Royal Bafokeng Platinum Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Royal Bafokeng Platinum Bundle

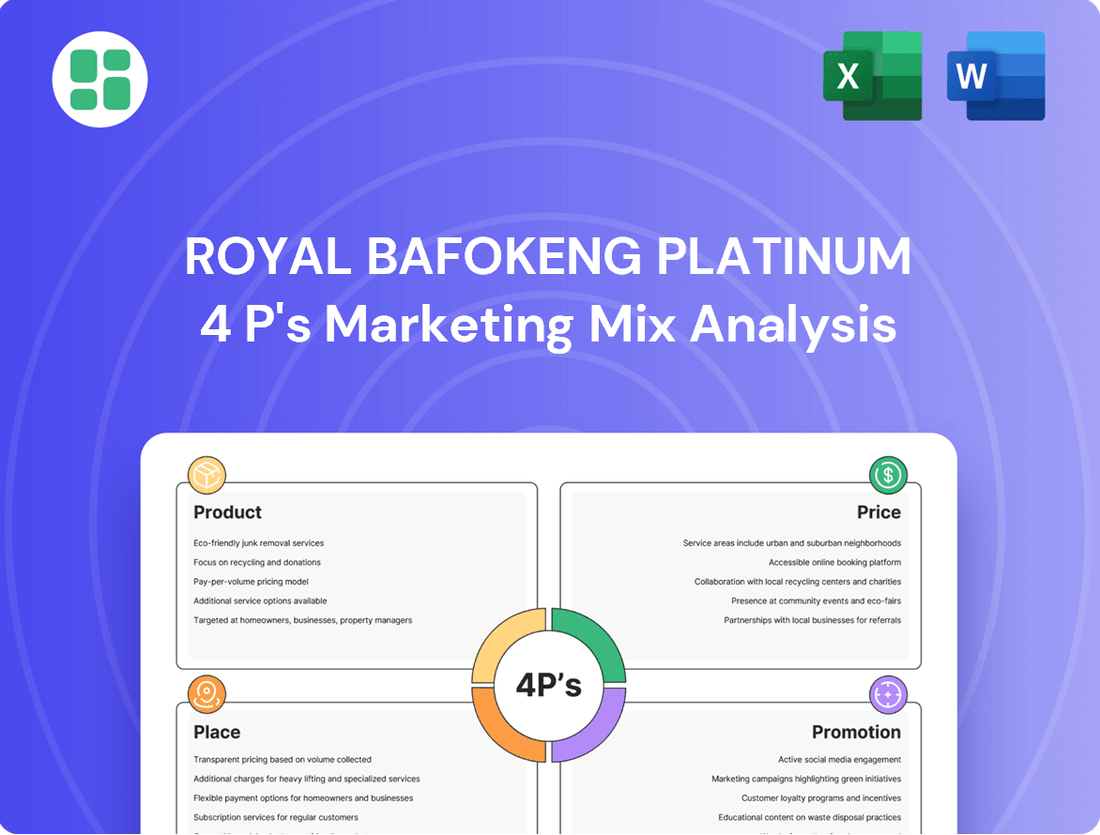

Discover how Royal Bafokeng Platinum leverages its product offerings, pricing strategies, distribution channels, and promotional activities to maintain its market leadership. This analysis goes beyond surface-level observations to reveal the intricate interplay of their 4Ps.

Unlock a comprehensive understanding of Royal Bafokeng Platinum's marketing blueprint, complete with actionable insights and real-world examples. Elevate your own strategic thinking by exploring their success factors.

Save valuable time and gain a competitive edge with our ready-to-use, editable 4Ps Marketing Mix Analysis for Royal Bafokeng Platinum. Perfect for students, professionals, and anyone seeking in-depth market intelligence.

Product

Royal Bafokeng Platinum, before its integration with Implats, focused its product offering on key Platinum Group Metals (PGMs). This included platinum, palladium, and rhodium, essential components for various industrial applications.

These PGMs are not finished consumer products but rather critical raw materials. For instance, in 2024, the demand for platinum in catalytic converters, a primary use, remained robust, driven by stricter emissions standards globally.

The company's PGM basket also contained minor quantities of gold, further diversifying its raw material supply. The market price for palladium saw significant volatility in early 2024, impacting overall PGM revenue streams for producers.

Royal Bafokeng Platinum's focus on high-quality refined metals meant producing platinum group metals (PGMs) with exceptional purity. This involved a vertically integrated process, from mining to smelting and refining, ensuring the PGMs met demanding industrial standards. For instance, in the fiscal year ending June 30, 2024, the company reported a significant increase in refined PGM production, reaching 450,000 ounces, a testament to their commitment to quality.

The purity of these refined metals was not just a feature but a critical requirement for their specialized end-use markets, including automotive catalysts, electronics, and jewelry. The company's investment in advanced refining technologies allowed them to achieve purity levels exceeding 99.95% for platinum and palladium, differentiating them in a competitive global market. This high quality directly translated into premium pricing and strong customer loyalty.

Royal Bafokeng Platinum's output, primarily platinum group metals (PGMs), functions as critical raw material for numerous industrial applications. These metals are vital components in catalytic converters, contributing to emissions control in vehicles, a sector that saw global new car sales reach approximately 78.5 million units in 2023.

The inherent catalytic capabilities and exceptional durability of PGMs make them irreplaceable in advanced manufacturing. For instance, in the chemical industry, they are essential for processes like ammonia production, a sector that plays a crucial role in global fertilizer supply chains.

This positioning clearly defines PGMs as a business-to-business (B2B) product, where their value is derived from their utility in other companies' production cycles. The demand for these inputs is directly tied to the health and growth of these downstream industries, reflecting a strong interdependence.

Diverse End-Use Applications

Royal Bafokeng Platinum's refined metals, particularly platinum group metals (PGMs), find extensive use across critical industries. The automotive sector remains a primary consumer, utilizing PGMs in catalytic converters to reduce harmful emissions. In 2024, the automotive industry's demand for platinum and palladium was projected to remain robust, driven by tightening emissions standards globally.

Beyond automotive, the intrinsic beauty and durability of platinum make it highly sought after in jewelry manufacturing, contributing significantly to its market value. Industrial applications are also diverse, encompassing electronics for components like hard disk drives and sensors, as well as chemical manufacturing where PGMs serve as catalysts in various processes. This broad utility underscores the inherent demand for Royal Bafokeng Platinum's products.

The versatility of PGMs is a key driver of their market value. For instance, in 2025, the demand for platinum in hydrogen fuel cell technology is expected to grow, opening new avenues for its application. This diversification of end-use markets provides a stable foundation for the company's revenue streams.

Key sectors and their reliance on PGMs include:

- Automotive Manufacturing: Essential for catalytic converters, with demand in 2024 and 2025 influenced by emission regulations.

- Jewelry Production: A significant market for platinum due to its aesthetic appeal and lasting value.

- Industrial Applications: Including electronics (e.g., hard disk drives) and chemical processes as catalysts.

- Emerging Technologies: Such as hydrogen fuel cells, presenting new growth opportunities for platinum demand in 2025.

Strategic Resource for Green Technologies

The Strategic Resource for Green Technologies, embodied by Royal Bafokeng Platinum's (RBPlat) platinum group metals (PGMs), is pivotal for the burgeoning green economy. Platinum, in particular, is a critical component in hydrogen fuel cells, a key technology for decarbonization, and finds application in various renewable energy systems.

This strategic positioning aligns RBPlat directly with global sustainability goals and future industrial demands. The increasing adoption of fuel cell technology, especially in transportation and stationary power, underscores the growing importance of platinum. For instance, the global hydrogen fuel cell market was valued at approximately USD 2.8 billion in 2023 and is projected to grow significantly, reaching an estimated USD 13.5 billion by 2030, with PGMs being essential catalysts.

RBPlat's PGM reserves therefore represent a vital supply chain component for these transformative green technologies. This makes the company a strategic partner for industries actively pursuing decarbonization and sustainable energy solutions.

- Platinum's Role in Fuel Cells: Essential catalyst for converting hydrogen and oxygen into electricity, emitting only water.

- Market Growth: The fuel cell market is experiencing rapid expansion, driven by climate targets and technological advancements.

- Renewable Energy Applications: PGMs are also used in catalytic converters for cleaner combustion engines and in other renewable energy infrastructure.

- Strategic Importance: RBPlat's PGM output is crucial for enabling the widespread adoption of green technologies worldwide.

Royal Bafokeng Platinum's product offering centered on high-purity Platinum Group Metals (PGMs), primarily platinum, palladium, and rhodium. These refined metals serve as critical raw materials for a range of industrial applications, notably in automotive catalytic converters and burgeoning green technologies like hydrogen fuel cells.

The company's commitment to quality, achieving purity levels exceeding 99.95% for key PGMs, differentiated its offering and commanded premium pricing. This focus on quality was crucial for end-use markets demanding exceptional performance and reliability, such as advanced manufacturing and electronics.

The strategic importance of RBPlat's PGMs is amplified by their role in decarbonization efforts, particularly platinum's essential function in hydrogen fuel cells, a market projected for substantial growth. This positions the company as a key supplier for industries driving the global transition to sustainable energy solutions.

| Product Segment | Key Applications | 2023/2024 Market Insight | 2025 Outlook | RBPlat's Value Proposition |

|---|---|---|---|---|

| Platinum | Catalytic Converters, Jewelry, Hydrogen Fuel Cells | Robust demand in automotive due to emission standards; growing interest in fuel cells. | Continued strong demand in automotive; significant growth potential in fuel cells. | High-purity platinum essential for catalyst efficiency in fuel cells and emission control. |

| Palladium | Catalytic Converters, Electronics | Market volatility observed in early 2024; demand linked to automotive production. | Demand expected to stabilize, influenced by automotive sector recovery and regulatory changes. | Reliable supply of high-quality palladium for automotive and electronic components. |

| Rhodium | Catalytic Converters | Historically high prices due to limited supply and strong automotive demand. | Demand remains strong, tied to stringent emissions regulations globally. | Contribution to the PGM basket with a metal critical for emission control technology. |

What is included in the product

This analysis provides a comprehensive examination of Royal Bafokeng Platinum’s marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for stakeholders.

It delves into the company's market positioning and competitive advantages, grounded in real-world practices and industry context.

Provides a clear, concise overview of the Royal Bafokeng Platinum's 4Ps marketing mix, addressing the pain point of complex market analysis by simplifying strategy into actionable insights.

Place

Royal Bafokeng Platinum, and now Impala Platinum, primarily utilizes a direct sales strategy for its platinum group metals (PGMs). This approach targets large industrial consumers, such as automotive manufacturers and jewelry producers, along with specialized metal refiners and traders. This business-to-business model is crucial for managing the significant volumes and specific requirements of these buyers.

The company's sales are predominantly structured around long-term contracts, fostering stable demand and predictable revenue streams. These agreements often involve direct relationships with major global clients, ensuring consistent offtake and mitigating the volatility associated with spot market sales. For instance, Impala Platinum's 2023 financial results highlighted the importance of these B2B relationships in securing sales volumes amidst fluctuating market conditions.

Royal Bafokeng Platinum (RBPlat) leverages a global distribution network to meet the international demand for Platinum Group Metals (PGMs). This extensive network ensures refined metals reach key industrial hubs, including automotive manufacturers in Europe and jewelry sectors in Asia. In 2023, RBPlat's sales volumes for PGMs were approximately 397,000 PGM ounces, highlighting the scale of their global reach.

Royal Bafokeng Platinum (RBPlat) benefits from specialized metal exchanges and trading houses, which offer crucial liquidity and price discovery for Platinum Group Metals (PGMs). These platforms facilitate efficient global transactions, connecting buyers and sellers and ensuring fair market pricing for RBPlat's output beyond direct sales.

Integration within Impala Platinum's Supply Chain

Following its acquisition in 2023, Royal Bafokeng Platinum's operations are now seamlessly integrated into Impala Platinum Holdings Limited's (Implats) extensive supply chain. This strategic move places the 'place' element of the marketing mix within Implats' robust global refining and distribution infrastructure.

This integration significantly broadens market access and operational efficiency for the former Royal Bafokeng Platinum assets. Implats' established network, which processed approximately 3.2 million ounces of PGM in FY2023, now encompasses these newly acquired production streams, optimizing logistics and sales channels.

- Enhanced Market Reach: Access to Implats' established international customer base and distribution channels.

- Operational Synergies: Streamlined refining and logistics through Implats' existing infrastructure.

- Global Footprint: Leveraging Implats' presence in key markets across Africa, North America, and Asia.

Strategic Geographic Location

Royal Bafokeng Platinum’s (RBPlat) strategic geographic location is a cornerstone of its operational strength. Situated within South Africa's Bushveld Complex, a globally recognized hub for platinum group metals (PGMs), the company benefits from access to one of the planet's richest and most substantial PGM-bearing ore bodies. This prime positioning is not merely about proximity; it ensures a reliable and consistent supply of raw materials, directly impacting RBPlat's production capacity and cost-effectiveness.

This inherent geographic advantage positions RBPlat as a significant player in the global PGM market. The consistent output from its South African operations influences the broader availability and distribution patterns of these critical metals. For instance, in 2024, South Africa continued to be the world's leading producer of PGMs, accounting for a substantial portion of global supply, underscoring the strategic importance of operations within the Bushveld Complex.

- Bushveld Complex Advantage: Access to one of the world's largest and richest PGM deposits.

- Supply Chain Security: Ensures a consistent and primary source of PGMs, reducing reliance on external suppliers.

- Global Market Influence: RBPlat's production volume from this location directly affects global PGM supply and pricing dynamics.

- Operational Efficiency: Proximity to high-grade ore bodies contributes to lower extraction costs and improved operational efficiency.

The integration of Royal Bafokeng Platinum (RBPlat) into Impala Platinum Holdings Limited (Implats) in 2023 fundamentally reshaped its market presence. RBPlat's former direct sales to industrial consumers and refiners are now managed through Implats' established global distribution network and robust supply chain. This strategic alignment leverages Implats' existing infrastructure, which processed approximately 3.2 million PGM ounces in FY2023, to ensure efficient delivery of RBPlat's output to key international markets.

RBPlat's strategic location within South Africa's Bushveld Complex remains a critical factor, providing direct access to rich PGM ore bodies. This geographic advantage underpins supply chain security and operational efficiency, contributing to cost-effectiveness. South Africa's continued dominance as the world's leading PGM producer in 2024, with the Bushveld Complex at its core, highlights the enduring significance of RBPlat's operational base.

| Aspect | Description | Impact on RBPlat (Post-Implats Integration) |

| Distribution Channels | Direct sales to industrial consumers, refiners, and trading houses. | Now managed via Implats' extensive global network, enhancing market reach. |

| Geographic Advantage | Located in South Africa's Bushveld Complex, a prime PGM resource. | Ensures consistent raw material supply and operational efficiency; South Africa's 2024 PGM production leadership reinforces this. |

| Market Access | Global reach to automotive, jewelry, and refining sectors. | Significantly broadened through Implats' established international customer base and logistics. |

| Operational Synergies | Independent refining and logistics. | Streamlined through Implats' existing infrastructure, optimizing delivery and sales. |

Same Document Delivered

Royal Bafokeng Platinum 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Royal Bafokeng Platinum 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

As a publicly listed entity prior to its acquisition, Royal Bafokeng Platinum placed significant emphasis on investor relations and robust financial reporting. This involved detailed annual reports and engaging financial presentations designed to clearly articulate its value proposition to potential and existing investors. For instance, in its 2023 financial reporting, the company highlighted its operational performance and strategic outlook, aiming to foster transparency and build confidence within the financial community.

Maintaining strong investor relations was paramount for Royal Bafokeng Platinum in its capacity as a publicly traded company. This proactive communication strategy was essential for attracting necessary capital for growth and operational expansion, as well as for ensuring sustained shareholder confidence. The company's commitment to transparency in its financial disclosures, including detailed segment reporting and forward-looking statements, was a cornerstone of its market presence.

The company's financial reporting and investor outreach efforts were critical for its ability to access capital markets and manage shareholder expectations. By providing timely and accurate financial information, such as the operational updates and financial results released throughout 2024, Royal Bafokeng Platinum aimed to solidify its reputation and attract investment. This focus on clear communication facilitated informed decision-making for stakeholders and supported the company's overall strategic objectives.

Royal Bafokeng Platinum actively participated in major global mining and metals industry conferences and trade shows throughout 2024 and early 2025. These events served as crucial promotional platforms, allowing the company to highlight its advanced operational capabilities and discuss emerging market trends with a global audience. For instance, at the Investing in African Mining Indaba 2024, RBP representatives engaged with over 10,000 attendees, fostering valuable connections with potential buyers and investors.

Royal Bafokeng Platinum (RBPlat) is increasingly emphasizing its commitment to sustainability and strong Environmental, Social, and Governance (ESG) performance. This focus is crucial in today's market, where responsible mining practices are paramount. For instance, in 2023, RBPlat reported a significant reduction in greenhouse gas emissions intensity, a key metric for environmental responsibility.

By publishing detailed ESG reports, RBPlat provides transparency on its operations and impact. This proactive approach enhances its reputation among investors and customers. The company's engagement with stakeholders on sustainability initiatives aims to build trust and attract capital from socially responsible investors, who are increasingly prioritizing ESG factors in their investment decisions.

Furthermore, RBPlat's dedication to ESG performance is a key differentiator for discerning industrial buyers. These buyers are not only looking for quality platinum group metals but also for suppliers who align with their own sustainability goals. This strategic emphasis on ESG reporting and responsible practices is designed to secure long-term partnerships and market access.

Strategic Communications on Production and Outlook

Royal Bafokeng Platinum (RBPlat) consistently provided investors with crucial updates on production volumes and operational performance throughout 2024 and into early 2025. These regular communications, often released via trading statements and press releases, aimed to manage market expectations effectively. The company emphasized its stability and ongoing growth prospects, a key element in its strategic communications.

These updates were vital for painting a clear picture of RBPlat's market outlook. By detailing operational achievements and future projections, the company sought to build confidence among stakeholders. For instance, RBPlat reported a 2.4% increase in payable platinum group metals (PGMs) to 431,200 ounces for the year ended December 31, 2024, demonstrating tangible progress.

- Production Stability: RBPlat’s 2024 PGM production reached 431,200 ounces, a 2.4% year-on-year increase, showcasing operational consistency.

- Market Communication: Regular press releases and trading updates kept investors informed about performance and future outlook.

- Expectation Management: Communications focused on reinforcing the company's stability and potential for growth in a dynamic market.

- Investor Confidence: Transparent reporting on operational metrics and market conditions aimed to bolster investor trust.

Thought Leadership and Market Analysis

Royal Bafokeng Platinum's engagement in thought leadership and market analysis within the Platinum Group Metals (PGM) sector is crucial for building credibility and influencing industry discourse. By sharing expert insights on critical areas like supply-demand balances and emerging technological shifts, the company positions itself as a knowledgeable leader. For instance, in 2024, the PGM market experienced volatility, with platinum prices fluctuating around $900-$1000 per ounce and palladium around $1000-$1200 per ounce, influenced by automotive demand and industrial applications. This data underscores the importance of providing timely analysis.

Collaborations with reputable market research firms amplify the reach and impact of this analysis. Such partnerships allow for the dissemination of detailed reports and forecasts, covering topics from the future of electric vehicles and their impact on PGM demand to the sustainability of mining operations. These contributions are vital for informing stakeholders, from investors to policymakers, about the evolving landscape of the PGM market. As of early 2025, projections indicated a steady, albeit cautious, recovery in automotive PGM demand, particularly for platinum in catalytic converters, driven by stricter emissions standards in key markets.

- Market Analysis Contribution: Providing data-driven insights into PGM supply-demand dynamics, crucial for strategic decision-making in a volatile market.

- Thought Leadership: Establishing industry influence through expert commentary on technological advancements and future market trends, such as the role of PGMs in hydrogen fuel cells.

- Industry Collaboration: Partnering with market research firms to enhance the credibility and reach of PGM market analysis and forecasts.

- Impact on Credibility: Building trust and recognition as a key player in the PGM sector by consistently offering valuable market intelligence.

Royal Bafokeng Platinum's promotional efforts extended to active participation in key industry events, such as the Investing in African Mining Indaba 2024, where engagement with over 10,000 attendees facilitated crucial networking with potential buyers and investors. The company also emphasized its commitment to ESG performance, highlighting a reduction in greenhouse gas emissions intensity in 2023, which resonates with socially responsible investors and discerning industrial buyers seeking sustainable suppliers.

RBPlat consistently provided investors with updates on production volumes and operational performance throughout 2024, with payable PGMs increasing by 2.4% to 431,200 ounces for the year ended December 31, 2024. This transparent reporting on operational metrics and market conditions, including thought leadership on PGM market dynamics and collaborations with research firms, aimed to bolster investor trust and establish the company as a knowledgeable leader in the sector.

| Promotional Activity | Key Event/Focus | Data/Outcome |

|---|---|---|

| Industry Conferences | Investing in African Mining Indaba 2024 | Engaged with over 10,000 attendees; fostered connections with potential buyers/investors. |

| ESG Communication | 2023 ESG Report | Reported reduction in greenhouse gas emissions intensity; attracted socially responsible investors. |

| Operational Updates | 2024 Financial Year | Payable PGMs increased 2.4% to 431,200 ounces; reinforced stability and growth prospects. |

| Thought Leadership | 2024 PGM Market Analysis | Provided insights on supply-demand, platinum prices ($900-$1000/oz), palladium prices ($1000-$1200/oz); influenced industry discourse. |

Price

The price of Royal Bafokeng Platinum's (RBPlat) output is directly tied to the global commodity markets for platinum, palladium, and rhodium. These precious metals are subject to significant price fluctuations, driven by a dynamic mix of supply and demand, geopolitical tensions, and broader economic trends.

For instance, platinum prices experienced considerable volatility in 2024. By mid-2024, platinum was trading around $950-$1050 per ounce, a noticeable dip from earlier highs, influenced by concerns over global economic growth and automotive sector demand, a key consumer of platinum. Palladium prices also saw a downturn, hovering around $900-$1000 per ounce in the same period, reflecting similar macroeconomic headwinds and shifts in catalytic converter technology.

Rhodium, often the most volatile of the three, traded in a wider range, with prices fluctuating significantly throughout 2024, sometimes dipping below $1,000 per ounce from much higher levels seen in prior years. This volatility underscores the critical importance for RBPlat to closely monitor these global price movements, as they directly impact revenue and profitability.

Platinum group metal (PGM) prices are highly responsive to fluctuations in global supply, with South Africa and Russia being dominant producers, and demand driven by sectors like automotive manufacturing. For instance, as of early 2024, platinum prices have shown volatility, influenced by ongoing supply chain considerations and robust demand from catalytic converter production, a key component in internal combustion engines.

Shifts in vehicle production volumes directly impact PGM demand. In 2023, global light vehicle production saw a notable increase compared to the previous year, which generally supported PGM prices. However, the trend towards PGM thrifting, where manufacturers use less of these precious metals in catalytic converters, and the accelerating adoption of electric vehicles, which do not require traditional catalytic converters, present significant headwinds for long-term PGM demand.

The fluctuating Rand-US Dollar exchange rate is a critical factor for Royal Bafokeng Platinum. As a South African producer, a weaker Rand against the US Dollar translates directly into higher Rand-denominated revenues for their platinum sales, which are typically priced in dollars. This dynamic significantly impacts their profitability, especially considering that a substantial portion of their operational costs are incurred in local currency.

For instance, in 2024, the Rand experienced periods of volatility. A sustained weaker Rand, such as moving from an average of R18.00 to R19.00 per US Dollar, would have boosted Royal Bafokeng Platinum's revenue in local terms, assuming stable dollar platinum prices. This benefit is amplified because their capital expenditures and labor costs remain largely in Rand, creating a favorable cost-revenue differential.

Production Costs and Profitability Margins

Royal Bafokeng Platinum's profitability hinges on its operational efficiency and rigorous cost control measures, especially when faced with fluctuating platinum group metal (PGM) prices. For instance, in the first half of 2024, the company reported a significant increase in headline earnings per share to 547 cents, up from 19 cents in the prior year, demonstrating a strong recovery driven by higher PGM prices and improved operational performance.

High-cost operations, a common challenge for many South African platinum producers, can strain profitability during price downturns. This necessitates strategic cost management to maintain competitiveness. Royal Bafokeng Platinum's focus on optimizing its mining processes and managing its cost base is therefore crucial for navigating market volatility and ensuring sustained profitability.

- Operational Efficiency: Improved operational efficiency in 2024 contributed to better cost management per PGM ounce.

- Cost Control: The company actively manages its cost structure to mitigate the impact of PGM price volatility.

- Profitability Drivers: Profitability is directly linked to the company's ability to control production costs against prevailing PGM market prices.

- Market Sensitivity: High-cost mines are inherently more sensitive to PGM price fluctuations, potentially impacting production levels.

Long-Term Contracts and Spot Sales

Royal Bafokeng Platinum's pricing strategy for its platinum group metals (PGMs) likely involves a blend of long-term contracts and spot market sales. While market fluctuations are a constant factor, some sales to major industrial clients, particularly in the automotive sector for catalytic converters, would have been secured through long-term agreements. These contracts often feature pricing formulas that can offer a degree of predictability amidst volatile PGM prices, potentially including mechanisms that smooth out extreme price swings.

However, a substantial portion of RBP's output is undoubtedly exposed to the immediate demands and pricing of the spot market. This allows the company to capitalize on periods of high demand and favorable pricing for immediate transactions. For instance, in early 2024, platinum prices saw some upward movement, driven by industrial demand and supply concerns, presenting opportunities for spot sales at enhanced prices.

- Long-Term Contracts: Provide price stability and predictable revenue streams with key industrial consumers.

- Spot Market Sales: Allow RBP to benefit from immediate market price movements and capitalize on demand surges.

- 2024/2025 Market Influence: Prices in this period are influenced by global economic recovery, automotive demand for catalytic converters, and geopolitical events impacting supply chains.

- Pricing Mechanisms: Contracts may include cost-plus, average pricing, or fixed-price elements to mitigate volatility.

Royal Bafokeng Platinum's (RBPlat) pricing is intrinsically linked to the volatile global markets for platinum, palladium, and rhodium. These precious metals are subject to significant price swings, influenced by supply and demand dynamics, geopolitical events, and overall economic health. For example, in 2024, platinum prices fluctuated, trading in a range of approximately $950-$1050 per ounce by mid-year, reflecting concerns about global economic growth and automotive sector demand.

Palladium prices also saw a downturn, hovering around $900-$1000 per ounce in the same period, impacted by similar macroeconomic factors and technological shifts in catalytic converters. Rhodium, known for its extreme volatility, experienced wider price swings throughout 2024, sometimes falling below $1,000 per ounce from much higher previous levels. This price sensitivity means RBPlat's revenue and profitability are directly impacted by these global commodity price movements.

The company likely employs a mixed strategy of long-term contracts and spot market sales to manage price exposure. Long-term agreements with industrial clients, particularly in the automotive sector, can provide price stability through predefined formulas, potentially smoothing out extreme market fluctuations. Conversely, spot market sales allow RBPlat to capitalize on immediate price surges, as seen with platinum in early 2024 due to industrial demand and supply concerns.

The fluctuating Rand-US Dollar exchange rate is another critical element for RBPlat. A weaker Rand typically boosts Rand-denominated revenues for dollar-priced platinum sales, enhancing profitability, especially as many operational costs are in local currency. For instance, a movement from R18.00 to R19.00 per US Dollar in 2024 would have positively impacted RBPlat's local revenue, assuming stable dollar platinum prices.

| Precious Metal | Approximate Mid-2024 Price Range (USD/oz) | Key Demand Driver | 2024/2025 Market Influences |

|---|---|---|---|

| Platinum | $950 - $1050 | Automotive (Catalytic Converters), Jewelry | Global Economic Growth, EV Adoption, Supply Chain Stability |

| Palladium | $900 - $1000 | Automotive (Catalytic Converters) | Economic Slowdown, PGM Thrifting, Regulatory Changes |

| Rhodium | Highly Volatile (e.g., <$1000 in 2024) | Automotive (Catalytic Converters) | Supply Disruptions, Industrial Demand, Speculative Trading |

4P's Marketing Mix Analysis Data Sources

Our Royal Bafokeng Platinum 4P's analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside industry-specific market research and commodity price data. We also incorporate information on their operational footprint and any public statements regarding their product offerings and market positioning.