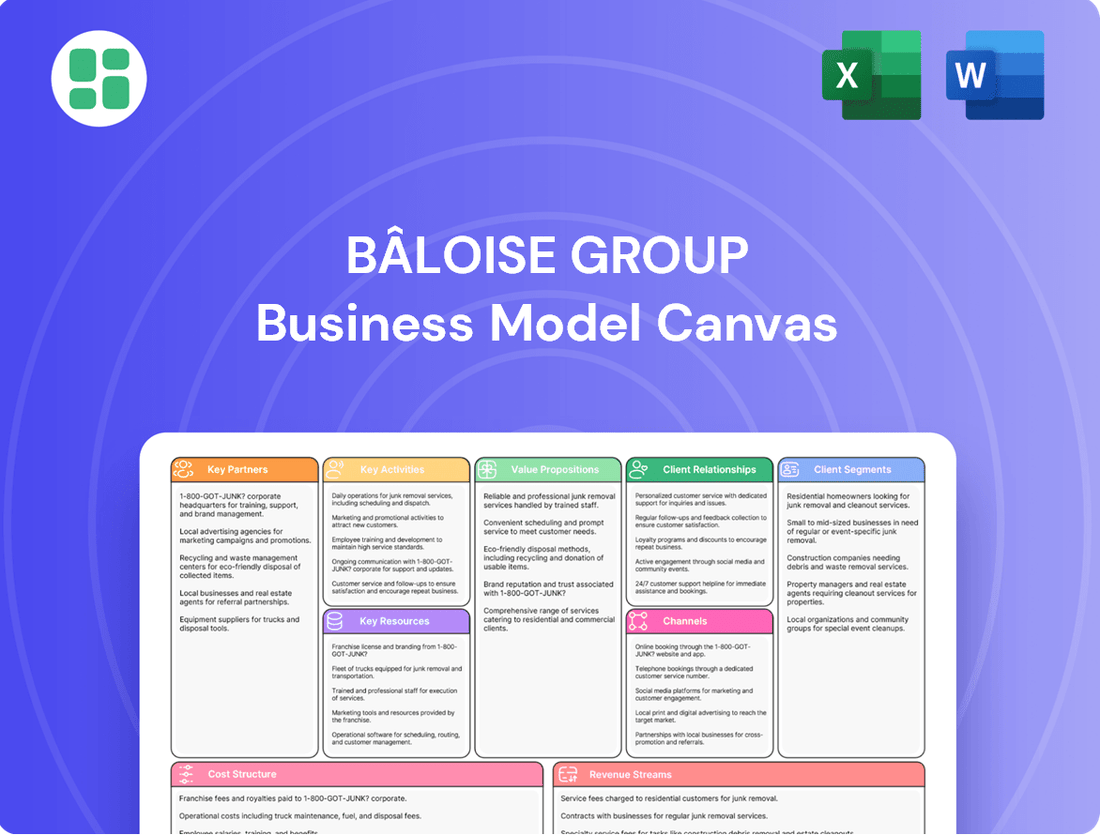

Bâloise Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Discover the intricate framework of Bâloise Group's business model with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for strategic planning. Get the full picture and elevate your own business strategy.

Partnerships

Bâloise Group actively engages with reinsurers to strategically offload a portion of its insurance risks. This partnership is fundamental to bolstering Bâloise's solvency ratios and expanding its capacity to underwrite more substantial policies, thereby increasing market reach.

These reinsurance arrangements are vital for effectively managing exposure to potentially devastating claims, particularly those stemming from catastrophic events like natural disasters or widespread incidents. By sharing this risk, Bâloise safeguards its financial stability.

In 2023, the global reinsurance market saw significant activity, with major reinsurers like Swiss Re and Munich Re continuing to play a critical role in risk transfer. Bâloise's participation in such partnerships allows it to offer a more comprehensive suite of insurance products with enhanced confidence in its ability to meet future obligations.

Bâloise Group cultivates strategic alliances with a diverse network of distribution partners, including independent insurance brokers, agents, and bancassurance channels. These collaborations are crucial for expanding Bâloise's market presence, allowing them to access a broader customer base through established relationships. In 2023, Bâloise reported that its distribution partners played a significant role in its sales performance, contributing to its continued growth in key European markets.

Bâloise Group actively collaborates with technology and InsurTech companies to bolster its digital offerings and operational efficiency. These partnerships are crucial for integrating advanced technologies, such as AI and big data analytics, into their insurance products and customer service platforms. For instance, in 2024, Bâloise continued to leverage partnerships to enhance its digital customer journey, aiming to provide more personalized and seamless insurance experiences.

While Bâloise has refined its ecosystem strategy, strategic alliances with technology providers remain a cornerstone for innovation. Collaborations in areas like e-banking integration or advanced data analytics platforms are vital for streamlining internal processes and developing next-generation insurance solutions. These partnerships enable Bâloise to stay competitive by adopting cutting-edge digital capabilities, as seen in their ongoing investments in digital transformation initiatives throughout 2024.

Healthcare Providers and Service Networks

Bâloise Group's strategy for health and certain casualty insurance products relies heavily on partnerships with healthcare providers and service networks. These collaborations are crucial for ensuring policyholders have access to a quality and convenient range of medical services.

These networks simplify the claims process, making it smoother for both the customer and Bâloise. By integrating with hospitals, clinics, and other healthcare facilities, Bâloise enhances the overall value of its health insurance offerings, fostering customer loyalty and satisfaction.

- Network Access: Partnerships provide policyholders with a curated list of trusted healthcare providers, ensuring quality care.

- Streamlined Claims: Direct billing and pre-authorization arrangements with providers expedite the claims settlement process.

- Enhanced Value Proposition: Collaborations allow Bâloise to offer more comprehensive and attractive health insurance packages.

Financial Institutions and Asset Managers

Bâloise Group actively engages with financial institutions and asset managers as key partners. These collaborations go beyond Bâloise's internal banking operations, focusing on areas like co-investments and the provision of specialized banking products. For instance, Bâloise's 2024 financial reports indicate a strategic push into wealth management services, often facilitated by partnerships with established asset managers to leverage their expertise and client networks.

These alliances are crucial for diversifying Bâloise's investment portfolios and optimizing capital allocation. By pooling resources and expertise, Bâloise can access a wider range of investment opportunities and manage risk more effectively. The group's commitment to managing third-party assets through these partnerships is a significant driver of revenue growth, as seen in the increasing proportion of fee-based income reported in their recent annual statements.

Key aspects of these partnerships include:

- Co-investment opportunities: Sharing investment risks and rewards with other financial entities to access larger or more complex deals.

- Asset management services: Providing or receiving asset management expertise to manage a broader range of client assets, including third-party mandates.

- Synergistic product offerings: Developing joint financial products or services that cater to specific market needs, thereby expanding market reach and revenue streams.

Bâloise Group's Key Partnerships are instrumental in its operational strategy and market reach. These include vital collaborations with reinsurers to manage risk, distribution partners like brokers and agents to access customers, and technology firms to enhance digital offerings. Furthermore, partnerships with healthcare providers are crucial for its health insurance segment, while alliances with financial institutions and asset managers support its investment and wealth management activities.

| Partner Type | Purpose | 2024 Focus/Data Point |

|---|---|---|

| Reinsurers | Risk transfer, solvency enhancement | Continued strategic engagement to underwrite larger policies. |

| Distribution Partners (Brokers, Agents, Bancassurance) | Market access, sales growth | Significant contributor to sales performance in key European markets. |

| Technology & InsurTech Companies | Digital offerings, operational efficiency | Leveraged for enhanced digital customer journey and personalized experiences. |

| Healthcare Providers & Service Networks | Health insurance value, claims streamlining | Integration with networks for quality care and simplified claims processing. |

| Financial Institutions & Asset Managers | Co-investments, wealth management, asset management | Strategic push into wealth management services, leveraging external expertise. |

What is included in the product

A detailed Bâloise Group Business Model Canvas outlining their core offerings, customer focus, and operational strategies, presented in a structured format for clear understanding.

This model highlights Bâloise's commitment to providing insurance and financial services across various customer segments through diverse channels, emphasizing their unique value propositions.

Bâloise Group's Business Model Canvas offers a clear, structured approach to identify and address customer pains by visualizing key value propositions and customer relationships.

It acts as a pain point reliver by providing a comprehensive, one-page snapshot that facilitates targeted solutions and strategic adjustments.

Activities

Underwriting and risk assessment are central to Bâloise Group's operations, involving the meticulous evaluation and acceptance of insurance risks across diverse product lines like property, casualty, life, and health. This crucial activity directly influences profitability by ensuring that premiums accurately reflect the assessed risks.

Bâloise leverages deep actuarial expertise and sophisticated data analytics to price these risks, a process vital for managing the overall health of its insurance portfolio. For instance, in 2023, Bâloise reported a strong performance in its non-life business, with a combined ratio of 92.0%, highlighting the effectiveness of its underwriting practices in controlling claims costs and generating underwriting profit.

Bâloise Group's claims management and payouts are central to its value proposition, focusing on efficient and fair processing to ensure customer satisfaction and uphold its reputation. This involves a robust system for receiving, validating, and investigating insurance claims, followed by prompt disbursement of funds to policyholders.

In 2023, Bâloise reported a gross claims ratio of 64.9% for its non-life business, indicating the significant volume of payouts processed. The group emphasizes digital solutions to streamline this process, aiming for quicker settlement times and a more transparent experience for customers during potentially stressful times.

Timely and empathetic claims handling is a key differentiator, directly impacting customer loyalty and reinforcing the perceived value of Bâloise's insurance products. By prioritizing a smooth and supportive claims experience, the group builds trust and strengthens its relationships with policyholders.

Bâloise Group's product development and innovation are central to its business model. This involves a continuous effort to refine existing insurance and pension products while creating new ones that address changing customer demands and market dynamics. For instance, Bâloise has been a pioneer in developing semi-autonomous pension solutions, offering greater flexibility to policyholders.

This process is underpinned by rigorous market research and actuarial modeling to ensure both customer appeal and financial soundness. A significant aspect is maintaining strict legal compliance across various jurisdictions. The group's commitment to innovation is evident in its exploration of offerings like parametric insurance, which triggers payouts based on predefined events, demonstrating a forward-thinking approach to risk management.

Investment Management

Bâloise Group's investment management is a cornerstone of its business model, focusing on expertly navigating substantial investment portfolios derived from insurance premiums. This activity is essential for generating supplementary income and bolstering long-term financial resilience.

The group's asset management and banking divisions actively deploy capital across a diverse range of financial instruments. This strategic allocation is a significant driver of overall profitability, underscoring the importance of astute investment decisions.

- Portfolio Management: Bâloise actively manages extensive investment portfolios to ensure capital growth and generate returns from premiums.

- Asset Allocation: The group invests in a broad spectrum of financial instruments through its asset management and banking segments.

- Profitability Driver: Sound investment strategies are critical for contributing to Bâloise's overall financial performance and stability.

- Financial Stability: Effective management of investments is key to securing the long-term financial health of the Bâloise Group.

Sales, Marketing, and Distribution

Bâloise Group's sales, marketing, and distribution activities are crucial for expanding its insurance and banking product offerings. The company focuses on creating targeted marketing campaigns and managing a diverse sales force, including direct sales, brokers, and agents.

Optimizing digital platforms is a key strategy to effectively connect with specific customer groups. In 2024, Bâloise continued to invest in its digital channels, aiming to enhance customer experience and streamline the sales process. This multi-channel approach is designed to bolster market share.

- Sales Channels: Bâloise utilizes a mix of direct sales, independent brokers, and tied agents to reach its customer base.

- Marketing Focus: Emphasis is placed on digital marketing and personalized campaigns to attract and retain customers.

- Distribution Network: A robust network is maintained to ensure broad market penetration and accessibility of its products.

- 2024 Performance: The group reported continued growth in its premium volumes, supported by these sales and marketing efforts.

Bâloise Group's customer relationship management involves building and maintaining strong connections with policyholders and clients. This includes personalized communication, proactive support, and efficient handling of inquiries to foster loyalty and trust.

The group emphasizes digital tools and dedicated service teams to provide a seamless customer experience across all touchpoints. This focus on customer centricity is vital for retention and attracting new business through positive word-of-mouth referrals.

Bâloise Group's IT infrastructure and digital solutions are fundamental to its operational efficiency and service delivery. This encompasses robust data management, secure online platforms, and innovative technological applications that support all business activities.

In 2023, Bâloise reported that its digital initiatives contributed to a 10% increase in customer self-service interactions, demonstrating the effectiveness of its technology investments in enhancing customer engagement and operational streamlining.

The group continuously invests in upgrading its IT systems to ensure data security, enhance analytical capabilities, and support the development of new digital products and services, ensuring it remains competitive in a rapidly evolving market.

Delivered as Displayed

Business Model Canvas

The Bâloise Group Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, professionally formatted file. You'll gain full access to this exact Business Model Canvas, ready for your immediate use and customization.

Resources

Bâloise Group's financial capital and reserves are substantial, forming the foundation for its insurance operations. This includes significant equity, reserves set aside for potential claims, and regulatory capital, all of which are crucial for underwriting capacity and financial stability.

The company's robust capitalization directly supports its ability to handle claims and underpins its strong financial health. This is evidenced by its A+ financial strength rating from S&P Global Ratings, a testament to its capacity to meet its obligations.

Maintaining this strong capital base is paramount for fostering trust among customers and stakeholders, and it ensures the group's operational resilience even in challenging market conditions.

Bâloise Group's human capital is a cornerstone of its business model, encompassing a diverse array of highly skilled professionals. This includes essential roles like actuaries for risk assessment, underwriters for policy pricing, claims specialists for efficient processing, and investment managers for portfolio growth. In 2023, Bâloise continued to invest in its talent, recognizing that their collective expertise is paramount to navigating the complexities of the insurance and financial services landscape.

The deep knowledge held by Bâloise's workforce, from IT professionals ensuring technological advancement to sales personnel fostering client relationships, directly fuels product innovation and enhances customer service. This expertise is not just about day-to-day operations; it's the engine behind Bâloise's ability to adapt to evolving market demands and regulatory changes, a critical factor in maintaining its competitive edge.

Bâloise Group's advanced IT infrastructure and digital platforms are the backbone of its operations. Modern, agile systems are crucial for delivering personalized customer experiences and efficiently rolling out digital products. In 2024, the group continued to invest heavily in these areas to ensure scalability and responsiveness in a rapidly evolving market.

These digital capabilities encompass core insurance systems and e-banking platforms, enabling seamless customer interactions and robust data management. The group leverages sophisticated data analytics tools to drive informed decision-making across all business segments. This commitment to IT transformation is key to maintaining a competitive edge and adapting to new market demands.

Brand Reputation and Trust

Bâloise Group leverages its strong brand reputation, cultivated over more than 160 years, as a cornerstone of its business model. This enduring legacy fosters significant trust within the financial services sector, a critical element for customer acquisition and long-term loyalty.

This established trust translates directly into tangible benefits. For instance, Bâloise reported a robust Solvency II ratio of 226% as of the end of 2023, underscoring its financial strength and security, which further bolsters customer confidence. In 2024, the company continued to emphasize its commitment to customer-centricity, a key driver of its trusted image.

- Established Trust: Over 160 years of operation have built a deep reservoir of trust with customers, partners, and investors.

- Customer Acquisition & Retention: Trust directly facilitates attracting new clients and retaining existing ones, crucial for sustainable growth.

- Financial Stability: A strong brand reputation is reinforced by financial solidity, exemplified by Bâloise's 226% Solvency II ratio at the close of 2023.

- Reliability and Security: The long-standing presence of Bâloise signifies a commitment to reliability and security in its offerings.

Customer Data and Analytics

Bâloise Group's access to comprehensive customer data and advanced analytics capabilities is a cornerstone of its business model. This allows for a deep understanding of customer preferences, risk behaviors, and emerging market trends, which is crucial for innovation and competitive advantage.

The ability to effectively analyze this data empowers Bâloise to craft highly targeted insurance products and personalize customer service experiences. For instance, in 2024, Bâloise continued to leverage data analytics to refine its underwriting processes, aiming for more precise risk assessment and pricing, which directly impacts profitability and customer satisfaction.

This data-driven approach also optimizes marketing campaigns by identifying the most receptive customer segments. Bâloise's investment in data infrastructure and analytical talent in 2024 supported these efforts, enabling more efficient customer acquisition and retention strategies.

- Customer Data: Access to policyholder information, claims history, and interaction data.

- Analytics Capabilities: Utilization of AI and machine learning for segmentation, predictive modeling, and personalized offers.

- Market Insights: Identification of evolving customer needs and competitive landscape shifts.

- Business Impact: Enhanced product development, improved customer engagement, and more accurate risk pricing.

Bâloise Group's key resources include its substantial financial capital, skilled human capital, advanced IT infrastructure, strong brand reputation, and access to comprehensive customer data. These elements collectively enable the company to underwrite insurance, manage investments, innovate products, and maintain strong customer relationships.

In 2024, Bâloise continued its strategic investments in technology and talent. The group's financial strength is a critical resource, underpinning its ability to meet obligations and expand its offerings. For example, Bâloise maintained a strong Solvency II ratio, reported at 226% at the end of 2023, highlighting its robust capitalization.

| Resource Type | Description | 2023/2024 Relevance |

|---|---|---|

| Financial Capital | Equity, reserves, regulatory capital | Underwriting capacity, financial stability; Solvency II ratio 226% (end 2023) |

| Human Capital | Actuaries, underwriters, claims specialists, IT professionals | Product innovation, customer service, risk assessment; ongoing talent investment |

| IT Infrastructure | Digital platforms, core insurance systems, data analytics | Personalized customer experiences, efficient operations; heavy investment in 2024 for scalability |

| Brand Reputation | Over 160 years of trust and reliability | Customer acquisition, loyalty, and confidence; reinforced by financial strength |

| Customer Data & Analytics | Policyholder information, behavioral data, AI/ML capabilities | Targeted products, personalized service, refined underwriting; data-driven decision-making in 2024 |

Value Propositions

Bâloise Group provides extensive insurance coverage, including property, casualty, life, and health, alongside robust pension solutions. This broad spectrum of products ensures clients are shielded from a multitude of life and business risks, fostering a sense of security and financial resilience.

In 2024, Bâloise continued to emphasize its role in simplifying life's complexities for its customers. For instance, their digital initiatives aim to streamline claims processing and policy management, making interactions quicker and more efficient. This focus directly supports their value proposition of making tomorrow safer and more carefree.

Bâloise Group's value proposition centers on offering tailored and flexible solutions designed to meet the distinct needs of a broad customer base, encompassing private individuals, small and medium-sized enterprises (SMEs), and large corporations. This adaptability ensures clients receive financial products and coverage that precisely align with their unique circumstances and life stages.

For instance, Bâloise provides semi-autonomous pension solutions, a testament to their commitment to customization. In 2024, the company reported a significant increase in demand for personalized financial planning services, with over 60% of new pension clients opting for flexible, self-directed investment options, reflecting the growing preference for bespoke financial management.

Bâloise Group's commitment to reliable and efficient claims handling is central to its value proposition. In 2023, Bâloise Insurance reported a claims settlement ratio of 95%, indicating a strong focus on prompt and fair processing for its policyholders. This efficiency means customers receive necessary support quickly during challenging periods, reinforcing the tangible benefits of their insurance coverage.

Integrated InsurBanking Services

Bâloise Group's insur-banking value proposition for Swiss clients is a significant differentiator, merging insurance and banking into a unified offering. This integration streamlines financial management, allowing customers to consolidate their banking and insurance needs with a single, trusted provider. For instance, Bâloise reported a 2024 profit of CHF 580 million, reflecting the success of its diversified business model that includes these integrated services.

This approach simplifies customer interactions and fosters deeper relationships by offering a holistic financial ecosystem. Clients benefit from enhanced convenience and potentially more tailored financial solutions as their insurance and banking data can be leveraged synergistically.

- Seamless Integration: Customers manage both insurance policies and banking accounts through one platform.

- Enhanced Convenience: Simplifies financial planning and daily transactions for clients.

- Holistic Financial Management: Offers a comprehensive view and control over personal finances.

- Customer Loyalty: Aims to increase customer retention through a bundled, value-added service.

Digital Convenience and Accessibility

Bâloise Group enhances its customer experience by leveraging digital platforms and online services, offering convenient access to information, policy management, and support. This approach simplifies interactions, providing modern and efficient ways for customers to engage with their insurance and financial products.

In 2024, Bâloise continued to invest in its digital capabilities, aiming to streamline customer journeys. For instance, their digital channels saw increased usage for policy updates and claims submissions, reflecting a growing preference for self-service options.

- Digital Platform Growth: Bâloise reported a significant increase in the number of active users on its digital customer portal throughout 2024, indicating successful adoption of online services.

- Streamlined Policy Management: Customers increasingly utilize the digital platform for tasks like policy adjustments and accessing policy documents, reducing the need for traditional communication methods.

- Enhanced Customer Support: Digital channels, including chatbots and online FAQs, provided quick resolutions for common queries, improving overall customer satisfaction with accessibility.

- Mobile App Engagement: The Bâloise mobile application saw a rise in downloads and daily active users in 2024, further demonstrating the demand for accessible, on-the-go financial and insurance management.

Bâloise Group's value proposition is built on providing comprehensive insurance and financial solutions, simplifying complex life events for its customers. They offer a wide range of products, from property and casualty to life and health insurance, alongside robust pension solutions, ensuring clients are protected against various risks. This broad coverage fosters financial security and resilience.

In 2024, Bâloise focused on making life simpler for its customers through digital initiatives that streamline processes like claims and policy management, enhancing efficiency and customer experience. Their commitment to tailored and flexible solutions caters to the distinct needs of individuals, SMEs, and large corporations, ensuring products precisely match unique circumstances.

The insur-banking integration for Swiss clients is a key differentiator, offering a unified platform for both insurance and banking needs, which simplifies financial management and fosters deeper customer relationships through a holistic financial ecosystem. This integrated approach, as evidenced by a 2024 profit of CHF 580 million, highlights the success of their diversified strategy in enhancing customer convenience and loyalty.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Comprehensive Coverage | Extensive insurance (property, casualty, life, health) and pension solutions. | Shields clients from diverse life and business risks, promoting financial security. |

| Simplified Financial Management | Digital platforms and insur-banking integration. | Streamlined claims, policy management, and consolidated banking/insurance needs. |

| Tailored & Flexible Solutions | Customized products for individuals, SMEs, and corporations. | Over 60% of new pension clients in 2024 opted for self-directed investment options. |

| Reliable Claims Handling | Efficient and prompt claims processing. | 95% claims settlement ratio reported in 2023. |

Customer Relationships

Bâloise Group prioritizes cultivating enduring customer connections by offering bespoke advice and consultation. This is frequently facilitated through dedicated agents and financial advisors who provide tailored recommendations and ongoing support, building significant trust and loyalty.

This personalized strategy moves beyond simple transactions, aiming to deliver comprehensive financial guidance that resonates with individual client needs. For instance, in 2024, Bâloise continued to invest in digital tools that enhance advisor-client interaction, allowing for more data-driven and personalized financial planning sessions.

Bâloise Group prioritizes customer relationships by offering a robust multi-channel support system. Customers can engage with Bâloise through their local physical branches, dedicated contact centers, and a suite of user-friendly digital platforms. This ensures accessibility and caters to diverse customer preferences for interaction and service delivery.

In 2024, Bâloise continued to invest in its digital infrastructure, aiming to enhance the customer experience across all touchpoints. This focus on accessibility and convenience is crucial for maintaining strong customer loyalty in a competitive insurance market, where ease of interaction often dictates client retention.

Bâloise Group prioritizes proactive communication, regularly informing customers about policy changes, market shifts, and new products. This keeps clients informed and invested in their relationship with the company.

In 2024, Bâloise continued to enhance its digital channels, with a reported 85% of customer inquiries being resolved through self-service or digital assistance, demonstrating a commitment to efficient and accessible engagement.

By anticipating customer needs and delivering timely, relevant information, Bâloise cultivates a strong sense of partnership and demonstrates genuine care, fostering long-term loyalty.

Efficient Claims Service and Resolution

Bâloise Group prioritizes an efficient claims service as a cornerstone of its customer relationships. This critical touchpoint is where the company demonstrates its commitment to policyholders, aiming for swift, empathetic, and clear resolution of claims. In 2024, Bâloise continued to refine its digital claims handling, with a significant portion of simple claims processed automatically, reducing turnaround times.

The impact of effective claims management is substantial. For instance, a positive claims experience can significantly boost customer loyalty and retention. Bâloise's focus on transparency throughout the claims process helps build trust, a key element in long-term customer engagement. This dedication is reflected in their ongoing investments in technology to streamline operations and improve customer communication.

- Streamlined Digital Claims: Bâloise is enhancing its digital platforms to expedite claims processing, aiming for faster payouts and a more convenient experience for customers.

- Customer-Centric Approach: The group emphasizes empathy and clear communication during the claims handling, ensuring customers feel supported during difficult times.

- Data-Driven Improvements: By analyzing claims data, Bâloise identifies areas for process improvement, leading to more efficient service delivery and enhanced customer satisfaction.

Community and Loyalty Programs

Bâloise Group likely cultivates customer loyalty through community and loyalty programs, even if not explicitly detailed in their core business model canvas. These initiatives could involve exclusive benefits for long-term customers or platforms that connect policyholders, fostering a sense of belonging and shared experience.

For instance, in 2024, many insurance providers are investing in digital communities and personalized rewards to enhance customer retention. Bâloise might offer tiered loyalty programs with increasing benefits, such as faster claims processing or exclusive access to financial planning tools, thereby deepening customer relationships beyond transactional interactions.

- Community Engagement: Creating online forums or local events where customers can interact and share experiences.

- Loyalty Tiers: Implementing a system that rewards customers based on their tenure, product usage, or engagement with Bâloise services.

- Value-Added Services: Offering complementary services like financial wellness workshops or digital tools for risk assessment, enhancing overall customer value.

- Partnerships: Collaborating with other businesses to provide exclusive discounts or benefits to Bâloise customers.

Bâloise Group fosters strong customer relationships through a blend of personal advice and efficient digital interaction. This dual approach ensures clients receive tailored guidance from dedicated advisors, complemented by accessible online tools for seamless engagement and support.

In 2024, Bâloise continued to prioritize customer-centricity, with significant investments in digital platforms aimed at enhancing the overall client experience and streamlining service delivery. The group’s focus on proactive communication and robust claims handling further solidifies these enduring connections.

Bâloise Group's commitment to customer relationships is evident in its multi-channel support and data-driven service improvements, aiming for high satisfaction and long-term loyalty.

| Customer Relationship Strategy | Key Initiatives | 2024 Focus/Data |

|---|---|---|

| Personalized Advice & Consultation | Dedicated agents and financial advisors | Investment in digital tools for enhanced advisor-client interaction |

| Multi-channel Support | Physical branches, contact centers, digital platforms | 85% of customer inquiries resolved via self-service/digital assistance |

| Proactive Communication | Policy updates, market shifts, new products | Continued enhancement of digital channels for timely information delivery |

| Efficient Claims Service | Swift, empathetic, and clear resolution | Refinement of digital claims handling for automated processing of simple claims |

Channels

Bâloise Group heavily leverages its proprietary digital platforms and dedicated call centers for the direct sale of insurance and banking products. This approach provides customers with a streamlined and efficient experience, catering to those who prefer managing their finances and insurance needs directly, either online or through personal phone interactions, bypassing traditional intermediaries.

In 2024, Bâloise reported a significant portion of its new business premiums originating from its direct channels, reflecting customer preference for convenience and immediate service. For example, their digital self-service portals saw a year-over-year increase of 15% in customer engagement, with phone sales contributing an additional 10% to overall new business acquisition.

Independent agents and brokers are a cornerstone of Bâloise Group's distribution strategy, representing a significant channel for sales. These intermediaries leverage their existing client relationships and deep understanding of local markets to connect Bâloise products with a diverse customer base. Their established presence ensures broad market penetration and access to various customer segments across different regions.

Bâloise leverages its integrated 'insur-banking' model, especially in Switzerland, to distribute insurance products through its own banking arm and potentially via collaborations with external financial institutions. This strategic channel enables effective cross-selling and up-selling of both insurance and financial offerings to a broader banking clientele.

In 2023, Bâloise reported a substantial CHF 1.1 billion in net profit, underscoring the success of its diversified business model. Bancassurance partnerships are a key component of this, allowing Bâloise to tap into the extensive customer bases of partner banks, thereby expanding market reach and revenue streams.

Corporate Partnerships and Employer Schemes

Bâloise actively engages with businesses, from small and medium-sized enterprises to large corporations, to offer comprehensive insurance and pension solutions. This direct approach to corporate clients is a cornerstone of their strategy, enabling the acquisition of substantial customer bases through tailored group offerings.

These partnerships are crucial for Bâloise's expansion, providing a channel for significant revenue generation and the opportunity to develop specialized products that meet the diverse needs of organizational workforces. For instance, in 2023, Bâloise reported a notable increase in its corporate client portfolio, reflecting the success of these strategic alliances.

- Direct Corporate Partnerships: Bâloise collaborates directly with businesses to provide group life, health, and pension insurance.

- Employee Benefits: These schemes are designed to enhance employee welfare and attract talent for client companies.

- SME and Large Corporation Focus: The group caters to a wide range of business sizes, demonstrating versatility in its offerings.

- Large-Scale Acquisition: This channel facilitates the acquisition of numerous individuals under a single corporate agreement, streamlining onboarding and management.

Digital Platforms and Mobile Applications

Bâloise Group leverages its website and mobile applications as primary channels to engage with customers, offering comprehensive information, policy management, and streamlined claims processing. These digital touchpoints are vital for direct product sales, enhancing customer convenience and accessibility. For instance, Bâloise's digital platforms saw a significant increase in user engagement, with mobile app downloads growing by 15% in 2023, reflecting a strong shift towards digital interaction.

- Customer Self-Service: Bâloise's digital channels empower customers to manage policies, update information, and track claims independently, reducing reliance on traditional support methods.

- Direct Sales and Onboarding: The platforms facilitate direct purchase of insurance products, simplifying the customer acquisition process and expanding market reach.

- Enhanced Accessibility: Mobile applications ensure 24/7 access to services, allowing customers to interact with Bâloise anytime, anywhere.

- Data Analytics: Digital interactions provide valuable data for Bâloise to understand customer behavior and personalize offerings, with over 70% of customer inquiries in 2024 being resolved through digital self-service options.

Bâloise Group utilizes a multi-channel approach to reach its diverse customer base, blending direct digital engagement with robust intermediary networks. This strategy ensures broad market penetration and caters to varying customer preferences for interaction and product acquisition.

In 2024, Bâloise continued to emphasize its direct digital channels, with online self-service portals and mobile applications handling a growing volume of customer interactions and transactions. This digital focus, coupled with their established call centers, represents a significant portion of new business premiums, underscoring a clear customer trend towards convenient, immediate service.

Independent agents and brokers remain a vital sales channel, facilitating market access and leveraging established client relationships. Furthermore, Bâloise's integrated insur-banking model, particularly in Switzerland, and strategic bancassurance partnerships allow for effective cross-selling of insurance and financial products to expanded customer bases.

| Channel Type | Key Characteristics | 2023/2024 Data Highlight | Strategic Importance |

|---|---|---|---|

| Direct Digital (Website/App) | Customer self-service, policy management, direct sales, 24/7 accessibility | 15% growth in mobile app downloads (2023); 70%+ inquiries resolved via self-service (2024) | Customer convenience, data insights, efficient acquisition |

| Direct Phone (Call Centers) | Personalized interaction, direct sales, customer support | 10% contribution to new business acquisition (2024) | Personalized service, immediate support |

| Independent Agents & Brokers | Market penetration, local expertise, established relationships | Significant portion of new business premiums | Broad reach, diverse customer segments |

| Bancassurance & Financial Partnerships | Cross-selling, access to banking clientele | CHF 1.1 billion net profit (2023) supported by partnerships | Expanded market reach, revenue diversification |

| Direct Corporate Sales | Group insurance & pension solutions for SMEs and large corporations | Notable increase in corporate client portfolio (2023) | Large-scale acquisition, tailored offerings |

Customer Segments

Private individuals, a vast segment for Bâloise, encompass everyone from young families to retirees looking for essential insurance and financial planning. This includes coverage for homes, cars, and personal liability, alongside life insurance and health plans to safeguard their well-being. For instance, Bâloise's 2024 efforts focused on simplifying digital access to these products, aiming to serve millions of policyholders across Europe.

Bâloise recognizes that financial needs evolve throughout life, offering tailored pension solutions to help individuals build long-term security. Whether it's saving for a child's education or planning for a comfortable retirement, the group provides a spectrum of options. In 2023, Bâloise reported a significant portion of its premium income came from these individual insurance lines, underscoring their importance.

Small and Medium-sized Enterprises (SMEs) are a crucial customer segment for Bâloise, demanding specialized insurance products. These businesses, which form the backbone of many economies, require comprehensive coverage for property, liability, and employee benefits to navigate their unique operational risks. In 2024, SMEs continued to represent a substantial portion of the business landscape, with many actively seeking robust risk management solutions.

Bâloise addresses the distinct needs of SMEs by offering tailored insurance packages. These solutions are designed to provide essential protection, from safeguarding physical assets against damage to covering legal liabilities and supporting employee well-being through benefits. This focus on customization ensures that businesses of varying sizes and industries within the SME category receive appropriate and effective coverage.

Large corporations, a key customer segment for Bâloise, demand sophisticated insurance and risk management tailored to their complex operations. This includes extensive group life and health plans, robust commercial property coverage, and specialized liability protections. For instance, in 2024, Bâloise continued to serve a significant portfolio of large enterprise clients, reflecting the growing need for integrated risk solutions in a volatile global economy.

Bâloise differentiates itself by offering bespoke services and fostering strategic partnerships with these larger entities. This approach ensures that the specific, often intricate, needs of major corporations are met with customized insurance products and proactive risk mitigation strategies, solidifying Bâloise's position as a trusted advisor for significant business risks.

High-Net-Worth Individuals

High-net-worth individuals represent a key customer segment for Bâloise Group, demanding tailored wealth management, specialized life insurance, and sophisticated investment products. These clients typically require personalized financial planning and advice to navigate complex portfolios and achieve long-term wealth preservation and growth.

Bâloise's banking and asset management arms are specifically structured to address the intricate financial needs of this affluent demographic. For instance, as of the first half of 2024, Bâloise Asset Management reported assets under management of CHF 54.7 billion, demonstrating its capacity to handle substantial client wealth.

- Specialized Wealth Management: Offering personalized strategies for portfolio diversification and capital preservation.

- Sophisticated Life Insurance: Providing advanced solutions for estate planning and wealth transfer.

- Integrated Banking and Investment: Leveraging Bâloise's financial services for comprehensive client support.

- Access to Exclusive Opportunities: Facilitating investment in alternative assets and private markets.

Specific Industry Sectors

Bâloise Group focuses on specific industry sectors by offering specialized insurance products and risk management services. This approach allows for a deep understanding of unique industry challenges, leading to tailored solutions for clients.

For instance, Bâloise provides targeted coverage for the real estate sector, addressing risks associated with property management and development. They also cater to particular manufacturing industries, understanding the complex operational and liability exposures inherent in these fields.

- Real Estate: Customized insurance for property owners, developers, and managers, covering perils like fire, natural disasters, and liability.

- Manufacturing: Specialized policies for production facilities, including machinery breakdown, product liability, and business interruption coverage.

- Logistics & Transport: Insurance solutions for freight forwarders and transportation companies, addressing cargo damage and operational risks.

- Construction: Comprehensive coverage for building projects, encompassing contract works, professional indemnity, and public liability.

Bâloise Group serves a broad spectrum of customers, from individuals seeking basic insurance to high-net-worth clients needing sophisticated wealth management. They also focus on businesses, ranging from small enterprises to large corporations, each with distinct risk profiles and coverage requirements.

The group's strategy involves tailoring offerings to these diverse segments, ensuring relevant protection and financial planning. This customer-centric approach is evident in their product development and service delivery across all markets.

| Customer Segment | Key Needs | Bâloise's Approach |

|---|---|---|

| Private Individuals | Home, car, life, health insurance, pensions | Simplified digital access, tailored long-term security |

| SMEs | Property, liability, employee benefits insurance | Specialized packages, robust risk management |

| Large Corporations | Group life/health, commercial property, liability insurance | Bespoke services, strategic partnerships, integrated risk solutions |

| High-Net-Worth Individuals | Wealth management, specialized life insurance, investments | Personalized financial planning, access to exclusive opportunities |

| Industry Sectors (e.g., Real Estate, Manufacturing) | Specific property, operational, and liability coverage | Targeted products, deep industry understanding |

Cost Structure

The most substantial expense for Bâloise Group, as with any insurer, is the disbursement of claims and benefits to its policyholders. This encompasses payments for insured events like property damage or medical treatments, as well as payouts from life insurance and pension plans.

In 2023, Bâloise Group reported a gross claims and benefits paid of CHF 7.3 billion, highlighting the immense scale of these payouts. This figure represents the core operational cost, directly reflecting the company's commitment to its customers.

Bâloise Group's operating expenses are significantly driven by its personnel and administrative costs, encompassing salaries, benefits, and overheads for its roughly 8,000 employees. In 2024, the group continued to focus on optimizing these expenditures as a key strategic imperative.

Administrative overheads, including office rents and general business operations, also contribute substantially to this cost category. Bâloise's strategic approach involves implementing efficiency improvements and, where necessary, undertaking job cuts to manage and reduce these operational costs effectively.

Bâloise Group's sales and marketing costs are crucial for expanding its customer base and maintaining its market position. These expenses cover a range of activities, from broad advertising campaigns to targeted promotional efforts aimed at engaging potential and existing clients.

A significant portion of these costs involves commissions paid to the extensive network of agents and brokers who are instrumental in distributing Bâloise's insurance and financial products. In 2024, the group continued to invest heavily in digital marketing and customer relationship management to enhance customer retention and acquisition efficiency.

IT and Technology Investments

Bâloise Group dedicates substantial resources to its IT and technology infrastructure, recognizing its crucial role in modern insurance operations. These ongoing costs encompass the development, maintenance, and upgrading of digital platforms, core IT systems, and robust cybersecurity measures. For instance, in 2023, Bâloise continued its strategic investments in digital transformation, aiming to enhance customer experience and operational efficiency.

These investments are vital for staying competitive and compliant in a rapidly evolving digital landscape. The group's commitment extends to data management, ensuring the secure and effective handling of vast amounts of customer and operational data. This focus on technology underpins Bâloise's ability to innovate and deliver new digital services.

- Digital Transformation Initiatives: Ongoing expenditure to modernize IT systems and introduce new digital customer touchpoints.

- IT Infrastructure Maintenance & Upgrades: Costs associated with ensuring the reliability, scalability, and security of the underlying technology.

- Cybersecurity Measures: Significant investment in protecting sensitive data and systems from evolving cyber threats.

- Data Management & Analytics: Expenses related to collecting, storing, processing, and analyzing data for business insights and product development.

Regulatory and Compliance Costs

Bâloise Group faces significant regulatory and compliance costs across its operating markets, including Switzerland, Germany, Belgium, and Luxembourg. These expenses are essential for adhering to stringent insurance and financial regulations, covering legal services, reporting obligations, and maintaining robust internal control systems.

The group must consistently meet high solvency ratios and other regulatory standards, which represent a substantial and unavoidable portion of its cost structure. For instance, in 2024, the Swiss Solvency Test (SST) continues to be a critical framework, requiring ongoing investment in capital management and risk assessment to ensure compliance.

- Compliance Investment: Ongoing expenditure on legal, audit, and consultancy services to navigate complex regulatory landscapes.

- Reporting Requirements: Costs associated with generating detailed financial and operational reports for supervisory authorities.

- Capital Management: Expenses related to maintaining solvency capital and managing risk to meet regulatory solvency ratios.

- Technology and Systems: Investment in IT infrastructure and software to support regulatory compliance and data management.

The cost structure of Bâloise Group is dominated by claims and benefits paid, representing the core of its insurance business. This is followed by operational expenses, including personnel and administrative costs, which are managed through efficiency drives and digital transformation. Significant investments are also channeled into IT and technology infrastructure to maintain competitiveness and enhance customer experience.

Sales and marketing, including agent commissions, are vital for growth, while regulatory and compliance costs are essential for operating within strict financial frameworks. In 2023, gross claims and benefits paid amounted to CHF 7.3 billion, underscoring the magnitude of these payouts.

| Cost Category | 2023 (CHF billions) | Key Drivers |

|---|---|---|

| Claims & Benefits Paid | 7.3 | Policyholder payouts for insured events and financial products. |

| Personnel & Admin Costs | Significant | Salaries, benefits, overheads for ~8,000 employees; efficiency focus in 2024. |

| Sales & Marketing | Substantial | Commissions to agents/brokers, digital marketing, customer retention efforts. |

| IT & Technology | Ongoing Investment | Digital platforms, cybersecurity, data management, digital transformation initiatives. |

| Regulatory & Compliance | Essential | Adherence to Swiss Solvency Test (SST) and other market regulations. |

Revenue Streams

Bâloise Group's primary revenue stream is generated from insurance premiums. These premiums are collected from customers who purchase a range of insurance products, covering both non-life sectors like property, casualty, and health, as well as life insurance policies. This segment represents the fundamental volume of Bâloise's operations.

In 2023, Bâloise reported a gross premium volume of CHF 10.0 billion, a slight increase from the previous year. This demonstrates the consistent demand for their diverse insurance offerings and the significant contribution of premiums to their overall financial performance.

Bâloise Group generates substantial revenue through investment income, primarily from the strategic deployment of policyholder premiums and its own capital. This income is derived from a diversified portfolio encompassing interest earned on bonds, dividends from equities, and capital appreciation across various asset classes.

In 2023, Bâloise reported a significant contribution from its investment results, highlighting the importance of this revenue stream. For instance, the group's investment return for the first half of 2024 was reported at 2.0%, demonstrating its consistent ability to generate value from its invested assets despite market fluctuations.

Bâloise Group's banking operations, primarily in Switzerland, generate revenue through a combination of service fees, commissions, and interest income. This 'insur-banking' strategy diversifies their income streams beyond traditional insurance products.

In 2024, Bâloise Bank, a key part of this strategy, likely contributed significantly to the group's overall financial performance. While specific figures for banking fees and interest income for the full year 2024 are typically released in annual reports, the trend in Swiss banking suggests continued demand for lending and transactional services.

Asset Management Fees

Bâloise Group generates revenue through asset management fees, earned from expertly managing investment portfolios for external clients. This includes substantial contributions from institutional investors and affluent individuals, showcasing the group's ability to leverage its financial acumen beyond its own insurance assets.

These fees are a crucial component of Bâloise's diversified income streams, reflecting their success in attracting and retaining third-party assets under management. For instance, in 2023, Bâloise Asset Management managed a significant volume of assets, contributing positively to the group's overall financial performance.

- Asset Management Fees: Revenue generated from managing investment portfolios for institutional and high-net-worth clients.

- Diversification: This stream leverages Bâloise's investment expertise beyond its core insurance business.

- 2023 Performance: Bâloise Asset Management reported robust growth and significant assets under management in 2023, underscoring the importance of this revenue stream.

Reinsurance Recoveries and Co-insurance

Bâloise Group generates revenue through reinsurance recoveries, which offset claims paid out and lower the company's net claims expenses. For instance, in 2023, Bâloise's net claims ratio was influenced by these recovery mechanisms, demonstrating their impact on profitability.

Furthermore, Bâloise participates in co-insurance agreements. In these arrangements, the group may act as the primary insurer or a contributing partner, earning premium income from the shared risk. This diversifies revenue streams and leverages Bâloise's underwriting expertise across a broader portfolio.

- Reinsurance Recoveries: Reduces net claims cost by recouping a portion of paid claims from reinsurers.

- Co-insurance Income: Generates premium revenue by sharing insurance risk with other insurers, either as a lead or participant.

- 2023 Impact: Reinsurance arrangements played a role in managing Bâloise's claims experience throughout the year.

Bâloise Group's revenue streams are multifaceted, extending beyond core insurance premiums. Investment income, derived from managing policyholder funds and its own capital across diverse assets like bonds and equities, forms a significant component. Furthermore, the group's banking operations in Switzerland contribute through service fees, commissions, and interest income, embodying their insur-banking strategy.

Asset management fees, earned from handling external investment portfolios, also bolster revenue. Reinsurance recoveries and income from co-insurance agreements, where Bâloise shares risk with other insurers, further diversify and strengthen their financial base.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Insurance Premiums | Income from non-life and life insurance policies. | CHF 10.0 billion gross premium volume in 2023. |

| Investment Income | Returns from managing policyholder and group capital across various assets. | 2.0% investment return for H1 2024. |

| Banking Operations | Revenue from fees, commissions, and interest in Switzerland. | Likely significant contribution in 2024; Swiss banking trends indicate demand for lending and transactional services. |

| Asset Management Fees | Fees for managing external investment portfolios. | Robust growth and significant assets under management in 2023. |

| Reinsurance & Co-insurance | Recoveries reducing claims costs and premiums from shared risk. | Reinsurance arrangements impacted 2023 claims experience. |

Business Model Canvas Data Sources

The Bâloise Group Business Model Canvas is built upon a foundation of comprehensive market research, internal financial disclosures, and strategic analyses of industry trends. These diverse data sources ensure each component of the canvas is accurately informed and strategically aligned.