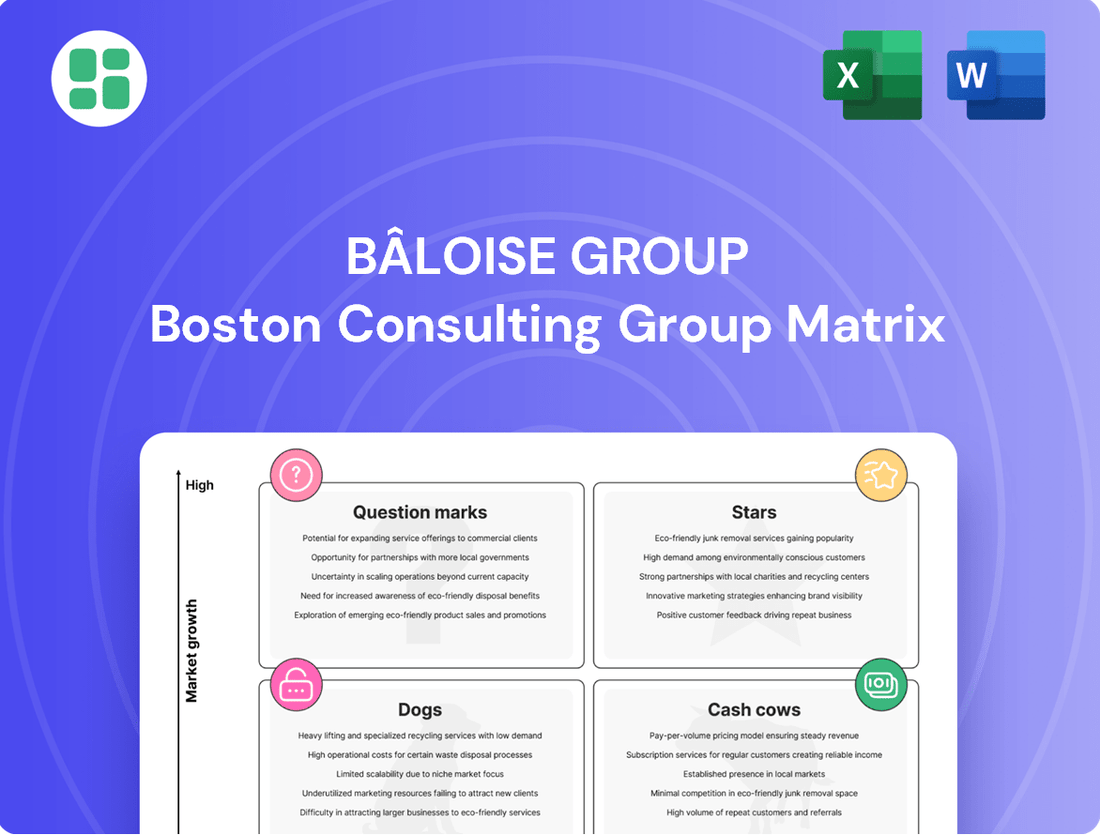

Bâloise Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Curious about the Bâloise Group's strategic positioning? This glimpse into their BCG Matrix reveals which business units are driving growth and which might need a closer look. Unlock the full potential of this analysis by purchasing the complete report to gain detailed quadrant placements and actionable insights for optimizing Bâloise's portfolio.

Stars

Bâloise's insurbanking model in Switzerland, a unique blend of insurance and banking, is a standout performer within the BCG matrix. This integrated offering has resonated strongly with customers, driving substantial growth.

In 2024, Bâloise achieved a significant milestone, with its banking sales volume surpassing CHF 1 billion for the first time. This impressive figure highlights the model's increasing market acceptance and Bâloise's strong position in this expanding financial sector.

The success of the insurbanking model, evidenced by its expansion and profit growth, firmly places it in the star category. It represents a high-growth, high-market-share business for Bâloise, demonstrating considerable potential for continued success.

The non-life insurance business in Switzerland, a cornerstone of the Bâloise Group, demonstrated remarkable resilience and growth in 2024. Premium volume saw a healthy uptick of 1.1%, underscoring its stable market presence.

Significantly, the combined ratio improved to a strong 92.5%, indicating efficient operations and robust profitability. This core segment, encompassing motor vehicle, property, accident, and health insurance, consistently delivers substantial earnings.

Its leadership in the vital Swiss home market, coupled with consistent growth, firmly establishes the non-life segment as a Star in the BCG Matrix. This position highlights its ability to generate significant profits even amidst market fluctuations and competitive pressures.

The Perspectiva Collective Foundation, Bâloise Group's semi-autonomous pension solution, demonstrated remarkable growth in 2024. It saw a significant 20% surge in assets under management, alongside an increase in both corporate clients and policyholders.

This robust expansion highlights the increasing market demand for adaptable occupational pension offerings. The foundation's continued growth and growing financial contribution solidify its position as a high-growth product with an expanding market share.

Digitalization of Core Customer Interactions

Bâloise Group's commitment to digitalizing core customer interactions is evident in its successful e-banking platform launch, recognized with an award. This digital advancement, coupled with the innovative #GrandTheftInsurance marketing campaign, signifies a strong push in transforming customer engagement.

These strategic moves not only elevate the customer experience but also boost operational efficiency, reinforcing Bâloise's competitive edge. The high adoption rates and industry accolades underscore market validation and the company's dedication to staying ahead in the digital sphere.

- Award-winning e-banking platform

- #GrandTheftInsurance marketing campaign success

- Enhanced customer experience and operational efficiency

- Strengthened market position through digital innovation

Profitability Across Core European Markets

Bâloise Group demonstrated robust profitability in its core European markets throughout 2024. The company saw an uplift in earnings before interest and taxes (EBIT) from all its national subsidiaries, highlighting a healthy and diversified business model.

Key markets contributing to this growth included Switzerland, Germany, Belgium, and Luxembourg. Notably, Luxembourg experienced particularly strong performance, with its EBIT contribution growing by an encouraging 6.7%.

- Switzerland: Consistent positive EBIT contribution.

- Germany: Increased EBIT from a significant market presence.

- Belgium: Demonstrated growth in profitability.

- Luxembourg: Showcased robust growth with a 6.7% EBIT increase.

The insurbanking model in Switzerland, a unique blend of insurance and banking, is a standout performer within the BCG matrix. This integrated offering has resonated strongly with customers, driving substantial growth.

In 2024, Bâloise achieved a significant milestone, with its banking sales volume surpassing CHF 1 billion for the first time. This impressive figure highlights the model's increasing market acceptance and Bâloise's strong position in this expanding financial sector.

The success of the insurbanking model, evidenced by its expansion and profit growth, firmly places it in the star category. It represents a high-growth, high-market-share business for Bâloise, demonstrating considerable potential for continued success.

The non-life insurance business in Switzerland, a cornerstone of the Bâloise Group, demonstrated remarkable resilience and growth in 2024. Premium volume saw a healthy uptick of 1.1%, underscoring its stable market presence.

Significantly, the combined ratio improved to a strong 92.5%, indicating efficient operations and robust profitability. This core segment, encompassing motor vehicle, property, accident, and health insurance, consistently delivers substantial earnings.

Its leadership in the vital Swiss home market, coupled with consistent growth, firmly establishes the non-life segment as a Star in the BCG Matrix. This position highlights its ability to generate significant profits even amidst market fluctuations and competitive pressures.

The Perspectiva Collective Foundation, Bâloise Group's semi-autonomous pension solution, demonstrated remarkable growth in 2024. It saw a significant 20% surge in assets under management, alongside an increase in both corporate clients and policyholders.

This robust expansion highlights the increasing market demand for adaptable occupational pension offerings. The foundation's continued growth and growing financial contribution solidify its position as a high-growth product with an expanding market share.

Bâloise Group's commitment to digitalizing core customer interactions is evident in its successful e-banking platform launch, recognized with an award. This digital advancement, coupled with the innovative #GrandTheftInsurance marketing campaign, signifies a strong push in transforming customer engagement.

These strategic moves not only elevate the customer experience but also boost operational efficiency, reinforcing Bâloise's competitive edge. The high adoption rates and industry accolades underscore market validation and the company's dedication to staying ahead in the digital sphere.

| Business Segment | 2024 Performance Highlights | BCG Matrix Classification |

| Insurbanking (Switzerland) | Banking sales volume exceeded CHF 1 billion. | Star |

| Non-Life Insurance (Switzerland) | Premium volume grew by 1.1%; Combined ratio at 92.5%. | Star |

| Perspectiva Collective Foundation | Assets under management increased by 20%. | Star |

| Digitalization Initiatives (e-banking, marketing) | Award-winning platform, successful #GrandTheftInsurance campaign. | Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualizes Bâloise's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Bâloise's traditional property and casualty insurance, particularly in its core Swiss market, acts as a significant cash cow. These segments benefit from high market penetration and enduring demand, meaning they don't require substantial reinvestment to maintain their position.

The operational efficiency of these mature lines is underscored by an improved combined ratio in 2024, indicating strong profitability and consistent cash generation. This stability allows Bâloise to leverage these businesses for funding growth initiatives elsewhere.

Despite a dip in new premium volumes for traditional individual and group life insurance in 2024, Bâloise's substantial existing life insurance portfolio remains a reliable source of steady cash flow. These mature products, characterized by long-term contracts, provide predictable revenue streams and benefit from reduced new business acquisition costs.

The life insurance segment continued to be a major contributor to Bâloise's overall profitability in 2024, reinforcing its status as a core cash cow for the group. This stability is crucial for funding growth initiatives and maintaining financial strength.

Bâloise's asset management services, distinct from its Insurbanking growth, are a mature business. In 2024, these operations managed CHF 59.5 billion in assets. This segment is a reliable source of stable, fee-based income and consistent profits.

The focus here is on managing existing client assets rather than aggressively pursuing new business. While growth prospects are lower than in newer ventures, this stability makes asset management a dependable cash generator for the Bâloise Group.

Robust Capitalization and Cash Remittance

Bâloise Group's robust capitalization is a key indicator of its financial health, underscored by an A+ rating from S&P Global Ratings in June 2024. This strong capital position directly supports its classification as a cash cow within the BCG Matrix.

The company's ability to consistently generate and remit substantial cash further solidifies this status. In 2024, Bâloise Group achieved a significant cash remittance of CHF 565 million, highlighting its capacity for strong free cash flow generation.

- Strong Capital Base: An A+ rating from S&P Global Ratings in June 2024 confirms Bâloise's solid financial foundation.

- High Cash Remittance: CHF 565 million remitted in 2024 demonstrates excellent free cash flow generation.

- Financial Flexibility: This strong cash flow enables funding for new ventures, dividend payments, and operational stability.

- Cash Cow Characteristics: A focus on generating substantial cash and maintaining a high payout ratio reinforces its cash cow profile.

Core Underwriting Operations

Bâloise Group's core underwriting operations are a prime example of a Cash Cow. The continuous improvement in their combined ratio, which reached an impressive 92.9% in 2024, highlights exceptional efficiency in both underwriting and claims handling. This strong performance directly fuels robust profit margins and consistent cash flow generation from their foundational insurance business.

This segment represents a mature and highly optimized business process for Bâloise. It consistently delivers significant financial gains without requiring substantial new investments in its core infrastructure. The focus here is on maximizing returns from established market positions and operational expertise.

- Combined Ratio Improvement: Reached 92.9% in 2024, indicating superior underwriting and claims management.

- Profitability: High operational efficiency translates into strong profit margins.

- Cash Generation: Core insurance activities are a consistent and reliable source of cash.

- Low Investment Needs: Mature processes require minimal additional capital for growth.

Bâloise's traditional property and casualty insurance, particularly in its core Swiss market, acts as a significant cash cow. These segments benefit from high market penetration and enduring demand, meaning they don't require substantial reinvestment to maintain their position.

The operational efficiency of these mature lines is underscored by an improved combined ratio in 2024, indicating strong profitability and consistent cash generation. This stability allows Bâloise to leverage these businesses for funding growth initiatives elsewhere.

Bâloise Group's core underwriting operations are a prime example of a Cash Cow. The continuous improvement in their combined ratio, which reached an impressive 92.9% in 2024, highlights exceptional efficiency in both underwriting and claims handling. This strong performance directly fuels robust profit margins and consistent cash flow generation from their foundational insurance business.

Bâloise Group's robust capitalization is a key indicator of its financial health, underscored by an A+ rating from S&P Global Ratings in June 2024. The company's ability to consistently generate and remit substantial cash further solidifies this status. In 2024, Bâloise Group achieved a significant cash remittance of CHF 565 million, highlighting its capacity for strong free cash flow generation.

| Business Segment | 2024 Metric | Cash Cow Characteristic |

| Property & Casualty (Swiss Market) | High Market Penetration, Enduring Demand | Stable cash generation, low reinvestment needs |

| Core Underwriting Operations | Combined Ratio: 92.9% (2024) | High profit margins, consistent cash flow |

| Asset Management | CHF 59.5 billion Assets Under Management (2024) | Reliable fee-based income, stable profits |

| Group Financial Strength | S&P Rating: A+ (June 2024), Cash Remittance: CHF 565 million (2024) | Strong capital base, excellent free cash flow generation |

What You’re Viewing Is Included

Bâloise Group BCG Matrix

The Bâloise Group BCG Matrix preview you see is the definitive document you will receive upon purchase, offering an in-depth strategic analysis of their business units. This comprehensive report, meticulously crafted by industry experts, provides actionable insights into Bâloise's market position and growth potential. You can be assured that the preview accurately represents the final, unwatermarked, and fully formatted BCG Matrix that will be immediately available for your strategic planning needs. This is not a sample or a demo; it is the complete, ready-to-use analytical tool designed to empower your decision-making regarding the Bâloise Group's portfolio.

Dogs

Bâloise Group made a decisive move in 2024 to discontinue its ecosystem strategy focused on Home and Mobility. This strategic pivot signals that these ventures did not meet expectations for market penetration or profitability.

The decision to cease these operations stems from a clear assessment that the resources invested were not yielding adequate returns, necessitating write-downs. This scenario is a classic example of 'Dogs' in the BCG matrix, representing business units with low growth and low market share that are not performing well.

The sale of the FRIDAY digital insurer portfolio in late 2024 firmly places it in the 'Dog' category of the BCG Matrix. This strategic divestment, which impacted Bâloise Group's profit with a non-recurring negative effect, highlights its status as an underperforming asset.

FRIDAY's low market share and limited growth potential made it a strategic misfit for Bâloise's evolving focus. The decision to exit this segment underscores its classification as a cash trap, where continued investment would yield diminishing returns compared to alternative opportunities.

Traditional Group Life Insurance, a segment within Bâloise Group's portfolio, faced a significant downturn in 2024. Premiums saw a 10.5% decrease, a clear indicator of shifting market preferences towards more flexible, semi-autonomous insurance products.

This business line is experiencing a shrinking market share within a sector that is either stagnant or contracting. The declining demand for traditional offerings means that further substantial investment in this area is unlikely to generate a positive return.

Consequently, Traditional Group Life Insurance is categorized as a 'Dog' in the BCG Matrix. This classification suggests that Bâloise Group may need to consider strategic options, such as a managed run-off or divestment, to reallocate resources more effectively.

Underperforming Legacy IT Systems/Processes

Underperforming legacy IT systems and processes within Bâloise Group represent significant operational drag, akin to 'cash cows' that are costly to maintain but no longer generate substantial returns. These systems likely hinder agility and innovation, contributing to the need for strategic refocusing measures.

The group's initiative to optimize operational efficiency and reduce costs, evidenced by 250 job cuts announced in 2024, directly addresses the inefficiencies inherent in outdated technology. These legacy systems, while perhaps once critical, now demand disproportionate resources for upkeep and offer diminishing returns compared to modern, streamlined alternatives.

- High Maintenance Costs: Legacy IT infrastructure often incurs substantial operational expenses due to specialized support, hardware upgrades, and integration challenges.

- Limited Scalability and Flexibility: These systems struggle to adapt to evolving market demands or integrate new technologies, impacting Bâloise's ability to innovate.

- Reduced Operational Efficiency: Outdated processes slow down workflows, increase error rates, and negatively impact customer experience, directly affecting profitability.

- Strategic Hindrance: The burden of maintaining legacy systems diverts resources and attention from strategic growth initiatives and digital transformation efforts.

Niche, Outdated Insurance Products

Within Bâloise Group's extensive insurance offerings, certain niche products might be considered outdated. These are often older policies designed for specific needs that have since diminished or been superseded by more modern, attractive alternatives. Such products typically exhibit low market share and minimal growth potential, meaning they contribute little to the company's profitability and could even tie up valuable capital.

The strategic direction of Bâloise, often involving a refocusing effort, would naturally lead to a review of these less efficient product lines. The aim is usually to streamline the portfolio by identifying and potentially discontinuing or significantly revamping these underperforming assets. This process is crucial for allocating resources more effectively towards areas with higher growth and profitability prospects.

- Low Market Share: Products with a very small customer base, often due to changing consumer needs or increased competition.

- Minimal Growth: These offerings are not attracting new customers and may even see a decline in their existing user base.

- Capital Inefficiency: Outdated products can require ongoing maintenance and regulatory compliance without generating significant returns, thus tying up capital.

- Strategic Pruning: Companies like Bâloise often analyze their product portfolios to identify and divest or discontinue offerings that no longer align with their core strategy or market demands.

Bâloise Group's strategic divestment of FRIDAY digital insurer in late 2024, alongside the decline in Traditional Group Life Insurance premiums by 10.5% in the same year, clearly illustrates 'Dogs' in its BCG Matrix. These segments, characterized by low market share and minimal growth, represent underperforming assets that consume resources without generating commensurate returns.

The discontinuation of ecosystem strategies in Home and Mobility in 2024 also points to ventures that failed to gain traction, fitting the 'Dog' profile. Furthermore, underperforming legacy IT systems, despite their past utility, now act as cash traps due to high maintenance costs and limited scalability, hindering Bâloise's agility.

Similarly, certain niche, outdated insurance products with low market share and minimal growth potential are being reviewed for streamlining. These elements collectively highlight Bâloise's efforts to prune its portfolio and reallocate capital towards more promising growth areas.

| BCG Category | Bâloise Group Business Unit/Segment | 2024 Performance Indicator | BCG Rationale |

|---|---|---|---|

| Dogs | FRIDAY digital insurer | Divested in late 2024 | Low market share, limited growth potential |

| Dogs | Traditional Group Life Insurance | Premiums decreased by 10.5% | Shrinking market share, stagnant/contracting sector |

| Dogs | Home and Mobility Ecosystem Ventures | Discontinued in 2024 | Failed to meet market penetration/profitability expectations |

| Dogs | Legacy IT Systems | High maintenance costs, limited scalability | Operational drag, hinders innovation, diminishing returns |

| Dogs | Outdated Niche Insurance Products | Low market share, minimal growth | Capital inefficiency, strategic misfit |

Question Marks

Bâloise Group is actively exploring early-stage digital innovation pilots beyond its established e-banking platform. These initiatives, focused on enhancing core insurance and banking services, represent potential high-growth areas but are currently in nascent stages of development and market acceptance. For instance, Bâloise might be experimenting with AI-driven claims processing or personalized digital insurance product configurators, areas where market penetration is still minimal.

These ventures, characteristic of the question marks in the BCG matrix, demand substantial investment to validate their feasibility and pave the way for future scaling. While specific pilot project investment figures for 2024 are not publicly detailed, the broader trend in the insurance technology sector saw venture capital funding reach approximately $10 billion globally in the first half of 2024, indicating significant investor appetite for such early-stage digital advancements.

Targeted cross-border digital expansion for Bâloise can be viewed as a potential 'Question Mark' in the BCG matrix. This involves introducing new digital services or platforms into emerging or difficult segments within existing European markets, or even in smaller, less established markets. These ventures would likely possess high growth potential but currently exhibit low market penetration, necessitating significant investment in marketing and localization to capture market share.

For instance, if Bâloise were to launch an innovative digital insurance platform specifically tailored for the gig economy in a country like Portugal, which has a growing but fragmented freelance sector, this would fit the 'Question Mark' profile. Such an initiative in 2024 would require substantial upfront capital for platform development, regulatory compliance, and localized customer acquisition strategies. Success would depend on Bâloise’s ability to adapt its offerings to local consumer behaviors and competitive landscapes, potentially leading to a future 'Star' if successful, or a 'Dog' if it fails to gain traction.

Bâloise's specialized cyber insurance solutions likely fall into the question mark category of the BCG matrix. These niche products, designed for specific industries facing unique cyber threats, cater to a rapidly evolving market. While the potential for high growth is evident, current market penetration for these specialized offerings might be limited due to their complexity or the early stage of demand, meaning Bâloise's market share is likely small and requires substantial investment to grow.

New Fintech Partnerships/Ventures

Bâloise's 'Insurbanking' strategy naturally opens doors for collaborations with fintech innovators. These partnerships are crucial for developing and delivering novel financial products and services, blending insurance and banking seamlessly.

New fintech ventures, by their nature, often begin with a small market footprint but hold significant potential for rapid expansion and market disruption. Bâloise's investment in these areas would likely be characterized by a need for substantial capital infusion and careful strategic planning to ensure successful scaling and integration.

The success of these ventures is inherently uncertain, placing them in the 'Question Marks' category of the BCG matrix. Bâloise must carefully manage the risks while nurturing the growth potential.

- High Growth Potential: Fintech partnerships can unlock new revenue streams and customer segments by offering innovative digital financial solutions.

- Low Market Share: Initially, these ventures will have a small share of the overall financial services market, requiring significant effort to gain traction.

- Capital Intensive: Scaling these new ventures demands substantial investment in technology, marketing, and talent to compete effectively.

- Strategic Importance: Successful fintech collaborations can redefine Bâloise's market position and competitive advantage in the evolving financial landscape.

Sustainability-Linked Insurance Products

Bâloise Group could leverage the growing demand for sustainability by launching new insurance products tied to ESG criteria. These offerings, while nascent in market penetration, represent a significant growth opportunity. Their success hinges on consumer acceptance and supportive regulatory environments, placing them as potential stars with currently low market share.

The market for sustainability-linked insurance is expanding, with global ESG investments projected to reach $50 trillion by 2025, indicating a strong consumer pull. Bâloise's entry into this space would align with this trend, potentially capturing a new customer segment. However, the regulatory landscape for such products is still evolving, which could impact their initial adoption rates.

- Product Development: Bâloise can innovate with policies that reward sustainable behaviors, such as lower premiums for electric vehicle owners or businesses with strong ESG ratings.

- Market Potential: With a growing global awareness of climate change and social responsibility, the demand for ESG-aligned financial products is set to increase significantly.

- Challenges: Establishing clear, verifiable ESG metrics and navigating evolving regulatory frameworks are key hurdles for widespread adoption.

- Strategic Positioning: These products could position Bâloise as a forward-thinking insurer, attracting environmentally and socially conscious customers.

Question Marks represent Bâloise Group's nascent digital ventures with high growth potential but currently low market share. These innovative initiatives, such as AI-driven claims processing or specialized cyber insurance, require significant investment to prove their viability and scale. Success in these areas could transform them into future market leaders, but failure risks them becoming underperforming assets.

The strategic exploration of new digital platforms and targeted cross-border expansion exemplifies these question marks. For instance, a 2024 initiative to launch a digital insurance platform for Portugal's gig economy, while promising high growth, faces the challenge of low initial penetration and requires substantial capital for localization and customer acquisition.

Bâloise's investment in fintech collaborations also falls into this category. These partnerships, while offering disruptive potential and new revenue streams, begin with a small market footprint and demand considerable capital for scaling and integration, highlighting the inherent uncertainty and strategic importance of managing these ventures.

The development of sustainability-linked insurance products, aligning with the growing ESG investment trend, also presents as a question mark. While the market potential is significant, with global ESG investments projected to reach $50 trillion by 2025, current market penetration for these specific products is limited, necessitating careful navigation of evolving regulatory frameworks.

| Bâloise Group Question Mark Examples | Market Growth Potential | Current Market Share | Investment Needs | Strategic Rationale |

|---|---|---|---|---|

| AI-driven Claims Processing | High | Low | Substantial | Enhance efficiency, improve customer experience |

| Digital Insurance for Gig Economy (e.g., Portugal) | High | Low | Significant Capital | Tap into emerging workforce needs |

| Fintech Partnerships | High | Low | Capital Intensive | Innovate financial products, expand customer base |

| Sustainability-Linked Insurance | High | Low | Moderate to High | Align with ESG trends, attract conscious consumers |

BCG Matrix Data Sources

Our Bâloise Group BCG Matrix leverages a robust blend of internal financial disclosures, comprehensive market research reports, and competitor analysis to accurately position each business unit.