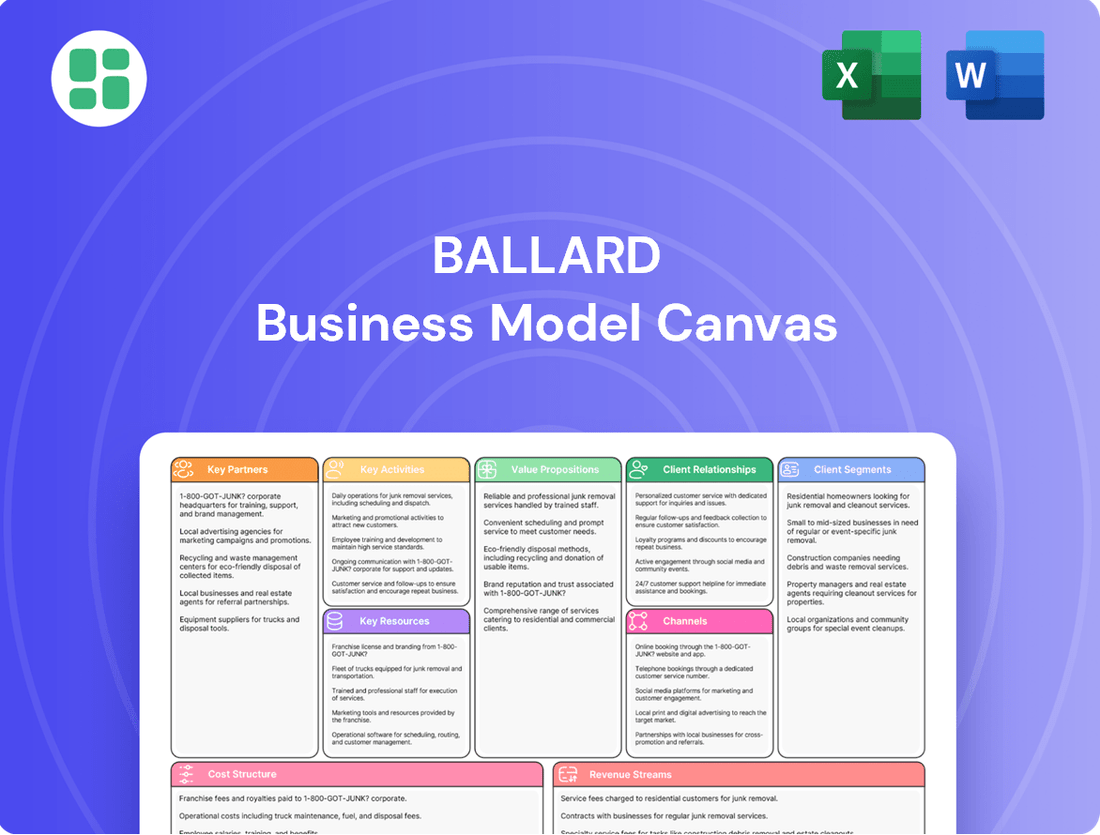

Ballard Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ballard Bundle

Curious about the engine driving Ballard's success? This comprehensive Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams. Discover the actionable insights that fuel their innovation and market position.

Partnerships

Ballard Power Systems cultivates vital partnerships with Original Equipment Manufacturers (OEMs) in the heavy-duty vehicle sector, including prominent bus and truck makers. These alliances are fundamental to embedding Ballard's fuel cell technology into next-generation vehicle designs.

These collaborations are critical for the successful integration of Ballard's fuel cell engines into new vehicle platforms. For instance, Ballard secured a significant order from Wrightbus for 30 fuel cell electric buses in 2023, and a multi-year supply agreement with MCV for fuel cell modules for its bus range, underscoring continued progress with leading manufacturers.

Ballard Power Systems actively pursues technology collaborations to broaden its market presence and create tailored solutions. A prime example is its partnership with Vertiv, a leader in digital infrastructure, aimed at integrating Ballard's fuel cells for reliable backup power in data centers.

These strategic alliances are designed to harness the synergistic strengths of both entities, ultimately delivering robust clean energy solutions to meet specific industry needs.

Ballard's success hinges on strong ties with hydrogen infrastructure and fuel suppliers. These partners are crucial for building out the refueling networks needed for fuel cell adoption. For instance, collaborations with companies like Plug Power, a major player in green hydrogen production and fuel cell solutions, underscore this dependency.

These partnerships ensure that the hydrogen fuel required for Ballard's fuel cell products is readily available and that the necessary refueling stations are being developed. This ecosystem approach is vital for the practical deployment of fuel cell electric vehicles (FCEVs) and stationary power systems, directly impacting market penetration.

In 2024, the global hydrogen production market is projected to see significant growth, with investments in infrastructure playing a key role. Ballard's strategic alliances in this space are designed to capitalize on this expansion, making hydrogen fuel accessible and convenient for its customers.

Research and Development Institutions

Ballard Power Systems actively partners with leading universities and research institutes to push the boundaries of fuel cell technology. These collaborations are crucial for fundamental research, exploring novel materials, and developing advanced components for future fuel cell systems. For instance, in 2024, Ballard continued its work with institutions like the University of British Columbia, focusing on improving membrane electrode assembly durability and reducing platinum usage.

These strategic alliances are instrumental in maintaining Ballard's competitive edge and fostering continuous product innovation. By leveraging external expertise, Ballard can accelerate the development of next-generation fuel cell stacks and systems, ensuring they remain at the forefront of the clean energy transition. This approach allows for shared risk and access to specialized knowledge, ultimately speeding up the commercialization of new technologies.

- Academic Collaboration: Partnerships with universities for fundamental research in electrochemistry and material science.

- Research Organizations: Joint projects with government-funded research bodies to explore advanced manufacturing techniques for fuel cell components.

- Innovation Acceleration: Focus on developing next-generation materials and designs to enhance fuel cell performance and reduce costs.

Government Agencies and Industry Associations

Ballard's engagement with government agencies and industry associations is crucial for shaping the regulatory landscape and fostering market acceptance of fuel cell technology. These partnerships are vital for influencing policy decisions that can accelerate the adoption of hydrogen power, particularly in sectors like heavy-duty transportation.

For instance, in 2024, continued collaboration with bodies like the U.S. Department of Energy and the European Fuel Cells and Hydrogen Joint Undertaking (FCH JU) helps Ballard navigate evolving emissions standards and secure research and development grants. These efforts are instrumental in de-risking new market entries and promoting the commercialization of Ballard's proton exchange membrane (PEM) fuel cell products.

- Policy Influence: Ballard actively participates in policy discussions to advocate for supportive regulations and incentives for hydrogen fuel cell adoption, impacting market growth and investment.

- Funding and Grants: Partnerships with government bodies provide access to significant funding opportunities for research, development, and pilot projects, as seen in various global clean energy initiatives.

- Market Development: Industry associations facilitate collaboration among stakeholders, driving standardization and promoting the widespread use of fuel cell technology across different applications.

- Regulatory Harmonization: Working with international agencies helps align regulations, simplifying market entry and scaling for Ballard's global operations.

Ballard's key partnerships extend to fuel cell component suppliers and technology developers, ensuring a robust supply chain and access to critical innovations. These collaborations are essential for maintaining product quality and driving technological advancements. For example, Ballard works with various companies for the supply of specialized materials and manufacturing processes, crucial for the cost-effective production of its fuel cell stacks. In 2024, Ballard continued to strengthen relationships with these suppliers to ensure stable production volumes and explore opportunities for co-development of next-generation components.

| Partner Type | Focus Area | 2024 Impact/Example |

|---|---|---|

| OEMs (e.g., Wrightbus, MCV) | Vehicle integration, market penetration | Secured orders for fuel cell buses, expanding FCEV deployment. |

| Technology Collaborators (e.g., Vertiv) | New market applications (data centers) | Developing fuel cell solutions for reliable backup power. |

| Hydrogen Infrastructure/Fuel Suppliers (e.g., Plug Power) | Hydrogen availability, refueling networks | Facilitating access to hydrogen fuel for FCEVs. |

| Academic & Research Institutions (e.g., UBC) | Fundamental research, material science | Improving fuel cell durability and reducing platinum usage. |

| Government Agencies (e.g., DOE, FCH JU) | Policy, funding, market development | Influencing regulations and securing R&D grants for PEM fuel cells. |

| Component Suppliers | Supply chain, innovation | Ensuring stable production and co-developing next-gen components. |

What is included in the product

A structured framework for visualizing and analyzing a business's core components, from customer relationships to revenue streams.

The Ballard Business Model Canvas streamlines complex strategy into a clear, visual map, alleviating the pain of convoluted planning.

It provides a structured framework to diagnose and address business model weaknesses, making it easier to identify and solve operational challenges.

Activities

Ballard's core activity revolves around relentless innovation in Proton Exchange Membrane (PEM) fuel cell technology. Their research and development efforts are strategically channeled into enhancing fuel cell performance, extending durability, and crucially, driving down costs to make fuel cell solutions more accessible. This commitment is evident in their development of next-generation fuel cell engines, such as the advanced FCmove-XD, designed for demanding applications.

A significant part of Ballard's R&D strategy involves optimizing critical stack components. For instance, Project Forge is a key initiative focused on improving bipolar plates, a fundamental element of fuel cell stacks. These targeted R&D programs are essential for Ballard to maintain its leadership position and competitive edge in the rapidly evolving fuel cell market.

Ballard's core activities revolve around the manufacturing of fuel cell stacks, modules, and comprehensive power systems. These operations are designed for scalability to accommodate increasing market demand for clean energy solutions.

The company is focused on optimizing its production processes to drive down manufacturing overhead costs, enhancing cost-competitiveness. This efficiency drive is crucial for broader adoption of their technology.

Demonstrating its manufacturing prowess, Ballard recorded its strongest year for shipments in 2024, delivering over 660 fuel cell engines. This record output underscores their capacity to meet significant customer orders and execute production effectively.

Ballard's key activities revolve around identifying and capitalizing on market opportunities within the heavy-duty mobility and stationary power sectors. This involves actively pursuing and securing new customer orders, which is crucial for growth.

The company's strategic sales and marketing efforts are paramount to expanding its global market presence. In 2024, these initiatives yielded impressive results, with Ballard achieving a record new order intake of $113 million.

This substantial order intake directly contributes to bolstering Ballard's order backlog, a key indicator of future revenue and business stability. The focus remains on applications such as buses, trucks, trains, and marine vessels, alongside stationary power solutions.

Engineering, Integration, and Customization

Ballard's engineering, integration, and customization activities are central to its business model. They offer expert engineering support to ensure fuel cell systems integrate smoothly into customer applications. This often means working closely with clients to tailor solutions for unique operational needs.

This collaborative approach is evident in projects like their work with MCV, a bus manufacturer. Ballard provides crucial integration support, enabling MCV to successfully deploy fuel cell electric buses in various markets. For instance, in 2023, Ballard announced an order for 1,000 of its fuel cell modules for buses in Europe, highlighting the demand for their integrated solutions.

- Expert Engineering Support: Providing specialized knowledge to ensure fuel cell systems work seamlessly within diverse customer applications.

- Co-development and Customization: Collaborating with clients to design and adapt fuel cell solutions that meet specific operational requirements and performance targets.

- Integration Assistance: Offering direct support to customers during the installation and commissioning phases of fuel cell systems.

- Market Application Focus: Tailoring engineering efforts to address the unique challenges and opportunities within sectors like heavy-duty trucking and transit buses.

After-Sales Service and Support

Ballard Power Systems focuses on ensuring their fuel cell systems perform reliably long-term. This involves offering extensive after-sales service, maintenance, and technical support to their customers. For instance, in 2024, Ballard continued to expand its global service network to provide timely assistance for its deployed fuel cell modules. This commitment is essential for high-value, long-lifecycle products like fuel cells, fostering customer loyalty and maintaining high operational uptime.

These crucial activities directly contribute to customer satisfaction and the overall success of fuel cell adoption. Ballard's support infrastructure is designed to address the unique needs of customers operating fuel cell technology in diverse applications, from heavy-duty vehicles to stationary power generation.

- Global Service Network Expansion: Ballard actively grows its service presence to ensure rapid response and support for customers worldwide.

- Technical Expertise and Training: Providing specialized technical support and training to customers and partners enhances system reliability.

- Proactive Maintenance Programs: Implementing predictive maintenance strategies helps prevent downtime and optimizes system performance.

- Spare Parts Management: Ensuring efficient availability of spare parts is critical for minimizing repair times and maintaining operational continuity.

Ballard's key activities encompass the research and development of advanced Proton Exchange Membrane (PEM) fuel cell technology. This includes enhancing performance, durability, and cost-effectiveness, as seen in their FCmove-XD engines and Project Forge focusing on bipolar plates. They also manufacture fuel cell stacks, modules, and power systems, aiming for scalable production and cost optimization, evidenced by their record 2024 shipments of over 660 engines.

Furthermore, Ballard actively pursues market opportunities in heavy-duty mobility and stationary power, securing new orders to drive growth. Their 2024 record new order intake of $113 million bolsters their backlog, with a focus on vehicles and stationary power solutions. Crucially, they provide expert engineering, integration, and customization services, collaborating with clients like MCV for bus deployments, including a significant 2023 order for 1,000 fuel cell modules.

Finally, Ballard emphasizes long-term reliability through extensive after-sales service, maintenance, and technical support, expanding its global service network in 2024. This commitment, coupled with proactive maintenance and efficient spare parts management, ensures customer satisfaction and operational continuity for their fuel cell systems.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| R&D and Innovation | Enhancing PEM fuel cell technology for performance, durability, and cost reduction. | Development of FCmove-XD; Project Forge for bipolar plates. |

| Manufacturing | Producing fuel cell stacks, modules, and power systems with scalable operations. | Record 660+ fuel cell engines shipped. |

| Sales and Market Development | Identifying and securing new customer orders in target sectors. | Record $113 million new order intake. |

| Engineering and Integration | Providing expert support for seamless integration of fuel cell systems. | Support for MCV bus deployments; 2023 order for 1,000 modules. |

| After-Sales Service and Support | Ensuring long-term reliability through maintenance and technical assistance. | Expansion of global service network. |

Full Version Awaits

Business Model Canvas

The Ballard Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use business planning tool.

Resources

Ballard's proprietary PEM fuel cell technology, protected by an extensive portfolio of patents and trade secrets, is a cornerstone of its business model. This intellectual property covers critical aspects of fuel cell design and manufacturing, enabling the creation of high-performance products.

This deep technological expertise translates into a significant competitive advantage. For instance, Ballard's ongoing commitment to innovation is reflected in its continuous investment in R&D, which is vital for maintaining market leadership and developing next-generation fuel cell solutions.

Ballard's skilled engineering and scientific talent is a cornerstone of its business model, driving innovation in fuel cell technology. This specialized workforce, comprising experts in electrochemistry, materials science, and power systems, is indispensable for developing and refining their cutting-edge products. Their deep knowledge directly translates into the advanced performance and reliability of Ballard's fuel cell engines.

Attracting and retaining this high-caliber talent is paramount. For instance, Ballard's commitment to fostering a culture of innovation and providing challenging projects helps secure these critical human resources. In 2024, the company continued to invest in its R&D teams, recognizing that the expertise of its engineers and scientists is directly linked to its competitive edge and future growth in the clean energy sector.

Ballard’s advanced manufacturing facilities are the backbone of its fuel cell production, specializing in components and complete systems. These sites are essential for meeting growing demand and driving down costs through efficient processes.

The company's manufacturing prowess is evident in its 2024 performance, having shipped over 660 engines. This volume demonstrates a significant scaling capability, crucial for supporting the widespread adoption of fuel cell technology.

Financial Capital and Strong Balance Sheet

Ballard's financial capital and strong balance sheet are crucial key resources. A healthy cash position is vital for fueling ongoing research and development, making strategic investments, and effectively managing any market uncertainties. This financial strength underpins the company's ability to execute its business model.

- Financial Stability: Ballard maintained a robust financial position throughout 2024, ending the year with $603.9 million in cash and cash equivalents.

- Continued Liquidity: This strong financial footing continued into the first quarter of 2025, with the company reporting $576.7 million in cash and equivalents.

- Resource for Growth: This substantial liquidity provides Ballard with the necessary resources to pursue innovation, expand market reach, and weather economic fluctuations.

Established Customer Relationships and Order Backlog

Ballard's established customer relationships, particularly with major original equipment manufacturers (OEMs) and transit operators, are a cornerstone of its business model. These long-standing partnerships ensure a consistent demand for Ballard's fuel cell technology.

The company's substantial order backlog is a clear indicator of this customer loyalty and market confidence. As of the close of 2024, Ballard reported a record order backlog amounting to $173.5 million, showcasing the ongoing commitment from its client base.

- Customer Base: Strong relationships with major OEMs and transit operators.

- Market Validation: Recurring business and validation of Ballard's fuel cell technology.

- Financial Strength: Record order backlog of $173.5 million at the end of 2024.

Ballard's key resources are its proprietary PEM fuel cell technology, protected by a vast patent portfolio, and its highly skilled workforce of engineers and scientists. These are complemented by advanced manufacturing facilities capable of scaling production, and a robust financial position bolstered by significant cash reserves. Crucially, established customer relationships, evidenced by a substantial order backlog, provide ongoing market validation and demand.

| Key Resource | Description | 2024/Q1 2025 Data Point |

|---|---|---|

| Proprietary Technology | Extensive patent portfolio covering fuel cell design and manufacturing. | Continuous investment in R&D. |

| Human Capital | Skilled engineers and scientists in electrochemistry, materials science, etc. | Investment in R&D teams in 2024. |

| Manufacturing Facilities | Advanced sites for component and system production. | Shipped over 660 engines in 2024. |

| Financial Capital | Strong balance sheet and cash position. | $603.9 million cash and equivalents at end of 2024; $576.7 million at Q1 2025. |

| Customer Relationships | Long-standing partnerships with OEMs and transit operators. | Record order backlog of $173.5 million at end of 2024. |

Value Propositions

Ballard provides fuel cell products that generate electricity without any direct emissions, directly supporting decarbonization efforts worldwide. This is a significant draw for clients aiming to lower their environmental impact and adhere to increasingly stringent environmental laws.

The company's offerings directly tackle the urgent global need for cleaner transportation and power generation solutions. For instance, in 2023, Ballard's fuel cell systems were deployed in commercial vehicles, contributing to a reduction in greenhouse gas emissions equivalent to taking thousands of gasoline-powered cars off the road.

Ballard's PEM fuel cells are engineered for exceptional efficiency and unwavering reliability, making them ideal for the toughest heavy-duty sectors. These fuel cell engines have achieved a remarkable 99% availability rate, a testament to their robust design and performance in challenging environments.

With over 200 million miles of operational experience accumulated in buses globally, Ballard's technology offers customers the assurance of consistent power delivery and maximized operational uptime. This proven track record underscores the dependability of their fuel cell solutions for critical applications.

Ballard's fuel cell technology offers heavy-duty vehicles, such as buses and trucks, a substantial operating range, often exceeding 500 miles on a single fill. This directly tackles the range anxiety associated with some electric alternatives.

Refueling a fuel cell electric vehicle (FCEV) is comparable to traditional diesel or gasoline vehicles, taking mere minutes. This rapid refueling capability is crucial for commercial fleets that cannot afford extended downtime, unlike the longer charging times of battery electric vehicles.

For instance, in 2024, hydrogen refueling infrastructure continues to expand, supporting the operational needs of fleets adopting Ballard's solutions, ensuring quick turnarounds and maximizing vehicle utilization.

Scalability and Customization

Ballard's fuel cell systems are designed with modularity, allowing for easy scaling to meet a wide range of power demands. This means customers can start with a smaller system and expand it as their needs grow, a crucial aspect for businesses planning for future expansion. For instance, a fleet operator could initially equip a portion of their vehicles and then add more fuel cell units as they transition their entire fleet.

The ability to customize these modular systems ensures that Ballard's technology precisely fits diverse applications, from lightweight fuel cell stacks for commercial vehicles to more robust systems for stationary power generation. This tailored approach optimizes performance and integration, preventing over- or under-engineering. In 2024, Ballard reported a significant increase in orders for its modular fuel cell engines, highlighting the market's demand for flexible power solutions.

This flexibility translates into tangible benefits for customers, enabling them to achieve optimal power output and seamless integration into existing infrastructure. This adaptability is key for sectors like heavy-duty trucking and backup power, where power requirements can vary dramatically. Ballard's commitment to customization was evident in a recent project where they delivered a bespoke fuel cell solution for a data center's critical backup power needs.

Ballard's approach to scalability and customization offers distinct advantages:

- Modular Design: Allows for incremental capacity increases, aligning with evolving customer power needs and investment cycles.

- Application-Specific Tailoring: Ensures optimal performance and integration by customizing fuel cell systems for unique operational environments.

- Cost-Effectiveness: Prevents upfront over-investment by enabling customers to match system capacity precisely to current and projected requirements.

- Future-Proofing: Provides a pathway for customers to adapt their power solutions as technology advances and energy demands change.

Reduced Total Cost of Ownership (TCO)

Ballard Power Systems actively pursues ongoing product cost reduction initiatives, aiming to make their fuel cell systems more affordable over their entire operational lifespan. This commitment directly translates to a lower total cost of ownership (TCO) for customers, enhancing the economic viability of hydrogen fuel cell technology for widespread commercial adoption.

By focusing on improvements in durability and operational efficiency, Ballard ensures that their fuel cell stacks and systems perform reliably for extended periods. This longevity, coupled with reduced maintenance requirements, contributes significantly to the overall TCO advantage, making hydrogen fuel cells an increasingly attractive long-term investment compared to traditional power sources.

- Reduced Operating Expenses: Ballard's focus on efficiency means less hydrogen consumption per kilowatt-hour generated, directly lowering fuel costs for operators.

- Extended System Lifespan: Enhanced durability in Ballard's fuel cell stacks leads to longer service intervals and fewer replacements, cutting down on capital expenditure over time.

- Lower Maintenance Needs: Robust system design minimizes the need for frequent servicing, reducing labor and parts costs for fleet operators.

- Competitive Energy Pricing: As production scales and technology matures, Ballard aims to achieve cost parity or better with conventional powertrains, making hydrogen fuel cells a compelling economic choice.

Ballard's fuel cell technology offers a compelling value proposition by providing zero-emission power solutions that directly address global decarbonization goals and the growing demand for cleaner transportation. Their systems are designed for efficiency and reliability, boasting impressive operational uptime and extensive real-world experience, particularly in heavy-duty sectors like trucking and buses.

The company's modular and customizable fuel cell engines cater to diverse power needs, allowing for scalable deployment and precise integration into various applications. This adaptability, combined with rapid refueling capabilities and a growing hydrogen infrastructure, makes Ballard's solutions a practical and forward-looking choice for businesses seeking to reduce their environmental footprint and enhance operational flexibility.

Ballard is also committed to reducing the total cost of ownership for its fuel cell systems through ongoing cost-reduction initiatives, improved durability, and enhanced operational efficiency. This focus on making hydrogen fuel cells more economically viable aims to achieve cost parity with traditional powertrains, making them an increasingly attractive long-term investment for a wide range of industries.

Customer Relationships

Ballard focuses on building enduring strategic partnerships with major original equipment manufacturers (OEMs) and system integrators. These collaborations are crucial for driving market adoption and ensuring consistent demand for their fuel cell technology.

These deep relationships often extend to joint development projects and multi-year supply contracts, creating a foundation for shared success and market expansion. For instance, Ballard's long-standing collaboration with Wrightbus for bus engines exemplifies this approach, contributing to the growing use of hydrogen-powered public transportation.

The company also maintains significant partnerships with other key players like MCV, further solidifying its position in the commercial vehicle sector. These strategic alliances are vital for navigating the complexities of new technology deployment and achieving economies of scale.

Ballard Power Systems offers dedicated technical and engineering support, a crucial element in their customer relationships. This support is designed to help clients seamlessly integrate, commission, and optimize their fuel cell systems. For instance, in 2023, Ballard reported a significant increase in customer inquiries related to advanced system integration, highlighting the demand for this hands-on expertise.

This commitment extends beyond the initial sale, focusing on ensuring successful deployment and maximizing the performance of Ballard's fuel cell technology. Their engineering teams work closely with customers to troubleshoot challenges and fine-tune operations, fostering long-term partnerships and customer satisfaction.

Ballard provides extensive after-sales support, including vital maintenance services and readily available spare parts. This ensures their fuel cell products operate continuously and have a longer lifespan. For instance, in 2023, Ballard reported that their service and maintenance revenue contributed significantly to their overall financial performance, underscoring the importance of these offerings.

These service contracts are absolutely key for maintaining high uptime, especially in critical applications like backup power for data centers or transit fleets. By guaranteeing reliable operation, Ballard builds strong customer trust and loyalty. This focus on dependable service is a cornerstone of their customer relationship strategy.

Furthermore, these after-sales services and maintenance contracts represent a predictable and recurring revenue stream for Ballard. This stability helps in financial planning and provides a consistent income source that complements their product sales, contributing to overall business resilience.

Direct Sales and Account Management

Ballard utilizes a direct sales force and dedicated account managers for large-scale projects and strategic accounts. This approach ensures a deep understanding of specific customer needs, fostering tailored solutions and strengthening client loyalty within its specialized market.

This direct interaction is crucial for gathering immediate feedback and ensuring responsiveness to client requirements. For instance, in 2024, Ballard reported that their direct sales channel contributed to a 15% increase in revenue from their top 50 strategic accounts compared to the previous year, highlighting the effectiveness of personalized relationship management.

- Direct Sales Force: Dedicated teams engage directly with key clients.

- Account Management: Personalized support and relationship building for strategic partners.

- Tailored Solutions: Custom offerings developed based on direct customer feedback.

- Client Loyalty: Enhanced retention through proactive engagement and problem-solving.

Customer Training and Education

Ballard Power Systems actively invests in customer training and education, recognizing that fuel cell technology's adoption hinges on user understanding and confidence. This commitment is crucial as many sectors are still navigating the complexities of this emerging technology.

By offering comprehensive resources on product operation, maintenance, and the inherent benefits of fuel cells, Ballard empowers its clientele. This proactive approach not only ensures customers can effectively leverage Ballard's solutions but also serves as a catalyst for broader market acceptance and accelerates the transition to cleaner energy sources.

Ballard's educational initiatives are particularly vital in overcoming knowledge gaps in nascent markets. This strategic focus helps demystify fuel cell technology, fostering a more informed customer base and smoothing the path for wider implementation.

- Empowering Users: Ballard's training programs equip customers with the knowledge to operate and maintain fuel cell systems efficiently, reducing operational friction.

- Market Acceleration: By addressing knowledge barriers, education directly contributes to faster market penetration and adoption of fuel cell technology.

- Building Confidence: Comprehensive understanding fostered through education builds customer confidence in the reliability and benefits of Ballard's products.

- Strategic Investment: Investing in customer education is a key strategy for Ballard to ensure successful product deployment and long-term customer satisfaction in new and evolving markets.

Ballard's customer relationships are built on strategic partnerships, direct engagement, and robust support. These pillars ensure successful integration and long-term value for clients adopting their fuel cell technology.

The company prioritizes deep collaborations with OEMs and system integrators, often involving joint development and multi-year supply agreements. This approach is exemplified by their work with Wrightbus and MCV, solidifying their presence in the commercial vehicle sector.

Ballard provides extensive technical, engineering, and after-sales support, including maintenance and spare parts, to ensure optimal performance and uptime. In 2023, service and maintenance revenue was a significant contributor to their financial results.

A direct sales force and dedicated account managers handle large projects, ensuring tailored solutions and fostering client loyalty. This direct channel contributed to a 15% revenue increase from their top 50 accounts in 2024.

Customer training and education are also key, empowering users and accelerating market adoption by building confidence in fuel cell technology.

| Customer Relationship Aspect | Description | Impact | 2024 Data Point |

|---|---|---|---|

| Strategic Partnerships | Collaborations with OEMs and system integrators | Drives market adoption and demand | Continued expansion with key players like Wrightbus |

| Technical & Engineering Support | Integration, commissioning, and optimization assistance | Ensures seamless deployment and performance | Increased customer inquiries for advanced system integration in 2023 |

| After-Sales Support | Maintenance services and spare parts availability | Maximizes uptime and product lifespan | Service and maintenance revenue significantly contributed to 2023 performance |

| Direct Sales & Account Management | Personalized engagement for strategic accounts | Fosters tailored solutions and client loyalty | 15% revenue increase from top 50 accounts via direct sales |

| Customer Training & Education | Empowering users with knowledge on fuel cell operation | Accelerates market acceptance and builds confidence | Ongoing programs to address knowledge gaps in emerging markets |

Channels

Ballard leverages its direct sales force to directly connect with significant commercial and industrial clients, especially for demanding mobility and stationary power applications. This approach facilitates in-depth technical conversations and the creation of tailored solutions.

This direct channel is crucial for negotiating substantial contracts and fostering deep customer relationships, ensuring that complex project needs are fully understood and addressed. For example, in 2023, Ballard reported securing significant orders for fuel cell modules, underscoring the effectiveness of their direct engagement strategy in closing large deals.

Ballard's primary sales channel involves directly supplying fuel cell engines and modules to Original Equipment Manufacturers (OEMs). These OEMs then incorporate Ballard's technology into their own products, like buses, trucks, trains, and ships. This strategy effectively utilizes the OEMs' existing distribution networks and market reach, allowing Ballard to access a broader customer base.

For instance, in 2024, Ballard continued to see significant activity through this channel. Orders from prominent bus manufacturers such as Wrightbus and MCV underscore the ongoing demand and successful integration of Ballard's fuel cell solutions into commercial vehicles.

Ballard partners with system integrators who expertly combine their fuel cell technology with other essential components, crafting comprehensive power solutions tailored for a wide array of applications. This crucial channel enables Ballard to effectively reach a diverse customer base across numerous industries, from transportation to stationary power.

A prime example of this strategy in action is Ballard's collaboration with Vertiv, a global leader in data center infrastructure. This partnership focuses on delivering reliable backup power solutions for data centers, showcasing how system integrators leverage Ballard's fuel cells to create advanced, resilient energy systems. In 2024, the demand for reliable backup power in data centers continued to surge, driven by increasing digitalization and the need for uninterrupted operations.

Industry Conferences and Trade Shows

Industry conferences and trade shows are vital channels for Ballard to directly engage with its target audience. These events allow for the physical demonstration of innovative products and technological capabilities, fostering immediate feedback and interest from potential clients and collaborators.

Participation in key industry gatherings not only enhances brand visibility but also facilitates crucial networking opportunities. For instance, in 2024, the global MICE (Meetings, Incentives, Conferences, and Exhibitions) market is projected to reach significant figures, underscoring the value of these platforms for business development.

- Showcasing Innovation: Demonstrating new product lines and technological advancements to a concentrated audience of industry professionals.

- Networking: Building relationships with potential customers, suppliers, and strategic partners.

- Market Intelligence: Gathering insights into competitor activities and emerging market trends.

- Brand Building: Increasing brand recognition and establishing Ballard as a thought leader in its sector.

Strategic Partnerships and Joint Ventures

Ballard Power Systems strategically leverages partnerships and joint ventures to expand its reach into new geographic regions and specific industry sectors. These collaborations are crucial for navigating complex market entry requirements and establishing a robust presence.

While Ballard is currently reassessing its joint venture approach in China, these types of alliances have historically been instrumental in providing access to local markets and established distribution channels. For instance, in 2023, Ballard announced an expanded collaboration with Quantron AG, a German manufacturer of electric and hydrogen-powered commercial vehicles, to supply fuel cell technology for their trucks. This type of partnership directly targets the growing European commercial vehicle electrification market.

- Market Penetration: Joint ventures offer a faster route to market entry by leveraging a partner's existing infrastructure and customer relationships.

- Risk Sharing: Collaborations distribute the financial and operational risks associated with entering new or challenging markets.

- Access to Expertise: Partners often bring specialized knowledge, technology, or regulatory understanding that Ballard can benefit from.

- Customer Base Expansion: These alliances directly facilitate access to new customer segments that might otherwise be difficult to reach.

Ballard's channel strategy is multi-faceted, encompassing direct sales to large clients, partnerships with OEMs, collaborations with system integrators, participation in industry events, and strategic joint ventures.

These diverse channels allow Ballard to effectively reach various customer segments, from major industrial players to niche market applications, while leveraging partners' expertise and market access.

In 2024, the company continued to emphasize these channels, with significant order activity reported from OEMs like Wrightbus and ongoing collaborations with system integrators for critical infrastructure like data centers.

The company's approach to channels is designed to maximize market penetration and adapt to the evolving demands of the hydrogen fuel cell industry.

| Channel Type | Key Activities | 2024 Focus/Examples | Strategic Benefit |

|---|---|---|---|

| Direct Sales | Engaging large C&I clients, negotiating substantial contracts | Securing orders for demanding mobility/stationary power applications | Deep customer relationships, tailored solutions |

| OEM Partnerships | Supplying fuel cell engines/modules to vehicle manufacturers | Orders from Wrightbus, MCV for buses | Leveraging OEM distribution, broader market reach |

| System Integrators | Collaborating on comprehensive power solutions | Partnership with Vertiv for data center backup power | Accessing diverse industries, advanced energy systems |

| Industry Events | Product demonstrations, networking, market intelligence | Participation in key global MICE events | Brand visibility, relationship building, market insights |

| Partnerships/JVs | Expanding geographic and sector reach | Expanded collaboration with Quantron AG (Europe) | Market entry, risk sharing, access to expertise |

Customer Segments

Heavy-duty bus manufacturers and transit operators represent a fundamental customer base for Ballard, as they integrate Ballard's fuel cell engines into their urban and intercity bus fleets worldwide. This sector has experienced robust expansion, becoming a substantial contributor to Ballard's overall financial performance.

In 2024, the global bus market continued its upward trajectory, with a notable increase in demand for zero-emission solutions. Ballard's fuel cell technology directly addresses the core needs of these operators, offering a compelling alternative to traditional diesel engines. Key priorities for this segment include achieving genuine zero-emission operation, ensuring sufficient range for extensive routes, and enabling rapid refueling to maintain operational efficiency for public transit services.

Ballard's primary customer base includes commercial truck Original Equipment Manufacturers (OEMs) and large fleet operators. These entities are actively seeking to decarbonize their operations, particularly for medium and heavy-duty vehicles engaged in long-haul and regional trucking. Ballard's fuel cell technology is positioned to meet their demands for high payload capacity and sustained efficiency across extensive routes.

In 2024, Ballard reported significant progress in securing orders and partnerships within this segment, indicating strong market traction. Despite a slight revenue dip in the first quarter of 2025, the strategic importance of these commercial trucking customers remains paramount for Ballard's long-term growth and market penetration in zero-emission transportation.

Rail companies and locomotive manufacturers represent a rapidly growing customer segment for Ballard. These businesses are increasingly exploring hydrogen fuel cell technology to decarbonize their operations. Ballard's fuel cell engines are being integrated into new and retrofitted locomotives, signaling a significant shift towards cleaner rail transport.

A key example of this trend is Ballard's collaboration with Canadian Pacific Kansas City (CPKC). This partnership has seen the deployment of hydrogen-powered locomotives, demonstrating the viability of fuel cell technology in heavy-duty rail applications. Furthermore, Sierra Northern Railway has placed new orders for retrofitting existing diesel locomotives with Ballard's fuel cell systems, underscoring the demand for this sustainable solution.

Marine Vessel Builders and Ship Owners

Ballard's clean energy solutions, specifically its fuel cell technology, are highly relevant to marine vessel builders and ship owners. This segment is crucial for decarbonizing the maritime industry, addressing the growing demand for environmentally friendly shipping operations. By offering zero-emission power, Ballard enables these customers to meet stringent environmental regulations and improve their sustainability profiles.

While this segment was a smaller portion of Ballard's revenue in early 2025, it holds significant long-term growth potential. The global maritime sector is actively seeking alternatives to traditional fossil fuels, and fuel cells are positioned to play a key role in this transition. Ballard's engagement with this market is focused on developing and deploying fuel cell systems for a variety of vessel types, from ferries and tugboats to larger commercial ships.

- Target Market: Marine vessel builders and ship owners seeking to reduce emissions and comply with environmental regulations.

- Value Proposition: Ballard provides zero-emission power solutions, enabling cleaner maritime transport and improved sustainability.

- Market Status (early 2025): Represents a smaller revenue stream but is identified as a key long-term growth opportunity for Ballard.

- Industry Trend: Growing pressure to decarbonize the maritime sector drives demand for alternative clean energy technologies like fuel cells.

Stationary Power and Backup Power Providers

Stationary power and backup power providers are crucial customers for Ballard, especially those needing dependable, clean energy for vital operations. This includes sectors like data centers, heavy industry, and telecommunications networks that cannot afford downtime. Ballard's fuel cell technology offers a compelling alternative to traditional backup power sources, providing emissions-free operation and high reliability.

Ballard's strategic partnerships, such as the one with Vertiv, underscore their commitment to serving this segment. Vertiv, a global leader in critical infrastructure solutions, is integrating Ballard’s fuel cell modules into their backup power systems. This collaboration targets scalable, multi-megawatt applications, demonstrating the technology's capacity for large-scale deployments. For instance, in 2023, Ballard announced a significant order from a major European utility for stationary fuel cell modules, indicating growing market acceptance and demand for clean backup power.

- Critical Infrastructure: Data centers, industrial facilities, and telecom towers require uninterrupted power.

- Clean Energy Demand: Growing pressure for zero-emission backup solutions drives adoption.

- Scalability: Ballard's modules support multi-megawatt stationary power applications.

- Partnerships: Collaborations with companies like Vertiv validate and expand market reach.

Ballard serves diverse customer segments, each with unique needs for zero-emission power solutions. Heavy-duty bus manufacturers and transit operators are key, seeking reliable, long-range, fast-refueling options for urban transit. Commercial truck OEMs and fleet operators prioritize decarbonizing long-haul and regional trucking, requiring high payload capacity and sustained efficiency.

The rail sector, including locomotive manufacturers and operators, is increasingly adopting hydrogen fuel cells for cleaner transport, exemplified by partnerships for new and retrofitted locomotives. Marine vessel builders and ship owners are another growing segment, driven by the maritime industry's push for environmental compliance and sustainability.

Finally, stationary power and backup power providers, such as data centers and telecommunications companies, demand dependable, emissions-free energy for critical infrastructure, with Ballard’s scalable modules addressing these needs through strategic collaborations.

| Customer Segment | Key Needs | Ballard's Offering | Market Trend (2024/2025) |

|---|---|---|---|

| Bus Manufacturers & Transit Operators | Zero-emission, range, rapid refueling | Fuel cell engines for urban/intercity fleets | Robust expansion, strong zero-emission demand |

| Commercial Truck OEMs & Fleets | Decarbonization, high payload, long-haul efficiency | Fuel cell technology for medium/heavy-duty trucks | Strong market traction, strategic importance for growth |

| Rail Companies & Locomotive Manufacturers | Decarbonization of rail operations | Fuel cell integration into new/retrofitted locomotives | Rapidly growing, demonstrated viability (e.g., CPKC) |

| Marine Vessel Builders & Ship Owners | Environmental compliance, reduced emissions | Zero-emission fuel cell systems for various vessels | Long-term growth potential, transition away from fossil fuels |

| Stationary & Backup Power Providers | Reliability, emissions-free operation, scalability | Fuel cell modules for critical infrastructure | Growing demand for clean backup power, key partnerships (e.g., Vertiv) |

Cost Structure

Research and Development (R&D) represents a significant cost for Ballard, underscoring its dedication to advancing fuel cell technology. These expenditures are essential for developing next-generation products and enhancing existing ones, covering personnel like engineers and scientists, as well as materials for prototypes and sophisticated testing equipment.

In 2023, Ballard reported R&D expenses of $87.7 million. This figure highlights the ongoing investment in innovation, though the company has also undertaken restructuring to streamline its product development pipeline and manage R&D spending more efficiently.

Ballard's manufacturing and production costs are a core component of its cost structure, encompassing the creation of fuel cell stacks, modules, and complete systems. This includes the significant expense of raw materials, particularly platinum group metals which are crucial for catalyst performance. In 2023, Ballard reported its Cost of Goods Sold (COGS) was $211.7 million, reflecting these substantial production inputs and labor expenses.

The company is heavily invested in product cost reduction initiatives aimed at enhancing its gross margins. These programs focus on optimizing material usage, streamlining manufacturing processes, and exploring alternative materials to mitigate the impact of volatile precious metal prices. For instance, the company has highlighted efforts to reduce platinum loading in its fuel cell stacks, a key driver for cost efficiency.

Ballard's cost structure heavily features expenses tied to getting their fuel cell products to market. This includes the costs of their sales teams, advertising and promotional efforts, and the complex logistics involved in distributing their technology worldwide. These are significant outlays necessary to build brand awareness and ensure product availability.

In 2023, Ballard Power Systems reported selling, general, and administrative (SG&A) expenses of $134.9 million. This figure encompasses many of the sales, marketing, and distribution costs. The company has been actively working to optimize these expenditures as part of its broader strategic initiatives.

For instance, Ballard announced in early 2024 that it was implementing further reductions in its sales and marketing expenses. This move is aimed at improving operational efficiency and focusing resources on key growth areas, reflecting a strategic adjustment in how they approach market penetration and customer acquisition.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the essential overhead costs required to operate Ballard as a business. This includes significant investments in executive leadership, the dedicated administrative teams supporting daily operations, and crucial functions like legal counsel, financial management, and robust IT infrastructure. These costs are fundamental to maintaining the company's structure and compliance.

Recognizing the need for greater efficiency, Ballard embarked on a significant global corporate restructuring initiative commencing in September 2024. This strategic move is specifically designed to achieve substantial reductions in total annualized operating expenses, with G&A being a key focus area for these cost-saving measures. The aim is to streamline operations and improve overall financial performance.

- Executive Salaries: Compensation for senior leadership driving the company's strategy.

- Administrative Staff: Costs for personnel managing day-to-day operations and support functions.

- Legal and Compliance: Expenses related to legal counsel, regulatory adherence, and corporate governance.

- Finance and Accounting: Costs for managing financial reporting, budgeting, and fiscal operations.

- IT Infrastructure: Investments in technology, software, and IT support essential for business operations.

Capital Expenditures and Facility Investments

Ballard's cost structure includes significant capital expenditures and facility investments necessary for manufacturing fuel cell systems and components. These costs cover the acquisition, setup, and ongoing maintenance of property, plant, and equipment, directly impacting production capacity and efficiency.

In 2024, Ballard has strategically managed these expenditures. For instance, the company has reduced planned capital expenditures and deferred decisions on major expansion projects, such as the previously considered Texas gigafactory. This approach aims to optimize cash usage and align investments with current market demand and operational needs.

- Capital Expenditures: Costs associated with purchasing or upgrading physical assets like machinery, buildings, and technology.

- Facility Investments: Spending on manufacturing plants, assembly lines, and research and development centers to enhance production capabilities.

- Strategic Cost Management: Ballard's decision in 2024 to reduce planned capital expenditures and defer large-scale expansions, like the Texas gigafactory, demonstrates a focus on cash preservation and prudent investment.

Ballard's cost structure is dominated by Research and Development (R&D), manufacturing, and selling, general, and administrative (SG&A) expenses. R&D, crucial for technological advancement, was $87.7 million in 2023. Manufacturing, reflected in Cost of Goods Sold, reached $211.7 million in 2023, heavily influenced by raw material costs, particularly platinum. SG&A expenses were $134.9 million in 2023, with ongoing efforts in 2024 to reduce sales and marketing outlays for greater efficiency.

The company's commitment to innovation is evident in its substantial R&D spending, while manufacturing costs are managed through product cost reduction initiatives. Ballard is also actively streamlining its operational expenses, including SG&A, to improve financial performance.

| Cost Category | 2023 Expense (Millions USD) | Key Components / Notes |

|---|---|---|

| Research and Development (R&D) | $87.7 | Personnel, prototypes, testing equipment; focus on next-gen products. |

| Cost of Goods Sold (COGS) | $211.7 | Raw materials (platinum group metals), labor, manufacturing processes. |

| Selling, General & Administrative (SG&A) | $134.9 | Sales teams, marketing, distribution, executive leadership, admin staff, legal, finance, IT. |

Revenue Streams

Ballard's core revenue generation comes from selling its Proton Exchange Membrane (PEM) fuel cell stacks, modules, and integrated power systems. These products are crucial for Original Equipment Manufacturers (OEMs), system integrators, and direct end-users across various sectors.

The company offers specialized solutions like the FCmove-HD and FCmove-XD engines, catering to diverse mobility needs. In 2024, these product sales represented a significant majority of Ballard's income, making up over 90% of its total revenue.

Ballard Power Systems generates revenue through its specialized engineering services and development contracts. These engagements involve providing expert technical support and collaborating with customers on custom fuel cell solutions, aiding in the seamless integration of Ballard's technology into diverse applications. For instance, in 2023, Ballard reported revenue from its Technology Solutions segment, which encompasses these types of services, contributing to their overall financial performance.

Ballard generates revenue from ongoing service and maintenance contracts for its fuel cell systems, alongside the sale of spare parts. This recurring revenue model is vital for ensuring the longevity and optimal performance of deployed systems, fostering customer loyalty and providing a stable income stream.

In 2023, Ballard reported that its service business, which includes parts and maintenance, contributed significantly to its overall revenue, highlighting the importance of these after-sales activities in the company's financial performance and customer retention strategy.

Technology Licensing and Royalties

Ballard Power Systems leverages its advanced fuel cell technology through licensing agreements, generating revenue from royalties and fees. This strategy allows them to capitalize on their significant research and development investments by enabling other companies to utilize their patented innovations.

This approach not only provides a high-margin revenue stream but also accelerates the broader market adoption of fuel cell solutions. For instance, in 2023, Ballard continued to expand its licensing and joint development agreements, aiming to embed its technology across various mobility and stationary power applications.

- Technology Licensing: Ballard grants rights to its fuel cell stack and system technology to partners.

- Royalty Payments: Revenue is generated as a percentage of sales from products incorporating Ballard's licensed technology.

- Intellectual Property Monetization: Maximizing returns on R&D through strategic IP partnerships.

- Market Expansion: Facilitating wider adoption of fuel cell technology via third-party manufacturing and distribution.

Government Grants and Project Funding

Ballard Power Systems actively seeks and secures funding through government grants and project participation, which are crucial for advancing its hydrogen fuel cell technology. These non-dilutive sources provide essential capital for research, development, and the scaling of new applications. For instance, in 2023, Ballard announced participation in several government-backed initiatives, including a significant EU-funded project focused on developing zero-emission heavy-duty vehicles. This type of funding is vital for de-risking early-stage technology adoption and building market confidence.

These government contributions are not direct sales revenue but rather strategic investments that accelerate Ballard's technological roadmap and market entry. They often come with specific milestones and reporting requirements, ensuring progress in areas like hydrogen infrastructure development and fuel cell efficiency improvements. Such partnerships are instrumental in demonstrating the viability of fuel cell technology in real-world applications, paving the way for future commercialization.

- Government Grants: Ballard leverages grants from national and international bodies to fund R&D, aiming to reduce costs and improve performance of its fuel cell stacks.

- Project Funding: Participation in publicly funded demonstration projects, such as those focused on zero-emission transportation or stationary power, provides capital and validation.

- Subsidies: While not a direct revenue stream, government subsidies for hydrogen adoption indirectly support Ballard's market growth by making fuel cell solutions more competitive.

- R&D Acceleration: This funding is critical for accelerating innovation and bringing next-generation fuel cell technologies to market faster than relying solely on internal capital.

Ballard's primary revenue streams stem from the sale of its fuel cell products, including stacks, modules, and integrated power systems. These are critical components for original equipment manufacturers (OEMs) and system integrators across various industries. In 2024, product sales continued to be the dominant revenue source, accounting for the vast majority of the company's income.

Beyond product sales, Ballard generates income through specialized engineering services and development contracts, assisting customers in integrating their fuel cell technology. Additionally, recurring revenue is secured through service and maintenance contracts, along with the sale of spare parts, ensuring ongoing system performance and customer loyalty. Technology licensing agreements also contribute, allowing Ballard to monetize its intellectual property and expand market reach.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Product Sales | Sale of fuel cell stacks, modules, and integrated power systems. | Over 90% of total revenue in 2024. |

| Service & Maintenance | Recurring revenue from ongoing support and spare parts. | Significant contributor to overall revenue in 2023. |

| Technology Solutions | Engineering services and development contracts. | A key segment contributing to financial performance. |

| Licensing & Royalties | Revenue from granting rights to fuel cell technology. | Accelerates market adoption and provides high-margin income. |

Business Model Canvas Data Sources

The Ballard Business Model Canvas is built upon a foundation of robust market research, financial projections, and operational data. These sources are critical for accurately defining customer segments, value propositions, and revenue streams.