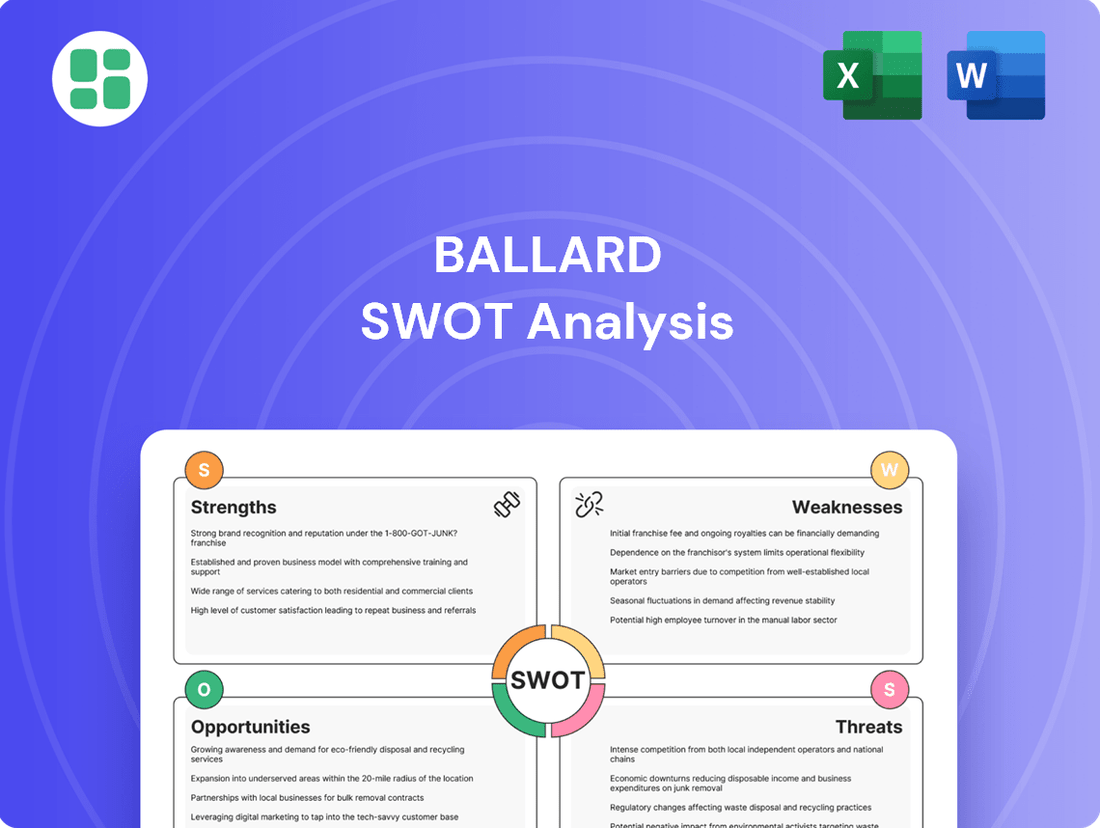

Ballard SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ballard Bundle

Ballard's innovative fuel cell technology presents a significant strength, positioning them at the forefront of the clean energy revolution. However, potential weaknesses lie in the high cost of production and the nascent stage of the hydrogen infrastructure. Want the full story behind Ballard's market position and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning.

Strengths

Ballard Power Systems stands out as a global leader in Proton Exchange Membrane (PEM) fuel cell technology. As of 2023, the company commanded an impressive 48% market share in this critical clean energy sector. This leadership is underpinned by a formidable intellectual property portfolio, boasting over 1,000 patents worldwide.

Ballard's fuel cell systems boast a proven track record of exceptional performance, accumulating over 60,000 hours of operational reliability in demanding heavy-duty mobility applications.

Their stationary power solutions have achieved an impressive 99.2% system uptime, underscoring the robust and dependable nature of Ballard's technology in real-world deployments.

With operations spanning 22 countries and diverse sectors, this extensive deployment history builds significant customer confidence and demonstrates the maturity of their fuel cell offerings.

Ballard maintains a robust financial foundation, evident in its significant cash reserves. As of the first quarter of 2025, the company reported $576.7 million in cash and cash equivalents. This substantial liquidity offers considerable financial flexibility, reducing reliance on external financing for immediate or medium-term needs.

This strong cash position acts as a vital cushion, empowering Ballard to weather market volatility and sustain its ongoing strategic projects and operational activities. It provides the stability necessary to invest in research and development, expand manufacturing capabilities, and pursue growth opportunities without immediate financial constraints.

Strategic Partnerships and Customer Base

Ballard's strategic partnerships are a significant strength, evidenced by securing key commercial milestones. The company has achieved new customer platform wins and sustained repeat business from existing clients, underscoring market confidence. For instance, a multi-year supply agreement with Solaris for 1,000 fuel cell engines and a technology partnership with Vertiv for data center backup power applications highlight this.

These collaborations are crucial as they not only validate Ballard's fuel cell technology but also substantially broaden its market access, especially within the expanding bus sector. The Vertiv partnership, in particular, taps into the growing demand for reliable backup power solutions in critical infrastructure like data centers.

- Multi-year supply agreement with Solaris for 1,000 fuel cell engines.

- Strategic technology partnership with Vertiv for data center backup power.

- Validation of Ballard's technology and expanded market reach, particularly in the bus segment.

Cost Reduction and Operational Efficiency Initiatives

Ballard's commitment to cost reduction is a significant strength. The company's global corporate restructuring, initiated in 2024, is projected to deliver over 30% in annualized operating expense reductions for both 2025 and 2026.

These strategic moves are already demonstrating tangible financial benefits. In the first quarter of 2025, Ballard achieved a notable 14-point improvement in gross margins, alongside considerable decreases in overall operating expenses. This intensified focus on operational efficiency is a key driver for enhancing the company's long-term profitability and competitive standing.

- Global Restructuring: Initiated in 2024, targeting over 30% annualized operating expense reduction by 2025-2026.

- Q1 2025 Performance: Achieved a 14-point gross margin improvement and substantial operating expense reductions.

- Profitability Focus: These initiatives are crucial for bolstering long-term financial health and market competitiveness.

Ballard's market leadership in PEM fuel cell technology is a significant strength, holding a 48% market share in 2023. This dominance is supported by over 1,000 global patents, showcasing a robust intellectual property portfolio. The company's proven reliability, demonstrated by 60,000+ operating hours in heavy-duty mobility and 99.2% uptime in stationary power, builds strong customer confidence.

| Metric | Value | Year/Period |

| PEM Market Share | 48% | 2023 |

| Global Patents | 1,000+ | Ongoing |

| Heavy-Duty Mobility Hours | 60,000+ | Operational Record |

| Stationary Power Uptime | 99.2% | Deployment Record |

What is included in the product

Analyzes Ballard’s competitive position through key internal and external factors, highlighting its technological strengths and market opportunities while acknowledging potential weaknesses and competitive threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities.

Weaknesses

Ballard Power Systems has consistently faced financial headwinds, marked by persistent net losses and negative gross margins. This means the expenses tied to creating their fuel cell products have frequently outpaced the income from selling them. For instance, in the first quarter of 2025, the company reported a negative gross margin of (23%), which, while an improvement, still highlights this persistent issue.

A primary driver behind these ongoing financial struggles is the relatively low sales volume. When fewer products are sold, the fixed costs associated with manufacturing, like factory overhead and labor, get spread across a smaller number of units. This makes it harder to achieve profitability, as the cost per unit remains high.

Furthermore, Ballard has encountered challenges with effectively absorbing its manufacturing costs. This suggests that even with efforts to streamline production, the expenses involved in making their fuel cell technology are not being fully covered by the revenue generated from sales, contributing to the negative gross margin.

Ballard's revenue is heavily concentrated in the bus segment, which accounted for 81% of its Q1 2025 revenue, showing a robust 41% year-over-year increase. However, this strong performance in one area is offset by significant revenue drops in other heavy-duty mobility sectors such as truck, rail, and marine.

This substantial dependence on the bus market exposes Ballard to considerable risk. Any slowdown or disruption within the bus industry could disproportionately impact the company's overall financial health. The current revenue imbalance across its various business verticals underscores a critical need for greater diversification to mitigate these risks.

Ballard's fuel cell system production costs are currently high, which is a major hurdle for widespread adoption and profitability. The company is aiming to reduce costs significantly, but there's a considerable gap to overcome.

Specifically, current production costs hover between $80 to $120 per kilowatt (kW). Ballard's ambitious target is to bring this down to the $40 to $50 per kW range. Closing this substantial cost reduction gap is absolutely essential for fuel cell technology to become truly competitive and accessible across a wider array of markets and applications.

Soft Order Intake and Declining Backlog

Ballard experienced a noticeable shift in order intake during Q1 2025. Following a robust Q4 2024, the first quarter of 2025 saw a softer inflow of new orders.

This softer intake directly impacted the company's order backlog, which decreased by 9% sequentially to $158 million. This decline suggests that the pace of product deliveries exceeded the rate at which new orders were secured.

The trend of deliveries outpacing new orders can signal a few things for Ballard:

- Potential Sales Delays: It might indicate that some anticipated sales opportunities are taking longer to materialize.

- Market Demand Slowdown: A broader slowdown in market demand for fuel cell solutions could also be a contributing factor.

- Reduced Future Revenue Visibility: This pattern directly impacts the predictability of future revenue streams, making forecasting more challenging.

Vulnerability to Industry Rationalization and Funding Environment

The hydrogen and fuel cell sector is currently experiencing a significant shake-up, often referred to as rationalization. This means that many companies are consolidating or struggling to survive due to a tough funding climate and lingering policy uncertainties. This situation has unfortunately pushed back the timelines for developing crucial hydrogen projects and rolling out fuel cell technologies by several years.

These broader industry headwinds directly affect Ballard's ability to grow and the pace at which its fuel cell solutions are adopted by the market. For instance, many large-scale hydrogen infrastructure projects, which would be key customers for Ballard, have seen their development schedules extended, impacting immediate demand. The overall difficulty in securing capital for these ambitious projects creates a challenging environment for all players in the hydrogen economy.

- Industry Rationalization: The hydrogen and fuel cell industry is facing consolidation and a slowdown in project development.

- Policy Uncertainty: Prolonged ambiguity in government policies creates a less predictable market for hydrogen technologies.

- Funding Environment: Securing investment for hydrogen projects and fuel cell deployments has become more challenging, delaying market entry.

- Impact on Ballard: These factors collectively slow down Ballard's growth prospects and the widespread adoption of its fuel cell products.

Ballard's financial performance remains a significant weakness, characterized by persistent net losses and negative gross margins, as evidenced by a negative 23% gross margin in Q1 2025. This is exacerbated by relatively low sales volumes, which prevent effective absorption of manufacturing costs and keep per-unit expenses high. The company's heavy reliance on the bus segment, representing 81% of Q1 2025 revenue, also poses a substantial risk due to potential disruptions in that specific market.

What You See Is What You Get

Ballard SWOT Analysis

The preview you see is the actual Ballard SWOT Analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professional report without any hidden surprises.

Opportunities

Governments worldwide are increasingly setting ambitious decarbonization targets, with many aiming for net-zero emissions by 2050. This global push is directly translating into substantial investments in clean energy technologies, including hydrogen fuel cells. For instance, the European Union's Green Deal aims to mobilize at least €1 trillion in sustainable investments over the next decade, a significant portion of which is expected to flow into hydrogen infrastructure and applications.

This growing commitment creates a robust and expanding market for Ballard's fuel cell solutions, particularly in heavy-duty transportation and stationary power generation. Companies are actively seeking to reduce their carbon footprints, driving demand for zero-emission alternatives. In 2024, it's estimated that global investment in clean energy technologies will surpass $2 trillion, with hydrogen being a key beneficiary of this capital allocation.

Ballard's fuel cell technology is not limited to heavy-duty trucks and buses; its versatility opens doors to numerous new applications. For instance, the company is exploring opportunities in stationary power generation, such as backup power for critical infrastructure like data centers. This diversification strategy is crucial for long-term growth.

The company's Q1 2025 results highlighted strong performance in emerging markets and other segments, signaling a growing demand for clean energy solutions. Strategic collaborations, like the one with Vertiv for data center backup power solutions, are already demonstrating the viability of these new revenue streams. These partnerships are key to unlocking Ballard's full market potential.

While policy landscapes can shift, there's a notable opportunity for governments, especially in North America and Europe, to bolster the hydrogen and fuel cell sector. Increased incentives and clearer regulations could significantly accelerate the adoption of fuel cell electric vehicles and the necessary hydrogen infrastructure, directly benefiting companies like Ballard.

For instance, in 2024, many regions are actively developing hydrogen strategies, with some governments earmarking billions for clean energy initiatives. This policy support, if translated into concrete financial incentives for fuel cell adoption and infrastructure development, could unlock substantial market growth for Ballard, enhancing its competitive position.

Technological Advancements and Product Cost Reduction

Ballard's commitment to ongoing research and development, coupled with aggressive product cost reduction initiatives, creates a prime opportunity to make its fuel cell technology more competitive and accessible. By successfully lowering production costs, Ballard can significantly accelerate the widespread adoption of its solutions. This is particularly important as the company targets further improvements in gross margins and overall profitability.

Achieving specific cost reduction milestones is key. For instance, Ballard's stated goal to reach $30 per kilowatt for its fuel cell modules by 2026 is a critical target. Meeting this objective would dramatically enhance the economic viability of fuel cell electric vehicles (FCEVs) and stationary power applications. This cost parity with or advantage over traditional internal combustion engines is a major driver for market penetration.

The company's strategic investments in manufacturing efficiency and supply chain optimization are directly supporting these cost reduction efforts. These advancements allow Ballard to scale production more effectively, further driving down per-unit costs. This creates a virtuous cycle where increased production volume leads to lower costs, which in turn fuels greater demand.

- Target Production Costs: Ballard aims for $30/kW by 2026, a critical step for market competitiveness.

- R&D Investment: Continued investment in innovation fuels technological advancements that enable cost reductions.

- Manufacturing Efficiency: Streamlining production processes and supply chains are central to achieving lower costs.

- Market Adoption: Reduced product costs are essential for broader commercial acceptance and market growth.

Industry Consolidation and Strategic Alliances

The hydrogen and fuel cell sector is experiencing significant rationalization, creating a fertile ground for industry consolidation. This presents Ballard with a prime opportunity to acquire smaller companies with complementary technologies or expertise, thereby enhancing its own capabilities. Strategic alliances can also be leveraged to accelerate market penetration and product adoption.

By strategically engaging in mergers, acquisitions, or partnerships, Ballard can solidify its competitive standing and broaden its technological portfolio. These moves are critical for navigating the evolving market landscape and capitalizing on emerging trends.

- Acquisition potential: Ballard can acquire smaller fuel cell technology firms to integrate unique innovations, similar to how Plug Power acquired Frames Group in 2023 to bolster its dispensing technology.

- Alliance benefits: Forming strategic alliances, like Ballard's existing partnership with Quantron AG for fuel cell electric trucks, can expand market reach and drive sales volume.

- Market share growth: Consolidation through strategic moves can lead to increased market share, especially as the demand for zero-emission solutions grows; for instance, the global fuel cell market was valued at approximately $2.5 billion in 2023 and is projected to reach $15.5 billion by 2030.

Governments worldwide are increasingly setting ambitious decarbonization targets, with many aiming for net-zero emissions by 2050. This global push is directly translating into substantial investments in clean energy technologies, including hydrogen fuel cells. For instance, the European Union's Green Deal aims to mobilize at least €1 trillion in sustainable investments over the next decade, a significant portion of which is expected to flow into hydrogen infrastructure and applications.

This growing commitment creates a robust and expanding market for Ballard's fuel cell solutions, particularly in heavy-duty transportation and stationary power generation. Companies are actively seeking to reduce their carbon footprints, driving demand for zero-emission alternatives. In 2024, it's estimated that global investment in clean energy technologies will surpass $2 trillion, with hydrogen being a key beneficiary of this capital allocation.

Ballard's fuel cell technology is not limited to heavy-duty trucks and buses; its versatility opens doors to numerous new applications. For instance, the company is exploring opportunities in stationary power generation, such as backup power for critical infrastructure like data centers. This diversification strategy is crucial for long-term growth.

The company's Q1 2025 results highlighted strong performance in emerging markets and other segments, signaling a growing demand for clean energy solutions. Strategic collaborations, like the one with Vertiv for data center backup power solutions, are already demonstrating the viability of these new revenue streams. These partnerships are key to unlocking Ballard's full market potential.

While policy landscapes can shift, there's a notable opportunity for governments, especially in North America and Europe, to bolster the hydrogen and fuel cell sector. Increased incentives and clearer regulations could significantly accelerate the adoption of fuel cell electric vehicles and the necessary hydrogen infrastructure, directly benefiting companies like Ballard.

For instance, in 2024, many regions are actively developing hydrogen strategies, with some governments earmarking billions for clean energy initiatives. This policy support, if translated into concrete financial incentives for fuel cell adoption and infrastructure development, could unlock substantial market growth for Ballard, enhancing its competitive position.

Ballard's commitment to ongoing research and development, coupled with aggressive product cost reduction initiatives, creates a prime opportunity to make its fuel cell technology more competitive and accessible. By successfully lowering production costs, Ballard can significantly accelerate the widespread adoption of its solutions. This is particularly important as the company targets further improvements in gross margins and overall profitability.

Achieving specific cost reduction milestones is key. For instance, Ballard's stated goal to reach $30 per kilowatt for its fuel cell modules by 2026 is a critical target. Meeting this objective would dramatically enhance the economic viability of fuel cell electric vehicles (FCEVs) and stationary power applications. This cost parity with or advantage over traditional internal combustion engines is a major driver for market penetration.

The company's strategic investments in manufacturing efficiency and supply chain optimization are directly supporting these cost reduction efforts. These advancements allow Ballard to scale production more effectively, further driving down per-unit costs. This creates a virtuous cycle where increased production volume leads to lower costs, which in turn fuels greater demand.

- Target Production Costs: Ballard aims for $30/kW by 2026, a critical step for market competitiveness.

- R&D Investment: Continued investment in innovation fuels technological advancements that enable cost reductions.

- Manufacturing Efficiency: Streamlining production processes and supply chains are central to achieving lower costs.

- Market Adoption: Reduced product costs are essential for broader commercial acceptance and market growth.

The hydrogen and fuel cell sector is experiencing significant rationalization, creating a fertile ground for industry consolidation. This presents Ballard with a prime opportunity to acquire smaller companies with complementary technologies or expertise, thereby enhancing its own capabilities. Strategic alliances can also be leveraged to accelerate market penetration and product adoption.

By strategically engaging in mergers, acquisitions, or partnerships, Ballard can solidify its competitive standing and broaden its technological portfolio. These moves are critical for navigating the evolving market landscape and capitalizing on emerging trends.

- Acquisition potential: Ballard can acquire smaller fuel cell technology firms to integrate unique innovations, similar to how Plug Power acquired Frames Group in 2023 to bolster its dispensing technology.

- Alliance benefits: Forming strategic alliances, like Ballard's existing partnership with Quantron AG for fuel cell electric trucks, can expand market reach and drive sales volume.

- Market share growth: Consolidation through strategic moves can lead to increased market share, especially as the demand for zero-emission solutions grows; for instance, the global fuel cell market was valued at approximately $2.5 billion in 2023 and is projected to reach $15.5 billion by 2030.

Ballard's expanding product portfolio and technological advancements offer significant opportunities for market penetration. The company's focus on developing more efficient and cost-effective fuel cell solutions, particularly for heavy-duty applications, aligns with growing global demand for decarbonization. Ballard's continued investment in R&D is crucial for staying ahead in this rapidly evolving sector.

Strategic partnerships and collaborations are key to unlocking new markets and applications for Ballard's technology. For example, collaborations in stationary power for data centers or backup power solutions present substantial growth avenues. These alliances not only expand market reach but also validate the technology's reliability and commercial viability, driving further adoption.

The increasing global focus on hydrogen as a clean energy carrier, supported by government policies and investments, creates a favorable environment for Ballard. As nations implement hydrogen strategies and incentivize fuel cell adoption, Ballard is well-positioned to capitalize on this momentum. The projected growth of the hydrogen fuel cell market, from an estimated $2.5 billion in 2023 to $15.5 billion by 2030, underscores this significant opportunity.

Furthermore, the potential for industry consolidation presents Ballard with strategic acquisition opportunities. Acquiring companies with complementary technologies or market access can accelerate growth and enhance Ballard's competitive position. This proactive approach to M&A can solidify its leadership in the fuel cell industry.

Threats

Prolonged policy uncertainty and the specter of trade tariffs present a significant threat to Ballard Power Systems. For instance, in the United States, the Inflation Reduction Act (IRA) offers substantial incentives, but the ongoing debate and potential modifications to these policies create a degree of unpredictability for hydrogen infrastructure development and fuel cell adoption. Similarly, evolving trade relations with China, a key manufacturing and market hub, could introduce tariffs that impact supply chains and cost competitiveness.

Ballard operates in a fiercely competitive hydrogen fuel cell market. The ongoing rationalization within the industry, characterized by competitor failures and consolidation, is likely to intensify pricing pressures. For instance, Plug Power, a significant player, experienced a substantial stock price decline in early 2024 amid financial concerns, highlighting the sector's volatility and the pressure on less robust competitors to either adapt or exit.

This market dynamic, marked by restructurings and consolidation, directly impacts Ballard. It can lead to disruptions in supply chains and shifts in customer relationships as stronger players absorb weaker ones. Ballard must continuously innovate and optimize its cost structure to navigate this environment and secure market share against both established and emerging competitors.

The widespread commercial adoption of Ballard's PEM fuel cells hinges on readily available low-carbon hydrogen and a developed refueling network. These crucial elements are currently facing multi-year delays and significant funding hurdles.

For instance, while the US Department of Energy's Hydrogen Shot aims for $1/kg of clean hydrogen by 2031, widespread commercial availability at this price point remains a challenge. Delays in building out this essential infrastructure directly slow down the deployment and scaling of fuel cell technologies like Ballard's.

Macroeconomic and Geopolitical Uncertainties

Global macroeconomic headwinds, such as persistent inflation and elevated interest rates, present a significant threat to Ballard's growth trajectory. For instance, the U.S. inflation rate remained elevated in early 2024, impacting project financing costs. These conditions can dampen investor appetite for clean energy initiatives, potentially slowing the adoption of fuel cell technology.

The geopolitical landscape adds another layer of complexity. Ongoing international conflicts and trade tensions can disrupt supply chains, leading to increased material costs for Ballard's components. Higher input expenses directly affect profitability and can make fuel cell solutions less competitive against traditional energy sources. For example, increased nickel prices in 2024 due to supply chain issues impacted various manufacturing sectors.

These external economic pressures collectively threaten to depress both consumer and industrial demand for Ballard's fuel cell solutions. A slowdown in market growth would directly impact Ballard’s revenue streams and could necessitate adjustments to operational strategies to mitigate rising costs.

- Rising Interest Rates: Increased borrowing costs make financing large-scale clean energy projects more expensive, potentially delaying or canceling investments.

- Inflationary Pressures: Higher material and labor costs squeeze profit margins for Ballard and its customers, impacting affordability.

- Geopolitical Instability: Supply chain disruptions and trade uncertainties can lead to unpredictable component availability and price fluctuations.

- Reduced Demand: Economic slowdowns can decrease overall industrial activity and consumer spending, lowering the demand for new fuel cell applications.

Declining Investor Sentiment for Pre-Profitability Companies

Investor sentiment towards companies not yet profitable, especially in the clean energy sector, has cooled significantly. This shift means less enthusiasm for long-term payoff promises, making it harder for companies like Ballard to attract new investment, even if they currently have cash reserves.

This trend directly impacts Ballard's ability to secure future funding. For instance, as of Q1 2024, Ballard reported a net loss, underscoring its pre-profitability status. A prolonged downturn in investor confidence could lead to more difficult financing rounds and negatively affect the company's stock valuation.

- Waning Enthusiasm: Investors are increasingly risk-averse regarding pre-profitability ventures, favoring companies with established revenue streams.

- Capital Access: Ballard may face greater challenges in raising capital for growth initiatives, potentially impacting expansion plans.

- Valuation Pressure: Declining investor confidence can put downward pressure on stock prices, affecting market capitalization and shareholder value.

Ballard faces significant threats from policy uncertainty and trade tensions, impacting the incentives for hydrogen infrastructure and potentially increasing costs through tariffs. The competitive landscape is intensifying due to competitor failures and consolidation, leading to price pressures and potential supply chain disruptions as seen with Plug Power's financial challenges in early 2024. Furthermore, delays in the development of low-carbon hydrogen availability and refueling networks, despite initiatives like the US Department of Energy's Hydrogen Shot, directly hinder the widespread adoption of Ballard's fuel cell technology.

Macroeconomic headwinds, including persistent inflation and high interest rates, coupled with geopolitical instability, threaten Ballard's growth by increasing project financing costs and disrupting supply chains, as evidenced by rising nickel prices in 2024. Investor sentiment has shifted, with a cooling of enthusiasm for pre-profitability companies, making it harder for Ballard, which reported a net loss in Q1 2024, to attract capital and potentially pressuring its stock valuation.

SWOT Analysis Data Sources

This Ballard SWOT analysis is built upon a foundation of robust data, drawing from publicly available financial filings, comprehensive market research reports, and expert industry analyses to provide an accurate and actionable assessment.