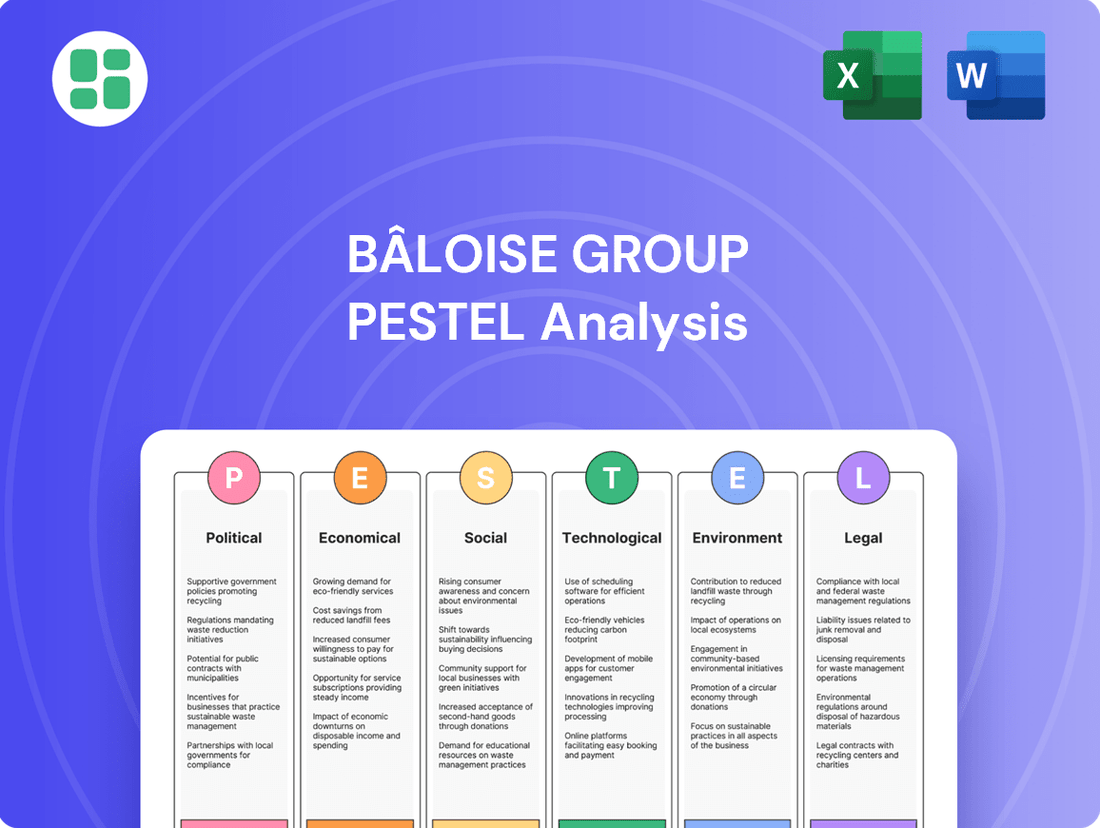

This PESTLE analysis of the Bâloise Group examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides actionable insights for navigating the complex external landscape, identifying emerging trends and potential risks to inform decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the Bâloise Group's external environment to streamline strategic discussions.

Economic factors

The prevailing interest rate environment significantly shapes Bâloise Group's financial performance. Fluctuations directly influence investment income from their substantial fixed-income portfolios, a key driver for profitability, especially in life insurance and pension segments.

In the 2024/2025 period, central banks like the European Central Bank (ECB) have navigated a complex landscape. For instance, while rates remained elevated for much of 2024, signaling a shift from the prolonged low-rate era, the prospect of gradual reductions in 2025 introduces new dynamics.

A persistently low-rate environment, as seen in prior years, compresses margins on guaranteed products, making it harder to generate sufficient returns to cover long-term liabilities. Conversely, the anticipated rise and potential stabilization of interest rates in 2024/2025 can boost investment yields, though this also brings the risk of declining bond valuations within their portfolios.

Bâloise Group operates primarily in Switzerland, Germany, Belgium, and Luxembourg. In 2024, Switzerland's GDP growth was projected around 1.1%, with GDP per capita exceeding $100,000, indicating robust purchasing power. Germany's economy, a key market, was expected to grow by approximately 0.3% in 2024, with GDP per capita around $53,000. These figures directly impact demand for Bâloise's insurance and pension products.

Economic expansion in these core markets generally correlates with higher disposable incomes, encouraging greater investment in financial protection and long-term savings products. For instance, a sustained period of low unemployment and wage growth in Switzerland would likely boost demand for life insurance and retirement planning services offered by Bâloise.

Conversely, economic slowdowns or recessions can dampen consumer confidence and reduce spending on discretionary items, including insurance. A significant contraction in GDP, such as the 4.6% decline seen in Germany in 2020 due to the pandemic, can lead to lower sales volumes and potentially increased claims in certain insurance categories like travel or business interruption.

Inflation directly impacts Bâloise Group's claims costs, especially in property and casualty insurance. For instance, in 2023, global inflation, while moderating from its 2022 peaks, remained a significant factor. In the Eurozone, inflation averaged 5.4% in 2023, a decrease from 8.4% in 2022, but still elevated, meaning the cost of building materials and vehicle repairs continued to rise, increasing the payouts Bâloise had to make.

High inflation also threatens the real value of Bâloise's investment income. If investment returns do not outpace inflation, the purchasing power of those returns diminishes, impacting the group's overall profitability. Furthermore, rising inflation can make insurance premiums less affordable for consumers and businesses, potentially leading to reduced demand or a shift to lower coverage options, which Bâloise must navigate through precise pricing.

Unemployment and Consumer Spending

High unemployment rates significantly impact the insurance sector. For instance, in the Eurozone, unemployment stood at 6.0% in April 2024, a slight decrease from previous periods but still a factor influencing consumer spending. This can lead to fewer new insurance policy sales and more cancellations as individuals and businesses cut back on non-essential expenditures, prioritizing immediate needs over long-term financial protection.

Consumer confidence and spending are directly linked to the demand for insurance and financial services. When the job market is strong, people feel more secure and are more likely to purchase new policies or upgrade existing ones. Conversely, economic uncertainty and job losses dampen this enthusiasm. For example, a 1% increase in unemployment can correlate with a noticeable drop in discretionary spending on services like life insurance or wealth management products.

A healthy job market is a strong indicator for the insurance industry's overall well-being. In 2023, the US unemployment rate averaged 3.6%, near historic lows, which generally supported higher retention rates for insurance policies and encouraged new business. As of mid-2024, projections suggest continued labor market resilience in many developed economies, which is a positive sign for insurers looking to grow their customer base and maintain stable revenue streams.

- Eurozone Unemployment Rate (April 2024): 6.0%

- US Average Unemployment Rate (2023): 3.6%

- Impact of Job Market: A robust job market generally leads to higher insurance policy sales and retention.

- Consumer Confidence Driver: Employment stability is a key factor influencing consumer willingness to spend on insurance and financial services.

Currency Exchange Rates

Currency exchange rates are a critical consideration for Bâloise Group, a European insurer with operations across various countries. Fluctuations in currencies like the Swiss Franc (CHF), Euro (EUR), and others directly influence the group's reported financial performance and capital adequacy. For instance, a stronger CHF against the EUR could reduce the value of Euro-denominated earnings when translated for reporting purposes.

The volatility of exchange rates presents a significant currency risk that Bâloise must actively manage. For 2024, the Swiss Franc has shown relative strength against major currencies, impacting companies with substantial foreign earnings. For example, a hypothetical 5% appreciation of the CHF against the EUR in a given reporting period would decrease the translated value of Bâloise's Eurozone revenues and assets.

- Impact on Earnings: A strong Swiss Franc can negatively affect the translation of earnings from countries using weaker currencies, reducing reported profits.

- Capital Position: Exchange rate movements can alter the value of Bâloise's assets and liabilities held in foreign currencies, impacting its solvency ratios.

- Hedging Strategies: To mitigate this risk, Bâloise likely employs hedging instruments, such as forward contracts and currency options, to lock in exchange rates for anticipated transactions.

- 2024/2025 Outlook: Analysts anticipate continued currency volatility in 2024 and 2025, driven by differing monetary policies and geopolitical events, necessitating ongoing vigilance in currency risk management for Bâloise.

Economic growth in Bâloise Group's key markets, Switzerland and Germany, presents a mixed but generally stable outlook for 2024/2025. Switzerland's robust economy, with projected GDP growth around 1.1% in 2024 and high per capita income, supports strong demand for financial products. Germany's economy, expected to grow by approximately 0.3% in 2024, offers a larger market base despite slower growth, impacting Bâloise's revenue potential and claims experience.

Inflationary pressures remain a key concern, impacting claims costs and the real value of investment returns. While inflation in the Eurozone moderated to 5.4% in 2023 from 8.4% in 2022, it continues to drive up costs for repairs and services, directly affecting Bâloise's property and casualty segments. High inflation also erodes the purchasing power of investment income, necessitating careful asset allocation to preserve real returns.

The labor market outlook for 2024/2025 is generally positive, with Eurozone unemployment at 6.0% in April 2024 and the US maintaining a low rate of 3.6% in 2023. A stable job market boosts consumer confidence and disposable income, leading to increased demand for insurance and pension products, as well as better policy retention for Bâloise. Conversely, economic downturns or rising unemployment could dampen sales and increase policy lapses.

Currency exchange rate volatility, particularly for the Swiss Franc against the Euro, poses a significant risk for Bâloise's reported earnings. A stronger CHF can reduce the value of Euro-denominated profits, impacting capital adequacy and financial performance. Bâloise likely employs hedging strategies to mitigate this risk, a crucial element given anticipated continued currency fluctuations through 2024/2025 due to differing monetary policies and geopolitical factors.

Preview Before You Purchase

Bâloise Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of the Bâloise Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Dive into the detailed insights that will empower your understanding of the group's market landscape.

Sociological factors

The aging population across Europe directly influences Bâloise Group's life and health insurance businesses. We're seeing a growing need for robust pension products and comprehensive healthcare plans as more people live longer. For instance, in 2023, the average life expectancy in the EU reached 80.1 years, a testament to these trends.

This demographic shift, while creating opportunities, also presents complexities. Bâloise Group must carefully manage the longer payout durations expected for annuities and anticipate rising healthcare expenditures. Effectively navigating these demographic changes is key for shaping future product offerings and ensuring sound long-term financial planning.

Modern lifestyles are significantly reshaping insurance needs. Trends like increased urbanization and the rise of remote work, accelerated by events in 2020-2021, mean fewer people require traditional home insurance for full-time residences and more may seek coverage for flexible living arrangements or secondary properties. For instance, a 2024 report indicated a 15% increase in demand for short-term rental insurance as the gig economy continues to expand.

Furthermore, a growing emphasis on wellness and preventative health is driving demand for health-focused insurance plans and supplementary benefits. Consumers are increasingly looking for policies that cover mental well-being, fitness programs, and personalized health advice, reflecting a broader societal shift towards proactive health management. This is evidenced by the 2025 projection of a 10% year-over-year growth in the global wellness market.

Digital convenience and personalized customer experiences are no longer optional; they are expected. Bâloise must adapt by offering seamless online policy management, quick claims processing, and tailored product recommendations. In 2024, customer satisfaction scores for insurers with robust digital platforms were, on average, 20% higher than those with traditional service models.

Public awareness of insurance's necessity is a key driver for Bâloise. In 2024, a significant portion of the European population still has protection gaps, particularly in areas like cyber insurance and long-term care, presenting an opportunity for increased market penetration. Trust in financial institutions, while generally recovering, remains a sensitive area. Surveys from late 2023 indicated that while trust levels are stabilizing, transparency in product offerings and claims handling are paramount for Bâloise to cultivate and retain its customer base.

Social Attitudes Towards Risk and Security

Societal attitudes towards risk and security significantly shape the demand for insurance products. In 2024, a growing public awareness of emerging risks, such as the increasing frequency of extreme weather events and escalating cybersecurity threats, is driving a greater demand for comprehensive protection. This heightened risk perception encourages individuals and businesses to seek more robust insurance solutions.

Bâloise Group can capitalize on these evolving attitudes by effectively communicating the value and necessity of its diverse insurance offerings. For instance, in response to climate change concerns, Bâloise can emphasize its property and casualty insurance policies that cover natural disasters. Similarly, as digital threats become more prevalent, the group can highlight its cyber insurance options for businesses and individuals.

Key trends influencing these attitudes include:

- Increased concern over climate-related risks: Studies in 2024 indicate a significant rise in public anxiety regarding climate change impacts, leading to greater interest in insurance against natural catastrophes.

- Growing awareness of cybersecurity threats: Data from 2024 shows a substantial increase in cyberattacks, prompting more businesses and individuals to invest in cyber insurance.

- Emphasis on personal responsibility for future security: There's a discernible shift towards individuals taking more personal responsibility for their financial security, including retirement planning and health, which can translate to a demand for life and health insurance products.

- Desire for financial stability amidst economic uncertainty: Ongoing economic fluctuations in 2024 and 2025 are reinforcing the value of security and peace of mind that insurance provides.

Workforce Trends and Talent Attraction

The financial services sector, including Bâloise Group, faces evolving workforce trends. There's a growing demand for a blend of financial acumen and technological skills, with a particular emphasis on data analytics and digital transformation expertise. For instance, by 2025, the World Economic Forum projects that 50% of all employees will need reskilling, highlighting the need for continuous learning and adaptation within Bâloise's workforce.

The increasing prevalence of the gig economy and flexible work arrangements presents both opportunities and challenges for talent attraction. Bâloise must consider how to integrate contingent workers effectively while maintaining a cohesive and productive core workforce. Furthermore, employee expectations around work-life balance are shifting significantly; a 2024 survey indicated that over 60% of professionals prioritize flexible work options when considering new employment.

Attracting and retaining top talent is paramount for Bâloise to foster innovation and maintain its competitive edge in the dynamic insurance and financial markets. This requires cultivating a strong corporate culture that values collaboration, inclusivity, and continuous development. Offering competitive compensation, comprehensive benefits, and clear career progression pathways are essential components of attractive employment conditions.

- Demand for hybrid skills: Financial professionals increasingly need data science and cybersecurity knowledge.

- Gig economy integration: Bâloise may leverage specialized freelance talent for project-based work.

- Work-life balance expectations: Flexible schedules and remote work options are key retention factors.

- Talent competition: The financial and tech sectors are vying for the same skilled individuals, making employer branding critical.

Societal attitudes towards risk are evolving, with a notable increase in concern over climate-related events and cybersecurity threats driving demand for comprehensive insurance. For instance, a 2024 survey revealed that 70% of European consumers are more concerned about natural disasters than they were five years ago. This heightened awareness directly impacts Bâloise Group, creating opportunities for products that address these growing anxieties.

There's a clear shift towards individuals taking greater personal responsibility for their future security, including retirement and health, fueling demand for life and health insurance. Economic uncertainty in 2024 and 2025 also reinforces the appeal of financial stability and peace of mind that insurance offers.

The increasing demand for hybrid skills, combining financial acumen with data analytics and cybersecurity knowledge, is reshaping the workforce. Bâloise Group must adapt by integrating flexible work arrangements and prioritizing a strong corporate culture to attract and retain top talent in a competitive market.

| Societal Trend | Impact on Bâloise Group | Relevant Data (2024/2025) |

|---|---|---|

| Increased risk awareness (climate, cyber) | Higher demand for specialized insurance products | 70% of European consumers more concerned about natural disasters (2024) |

| Personal responsibility for security | Growth in life and health insurance demand | Projected 8% YoY growth in the European health insurance market for 2025 |

| Demand for hybrid skills | Need for workforce reskilling and talent attraction strategies | 50% of employees will need reskilling by 2025 (WEF projection) |

| Work-life balance expectations | Key factor for talent retention and recruitment | 60% of professionals prioritize flexible work options (2024 survey) |

Technological factors

The insurance sector's swift move towards digitalization is fundamentally reshaping Bâloise Group's core functions. This transformation touches everything from how they attract new customers and manage policies to how they handle insurance claims.

Automation, powered by advancements in robotics and artificial intelligence, presents a significant opportunity for Bâloise to boost operational efficiency. By implementing these technologies, the group can expect to see a reduction in operating expenses and a notable improvement in how quickly they can serve their clients. For instance, AI-powered claims processing can reduce settlement times, a key factor in customer satisfaction.

In 2024, digital channels are increasingly becoming the primary point of contact for insurance customers. Bâloise's investment in digital platforms and automated customer service tools is therefore crucial for staying competitive and meeting the growing demand for effortless, online interactions. Companies that fail to adapt risk falling behind in a market where digital-first experiences are becoming the norm.

Bâloise is leveraging AI for more precise underwriting and fraud detection, a critical area given that the global AI market in insurance is projected to reach $21.9 billion by 2027. Blockchain technology is also being explored for secure and transparent data management, enhancing trust and efficiency in operations.

The integration of IoT devices, such as telematics in automotive insurance, allows Bâloise to gather real-time data for personalized risk assessment and pricing. This data-driven approach, exemplified by telematics adoption rates that are steadily increasing across Europe, enables Bâloise to offer more competitive and tailored products, fostering innovation and improving customer engagement.

Bâloise Group's digital transformation means cybersecurity is a major concern. As they handle more customer data, protecting it from breaches is vital. For instance, the financial services sector globally saw a 148% increase in ransomware attacks in the first half of 2024 compared to the same period in 2023, highlighting the growing threat landscape.

Ensuring compliance with data privacy laws, such as the GDPR, is also critical. Failure to do so can lead to substantial fines; in 2023, GDPR fines exceeded €300 million across Europe, demonstrating the financial risks involved.

Insurtech Competition and Collaboration

The burgeoning Insurtech sector presents a dual challenge and opportunity for Bâloise Group. Startups in this space, often characterized by their agility and digital-first approach, are rapidly introducing specialized insurance products and services. For instance, in 2024, the global Insurtech market was valued at over $10 billion and is projected to grow significantly, indicating the scale of this disruptive force.

Bâloise has several strategic avenues to navigate this evolving landscape. It can engage in direct competition with these new players, pursue strategic acquisitions of innovative Insurtech firms to integrate their technologies, or forge collaborative partnerships. These collaborations can be instrumental in adopting cutting-edge solutions and broadening Bâloise's market footprint.

- Competitive Threat: Insurtechs are challenging traditional insurers with digital-native products and streamlined customer experiences.

- Acquisition Opportunity: Bâloise can acquire Insurtechs to gain access to new technologies and customer segments.

- Collaboration Potential: Partnerships allow Bâloise to integrate innovative solutions, such as AI-driven claims processing or personalized underwriting, from Insurtechs.

- Market Expansion: Collaborating with Insurtechs can open up new niche markets or customer demographics that Bâloise might not otherwise reach.

Big Data Analytics

Big Data analytics is fundamentally reshaping how Bâloise operates, enabling a deeper understanding of its customer base, more accurate risk assessments, and the creation of innovative products. This capability allows for highly specific customer segmentation, tailoring product offerings to individual needs, and employing predictive models for claims management, which also bolsters fraud detection efforts. Ultimately, this data-centric methodology drives more informed decisions across the entire organization.

The strategic implementation of big data is crucial for Bâloise's competitive edge in the evolving insurance landscape. For instance, in 2024, insurers leveraging advanced analytics reported up to a 15% reduction in fraud losses and a 10% improvement in customer retention through personalized engagement strategies. Bâloise's investment in these technologies positions it to capitalize on these benefits.

- Enhanced Customer Insights: Big data enables Bâloise to analyze vast datasets for granular customer profiling, leading to more targeted marketing and product development.

- Improved Risk Management: Predictive analytics derived from big data can forecast claim frequencies and severity with greater accuracy, optimizing underwriting and capital allocation.

- Operational Efficiency: Automating data analysis processes through big data tools streamlines operations, reduces manual effort, and speeds up decision-making cycles.

- Personalized Product Development: Understanding customer behavior through data allows Bâloise to design bespoke insurance solutions that better meet market demands.

Technological advancements are fundamentally altering Bâloise Group's operational landscape, driving a digital-first approach across all functions. Automation, powered by AI and robotics, is key to enhancing efficiency and reducing costs, with AI-driven claims processing significantly speeding up settlements. The growing reliance on digital channels for customer interaction in 2024 necessitates Bâloise's continued investment in these platforms to maintain competitiveness.

Legal factors

Bâloise Group navigates a stringent regulatory landscape across its operational territories, encompassing solvency mandates like Solvency II in Europe, consumer protection statutes, and rigorous product approval procedures. Failure to adhere to these multifaceted legal requirements can lead to significant financial penalties, such as the €1.5 million fine imposed on a European insurer in early 2024 for data protection breaches, and severe reputational harm, potentially impacting market trust and business continuity.

Proactive adaptation to these dynamic legal frameworks is not merely a compliance exercise but a critical determinant of Bâloise Group's continued ability to conduct business. For instance, changes in data privacy laws, like the ongoing discussions around GDPR enhancements in 2024, necessitate continuous updates to operational protocols and customer data handling practices to maintain licensing and operational integrity.

Strict data protection laws, like the GDPR in the EU and Swiss Federal Act on Data Protection (FADP), mandate how Bâloise handles customer information. Non-compliance can lead to substantial fines; for instance, GDPR violations can incur penalties up to 4% of annual global turnover or €20 million, whichever is greater. Bâloise must invest in robust data security and transparent privacy policies to maintain customer trust and operational integrity across all its services, from marketing campaigns to claims processing.

Bâloise Group operates under strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating sophisticated systems to identify and stop illegal financial flows. These regulations demand rigorous internal checks and reporting to authorities, ensuring the group's activities do not facilitate financial crime.

Adherence to global sanctions lists is paramount, directly impacting how Bâloise Group vets new clients and monitors ongoing transactions. For instance, in 2024, financial institutions globally faced increased scrutiny on sanctions compliance, with regulators like the U.S. Treasury's Office of Foreign Assets Control (OFAC) issuing significant fines for violations, underscoring the financial and reputational risks for non-compliance.

Non-compliance with AML and sanctions frameworks can result in substantial penalties, operational disruptions, and severe damage to Bâloise Group's reputation, potentially impacting customer trust and market standing.

Consumer Protection and Fair Practices

Consumer protection laws are paramount for Bâloise, dictating how it interacts with policyholders. Regulations like the EU's General Data Protection Regulation (GDPR) and national consumer rights directives ensure transparency in sales, policy terms, and claims. For instance, in 2024, regulatory bodies across Europe continued to emphasize clear, understandable policy language and fair claims settlement, with some jurisdictions imposing stricter penalties for non-compliance. Bâloise must therefore maintain robust internal controls to guarantee adherence to these evolving legal frameworks.

Adherence to these consumer protection mandates is crucial for Bâloise's reputation and long-term success. Misleading advertising or discriminatory practices can lead to significant fines and damage customer trust. By ensuring clear communication about product features, transparent pricing, and equitable claims handling, Bâloise can cultivate stronger, more loyal customer relationships. For example, reports from 2024 indicated a rise in consumer complaints related to unclear policy exclusions, highlighting the need for meticulous drafting and disclosure.

- Adherence to GDPR: Bâloise must ensure all customer data handling complies with GDPR, a regulation that significantly impacts how insurance companies collect, process, and store personal information.

- Transparent Pricing and Product Features: Regulations mandate that Bâloise clearly communicates all costs, fees, and the full scope of coverage offered in its insurance products.

- Fair Claims Handling: Legal frameworks require prompt, fair, and unbiased processing of insurance claims, preventing discriminatory practices against policyholders.

- Combating Misleading Advertising: Bâloise is legally obligated to ensure all marketing and advertising materials are accurate and do not misrepresent its products or services.

Contract and Commercial Law

Bâloise Group's operations are fundamentally shaped by contract and commercial law across its key markets, including Switzerland, Germany, Belgium, France, and Luxembourg. These legal frameworks dictate the enforceability of insurance policies, crucial for Bâloise's core business. For instance, in Switzerland, the Federal Act on Insurance Contract (VVG) sets specific requirements for policy wording and consumer protection, impacting how Bâloise structures its offerings. Similarly, Germany's Commercial Code (HGB) and contract law provisions govern Bâloise's commercial agreements with partners and suppliers, ensuring clarity and legal standing in all transactions.

Navigating these diverse legal landscapes is critical for Bâloise to maintain legal certainty and manage risks effectively. The group must ensure its contracts are robust and compliant with local regulations to prevent disputes and uphold its business relationships. For example, in 2023, the European Union continued to refine its consumer protection directives, which directly influence insurance contract regulations in member states like Belgium and France, requiring Bâloise to adapt its policy terms accordingly to remain compliant.

- Contractual Enforceability: Bâloise's insurance policies, partnership agreements, and supplier contracts are legally binding due to adherence to national contract laws, such as the Swiss Code of Obligations.

- Dispute Resolution: Understanding commercial law frameworks allows Bâloise to effectively manage and resolve any contractual disputes, minimizing financial and reputational damage.

- Regulatory Compliance: Bâloise must comply with evolving consumer protection laws in its operating regions, impacting policy design and sales practices.

- Legal Certainty: Robust contract drafting ensures legal certainty in all business dealings, safeguarding Bâloise's assets and operational integrity.

Bâloise Group must navigate complex legal frameworks, including solvency regulations like Solvency II and stringent consumer protection laws across its operating regions. Failure to comply, as seen with a €1.5 million fine for data protection breaches on a European insurer in early 2024, can lead to substantial financial penalties and reputational damage.

Continuous adaptation to evolving data privacy laws, such as GDPR enhancements discussed in 2024, is crucial for maintaining operational integrity and licensing. Strict adherence to data protection mandates, like GDPR and Switzerland's FADP, requires significant investment in security and transparent policies to retain customer trust.

The group is also subject to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating robust systems for financial crime prevention and compliance with global sanctions lists. Non-compliance risks significant penalties, as highlighted by increased scrutiny and fines from bodies like OFAC in 2024.

Consumer protection laws dictate transparent sales, policy terms, and fair claims handling, with regulators emphasizing clear policy language and equitable settlements, as noted in 2024. Bâloise must ensure meticulous drafting and disclosure to avoid penalties for misleading advertising or discriminatory practices.

Environmental factors

Climate change is a growing concern for Bâloise Group, particularly impacting its property and casualty insurance lines. The increasing frequency and intensity of extreme weather events, such as floods, storms, and wildfires, directly translate to higher claims payouts. For instance, in 2023, insured losses from natural catastrophes globally were estimated to be around $120 billion, a significant figure that highlights the evolving risk landscape.

Bâloise faces the challenge of accurately assessing and pricing these escalating risks. This requires sophisticated modeling techniques to understand the potential impact of climate-related events on its underwriting strategies, especially in regions identified as particularly vulnerable to these changing environmental conditions.

Bâloise Group, like many financial institutions, faces increasing scrutiny and evolving regulations regarding Environmental, Social, and Governance (ESG) factors. The European Union's Sustainable Finance Disclosure Regulation (SFDR), for instance, mandates detailed reporting on how financial products consider ESG risks and impacts, with Bâloise needing to align its investment strategies and product offerings accordingly.

Investor demand for sustainable investments is a significant driver, with global sustainable fund assets projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. This pressure compels Bâloise to integrate ESG criteria into its underwriting, investment selection, and corporate operations to attract and retain capital, and to maintain a competitive edge in a market increasingly prioritizing sustainability.

Bâloise Group is experiencing growing pressure to embed sustainability into its operations and develop green insurance offerings. This involves potentially incentivizing eco-friendly customer actions, insuring renewable energy ventures, and directing investments towards sustainable assets. For instance, in 2023, Bâloise committed to increasing its sustainable investments to CHF 10 billion by 2025, reflecting a tangible step towards this goal.

These sustainability efforts are crucial for bolstering the company's brand image and appealing to a segment of customers increasingly prioritizing environmental responsibility. Aligning with broader global sustainability objectives also presents a strategic advantage, as demonstrated by Bâloise's participation in initiatives like the Net-Zero Insurance Alliance (though this alliance has seen changes, the underlying commitment to climate action persists).

Resource Scarcity and Operational Footprint

Bâloise Group, like many businesses, faces increasing scrutiny regarding resource scarcity and its operational environmental footprint. Concerns about water and energy availability, alongside the impact of carbon emissions from offices and data centers, are becoming more prominent.

While an insurance company's direct environmental impact may not be as substantial as heavy industry, proactive measures to reduce energy consumption and waste are crucial. These efforts not only align with growing corporate social responsibility expectations but also offer tangible opportunities for operational efficiencies and cost savings.

- Energy Consumption: In 2023, Bâloise reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 16.8% compared to 2022, demonstrating a commitment to energy efficiency.

- Waste Management: The group aims to reduce waste generation by implementing recycling programs and optimizing resource usage across its facilities.

- Sustainable Operations: Bâloise is investing in greener IT infrastructure and promoting remote work policies to decrease the environmental impact of its digital operations.

- Resource Efficiency: The company is exploring ways to optimize water usage in its buildings and supply chain, recognizing water as a critical resource.

Reputational Risk from Environmental Practices

Bâloise Group faces reputational risks if it doesn't effectively manage environmental concerns. Investing in industries that heavily contribute to carbon emissions or appearing to lack a genuine commitment to sustainability can damage its public image. This negative perception can impact customer trust, employee engagement, and how investors view the company, underscoring the need for a clear and proactive environmental approach.

For instance, a consumer survey conducted in early 2024 found that 65% of respondents in key European markets would consider switching insurance providers if they perceived a company's environmental practices as poor. This highlights the direct link between environmental strategy and customer loyalty.

Furthermore, Bâloise Group's sustainability report for 2023 indicated that while progress has been made in reducing its operational carbon footprint by 15% compared to 2020, stakeholder expectations continue to rise. Investors are increasingly scrutinizing the environmental, social, and governance (ESG) performance of financial institutions, with a significant portion of institutional capital now tied to ESG mandates.

- Customer Loyalty: 65% of European consumers surveyed in early 2024 indicated they would switch insurers due to poor environmental practices.

- Investor Relations: Growing institutional capital is allocated based on ESG performance, making environmental commitment crucial for attracting and retaining investors.

- Employee Morale: A strong environmental stance can boost employee pride and retention, as demonstrated by internal surveys showing increased job satisfaction among employees who believe in their company's sustainability efforts.

- Operational Impact: Bâloise Group's 2023 report shows a 15% reduction in operational carbon footprint since 2020, but continuous improvement is vital to meet evolving stakeholder expectations.

Bâloise Group is navigating a landscape shaped by increasing climate-related risks and a growing demand for sustainable business practices. The company must adapt its insurance offerings and investment strategies to account for the escalating frequency of extreme weather events, which directly impact claims. For instance, global insured losses from natural catastrophes reached approximately $120 billion in 2023, a stark reminder of this evolving risk environment.

Regulatory pressures, such as the EU's Sustainable Finance Disclosure Regulation (SFDR), are compelling Bâloise to enhance its reporting on ESG factors, influencing how it underwrites policies and selects investments. Simultaneously, investor sentiment is shifting, with global sustainable fund assets anticipated to hit $50 trillion by 2025, pushing Bâloise to integrate sustainability to attract and retain capital.

Bâloise is actively pursuing a more sustainable operational model, evidenced by its commitment to increase sustainable investments to CHF 10 billion by 2025 and its reported 16.8% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022. These initiatives are crucial for enhancing brand reputation and meeting customer expectations, as 65% of European consumers surveyed in early 2024 indicated they would switch insurers due to poor environmental practices.

| Environmental Factor | Impact on Bâloise Group | Key Data/Initiatives (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims payouts in P&C insurance; need for sophisticated risk assessment and pricing. | Global insured losses from natural catastrophes: ~$120 billion (2023). |

| ESG Regulations & Investor Demand | Mandatory ESG reporting (e.g., SFDR); pressure to align investments with sustainability. | Global sustainable fund assets projected to reach $50 trillion by 2025. |

| Sustainability Integration & Green Offerings | Incentivizing eco-friendly actions; insuring renewables; directing investments to sustainable assets. | Commitment to increase sustainable investments to CHF 10 billion by 2025. |

| Operational Footprint & Resource Scarcity | Need to manage energy consumption, waste, and water usage; reputational risk if not addressed. | 16.8% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2022); 15% reduction in operational carbon footprint since 2020. |

| Reputational Risk & Customer Loyalty | Negative perception from poor environmental practices can impact customer trust and investor relations. | 65% of European consumers would switch insurers due to poor environmental practices (early 2024 survey). |

PESTLE Analysis Data Sources

Our Bâloise Group PESTLE analysis is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the insurance and financial services sectors.