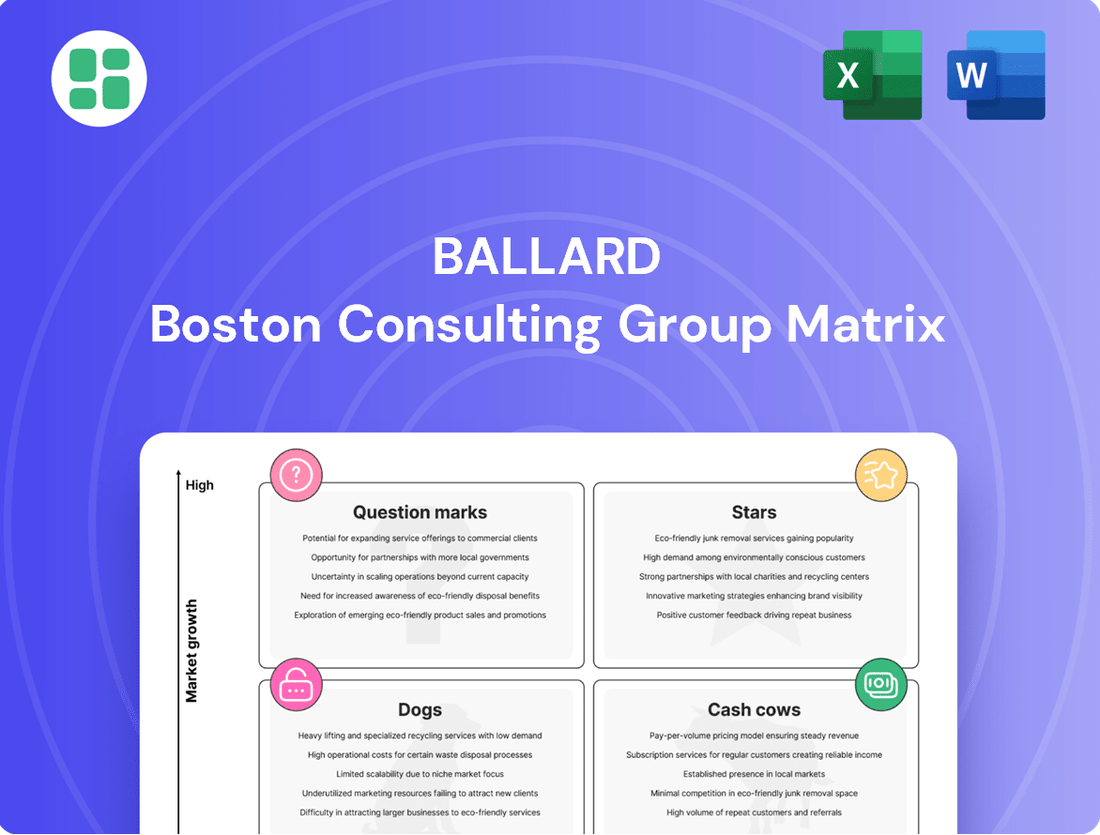

Ballard Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ballard Bundle

The Ballard BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing each product into Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. This framework provides a vital snapshot of where your business stands, highlighting opportunities and potential challenges.

To truly harness the strategic power of this analysis, dive deeper with the full BCG Matrix report. Unlock detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize your product investments and drive smarter business decisions.

Stars

Ballard's fuel cell engines for transit buses are a clear Star in their product portfolio. The company saw a remarkable 51% revenue jump in its bus segment for the entirety of 2024, and continued this strong performance with a 41% year-over-year increase in Q1 2025. This segment now accounts for a dominant 81% of Ballard's total revenue, underscoring its market leadership and rapid expansion.

Ballard Power Systems stands as a clear leader in Proton Exchange Membrane (PEM) fuel cell technology. This is a crucial advantage as PEM represents the largest and most rapidly growing segment of the fuel cell market, particularly for vehicles. Their strong technological foundation translates into a significant market share in the burgeoning clean energy sector.

Ballard's commitment to innovation is evident in their continuous improvements to PEM efficiency and durability. For instance, in 2023, they reported a 10% increase in the power density of their latest fuel cell stacks, a key metric for vehicular applications. This ongoing development solidifies their competitive standing in a dynamic industry.

Ballard Power Systems strategically partners with leading vehicle manufacturers and operators in crucial markets like Europe and North America. These collaborations are vital for driving fuel cell adoption in heavy-duty transportation.

A prime example is Ballard's long-term supply agreement with New Flyer, a major bus manufacturer. This partnership guarantees substantial order intake and strengthens Ballard's market penetration for its fuel cell products.

In 2023, Ballard reported revenue growth driven by these strategic relationships, with Europe and North America representing significant portions of their market presence, reflecting the success of these key partnerships.

Record Order Backlog

Ballard Power Systems demonstrated significant commercial momentum in 2024, culminating in a record year-end order backlog of $173.5 million. This backlog represented a substantial 41% surge from the previous quarter, highlighting robust demand for their fuel cell power products.

While the first quarter of 2025 saw a modest dip in the order backlog, attributed to ongoing product deliveries, the underlying strength of the order book remains a key indicator. This sustained backlog signals continued customer trust and substantial future revenue potential across Ballard's core business segments.

- Record 2024 Year-End Backlog: $173.5 million.

- Quarter-over-Quarter Growth: 41% increase in backlog by the end of 2024.

- Q1 2025 Backlog Trend: Slight decrease due to deliveries, but overall strength maintained.

- Indicator of Future Revenue: Robust backlog signifies strong customer confidence and potential sales.

Growing Engine Shipments

Ballard Power Systems is showing promising growth in its fuel cell engine shipments, a key indicator for its position in the market. Despite broader revenue pressures, the company saw a significant uptick in the number of engines it delivered.

Specifically, Ballard reported a 30% increase in fuel cell engine shipments for the full year 2024, totaling over 660 units. This momentum carried into the first quarter of 2025, with another 31% increase in engine shipments. This consistent rise in unit volume suggests that Ballard is expanding its production capabilities and that its fuel cell technology is gaining traction with customers.

- 2024 Engine Shipments: Over 660 units delivered, a 30% increase year-over-year.

- Q1 2025 Engine Shipments: Continued growth with a 31% increase.

- Market Acceptance: Growing unit volumes signal increasing demand and adoption of fuel cell technology.

- Future Outlook: This expansion in shipments positions Ballard for potential future revenue growth as the hydrogen economy develops.

Ballard's fuel cell engines for transit buses are a clear Star in their product portfolio, demonstrating exceptional market growth and dominance. The company experienced a substantial 51% revenue increase in its bus segment for the entirety of 2024, and this robust performance continued with a 41% year-over-year increase in Q1 2025. This segment now represents a significant 81% of Ballard's total revenue, highlighting its leadership and rapid expansion in the clean energy transportation sector.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| Bus Segment Revenue Growth | 51% | 41% (YoY) |

| Bus Segment Revenue Share | 81% | 81% |

| Engine Shipments Growth | 30% | 31% |

| Year-End Order Backlog | $173.5 million | N/A (trend noted) |

What is included in the product

The Ballard BCG Matrix categorizes business units by market share and growth rate to guide investment decisions.

The Ballard BCG Matrix offers a clear visual of your portfolio, instantly highlighting underperforming units that drain resources.

Cash Cows

Ballard Power Systems, a key player in the burgeoning fuel cell sector, currently lacks products that fit the traditional 'Cash Cow' classification within the Boston Consulting Group matrix. This means none of its offerings are mature, high-market-share products generating significant surplus cash to fund other ventures.

The company's financial performance in 2024 and the first quarter of 2025 highlights this situation. Ballard reported negative gross margins for both periods. For instance, in Q1 2025, Ballard's gross margin was -23.5%, underscoring that even its most advanced product lines are not yet profitable enough to be considered cash cows.

Ballard's fuel cell products, despite strong market positions, are currently in an investment-heavy growth phase. This means even successful offerings are consuming significant capital for R&D and scaling, rather than generating surplus cash. For instance, the global fuel cell market was projected to reach $45.7 billion by 2027, indicating substantial ongoing investment needs across the industry.

Ballard's approach to its established products within the BCG framework isn't about passive "milking." Instead, the company is actively reinvesting to solidify and grow its dominant position in critical heavy-duty mobility sectors. This focus on market leadership is paramount for sustained success.

This strategy necessitates ongoing investment in enhancing the efficiency, longevity, and affordability of their proton exchange membrane (PEM) fuel cell technology. For instance, Ballard's 2024 revenue reached $270.7 million, demonstrating continued market engagement and the financial capacity to support these advancements.

Industry Rationalization Impact

The hydrogen and fuel cell sector is currently experiencing significant 'rationalization.' This means companies are consolidating, exiting less profitable areas, or refocusing their strategies. Policy uncertainties and a challenging funding landscape are making it tough for any segment to consistently generate substantial cash flow, a key characteristic of a cash cow.

Consequently, businesses in this industry are largely prioritizing cost reduction and making strategic investments in future growth areas. They are not typically relying on established, mature products that would normally be considered cash cows. For instance, in 2024, many hydrogen startups faced funding challenges, with venture capital investment in the sector seeing a notable slowdown compared to previous years, making stable cash generation a rarity.

This environment means that identifying traditional cash cows within the hydrogen and fuel cell industry is difficult at present. Instead, the focus is on innovation and market development, rather than milking existing, profitable products.

- Industry Rationalization: The hydrogen and fuel cell sector is consolidating and refocusing, impacting the potential for stable cash generation.

- Policy and Funding Challenges: Uncertainties in policy and a difficult funding environment in 2024 are stressing the industry's ability to produce cash cows.

- Strategic Prioritization: Companies are concentrating on cost reduction and strategic investments rather than relying on mature, cash-generating products.

Future Potential, Not Current Reality

Ballard's bus segment, while demonstrating robust growth and a solid market standing, currently operates with negative gross margins, indicating it's firmly in a growth phase rather than a mature cash-generating one. This financial reality means it hasn't yet achieved the profitability needed to be classified as a Cash Cow.

The path to becoming a Cash Cow for Ballard's bus operations hinges on substantial improvements in cost management and the overall maturation of the fuel cell market. Without these critical shifts, the segment will continue to require investment rather than contribute to company profits.

For instance, while Ballard reported significant revenue growth in its bus applications, the company's overall operating losses in recent periods, including those reported in early 2024, underscore the ongoing investment required. The transition to a Cash Cow status is contingent upon achieving operational efficiencies and a more stable, profitable market environment.

- Negative Gross Margins: The bus segment's current financial performance shows it's not yet generating profits on its sales.

- Growth-Oriented Phase: Ballard's bus business is focused on expansion and market penetration, not immediate cash generation.

- Cost Reduction Imperative: Achieving Cash Cow status requires significant improvements in operational costs and efficiency.

- Market Maturity Dependency: The broader adoption and economic viability of fuel cell technology in the bus sector are crucial for future profitability.

Ballard Power Systems does not currently have products fitting the traditional Cash Cow definition in the BCG matrix. This means no current offerings are mature, high-market-share products generating significant surplus cash. For example, Ballard's gross margins remained negative throughout 2024 and into Q1 2025, with Q1 2025 at -23.5%, indicating ongoing investment needs rather than cash generation.

The company's fuel cell products are in an investment-heavy growth phase, consuming capital for R&D and scaling. While the global fuel cell market was projected to reach $45.7 billion by 2027, this growth necessitates substantial ongoing investment across the industry. Ballard's 2024 revenue of $270.7 million reflects continued market engagement and the financial capacity to support these advancements.

The hydrogen and fuel cell sector is undergoing rationalization, with companies consolidating or refocusing due to policy uncertainties and challenging funding landscapes in 2024, making stable cash generation rare. This environment prioritizes cost reduction and strategic investments over relying on mature, cash-generating products. Many hydrogen startups faced funding challenges in 2024, with venture capital investment slowing, further hindering the emergence of cash cows.

Ballard's bus segment, despite growth and market standing, also operates with negative gross margins, placing it in a growth phase. Achieving Cash Cow status depends on improved cost management and market maturation. For instance, Ballard's operating losses in recent periods, including early 2024, highlight the ongoing investment required for operational efficiencies and market stability.

Full Transparency, Always

Ballard BCG Matrix

The Ballard BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis tool is designed to provide actionable insights into your business portfolio, with no watermarks or demo content present. You can confidently expect the same professional layout and strategic depth in the final version, ready for immediate application in your business planning and decision-making processes.

Dogs

Ballard's stationary power segment is currently positioned as a 'Dog' within the BCG matrix due to significant revenue declines. The company saw a steep 46% drop in revenue for this segment in Q4 2024, followed by an even more dramatic 84% decrease in Q1 2025. This sharp downturn indicates a weak market position and declining demand for Ballard's stationary power solutions, contributing very little to the company's overall financial performance.

Ballard's decision to strategically pull back from its China Joint Venture with Weichai, which specializes in fuel cell engines, aligns with the characteristics of a 'Dog' in the BCG Matrix. This move involves reducing its cost structure in China and halting significant further investments, signaling a move towards divestment or minimal engagement due to market underperformance and persistent challenges within the Chinese market.

Underperforming legacy applications represent the Dogs in Ballard's BCG matrix. These are segments that have historically not gained significant traction or have faced increased competition, presenting limited growth prospects for Ballard. For instance, if a specific software suite developed by Ballard in the early 2010s is now facing strong competition from cloud-native solutions and has seen its market share decline by 15% in 2023, it would likely fall into this category.

Companies typically reduce or cease investment in these Dog segments to free up resources for more promising ventures. This strategic divestment allows Ballard to reallocate capital and talent towards areas with higher potential returns. In 2024, Ballard might consider phasing out support for such applications, potentially impacting a small but declining user base, estimated at less than 5% of their total customer portfolio.

Low-Return Business Units

Low-Return Business Units, often referred to as Dogs in the Ballard BCG Matrix, represent products or services that consistently generate meager profits and tie up valuable resources without significantly boosting market share or overall profitability. These units are essentially cash traps, draining company assets without offering a clear path to growth or substantial returns. Ballard's financial performance in 2024, with overall negative gross margins, highlights this issue, indicating that some of its smaller, declining revenue streams are particularly problematic.

These underperforming units can mask underlying issues within a company's portfolio. For instance, if a company has several such units, it suggests a potential lack of strategic focus or an inability to adapt to changing market conditions. Ballard's situation, where negative gross margins are a company-wide concern, implies that these low-return units are not isolated incidents but rather a systemic challenge impacting the entire organization's financial health.

- Definition: Products or services with low profitability and minimal market share growth potential.

- Resource Drain: These units consume capital and management attention without generating commensurate returns.

- Ballard's Context: Ballard's negative gross margins in 2024 suggest that some of its smaller, declining revenue streams are acting as cash traps, exacerbating the problem of low-return units.

- Strategic Implication: Companies must carefully evaluate these units for potential divestiture, turnaround strategies, or complete discontinuation to reallocate resources to more promising areas.

Candidates for Divestiture or Minimization

Products or services exhibiting low market share and low growth potential are often considered ‘Dogs’ in the BCG matrix. For a company like Ballard, focusing on heavy-duty mobility, any product lines or regional ventures that haven't gained traction and are unlikely to in the near future, especially amidst restructuring and delayed market adoption, fall into this category. For instance, if a specific fuel cell technology for a niche, non-heavy-duty application is underperforming, it might be a candidate for divestiture.

Ballard’s strategic shift towards heavy-duty mobility means that business units or product lines that do not directly contribute to this core focus, and are simultaneously demonstrating weak financial performance, warrant close examination. Consider a situation where a particular regional market for a less advanced fuel cell system is experiencing declining sales, perhaps due to intense competition or regulatory hurdles, and has minimal synergy with the company's heavy-duty strategy. Such an operation might be a prime candidate for minimization or divestiture to reallocate resources more effectively.

The need to reduce operating costs and align with market realities, particularly delayed adoption in certain sectors, further highlights the importance of identifying ‘Dogs’. Companies must be pragmatic about investments. If a product line, despite initial promise, consistently fails to meet sales targets and requires significant ongoing investment without a clear path to profitability or strategic alignment with the heavy-duty focus, it represents a drain on resources. For example, if Ballard’s 2023 financial reports indicated a specific product segment with a negative contribution margin and a shrinking market share, this would signal it as a ‘Dog’ needing attention.

- Underperforming Niche Products: Product lines with low market share and no clear growth trajectory, especially those outside the prioritized heavy-duty mobility focus.

- Struggling Regional Markets: Geographic segments where Ballard’s fuel cell solutions for non-heavy-duty applications are experiencing declining sales and have limited strategic fit.

- Resource Draining Ventures: Business units or technologies that consistently underperform financially, require substantial investment, and do not align with the company’s core strategic objectives.

Ballard's stationary power segment, marked by a 46% revenue decline in Q4 2024 and an 84% drop in Q1 2025, is a clear 'Dog' in the BCG matrix. This segment's poor performance and minimal contribution to overall financials underscore its weak market position. The strategic withdrawal from the Weichai Joint Venture, a move to reduce costs and halt further investment, also signifies a recognition of this segment's underperformance and challenges within the Chinese market.

| Segment/Venture | BCG Classification | Key Performance Indicator (2024-2025) | Strategic Action |

|---|---|---|---|

| Stationary Power | Dog | Revenue decline: -46% (Q4 2024), -84% (Q1 2025) | Minimal contribution, weak market position. |

| China JV (Weichai) | Dog | Reduced investment, cost structure optimization. | Strategic pullback due to market underperformance. |

Question Marks

The heavy-duty truck market represents a significant growth opportunity for hydrogen fuel cells, with North America expected to see a 44.6% compound annual growth rate from 2025 to 2034. This burgeoning sector offers substantial long-term potential for companies like Ballard.

Despite this promising outlook, Ballard's truck revenue experienced a substantial 73% decrease in the first quarter of 2025. This sharp decline suggests that Ballard currently holds a very small share of this rapidly expanding market, highlighting the challenges in capturing immediate traction.

The rail sector represents a promising frontier for fuel cell adoption, with initial commercial deployments gaining momentum. Ballard is actively pursuing this emerging market, recognizing its substantial growth potential.

However, Ballard's rail revenue experienced a significant decline of 68% in the first quarter of 2025. This downturn indicates that while the market is developing, Ballard is still in the process of solidifying its market presence and capturing substantial share within this relatively new segment.

Marine applications for fuel cells are a growing area of interest, driven by the global push for decarbonization. Ammonia is particularly highlighted as a fuel with high growth potential in this sector, making it a key focus for future marine propulsion systems.

Despite this promising outlook, Ballard Power Systems experienced a significant downturn in its marine segment. In the first quarter of 2025, the company's marine revenue saw a dramatic drop of 99%. This sharp decline suggests that Ballard currently holds a very small market share in the marine fuel cell market, which, while showing potential, remains in its early stages of development.

Emerging and Other Markets

Ballard's Emerging and Other Markets segment, encompassing material handling and off-road equipment, demonstrated remarkable growth, with revenue soaring by 757% year-over-year in the first quarter of 2025. This significant expansion, while originating from a smaller base, signals considerable potential in nascent applications where Ballard is actively pursuing opportunities.

The segment's performance highlights the company's strategic focus on diversifying its market presence beyond traditional sectors. Although market share in these new areas is still developing, the rapid revenue increase points to successful initial traction and a promising outlook for future penetration.

- Segment Revenue Growth: 757% year-over-year increase in Q1 2025.

- Key Markets: Material handling and off-road equipment.

- Growth Driver: Exploration of new applications and potential market capture.

- Strategic Importance: Demonstrates Ballard's diversification efforts and future growth avenues.

Data Center Backup Power Solutions

Ballard's strategic partnership with Vertiv to develop hydrogen fuel cell backup power for data centers positions them in a promising but unproven market segment, characteristic of a Question Mark in the BCG matrix. This venture is in its nascent stages, focused on establishing a foothold in a sector demanding reliable and sustainable power solutions.

The data center industry is rapidly expanding, with global data center revenue projected to reach over $330 billion by 2024. This growth underscores the significant potential for backup power solutions like Ballard's hydrogen fuel cells, which offer an alternative to traditional diesel generators.

- Emerging Technology: Hydrogen fuel cells represent a new approach to data center backup, offering zero-emission operation and longer run times compared to batteries.

- Market Uncertainty: While the demand for reliable data center power is high, the widespread adoption of hydrogen fuel cell technology in this specific application is still uncertain.

- Strategic Investment: Ballard's investment in this area is a strategic move to diversify its revenue streams and tap into the growing demand for green energy infrastructure.

- Competitive Landscape: The backup power market for data centers is competitive, with established players offering diesel and battery solutions, making market penetration a key challenge for Ballard.

Question Marks in Ballard's portfolio represent areas with high growth potential but low current market share. These segments require significant investment to develop and capture market position.

Segments like heavy-duty trucks, rail, and marine, while showing growth, currently have minimal revenue contribution for Ballard, indicating they are in the early stages of market penetration.

The emerging markets, particularly material handling and off-road equipment, demonstrate substantial growth, albeit from a small base, suggesting a potential to become future stars if market share can be effectively captured.

Ballard's venture into data center backup power with Vertiv also falls into this category, presenting a high-growth opportunity with significant market uncertainty regarding widespread adoption of their technology.

| Segment | 2025 Q1 Revenue | Year-over-Year Change | Market Potential | Ballard's Market Share |

|---|---|---|---|---|

| Heavy-Duty Trucks | Not specified (significant decrease) | 73% decrease | High (44.6% CAGR 2025-2034) | Low |

| Rail | Not specified (significant decrease) | 68% decrease | High | Low |

| Marine | Not specified (dramatic decrease) | 99% decrease | Growing (Ammonia focus) | Very Low |

| Emerging/Other (Material Handling, Off-Road) | Not specified (significant increase) | 757% increase | High | Developing |

| Data Centers (Vertiv Partnership) | Not specified | Not specified | High (>$330B data center revenue by 2024) | Nascent |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.