Royal Bafokeng Platinum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Royal Bafokeng Platinum Bundle

Navigate the complex external forces impacting Royal Bafokeng Platinum with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the platinum mining sector and the company's future. This detailed report offers actionable intelligence for investors and strategic planners.

Gain a competitive edge by dissecting the social, technological, legal, and environmental factors influencing Royal Bafokeng Platinum. Our expertly crafted PESTLE analysis provides the insights you need to anticipate market shifts and mitigate risks. Download the full version for immediate access to critical strategic data.

Political factors

South Africa's political landscape shifted significantly with the establishment of a Government of National Unity in May 2024. This new political arrangement could reshape mining policies and the overall stability of regulations governing the sector.

The Minerals Council South Africa anticipates this unity government might foster a more cohesive legislative environment. Such a development is crucial for attracting investment in exploration activities and the establishment of new mining operations, which are vital for economic growth.

The evolving Black Economic Empowerment (BEE) framework, with the proposed Mineral Resources Development Bill of 2025, remains a key political consideration. This legislation aims to modify the current Mineral and Petroleum Resources Development Act (MPRDA).

Potential changes to ownership thresholds and beneficiation requirements could influence investment decisions in the mining sector, impacting companies like Royal Bafokeng Platinum. For instance, the Department of Mineral Resources and Energy noted in late 2024 that discussions around increasing local beneficiation targets were ongoing, which could necessitate significant capital expenditure for miners to process more resources domestically.

Labor relations in South Africa's mining sector, a key political factor for Royal Bafokeng Platinum, remain dynamic. Unions continue to be vocal on wage negotiations and the impact of job losses, a persistent concern. For instance, in early 2024, significant wage agreements were reached in some mining sub-sectors, but underlying tensions regarding retrenchments and working conditions persist, as evidenced by sporadic protests.

Regulatory Environment and Cadastre System

South Africa is actively working to improve its regulatory landscape for mining. A key development is the planned launch of a digital mining rights portal, a cadastre system, by July 2025. This aims to boost transparency and simplify how companies apply for mining and prospecting rights.

This digital initiative is designed to cut down on regulatory uncertainty, which could encourage more investment in the sector. By making processes clearer and more efficient, the government hopes to create a more attractive environment for mining operations, potentially benefiting companies like Royal Bafokeng Platinum.

- Digital Cadastre System Launch: Planned for July 2025 in South Africa.

- Objective: Enhance transparency and streamline mining rights applications.

- Expected Impact: Reduction in regulatory ambiguity, potential for increased investment.

International Trade and Geopolitical Landscape

Global geopolitical tensions and evolving trade policies significantly shape the demand and pricing of Platinum Group Metals (PGMs), directly affecting South African producers such as Implats, which now controls Royal Bafokeng Platinum (RBPlat). These international dynamics can create volatility in commodity markets, impacting revenue streams for companies reliant on PGM exports.

The outlook for PGM demand in 2025 faces uncertainty, partly due to potential shifts in trade agreements. For instance, the imposition of US import tariffs or retaliatory measures could disrupt key markets, particularly the automotive sector, a major consumer of PGMs used in catalytic converters. This could lead to reduced demand and potentially lower prices for PGMs.

- Trade Policy Impact: Potential US import tariffs on vehicles or components could reduce demand for PGMs in 2025.

- Automotive Sector Sensitivity: The automotive industry's reliance on PGMs makes it vulnerable to trade disputes and economic slowdowns.

- Geopolitical Risk Premium: Heightened international tensions can introduce a risk premium into PGM pricing, reflecting supply chain vulnerabilities.

- South African Production: As a major global supplier, South Africa's PGM production, including RBPlat, is sensitive to international market access and demand fluctuations.

South Africa's political stability is currently under review following the formation of a Government of National Unity in May 2024, which could influence mining legislation and investment attractiveness. The Minerals Council South Africa anticipates this new political alignment may lead to a more unified legislative framework, essential for fostering exploration and new mining ventures.

The proposed Mineral Resources Development Bill of 2025, aiming to update the MPRDA, will likely introduce changes to BEE ownership thresholds and beneficiation requirements. These potential policy shifts could significantly impact investment decisions for companies like Royal Bafokeng Platinum, with ongoing discussions about increasing domestic processing targets by the Department of Mineral Resources and Energy in late 2024.

Labor relations remain a critical political factor, with ongoing union engagement on wage negotiations and concerns over job security, as seen in sporadic protests and wage agreements in early 2024. Furthermore, the planned July 2025 launch of a digital cadastre system by the South African government is intended to enhance transparency in mining rights applications, aiming to reduce regulatory ambiguity and encourage investment.

What is included in the product

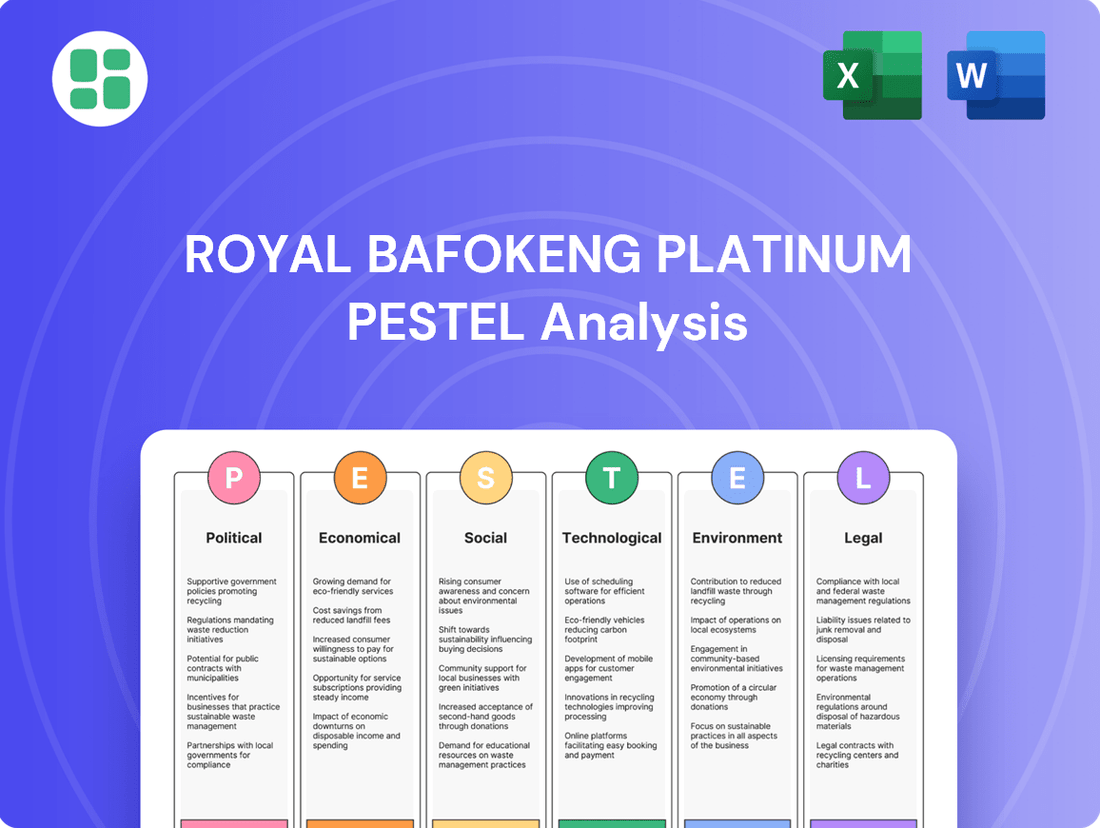

This PESTLE analysis examines the external macro-environmental factors influencing Royal Bafokeng Platinum's operations across political, economic, social, technological, environmental, and legal dimensions.

It provides a comprehensive understanding of how these global and regional forces create both challenges and strategic advantages for the company.

A clear, actionable PESTLE analysis for Royal Bafokeng Platinum provides a vital framework to proactively address external challenges, transforming potential market disruptions into opportunities for strategic advantage.

Economic factors

The platinum group metals (PGM) market is currently experiencing a downturn, with platinum, palladium, and rhodium prices facing pressure. This is primarily driven by companies reducing their inventories, also known as industrial destocking, coupled with a general sense of unease in the global economy and geopolitical situations. For instance, palladium prices have seen significant declines throughout 2023 and into early 2024, trading well below previous highs.

Looking ahead to 2025, projections suggest potential supply deficits for platinum and rhodium, which could offer some price support. However, the overall PGM market is expected to remain volatile. This volatility directly impacts the revenue streams of companies like Royal Bafokeng Platinum, making financial planning and operational efficiency crucial.

Fluctuations in the Rand/USD exchange rate are a critical economic factor for Royal Bafokeng Platinum. Since platinum group metals (PGM) are typically priced in US dollars on the global market, while a significant portion of operating costs, such as labor and local supplies, are incurred in South African Rand, a stronger Rand can erode profitability. For instance, if the Rand strengthens from R18.00/$ to R16.00/$, the Rand-equivalent revenue from dollar-denominated sales decreases, even if the dollar price of platinum remains stable. This volatility directly impacts the company's ability to convert its export earnings into local currency, influencing margins and investment decisions.

South Africa's ongoing energy crisis, marked by frequent load shedding, remains a substantial threat to mining activities. While 2024 saw some stabilization in Eskom's power generation, the underlying structural issues mean the long-term energy supply is still uncertain. This directly affects Royal Bafokeng Platinum's operational costs and the reliability of its production schedules.

Inflation and Operating Costs

Persistent inflation in South Africa directly impacts Royal Bafokeng Platinum by increasing its operating expenses. This rise in costs, driven by broader economic trends, can squeeze profit margins if not effectively managed.

Input inflation, a key component of operating costs, has been a notable challenge. For instance, Impala Platinum (Implats), a major player in the platinum group metals sector, reported higher unit costs in its interim results for the six months ended December 2024, directly attributable to these inflationary pressures. This trend suggests similar cost pressures are likely faced by Royal Bafokeng Platinum.

- Rising Input Costs: Fuel, electricity, and consumables are all subject to inflationary increases, directly adding to mining operational expenses.

- Impact on Profitability: Higher operating costs can reduce earnings per share and overall profitability if not offset by increased revenue or efficiency gains.

- Unit Cost Increases: As demonstrated by industry peers like Implats in late 2024, inflationary pressures are leading to a rise in the cost to produce each ounce of platinum.

Global Economic Growth and Industrial Demand

Global economic growth is a primary driver for platinum group metals (PGMs) demand. Key industries like automotive manufacturing, which relies heavily on PGMs for catalytic converters, and the chemical sector are directly impacted by the pace of economic expansion. A robust global economy typically translates to higher industrial output and, consequently, increased PGM consumption.

The PGM catalysts market, specifically for emission control, is expected to see growth. This is largely due to increasingly strict environmental regulations worldwide, pushing automakers to adopt more advanced catalytic technologies. However, the actual extent of PGM demand will be tempered by the broader economic climate and the capacity of industries to expand their operations.

- Global GDP Growth Projections: The IMF projected global GDP growth at 3.2% for both 2024 and 2025 in its April 2024 World Economic Outlook, indicating a stable but moderate economic environment.

- Automotive Sector Influence: The automotive industry accounts for a significant portion of PGM demand, with catalyst production being a major use case.

- Industrial Demand Indicators: Manufacturing PMIs (Purchasing Managers' Index) serve as a key indicator for industrial demand; for instance, the JPMorgan Global Manufacturing PMI hovered around 50.0-50.5 in early to mid-2024, suggesting a near-stagnant but not contracting global manufacturing sector.

- Environmental Regulations: Stricter emissions standards, such as Euro 7 in Europe, are designed to boost the demand for more efficient and PGM-intensive catalysts.

The South African economic landscape presents a mixed bag for Royal Bafokeng Platinum. While global PGM demand is linked to economic growth, local factors like inflation and the Rand's strength significantly impact profitability. The ongoing energy crisis continues to pose operational risks, directly affecting production costs and reliability.

Persistent inflation in South Africa, particularly regarding input costs like fuel and electricity, directly increases Royal Bafokeng Platinum's operating expenses. For example, South Africa's CPI remained elevated, averaging around 5.9% in 2024, impacting the cost of goods and services for mining operations. This rise in expenses can compress profit margins if not offset by revenue increases or efficiency improvements.

The volatility of the Rand against the US Dollar is a critical economic consideration. With PGMs priced in dollars and many operational costs in Rand, a stronger Rand reduces the Rand-equivalent revenue from dollar-denominated sales. For instance, if the Rand strengthens from R18.00/$ to R16.00/$, the company's local currency earnings from the same dollar sale diminish.

South Africa's energy crisis, characterized by load shedding, remains a significant operational challenge. Although Eskom's generation capacity saw some improvements in 2024, the long-term energy security is still a concern, leading to unpredictable power supply and increased costs for backup power solutions.

What You See Is What You Get

Royal Bafokeng Platinum PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Royal Bafokeng Platinum delves into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic outlook.

Sociological factors

Royal Bafokeng Platinum (RBPlat) places immense importance on its community relations, recognizing that a strong social license to operate is fundamental for sustained mining activities in South Africa. This involves active engagement with the communities surrounding its operations, such as the Royal Bafokeng Nation, and a commitment to addressing their socio-economic development needs.

In 2023, RBPlat continued its investment in community upliftment, with a significant portion of its corporate social responsibility budget directed towards education and skills development initiatives. For instance, the company supported over 5,000 learners through various educational programs, aiming to foster local talent and create future employment opportunities within the mining sector and beyond.

Furthermore, RBPlat’s commitment extends to improving local infrastructure and healthcare services, recognizing these as critical components for community well-being and economic growth. These investments are designed to build shared value and ensure that the benefits of mining are distributed equitably, solidifying the company’s positive standing within its operational areas.

Employment levels and job creation are paramount in South Africa's mining sector, a major contributor to the national economy. Royal Bafokeng Platinum, like its peers, operates within this context, where job retention and creation are vital social considerations for the communities it serves. The sector's ability to provide stable employment directly impacts the well-being of thousands of households.

However, the mining industry is susceptible to volatility. Fluctuating platinum group metal (PGM) prices and necessary operational adjustments can unfortunately lead to retrenchments. For instance, in early 2024, the broader South African mining sector saw reports of potential job cuts impacting thousands, underscoring the precariousness of employment in this capital-intensive and cyclical industry. These job losses have a ripple effect, significantly affecting the economic stability of mining-dependent towns.

The South African mining industry is increasingly focused on a 'Zero Harm' approach to worker health and safety. This commitment is crucial, especially given that mining fatalities in the sector hit a record low in 2024, with preliminary data indicating a significant reduction compared to previous years.

Despite this positive trend, continuous vigilance and strict adherence to evolving safety regulations are essential. The industry must remain proactive in addressing issues such as non-compliance with safety protocols and ensuring robust health monitoring for all mine workers.

Skills Development and Local Content Initiatives

Royal Bafokeng Platinum's commitment to skills development and local content initiatives is crucial for fostering inclusive growth and maximizing socio-economic benefits within its operating communities. These programs are designed to uplift historically disadvantaged South Africans by creating pathways into the mining sector, from operational roles to leadership positions.

These initiatives are not just about compliance; they are about building a sustainable future. For instance, in 2023, the company reported investing significantly in training and development programs. These efforts aim to ensure that a greater percentage of the workforce and management team comprises individuals from the local communities, aligning with broader national objectives for economic empowerment.

The impact of these programs can be seen in tangible outcomes:

- Increased Local Employment: Efforts to prioritize local hiring have led to a measurable increase in the proportion of employees residing within the Royal Bafokeng Platinum's host communities.

- Skills Transfer and Capacity Building: Targeted training programs have equipped local individuals with specialized mining skills, enhancing their employability and career progression opportunities.

- Supplier Development: Local content initiatives extend to procurement, encouraging the growth of local businesses and service providers, thereby diversifying the local economy beyond direct employment.

- Community Empowerment: By fostering local talent and businesses, these programs contribute to greater community self-sufficiency and a stronger sense of ownership in the mining operation's success.

Social Impact of Mining on Local Infrastructure and Services

Mining activities significantly strain local infrastructure and services, impacting housing, water, and sanitation in surrounding communities. Royal Bafokeng Platinum (RBP) acknowledges this and is actively involved in developing sustainable human settlements for its employees. For instance, RBP's commitment to employee housing is evident in its ongoing projects aimed at providing decent accommodation, directly addressing the strain on local residential services.

Beyond employee housing, RBP also contributes to the enhancement of public physical infrastructure. These contributions are crucial for mitigating the negative externalities of large-scale mining operations on local communities. For example, RBP's investment in local water infrastructure projects in the North West Province during 2023 aimed to improve access and quality for both its employees and the wider community, reflecting a broader commitment to shared infrastructure development.

- Infrastructure Strain: Mining operations often lead to increased demand on local roads, water supply, and waste management systems.

- RBP's Housing Initiatives: The company focuses on providing sustainable housing solutions for its workforce, reducing pressure on existing local housing stock.

- Public Infrastructure Support: RBP contributes to public works, such as road upgrades and water treatment facilities, to benefit the broader community.

- 2024/2025 Focus: Continued investment in community infrastructure, including sanitation upgrades and access to clean water, remains a priority for RBP in the current fiscal year.

Community relations and social impact are central to RBPlat's operational strategy, with a strong emphasis on local employment and skills development. The company's commitment to socio-economic upliftment is demonstrated through significant investments in education and community projects. For instance, in 2023, RBPlat supported over 5,000 learners, underscoring its dedication to fostering local talent and creating sustainable opportunities within its host communities.

Employment in the mining sector is a critical social factor, and RBPlat navigates the challenges of job creation and retention within a volatile industry. While the broader South African mining sector faced potential job cut reports in early 2024, RBPlat's focus on skills transfer and local content initiatives aims to bolster community economic stability. These programs are vital for empowering historically disadvantaged individuals and fostering inclusive growth.

RBPlat also addresses the infrastructure strain caused by mining operations by investing in sustainable housing and public works. For example, the company's commitment to improving water infrastructure in the North West Province in 2023 highlights its role in mitigating negative externalities and enhancing community well-being. Continued investment in sanitation and clean water access is a key priority for 2024/2025.

| Sociological Factor | RBPlat's Response/Initiative | 2023/2024 Data/Focus |

|---|---|---|

| Community Relations | Active engagement and socio-economic development | Supported over 5,000 learners in educational programs |

| Employment & Skills | Local hiring prioritization and skills transfer | Focus on increasing local workforce percentage and capacity building |

| Infrastructure Impact | Addressing strain through housing and public works | Investment in water infrastructure and commitment to sanitation upgrades |

Technological factors

The South African mining sector, including platinum group metals (PGM), is embracing technological advancements. Automation and digitalization are key drivers, aiming to boost operational efficiency and worker safety. For instance, the adoption of reef boring machines is being explored to optimize extraction from narrow tabular orebodies, potentially leading to higher PGM grades and reduced operating costs.

Technological advancements are significantly boosting the efficiency of processing and smelting platinum group metals (PGMs). Innovations in comminution and flotation, for instance, are allowing for higher recovery rates from the ore. In 2023, the PGM mining sector saw continued investment in advanced smelting technologies aimed at reducing energy consumption and emissions, a trend expected to accelerate through 2024 and 2025.

These efficiency gains directly translate to better metal recovery, meaning more PGMs are extracted from the same amount of ore. This optimization is vital for reducing operational costs, making companies like Royal Bafokeng Platinum more competitive in the global market. For example, upgrades to smelting furnaces can improve throughput by up to 15% while simultaneously lowering the carbon footprint.

Advancements in exploration technologies are crucial for Royal Bafokeng Platinum (RBPlat) to pinpoint and develop new Platinum Group Metal (PGM) reserves, thereby prolonging the operational life of its mines. These innovations directly impact the efficiency and success rate of identifying commercially viable deposits.

RBPlat's strategic adoption of a digital mining cadastre system, slated for implementation by July 2025, is designed to significantly enhance the transparency and accessibility of exploration areas. This digital transformation is anticipated to simplify and expedite the application process for new exploration rights, fostering a more dynamic environment for PGM discoveries.

Safety Technologies and Remote Monitoring

Technological advancements are significantly boosting safety in mining operations, particularly in deep-level PGM mines like those operated by Royal Bafokeng Platinum. The integration of remote monitoring systems allows for real-time oversight of hazardous areas, enabling quicker responses to incidents and proactive risk management. These systems are crucial for protecting personnel in challenging underground environments, a key focus for the mining sector aiming to minimize accidents and improve worker well-being.

Royal Bafokeng Platinum, like many in the platinum group metals (PGM) sector, is increasingly adopting advanced safety technologies. For instance, innovations such as automated equipment, gas detection sensors, and sophisticated ventilation controls are being deployed. These technological solutions directly contribute to a safer working environment by mitigating exposure to risks like rockfalls, gas leaks, and poor air quality. By investing in these areas, the company aims to enhance operational efficiency while prioritizing the health and safety of its workforce, a critical factor in sustainable mining practices.

- Remote Monitoring: Real-time tracking of personnel and equipment in hazardous zones.

- Advanced Safety Systems: Implementation of automated safety checks and environmental monitoring.

- Risk Reduction: Direct impact on decreasing worker exposure to mining-related hazards.

- Operational Safety: Overall improvement in the safety performance of deep-level PGM mines.

Research and Development in PGM Applications

Ongoing research and development into new applications for Platinum Group Metals (PGMs), especially in green technologies, are shaping future demand. The focus on areas like fuel cells and hydrogen production, beyond traditional automotive catalysts, is a significant driver for innovation and market diversification.

For instance, the global fuel cell market is projected to grow substantially, with some forecasts indicating a compound annual growth rate (CAGR) of over 20% through 2030, directly impacting PGM demand. This expansion into new sectors, such as stationary power and heavy-duty transport, represents a key technological factor for companies like Royal Bafokeng Platinum.

- Growing demand for PGMs in green hydrogen production: Research into electrolyzers, crucial for green hydrogen, heavily relies on PGMs like platinum and iridium.

- Advancements in fuel cell technology: Innovations are making fuel cells more efficient and cost-effective, increasing their adoption in vehicles and power generation.

- Diversification beyond automotive catalysts: New applications in electronics, medical devices, and chemical processing are opening up additional PGM markets.

- Investment in PGM recycling technologies: Enhanced recycling processes are becoming critical to meet demand and ensure a sustainable supply chain for PGMs.

Technological advancements are critical for Royal Bafokeng Platinum (RBPlat) to enhance operational efficiency and safety. Automation, digitalization, and advanced processing techniques are key. For example, the exploration of reef boring machines and upgrades to smelting furnaces are expected to improve PGM extraction grades and reduce costs. RBPlat's planned digital mining cadastre system by July 2025 aims to streamline exploration rights applications, fostering new discoveries.

The PGM sector is seeing continued investment in technologies that boost processing efficiency and metal recovery rates. Innovations in comminution and flotation are improving how PGMs are extracted from ore. Smelting technology advancements in 2023, focusing on reduced energy consumption and emissions, are set to continue through 2024 and 2025, with some furnace upgrades potentially increasing throughput by up to 15% while lowering the carbon footprint.

Safety in deep-level PGM mines is being significantly enhanced through technology. Remote monitoring systems provide real-time oversight of hazardous areas, allowing for faster incident response and proactive risk management. RBPlat is deploying automated equipment, gas detection sensors, and improved ventilation controls to mitigate risks like rockfalls and gas leaks, prioritizing worker well-being.

Future demand for PGMs is being shaped by new applications, particularly in green technologies like fuel cells and hydrogen production. The global fuel cell market is projected for substantial growth, with some forecasts indicating a CAGR exceeding 20% through 2030, directly influencing PGM demand. This diversification into sectors beyond traditional automotive catalysts is a key technological factor for RBPlat.

| Technological Factor | Impact on RBPlat | Example/Data Point |

| Automation & Digitalization | Increased operational efficiency, improved safety | Exploration of reef boring machines for optimized extraction |

| Advanced Processing | Higher PGM recovery rates, reduced costs | Smelting furnace upgrades potentially increasing throughput by up to 15% |

| Safety Technologies | Reduced worker exposure to hazards, enhanced well-being | Remote monitoring systems for real-time oversight of hazardous zones |

| New PGM Applications | Future demand growth, market diversification | Projected CAGR of over 20% for the global fuel cell market through 2030 |

Legal factors

South Africa's mining sector is navigating substantial legislative shifts, particularly with the anticipated Mineral Resources Development Bill of 2025, which proposes significant amendments to the existing Mineral and Petroleum Resources Development Act (MPRDA). These changes are designed to integrate artisanal and small-scale mining operations more formally into the regulatory landscape, enhance the depth and breadth of community engagement processes, and provide clearer guidelines for the management and utilization of historical mine dumps.

Royal Bafokeng Platinum faces evolving environmental legal landscapes, with the recent Climate Change Act (No. 22 of 2024) and updated air quality regulations imposing more stringent emission reduction targets. These legislative shifts necessitate enhanced monitoring and reporting, directly impacting operational costs and strategic planning for compliance.

Failure to adhere to these new environmental mandates, including stricter air quality standards, could result in significant penalties and reputational damage, potentially affecting investor confidence and access to capital. The company must integrate these legal requirements into its operational framework to mitigate risks and demonstrate commitment to national climate objectives.

Labor laws and collective bargaining agreements are critical in shaping the operational landscape for Royal Bafokeng Platinum. These frameworks dictate the terms of employment, worker rights, and the negotiation process between the company and its organized labor. Navigating these regulations effectively is paramount for maintaining stable industrial relations and avoiding costly disputes.

Recent years have seen significant attention on wage negotiations and restructuring within the mining sector, impacting employment levels. For instance, in 2024, ongoing discussions around operational efficiency and potential job adjustments underscore the need for Royal Bafokeng Platinum to meticulously adhere to labor legislation and maintain constructive dialogue with its recognized unions to manage these sensitive transitions.

Corporate Governance and Financial Reporting Standards

Royal Bafokeng Platinum, like other major mining operations such as Impala Platinum, operates under rigorous corporate governance and financial reporting mandates. These regulations are critical for maintaining transparency and accountability, thereby fostering investor trust.

Publicly traded entities must adhere to standards set by regulatory bodies, ensuring that financial statements accurately reflect the company's performance and position. For instance, Impala Platinum's 2024 financial reports detail their compliance with International Financial Reporting Standards (IFRS), a common benchmark for global mining firms.

- Corporate Governance: Publicly listed mining companies must comply with King IV principles in South Africa, focusing on ethical leadership and accountability.

- Financial Reporting: Adherence to IFRS ensures standardized and comparable financial disclosures, crucial for investor analysis.

- Transparency: Regular reporting, including annual and interim financial results, provides stakeholders with insights into operational performance and financial health.

- Investor Confidence: Robust governance and transparent reporting directly contribute to maintaining and enhancing investor confidence in the company's long-term viability.

Black Economic Empowerment (BEE) Legislation

South Africa's Broad-Based Black Economic Empowerment (B-BBEE) Act and the Mining Charter remain key legal drivers for economic transformation within the mining sector. These frameworks mandate increased participation for historically disadvantaged South Africans, impacting companies like Royal Bafokeng Platinum.

While the intent is to foster inclusivity, evolving interpretations and potential amendments to B-BBEE policies can introduce regulatory ambiguity. This uncertainty can affect investor confidence and strategic planning for mining operations.

For instance, the Department of Mineral Resources and Energy's ongoing review of mining ownership targets under the Mining Charter could lead to adjustments in compliance requirements. Such changes directly influence how companies structure their ownership and procurement strategies.

- B-BBEE Act Compliance: Royal Bafokeng Platinum must adhere to specific ownership, management control, skills development, and enterprise and supplier development targets.

- Mining Charter III: This charter sets out specific requirements for majority black ownership, aiming for 30% historically disadvantaged South African ownership in mining entities.

- Regulatory Uncertainty: Fluctuations in policy interpretation, particularly regarding the 'once-empowered, always-empowered' principle, create a dynamic compliance landscape.

- Economic Transformation Goals: Legislation aims to address historical economic imbalances by promoting broader participation and ownership by black South Africans in the mining value chain.

The legal framework surrounding South Africa's mining sector continues to evolve, with the anticipated Mineral Resources Development Bill of 2025 set to refine regulations for artisanal mining and community engagement, impacting how companies like Royal Bafokeng Platinum interact with local stakeholders.

Stricter environmental laws, including the Climate Change Act of 2024, impose rigorous emission standards, demanding increased operational oversight and investment in compliance technologies, which directly influences cost structures and strategic planning.

Navigating complex labor laws and collective bargaining agreements is crucial for maintaining stable industrial relations, especially given ongoing discussions around operational efficiency and employment levels within the sector in 2024, requiring meticulous adherence to legislation and union dialogue.

Compliance with Broad-Based Black Economic Empowerment (B-BBEE) and the Mining Charter remains a significant legal requirement, with ongoing reviews of ownership targets potentially affecting strategic structuring and investor confidence.

| Legal Area | Key Legislation/Regulation | Impact on Royal Bafokeng Platinum | 2024/2025 Focus |

|---|---|---|---|

| Mining Law | Mineral Resources Development Bill (Anticipated 2025) | Formalizes artisanal mining, enhances community engagement. | Adapting to new community consultation protocols. |

| Environmental Law | Climate Change Act (2024), Air Quality Regulations | Stricter emission targets, increased monitoring costs. | Investing in emissions reduction technology. |

| Labor Law | Basic Conditions of Employment Act, LRA | Governs employment terms, collective bargaining. | Managing workforce adjustments and wage negotiations. |

| Economic Empowerment | B-BBEE Act, Mining Charter III | Mandates increased black ownership and participation. | Reviewing ownership structures against evolving targets. |

Environmental factors

Water management is a significant environmental challenge for Royal Bafokeng Platinum, especially considering South Africa's ongoing water scarcity issues. The company must prioritize sustainable water use and efficient resource management to mitigate its environmental footprint and maintain operational continuity.

In 2023, the mining sector in South Africa, including platinum operations, faced increasing pressure to demonstrate responsible water stewardship. While specific figures for Royal Bafokeng Platinum's water consumption in 2024 or 2025 are not yet publicly available, the national context highlights the urgency. For instance, the Department of Water and Sanitation reported in late 2023 that several regions were experiencing low dam levels, impacting water availability for industrial users.

The mining industry, including platinum group metals, is a significant energy consumer, directly impacting its carbon footprint. In 2023, South Africa's mining sector was estimated to account for roughly 10% of the nation's total greenhouse gas emissions, primarily from diesel and electricity use.

The implementation of the Climate Change Act 2024 is a pivotal development, introducing mandatory carbon budgets and specific emission reduction targets for various sectors, including mining. This legislation compels companies like Royal Bafokeng Platinum to actively pursue strategies for decarbonization and a shift towards cleaner energy sources.

Royal Bafokeng Platinum's operations are significantly influenced by environmental factors, particularly concerning waste management and tailings dam safety. Effective management of residue deposits and stockpiles, commonly known as tailings, is paramount for safeguarding the environment. The company must adhere to stringent regulations governing these materials.

Recent developments in South Africa, where Royal Bafokeng Platinum primarily operates, indicate a shift in how mine residue is viewed. Draft amendments to environmental impact assessment regulations propose re-characterizing residue as a resource. This change could significantly impact reclamation efforts and the potential expansion of historical mine dumps, ultimately aiming to reduce the associated environmental risks.

Biodiversity Impact and Land Rehabilitation

Royal Bafokeng Platinum's operations, like all mining ventures, inherently carry the potential to impact local biodiversity. This necessitates a strong commitment to land rehabilitation to restore ecosystems once mining activities cease. The company is actively integrating environmental sustainability into its core practices, aiming to minimize ecological disruption throughout the mine's lifecycle.

Recognizing the importance of biodiversity, companies in the mining sector are increasingly investing in comprehensive rehabilitation programs. These efforts are crucial for meeting regulatory requirements and for maintaining a positive social license to operate. For instance, in 2023, the mining sector globally saw significant investment in ESG (Environmental, Social, and Governance) initiatives, with rehabilitation often being a key component.

- Biodiversity Impact: Mining can disrupt habitats and affect local flora and fauna.

- Land Rehabilitation: Essential for restoring mined areas to a functional ecosystem.

- Sustainability Integration: Companies are embedding environmental stewardship into operational planning.

- Regulatory Compliance: Robust rehabilitation plans are often mandated by environmental legislation.

Climate Change Regulations and Adaptation Strategies

South Africa's dedication to tackling climate change, solidified by its Climate Change Act, places a significant onus on the mining industry, including Royal Bafokeng Platinum, to create and execute strategies for reducing greenhouse gas emissions.

This regulatory landscape necessitates adaptation to climate-related challenges such as increasingly severe weather patterns and growing water scarcity, directly impacting operational continuity and resource availability.

The mining sector is expected to play a crucial role in South Africa's broader objective of transitioning towards a climate-resilient economy, which could involve investments in renewable energy and sustainable mining practices.

- Mitigation Plans: Mining companies must develop and implement plans to reduce their greenhouse gas emissions, aligning with national targets.

- Adaptation Measures: Strategies are needed to cope with climate impacts like extreme weather events and water shortages.

- Economic Transition: The sector is expected to contribute to South Africa's shift to a climate-resilient economic model.

- Regulatory Compliance: Adherence to the Climate Change Act and related policies is paramount for operational legitimacy.

Environmental factors significantly shape Royal Bafokeng Platinum's operational landscape. Water scarcity in South Africa presents a critical challenge, demanding efficient water management and sustainable practices to ensure operational continuity. The company's carbon footprint is also under scrutiny, particularly with the implementation of the Climate Change Act 2024, which mandates emission reductions for the mining sector.

Waste management, specifically tailings, requires rigorous adherence to environmental regulations to mitigate risks. Furthermore, the potential impact on biodiversity necessitates proactive land rehabilitation efforts, a growing focus for mining companies globally as they integrate environmental stewardship into their strategies. These environmental considerations are not only regulatory imperatives but also crucial for maintaining a social license to operate.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Royal Bafokeng Platinum is built on data from reputable sources including government reports, financial institutions, and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the platinum mining sector.