Royal Bafokeng Platinum Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Royal Bafokeng Platinum Bundle

Royal Bafokeng Platinum navigates a complex landscape shaped by powerful buyer and supplier forces, alongside the ever-present threat of substitutes. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Royal Bafokeng Platinum’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In the South African mining sector, labor unions wield considerable influence, directly impacting companies like Royal Bafokeng Platinum (now part of Impala Platinum). Major unions such as the National Union of Mineworkers (NUM) and the Association of Mineworkers and Construction Union (AMCU) have historically negotiated for better wages and working conditions. This bargaining power can translate into increased operational expenses and potential work stoppages if demands aren't met.

Recent collective bargaining agreements in South Africa's mining industry have seen wage increases exceeding inflation, underscoring the persistent strength of labor as a supplier. For example, agreements secured in 2023 included multi-year wage hikes, demonstrating unions' ability to extract favorable terms. This trend suggests that mining firms must continue to factor in potentially rising labor costs and the risk of industrial action when planning operations and financial forecasts.

Suppliers of specialized equipment and technology for deep-level PGM mining, like those used by Royal Bafokeng Platinum, wield considerable influence. Their offerings are critical for efficient and safe extraction, making them indispensable.

The high cost of this advanced machinery, coupled with a limited supplier base, amplifies their bargaining power. For instance, a major PGM mining equipment manufacturer might see its order backlog extend well into 2025, indicating strong demand and pricing leverage.

Moreover, the substantial switching costs involved for mining companies—encompassing training, retooling, and integration challenges—further solidify these suppliers' strong market position, allowing them to command premium pricing.

Electricity and water are absolutely essential for mining platinum group metals (PGMs) and for processing them. Without a reliable supply, operations simply can't happen.

South Africa has been grappling with a significant energy crisis, often referred to as load shedding. This means planned power outages are a regular occurrence. In 2023, South Africa experienced an unprecedented number of load shedding hours, impacting various industries, including mining, and leading to increased operational costs due to the need for backup power generation.

These power outages, coupled with steadily increasing electricity tariffs from suppliers like Eskom, directly hurt mining productivity and make South African mines less competitive on the global stage. This situation gives energy suppliers considerable bargaining power.

To counter this, mining companies like Royal Bafokeng Platinum are compelled to invest heavily in alternative power sources, such as solar and wind energy projects. These investments are crucial for reducing reliance on the national grid, mitigating the risks associated with power instability, and gaining better control over energy expenses.

Chemicals and Consumables

The bargaining power of suppliers for chemicals and consumables in the platinum group metals (PGM) sector, particularly for Royal Bafokeng Platinum, is influenced by the specialization of the required materials. While many basic chemicals might have numerous suppliers, certain reagents critical for efficient PGM extraction and refining are often sourced from a more limited pool of specialized providers.

The dependency on these specialized suppliers for consistent quality and availability directly impacts operational efficiency and the purity of the final PGM products. For instance, in 2023, the global market for mining chemicals, which includes reagents for PGM processing, saw significant price fluctuations driven by supply chain disruptions and demand from various mining sectors.

- Specialized Reagents: Key chemicals for PGM processing, like specific flotation reagents or leaching agents, may have fewer alternative suppliers.

- Operational Dependence: Consistent supply and quality of these chemicals are paramount for maintaining high recovery rates and product purity in PGM refining.

- Market Dynamics: In 2023, the cost of certain industrial chemicals used in mining saw increases, impacting operational expenses for companies like Royal Bafokeng Platinum.

Logistics and Infrastructure Services

The bargaining power of suppliers in logistics and infrastructure services significantly impacts Royal Bafokeng Platinum (RBPlat). Reliable transportation, especially rail and port access, is vital for exporting refined Platinum Group Metals (PGMs) and importing essential materials. In 2024, South Africa's Transnet, the primary provider of rail and port services, continued to face operational challenges. These issues, including infrastructure maintenance backlogs and capacity constraints, can lead to delays and increased operational costs for mining firms like RBPlat, thereby enhancing Transnet's leverage.

Bottlenecks within South Africa's logistics network, particularly those affecting rail freight and port efficiency, directly translate into higher costs and potential revenue losses for RBPlat. For instance, disruptions in rail services can impede the timely delivery of inputs or the export of finished products, giving logistics providers considerable sway over pricing and service availability. The state of infrastructure development and maintenance directly influences the operational efficiency and profitability of the mining sector.

- Transnet's operational challenges in 2024 impacted the reliability of rail and port services for South African mining companies.

- Logistical bottlenecks can increase costs and create delays for exporting refined PGMs and importing supplies.

- These limitations grant significant bargaining power to logistics and infrastructure service providers.

Suppliers of specialized mining equipment and critical chemicals hold significant sway due to the unique nature of their products and the high costs associated with switching. For instance, in 2023, global demand for certain mining reagents outstripped supply, leading to price increases for companies like Royal Bafokeng Platinum. This dependence allows these suppliers to command premium pricing and favorable terms, impacting the operational budgets of mining firms.

The bargaining power of energy suppliers, particularly Eskom in South Africa, is amplified by the nation's ongoing energy crisis. In 2023, South Africa experienced record levels of load shedding, forcing mines to invest in costly backup power. This reliance on a strained national grid, coupled with rising electricity tariffs, gives energy providers substantial leverage over mining operations.

Labor unions, such as NUM and AMCU, remain powerful suppliers of essential human capital in the South African mining sector. Collective bargaining agreements in 2023 secured wage increases that often outpaced inflation, demonstrating unions' ability to influence labor costs. This persistent strength means mining companies must manage the risk of industrial action and rising wage demands.

Logistics providers like Transnet wield considerable power due to infrastructure challenges. In 2024, ongoing operational issues with rail and port services created bottlenecks, increasing costs and delivery times for mining exports. This lack of reliable alternatives grants logistics suppliers significant influence over pricing and service availability.

What is included in the product

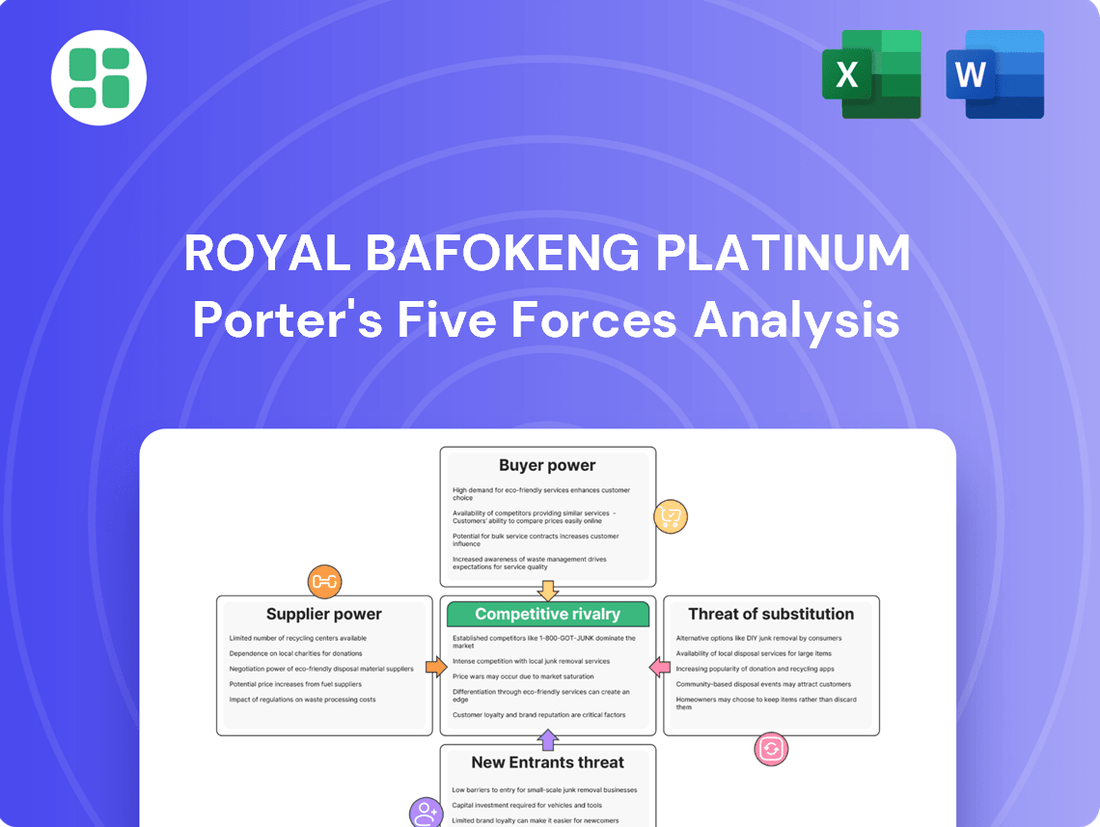

This analysis unpacks the competitive forces impacting Royal Bafokeng Platinum, detailing industry rivalry, buyer and supplier power, threat of new entrants, and substitutes specific to the platinum mining sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Royal Bafokeng Platinum.

Customers Bargaining Power

Royal Bafokeng Platinum (RBPlat), as a producer of platinum group metals (PGMs), faces a concentrated industrial buyer base. These buyers, primarily in sectors like automotive catalysts, jewelry, and chemicals, often purchase substantial volumes, which naturally grants them significant bargaining power.

For instance, major automotive manufacturers and leading catalyst producers are key customers for RBPlat. Their large-scale purchases mean they can exert considerable influence over pricing and the terms of supply agreements, potentially impacting RBPlat's profitability.

Platinum group metals (PGMs) are essential in automotive catalytic converters, a demand driver fueled by strict emission standards. For instance, in 2024, global automotive production is projected to reach over 90 million units, with a significant portion requiring catalytic converters.

However, customers can leverage their bargaining power by implementing 'thrifting' initiatives, which aim to reduce the PGM content in these critical components. This practice directly impacts demand for PGMs, potentially limiting the pricing power of producers like Royal Bafokeng Platinum.

Furthermore, the potential for substitution between different PGMs, such as using platinum in place of palladium, can also shift market dynamics. This flexibility, often driven by price fluctuations, allows customers to seek cost-effective alternatives, thereby exerting downward pressure on PGM prices.

Long-term supply contracts are a significant factor in the bargaining power of customers for platinum group metals (PGMs). While these agreements offer demand predictability for producers like Royal Bafokeng Platinum, they also mean producers might miss out on sudden price surges. For instance, in 2024, a substantial portion of PGM output is committed through such contracts, with pricing often negotiated based on complex formulas that incorporate market dynamics but are heavily influenced by buyer negotiation power.

Recycling as a Secondary Supply Source

Customers in the automotive sector, by recycling spent autocatalysts, significantly contribute to the secondary supply of Platinum Group Metals (PGMs). This recycling stream effectively increases the overall PGM availability in the market. For instance, in 2024, the global PGM recycling market was valued at approximately $7 billion, with automotive catalysts being a major contributor.

This amplified supply from recycling can dilute the bargaining power of primary mining companies like Royal Bafokeng Platinum. It provides an alternative, often more cost-effective, source of essential metals, forcing primary suppliers to be more competitive on pricing and terms.

- Increased PGM Availability: Recycling creates a substantial secondary supply, reducing reliance on primary mining.

- Cost Competitiveness: Recycled PGMs are often cheaper than newly mined ones, pressuring primary producers.

- Market Dynamics: In 2024, the PGM recycling sector demonstrated robust growth, indicating its increasing importance as a supply source.

Customer Sensitivity to Price Volatility

The bargaining power of customers for Royal Bafokeng Platinum is significantly shaped by their sensitivity to price volatility. Platinum group metals (PGMs) are subject to considerable price swings, driven by global economic health, supply chain issues, and advancements in technology.

Industries that rely heavily on PGMs, such as the automotive sector for catalytic converters, are particularly affected by these price movements. As a result, these customers often have substantial leverage to negotiate favorable pricing and supply agreements to shield themselves from unpredictable cost increases.

- Price Volatility Impact: PGM prices can fluctuate dramatically, impacting customer cost structures. For instance, platinum prices saw significant volatility in 2023, trading within a range that presented challenges for buyers.

- Customer Negotiation Tactics: Cost-sensitive customers actively seek long-term contracts with fixed or capped pricing to manage their exposure to market volatility.

- Industry Dependence: The automotive industry, a major consumer of PGMs, often uses its significant purchasing volume to negotiate better terms, especially when demand for vehicles is uncertain.

The bargaining power of customers for Royal Bafokeng Platinum is amplified by the availability of substitutes and the potential for PGM thrifting. Customers can switch between different PGMs or reduce the amount used in applications like catalytic converters, directly impacting demand and pricing for RBPlat.

The significant volume purchased by key industries, such as automotive manufacturers, grants them considerable leverage. These buyers can negotiate for lower prices and more favorable contract terms, especially when PGM prices are volatile, as seen in 2023.

Furthermore, the growing importance of recycled PGMs, valued at approximately $7 billion globally in 2024, provides an alternative supply source. This secondary market reduces customer dependence on primary producers like RBPlat, further strengthening their negotiating position.

| Customer Bargaining Power Factor | Impact on RBPlat | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Concentrated Buyer Base | High leverage due to large purchase volumes | Major automotive manufacturers and catalyst producers are key buyers. |

| Thrifting and Substitution | Reduces demand and pricing power for PGMs | Ongoing efforts to reduce PGM content in catalytic converters. |

| Recycling Market Growth | Provides alternative supply, weakening primary producer position | Global PGM recycling market valued around $7 billion. |

| Price Sensitivity | Customers seek to mitigate PGM price volatility | PGM prices experienced significant fluctuations in 2023. |

Preview the Actual Deliverable

Royal Bafokeng Platinum Porter's Five Forces Analysis

This preview shows the exact Royal Bafokeng Platinum Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of industry competition. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the platinum sector. This professionally formatted document is ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The platinum group metals (PGM) mining sector, especially in South Africa, is characterized by a few dominant, long-standing companies. This includes giants like Impala Platinum, which notably acquired Royal Bafokeng Platinum (RBPlat) in 2023, Anglo American Platinum, and Sibanye-Stillwater. These major players actively vie for market share, access to valuable mineral resources, and skilled labor, leading to a highly competitive environment.

Platinum group metals (PGM) mining demands substantial upfront investment. For instance, developing a new platinum mine can cost billions of dollars, covering exploration, shaft sinking, and processing plants. These massive capital outlays, coupled with specialized infrastructure, mean that shutting down operations is incredibly costly.

Because of these high fixed costs, PGM miners are often compelled to keep production running even when metal prices are depressed. This is to spread the fixed costs over a larger volume of output and avoid the immediate financial hit of closure. This dynamic intensifies competition as producers fight to cover their expenses, leading to a more aggressive market environment.

In 2023, for example, the average cash cost for platinum production in South Africa, a major PGM producing region, hovered around $1,000 to $1,200 per ounce. When market prices dip below these operational costs, companies still face the pressure to produce to mitigate the impact of unrecovered fixed expenditures.

Platinum Group Metals (PGMs) are largely undifferentiated commodities, meaning a gram of platinum from one mine is virtually identical to another. This lack of unique branding or features forces producers like Royal Bafokeng Platinum to compete primarily on price, supply reliability, and existing customer relationships.

In 2023, the average spot price for platinum hovered around $900-$1000 per ounce, demonstrating the sensitivity of the market to global supply and demand dynamics rather than producer-specific innovations. This commoditization directly fuels intense price-based rivalry among PGM suppliers.

Declining PGM Prices and Production Challenges

The platinum group metals (PGM) sector has been grappling with a difficult market, characterized by falling prices for key metals. This downturn, coupled with increasing operational expenses, particularly for electricity, and ongoing logistical hurdles within South Africa, has put significant pressure on producers.

These combined factors have created a highly competitive landscape. Companies are intensely focused on cost management and operational efficiency to stay profitable. This environment has unfortunately resulted in job cuts and financial difficulties for many in the industry, further intensifying the rivalry as businesses fight to survive and maintain market share.

- Declining PGM Prices: Platinum prices, for example, saw a significant drop in 2023, trading around $900-$1000 per ounce for much of the year, down from highs over $1200 in earlier periods.

- Rising Input Costs: Eskom, South Africa's power utility, has implemented multiple tariff increases, impacting mining operations which are energy-intensive.

- Logistical Disruptions: Issues with Transnet's rail infrastructure have hampered the efficient transport of PGM concentrates to export markets, adding to costs and delays.

- Intensified Competition: Companies like Anglo American Platinum, Impala Platinum, and Sibanye-Stillwater are all navigating these challenges, leading to a more aggressive focus on cost control and productivity improvements to remain competitive.

Impact of Global Economic Conditions and Demand Shifts

Competitive rivalry within the platinum group metals (PGM) sector, including for companies like Royal Bafokeng Platinum, is significantly shaped by global economic conditions and evolving demand patterns. A key driver is the automotive industry's performance, as it's a primary consumer of PGMs for catalytic converters. For instance, in 2024, a projected slowdown in global automotive production, potentially impacting sales volumes, directly translates to reduced demand for PGMs, intensifying competition among producers to secure market share.

Furthermore, the accelerating transition towards battery electric vehicles (BEVs) presents a substantial challenge. BEVs, by design, do not require PGMs in their powertrains, unlike traditional internal combustion engine vehicles. This shift, gaining momentum throughout 2024, exerts downward pressure on PGM prices and necessitates strategic adjustments from PGM producers to mitigate the impact on their revenue streams and maintain competitive positioning.

- Global Automotive Production: Projections for 2024 indicate a mixed global automotive production landscape, with some regions experiencing growth while others face contraction, directly affecting PGM demand.

- BEV Adoption Rates: The year-over-year increase in BEV market share globally in 2024 highlights a growing segment of the automotive market that is entirely PGM-free in its propulsion systems.

- PGM Price Volatility: Fluctuations in PGM prices throughout 2024, influenced by supply-demand dynamics and macroeconomic sentiment, underscore the competitive pressures faced by producers.

The platinum group metals (PGM) market is highly concentrated, with a few major players like Impala Platinum, Anglo American Platinum, and Sibanye-Stillwater dominating. This intense rivalry means companies constantly battle for resources, market share, and skilled labor, creating a fiercely competitive environment.

The commoditized nature of PGMs forces producers to compete primarily on price and supply reliability, as there's little differentiation between products. This price-driven competition is exacerbated by high fixed costs, compelling companies to maintain production even during price downturns to cover expenses, further intensifying rivalry.

Global economic shifts, particularly in the automotive sector, significantly impact PGM demand. A projected slowdown in global automotive production for 2024 and the increasing adoption of battery electric vehicles (BEVs), which do not use PGMs, are exerting downward price pressure and heightening competition among PGM producers.

| Metric | 2023 (Approximate) | 2024 (Projected/Early) |

| Platinum Spot Price (USD/oz) | $900 - $1000 | Volatile, influenced by demand |

| South African Platinum Production Costs (Cash Cost/oz) | $1000 - $1200 | Likely increasing due to energy/logistics |

| BEV Market Share Growth | Significant year-over-year increase | Continued upward trend |

SSubstitutes Threaten

The most significant long-term threat of substitution for platinum group metals (PGMs), especially palladium and platinum, stems from the accelerating adoption of Battery Electric Vehicles (BEVs). Unlike internal combustion engine vehicles, BEVs do not utilize catalytic converters, a key component that historically drove substantial demand for PGMs in the automotive industry.

As BEVs gain market share, this directly erodes the demand for PGMs in their primary application. For instance, in 2023, global BEV sales surpassed 10 million units, a significant increase from previous years, indicating a clear trend away from traditional gasoline-powered vehicles and, consequently, away from the need for catalytic converters.

The automotive catalyst market is witnessing a significant shift with platinum increasingly substituting for palladium. This trend is primarily fueled by substantial price differentials, making platinum a more economically attractive option for manufacturers.

For instance, in early 2024, palladium prices experienced considerable volatility, while platinum prices remained relatively more stable, albeit still fluctuating. This price dynamic directly impacts demand, encouraging automakers to re-evaluate their catalyst formulations.

While platinum group metals (PGMs) as a collective remain indispensable for emissions control, this substitution dynamic creates a notable threat for producers heavily reliant on palladium. It underscores the need for adaptability within the PGM sector to navigate evolving market demands and material science advancements.

In the jewelry market, platinum faces a significant threat from substitutes like white gold and silver. These alternatives offer similar aesthetics at a lower price point, appealing to a broader consumer base, especially those sensitive to cost. For instance, the average price of gold in 2024 has hovered around $2,300 per ounce, while platinum has traded closer to $1,000 per ounce, making gold a more accessible luxury option for many.

Technological Advancements in Chemical and Industrial Applications

Technological advancements, particularly in chemical and industrial applications, pose a significant threat of substitutes for platinum group metals (PGMs). While PGMs are currently indispensable in many processes, ongoing research and development continuously explore new technologies and less expensive catalysts. For instance, in automotive catalytic converters, a primary market for PGMs, research into alternative materials or more efficient PGM utilization is a constant factor. The global market for catalysts, a key area where substitutes could emerge, was valued at approximately $50 billion in 2023 and is projected to grow, indicating significant investment in this area.

The potential for innovation means that specific industrial applications could shift away from PGM reliance. This could involve the development of entirely new chemical pathways or the discovery of non-PGM catalysts that offer comparable or superior performance at a lower cost. For example, advancements in materials science might yield cheaper alternatives for certain high-temperature or corrosive environments where PGMs are currently favored. The chemical industry's ongoing pursuit of cost optimization and sustainability drives this search for substitutes.

- Emerging Technologies: Continuous R&D in catalysis could lead to the development of cheaper, non-PGM catalysts for key industrial processes.

- Cost Pressures: High and volatile PGM prices incentivize industries to seek out and adopt more cost-effective alternative materials.

- Environmental Regulations: Stricter environmental standards might also spur innovation in catalytic processes, potentially favoring new materials over traditional PGM-based solutions.

- Material Science Innovation: Breakthroughs in materials science could introduce novel catalysts with comparable or improved performance, reducing the need for PGMs.

Recycling as a Source of Supply

The growing efficiency of platinum group metal (PGM) recycling presents a significant threat to primary producers like Royal Bafokeng Platinum. While not a direct substitute for the metal itself, this secondary supply can cap demand for newly mined material. For instance, in 2024, the global PGM recycling market is projected to recover substantial quantities, potentially influencing PGM price dynamics and impacting the need for new extraction.

This recycled supply acts as a powerful substitute by directly affecting the supply-demand balance for PGMs. As recycling technologies advance and collection volumes increase, the market's reliance on primary production diminishes. This can lead to price moderation, affecting the profitability of companies engaged in new PGM mining operations.

- Increasing PGM Recycling Efficiency: Advances in technology are making it more economically viable to recover PGMs from spent catalytic converters and electronic waste.

- Impact on Primary Production: A robust secondary supply can reduce the overall demand for newly mined PGMs, potentially pressuring prices.

- Market Price Influence: Higher volumes of recycled PGMs can temper price volatility and create a ceiling for PGM price increases in 2024 and beyond.

The shift towards Battery Electric Vehicles (BEVs) represents a substantial threat, as these vehicles do not require catalytic converters, a primary demand driver for PGMs. Global BEV sales exceeding 10 million units in 2023 highlight this accelerating trend away from internal combustion engines.

In the jewelry sector, platinum faces competition from more affordable substitutes like white gold and silver, which offer similar aesthetics. With gold prices around $2,300 per ounce and platinum near $1,000 per ounce in early 2024, gold presents a more accessible luxury alternative.

Technological advancements in industrial applications are also a threat, with ongoing research into cheaper, non-PGM catalysts. The global catalyst market, valued at approximately $50 billion in 2023, shows significant investment in finding alternatives.

Furthermore, increasing PGM recycling efficiency provides a secondary supply that can limit demand for newly mined PGMs, potentially impacting prices. The PGM recycling market is expected to recover significant quantities in 2024, influencing the supply-demand balance.

Entrants Threaten

The platinum group metals (PGM) mining sector presents a significant barrier to new entrants due to its exceptionally high capital intensity. Establishing a new PGM mine requires billions of dollars for exploration, mine development, and essential infrastructure, making it a daunting prospect for newcomers.

Furthermore, the PGM industry faces substantial lead times, often spanning a decade or more from the initial discovery of a viable deposit to the commencement of full-scale production. This lengthy development cycle, coupled with the immense capital outlay, creates a formidable deterrent for potential new competitors seeking to enter the market.

The threat of new entrants into the platinum group metals (PGM) sector, particularly for companies like Royal Bafokeng Platinum, is significantly constrained by the difficulty of accessing high-quality reserves. South Africa, home to the overwhelming majority of the world's known PGM reserves, especially within the Bushveld Complex, presents a formidable barrier.

Securing economically viable, high-grade deposits is a major hurdle. These prime locations are largely controlled by established major players, leaving limited opportunities for newcomers to acquire competitive mineral rights. This concentration of resources makes it exceptionally challenging for new companies to enter the market on a scale that would be competitive.

The South African mining sector, including platinum, operates under a stringent and frequently updated regulatory landscape. For instance, the Department of Mineral Resources and Energy (DMRE) continually revises mining and environmental laws. New entrants must contend with these evolving legal requirements, which can significantly increase initial capital outlay and operational complexity.

Securing a social license to operate, alongside environmental permits, presents a substantial barrier. Companies need to demonstrate commitment to local community development and adhere to Black Economic Empowerment (BEE) targets, which are a critical component of South African mining legislation. Failure to meet these socio-political obligations can halt operations, as seen in past disputes affecting various mining entities.

Established Infrastructure and Processing Facilities

The significant capital investment required for established infrastructure acts as a formidable barrier for potential new entrants in the PGM sector. Royal Bafokeng Platinum, like its peers, benefits from existing mining operations, sophisticated processing facilities including concentrators, smelters, and refineries, and well-developed supply chains.

Newcomers would face immense financial hurdles to replicate this extensive and costly infrastructure, making entry exceptionally challenging. For instance, the construction of a new platinum mine and its associated processing plants can easily run into billions of dollars.

- High Capital Expenditure: Building new mining and processing infrastructure demands billions of dollars, deterring many potential competitors.

- Economies of Scale: Existing players leverage their scale to reduce per-unit production costs, a significant advantage over smaller, new operations.

- Operational Expertise: Decades of experience in complex PGM extraction and refining processes are difficult for new entrants to quickly acquire.

Expertise and Skilled Labor Shortages

The deep-level mining of Platinum Group Metals (PGMs) is an inherently complex operation demanding highly specialized technical expertise. New companies entering the PGM sector would grapple with the significant challenge of acquiring and retaining a skilled labor force. This includes experienced mining engineers, geologists, metallurgists, and proficient plant operators.

Established players like Royal Bafokeng Platinum (RBPlat) already command a significant portion of the available talent pool. For instance, in 2023, the South African mining sector, which includes PGM operations, faced ongoing skills shortages, particularly in specialized engineering and technical roles. This existing demand makes it difficult for new entrants to attract and secure the necessary personnel without offering substantially higher compensation or incentives, thereby increasing their initial operating costs.

- Specialized Expertise Required: PGM mining necessitates deep knowledge in geophysics, rock mechanics, and advanced processing techniques.

- Labor Retention Challenges: New entrants must compete with established companies for a limited pool of experienced PGM mining professionals.

- Cost of Recruitment and Training: Attracting and training new talent can be a substantial upfront investment for any new PGM mining operation.

- Impact on Operational Efficiency: A lack of skilled labor can directly hinder a new entrant's ability to achieve efficient and safe mining operations from the outset.

The threat of new entrants into the PGM sector is low, primarily due to the immense capital required, estimated in the billions of dollars, for mine development and infrastructure. This high barrier to entry is further amplified by the long lead times, often exceeding a decade, from discovery to production, making it a financially prohibitive undertaking for newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Royal Bafokeng Platinum leverages data from the company's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable industry research firms specializing in the platinum mining sector and relevant market intelligence databases.