Royal Bafokeng Platinum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Royal Bafokeng Platinum Bundle

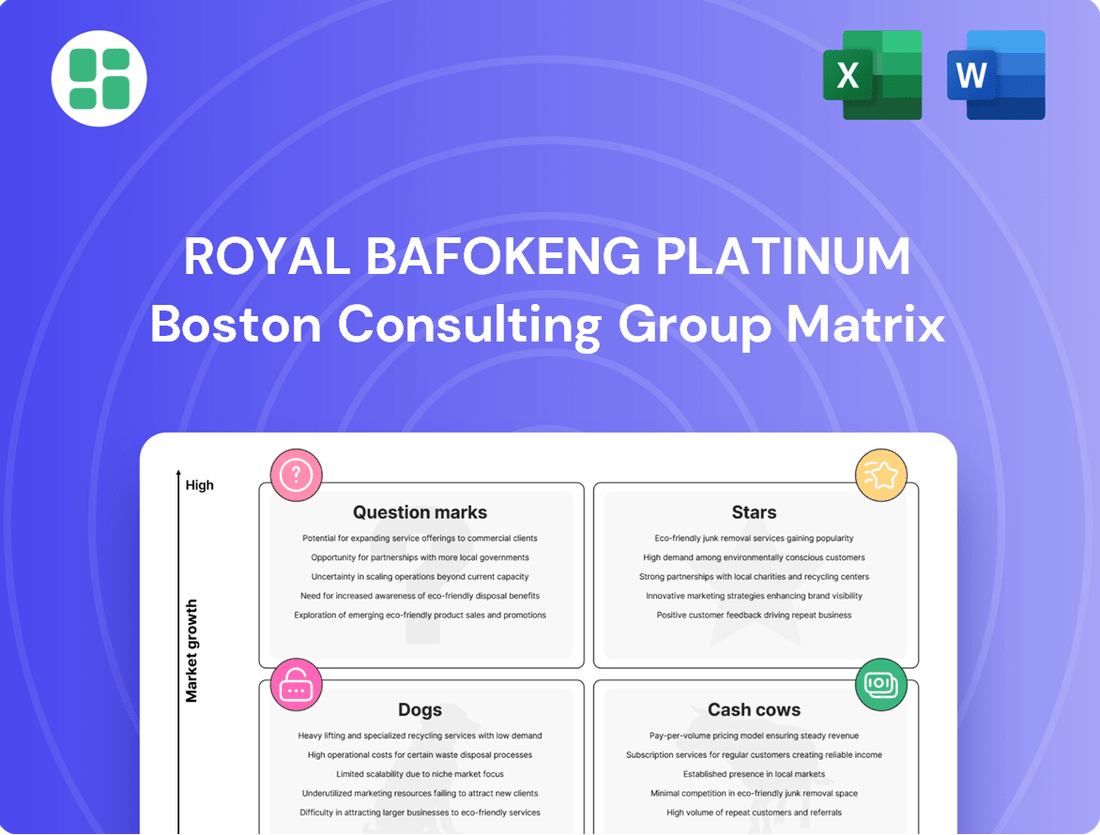

The Royal Bafokeng Platinum BCG Matrix offers a critical snapshot of its diverse portfolio, highlighting which ventures are poised for growth and which require careful management.

Understanding these dynamics is key to unlocking strategic advantages in the competitive platinum market.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Before its acquisition by Implats, the Styldrift Mine was a standout asset for Royal Bafokeng Platinum (RBPlat), fitting the profile of a star in the BCG matrix. Its modern, shallow, and mechanized mining approach promised significant growth potential and operational efficiencies.

Styldrift's appeal lay in its ability to boost production volumes and achieve lower operating costs, making it a prime target for Implats' expansion strategy. This potential was crucial for enhancing the combined entity's market position.

The strategic importance of Styldrift's resources, particularly those on the Merensky Reef, was a major factor in the acquisition. The goal was to lengthen the operational life of the mines and decrease the depth of mining for Implats, thereby securing long-term value.

Royal Bafokeng Platinum's (RBPlat) access to high-grade Merensky Reef resources, especially at its Styldrift project, represented a significant strength. These reserves boast superior geological attributes compared to many legacy mines, suggesting robust future production and profitability. For instance, in 2023, RBPlat's attributable PGM ounces from Styldrift were substantial, contributing to its overall resource base.

This strategic advantage was a key factor in the acquisition by Implats, as these rich, shallower resources were geographically complementary to Implats' existing mining footprint. The inherent quality of the Merensky Reef at Styldrift offered a compelling value proposition, underpinning its classification as a high-potential asset in the platinum group metals (PGM) sector.

The acquisition of Royal Bafokeng Platinum (RBPlat) by Implats was a calculated move to bolster Implats' long-term growth trajectory, primarily by expanding its platinum production capabilities. RBPlat's assets were considered stars due to their potential to significantly enhance Implats' future output and solidify its standing in the platinum market.

This integration was designed to unlock operational synergies and extend the productive lifespan of the combined mining assets. For instance, in 2023, Implats' total platinum group metals (PGM) production reached 3.2 million ounces, and the RBPlat acquisition is expected to contribute to further growth in the coming years, building on RBPlat's existing production base.

Mechanized Mining Operations

Royal Bafokeng Platinum's (RBPlat) strategic focus on mechanized mining operations, especially at its Styldrift mine, positions it as a potential Star in the BCG matrix. This advanced extraction method promises significantly higher productivity and reduced unit costs compared to traditional deep-level mining techniques.

This aligns with a growing market demand for efficient production methods, a key indicator for Star status. Implats' acquisition of RBPlat further reinforces this, with Implats intending to boost the share of mechanized mining within its enlarged operational footprint.

- Mechanized mining at Styldrift aims for enhanced productivity and cost efficiency.

- This modern approach caters to market demand for efficient resource extraction.

- Implats' acquisition strategy includes increasing mechanized mining within its portfolio.

Platinum as a Key Growth Metal

Platinum is emerging as a crucial growth driver within the platinum group metals (PGM) sector. Despite broader market pressures on PGM prices, platinum has demonstrated notable resilience, largely fueled by its expanding role in new energy technologies. This demand surge positions platinum as a key catalyst for PGM miners looking to capitalize on future market trends.

Royal Bafokeng Platinum (RBPlat) is particularly well-situated to benefit from this platinum-centric growth. The company holds significant platinum reserves, especially within the valuable Merensky Reef. This strategic advantage allows RBPlat to effectively leverage the increasing demand for platinum, solidifying its position as a 'Star' performer in the dynamic PGM landscape.

- Platinum's Demand Drivers: Increasing adoption in hydrogen fuel cells and catalytic converters for cleaner vehicle emissions.

- RBPlat's Platinum Reserves: Significant holdings, particularly in the Merensky Reef, a prime source of platinum.

- Market Positioning: RBPlat's focus on platinum aligns with emerging trends, making it a strong contender for future growth.

- 2024 Outlook: Continued investment in platinum-focused exploration and processing is anticipated to drive RBPlat's performance.

The Styldrift Mine, a key asset of Royal Bafokeng Platinum (RBPlat), exemplifies a Star in the BCG matrix due to its high growth potential and strong market position. Its modern, shallow mining operations and access to high-grade Merensky Reef resources contribute to its stellar performance.

This strategic positioning, particularly with its rich platinum reserves, aligns perfectly with the growing demand for platinum in new energy technologies like hydrogen fuel cells. RBPlat's focus on mechanized mining further enhances its efficiency, making it an attractive asset within the PGM sector.

The acquisition by Implats in 2023 was a strategic move to leverage RBPlat's Star qualities, aiming to boost Implats' platinum production and extend the life of its mining assets. This integration is expected to drive significant growth for the combined entity in the coming years.

| Asset | BCG Category | Key Strengths | Growth Potential | Market Share |

| Styldrift Mine (RBPlat) | Star | High-grade Merensky Reef, mechanized mining, shallow operations | High (driven by platinum demand in new energy) | Strong (within RBPlat's portfolio, enhancing Implats') |

What is included in the product

The Royal Bafokeng Platinum BCG Matrix offers strategic insights into its platinum assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG matrix visual for Royal Bafokeng Platinum offers a strategic roadmap, alleviating the pain of resource allocation uncertainty.

Cash Cows

The Bafokeng Rasimone Platinum Mine (BRPM), now part of Implats' operations, has historically been a cornerstone of Royal Bafokeng Platinum's (RBPlat) portfolio, consistently contributing to platinum group metal (PGM) production. As a mature asset with an estimated mine life extending to 2052, it has been a reliable source of stable cash flows for the company.

Despite facing operational hurdles, such as instances of illegal industrial action, BRPM has demonstrated resilience and generally strong performance. For instance, in the first half of 2024, RBPlat reported that BRPM's attributable PGM ounces sold increased by 12.7% compared to the previous period, underscoring its ongoing operational capacity.

Royal Bafokeng Platinum, before its acquisition by Implats, consistently produced significant volumes of Platinum Group Metals (PGMs) from its established mines. This steady output in a well-developed PGM market provided a dependable source of revenue and was a key contributor to the company's overall cash flow. For instance, in the fiscal year ending June 30, 2023, Royal Bafokeng Platinum reported a total PGM production of approximately 424,000 ounces.

Royal Bafokeng Platinum's (RBPlat) concentrator plants and processing infrastructure represent significant cash cows. These facilities are crucial for refining mined ore into valuable PGM concentrates, ensuring efficient and profitable operations.

In a mature operational phase, these assets demand lower capital expenditure for maintenance, allowing them to consistently generate steady cash flow. For instance, in 2024, RBPlat reported that its processing infrastructure continued to be a bedrock for Impala Bafokeng's ongoing production, underscoring their reliable cash-generating capabilities.

Long-Term Supply Agreements

Royal Bafokeng Platinum's (RBPlat) long-term supply agreements, particularly its concentrate disposal agreement with Anglo American Platinum (Amplats), position its PGM operations as a classic Cash Cow within the BCG Matrix. These agreements guarantee a consistent buyer for RBPlat's platinum group metals (PGM) concentrate, creating a predictable and stable revenue stream.

This stability is a hallmark of a Cash Cow, as it minimizes exposure to the volatile PGM market. For example, RBPlat's significant PGM output is channeled through these arrangements, ensuring steady cash generation. In 2023, RBPlat reported record PGM sales volumes, underscoring the effectiveness of its offtake agreements in providing market access and consistent revenue.

- Stable Revenue: Long-term contracts like the one with Amplats secure predictable income, reducing the impact of PGM price fluctuations.

- Reduced Market Risk: These agreements effectively eliminate the need for RBPlat to find individual buyers for its concentrate, mitigating market search costs and risks.

- Consistent Cash Flow: The guaranteed sales provide a reliable source of cash, which can then be reinvested or distributed to shareholders.

- Operational Efficiency: Knowing its output is secured allows RBPlat to focus on efficient mining and processing operations.

Merensky and UG2 Reef Production

The Merensky and UG2 reefs at Royal Bafokeng Platinum (RBPlat) operations are classic cash cows. Their consistent extraction delivers a diverse platinum group metal (PGM) basket, which underpins stable revenue streams. This geological understanding translates into predictable mining plans and effective cost control, solidifying their role as reliable cash generators within the mature PGM sector.

RBPlat's combined production from Merensky and UG2 reefs in 2024 is projected to be a significant contributor to its overall output. For instance, in the first half of 2024, RBPlat reported total PGM ounces sold of 172,200, with the Merensky and UG2 reefs forming the backbone of this production.

- Diversified PGM Basket: Mining both Merensky and UG2 reefs provides a broader range of PGMs, reducing reliance on any single metal and enhancing revenue stability.

- Predictable Mining and Costs: The well-established nature of these reefs allows for more accurate forecasting of production volumes and operational expenses, crucial for consistent cash flow.

- Mature Sector Reliability: In the PGM market, these established reef types represent dependable assets, capable of generating steady cash even amidst market fluctuations.

- Operational Stability: The dual-reef mining strategy inherently boosts the overall stability and resilience of RBPlat's mining operations.

Royal Bafokeng Platinum's (RBPlat) established mining operations, particularly those focused on the Merensky and UG2 reefs, function as its primary cash cows. These assets, characterized by their mature status and consistent output, generate substantial and reliable cash flows for the company.

The predictable nature of these operations, supported by a diverse PGM basket and well-understood geological profiles, allows for efficient cost management and stable revenue generation. This stability is crucial for funding other areas of the business or for shareholder returns.

In the first half of 2024, RBPlat reported that its attributable PGM ounces sold increased by 12.7%, with these mature operations forming the bedrock of this performance. This demonstrates their continued capacity to deliver strong financial results.

| Asset Category | RBPlat's Cash Cows | Key Characteristics | 2024 Performance Indicator (H1) | Strategic Importance |

|---|---|---|---|---|

| Mining Operations | Merensky & UG2 Reefs | Mature, consistent PGM output, diverse basket | 172,200 PGM ounces sold (attributable) | Core revenue generation, stable cash flow |

| Processing Infrastructure | Concentrator Plants | Efficient refining, low capex for maintenance | Continued bedrock for production | Enables profitable extraction, cash flow stability |

| Offtake Agreements | Concentrate Disposal (e.g., Amplats) | Guaranteed buyer, reduced market risk | Record PGM sales volumes in 2023 | Predictable revenue stream, market access |

Delivered as Shown

Royal Bafokeng Platinum BCG Matrix

The BCG Matrix for Royal Bafokeng Platinum you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, showcasing the strategic positioning of Royal Bafokeng Platinum's assets, is ready for your direct use without any alterations or additional content. You are seeing the final, professionally designed report, complete with all data and insights, ensuring you gain immediate strategic clarity upon acquisition.

Dogs

The Maseve mining operations, now under the Implats umbrella following their acquisition from RBPlat, are currently in a state of care and maintenance. This means they are not actively extracting resources, and therefore not generating any income.

Assets in this condition, especially within a low-growth market and with no current market share, are typically categorized as Dogs in the BCG Matrix. They represent a drain on capital, tying up resources without contributing to revenue or growth.

For example, during the fiscal year ending June 30, 2023, Implats reported that the Maseve mine incurred operating costs while remaining on care and maintenance, highlighting the ongoing expenses associated with such assets.

Prior to the integration with Implats, certain shafts within the Impala Bafokeng operations, formerly Royal Bafokeng Platinum (RBPlat), exhibited characteristics of high operating costs and underperformance. These were considered 'Dogs' in the BCG Matrix framework.

For example, the Styldrift mine was operating at only 70% of its capacity while being resourced at 100%, resulting in financial losses before efficiency enhancements were implemented. Such underperforming assets, especially during periods of low platinum group metal (PGM) prices, fit the 'Dog' profile due to their low profitability and market share.

Legacy operational inefficiencies within Royal Bafokeng Platinum (RBPlat) operations, particularly those predating or during the integration with Implats, likely contributed to a diminished market share in specific segments. These older, less optimized mining areas would have faced higher production costs and lower output volumes, thereby generating minimal cash flow and struggling to compete effectively.

The impact of these inefficiencies is reflected in the company's financial performance, where areas with legacy issues would naturally show lower profitability. For instance, during 2023, RBPlat reported a decrease in headline earnings per share, partly attributable to operational challenges and inflationary pressures, which can be exacerbated by legacy systems.

Initiatives like the Section 189 consultations undertaken by Implats were designed to tackle such legacy inefficiencies and streamline operations, which could involve workforce adjustments to improve overall cost structures and enhance productivity in these underperforming areas.

Reliance on Depressed PGM Prices (Palladium/Rhodium)

Royal Bafokeng Platinum (RBPlat) has historically benefited from a diverse PGM basket. However, a significant dependence on palladium and rhodium, both of which have seen considerable price drops since 2023, places its related production in a precarious position. For instance, palladium prices fell from over $2,000 per ounce in early 2023 to below $1,000 by mid-2024, while rhodium experienced an even steeper decline from over $4,000 to under $1,500 in the same period. This sharp downturn significantly impacts RBPlat's profitability.

The substantial decrease in PGM prices has created industry-wide profitability challenges, transforming operations that were once cash cows into potential cash drains. This scenario aligns with the characteristics of a 'cash cow' or 'dog' in the BCG matrix, depending on the sustainability of the price recovery and RBPlat's cost structure. The company's 2023 financial results reflected this pressure, with revenue declining due to lower commodity prices, impacting earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Palladium Price Decline: Palladium prices have fallen by more than 50% from their early 2023 highs to mid-2024 levels.

- Rhodium Price Decline: Rhodium prices have also dropped by over 60% in the same timeframe.

- Profitability Impact: These price drops have severely compressed PGM producer margins, including those of RBPlat.

- BCG Matrix Classification: Reliance on depressed PGM prices could categorize RBPlat's related production as a 'dog' in the short to medium term, indicating low market share and low growth prospects.

Projects with Limited Future Prospects

Projects with limited future prospects, often categorized as Dogs in the BCG matrix, represent ventures that are unlikely to generate significant returns. These are typically characterized by low market share and stagnant or declining growth prospects. For Royal Bafokeng Platinum (RBPlat), this would include mining projects or exploration targets that, upon closer examination, revealed economically unviable reserves or insurmountable operational hurdles.

An example of such a project within RBPlat's historical portfolio could be the Maseve mine. While Maseve was acquired with the intention of expanding RBPlat's platinum group metals (PGM) production, it faced significant challenges. These challenges ultimately led to its classification as a Dog, necessitating a strategic decision regarding its future. In 2023, RBPlat continued to assess its strategic options for Maseve, highlighting the ongoing management of assets with limited future prospects.

- Maseve Mine Challenges: Faced significant operational and economic viability issues, impacting its potential for future profitability.

- Divestiture or Care and Maintenance: Projects in the Dog category are often candidates for divestiture or being placed on care and maintenance to conserve resources.

- Strategic Re-evaluation: RBPlat's ongoing assessment of Maseve in 2023 underscores the active management of assets with limited future prospects.

- Low Market Share & Growth: These projects typically exhibit a low market share in a low-growth or declining market, offering little potential for expansion.

Assets like the Maseve mine, now under Implats and in care and maintenance, fit the 'Dog' category due to their lack of income generation and low market share. These operations tie up capital without contributing to revenue, a scenario exemplified by Maseve's ongoing costs without production.

Historically, certain RBPlat shafts also exhibited 'Dog' characteristics, marked by high operating costs and underperformance, such as Styldrift operating at reduced capacity. This underperformance, particularly during periods of depressed PGM prices, solidifies their 'Dog' status.

The significant price drops in palladium and rhodium since early 2023, with palladium falling over 50% and rhodium over 60% by mid-2024, have severely impacted PGM producer margins, including RBPlat's. This market downturn further solidifies the 'Dog' classification for RBPlat's production tied to these depressed commodities.

Projects with limited future viability, like the Maseve mine which faced economic and operational hurdles, are classic 'Dogs.' RBPlat's continued strategic assessment of Maseve in 2023 highlights the active management of such assets with low growth prospects and minimal returns.

| Asset/Operation | BCG Category | Key Characteristics | Financial Impact (Illustrative) |

| Maseve Mine (RBPlat/Implats) | Dog | Care and maintenance, no income generation, low market share. | Ongoing operating costs without revenue contribution. |

| Underperforming RBPlat Shafts (Historical) | Dog | High operating costs, low capacity utilization, financial losses. | Negative cash flow, reduced profitability. |

| RBPlat Production (Palladium/Rhodium Dependent) | Dog (Current Market Conditions) | Reliance on depressed PGM prices, significantly compressed margins. | Revenue decline, reduced EBITDA due to price drops (e.g., palladium < $1,000/oz, rhodium < $1,500/oz by mid-2024). |

Question Marks

Royal Bafokeng Platinum (RBPlat), like many in the mining sector, would have identified early-stage exploration targets. These are promising areas with potential for new discoveries but are still in the very initial phases of assessment. These ventures represent significant future growth possibilities, but currently have no established market share and demand substantial capital investment with no certainty of success.

New technology adoption initiatives within Royal Bafokeng Platinum (RBPlat), such as advanced mechanization or alternative energy solutions, would be classified as Stars in the BCG matrix. These represent high-growth potential areas, crucial for the PGM mining industry's efficiency and sustainability goals. For instance, RBPlat's investment in automation can significantly reduce operational costs and improve safety metrics.

Diversifying into new metals or applications represents a potential question mark for Royal Bafokeng Platinum (RBPlat) within a BCG matrix framework. While RBPlat's established strength lies in Platinum Group Metals (PGMs), exploring ventures into other metals or novel applications beyond conventional automotive catalysts and jewelry could position the company for future growth. These emerging markets, such as those for hydrogen fuel cells and battery metals, offer significant expansion potential, even if RBPlat currently holds minimal to no market share in these areas. For context, Impala Platinum (Implats), a significant player in the PGM sector, has publicly expressed interest in hydrogen technology, signaling a broader industry trend towards these new applications.

Unproven Expansion Projects within Existing Mines

Unproven expansion projects within existing mines, like certain phases at Royal Bafokeng Platinum's operations, often fall into the question mark category of the BCG matrix. These are ventures with high growth potential but also high uncertainty and cash requirements. For example, the ongoing ramp-up at the Styldrift mine, following its acquisition, represents such a project. While it holds promise for future profitability and market share, it currently demands substantial investment without guaranteed returns.

- Styldrift's ramp-up challenges: The project is still working towards its full production capacity, indicating it's not yet a proven cash cow.

- High growth potential: Once fully operational and optimized, Styldrift is expected to significantly boost platinum group metal output.

- Significant cash consumption: Expansion projects of this nature require considerable capital expenditure before they generate substantial revenue.

- Uncertain market share and profitability: The ultimate market position and profitability of these expanded operations are not yet firmly established.

Response to Shifting PGM Demand Dynamics

The platinum group metals (PGM) market is undergoing a significant transformation, largely driven by the accelerating adoption of battery electric vehicles (BEVs) and a growing interest in hydrogen fuel cells, which also utilize PGMs. This shift presents both challenges and opportunities for producers like Royal Bafokeng Platinum (now Impala Bafokeng).

Given these evolving demand dynamics, any strategic pivot by Impala Bafokeng to adapt to the rise of BEVs and fuel cell technology would be a crucial move. These initiatives, while still in their nascent stages of market impact, necessitate substantial investment to secure future market share and remain competitive in a changing PGM landscape.

- Rethinking Product Mix: Exploring opportunities to increase production of platinum and palladium, which are key components in catalytic converters for internal combustion engines, while simultaneously investigating applications of PGMs in emerging technologies like fuel cells.

- Investment in R&D: Allocating capital towards research and development focused on PGM applications in hydrogen fuel cells and other green technologies, potentially through partnerships or internal innovation.

- Diversification of Revenue Streams: Investigating non-traditional PGM uses or exploring strategic acquisitions that align with the future demand for PGMs in sustainable technologies.

Diversifying into new metals or applications represents a potential question mark for Royal Bafokeng Platinum (now Impala Bafokeng) within a BCG matrix framework. While the company's established strength lies in Platinum Group Metals (PGMs), exploring ventures into other metals or novel applications beyond conventional automotive catalysts and jewelry could position the company for future growth.

These emerging markets, such as those for hydrogen fuel cells and battery metals, offer significant expansion potential, even if Impala Bafokeng currently holds minimal to no market share in these areas. For context, the global market for hydrogen fuel cells is projected to grow substantially, with various estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years, driven by decarbonization efforts.

Unproven expansion projects within existing mines, like certain phases at Impala Bafokeng's operations, often fall into the question mark category of the BCG matrix. These are ventures with high growth potential but also high uncertainty and cash requirements. For example, the ongoing ramp-up at the Styldrift mine, following its acquisition, represents such a project. While it holds promise for future profitability and market share, it currently demands substantial investment without guaranteed returns.

In 2024, the PGM market is navigating shifts due to electric vehicle trends and hydrogen technology. Impala Bafokeng's strategic adjustments to these evolving demand dynamics, such as investing in R&D for fuel cell applications or exploring new revenue streams in sustainable technologies, are crucial. These initiatives require significant capital to secure future market share and competitiveness in a transforming PGM landscape.

| Strategic Area | BCG Category | Rationale | 2024 Data/Context |

|---|---|---|---|

| Diversification into Battery Metals | Question Mark | High growth potential, low current market share, requires significant investment. | The demand for battery metals like nickel and cobalt, often found alongside PGMs, is surging due to EV battery production. Companies are evaluating their potential in this space. |

| Hydrogen Fuel Cell Technology Adoption | Question Mark | Emerging market, requires R&D and capital, uncertain future market share. | Global investment in hydrogen infrastructure and fuel cell technology is increasing, creating new demand avenues for PGMs like platinum and palladium. |

| Styldrift Mine Ramp-up | Question Mark | High growth potential, capital intensive, uncertain near-term profitability. | The Styldrift project is expected to increase Impala Bafokeng's PGM output, but achieving full operational efficiency and market absorption of the increased supply presents ongoing challenges. |

BCG Matrix Data Sources

Our Royal Bafokeng Platinum BCG Matrix leverages comprehensive data from financial statements, industry growth forecasts, and market share analysis to provide strategic clarity.