Ballard Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ballard Bundle

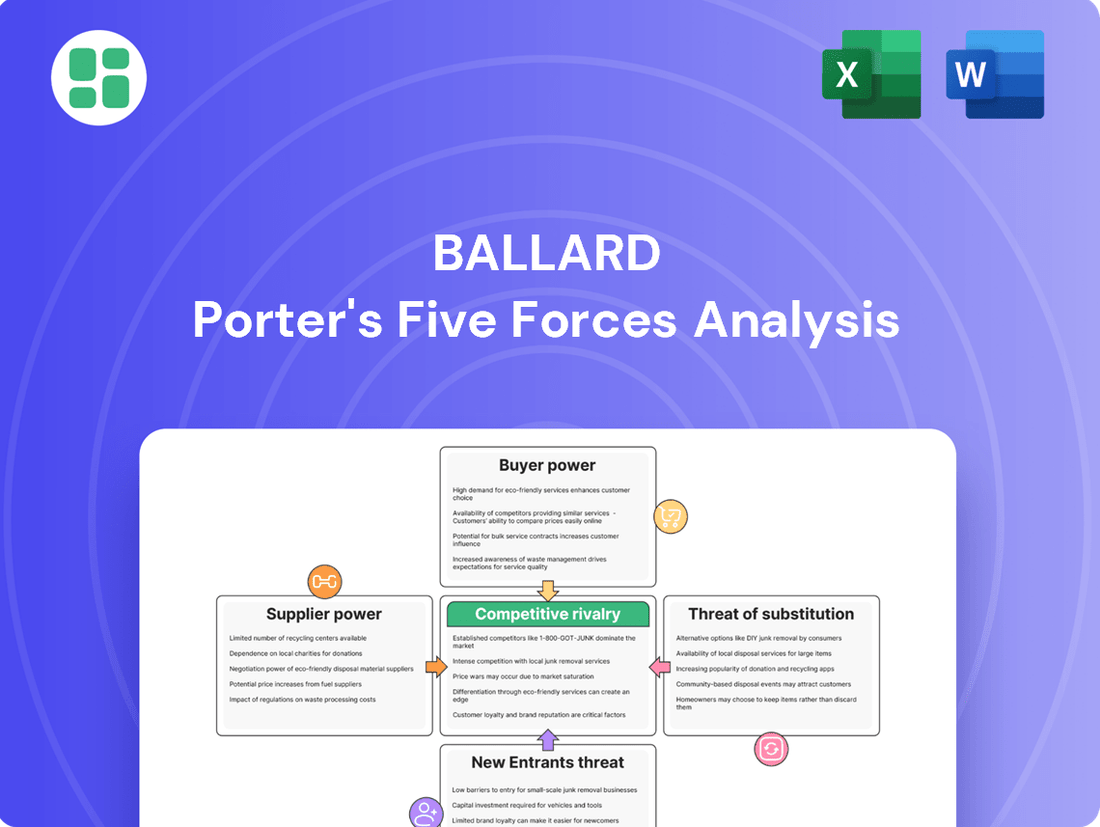

Porter's Five Forces Analysis for Ballard reveals the intense competitive landscape they navigate, highlighting the power of buyers and the threat of substitutes. Understanding these forces is crucial for any business looking to thrive in their sector.

The complete report reveals the real forces shaping Ballard’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ballard Power Systems' reliance on niche raw materials like platinum group metals (PGMs) for its PEM fuel cell catalysts and advanced proton exchange membranes creates significant supplier bargaining power. These specialized components are not readily available from multiple sources. For instance, the price of platinum, a key PGM, has seen volatility, with averages around $900-$1000 per ounce in early 2024, directly impacting Ballard's cost structure.

Replacing Ballard's highly engineered fuel cell components, like bipolar plates or membrane electrode assemblies, involves significant redesign, rigorous testing, and lengthy certification processes. This can easily add millions of dollars and months, if not years, to product development timelines.

These substantial switching costs effectively lock Ballard into its existing supplier relationships, granting those suppliers considerable leverage. For instance, a single critical component supplier experiencing production issues could severely disrupt Ballard's manufacturing, highlighting the suppliers' power.

Proprietary technology held by a few fuel cell component suppliers creates a significant barrier for Ballard. When key materials or manufacturing processes are patented, Ballard faces limited options, giving these specialized suppliers leverage in negotiating prices and contract terms. This reliance on a narrow base of technologically advanced suppliers can directly impact Ballard's cost of goods sold and operational flexibility.

Potential for Forward Integration by Suppliers

Suppliers possessing robust manufacturing prowess or significant material science knowledge might consider integrating forward into producing fuel cell stacks or modules. This potential threat, even if not actively pursued, encourages Ballard to nurture positive relationships and favorable terms with its critical suppliers.

For instance, a supplier of advanced membrane electrode assemblies (MEAs) could potentially develop the capability to assemble these into complete fuel cell stacks. This would directly compete with Ballard's core business. In 2024, the global fuel cell market continued its growth trajectory, with significant investment flowing into component manufacturing and supply chains, making forward integration a more tangible possibility for well-positioned suppliers.

- Suppliers' Forward Integration Threat: Suppliers with advanced manufacturing or material science expertise could enter Ballard's value chain by producing fuel cell stacks or modules.

- Impact on Ballard: This latent threat necessitates maintaining strong supplier relationships and favorable contract terms.

- Example: A key supplier of critical components like MEAs could potentially expand into stack assembly, directly challenging Ballard's market position.

- Market Context (2024): The expanding global fuel cell market in 2024 saw increased investment in component manufacturing, heightening the feasibility of forward integration for capable suppliers.

Quality and Reliability of Supplied Components

The performance, durability, and safety of Ballard's fuel cell products are intrinsically linked to the quality and reliability of components sourced from its suppliers. A lapse in supplier quality can directly undermine Ballard's product reputation and customer satisfaction, thereby amplifying the suppliers' leverage.

Ballard's reliance on specialized, high-precision components means that a limited number of suppliers may possess the necessary expertise and manufacturing capabilities. This scarcity of alternatives can significantly bolster the bargaining power of these key suppliers, especially for critical fuel cell stack materials and control systems.

- Component Criticality: Key components, such as membrane electrode assemblies (MEAs) and bipolar plates, are vital for fuel cell operation, making their consistent quality paramount.

- Supplier Concentration: The specialized nature of fuel cell technology often leads to a concentrated supplier base for certain critical inputs.

- Impact of Defects: A single defective component can lead to system failure, requiring costly recalls and damaging brand trust, giving suppliers leverage in price negotiations.

Ballard Power Systems faces considerable supplier bargaining power due to its reliance on specialized, high-quality components essential for its PEM fuel cell technology. The limited availability of these critical inputs, such as platinum-based catalysts and advanced membrane electrode assemblies (MEAs), means few suppliers can meet Ballard's stringent specifications. This scarcity, coupled with the high switching costs for Ballard to change suppliers, grants existing providers significant leverage in pricing and contract negotiations.

The concentration of expertise among a few key suppliers for components like bipolar plates and control systems further amplifies their bargaining power. Any disruption from these suppliers, whether due to production issues or price increases, can directly impact Ballard's manufacturing and profitability. For instance, the price of platinum, a key catalyst material, saw fluctuations in early 2024, with average prices hovering around $900-$1000 per ounce, illustrating the cost sensitivity to raw material suppliers.

| Component Category | Key Materials/Parts | Supplier Bargaining Power Factors | 2024 Market Context Impact |

|---|---|---|---|

| Catalysts | Platinum Group Metals (PGMs) | High raw material cost volatility, limited PGM suppliers | Platinum price averages around $900-$1000/oz in early 2024, impacting input costs. |

| Membrane Electrode Assemblies (MEAs) | Proton Exchange Membranes, Catalyst Layers | Proprietary technology, high R&D investment, stringent quality requirements | Growing demand for MEAs in expanding fuel cell market increases supplier leverage. |

| Bipolar Plates | Graphite, Coated Metals | Specialized manufacturing processes, high precision engineering | Need for advanced materials and manufacturing capabilities limits supplier options. |

What is included in the product

This analysis dissects the competitive intensity within Ballard's industry by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a structured overview of industry power dynamics.

Customers Bargaining Power

Ballard's customer base in heavy-duty sectors like buses, trucks, trains, and marine is often concentrated among large, sophisticated original equipment manufacturers (OEMs) and fleet operators. These major clients, placing substantial orders, wield significant bargaining power. For instance, in 2024, Ballard's revenue was impacted by large order timings, demonstrating the influence of these key customers.

Customers looking to adopt fuel cell technology, like those using Ballard's products, often face significant upfront costs. This includes the purchase of fuel cell vehicles and the development of essential hydrogen fueling infrastructure. For instance, the cost of a fuel cell electric truck can be considerably higher than a traditional diesel truck, and building out a robust hydrogen refueling network requires substantial investment from fleet operators or governments.

This high initial capital expenditure makes customers very focused on the total cost of ownership over the lifespan of the equipment. Consequently, they possess considerable bargaining power, as they can leverage this sensitivity to demand competitive pricing from Ballard and insist on strong, reliable after-sales service and support to ensure their investment is protected and operational efficiency is maintained.

Customers in the heavy-duty sector often require fuel cell solutions tailored specifically for their unique platforms. This need for customization means Ballard must dedicate significant resources to meet these bespoke requirements, thereby enhancing the customers' leverage.

The demand for deep integration into existing heavy-duty systems, from trucking to stationary power, further amplifies customer bargaining power. Ballard's need to provide extensive technical support and ensure seamless compatibility adds to the cost and complexity of serving these clients, giving them more sway in negotiations.

Availability of Competing Decarbonization Technologies

The availability of competing decarbonization technologies significantly impacts the bargaining power of Ballard's customers. Customers can choose from alternatives like battery electric vehicles (BEVs), which are increasingly prevalent, and to a lesser extent, hydrogen combustion engines or internal combustion engines running on alternative fuels.

These viable substitutes empower customers to demand greater cost-effectiveness and superior performance from Ballard's fuel cell solutions. For instance, the total cost of ownership for BEVs, including purchase price and charging infrastructure, is becoming more competitive, forcing Ballard to justify its pricing and technological advantages.

- BEV Market Growth: The global battery electric vehicle market is projected to reach over 30 million units sold annually by 2024, presenting a substantial alternative.

- Hydrogen Adoption Trends: While less mature, investments in hydrogen infrastructure and vehicle development continue, offering a future competitive landscape.

- Cost Sensitivity: Customers, particularly in fleet operations, closely scrutinize the upfront costs and operational expenses of different decarbonization pathways.

- Performance Benchmarking: The range, refueling/recharging times, and power output of competing technologies set benchmarks that Ballard's products must meet or exceed.

Customer's Influence on Industry Standards and Adoption

Large, influential customers, particularly those in the transit and heavy-duty trucking sectors, wield significant power to shape industry standards and drive technology adoption. Their decisions to embrace hydrogen fuel cell technology can accelerate market growth and influence the pace of innovation.

For Ballard, the strategic choices of major fleet operators and vehicle manufacturers are paramount. For instance, a large transit agency committing to a substantial hydrogen bus order can create a ripple effect, encouraging other players to invest and normalize the technology, directly impacting Ballard’s sales volumes and market penetration strategies.

- Customer Influence: Major fleet operators and vehicle manufacturers can dictate technology preferences and drive widespread adoption of hydrogen fuel cell solutions.

- Market Shaping: The collective purchasing power of key customers can establish new industry standards for fuel cell performance and durability.

- Ballard's Dependence: Ballard's revenue and growth are heavily influenced by the willingness of these large customers to integrate hydrogen technology into their operations.

- Strategic Partnerships: Collaborations with influential customers are critical for Ballard to validate its technology and secure large-scale deployment contracts.

Ballard's customer base, largely composed of major Original Equipment Manufacturers (OEMs) and fleet operators in heavy-duty sectors, possesses considerable bargaining power due to the substantial volume of their orders. This concentration means that the timing of large customer orders can significantly influence Ballard's revenue, as observed in 2024. Customers are also highly sensitive to the total cost of ownership, given the high initial capital expenditures for fuel cell vehicles and hydrogen infrastructure, which compels them to negotiate for competitive pricing and robust after-sales support.

The need for customized fuel cell solutions tailored to specific heavy-duty platforms and the requirement for deep integration into existing systems further amplify customer leverage. This necessitates significant resource allocation from Ballard for bespoke development and extensive technical support, strengthening the customers' negotiating position. Furthermore, the availability of competing decarbonization technologies, such as battery electric vehicles (BEVs), allows customers to benchmark performance and cost-effectiveness, forcing Ballard to demonstrate clear advantages.

| Factor | Impact on Ballard | Customer Action |

|---|---|---|

| Concentrated Customer Base | High dependence on large orders | Negotiate pricing and terms based on volume |

| High Upfront Costs | Focus on Total Cost of Ownership (TCO) | Demand competitive pricing and strong service |

| Customization Needs | Increased R&D and support costs | Leverage unique requirements for better terms |

| Availability of Alternatives | Pressure to match BEV competitiveness | Benchmark against BEVs for cost and performance |

Full Version Awaits

Ballard Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis you'll receive instantly after purchase. You're viewing the exact, professionally formatted document, offering a clear understanding of competitive intensity and industry attractiveness. This detailed report is ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

The fuel cell market is a crowded space with significant players like Plug Power, Bloom Energy, Panasonic, and Doosan Fuel Cell. These companies possess substantial funding and advanced technology, directly competing for dominance in key sectors such as heavy-duty transportation and stationary power generation.

This intense competition translates into fierce rivalry for securing lucrative contracts and forging essential strategic alliances. For instance, Plug Power, a major competitor, reported $891.6 million in revenue for 2023, highlighting the scale of investment and operational capacity within the industry.

The fuel cell manufacturing industry faces intense competition, largely driven by substantial upfront investments in research, development, and production infrastructure. These high fixed costs compel companies to aggressively seek out large-scale orders and ramp up production volumes. For instance, Ballard Power Systems, a key player, reported capital expenditures of $57.9 million in 2023 as they invested in expanding their manufacturing capabilities, highlighting the significant cost base.

This pursuit of economies of scale to offset these considerable fixed costs inevitably leads to fierce price competition. Companies are incentivized to secure higher production runs, even at lower margins, to spread the cost of their advanced manufacturing facilities. This dynamic creates a challenging environment where achieving profitability often hinges on securing substantial market share and optimizing operational efficiency.

The fuel cell industry is locked in a relentless pursuit of technological superiority, where companies like Ballard Power Systems are compelled to invest heavily in research and development. This continuous innovation cycle, focused on enhancing fuel cell efficiency, extending lifespan, and reducing manufacturing costs, directly fuels competitive rivalry. For instance, Ballard's 2023 R&D spending was a significant portion of its revenue, reflecting this critical need to stay ahead.

Government Policies and Subsidies Impacting Competition

Government policies and subsidies are a major force shaping competition within the clean energy sector. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, provides substantial tax credits and incentives for renewable energy projects, significantly lowering the cost of entry and operation for companies. This has spurred increased investment and competition as more players seek to capitalize on these benefits.

These incentives can create an uneven playing field, favoring companies that are well-positioned to leverage them. For example, in 2024, the IRA's manufacturing tax credits are expected to drive a surge in domestic production of solar panels and wind turbine components, potentially giving U.S.-based manufacturers a competitive edge over international rivals.

The regulatory environment also plays a crucial role. Stringent environmental regulations can increase operational costs for less compliant firms, while supportive policies for grid modernization can accelerate the adoption of new technologies, intensifying competition among those offering advanced solutions.

- Government incentives, such as the IRA's production tax credits (PTC) and investment tax credits (ITC), directly reduce the capital expenditure and operating costs for renewable energy projects.

- Regional variations in subsidies can lead to concentrated investment and competitive activity in areas offering the most favorable policy environments.

- Regulatory frameworks, like renewable portfolio standards (RPS) in various states, mandate a certain percentage of electricity generation from renewable sources, driving demand and competition for compliant technologies.

- In 2024, the global market for green hydrogen is projected to see significant growth, partly driven by government support and subsidies aimed at decarbonizing heavy industry.

High Exit Barriers Due to Specialized Investments

Companies in the fuel cell sector have poured significant capital into specialized assets, including proprietary intellectual property, extensive research and development, and dedicated manufacturing facilities. These substantial, often industry-specific investments create high exit barriers.

Consequently, even when market conditions become unfavorable, firms are incentivized to stay operational and continue competing rather than divesting. This persistence fuels ongoing, intense rivalry within the industry.

- Specialized Capital Investments: Fuel cell companies often invest heavily in unique technologies and production lines, making it difficult and costly to pivot or exit.

- R&D Intensity: Significant ongoing R&D spending is crucial for innovation, further locking companies into the sector.

- Manufacturing Infrastructure: Building specialized fuel cell manufacturing plants requires immense capital, creating a high barrier to entry and exit.

Competitive rivalry in the fuel cell market is intense, driven by numerous players vying for market share. Companies like Plug Power and Bloom Energy are heavily invested in advanced technology, leading to a constant push for innovation and cost reduction. This dynamic is further amplified by substantial upfront investments in research, development, and manufacturing infrastructure, creating high fixed costs that necessitate aggressive competition to achieve economies of scale.

The pursuit of technological superiority and market dominance fuels this rivalry, with companies dedicating significant resources to R&D. For example, Ballard Power Systems' 2023 R&D spending reflects this commitment to staying ahead in a rapidly evolving industry. Moreover, government incentives and supportive regulations, such as those provided by the Inflation Reduction Act in the US, are attracting more competitors and intensifying the battle for market access and growth opportunities.

| Company | 2023 Revenue | 2023 R&D Spending (Estimated % of Revenue) | 2023 Capital Expenditures |

|---|---|---|---|

| Plug Power | $891.6 million | N/A | N/A |

| Ballard Power Systems | N/A | Significant portion of revenue | $57.9 million |

| Bloom Energy | N/A | N/A | N/A |

SSubstitutes Threaten

Battery Electric Vehicles (BEVs) present a significant threat to Fuel Cell Electric Vehicles (FCEVs), especially in the passenger car and shorter-range heavy-duty segments. As of early 2024, BEV technology continues to mature, with battery costs declining and energy density improving, making them a more accessible and appealing option for many consumers and fleet operators.

The expanding charging infrastructure further bolsters the competitive position of BEVs. For instance, by the end of 2023, the number of public charging points globally surpassed 2.7 million, a substantial increase from previous years, reducing range anxiety and making BEVs a practical choice for daily use and even longer journeys.

Despite the significant global momentum towards decarbonization, traditional internal combustion engine (ICE) vehicles, particularly those utilizing cleaner fuels such as natural gas or biofuels, represent a persistent and cost-effective substitute. Their widespread availability and lower initial purchase prices continue to present a considerable threat, especially in markets where environmental regulations are less rigorous.

Hydrogen combustion engines represent a notable threat to fuel cell technology in heavy-duty sectors. These engines directly combust hydrogen, offering a potentially less complex integration for manufacturers accustomed to internal combustion engine technology. For instance, companies like Cummins have been actively developing hydrogen internal combustion engines, signaling industry interest and investment in this alternative.

While hydrogen combustion engines are generally less efficient than fuel cells, their appeal lies in leveraging existing manufacturing infrastructure and potentially lower upfront costs. This could make them an attractive option for some fleet operators seeking to transition to hydrogen without a complete overhaul of their powertrain knowledge base. This technological pathway could capture market share from fuel cell solutions, particularly in segments where absolute peak efficiency is not the primary driver.

Alternative Energy Storage for Stationary Power

For stationary power needs, battery energy storage systems (BESS), particularly lithium-ion, present a significant threat of substitution to fuel cells. These battery solutions are increasingly competitive on cost and are often paired with solar and wind power installations, making them a more integrated renewable energy option.

The falling costs of battery technology are a key driver. For example, the average cost of lithium-ion battery packs for energy storage systems saw a notable decline, with projections indicating further reductions through 2024 and beyond, making them a more attractive alternative to hydrogen fuel cells in many applications.

- Cost Competitiveness: Battery storage costs continue to decrease, approaching parity with or even undercutting fuel cell solutions for certain stationary power use cases.

- Integration with Renewables: BESS are seamlessly integrated with intermittent renewable sources like solar and wind, offering a complete renewable energy storage package.

- Technological Advancements: Ongoing improvements in battery chemistries and manufacturing processes are enhancing performance and lifespan, further strengthening their position as substitutes.

Other Fuel Cell Technologies

Within the broader fuel cell landscape, alternative technologies like Solid Oxide Fuel Cells (SOFCs) and Molten Carbonate Fuel Cells (MCFCs) present a significant threat of substitution. These technologies are capable of serving similar heavy-duty transportation and stationary power generation markets, offering distinct operational advantages and fuel versatility that can appeal to customers.

These internal substitutes directly compete for the same market opportunities that Ballard Power Systems targets. For instance, SOFCs can operate at higher temperatures, potentially leading to greater efficiency and simpler balance-of-plant components in certain applications, while MCFCs offer inherent carbon capture capabilities. The competitive positioning of these technologies means that Ballard must continually innovate to maintain its market share.

- SOFCs and MCFCs offer alternative solutions for heavy-duty and stationary power markets.

- These technologies provide different operational characteristics and fuel flexibilities compared to Ballard's offerings.

- The presence of these internal substitutes intensifies competition for market share in key sectors.

The threat of substitutes for fuel cell electric vehicles (FCEVs) is multifaceted, encompassing both alternative powertrain technologies and evolving energy storage solutions. Battery electric vehicles (BEVs) continue to mature, with improving battery technology and expanding charging infrastructure making them increasingly competitive, especially in lighter-duty segments. By early 2024, global public charging points exceeded 2.7 million, enhancing BEV practicality.

Internal combustion engine (ICE) vehicles, particularly those using cleaner fuels, remain a significant substitute due to their established infrastructure and lower initial costs. Hydrogen internal combustion engines also pose a threat, offering a familiar technology for manufacturers and potentially lower integration costs. For stationary power, battery energy storage systems (BESS) are becoming more cost-competitive, with lithium-ion battery pack costs for energy storage systems seeing notable declines through 2024.

| Substitute Technology | Key Advantages | Market Segments Targeted | 2024 Status/Trend |

|---|---|---|---|

| Battery Electric Vehicles (BEVs) | Established infrastructure, improving battery density, declining costs | Passenger cars, light-to-medium duty commercial vehicles | Continued rapid growth, increasing range and charging speed |

| Internal Combustion Engine (ICE) Vehicles (cleaner fuels) | Widespread availability, lower upfront cost, familiar technology | All vehicle segments, particularly where regulations are less stringent | Persistent market share, especially in developing economies |

| Hydrogen Internal Combustion Engines | Leverages existing ICE manufacturing, simpler integration | Heavy-duty trucking, industrial applications | Growing R&D and pilot programs, potential for niche adoption |

| Battery Energy Storage Systems (BESS) | Cost-competitiveness with renewables, seamless integration | Stationary power generation, grid stabilization | Rapidly falling costs, significant deployment alongside solar/wind |

Entrants Threaten

Entering the proton exchange membrane (PEM) fuel cell market demands substantial capital, particularly for research and development. Companies like Ballard Power Systems, a leader in this space, invest heavily to innovate and improve their technology. For instance, in 2023, Ballard reported R&D expenses of $60.3 million, highlighting the ongoing need for significant financial commitment to stay competitive.

Beyond R&D, establishing specialized manufacturing facilities and scaling production represents another massive financial hurdle. Building out the necessary infrastructure to produce PEM fuel cells efficiently and at scale requires hundreds of millions of dollars. This high upfront cost acts as a significant deterrent, making it difficult for new players to challenge established companies with existing production capabilities and market presence.

Ballard Power Systems, a leader in fuel cell technology, has built a formidable intellectual property fortress. Their extensive patent portfolio, developed over years of dedicated research and development, acts as a significant deterrent to potential new entrants. For instance, as of early 2024, Ballard held over 1,000 patents globally, covering core fuel cell components and system designs.

Navigating this landscape is a major hurdle. New companies entering the fuel cell market must either invest heavily in developing entirely novel technologies to avoid infringement or secure expensive licensing agreements from incumbents like Ballard. This financial and technical burden can make market entry prohibitively difficult, effectively raising the barriers to entry.

The complex nature of fuel cell technology presents a significant barrier to entry for new companies. Designing, developing, and manufacturing high-performance fuel cells requires deep technical expertise in engineering, chemical processes, and materials science. For instance, companies like Ballard Power Systems invest heavily in R&D to maintain their technological edge, a costly endeavor for newcomers.

Complex Regulatory Landscape and Safety Standards

The hydrogen and fuel cell sector is burdened by a complex web of safety regulations, codes, and standards governing everything from hydrogen production and storage to its ultimate use. This intricate regulatory environment acts as a substantial barrier to entry.

New companies must invest considerable resources and time to understand and comply with these evolving requirements, often needing to secure numerous certifications before market entry. For instance, in 2024, the lengthy approval processes for new hydrogen infrastructure projects in many regions can extend timelines by several years, significantly increasing upfront capital expenditure and delaying revenue generation.

- Stringent Safety Regulations: The industry adheres to rigorous safety protocols, impacting operational design and investment.

- Navigational Hurdles: Understanding and complying with diverse and changing regulations requires specialized expertise and significant lead time.

- Certification Costs: Obtaining necessary certifications for hydrogen production, storage, and fuel cell systems adds substantial financial burdens for new players.

- Time and Cost Barriers: The combined effect of regulatory complexity and certification requirements creates a high threshold for new entrants, delaying market penetration and increasing initial investment.

Brand Reputation and Established Customer Relationships

Ballard Power Systems benefits significantly from its strong brand reputation and deeply entrenched customer relationships within the heavy-duty mobility and stationary power sectors. For instance, Ballard's long history has allowed them to build trust through consistent product reliability, a critical factor for demanding industrial applications. This established presence makes it exceptionally difficult for new companies to penetrate the market, as they must overcome significant hurdles in gaining customer confidence and market acceptance.

New entrants face a considerable challenge in replicating Ballard's established market position. Consider that in 2023, Ballard secured significant orders, including a major fuel cell system supply agreement for transit buses in Germany, underscoring their existing customer commitments. Newcomers must not only offer competitive technology but also demonstrate a proven track record and build comparable levels of trust, which takes considerable time and investment.

- Brand Loyalty: Ballard's long-standing presence has fostered significant brand loyalty among its customer base.

- Reliability Track Record: Decades of operation have built a reputation for product reliability crucial in heavy-duty applications.

- Customer Trust: Established relationships with key clients provide a significant barrier to entry for new competitors.

- Market Acceptance: New entrants struggle to achieve the same level of market acceptance as incumbents like Ballard.

The threat of new entrants in the PEM fuel cell market is significantly mitigated by the immense capital required for research and development, as well as for establishing manufacturing capabilities. Ballard Power Systems, for example, invested $60.3 million in R&D in 2023, illustrating the substantial financial commitment needed to remain competitive.

Furthermore, a robust intellectual property portfolio, such as Ballard's over 1,000 global patents as of early 2024, creates a formidable barrier. New companies must either innovate to avoid infringement or incur licensing costs, adding to the already high entry threshold.

| Barrier Type | Description | Example (Ballard) |

|---|---|---|

| Capital Requirements | High R&D and manufacturing setup costs. | $60.3 million R&D spend in 2023. |

| Intellectual Property | Extensive patent portfolio. | Over 1,000 patents globally (early 2024). |

| Technology & Expertise | Deep technical knowledge required. | Continuous investment in innovation. |

| Regulatory Compliance | Complex safety standards and certifications. | Lengthy approval processes for hydrogen infrastructure. |

| Brand Reputation & Relationships | Established trust and customer loyalty. | Secured major transit bus orders in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company financial statements, industry-specific market research reports, and expert commentary from financial analysts to provide a comprehensive view of competitive pressures.