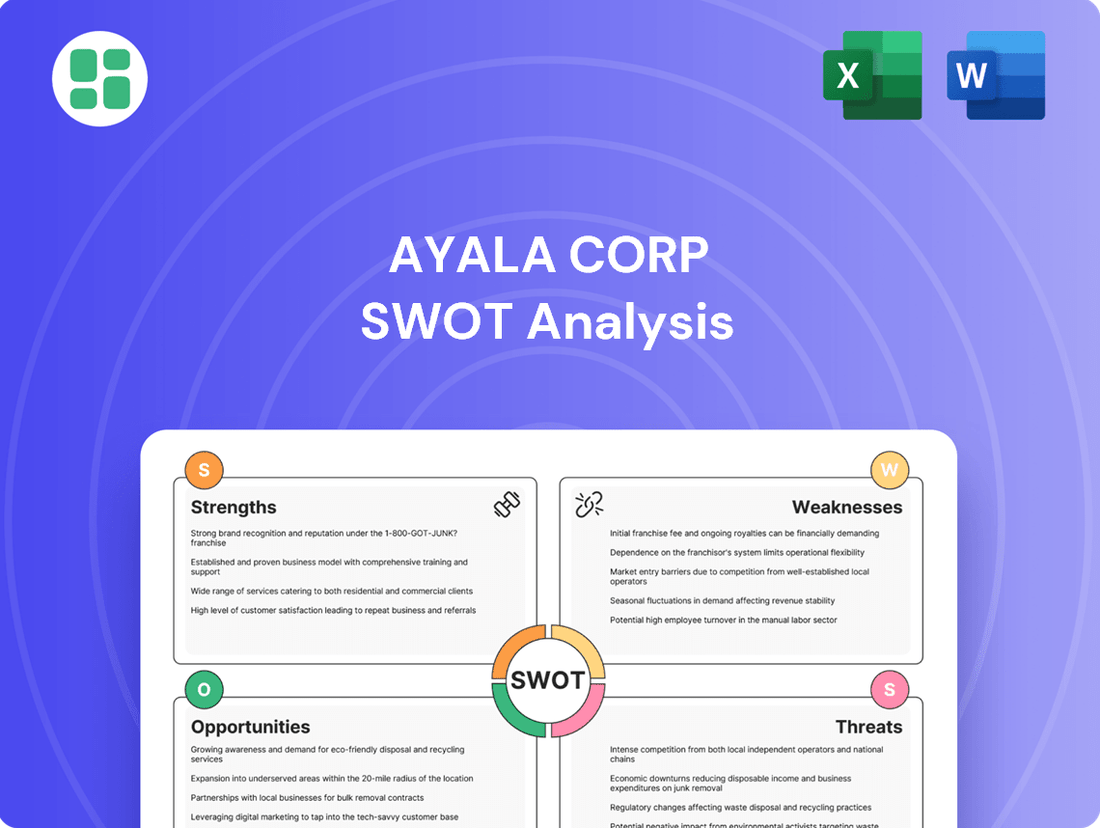

Ayala Corp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Ayala Corporation, a diversified conglomerate, boasts significant strengths in its established brands and broad market reach across key sectors. However, understanding its potential vulnerabilities and the competitive landscape is crucial for strategic planning. Our comprehensive SWOT analysis delves into these critical areas, providing actionable insights.

Want the full story behind Ayala Corp's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Ayala Corporation boasts a highly diversified portfolio, with significant stakes in key sectors like real estate through Ayala Land, banking via BPI, and telecommunications with Globe Telecom. This broad industry exposure, as of early 2024, provides a strong buffer against sector-specific downturns, contributing to more predictable financial performance. For instance, Ayala Land's consistent revenue generation from its extensive property developments and BPI's stable earnings from its wide customer base in banking underscore this strength.

Ayala Corporation boasts a formidable brand reputation, deeply rooted in its century-long legacy of developing integrated communities and providing essential services across the Philippines. This enduring trust, cultivated through consistent delivery of quality and innovation, translates directly into significant customer loyalty, a vital asset in sectors like real estate and financial services.

Ayala Corporation's robust financial standing as a major conglomerate provides it with exceptional access to capital, crucial for its diverse and often capital-intensive ventures. This financial stability is underscored by its credit rating, which aligns with the Philippine sovereign rating, signaling a low risk for lenders and investors.

This strong creditworthiness empowers Ayala to secure favorable terms on loans and tap into capital markets with greater ease, facilitating significant investments in areas like infrastructure development and renewable energy projects. For instance, in 2024, Ayala secured a significant P30 billion ($500 million USD) sustainability-linked loan, demonstrating its ongoing ability to access substantial funding for growth initiatives.

Strategic Investments in Growth Sectors

Ayala Corporation is strategically investing in high-growth areas like energy through ACEN, healthcare via AC Health, and infrastructure. These investments are designed to capture emerging market demands and support national development initiatives. For instance, ACEN reported a 22% increase in renewable energy capacity to 4,747 MW by the end of 2023, demonstrating tangible progress in its energy expansion.

These targeted investments in nascent businesses are aimed at achieving profitability, reflecting a proactive approach to future market opportunities. The company's commitment to these sectors is evident in its ongoing capital allocation, positioning Ayala for sustained growth.

- Expansion in Renewable Energy: ACEN's capacity grew to 4,747 MW by end-2023, a 22% year-on-year increase.

- Healthcare Focus: AC Health is expanding its network of clinics and hospitals to address growing healthcare needs.

- Infrastructure Development: Investments in infrastructure aim to support economic growth and improve public services.

Commitment to Innovation and Digital Transformation

Ayala Corporation's commitment to innovation is a significant strength, evident in its proactive embrace of new technologies. This digital transformation fuels growth across its diverse business portfolio.

Globe Telecom, a key Ayala subsidiary, exemplifies this with its ongoing 5G network expansion and investments in digital infrastructure. This strategic move is designed to enhance connectivity and unlock new revenue streams.

The success of GCash, an e-wallet platform, highlights Ayala's ability to leverage digital innovation to create successful new business models. In 2023, GCash played a crucial role in Globe's financial performance, contributing significantly to its attributable net income, demonstrating the tangible financial benefits of their digital-first approach.

- 5G Expansion: Globe Telecom continues its nationwide 5G rollout, aiming to improve data speeds and network capacity.

- Digital Infrastructure: Investments are being made in fiber broadband and data centers to support digital services.

- GCash Growth: The e-wallet platform saw substantial user adoption and transaction volume increases in 2023, bolstering Globe's digital segment.

Ayala Corporation's diversified business model acts as a significant strength, spreading risk across various sectors like real estate, banking, and telecommunications. This broad exposure, as seen in early 2024, contributes to more stable financial results, with key subsidiaries like Ayala Land and BPI consistently delivering reliable earnings. The conglomerate's strong brand reputation, built over a century, fosters deep customer loyalty across its diverse service offerings.

The company's robust financial health provides exceptional access to capital, evidenced by its credit rating aligning with the Philippine sovereign rating. This financial stability allows Ayala to secure favorable financing terms, as demonstrated by a P30 billion sustainability-linked loan obtained in 2024 for growth initiatives. Strategic investments in high-growth sectors such as renewable energy through ACEN, which expanded its capacity by 22% to 4,747 MW by end-2023, and healthcare via AC Health, position Ayala for future expansion and alignment with national development goals.

Ayala's commitment to innovation is a key driver of its success, particularly in the digital space. Globe Telecom's ongoing 5G network expansion and investments in digital infrastructure are enhancing connectivity. The remarkable growth of GCash, an e-wallet platform, underscores Ayala's ability to create successful digital business models, contributing significantly to Globe's financial performance in 2023.

| Business Segment | Key Subsidiary | 2023/2024 Highlight |

|---|---|---|

| Real Estate | Ayala Land | Consistent revenue generation from property developments. |

| Banking | BPI | Stable earnings from a wide customer base. |

| Telecommunications | Globe Telecom | Nationwide 5G rollout and digital infrastructure investment. |

| Energy | ACEN | 22% increase in renewable energy capacity to 4,747 MW by end-2023. |

| Digital Payments | GCash (via Globe) | Significant user adoption and transaction volume growth in 2023. |

What is included in the product

Delivers a strategic overview of Ayala Corp’s internal and external business factors, highlighting its diversified portfolio and market leadership against evolving economic and competitive landscapes.

Offers a clear, actionable framework to address Ayala Corp's strategic challenges by highlighting key strengths and mitigating weaknesses.

Weaknesses

Ayala Corporation's significant exposure to the Philippine economy remains a key weakness. Despite its diversified portfolio, the majority of its revenue streams are generated domestically, leaving it vulnerable to shifts in the country's economic landscape. For instance, a slowdown in the Philippine GDP growth, which was projected to be around 5.5% to 6.5% for 2024 by the Philippine government, could directly dampen consumer spending and business investment across Ayala's various sectors, from real estate to telecommunications.

This concentration means that factors like inflation, interest rate hikes, or even political uncertainty within the Philippines can have a pronounced negative effect on Ayala's overall financial performance. Any significant downturn in the domestic market could translate into reduced earnings and potentially lower shareholder returns, highlighting a critical dependency on national economic stability.

Ayala Corporation's diversified portfolio, spanning banking, telecommunications, and utilities, places it squarely in the path of significant regulatory and political risks. For instance, shifts in the Bangko Sentral ng Pilipinas' monetary policy or new regulations on data privacy for Globe Telecom could directly affect earnings. The company's exposure to infrastructure projects also means it's susceptible to changes in government spending or environmental regulations, impacting its bottom line.

Managing Ayala Corporation's diverse portfolio, which includes interests in real estate, telecommunications, banking, and water utilities, presents significant operational hurdles. This broad scope can lead to slower decision-making and challenges in efficiently allocating capital across its various business units.

For instance, while Ayala Land is a leading property developer, Globe Telecom operates in a rapidly evolving tech landscape, and BPI navigates the complexities of financial regulations. This inherent diversity, though a strength for resilience, can create management complexities that a more specialized company might avoid.

Capital-Intensive Operations

Ayala Corporation's involvement in capital-intensive sectors like real estate, infrastructure, and energy necessitates significant upfront investment. For instance, its infrastructure arm, AC Infrastructure Holdings, consistently invests in large-scale projects, and as of early 2024, ongoing projects represent billions in capital commitments.

These substantial capital expenditures can place a strain on the company's liquidity and may lead to increased debt levels. While Ayala Corporation generally maintains a healthy balance sheet, managing these high investment needs is crucial for preserving financial flexibility.

The company's commitment to developing new infrastructure projects, such as the expansion of its toll road network, requires continuous capital allocation. This focus, while driving future growth, inherently means a significant portion of its resources are tied up in long-term, high-cost ventures.

- High Capital Requirements: Core businesses demand substantial upfront investment, impacting cash flow.

- Liquidity Strain: Large expenditures can limit immediate financial maneuverability.

- Debt Management: Increased borrowing may be necessary to fund ongoing projects.

- Financial Flexibility: Balancing investment needs with debt levels is key to maintaining strategic options.

Performance Volatility in Certain Segments

Ayala Corporation's performance can be uneven across its diverse portfolio. While its established sectors like banking and real estate demonstrate resilience, other areas have experienced challenges. This unevenness can create volatility in overall earnings, impacting investor sentiment and the company's consolidated financial results.

For instance, the telecommunications segment, primarily represented by Globe Telecom, has faced increased competition and significant capital expenditure requirements. Similarly, ACEN Corporation, the energy arm, has navigated fluctuating energy prices and regulatory shifts. These factors have, at times, led to weaker contributions from these segments, dampening the impact of stronger performances elsewhere.

- Telecommunications (Globe): Faced with intense market competition and the need for ongoing network upgrades, Globe's profitability has seen pressure. For the first quarter of 2024, Globe reported a net income of PHP 5.6 billion, a decrease from PHP 6.4 billion in the same period of 2023, reflecting these ongoing challenges.

- Energy (ACEN): While ACEN is a significant player in renewable energy, its financial performance can be sensitive to commodity prices and project execution timelines.

- Segmental Contribution: The differing performance trajectories of these key segments mean that not all parts of Ayala Corporation consistently contribute to growth at the same pace, leading to some degree of earnings volatility.

Ayala Corporation's significant exposure to the Philippine economy remains a key weakness, making it vulnerable to domestic economic shifts. For example, the Philippine government projected GDP growth of 5.5% to 6.5% for 2024, but any slowdown could directly impact consumer spending and business investment across Ayala's diverse sectors.

The company's broad portfolio, spanning banking, telecommunications, and utilities, exposes it to substantial regulatory and political risks. Changes in monetary policy by the Bangko Sentral ng Pilipinas or new data privacy regulations for Globe Telecom could directly affect earnings, highlighting a dependence on favorable government actions.

Managing Ayala Corporation's diverse business units, from real estate to telecommunications and banking, presents significant operational complexities. This broad scope can lead to slower decision-making and challenges in optimizing capital allocation across its various subsidiaries, potentially hindering overall efficiency.

Ayala's involvement in capital-intensive sectors like infrastructure and energy requires substantial upfront investment, with ongoing projects representing billions in capital commitments as of early 2024. This can strain liquidity and necessitate increased borrowing, impacting financial flexibility.

Preview the Actual Deliverable

Ayala Corp SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Ayala Corporation has a prime opportunity to expand its footprint in emerging and high-growth sectors within the Philippines. This includes deepening its engagement in healthcare through AC Health, logistics via AC Logistics, and mobility solutions under AC Mobility.

These segments are experiencing robust growth, fueled by rising consumer demand for essential services and ongoing infrastructure development across the nation. For instance, the Philippine healthcare market is projected to grow significantly, with AC Health aiming to capture a larger share of this expanding industry.

AC Logistics is well-positioned to benefit from the increasing need for efficient supply chain solutions, a critical component for economic development. Similarly, AC Mobility can capitalize on the growing demand for integrated transportation and vehicle services, aligning with the country's infrastructure push.

Ayala Corporation can significantly boost its growth by fully leveraging its digital transformation initiatives. Globe Telecom, a key subsidiary, provides a robust digital infrastructure that can be the foundation for innovative new services. For instance, GCash, a leading mobile wallet, processed over PHP 3.4 trillion in transactions in 2023, showcasing immense potential for further expansion into new fintech solutions and digital platforms.

This strategic focus on technology allows Ayala to tap into emerging digital ecosystems and create diversified revenue streams. By investing in and expanding its digital offerings, the company can enhance customer engagement and operational efficiency across its diverse business segments, solidifying its market position in the evolving digital landscape.

The Philippine government's robust infrastructure development agenda, with a projected P2.5 trillion to P4.5 trillion in spending for 2024-2028, offers a substantial runway for Ayala Corporation. This push directly benefits Ayala's core businesses in power (ACEN), water (Manila Water), and telecommunications (Globe), all crucial components of modern infrastructure.

Ayala's strategic positioning in essential services, coupled with its expertise in managing large-scale projects, makes it a prime beneficiary of these government initiatives. The company's involvement in key sectors like energy generation and distribution, water supply, and digital connectivity will be paramount in realizing the nation's infrastructure goals.

Growing Middle Class and Urbanization in the Philippines

The Philippines' burgeoning middle class and accelerating urbanization are significant tailwinds, expected to fuel robust demand across key sectors like real estate, financial services, and telecommunications. This demographic evolution presents a substantial opportunity for companies like Ayala Corporation.

Ayala Land, a key subsidiary, is particularly well-positioned to capitalize on these trends. The company can expand its portfolio of residential, commercial, and mixed-use developments to cater to the growing needs of an increasingly urbanized and affluent population.

For instance, the Philippine Statistics Authority reported that by 2023, the urban population reached approximately 52% of the total, a figure projected to climb further. This, coupled with a growing disposable income among the middle class, directly translates into increased consumer spending and investment in housing and services.

- Rising Disposable Income: The Philippine middle class's purchasing power is on an upward trajectory, increasing demand for quality housing and consumer goods.

- Urban Infrastructure Development: Ongoing urbanization necessitates significant investment in infrastructure, creating opportunities for Ayala's diverse business units.

- Consumer Demand Growth: An expanding middle class directly correlates with higher demand for financial services, telecommunications, and retail offerings.

- Real Estate Market Expansion: Urban migration and economic growth are driving demand for residential and commercial spaces, benefiting Ayala Land's development pipeline.

Potential for Regional Expansion

Ayala Corporation's strong financial footing and proven track record in the Philippines present a compelling opportunity for expansion across Southeast Asia. The company's established expertise in key sectors like telecommunications, infrastructure, and real estate can be leveraged in neighboring high-growth markets. For example, with the Philippines' GDP projected to grow by 5.8% in 2024 and 5.9% in 2025, the success seen domestically can be a blueprint for regional ventures.

This regional push could involve direct replication of successful business models or strategic joint ventures and partnerships. Such moves would allow Ayala to capitalize on the burgeoning economies and increasing consumer demand across the ASEAN region. The company's robust balance sheet, evidenced by its consistent financial performance, provides the necessary capital for these ambitious expansion plans.

- Leveraging proven Philippine business models in high-growth ASEAN markets.

- Forming strategic partnerships to accelerate regional market penetration.

- Capitalizing on the economic growth projected for Southeast Asian nations.

Ayala Corporation is strategically positioned to capitalize on the Philippine government's ambitious infrastructure development plans, with an estimated P2.5 trillion to P4.5 trillion slated for spending between 2024 and 2028. This directly benefits its power, water, and telecommunications businesses, vital for national progress.

The company can further enhance its growth by leveraging digital transformation, building on Globe Telecom's robust infrastructure and GCash's significant transaction volume, which exceeded PHP 3.4 trillion in 2023. This digital push opens avenues for innovative fintech solutions and expanded digital platforms.

Ayala's strong domestic performance, with the Philippines' GDP projected to grow by 5.8% in 2024 and 5.9% in 2025, provides a solid foundation for regional expansion into high-growth Southeast Asian markets, leveraging established business models and strategic partnerships.

| Opportunity Area | Key Driver | Ayala Corp. Subsidiary |

|---|---|---|

| Digital Transformation | GCash transaction volume PHP 3.4T (2023) | Globe Telecom |

| Infrastructure Development | P2.5T-P4.5T Gov't Spending (2024-2028) | ACEN, Manila Water, Globe |

| Regional Expansion | Philippine GDP Growth 5.8% (2024), 5.9% (2025) | Various |

Threats

Ayala Corporation is navigating a landscape of fierce competition across its primary sectors. In real estate, established players like SM Prime Holdings are a constant challenge, while the banking and telecommunications industries also present formidable rivals, potentially squeezing profit margins and making customer acquisition more expensive.

This intensified competition can directly impact Ayala's market share and necessitate increased spending on marketing and product development. For instance, in the telecommunications sector, aggressive pricing strategies from competitors can put pressure on average revenue per user (ARPU), a key metric for profitability.

Adverse macroeconomic conditions, such as high inflation and rising interest rates, could significantly impact consumer spending and demand for services across Ayala's portfolio. For instance, the Philippines experienced inflation averaging 5.1% in 2023, a notable increase from 2022, which could dampen discretionary spending on real estate and other consumer-facing businesses.

A significant economic slowdown or recession, both globally and domestically, poses a substantial threat. This could lead to reduced loan demand for BPI, lower real estate sales for Ayala Land, and decreased demand for telecommunications services from Globe Telecom, ultimately affecting profitability across the conglomerate.

Ayala Corporation operates in sectors like banking and telecommunications, which are particularly susceptible to shifts in government regulations. For instance, in 2024, the Bangko Sentral ng Pilipinas (BSP) continued its focus on enhancing cybersecurity and data privacy for financial institutions, potentially requiring increased IT investments from BPI. Similarly, changes in the National Telecommunications Commission's (NTC) policies regarding spectrum allocation or pricing could impact Globe Telecom's infrastructure expansion plans and profitability.

Technological Disruption and Rapid Innovation

The relentless pace of technological advancement, especially in areas like telecommunications and financial services where Ayala Corporation has significant interests, presents a substantial threat. If the company cannot keep pace with these rapid changes, its market position could erode.

Emerging technologies and disruptive business models from nimbler competitors pose a risk to Ayala Corporation's established revenue streams. For instance, in the telecommunications sector, the rise of over-the-top (OTT) services continues to challenge traditional telco revenues. In 2024, the global telecommunications market is expected to see continued growth, but the competitive landscape is increasingly shaped by digital innovation, with companies that leverage AI and data analytics gaining an edge.

- Telecommunications Disruption: The ongoing shift to digital services and the increasing competition from global tech giants in areas like cloud computing and digital payments require constant adaptation.

- Financial Services Innovation: Fintech startups are rapidly introducing new payment solutions, lending platforms, and investment tools, potentially siphoning off market share from traditional financial institutions like BPI.

- AI and Automation: Failure to integrate artificial intelligence and automation across operations could lead to inefficiencies and a competitive disadvantage compared to more digitally advanced rivals.

- Cybersecurity Threats: As digital operations expand, so does the risk of cyberattacks, which could lead to financial losses and reputational damage if not adequately managed.

Geopolitical Risks and Natural Disasters

Ayala Corporation's significant presence in the Philippines exposes it to the volatility of geopolitical tensions within the region. These can manifest as trade disruptions or altered investment climates, impacting the company's various business units. For instance, the South China Sea disputes, while not directly impacting Ayala's core infrastructure, create an undercurrent of economic uncertainty that can influence consumer and business confidence across the archipelago.

The Philippines is also highly susceptible to natural disasters, a consistent threat to Ayala's operations. In 2023, the country experienced numerous typhoons, such as Typhoon Odette (Rai) which caused widespread damage. Such events can lead to substantial repair costs for infrastructure, like telecommunications networks operated by Globe Telecom, and disrupt supply chains for its manufacturing and automotive segments.

The economic ramifications of these natural disasters are considerable. Beyond direct damage, they can lead to prolonged power outages, hindering productivity across all Ayala businesses. For example, the aftermath of major typhoons often sees a slowdown in construction projects and a dip in consumer spending, directly affecting revenue streams for companies like Ayala Land and AC Motors.

- Geopolitical Instability: Regional tensions can disrupt trade flows and impact foreign direct investment, potentially affecting market access and growth opportunities for Ayala's diverse portfolio.

- Natural Disaster Frequency: The Philippines consistently ranks among the most disaster-prone countries globally, with typhoons, earthquakes, and volcanic activity posing a recurring threat to physical assets and operational continuity.

- Economic Disruption: Natural calamities can lead to significant infrastructure damage, estimated in the billions of pesos annually, causing widespread business interruptions and impacting consumer demand across sectors where Ayala operates.

- Infrastructure Vulnerability: Ayala's extensive investments in utilities, telecommunications, and real estate are directly exposed to damage from extreme weather events, necessitating continuous investment in resilience and disaster preparedness.

Intensified competition across real estate, banking, and telecommunications sectors poses a significant threat, potentially eroding market share and increasing customer acquisition costs. For instance, in 2023, the Philippine telecommunications sector saw fierce competition, impacting Globe Telecom's average revenue per user. Adverse macroeconomic conditions, including inflation averaging 5.1% in the Philippines in 2023, can dampen consumer spending and impact demand for Ayala's diverse offerings, from real estate to financial services.

Technological disruption, particularly from fintech and over-the-top services, requires constant adaptation to maintain market relevance. Failure to integrate AI and automation could lead to inefficiencies and a competitive disadvantage. Cybersecurity threats are also a growing concern, with the potential for financial losses and reputational damage as digital operations expand.

Geopolitical instability in the region can disrupt trade flows and impact foreign investment, affecting growth opportunities. The Philippines' high susceptibility to natural disasters, with numerous typhoons in 2023 causing billions in damage, poses a recurring threat to physical assets and operational continuity across Ayala's infrastructure-heavy businesses.

| Threat Category | Specific Examples | Potential Impact |

|---|---|---|

| Competition | SM Prime Holdings (Real Estate), Fintech startups (Financial Services), Global Tech Giants (Telecom) | Reduced market share, squeezed profit margins, increased operational costs |

| Macroeconomic Factors | Inflation (5.1% average in PH 2023), Rising Interest Rates, Economic Slowdown | Decreased consumer spending, reduced demand for services, lower profitability |

| Technological Disruption | OTT Services, Fintech Innovations, AI/Automation adoption | Erosion of traditional revenue streams, competitive disadvantage, operational inefficiencies |

| Geopolitical & Environmental | Regional Tensions, Natural Disasters (Typhoons, Earthquakes) | Trade disruptions, infrastructure damage, operational interruptions, increased resilience costs |

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of Ayala Corporation's official financial statements, recent market intelligence reports, and expert analyses of the Philippine business landscape to ensure a robust and informed assessment.