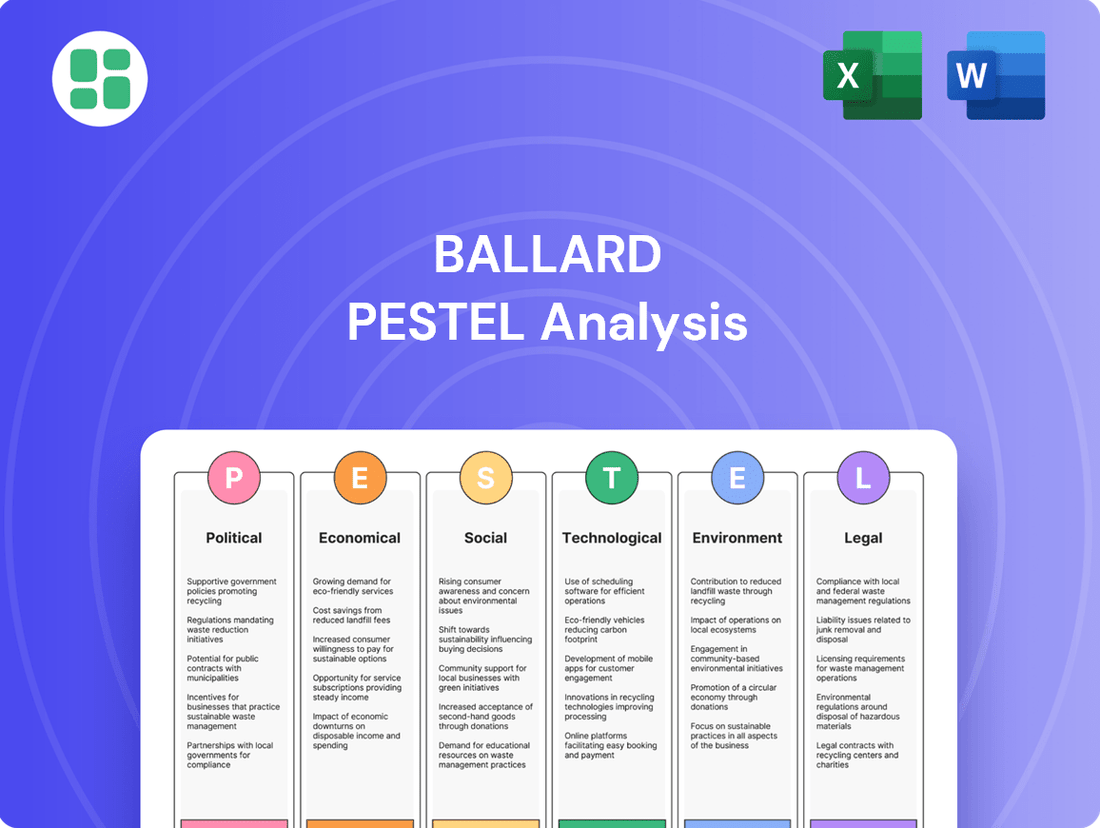

Ballard PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ballard Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors impacting Ballard's trajectory. Our expert-crafted PESTLE analysis provides a clear roadmap to navigate these external forces, empowering you to make informed strategic decisions. Don't get left behind; download the full, actionable report now and gain a significant competitive advantage.

Political factors

Governments globally are stepping up with substantial financial backing for hydrogen fuel cell technology. This includes grants, subsidies, and tax credits designed to lower the upfront costs of fuel cell systems and speed up their adoption. For Ballard, this translates into a more favorable market environment, encouraging greater investment in research and development and boosting sales prospects.

For instance, the U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office has allocated significant funding, with a projected $2.5 billion investment through 2027 aimed at advancing hydrogen production, storage, and utilization. Similarly, the European Union's Green Deal and related initiatives are channeling billions into the hydrogen economy. These policy shifts directly influence Ballard's revenue streams and strategic investment decisions, making government support a critical factor in its growth trajectory.

Stricter global emissions standards for heavy-duty vehicles and marine vessels are significantly boosting the demand for zero-emission technologies like Ballard's fuel cells. For instance, the European Union's CO2 emission performance standards for new heavy-duty vehicles, which aim for a 15% reduction by 2025 and 30% by 2030 compared to 2019 levels, directly encourage the adoption of fuel cell electric vehicles.

National and international commitments to net-zero carbon goals, such as the Paris Agreement's objective to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels, are creating a more favorable regulatory landscape. This compels industries to accelerate their transition away from fossil fuels, opening substantial market opportunities for hydrogen fuel cell solutions in transportation and power generation.

Ballard's reliance on global supply chains makes it susceptible to shifts in international trade policies. For instance, the imposition or removal of tariffs on key components or finished fuel cell products can directly impact manufacturing costs and the competitiveness of its offerings in various markets. The continuation of favorable trade agreements, such as those facilitating cross-border movement of goods and technology, is crucial for Ballard's ability to source materials efficiently and expand its market reach. Geopolitical tensions or disruptions in trade relations can create significant uncertainty and potentially hinder Ballard's international operations and growth strategies.

Hydrogen Strategy Development

Many nations are actively developing comprehensive national hydrogen strategies. These plans detail pathways for producing, transporting, and utilizing hydrogen across various sectors, directly impacting the growth potential for companies like Ballard Power Systems. For instance, the European Union’s Hydrogen Strategy aims to produce 10 million tonnes of renewable hydrogen by 2030, a significant target that necessitates substantial fuel cell adoption.

These governmental strategies are crucial for unlocking market opportunities and driving the necessary infrastructure development for hydrogen’s widespread adoption. Such initiatives, like Germany’s National Hydrogen Strategy which earmarks billions in funding, are vital for scaling up the technology that Ballard specializes in.

- Governmental Support: National hydrogen strategies provide policy frameworks and financial incentives, fostering market growth for fuel cell technologies.

- Infrastructure Investment: These strategies often include plans for hydrogen production facilities, pipelines, and refueling stations, essential for Ballard's market penetration.

- Market Expansion: Clear policy direction encourages investment and accelerates the deployment of fuel cell electric vehicles and stationary power systems.

- Regulatory Clarity: Defined strategies offer regulatory certainty, reducing investment risk and promoting long-term business planning for hydrogen ecosystem participants.

Political Stability and Governance

Ballard Power Systems operates globally, making political stability in its key markets, including Canada, the United States, Germany, and China, crucial. Instability or shifts in government policy in these regions can directly impact investment security and the company's ability to operate smoothly. For instance, changes in hydrogen fuel cell incentive programs or trade agreements could significantly alter Ballard's operational landscape.

A predictable governance structure and a stable regulatory environment are foundational for Ballard's long-term strategic planning. Uncertainty in regulations, such as emissions standards or energy policies, can create headwinds for the adoption of fuel cell technology. In 2024, many governments are actively reviewing and updating their climate and energy transition strategies, which could present both opportunities and challenges for Ballard.

- Geopolitical Risk Assessment: Ballard's reliance on international supply chains and diverse customer bases necessitates ongoing monitoring of geopolitical stability in regions like Europe and Asia, where significant market development is anticipated.

- Regulatory Frameworks: The company's growth is closely tied to supportive government policies for zero-emission transportation and energy, with potential policy shifts in major economies like the US and EU in 2024-2025 being closely watched.

- Trade Relations: Evolving trade policies and tariffs between major economic blocs could impact the cost-effectiveness of Ballard's components and systems, influencing its competitive pricing strategies.

- Government Subsidies and Incentives: The continuation or modification of hydrogen fuel cell subsidies by governments worldwide directly influences market demand and Ballard's revenue streams, with many programs subject to periodic review and renewal.

Governmental support remains a cornerstone for Ballard's growth, with significant public funding and incentives shaping the hydrogen market. For example, the U.S. Inflation Reduction Act of 2022 provides substantial tax credits for clean hydrogen production, a move expected to drive demand for fuel cell technologies. Similarly, European nations are channeling billions into hydrogen infrastructure as part of their decarbonization efforts, creating a more predictable and favorable environment for Ballard's expansion.

Stricter emissions regulations globally are compelling industries to adopt zero-emission solutions, directly benefiting Ballard. The EU's CO2 emission standards for heavy-duty vehicles, targeting a 45% reduction by 2030, are a prime example. This regulatory push is accelerating the adoption of fuel cell electric vehicles, a key market for Ballard's products.

National hydrogen strategies are crucial for market development. Many countries, including Germany and Japan, have outlined ambitious targets for hydrogen production and utilization through 2030 and beyond. These strategies often include investments in refueling infrastructure and fleet deployment, directly supporting Ballard's business model and market penetration efforts.

| Policy Area | Key Initiative/Regulation | Impact on Ballard | 2024-2025 Outlook |

|---|---|---|---|

| Government Funding & Incentives | U.S. Inflation Reduction Act (IRA) - Clean Hydrogen Production Tax Credit (45V) | Reduces cost of green hydrogen production, increasing demand for fuel cells. | Continued strong demand driver, potential for increased project financing. |

| Emissions Standards | EU CO2 Emission Standards for Heavy-Duty Vehicles | Mandates lower emissions, driving adoption of zero-emission trucks. | Accelerated fleet transitions, increased sales opportunities for fuel cell trucks. |

| National Hydrogen Strategies | Germany's National Hydrogen Strategy | Targets 10 GW of electrolyzer capacity by 2030, supporting hydrogen ecosystem growth. | Increased infrastructure build-out, greater demand for stationary power fuel cells. |

| Trade Policy | Global Tariffs and Trade Agreements | Affects component costs and international market competitiveness. | Ongoing monitoring required for supply chain stability and pricing strategies. |

What is included in the product

The Ballard PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the business, providing a comprehensive overview of the external landscape.

Provides a clear, actionable framework that simplifies complex external factors, reducing the overwhelm and uncertainty often associated with strategic planning.

Economic factors

The economic competitiveness of fuel cell technology against internal combustion engines and battery electric vehicles is a critical factor for market penetration. Ballard's pricing and market share are directly impacted by reductions in fuel cell manufacturing costs, gains in efficiency, and the overall cost of hydrogen fuel production.

For instance, in 2024, the cost of producing a kilowatt of fuel cell power continues to be a focus for manufacturers like Ballard, with ongoing efforts to bring it closer to parity with established technologies. While specific pricing details are proprietary, industry analysts project that by 2025, the levelized cost of hydrogen fueling for fuel cell electric vehicles (FCEVs) could become increasingly competitive, especially in regions with robust hydrogen infrastructure development and supportive government incentives.

Global economic growth is a significant driver for Ballard's heavy-duty mobility solutions. A healthy global economy, projected to grow by 2.7% in 2024 according to the IMF, spurs investment in transportation and logistics. This increased economic activity directly translates to higher demand for trucks, buses, and other commercial vehicles, which in turn benefits Ballard.

Industrial activity, especially within the transportation sector, is crucial. For instance, the global commercial vehicle market, a key segment for Ballard, is expected to see continued expansion. A strong industrial base encourages fleet modernization and adoption of new technologies, including fuel cell electric vehicles, as companies look to improve efficiency and meet environmental regulations.

Fluctuations in energy prices, particularly for diesel, natural gas, electricity, and hydrogen, directly impact the operational costs for Ballard's customer base. For instance, as of late 2024, diesel prices have seen periods of volatility, making the long-term cost predictability of fuel cells an increasingly appealing proposition for fleet operators.

High and unpredictable fossil fuel costs can significantly enhance the economic attractiveness of Ballard's fuel cell solutions. Conversely, the widespread adoption and long-term competitiveness of hydrogen fuel cells are heavily reliant on the availability of affordable green hydrogen, a factor that continues to evolve with renewable energy investments and infrastructure development throughout 2025.

Investment in Green Technologies

Investment in green technologies is a significant economic factor influencing Ballard's trajectory. The availability of capital and evolving investment trends within the renewable energy and clean transportation sectors are paramount for Ballard's ongoing growth and innovation. These trends directly impact the company's capacity to fund crucial research and development, scale up manufacturing operations, and successfully deploy its hydrogen fuel cell solutions.

The global push towards decarbonization is unlocking substantial investment opportunities. For instance, in 2024, the International Energy Agency reported that global clean energy investment reached an estimated $2 trillion, with a significant portion directed towards renewables and electric vehicles. This influx of capital bodes well for companies like Ballard, which are at the forefront of hydrogen technology.

Ballard's ability to secure funding for its various initiatives, from developing next-generation fuel cell stacks to expanding its market reach in heavy-duty trucking and stationary power, is directly tied to these investment trends. Access to this capital influences its competitive standing and its potential for broader market expansion.

- Global clean energy investment is projected to continue its upward trend, with estimates suggesting it could reach $3 trillion annually by 2030, according to various market analyses.

- Government incentives and private equity interest in hydrogen infrastructure and fuel cell applications are increasing, providing a more favorable funding environment.

- Ballard's strategic partnerships and supply agreements in 2024 and early 2025 are crucial for attracting further investment and demonstrating market validation.

- The cost reduction in electrolyzer technology and renewable energy generation directly impacts the economic viability of hydrogen fuel cells, thereby influencing investment decisions.

Supply Chain Costs and Inflation

Inflationary pressures continue to impact raw material and component costs for hydrogen fuel cell manufacturers like Ballard. For instance, in early 2024, the Producer Price Index (PPI) for manufactured goods saw notable increases, reflecting higher input costs that can directly affect Ballard's cost of goods sold and overall profitability.

Global supply chain disruptions, a persistent challenge since 2021, remain a critical factor. These disruptions can lead to extended lead times for essential components and impact Ballard's manufacturing schedules, potentially delaying product delivery and affecting revenue realization. Effective supply chain management and diversification of suppliers are therefore paramount for maintaining operational efficiency and product availability through 2025.

- Rising Input Costs: Persistent inflation in 2024 and projected into 2025 means higher prices for key materials like platinum group metals and specialized components, directly squeezing Ballard's margins.

- Labor Market Dynamics: Wage inflation and a competitive labor market can increase Ballard's operational expenses, particularly for skilled manufacturing and engineering roles.

- Logistics and Transportation: Elevated shipping rates and potential port congestion in 2024-2025 add to the overall cost of bringing components to manufacturing facilities and delivering finished products.

- Geopolitical Impacts: Ongoing geopolitical tensions can further exacerbate supply chain vulnerabilities, leading to unexpected cost increases and availability issues for critical inputs.

Economic competitiveness hinges on cost parity with established technologies, with ongoing efforts in 2024 to reduce fuel cell manufacturing costs. Projections for 2025 suggest the levelized cost of hydrogen fueling could become increasingly competitive, especially with robust infrastructure and incentives.

Global economic growth, estimated at 2.7% for 2024 by the IMF, directly fuels demand for commercial vehicles, a key market for Ballard. Fluctuations in energy prices, like volatile diesel costs in late 2024, highlight the long-term cost predictability of fuel cells.

Investment in green technologies is crucial, with global clean energy investment reaching an estimated $2 trillion in 2024. Ballard's ability to secure funding for R&D and manufacturing expansion is directly tied to these evolving investment trends.

Inflationary pressures in 2024 increased raw material and component costs, impacting Ballard's profitability. Supply chain disruptions also remain a critical factor, affecting manufacturing schedules and product delivery through 2025.

| Economic Factor | 2024/2025 Data Point | Impact on Ballard |

|---|---|---|

| Global Economic Growth | IMF projects 2.7% for 2024 | Drives demand for heavy-duty mobility solutions |

| Clean Energy Investment | Estimated $2 trillion in 2024 | Supports R&D and manufacturing expansion |

| Diesel Price Volatility | Periods of volatility in late 2024 | Enhances economic attractiveness of fuel cells |

| Inflation (PPI) | Notable increases in manufactured goods in early 2024 | Increases raw material and component costs |

What You See Is What You Get

Ballard PESTLE Analysis

The preview shown here is the exact Ballard PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive understanding of the external factors impacting Ballard.

The content and structure shown in the preview is the same Ballard PESTLE analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Public perception of hydrogen and fuel cells significantly impacts market adoption. A recent survey in early 2024 indicated that while awareness of hydrogen as a clean energy source is growing, a notable portion of the public still harbors concerns regarding its safety and cost-effectiveness compared to established technologies.

Positive public perception, fostered by successful demonstrations and accessible information, is key to accelerating the adoption of hydrogen-powered vehicles. For instance, the increasing visibility of hydrogen buses in cities across Europe, with over 300 operating by late 2023, helps to normalize the technology and build consumer confidence in its practical application.

Societal awareness regarding climate change and air pollution is increasingly influencing consumer and corporate choices, creating a significant demand for sustainable transportation solutions. This growing consciousness directly supports the market for Ballard's zero-emission fuel cell technology, particularly in heavy-duty sectors like trucking and buses.

For instance, a 2024 report indicated that over 60% of consumers consider environmental impact when making purchasing decisions, a figure that has steadily risen. This societal shift translates into a powerful market pull for clean energy alternatives, aligning perfectly with Ballard's product offerings.

Ballard's success hinges on a readily available pool of workers skilled in creating, building, and servicing fuel cell technology. As of early 2024, the demand for specialized engineering and technical roles within the clean energy sector, including hydrogen fuel cells, continues to outpace supply in many regions.

Initiatives like the Hydrogen Council's 2023 report highlighting the need for significant workforce development underscore the importance of robust educational and training programs. These efforts are crucial for nurturing the talent pipeline necessary to support the projected growth of the hydrogen economy, with estimates suggesting millions of new jobs globally by 2030.

Corporate Social Responsibility (CSR)

There's a growing expectation for companies to act responsibly, and this is significantly impacting how they make purchasing choices. Many organizations are now prioritizing suppliers and technologies that demonstrate a commitment to sustainability and ethical practices. This shift means that companies with strong Corporate Social Responsibility (CSR) initiatives are often favored.

Ballard's focus on clean energy solutions, particularly its fuel cell technology, directly addresses many of these evolving CSR objectives. By offering products that reduce emissions and promote environmental stewardship, Ballard positions itself as an attractive partner for entities looking to meet their sustainability goals. This alignment can translate into a competitive advantage in the marketplace.

- Growing CSR Investment: Global spending on ESG (Environmental, Social, and Governance) funds reached over $3.9 trillion in early 2024, indicating a strong market preference for responsible businesses.

- Government Mandates: Many governments are implementing stricter environmental regulations and procurement policies that favor green technologies, directly benefiting companies like Ballard.

- Consumer and Investor Pressure: Public awareness of climate change and social equity issues is increasing, leading consumers and investors to demand greater accountability from corporations.

- Ballard's Alignment: Ballard's fuel cell technology supports decarbonization efforts, aligning with the CSR priorities of transportation, power generation, and stationary power sectors seeking to reduce their carbon footprint.

Urbanization and Air Quality Concerns

The accelerating trend of urbanization globally is a significant driver for cleaner transportation. As more people flock to cities, the concentration of vehicles intensifies, leading to a direct correlation with rising air pollution levels. This societal pressure is pushing urban planners and policymakers to prioritize zero-emission solutions for public transport and freight movement, presenting a substantial market for Ballard's fuel cell technology.

For instance, by the end of 2024, it's projected that over 60% of the world's population will reside in urban areas. This demographic shift amplifies concerns about air quality, with studies in major metropolitan areas like London and Beijing consistently showing elevated levels of particulate matter and nitrogen oxides, largely attributed to road transport. Consequently, cities are actively investing in cleaner fleets; for example, the European Union aims to have at least 30 million zero-emission vehicles on its roads by 2030, a target that directly benefits companies like Ballard offering hydrogen fuel cell solutions for buses and trucks.

- Urban Population Growth: Over 60% of the global population is expected to live in urban areas by the end of 2024.

- Air Pollution Impact: Urban transportation is a primary contributor to air quality degradation in major cities worldwide.

- Policy Drivers: Government regulations and public demand for cleaner air are accelerating the adoption of zero-emission vehicles.

- Market Opportunity: Ballard is positioned to capitalize on the growing demand for hydrogen fuel cell technology in public transit and logistics sectors.

Societal expectations for corporate responsibility are evolving, pushing companies toward sustainable practices. This trend is evident in the increasing investment in ESG funds, which surpassed $3.9 trillion globally by early 2024, reflecting a strong market preference for ethically aligned businesses.

Ballard's commitment to clean energy and emission reduction through its fuel cell technology directly aligns with these growing CSR objectives. By offering solutions that help sectors like transportation and power generation reduce their carbon footprint, Ballard enhances its appeal as a strategic partner for organizations aiming to meet their sustainability targets.

The increasing global urbanization, with over 60% of the world's population projected to live in urban areas by the end of 2024, exacerbates air quality concerns. This demographic shift drives demand for zero-emission transportation solutions, creating a significant market opportunity for Ballard's hydrogen fuel cell technology in public transit and logistics.

| Sociological Factor | Description | Impact on Ballard | Supporting Data (2023-2024) |

|---|---|---|---|

| Public Perception | Growing awareness of climate change and concerns about air pollution. | Increases demand for zero-emission solutions like fuel cells. | 60% of consumers consider environmental impact in purchasing decisions (2024). |

| Workforce Skills | Demand for specialized engineering and technical talent in clean energy. | Requires investment in talent development and training programs. | Demand for clean energy roles outpaces supply in many regions (early 2024). |

| Corporate Social Responsibility (CSR) | Emphasis on sustainability and ethical business practices. | Favors companies with strong environmental credentials. | Global ESG fund investment exceeded $3.9 trillion (early 2024). |

| Urbanization | Increased population density in cities leads to higher pollution levels. | Drives demand for cleaner urban transport solutions. | Over 60% global population in urban areas by end of 2024. |

Technological factors

Ballard Power Systems is heavily reliant on ongoing technological progress, particularly in fuel cell efficiency and durability. Continuous research and development are key to making their Proton Exchange Membrane (PEM) fuel cell stacks and systems more effective, longer-lasting, and ultimately cheaper to produce. This drive for improvement directly impacts how attractive their technology is for demanding sectors like heavy-duty trucking and buses.

In 2023, Ballard reported a significant increase in gross margin for their fuel cell products, reaching 18%, up from 14% in 2022, indicating progress in cost-effectiveness. Furthermore, their ongoing investment in R&D, which represented 25% of their revenue in 2023, is focused on enhancing power density and extending the operational lifespan of their fuel cell modules. These advancements are crucial for Ballard to maintain its competitive standing and meet the evolving performance requirements of the zero-emission transportation market.

The scalability and cost-effectiveness of green hydrogen production are critical. For instance, the International Energy Agency (IEA) reported in 2024 that the cost of producing green hydrogen via electrolysis using renewable electricity has fallen by over 40% since 2014, reaching approximately $3-6 per kilogram in favorable locations. This downward trend is essential for making hydrogen competitive with fossil fuels.

Advancements in safe and efficient hydrogen storage and distribution are equally vital for Ballard's fuel cell technology. Innovations in high-pressure tanks and liquefaction methods are improving storage density and reducing infrastructure costs. By 2025, projections suggest that the cost of hydrogen storage solutions could decrease further, making hydrogen more accessible for transportation and industrial applications.

The rapid advancement and increasing adoption of alternative clean energy solutions, particularly battery electric vehicles (BEVs) and emerging synthetic fuels, pose a significant competitive challenge for Ballard. These technologies are gaining traction due to improving battery density and decreasing costs, directly impacting market share projections for hydrogen fuel cell solutions.

Ballard's ability to maintain its competitive edge hinges on its commitment to continuous innovation in fuel cell technology, aiming for higher efficiency and lower production costs to rival the evolving performance and economic viability of BEVs and synthetic fuels. For instance, while BEV sales are projected to reach over 15% of global passenger car sales by 2025, fuel cells are targeting specific heavy-duty segments where their range and refueling advantages are more pronounced.

Digitalization and Integration

Ballard's fuel cell systems benefit significantly from the integration of digital technologies. Artificial intelligence (AI) is being employed to optimize system performance, enabling predictive maintenance and more efficient fleet management, which translates to smarter, more reliable, and cost-effective operations.

The ongoing digitalization trend allows for enhanced data analytics, providing deeper insights into fuel cell operation and maintenance needs. This proactive approach minimizes downtime and extends the lifespan of Ballard's products, crucial for sectors like heavy-duty transport where reliability is paramount.

- AI-driven predictive maintenance can reduce unscheduled downtime by an estimated 20-30% in industrial applications.

- Real-time fleet management powered by digital integration allows for optimized route planning and energy usage, potentially improving fuel efficiency by up to 15%.

- Digital twin technology is increasingly used to simulate and test fuel cell performance under various conditions, accelerating product development and validation cycles.

Manufacturing Process Innovation

Ballard's commitment to manufacturing process innovation is key to lowering the cost of its fuel cell products. By integrating advanced automation and achieving greater economies of scale, the company can significantly reduce the per-unit production expenses. This focus on efficiency is vital for making fuel cell technology more competitive and accessible, especially as demand for clean energy solutions continues to surge.

Innovation in production techniques directly impacts Ballard's profitability and its capacity to scale operations. For instance, improvements in automated assembly lines and streamlined supply chain management can lead to substantial cost savings. Ballard reported that its gross margin improved to 27% in the first quarter of 2024, partly due to manufacturing efficiencies.

- Manufacturing Efficiency Gains: Ballard's ongoing efforts to optimize its production lines are designed to reduce labor and material costs per unit.

- Automation Investment: Strategic investments in automated manufacturing equipment are enhancing throughput and consistency, crucial for high-volume production.

- Economies of Scale: As production volumes increase, Ballard benefits from lower per-unit costs, making its fuel cell systems more price-competitive in the market.

- Cost Reduction Targets: Ballard has publicly stated targets for reducing the cost of its fuel cell stacks, aiming for specific dollar-per-kilowatt metrics by 2025 to drive market adoption.

Technological advancements are central to Ballard's success, focusing on enhancing fuel cell efficiency, durability, and cost-effectiveness. Innovations in areas like power density and operational lifespan are critical for competing with established technologies like battery electric vehicles (BEVs), especially in demanding sectors such as heavy-duty transportation.

Ballard's commitment to research and development, representing a significant portion of its revenue, aims to improve its Proton Exchange Membrane (PEM) fuel cell technology. For example, in 2023, R&D accounted for 25% of revenue, focused on making fuel cells more competitive against rapidly evolving alternatives.

The company's progress is evident in its increasing gross margins, reaching 18% in 2023 compared to 14% in 2022, signaling improved cost management and manufacturing efficiencies. Furthermore, strategic investments in digital technologies like AI for predictive maintenance and real-time fleet management are enhancing product reliability and operational performance.

The cost-competitiveness of green hydrogen production and storage solutions is also a key technological factor. As the International Energy Agency noted in 2024, green hydrogen production costs have fallen significantly, making it more viable. Ballard's fuel cell systems directly benefit from these broader industry advancements.

| Metric | 2023 | 2024 (Q1) | Target/Projection |

|---|---|---|---|

| Fuel Cell Gross Margin | 18% | 27% | Continued improvement |

| R&D as % of Revenue | 25% | N/A | Ongoing investment |

| Green Hydrogen Cost | ~$3-6/kg (2024) | N/A | Projected further decrease |

| BEV Market Share (Cars) | N/A | Projected >15% by 2025 | Key competitive benchmark |

Legal factors

International bodies like the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) are actively developing and harmonizing safety standards for hydrogen, crucial for Ballard's global market entry. For instance, ISO 19880 series covers hydrogen fueling station safety, with ongoing updates in 2024 and 2025 anticipated. Adherence to these evolving regulations is not just a legal requirement but a fundamental step towards securing public trust and enabling widespread adoption of fuel cell technology.

Product liability and warranty laws significantly shape Ballard's operational landscape, particularly concerning its advanced fuel cell technologies. These regulations dictate the responsibilities and potential liabilities manufacturers face, directly influencing product development, rigorous testing protocols, and customer service commitments. For instance, stringent product liability statutes can increase the cost of doing business through higher insurance premiums and potential litigation expenses if a product fails to perform as expected or causes harm.

In 2023, the global market for fuel cells saw continued growth, with increasing regulatory scrutiny accompanying this expansion. While specific liability case data for Ballard isn't publicly detailed, the general trend in advanced manufacturing suggests a heightened awareness of product safety and performance guarantees. Companies like Ballard must navigate a complex web of international and national warranty laws, which vary in their requirements for repair, replacement, or refund, directly impacting customer trust and long-term relationships.

Ballard Power Systems relies heavily on its robust portfolio of patents and trademarks to secure its technological edge in the fuel cell industry. For instance, in 2023, Ballard reported holding over 1,500 active patents globally, a testament to its commitment to innovation and protecting its intellectual property.

The effectiveness of these legal protections directly impacts Ballard's ability to commercialize its advanced fuel cell technologies without fear of direct imitation. Strong patent enforcement mechanisms are therefore critical for preventing competitors from leveraging Ballard's research and development investments, ensuring its long-term market position.

Environmental Permitting and Licensing

Environmental permitting and licensing are critical legal hurdles for Ballard, as the requirements for manufacturing facilities and fuel cell system deployment differ significantly across jurisdictions. Successfully navigating these complex regulatory landscapes is essential for efficient project execution and expansion.

Failure to secure the necessary permits can lead to substantial delays and increased costs. For instance, in 2023, the average time to obtain major environmental permits in the US could range from several months to over a year, impacting project timelines and capital deployment for companies like Ballard.

- Jurisdictional Variability: Legal requirements for environmental permits and operational licenses for manufacturing and fuel cell deployment vary by country, state, and even local municipality.

- Timely Execution: Efficiently navigating these regulatory processes is crucial for Ballard to ensure timely project execution and expansion plans.

- Cost Implications: Delays in obtaining permits can significantly increase project costs due to extended timelines and potential penalties.

- Compliance Burden: Ballard must maintain robust compliance programs to meet evolving environmental regulations, including emissions standards and waste management protocols.

International Trade Laws and Sanctions

Ballard's global operations hinge on meticulous adherence to international trade laws, customs regulations, and sanctions across diverse jurisdictions. Navigating these complex legal landscapes directly impacts import/export activities, influencing supply chain efficiency and market penetration. For instance, in 2024, the World Trade Organization (WTO) reported that trade facilitation measures, aimed at streamlining customs procedures, could reduce trade costs by an average of 14.3% for developing countries, a benefit Ballard actively seeks to leverage.

These legal frameworks are dynamic, with sanctions regimes, such as those imposed by the United States and the European Union on various nations, requiring constant monitoring. Failure to comply can result in severe penalties, including hefty fines and reputational damage. Ballard's commitment to robust compliance programs ensures it can operate effectively within these global legal constraints.

- Compliance with international trade laws is critical for managing import/export processes and market access.

- Customs regulations directly affect supply chain logistics and the cost of goods.

- Sanctions in key markets necessitate vigilant monitoring and adherence to avoid legal repercussions.

Ballard's operations are significantly influenced by evolving safety standards and certifications, particularly those from bodies like ISO and IEC, with ongoing updates in 2024 and 2025 shaping hydrogen fueling station safety. Product liability and warranty laws are paramount, dictating manufacturer responsibilities and potentially increasing costs through insurance and litigation risks. Intellectual property protection, evidenced by Ballard's over 1,500 active patents in 2023, is crucial for maintaining its competitive edge and preventing imitation of its fuel cell technologies.

Environmental factors

Global and national commitments to reduce greenhouse gas emissions are a major catalyst for Ballard's fuel cell technology. For instance, the Paris Agreement aims to limit global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. This overarching goal directly fuels demand for zero-emission solutions like those Ballard offers.

Ballard's fuel cell products are intrinsically linked to these environmental objectives, positioning the company favorably within the evolving regulatory landscape. As of early 2024, many countries are setting ambitious net-zero targets, with some aiming for 2050 or even earlier. This creates a strong policy tailwind for companies like Ballard that provide clean energy alternatives.

The increasing focus on climate change mitigation is translating into tangible market opportunities for Ballard. In 2023, the global hydrogen fuel cell market was valued at approximately $3.1 billion and is projected to grow significantly, with CAGR estimates often exceeding 20% through 2030. This growth is largely driven by government incentives and corporate sustainability initiatives, directly benefiting Ballard's market position.

Growing concerns over urban air quality, especially in major cities, are driving stricter regulations. For instance, by 2030, the European Union aims to phase out the sale of new internal combustion engine cars, creating a significant market opportunity for zero-emission transport.

This environmental push directly fuels demand for Ballard's fuel cell technology as a viable alternative for heavy-duty vehicles like buses and trucks. In 2023, Ballard reported a substantial increase in orders for its fuel cell modules, indicating strong market adoption driven by these clean air initiatives.

The environmental footprint of fuel cells hinges directly on how their hydrogen fuel is sourced. Ballard's commitment to zero-emission solutions is amplified by the growing availability and decreasing cost of green hydrogen, produced using renewable energy sources.

As of early 2024, the global green hydrogen market is experiencing significant growth, with projections indicating substantial expansion through 2030. For instance, the International Energy Agency (IEA) reported in its 2023 Hydrogen report that the cost of green hydrogen production is declining, driven by falling renewable electricity prices and improved electrolyzer efficiency, making it increasingly competitive with conventional hydrogen production methods.

Resource Scarcity and Lifecycle Impact

Ballard's manufacturing processes and the sourcing of raw materials for its fuel cell components are under increasing scrutiny regarding their environmental footprint. This extends to the end-of-life disposal of these advanced materials, a critical consideration for a company positioning itself as a leader in clean energy technology.

To maintain its reputation and meet evolving regulatory demands, Ballard must proactively address the entire lifecycle environmental impact of its products. This includes not only the operational efficiency of its fuel cells but also the sustainability of their creation and eventual decommissioning.

Key environmental considerations for Ballard include:

- Raw Material Sourcing: Ensuring responsible and sustainable sourcing of platinum group metals and other critical materials used in fuel cell catalysts and membranes. For instance, the price of platinum, a key component, has seen fluctuations, with averages around $950-$1050 per ounce in early 2024, impacting sourcing costs and strategies.

- Manufacturing Emissions: Minimizing greenhouse gas emissions and waste generation during the production of fuel cell stacks and systems. Ballard reported its Scope 1 and 2 greenhouse gas emissions for 2023, aiming for reductions aligned with industry best practices.

- End-of-Life Management: Developing effective strategies for recycling and recovering valuable materials from spent fuel cell components, thereby closing the loop in the product lifecycle.

Noise Pollution Reduction

Beyond tailpipe emissions, fuel cell vehicles (FCVs) offer a significant environmental advantage through drastically reduced noise pollution. This quiet operation enhances urban quality of life, a factor gaining traction in transportation policy and urban planning initiatives.

The quiet operation of fuel cell technology is a key differentiator. For instance, hydrogen fuel cell buses are notably quieter than their diesel counterparts, contributing to a more pleasant urban soundscape. This quietness is not just a comfort feature; it directly addresses public health concerns related to noise-induced stress and sleep disturbances.

- Reduced Noise Levels: Fuel cell vehicles typically operate at significantly lower decibel levels than internal combustion engine vehicles, improving urban environments.

- Urban Quality of Life: Quieter streets contribute to better public health and a more livable city, a growing consideration for urban planners.

- Transportation Planning: The noise reduction benefit is increasingly factored into decisions regarding public transportation fleets and urban infrastructure development.

Ballard's fuel cell technology directly benefits from global and national commitments to reduce greenhouse gas emissions, such as those outlined in the Paris Agreement. As of early 2024, many nations are actively pursuing net-zero targets, creating a favorable policy environment for zero-emission solutions like Ballard's.

The environmental push is translating into tangible market growth, with the global hydrogen fuel cell market projected for significant expansion, often estimated at over 20% CAGR through 2030, driven by incentives and corporate sustainability goals. Stricter regulations on urban air quality, exemplified by the EU's aim to phase out new internal combustion engine car sales by 2030, further bolster demand for Ballard's clean transport alternatives.

The environmental viability of Ballard's fuel cells is increasingly tied to the availability of green hydrogen, produced using renewable energy. As of early 2024, the green hydrogen market is expanding, with declining production costs due to falling renewable electricity prices and improved electrolyzer efficiency making it more competitive.

Ballard must also manage the environmental footprint of its manufacturing processes and raw material sourcing, including the end-of-life management of its products. This lifecycle approach is crucial for maintaining its leadership in clean energy. Key considerations include the responsible sourcing of platinum group metals, with platinum prices fluctuating around $950-$1050 per ounce in early 2024, minimizing manufacturing emissions, and developing effective recycling strategies for spent fuel cell components.

Fuel cell vehicles offer a substantial environmental advantage through significantly reduced noise pollution, enhancing urban quality of life and influencing transportation planning. For instance, hydrogen fuel cell buses operate at much lower decibel levels than their diesel counterparts.

| Environmental Factor | Impact on Ballard | Data Point/Example |

|---|---|---|

| Climate Change Mitigation Policies | Drives demand for zero-emission solutions | Paris Agreement goals; Net-zero targets by 2050+ |

| Air Quality Regulations | Creates market opportunities in transportation | EU's planned ICE vehicle sales phase-out by 2030 |

| Green Hydrogen Availability | Enhances the environmental credentials and cost-competitiveness of fuel cells | Declining green hydrogen production costs (IEA 2023 report) |

| Lifecycle Environmental Impact | Requires focus on sourcing, manufacturing, and end-of-life management | Platinum prices ~$950-$1050/oz (early 2024); Ballard's 2023 emissions reporting |

| Noise Pollution Reduction | Improves urban quality of life and transportation planning | Quieter operation of fuel cell buses compared to diesel |

PESTLE Analysis Data Sources

Our Ballard PESTLE Analysis is grounded in a comprehensive review of publicly available data, including government reports, economic indicators from international bodies, and reputable industry publications. We meticulously gather information on technological advancements, social trends, and environmental regulations to ensure a robust and current assessment.