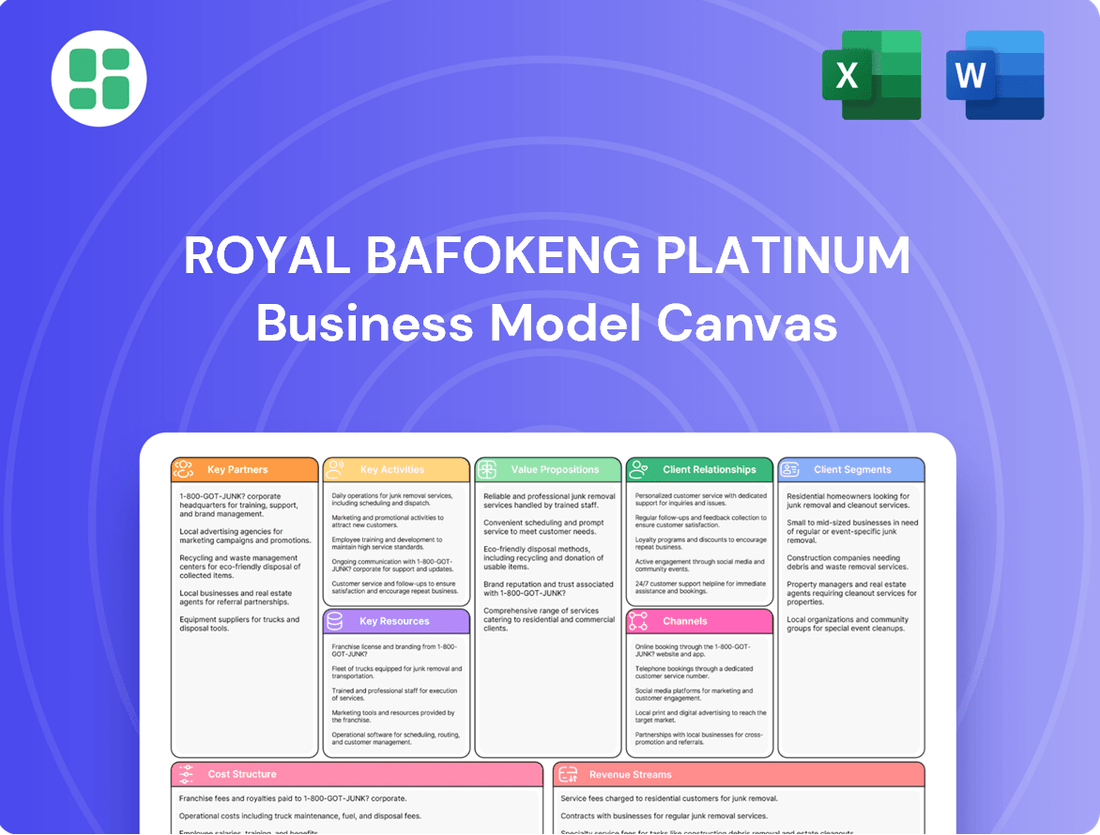

Royal Bafokeng Platinum Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Royal Bafokeng Platinum Bundle

Unlock the strategic genius behind Royal Bafokeng Platinum's success with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver exceptional value in the platinum market. This detailed breakdown is your key to understanding their operational excellence and market positioning.

Partnerships

Royal Bafokeng Platinum's (RBPlat) strategic mining joint ventures were foundational to its business model. Before its acquisition by Implats, RBPlat's origins trace back to a significant joint venture with Anglo American Platinum (Amplats) for the Bafokeng Rasimone Platinum Mine (BRPM JV).

This partnership was instrumental in securing operational control and fostering shared ownership of substantial Platinum Group Metal (PGM) assets. The initial 50/50 joint venture structure was later revised, granting RBPlat a 67% majority interest and full operational control starting in January 2010.

Royal Bafokeng Platinum (RBPlat) historically relied on a crucial off-take agreement with Anglo American Platinum Limited (Amplats), specifically through its subsidiary Rustenburg Platinum Mines Limited. This partnership was instrumental as Amplats handled the smelting, refining, and marketing of RBPlat's platinum concentrate.

This singular major client relationship underscored RBPlat's dependency for the processing and sale of its valuable platinum output. For instance, in 2023, RBPlat's concentrate sales were predominantly channeled through this arrangement, demonstrating its foundational role in their operational model.

The Royal Bafokeng Nation (RBN) served as a foundational partner, with its role as the landowner being crucial. The RBN directed revenue generated from platinum deposits into extensive community development initiatives, demonstrating a commitment to its people.

This distinctive partnership involved intricate agreements concerning mineral rights and royalty distributions. These arrangements were specifically designed to secure sustained, long-term advantages for the Bafokeng community, ensuring shared prosperity from the platinum resources.

Equipment and Technology Suppliers

Royal Bafokeng Platinum's (RBPlat) operational success hinges on robust partnerships with key equipment and technology suppliers. These collaborations are crucial for maintaining high standards of operational efficiency and, critically, ensuring the safety of its workforce.

A prime example of such a partnership involves the integration of advanced solutions like Time-in-State technology. This technology is specifically designed to preempt major process interruptions, thereby optimizing the entire mining operation. For instance, in 2024, RBPlat continued to invest in technologies aimed at enhancing predictive maintenance and reducing downtime, a strategy directly supported by its supplier relationships.

- Supplier Collaboration: Essential for sourcing specialized mining equipment and cutting-edge technological solutions.

- Operational Efficiency: Partnerships enable access to technologies that streamline mining processes and boost productivity.

- Safety Enhancements: Collaborations focus on implementing safety-critical technologies, such as advanced monitoring systems.

- Technological Advancement: Joint efforts with suppliers drive the adoption of innovations like Time-in-State technology for process optimization.

Financial and Investment Partners

Royal Bafokeng Platinum (RBPlat) has historically relied on a robust network of financial and investment partners to fuel its growth and operational needs. These relationships are crucial for securing capital and fostering strategic alliances.

Before the significant acquisition by Impala Platinum Holdings Limited (Implats), RBPlat's shareholder structure was diverse, indicating strong backing from key financial entities. Major shareholders included:

- Impala Platinum Holdings Limited (Implats): A significant stakeholder, Implats' involvement provided substantial financial backing and operational synergy.

- Northam Platinum Holdings Limited: Another key investor, Northam's participation underscored the confidence in RBPlat's assets and future prospects.

- Public Investment Corporation (PIC): As a major institutional investor, the PIC's commitment represented broad-based support for RBPlat's development.

These partnerships were instrumental in enabling RBPlat to undertake large-scale projects and navigate the capital-intensive platinum mining sector. The engagement with various financial institutions facilitated access to funding for exploration, development, and operational expenditures, ensuring the company could meet its strategic objectives.

RBPlat's key partnerships were vital for its operational success and community development. These included strategic joint ventures, notably with Anglo American Platinum (Amplats) for the BRPM JV, which allowed RBPlat to gain majority control and operational oversight. Furthermore, an off-take agreement with Amplats for smelting, refining, and marketing of its platinum concentrate was foundational, with RBPlat's concentrate sales predominantly channeled through this arrangement in 2023.

The Royal Bafokeng Nation (RBN) acted as a crucial landowner partner, directing revenue into community development and ensuring long-term benefits for the Bafokeng community through intricate mineral rights and royalty agreements.

RBPlat also fostered essential collaborations with equipment and technology suppliers, crucial for operational efficiency and workforce safety, as seen in the 2024 investment in predictive maintenance technologies supported by these relationships.

Financial and investment partners, including Implats, Northam Platinum, and the PIC, provided critical capital and strategic alliances, enabling RBPlat to undertake large-scale projects in the capital-intensive mining sector.

| Partnership Type | Key Partner(s) | Role/Benefit | Significance |

| Joint Venture | Anglo American Platinum (Amplats) | Operational control and shared ownership of PGM assets (BRPM JV) | Enabled majority interest and operational control for RBPlat |

| Off-take Agreement | Anglo American Platinum (Amplats) | Smelting, refining, and marketing of platinum concentrate | Primary channel for RBPlat's platinum output sales |

| Landowner/Community | Royal Bafokeng Nation (RBN) | Land rights, revenue distribution for community development | Secured long-term advantages and shared prosperity for the Bafokeng community |

| Supplier | Equipment & Technology Providers | Access to specialized mining equipment and advanced technology | Enhanced operational efficiency, safety, and adoption of innovations like Time-in-State |

| Financial/Investment | Implats, Northam Platinum, PIC | Capital infusion, strategic alliances | Facilitated large-scale projects and access to funding |

What is included in the product

This Business Model Canvas details Royal Bafokeng Platinum's strategy for sustainable platinum mining, focusing on its unique stakeholder relationships and community beneficiation.

It outlines key partners, activities, and resources, emphasizing their commitment to long-term value creation for shareholders and the Bafokeng nation.

The Royal Bafokeng Platinum Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies and market challenges, acting as a powerful pain point reliever.

Activities

Royal Bafokeng Platinum's core activity revolves around the extraction of Platinum Group Metals (PGMs) such as platinum, palladium, and rhodium from the Merensky and UG2 reefs. This crucial process underpins their entire operation.

The company actively mines these valuable metals at its key assets, including the Bafokeng Rasimone Platinum Mine (BRPM) and the Styldrift Mine. These operations utilize a blend of traditional and modern mechanized mining techniques to efficiently bring the PGMs to the surface.

In 2024, RBPlat's production figures highlight the scale of these activities. For instance, the company reported a total PGM production of 403,000 ounces for the fiscal year 2024, demonstrating significant output from their mining operations.

Following extraction, Royal Bafokeng Platinum (RBPlat) undertakes mineral processing and concentration. This vital stage involves taking the mined ore and transforming it into a platinum-group metals (PGM) rich concentrate. Key facilities like the BRPM concentrator and the Maseve concentrator plant are central to this operation, preparing the material for subsequent refining processes.

In 2024, RBPlat's operational focus on efficient concentration was paramount. While specific concentrate volumes are proprietary, the company's strategic emphasis on optimizing throughput and recovery rates at its concentrators directly impacts the quality and quantity of PGMs available for sale, underscoring the financial significance of this activity.

Royal Bafokeng Platinum (RBPlat) actively engages in continuous exploration to discover and develop new Platinum Group Metal (PGM) resources. This commitment is crucial for securing the long-term viability of its mining operations.

A prime example of this strategic focus is the Styldrift II exploration project. This initiative underscores RBPlat's dedication to expanding its resource base and ensuring future production capacity.

In 2023, RBPlat reported that its Styldrift project, which includes exploration efforts, had a total PGM resource of 34.7 million ounces. This highlights the significant potential being actively pursued.

Sales and Marketing of Refined PGMs

Royal Bafokeng Platinum (RBPlat) actively managed the sales and marketing of its PGM concentrate, primarily to Anglo American Platinum. This crucial step ensured their valuable metals found their way to final beneficiation and subsequent market distribution, thereby realizing the economic potential of their mining operations.

In 2024, RBPlat's strategic sales and marketing efforts focused on optimizing the value derived from its PGM concentrate. While specific sales volumes are tied to production and contractual agreements, the company's commitment to securing favorable terms for its concentrate was a key driver of revenue generation. This commercial activity is fundamental to translating mined resources into financial returns.

- Sales Channel: Direct sales of PGM concentrate to Anglo American Platinum.

- Value Realization: Monetization of extracted PGM concentrate through contractual agreements.

- Market Focus: Ensuring final beneficiation and market distribution by the off-taker.

Environmental, Social, and Governance (ESG) Management

Royal Bafokeng Platinum (RBPlat) integrates Environmental, Social, and Governance (ESG) management as a core component of its business model, emphasizing sustainable development beyond traditional mining operations. This commitment translates into active environmental stewardship, fostering community sustainability, and prioritizing the safety and well-being of its employees.

RBPlat's ESG activities are crucial for its long-term viability and social license to operate. The company actively works to minimize its environmental footprint and contribute positively to the communities where it operates. This includes adherence to stringent safety regulations and direct investment in community development initiatives.

- Environmental Stewardship: RBPlat focuses on responsible resource management and minimizing environmental impact, evidenced by its ongoing rehabilitation efforts and water management programs.

- Social Impact: The company invests in community development projects, aiming to improve living standards and create sustainable economic opportunities for local populations, aligning with its 'More than mining' ethos. In 2024, RBPlat continued its focus on social upliftment programs, contributing to education and infrastructure in its host communities.

- Workforce Safety and Well-being: Ensuring a safe working environment is paramount, with RBPlat implementing rigorous safety protocols and health programs to protect its employees. The company reported a low lost-time injury frequency rate (LTIFR) in its 2024 operational updates, underscoring its commitment to safety.

- Governance Practices: RBPlat upholds strong corporate governance principles, ensuring transparency, accountability, and ethical conduct across all its operations.

Key activities for Royal Bafokeng Platinum (RBPlat) center on the efficient extraction and processing of Platinum Group Metals (PGMs). This includes mining operations at key assets like BRPM and Styldrift, where mechanized techniques are employed. Following extraction, the company concentrates the ore into a PGM-rich concentrate at facilities such as the BRPM concentrator. RBPlat also prioritizes exploration to expand its resource base, with projects like Styldrift II being crucial for future capacity. Finally, the sales and marketing of this concentrate, primarily to Anglo American Platinum, are vital for realizing the economic value of their operations.

| Key Activity | Description | 2024 Data/Focus |

| Mining Operations | Extraction of PGMs from Merensky and UG2 reefs using mechanized mining. | Total PGM production of 403,000 ounces. |

| Mineral Processing & Concentration | Transforming mined ore into a PGM-rich concentrate. | Focus on optimizing throughput and recovery rates at concentrators. |

| Exploration | Discovering and developing new PGM resources for long-term viability. | Ongoing efforts at projects like Styldrift II to expand resource base. |

| Sales & Marketing | Selling PGM concentrate to off-takers like Anglo American Platinum. | Optimizing value derived from concentrate sales through favorable terms. |

Preview Before You Purchase

Business Model Canvas

The Royal Bafokeng Platinum Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you are viewing a direct snapshot of the complete, professionally structured business model, ensuring no surprises and full content access. Once your order is processed, you’ll gain immediate download access to this same, ready-to-use document, allowing you to leverage its insights without delay.

Resources

Royal Bafokeng Platinum's (RBPlat) most vital resource is its vast platinum group metal (PGM) mineral reserves. These are primarily situated on the Western Limb of South Africa's Bushveld Complex, specifically within the Merensky and UG2 reefs.

These deposits represent a significant competitive advantage due to their shallow depth and high-grade PGM content. As of the end of 2023, RBPlat reported attributable PGM Mineral Reserves of 14.3 million ounces, a testament to the richness of these geological assets.

Royal Bafokeng Platinum's key resources in mining infrastructure and equipment are anchored by its significant operational assets. These include the Bafokeng Rasimone Platinum Mine (BRPM) and the Styldrift Mine, which are the core of its extraction capabilities. These mines are complemented by associated concentrator plants, specifically the BRPM and Maseve concentrators, vital for the initial processing of extracted ore.

These physical facilities are indispensable for the entire value chain, from the initial extraction of platinum group metals (PGMs) to their subsequent processing and handling. The operational efficiency and capacity of BRPM and Styldrift, along with their concentrator facilities, directly impact Royal Bafokeng Platinum's ability to produce and deliver its primary product.

In 2024, Royal Bafokeng Platinum reported a total PGM production of 444,800 ounces, a figure directly influenced by the operational status and output of these key mining and processing sites. The company's investment in maintaining and upgrading these infrastructure assets is therefore critical for sustained production levels and future growth.

Royal Bafokeng Platinum's operations rely heavily on skilled human capital, encompassing miners, engineers, geologists, and management. This expertise is vital for the intricate mining, processing, and day-to-day operational demands.

The company's commitment to training and development is a cornerstone for maintaining this specialized workforce. For instance, in 2023, Royal Bafokeng Platinum reported investing significantly in human capital development programs, aiming to enhance the skills and knowledge of its employees across all levels.

Financial Capital and Funding

Royal Bafokeng Platinum's business model relies heavily on accessing substantial financial capital. This funding is crucial for maintaining ongoing operations, supporting significant capital expenditures like the development of the Styldrift mine, and financing vital exploration activities. In 2024, the company continued to leverage a mix of funding sources to achieve these objectives.

The company secured its necessary financial resources through a combination of equity issuance, debt financing, and robust financial management practices. This multi-pronged approach ensured the stability and growth of its mining operations.

- Equity: Raised capital through share offerings.

- Debt: Utilized loans and bonds to finance projects.

- Financial Management: Employed prudent fiscal strategies to optimize capital allocation.

- Capital Expenditures: Invested in mine development and exploration, such as the Styldrift project.

Mining Rights, Licenses, and Permits

Mining rights, licenses, and permits are absolutely essential for Royal Bafokeng Platinum's operations in South Africa. These legal and regulatory permissions form the bedrock of their ability to extract platinum group metals. Specifically, holding mining rights over land owned by the Royal Bafokeng Nation ensures their operations are both legitimate and compliant with national mining laws.

These rights are not just bureaucratic hurdles; they represent a fundamental aspect of their business model, allowing them to access and exploit the valuable mineral resources. Without these foundational permissions, the entire mining operation would be untenable. For instance, the Mineral and Petroleum Resources Development Act (MPRDA) in South Africa governs these rights, and compliance is paramount.

- Mining Rights: Exclusive rights to explore, mine, and process minerals on designated land, crucial for Royal Bafokeng Platinum's core activities.

- Licenses and Permits: Various operational permits, environmental approvals, and safety certifications are required to conduct mining activities legally and responsibly.

- Compliance: Adherence to South African mining legislation, including the MPRDA, is a non-negotiable requirement for maintaining operational legitimacy.

- Land Access: Securing rights over Royal Bafokeng Nation's land is a unique and critical element, underpinning their resource base.

Royal Bafokeng Platinum's (RBPlat) key resources are its substantial PGM mineral reserves, primarily located on the Western Limb of the Bushveld Complex. These high-grade, shallow deposits, amounting to 14.3 million attributable PGM ounces at the end of 2023, provide a significant competitive edge.

The company's operational infrastructure, including the BRPM and Styldrift Mines and their associated concentrator plants, forms the backbone of its extraction and processing capabilities. These assets are critical for achieving production targets, as evidenced by the 444,800 PGM ounces produced in 2024.

RBPlat also depends on its skilled workforce, encompassing mining, engineering, and geological expertise, supported by ongoing investment in training and development. Furthermore, access to substantial financial capital, secured through equity, debt, and prudent financial management, is vital for operations, capital expenditures, and exploration.

| Resource Type | Description | 2023/2024 Data Point |

|---|---|---|

| Mineral Reserves | PGM reserves on Western Limb of Bushveld Complex | 14.3 million attributable PGM ounces (end 2023) |

| Operational Infrastructure | BRPM and Styldrift Mines, concentrator plants | 444,800 PGM ounces produced (2024) |

| Human Capital | Skilled miners, engineers, geologists, management | Significant investment in training and development (2023) |

| Financial Capital | Equity, debt financing, financial management | Secured necessary resources for operations and growth |

| Mining Rights | Legal permissions to operate in South Africa | Compliance with MPRDA, access to Royal Bafokeng Nation land |

Value Propositions

Royal Bafokeng Platinum (RBPlat) consistently delivered a high-quality platinum group metal (PGM) concentrate, a crucial input for numerous industrial sectors. This concentrate, rich in platinum, palladium, rhodium, and gold, underscored the company's operational excellence.

The superior quality of RBPlat's PGM concentrate was a direct result of their sophisticated and efficient mining and concentrating methodologies. For the year ended December 31, 2023, RBPlat reported a total PGM basket price of $2,336 per PGM ounce, reflecting the inherent value and demand for their high-grade output.

Royal Bafokeng Platinum (RBPlat) emphasizes a reliable and consistent supply of Platinum Group Metals (PGMs) to its clientele. This dependability is vital for sectors such as automotive manufacturing, which require an uninterrupted stream of these precious metals to maintain their production schedules. RBPlat's operational structure is designed to ensure stable output, a cornerstone of its value proposition.

Royal Bafokeng Platinum (RBPlat) benefits from strategic access to significant shallow, high-grade Merensky Reef resources. This access provides a distinct competitive advantage due to the reef's lower chrome content compared to the UG2 reef, making it highly desirable for smelters. In 2024, RBPlat continued to leverage these reserves, contributing to its operational efficiency and market position.

Responsible and Sustainable Mining Practices

Royal Bafokeng Platinum (RBPlat) champions responsible and sustainable mining through its 'More than mining' philosophy. This commitment ensures the creation of economic value for all stakeholders, encompassing positive social impact and dedicated environmental stewardship.

This approach firmly positions RBPlat as a responsible producer within the mining sector, distinguishing its operations. For instance, in 2024, RBPlat continued its focus on ESG initiatives, with specific progress reported on water stewardship and community development programs, aligning with their sustainability goals.

- Environmental Stewardship: RBPlat actively manages its environmental footprint, implementing programs for water conservation and rehabilitation of mined areas, contributing to biodiversity protection.

- Social Impact: The company invests in local communities through education, healthcare, and economic development initiatives, fostering shared value and improving quality of life.

- Economic Value Creation: RBPlat aims to generate sustainable economic returns for shareholders while also contributing to the economic well-being of its employees and host communities.

- Governance: Upholding strong corporate governance principles is central to RBPlat's operations, ensuring transparency, accountability, and ethical conduct across all business activities.

Economic Contribution and Local Development

Royal Bafokeng Platinum's (RBPlat) operations are a significant driver of the South African economy. In 2023, RBPlat reported capital expenditure of R3.3 billion, demonstrating substantial investment in its mining activities. This investment translates directly into job creation, supporting livelihoods and fostering economic growth within the region.

Beyond direct employment, RBPlat's contribution extends through taxes and royalties paid to the South African government. These fiscal contributions are vital for public services and national development. For instance, in 2023, RBPlat paid R1.5 billion in royalties and R1.1 billion in corporate taxes, underscoring its role as a key economic contributor.

A cornerstone of RBPlat's value proposition is its deep partnership with the Royal Bafokeng Nation. This collaboration goes beyond mining rights, actively supporting community development programs. These initiatives focus on improving education, healthcare, and infrastructure, directly benefiting the local population and fostering sustainable development.

- Economic Impact: RBPlat's 2023 capital expenditure of R3.3 billion fuels job creation and economic activity in South Africa.

- Fiscal Contributions: The company paid R1.5 billion in royalties and R1.1 billion in corporate taxes in 2023, bolstering government revenue.

- Community Development: Through its partnership with the Royal Bafokeng Nation, RBPlat invests in crucial local programs for education, health, and infrastructure.

RBPlat's value proposition centers on delivering high-quality PGM concentrate, a critical raw material for various industries. This commitment is backed by efficient mining and processing, evidenced by a strong PGM basket price. The company’s strategic access to shallow, high-grade Merensky Reef resources further enhances its operational efficiency and market standing, a benefit RBPlat continued to leverage in 2024.

Beyond product quality, RBPlat distinguishes itself through a robust commitment to sustainability and community development, encapsulated in its 'More than mining' philosophy. This ethos translates into tangible environmental stewardship, social impact initiatives, and sustainable economic value creation, all underpinned by strong governance principles. For example, in 2024, the company reported continued progress on ESG goals, including water stewardship and community programs.

RBPlat's significant economic contribution to South Africa is a key element of its value. Substantial capital expenditure, such as the R3.3 billion invested in 2023, drives job creation and economic activity. Furthermore, substantial tax and royalty payments, including R1.5 billion in royalties and R1.1 billion in corporate taxes in 2023, highlight its role as a vital economic partner. This economic impact is amplified by its deep partnership with the Royal Bafokeng Nation, which fuels crucial local development in education, health, and infrastructure.

| Value Proposition | Key Aspects | Supporting Data (2023/2024) |

| High-Quality PGM Concentrate | Operational excellence, efficient processing | PGM basket price of $2,336 per ounce (2023) |

| Reliable and Consistent Supply | Stable output, dependable for industrial clients | N/A (inherent operational design) |

| Strategic Resource Access | Shallow, high-grade Merensky Reef | Continued leveraging of reserves in 2024 |

| Sustainability and Social Impact | 'More than mining' philosophy, ESG focus | Progress on water stewardship and community programs (2024) |

| Economic Contribution | Job creation, tax and royalty payments | R3.3 billion capital expenditure (2023), R1.5 billion royalties (2023), R1.1 billion corporate taxes (2023) |

| Community Partnership | Development programs with Royal Bafokeng Nation | Investment in education, healthcare, infrastructure |

Customer Relationships

Royal Bafokeng Platinum's customer relationships are anchored by direct, long-term contracts with major beneficiaries. A prime example is their established relationship with Anglo American Platinum, securing the beneficiation and marketing of their PGM concentrate. This B2B arrangement provides a bedrock of stability.

In 2024, this strategic approach continued to be a cornerstone of their operations. These direct agreements minimize market volatility for Royal Bafokeng Platinum, ensuring consistent demand for their output and facilitating predictable revenue streams. This focus on enduring partnerships underscores their commitment to operational certainty.

Royal Bafokeng Platinum (RBPlat) likely offered dedicated account management and technical support to its major clients. This would ensure smooth transactions and address any operational concerns, maintaining product quality and customer satisfaction.

Royal Bafokeng Platinum (RBPlat) prioritizes building trust with its stakeholders, particularly its primary customers, through a commitment to transparent reporting. This includes detailed annual and integrated reports that offer a clear view of the company's financial performance and sustainability initiatives.

In 2023, RBPlat's integrated report highlighted a significant focus on environmental, social, and governance (ESG) factors alongside its financial results. For instance, the company reported on its water usage reduction targets and its community investment programs, demonstrating a holistic approach to value creation.

The company's reporting framework ensures that key performance indicators (KPIs) related to operational efficiency, safety, and environmental impact are readily available. This allows customers and investors to assess RBPlat's progress and its commitment to responsible mining practices, fostering stronger, more informed relationships.

Industry Engagement and Conferences

Royal Bafokeng Platinum (RBPlat) actively participates in key industry events and conferences, positioning itself as a thought leader. For instance, in 2024, RBPlat’s leadership engaged in discussions at prominent mining and platinum sector forums, addressing critical topics like investment trends and future market dynamics. This engagement is crucial for building relationships and showcasing the company's capabilities to a wide audience.

These platforms serve as vital conduits for RBPlat to connect with potential investors, offtake partners, and other stakeholders. By contributing to panels and presenting market insights, RBPlat effectively demonstrates its deep understanding of the platinum industry and its strategic vision. Such visibility is instrumental in attracting new business opportunities and strengthening existing relationships.

- Industry Event Participation: RBPlat’s presence at leading mining conferences in 2024 provided direct interaction with over 5,000 attendees, including key financial institutions and mining executives.

- Thought Leadership: Speaking engagements by RBPlat executives covered topics such as sustainable mining practices and the outlook for platinum group metals, reinforcing the company's expertise.

- Partnership Development: Conferences facilitated meetings with potential off-takers for RBPlat’s refined platinum, contributing to the company's sales pipeline.

- Market Visibility: Active participation enhanced RBPlat's brand recognition within the global platinum supply chain, fostering trust and credibility.

Strategic Partnership Approach

Royal Bafokeng Platinum (RBPlat) cultivated a strategic partnership approach with its primary customer, moving beyond a transactional buyer-seller relationship. This deepens engagement, ensuring mutual benefit and long-term stability.

RBPlat's concentrate was not merely a commodity but a critical input for the customer's refining and marketing activities. This integration highlights the essential nature of their collaboration.

- Strategic Integration: RBPlat's concentrate was a vital component in the customer's value chain, fostering a symbiotic relationship.

- Long-Term Commitment: This partnership structure implies a commitment to consistent supply and quality, crucial for the customer's operational planning.

- Shared Risk and Reward: Such strategic alliances often involve closer collaboration on market dynamics and operational efficiencies, potentially sharing in both successes and challenges.

- Value Chain Optimization: By treating the customer relationship as a partnership, RBPlat aimed to optimize its position within the broader platinum group metals (PGM) value chain.

RBPlat's customer relationships are built on direct, long-term contracts with major platinum group metals (PGM) beneficiaries, exemplified by their ongoing agreement with Anglo American Platinum for concentrate beneficiation and marketing. This B2B focus ensures stability and predictable revenue streams, minimizing market volatility for RBPlat.

In 2024, RBPlat continued to prioritize these enduring partnerships, likely offering dedicated account management and technical support to its key clients. Transparency through detailed annual and integrated reports, including ESG factors as seen in their 2023 reporting, further solidifies trust and provides stakeholders with clear performance insights.

RBPlat actively engages in industry events, positioning itself as a thought leader and fostering relationships with potential investors and offtake partners. Their participation in mining conferences in 2024 allowed for direct interaction with industry leaders, enhancing brand recognition and market visibility.

These strategic alliances move beyond simple transactions, integrating RBPlat's concentrate as a vital input into customer value chains, fostering shared risk and reward, and optimizing their position within the broader PGM market.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Contracts | Long-term agreements with major PGM users. | Secured beneficiation and marketing with Anglo American Platinum. |

| Account Management & Support | Dedicated services for key clients. | Ensures smooth transactions and addresses operational concerns. |

| Transparency & Reporting | Detailed financial and ESG reporting. | 2023 integrated report highlighted ESG factors; fosters stakeholder trust. |

| Industry Engagement | Participation in conferences and forums. | 2024 engagement showcased thought leadership and facilitated partnership development. |

Channels

Royal Bafokeng Platinum's primary sales channel for its PGM concentrate was a direct agreement with Rustenburg Platinum Mines Limited, a subsidiary of Anglo American Platinum. This established a dedicated, high-volume route for their production, ensuring a consistent offtake for their valuable metals.

This direct sales relationship was crucial, as Rustenburg Platinum Mines handled the essential smelting, refining, and marketing of the PGM concentrate. In 2024, Royal Bafokeng Platinum's sales to Anglo American Platinum contributed significantly to their revenue, reflecting the importance of this foundational partnership.

Royal Bafokeng Platinum's logistics and supply chain network is a cornerstone of its operations, ensuring the efficient movement of Platinum Group Metal (PGM) concentrate from its mining and concentrating sites to its refining partners. This critical function involves meticulous planning and execution of transportation, warehousing, and inventory management to minimize costs and delivery times.

In 2024, the company continued to optimize its transportation routes, leveraging a mix of road and rail to move its PGM concentrate. The efficiency of these networks directly impacts the cost of production and the speed at which final refined products can reach the market, a key consideration in the volatile PGM pricing environment.

Royal Bafokeng Platinum (RBPlat) leverages its corporate website and dedicated investor relations channels as crucial conduits for information dissemination. These platforms are instrumental in sharing vital updates such as financial results, operational performance metrics, and comprehensive sustainability reports with a broad stakeholder base.

These communication channels are particularly vital for fostering strong relationships with financial and strategic partners. For instance, in 2024, RBPlat's investor relations team actively engaged with stakeholders, providing detailed insights into the company's strategic direction and financial health, reinforcing transparency and trust.

Industry Forums and Publications

Royal Bafokeng Platinum actively engages with the broader mining and PGM industry. This participation occurs through various channels, including forums, conferences, and contributions to industry publications. Such engagement is crucial for maintaining the company's reputation and effectively communicating its strategic direction and achievements within the sector.

In 2024, Royal Bafokeng Platinum's commitment to industry dialogue was evident. For instance, participation in key mining conferences allowed for direct interaction with peers, regulators, and investors, fostering a shared understanding of industry challenges and opportunities. These platforms are vital for sharing insights and shaping future industry practices.

The company's presence in industry publications further solidifies its thought leadership. By contributing articles and reports, Royal Bafokeng Platinum can highlight its operational successes, technological advancements, and commitment to sustainability. This transparency builds trust and reinforces its position as a responsible and forward-thinking player in the PGM market.

Key aspects of this engagement include:

- Industry Forums and Conferences: Providing platforms for knowledge exchange and networking with stakeholders.

- Industry Publications: Contributing expert insights and company updates to relevant trade journals and online platforms.

- Reputation Management: Actively shaping the narrative around the company's operations and strategic goals.

- Strategic Positioning: Communicating its value proposition and competitive advantages to the wider industry.

Public and Media Relations

Royal Bafokeng Platinum (RBPlat) actively managed its public and media relations throughout 2024 to highlight its operational successes and positive social contributions. This proactive communication strategy aimed to shape a favorable public image and enhance stakeholder trust amidst evolving industry dynamics.

Key initiatives included transparent reporting on environmental, social, and governance (ESG) performance, alongside updates on community development projects. RBPlat’s engagement sought to demonstrate its commitment to sustainable mining practices and its role as a responsible corporate citizen.

- Stakeholder Engagement: RBPlat’s media relations efforts in 2024 focused on building stronger relationships with key stakeholders, including local communities, government bodies, and investors, by providing clear and consistent information.

- Reputation Management: The company addressed industry challenges through open communication, aiming to mitigate negative perceptions and reinforce its reputation for resilience and responsible operations.

- Social Impact Communication: RBPlat showcased its significant social impact, detailing investments in education, healthcare, and infrastructure, which contributed to a positive perception of its community upliftment programs.

Royal Bafokeng Platinum's primary sales channel is its direct agreement with Anglo American Platinum, ensuring a consistent offtake for its PGM concentrate. This relationship is critical as Anglo American Platinum handles smelting, refining, and marketing. In 2024, sales to Anglo American Platinum were a significant revenue driver for RBPlat.

Customer Segments

Automotive catalyst manufacturers represent a crucial customer segment for platinum group metals (PGMs), with platinum, palladium, and rhodium being essential components in catalytic converters. These metals are vital for reducing harmful vehicle emissions, directly linking their demand to the automotive sector's performance and environmental regulations. In 2024, the automotive industry's recovery and the increasing stringency of emission standards globally continued to underpin strong demand for these PGMs.

Jewelry manufacturers represent a crucial customer segment for Royal Bafokeng Platinum, particularly for refined platinum. This precious metal has historically been a cornerstone of the luxury jewelry market, prized for its brilliance, durability, and hypoallergenic properties. In 2024, the demand for platinum jewelry remained robust, driven by consumers seeking high-quality, lasting pieces. The global jewelry market, valued at approximately $250 billion in 2023, saw platinum hold a significant, albeit niche, share, especially in high-end designs.

The Industrial and Chemical Industries represent a significant customer segment for platinum group metals (PGMs). These sectors leverage PGMs for their unique catalytic properties and durability in demanding applications. For instance, PGMs are crucial in the production of nitric acid, a key component in fertilizers and explosives, and in petroleum refining to improve fuel efficiency.

In 2024, the demand for PGMs in industrial catalysts remained robust, driven by stricter environmental regulations globally that necessitate advanced emission control technologies. The automotive sector, a major consumer of PGMs for catalytic converters, saw continued demand, though shifts towards electric vehicles are influencing long-term PGM usage patterns in this specific application.

Beyond catalysis, PGMs find specialized uses in electronics, such as in hard disk drives and electrical contacts due to their excellent conductivity and resistance to corrosion. The medical device industry also utilizes PGMs in pacemakers and other implantable devices, valuing their biocompatibility and reliability. This diverse application base underscores the broad reach of PGMs across various high-value industrial and chemical processes.

Precious Metals Traders and Investment Funds

Precious metals traders and investment funds represent a crucial customer segment for Royal Bafokeng Platinum, primarily driven by the global demand for Platinum Group Metals (PGMs). These entities invest in physical PGM bullion and various financial instruments, with their decisions heavily influenced by market prices and broader investment trends. For instance, in 2024, the price of platinum fluctuated, impacting the trading volumes and investment strategies of these funds. Their interest in PGMs is often tied to their use in industrial applications, such as catalytic converters, as well as their appeal as a store of value and a hedge against inflation.

This segment actively participates in the PGM market, seeking to profit from price movements and diversify their portfolios. Their investment strategies can range from short-term trading of futures contracts to long-term holdings of physical metals. The demand from these sophisticated investors directly impacts the liquidity and pricing of PGMs, making them a key consideration for producers like Royal Bafokeng Platinum.

- Market Demand Drivers: Investment demand for PGMs as a store of value and hedge against economic uncertainty.

- Financial Instruments: Trading in physical bullion, ETFs, futures, and other derivatives linked to PGM prices.

- Price Sensitivity: High sensitivity to global PGM market prices, driven by supply and demand dynamics.

- 2024 Market Context: Continued interest in PGMs for industrial applications (automotive, electronics) and investment purposes, despite price volatility.

Other PGM Producers (for toll treatment/synergy)

Other PGM Producers represent a crucial customer segment for Royal Bafokeng Platinum (RBPlat), particularly for toll treatment services. These producers, like Anglo American Platinum or Sibanye-Stillwater, may have excess processing capacity or require specialized refining for their own concentrate. This allows RBPlat to leverage its infrastructure and expertise, generating additional revenue streams beyond its direct sales. For instance, the significant transaction in 2024 involving Implats' acquisition of RBPlat highlights the strategic importance of such relationships and potential for synergy within the PGM sector.

This segment also includes producers looking for strategic partnerships or asset consolidation. The Implats acquisition of RBPlat, valued at approximately R10.9 billion (or roughly $576 million USD at the time of announcement in early 2024), underscores the drive for scale and operational efficiencies within the PGM industry. Such moves allow companies to integrate value chains, optimize resource utilization, and enhance market positioning.

- Toll Treatment Services: Other PGM producers utilize RBPlat's refining capacity for their own concentrate, creating a fee-based revenue stream.

- Strategic Synergies: Companies seek to acquire or partner with entities like RBPlat to gain access to processing capabilities, expand their resource base, or achieve operational efficiencies.

- Industry Consolidation: The Implats acquisition of RBPlat in 2024 demonstrates a trend towards consolidation, driven by the pursuit of greater market share and cost savings.

Royal Bafokeng Platinum (RBPlat) serves a diverse range of customer segments, each with unique demands for its platinum group metals (PGMs). These segments are critical to RBPlat's revenue generation and strategic positioning within the global PGM market.

Key customer groups include automotive catalyst manufacturers, who rely on PGMs for emission control, and jewelry manufacturers, valuing platinum's aesthetic and durable properties. Additionally, industrial and chemical sectors utilize PGMs for catalysis in processes like fertilizer production, while precious metals traders and investment funds engage with PGMs as both industrial commodities and investment assets.

Furthermore, other PGM producers represent a significant segment, particularly for RBPlat's toll treatment services, allowing for optimized processing and revenue diversification. This interconnectedness highlights RBPlat's integral role across multiple value chains within the PGM ecosystem.

| Customer Segment | Primary PGM Products/Services | 2024 Market Relevance |

|---|---|---|

| Automotive Catalyst Manufacturers | Platinum, Palladium, Rhodium | Continued strong demand driven by emission standards; EV transition presents long-term shifts. |

| Jewelry Manufacturers | Refined Platinum | Robust demand for luxury goods; platinum maintains appeal for quality and durability. |

| Industrial & Chemical Industries | PGMs (various) | Essential for nitric acid production, petroleum refining, electronics, and medical devices. |

| Precious Metals Traders & Investment Funds | Physical Bullion, ETFs, Futures | Investment demand influenced by price volatility and inflation hedge appeal; significant trading volumes. |

| Other PGM Producers | Toll Treatment Services | Strategic partnerships and consolidation trends, exemplified by the Implats acquisition of RBPlat in 2024. |

Cost Structure

Mining and processing operational costs represent the most significant portion of Royal Bafokeng Platinum's (RBPlat) expenses. These costs encompass a broad range of activities essential for extracting and refining platinum group metals.

Key drivers within this category include substantial labor wages, reflecting the workforce required for underground operations and processing. Energy consumption, particularly electricity for mining machinery and smelting processes, along with fuel for vehicles, is another major outlay. Consumables like explosives and reagents, alongside the ongoing maintenance of heavy-duty mining equipment and surface infrastructure, also contribute heavily to the operational cost base.

For the year ending December 31, 2023, RBPlat reported total cash operating costs of R10,559 million. This figure underscores the substantial investment needed to sustain their mining and processing activities, with labor and energy being particularly impactful components.

Royal Bafokeng Platinum's capital expenditure (CAPEX) is substantial, reflecting the immense investment needed to develop and expand its mining operations. For instance, the Styldrift project, a key growth initiative, demanded significant upfront capital for sinking shafts, establishing infrastructure, and acquiring specialized mining machinery.

These long-term investments are not merely about maintaining current production levels; they are foundational for future growth and efficiency. In 2023, the company reported CAPEX of R4.1 billion, a significant portion of which was allocated to Styldrift and the ongoing modernization of existing assets.

The acquisition of new mining equipment, from large-scale excavators to sophisticated processing technology, represents another critical component of their CAPEX strategy. This ensures they can access deeper ore bodies and process materials more effectively, directly impacting their cost structure and future revenue potential.

Royalties, taxes, and regulatory compliance represent significant costs for Royal Bafokeng Platinum. These include royalties paid to the Royal Bafokeng Nation for the right to mine, which are a direct cost of accessing the mineral resources. In 2023, the company reported paying R1.2 billion in royalties.

Corporate income tax is another substantial expense, reflecting the profitability of its operations. Furthermore, expenses are incurred to ensure adherence to South Africa's stringent mining regulations and environmental compliance standards, which are crucial for sustainable operations and maintaining a social license to operate.

Labour and Employee-Related Costs

Labour and employee-related costs are a significant expenditure for Royal Bafokeng Platinum due to the inherently labor-intensive nature of mining operations. These costs encompass not only salaries and wages but also crucial benefits, ongoing training programs to enhance skills and safety, and expenditures dedicated to ensuring a safe working environment for all employees.

In 2024, such costs represented a substantial portion of the company's overall operational expenses. For instance, the company reported employee-related costs that were a key driver of its cost of sales, reflecting the large workforce required for extraction and processing activities.

- Salaries and Wages: Direct compensation for the mining workforce.

- Employee Benefits: Including medical aid, retirement funds, and other statutory contributions.

- Training and Development: Investments in skills enhancement and safety protocols.

- Safety Expenditures: Costs associated with maintaining a secure and healthy mining environment.

Exploration and Development Costs

Royal Bafokeng Platinum's cost structure heavily relies on significant investment in exploration and development. These expenditures are crucial for identifying new mineral deposits and assessing their economic viability, ensuring the long-term sustainability of the company's operations. For instance, in 2023, the company reported capital expenditure of R1.7 billion, a substantial portion of which was allocated to sustaining and expanding its mining operations, including exploration and development activities.

The company incurs costs related to geological surveys, drilling programs, and extensive feasibility studies to determine the potential of new projects. These studies are vital for de-risking future investments and optimizing resource extraction strategies. Ongoing development costs are also a significant component, covering the infrastructure and equipment needed to bring new reserves into production and maintain existing ones.

- Geological Exploration: Costs associated with identifying and evaluating new platinum group metal (PGM) deposits.

- Feasibility Studies: Expenses incurred in conducting detailed technical and economic assessments for new mining projects.

- Resource Development: Investment in infrastructure, equipment, and personnel to access and extract PGMs from identified reserves.

- Reserve Replenishment: Ongoing expenditure to ensure a continuous pipeline of future production and maintain operational capacity.

Royal Bafokeng Platinum's cost structure is dominated by operational expenses, including labor, energy, and consumables, essential for mining and processing. Capital expenditures are substantial, particularly for projects like Styldrift, and are crucial for future growth and efficiency. Royalties, taxes, and regulatory compliance, such as the R1.2 billion in royalties paid in 2023, are also significant cost components, alongside ongoing investments in exploration and development to ensure long-term resource sustainability.

| Cost Category | 2023 Actual (R million) | Key Components |

|---|---|---|

| Total Cash Operating Costs | 10,559 | Labor, Energy, Consumables, Maintenance |

| Capital Expenditure (CAPEX) | 4,100 | Styldrift Project, Asset Modernization, New Equipment |

| Royalties | 1,200 | Payments to Royal Bafokeng Nation |

| Exploration & Development | 1,700 (part of CAPEX) | Geological Surveys, Drilling, Feasibility Studies |

Revenue Streams

Royal Bafokeng Platinum's main income source in 2024 was the sale of its platinum-rich concentrate. This concentrate was sold to Anglo American Platinum, which then handled the further refining and marketing of the precious metals. This arrangement formed the core of their revenue generation strategy.

Sales of palladium concentrate represent a crucial revenue stream for Royal Bafokeng Platinum, arising as a valuable co-product from their primary platinum group metal (PGM) mining operations. The demand for palladium, particularly from the automotive sector for catalytic converters, directly influences the financial performance generated from these sales.

In 2024, the price of palladium experienced fluctuations, impacting the overall revenue generated. For instance, while specific figures for Royal Bafokeng Platinum's palladium concentrate sales in 2024 are proprietary, the global average price of palladium hovered around $900-$1,000 per ounce for much of the year, reflecting ongoing industrial demand and supply dynamics.

Sales of rhodium concentrate represent a significant revenue stream for Royal Bafokeng Platinum. Rhodium, a highly prized platinum group metal (PGM), contributes substantially due to its essential use in automotive catalytic converters and its consistently high market value.

In 2024, rhodium prices have experienced volatility but remain elevated, underscoring its importance. For instance, average rhodium prices in early 2024 hovered around $4,000 per ounce, a testament to its scarcity and industrial demand, directly impacting the revenue generated from its sale.

Sales of Gold and Other Minor PGMs

Royal Bafokeng Platinum's revenue streams extend beyond platinum group metals (PGMs) to include the sale of gold and other minor PGMs. These by-products, recovered during the complex extraction process, represent a valuable diversification of income. For instance, in 2023, the company reported that the contribution from these other metals, including gold, silver, copper, and nickel, was significant, adding to the overall financial performance.

The extraction of gold alongside the primary PGMs is a natural outcome of the geological formations where these metals are found. Similarly, minor PGMs such as ruthenium and iridium, while present in smaller quantities, command high market prices and contribute meaningfully to the company's top line. This multi-metal recovery strategy enhances the economic viability of the mining operations.

- By-product Revenue: Gold, ruthenium, and iridium sales provide additional income streams.

- Geological Synergy: Extraction of these metals is intrinsically linked to PGM mining.

- Market Value: High prices for minor PGMs boost overall revenue contribution.

- 2023 Performance: The company benefited from the sales of these associated metals, enhancing financial results.

By-product Sales and Royalties (if applicable)

Beyond platinum group metals, Royal Bafokeng Platinum (RBPlat) also benefits from the sale of base metal by-products like copper and cobalt extracted during mining operations. These metals, though secondary to PGMs, contribute to a diversified revenue base.

In 2024, RBPlat continued to leverage its operational efficiencies to maximize the value derived from all extracted minerals. The company's focus on integrated processing allows for the effective recovery of these valuable by-products.

- Base Metal By-products: Revenue generated from the sale of copper and cobalt, recovered during PGM mining.

- Royalty Income: Earnings derived from royalty agreements with other mining entities operating in shared or adjacent areas.

Royal Bafokeng Platinum's revenue is primarily driven by the sale of platinum, palladium, and rhodium concentrates. These sales are made to Anglo American Platinum, which handles the downstream refining and marketing. The company also generates income from the sale of base metals like copper and cobalt, as well as minor PGMs such as gold, ruthenium, and iridium, which are recovered as by-products.

| Revenue Stream | Primary Metal | Key By-products | 2024 Market Context (Illustrative) |

|---|---|---|---|

| Concentrate Sales | Platinum | Palladium, Rhodium | Platinum prices averaged around $900-$1,000/oz in early 2024. |

| By-product Sales | Gold | Copper, Cobalt, Ruthenium, Iridium | Rhodium prices were volatile but remained high, near $4,000/oz in early 2024. |

Business Model Canvas Data Sources

The Royal Bafokeng Platinum Business Model Canvas is informed by comprehensive industry analysis, internal financial reports, and operational data from mining activities. These sources provide a robust foundation for understanding market dynamics, cost structures, and revenue streams.