Ayala Corp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

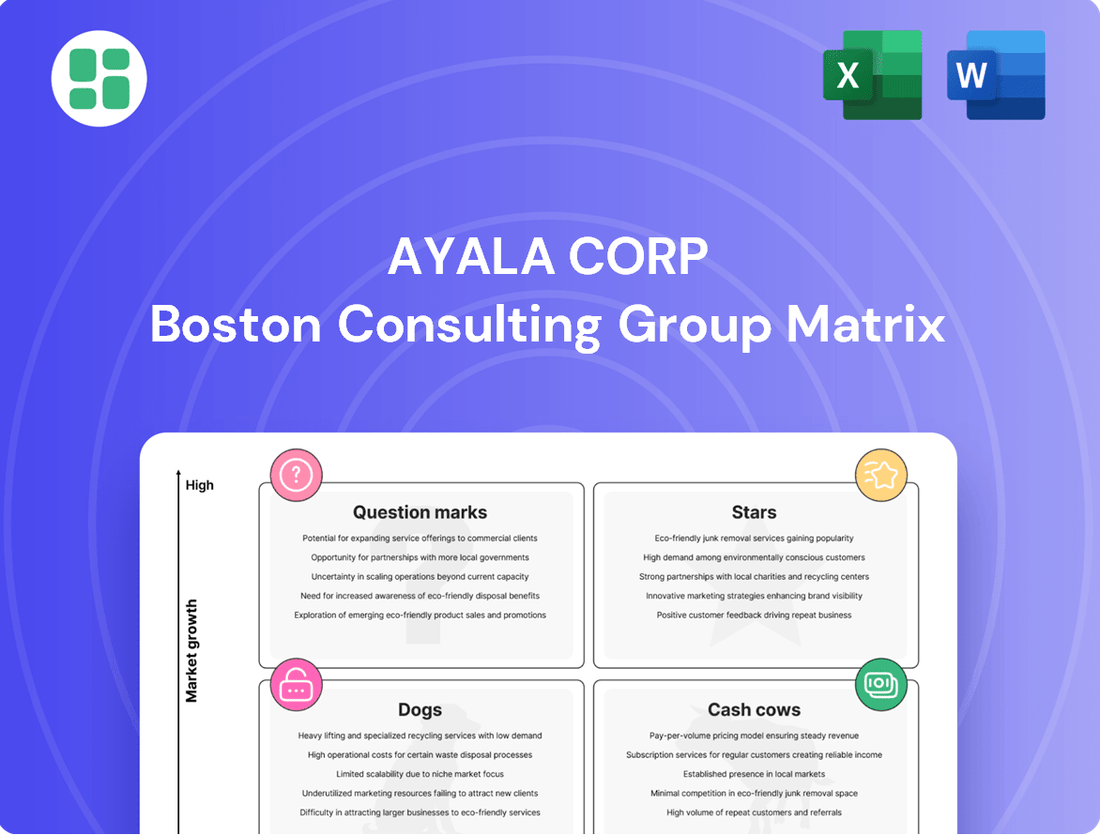

Ayala Corporation's BCG Matrix paints a fascinating picture of its diverse portfolio, showcasing a strategic blend of established leaders and emerging opportunities. Understanding these placements is crucial for informed decision-making.

This preview offers a glimpse into how Ayala's various business units are positioned for growth and profitability. To truly unlock the strategic potential and gain actionable insights for resource allocation and future investment, dive deeper into the complete BCG Matrix.

Purchase the full report to receive a comprehensive breakdown of each quadrant, complete with expert analysis and clear recommendations tailored to Ayala's unique market landscape, empowering you to navigate its strategic path with confidence.

Stars

ACEN Corporation, Ayala's dedicated energy subsidiary, is positioned as a Star in the BCG matrix. This is largely due to its substantial market share within the burgeoning renewable energy industry and its aggressive growth strategies. The company’s performance in 2024 reflected this, with a notable 27% increase in net income, primarily fueled by enhanced renewable energy generation.

Looking ahead, ACEN is projecting continued strong performance through 2026 and 2027 as its pipeline of new renewable energy projects becomes operational. The company has set an ambitious target of achieving 20 gigawatts of renewable energy capacity by 2030, actively pursuing this goal through expansions in the Philippines, Australia, and other global markets.

Ayala Land Premier (ALP) and Alveo, Ayala Land's premier residential brands, are firmly positioned as Stars in the BCG Matrix. These luxury segments are driving significant growth, contributing approximately two-thirds of Ayala Land's residential sales in 2024. This strong performance is fueled by increasing wealth among Filipinos and sustained demand for high-quality properties.

The premium residential market, where ALP and Alveo operate, continues to be a robust growth engine for Ayala Land. The company's strategy includes an aggressive rollout of new luxury developments and an expansion of commercial and industrial lot sales, underscoring the high growth potential and dominant market position of this segment.

GCash, operated by Mynt, stands as a leading digital financial services platform in the Philippines, boasting significant user adoption and a rapidly expanding digital payments market. Its dominance in this high-growth fintech sector, despite current cash consumption for expansion, strongly positions it as a Star within the BCG Matrix.

With a leading market share and clear potential for a future Initial Public Offering (IPO), GCash exemplifies a strong Star. The company is actively working to further solidify its digital footprint and advance its financial inclusion goals, reinforcing its growth trajectory.

Ayala Land Commercial & Industrial Lots

Ayala Land's Commercial & Industrial Lots segment is increasingly becoming a key growth engine, shifting from its established reputation. The company is actively pursuing these sales, signaling strong potential as businesses increasingly demand commercial spaces and industrial sites. This strategic pivot highlights a concentrated effort on a market segment experiencing both high demand and rapid expansion.

In 2024, Ayala Land has demonstrated a more assertive approach to these sales. This aggressive stance is supported by the robust demand for commercial and industrial properties. For instance, in the first quarter of 2024, Ayala Land reported a 27% increase in its total revenue, with its property development business, which includes these lots, showing significant contributions.

- Growing Demand: Businesses are actively seeking prime locations for expansion and operational needs.

- Strategic Focus: Ayala Land is prioritizing this segment due to its high growth and profitability potential.

- Market Performance: The company's financial reports for 2024 indicate strong revenue contributions from property development.

Ayala Land's Redevelopment Projects

Ayala Land's significant P13 billion investment in redeveloping its flagship malls, including Glorietta, Greenbelt, TriNoma, and Ayala Center Cebu, underscores a strategic move to bolster its market position. This initiative is designed to refresh these iconic retail destinations, ensuring they remain competitive and appealing to modern consumers by adapting to evolving shopping behaviors and preferences. These substantial upgrades are expected to enhance customer experience and drive foot traffic, reinforcing their status as market leaders.

The redevelopment strategy focuses on creating more engaging and experiential retail environments, a crucial factor in today's competitive landscape. By investing in these high-traffic, high-value assets, Ayala Land aims to solidify their star potential within its portfolio. This proactive approach to asset enhancement is key to maintaining high market share and profitability in the face of changing retail dynamics.

- Flagship Mall Redevelopment: Ayala Land is investing P13 billion to revitalize key malls like Glorietta, Greenbelt, TriNoma, and Ayala Center Cebu.

- Market Dominance Strategy: The goal is to cater to evolving consumer preferences and maintain market leadership in the retail sector.

- Enhanced Customer Experience: Redevelopments focus on creating more engaging and experiential retail spaces to attract and retain shoppers.

- Star Potential: These investments in existing, high-performing assets are projected to further enhance their value and market appeal.

ACEN Corporation, Ayala's renewable energy arm, is a clear Star. Its significant market share in the growing renewables sector and aggressive expansion plans are key drivers. In 2024, ACEN saw a notable 27% net income increase, largely due to improved renewable energy output.

Ayala Land Premier and Alveo, its luxury residential brands, are also Stars. These brands contributed about two-thirds of Ayala Land's residential sales in 2024, benefiting from rising Filipino wealth and strong demand for premium properties.

GCash, operated by Mynt, is a leading digital financial services platform in the Philippines, capturing a significant share of the rapidly expanding digital payments market. Its strong position in the high-growth fintech sector, despite ongoing investment for expansion, firmly places it as a Star.

Ayala Land's Commercial & Industrial Lots segment is increasingly showing Star potential. The company's proactive sales strategy in 2024, supported by robust demand for these properties, contributed significantly to its overall revenue growth.

| Ayala Corp. Business Unit | BCG Matrix Category | Key Performance Indicators (2024 Data & Projections) |

|---|---|---|

| ACEN Corporation | Star | 27% net income increase (2024); Targeting 20 GW renewable capacity by 2030. |

| Ayala Land Premier & Alveo | Star | Contributed two-thirds of Ayala Land's residential sales (2024); Strong demand in luxury segment. |

| GCash (Mynt) | Star | Leading digital financial services platform; High user adoption; Clear IPO potential. |

| Ayala Land Commercial & Industrial Lots | Star | Significant contribution to property development revenue (Q1 2024); Robust demand for commercial/industrial spaces. |

What is included in the product

Ayala Corp's BCG Matrix analysis identifies strategic priorities for its diverse portfolio, guiding investment and divestment decisions.

The Ayala Corp BCG Matrix provides a clear, visual roadmap, alleviating the pain of strategic uncertainty by pinpointing which business units require investment, divestment, or harvesting.

Cash Cows

The Bank of the Philippine Islands (BPI) stands as a definitive Cash Cow for the Ayala Corporation. Its consistent delivery of record profits and robust financial performance within the Philippines' mature banking sector solidifies this position. BPI's net profit surged by an impressive 20% in 2024, reaching an all-time high of P62 billion, fueled by strong revenue growth and an expanding loan book.

This consistent profitability allows BPI to generate substantial cash flow. These generated funds are crucial for supporting other ventures and investments across the broader Ayala Group, demonstrating its vital role in the conglomerate's overall financial strategy.

Ayala Land's established leasing portfolio, encompassing malls, offices, and hotels, functions as a classic Cash Cow within its business operations. These segments are characterized by their maturity, consistently generating substantial revenue with predictable, albeit lower, growth rates.

These mature businesses are the bedrock of Ayala Land's financial stability, providing a consistent and robust stream of cash flow. In 2024, the leasing and hospitality segments alone contributed P45.6 billion in revenue, underscoring their reliable performance and significant impact on the company's overall profitability.

Globe Telecom's core mobile and corporate data segments are firmly established as cash cows within Ayala Corporation's portfolio. These businesses, despite facing a more competitive landscape, continue to exhibit robust cash-generating capabilities and maintain significant market share. For instance, in 2024, Globe reported a substantial contribution from these core operations, underpinning its financial stability.

While the rapid expansion seen in prior years might be moderating, with single-digit revenue growth anticipated for 2025 in these segments, the sheer volume and consistent demand ensure a steady and substantial cash inflow. This reliable cash flow is crucial, enabling Globe to effectively manage its capital expenditures and consistently achieve positive free cash flows, a hallmark of a mature and profitable business.

Ayala Land's Core Residential Brands (Avida Land, Amaia)

Avida Land and Amaia, Ayala Land's core residential brands, are strong cash cows within the corporation's portfolio. Despite facing some headwinds in the middle-market segment, they maintain a significant market share and are recognized for their consistent performance.

These brands are crucial revenue drivers for Ayala Land's residential segment, generating substantial and reliable cash flow. While their growth trajectory might be more mature compared to the premium offerings, their established presence ensures ongoing profitability.

- Market Position: Avida Land and Amaia hold a solid position in the middle-market residential segment, demonstrating resilience against market fluctuations.

- Revenue Contribution: In 2023, Ayala Land reported a 24% increase in its overall revenue, with its residential segment playing a vital role, and Avida and Amaia are significant contributors to this success.

- Brand Strength: The consistent demand for Avida and Amaia properties underscores their brand equity and customer trust, ensuring sustained sales.

- Financial Stability: These brands provide a stable and predictable income stream, essential for funding other ventures within the Ayala Land ecosystem.

AC Industrials (excluding IMI)

The established segments within AC Industrials, excluding the more volatile IMI, are likely functioning as cash cows for Ayala Corporation. These mature industrial businesses, by their nature, generate consistent revenue. They typically require less capital expenditure to maintain their operations compared to newer, high-growth initiatives. This stability contributes significantly to Ayala Corporation's financial strength.

For instance, in 2023, Ayala Corporation's industrial segment, which includes these established businesses, demonstrated resilience. While specific profit breakdowns for each sub-segment are not always publicly detailed, the overall performance of industrial holdings indicates their role as reliable income generators. These operations are vital for funding other strategic investments within the conglomerate.

- Established industrial assets within AC Industrials likely act as cash cows.

- These segments provide stable revenue streams to Ayala Corporation.

- Lower reinvestment needs characterize these mature businesses.

- Their contribution enhances the conglomerate's overall financial stability.

Ayala Corporation's portfolio features several established businesses that act as Cash Cows, generating consistent profits and stable cash flows. These mature operations, while exhibiting slower growth, are vital for funding the conglomerate's expansion into new and emerging sectors. Their reliable financial performance underpins the overall strength and strategic flexibility of Ayala Corporation.

These Cash Cow businesses are characterized by their strong market positions and established customer bases, allowing them to maintain profitability even in mature industries. The significant cash generated from these ventures enables Ayala Corporation to pursue strategic investments, manage debt, and return value to shareholders.

For example, BPI's 20% net profit surge in 2024 to P62 billion highlights its Cash Cow status. Similarly, Ayala Land's leasing and hospitality segments contributed P45.6 billion in revenue in 2024, showcasing their dependable cash generation. Globe Telecom's core mobile and data services also provide a steady inflow, essential for capital expenditures.

| Business Unit | Segment | 2024 Contribution (Illustrative) | Growth Outlook (2025) | Role |

|---|---|---|---|---|

| Bank of the Philippine Islands (BPI) | Financial Services | P62 billion net profit | Moderate | Cash Cow |

| Ayala Land | Real Estate (Leasing & Hospitality) | P45.6 billion revenue | Low to Moderate | Cash Cow |

| Globe Telecom | Telecommunications (Core Services) | Significant contribution to revenue | Single-digit | Cash Cow |

Preview = Final Product

Ayala Corp BCG Matrix

The Ayala Corp BCG Matrix preview you see is the precise, unedited document you will receive upon purchase. This comprehensive analysis, detailing Ayala Corporation's business units within the BCG framework, is fully prepared for immediate strategic application. You can confidently expect the exact same professionally formatted report, ready for integration into your business planning and decision-making processes, with no watermarks or demo content.

Dogs

Ayala Corporation is strategically divesting smaller, non-core industrial assets. This move is part of a broader effort to streamline its business portfolio and generate capital. These particular assets often exhibit low market share and limited growth potential, meaning they consume resources without delivering substantial returns.

The company has set a target of $1 billion in divestments, and these less critical industrial holdings are key targets for sale. For instance, in 2023, Ayala Corporation completed the sale of its stake in a minor industrial subsidiary for an undisclosed sum, contributing to its capital generation goals.

Ayala Corporation's stake in Light Rail Manila Corporation (LRMC), the operator of LRT-1, is being considered for divestment. This move comes as LRMC faced an accounting loss in 2024, despite a fare increase approval. The loss stemmed from the impact of delayed fare adjustments and passenger numbers falling short of projections, suggesting challenges in profitability and market position.

AC Logistics, a relatively new player in Ayala Corporation's portfolio, faced significant challenges in 2024. The company reported widening losses, prompting strategic decisions such as ceasing operations for its last-mile delivery service, Entrego, and consolidating other business segments. This move highlights a segment with substantial negative cash flow and a weak competitive position.

The decision to shut down Entrego and streamline other operations strongly suggests that these logistics ventures fall into the Dogs category of the BCG Matrix. This classification signifies segments with low market share in a slow-growing or declining industry, demanding careful consideration for restructuring or potential divestment to free up capital for more promising ventures.

Specific Legacy Niche Ventures

Ayala Corporation's strategic review likely places certain legacy or niche ventures in the Dogs category of the BCG Matrix. These are often smaller, less impactful investments that aren't generating significant returns or requiring substantial capital. For instance, if Ayala were to divest a small, non-core manufacturing unit that contributed minimally to its overall revenue, it would fit this classification.

These ventures typically exhibit low market share and low growth potential. Their primary purpose in this category is to be managed for cash or prepared for divestiture. Ayala's ongoing portfolio rationalization efforts, aiming to streamline operations and focus on high-growth sectors, naturally identify such businesses.

- Low Market Share: Ventures with a negligible presence in their respective markets.

- Low Growth Potential: Industries or segments experiencing minimal expansion.

- Cash Neutrality: Typically neither a significant cash drain nor a major cash generator.

- Divestiture Candidates: Often considered for sale to reallocate resources to more promising areas.

Certain Manufacturing Assets

Certain manufacturing assets within Ayala Corporation, particularly those not directly tied to high-growth sectors or innovative technologies, could be positioned as Dogs in the BCG matrix. This classification suggests these operations may exhibit low market share and low market growth. For instance, Ayala's strategic divestment of non-core industrial assets, a trend observed in recent years, often targets businesses with limited growth potential or those that do not align with the company's future strategic direction.

These manufacturing segments might be characterized by mature markets with limited expansion opportunities and face intense competition, leading to a struggle for market dominance. Ayala's approach of streamlining its portfolio indicates a deliberate effort to shed such underperforming or less strategic units.

- Low Market Share: Many of these manufacturing operations may hold a small percentage of their respective market.

- Low Market Growth: The industries these assets operate in might be experiencing stagnation or decline.

- Divestment Focus: Ayala's strategy often involves divesting less strategic or underperforming manufacturing units.

- Resource Reallocation: These assets may be candidates for divestment to free up capital for more promising ventures.

Ayala Corporation's strategic portfolio review identifies certain ventures as "Dogs" in the BCG Matrix, characterized by low market share and low growth potential. These are often non-core industrial assets or segments struggling to gain traction. For instance, AC Logistics' widening losses in 2024, leading to the cessation of its Entrego last-mile delivery service, exemplifies a business unit likely falling into this category.

These "Dog" businesses typically consume resources without generating significant returns, making them prime candidates for divestment or restructuring. Ayala's stated target of $1 billion in divestments underscores its commitment to shedding such underperforming assets to reallocate capital towards more promising growth areas.

The consideration of divesting its stake in Light Rail Manila Corporation (LRMC) also points to potential "Dog" classification, especially given LRMC's accounting loss in 2024 despite a fare increase. This suggests challenges in market position and profitability.

Ayala Corporation's divestment of non-core industrial assets, such as a minor industrial subsidiary sold in 2023, aligns with the strategy of moving "Dogs" out of the portfolio. These assets, often in mature or declining industries, offer limited growth prospects and are managed for cash or sale.

| Business Segment Example | BCG Category | Rationale | 2024 Financial Indication |

|---|---|---|---|

| AC Logistics (Entrego) | Dog | Low market share in a competitive logistics sector, widening losses. | Widening losses, cessation of operations. |

| Certain Non-Core Industrial Assets | Dog | Low market share, limited growth potential, not strategically aligned. | Minimal contribution to overall revenue, targets for divestment. |

| Light Rail Manila Corporation (LRMC) | Potential Dog | Facing profitability challenges despite fare increases, potential for divestment. | Accounting loss in 2024. |

Question Marks

AC Health, Ayala Corporation's healthcare subsidiary, is positioned as a Question Mark in the BCG Matrix. This classification stems from its operation within the rapidly expanding healthcare sector, a market characterized by high growth potential.

The company is actively investing to broaden its service offerings, which include a network of clinics, pharmacies, and digital health platforms. This aggressive expansion strategy is designed to capture a larger market share in a dynamic industry.

Despite ambitious targets, such as becoming a $2 billion enterprise by 2035, AC Health reported combined losses in 2024. This financial performance underscores its current low market share, a hallmark of Question Marks, while simultaneously highlighting its significant growth prospects that necessitate continued substantial capital investment.

AC Mobility, encompassing electric vehicles and charging infrastructure, represents a high-growth segment for Ayala Corporation. This initiative is positioned as a Question Mark within the BCG framework because, while it's a burgeoning market with substantial future potential, its current market share remains relatively low as the ecosystem continues to develop.

Ayala's commitment to this sector is underscored by a significant $100 million financing package secured from the Asian Development Bank (ADB). This funding is earmarked for the procurement of electric vehicles and the establishment of crucial charging infrastructure, signaling strong confidence in the long-term viability and expansion of electric mobility.

While certain segments of AC Logistics might have been categorized as Dogs in the past, its strategic pivot towards new growth pillars like cold chain and cross-border logistics signals a move into more promising markets. These areas are capital-intensive, demanding substantial investment to capture market share in increasingly competitive but expanding logistics sectors.

For instance, the global cold chain logistics market was valued at approximately $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, highlighting the significant potential in this segment. Similarly, cross-border e-commerce logistics is experiencing robust expansion, driven by increasing online retail and global trade, with projections indicating continued strong growth in the coming years.

New Technology Investments (e.g., Merlin Solar)

Ayala Corporation's strategic investment in new technologies, exemplified by its backing of Merlin Solar, positions it within the Stars quadrant of the BCG Matrix. Merlin Solar, a company focused on advanced solar technology, secured $31 million in equity funding, highlighting Ayala's commitment to high-growth potential in emerging tech sectors. This investment reflects Ayala's strategy to build market share and establish a strong presence in these dynamic industries.

- High Growth Potential: Merlin Solar operates in the rapidly expanding renewable energy market, a sector projected for significant growth in the coming years.

- Capital Intensive: Investments in companies like Merlin Solar typically require substantial initial capital for research, development, and scaling operations to capture market opportunities.

- Market Share Expansion: Ayala's involvement signifies an intent to gain a competitive edge and increase its market share in the evolving technology landscape.

- Strategic Focus: This aligns with Ayala's broader objective of diversifying its portfolio and embracing innovation to drive future profitability.

New Infrastructure Projects (e.g., Ayala Greenfield Interchange)

New infrastructure projects, such as the Ayala Greenfield Interchange, represent significant long-term strategic plays for Ayala Corporation. These ventures are currently in their nascent stages, demanding considerable capital investment. While positioned in high-growth corridors like Southern Luzon, their market share and revenue generation capabilities are still developing.

The Ayala Greenfield Interchange, for instance, is part of a broader vision to enhance connectivity and spur economic activity in the region. As of early 2024, infrastructure spending in the Philippines has been a key government priority, with the Department of Public Works and Highways allocating a substantial budget for various projects. Ayala's involvement in such developments aligns with this national agenda.

- Strategic Investment: Ayala Greenfield Interchange is a long-term capital commitment, aiming to capitalize on anticipated regional growth.

- Early Stage Development: The project is still in its initial phases, meaning it has not yet achieved significant market penetration or profitability.

- High-Growth Area Focus: Its location in Southern Luzon targets a region with projected economic expansion and increasing demand for improved infrastructure.

- Capital Intensive: These infrastructure undertakings require substantial upfront financial resources before they can yield returns.

AC Health and AC Mobility are classified as Question Marks due to their operation in high-growth sectors with currently low market share.

These ventures require significant capital investment to expand their services and capture market potential, as seen with AC Health's ambitious growth targets and AC Mobility's substantial financing from the ADB.

The strategic pivot of AC Logistics into cold chain and cross-border logistics also places it in a Question Mark category, targeting expanding but competitive markets with high capital requirements.

New infrastructure projects like the Ayala Greenfield Interchange are also considered Question Marks, representing early-stage, capital-intensive investments in high-growth corridors with developing market share.

| Ayala Corp BCG Matrix: Question Marks | Sector | Growth Potential | Current Market Share | Capital Investment Needs | Key Initiatives/Data |

|---|---|---|---|---|---|

| AC Health | Healthcare | High | Low | Substantial | Aiming for $2 billion by 2035; reported losses in 2024. |

| AC Mobility | Electric Vehicles & Infrastructure | High | Low | Substantial | Secured $100 million from ADB for EVs and charging infrastructure. |

| AC Logistics (New Pillars) | Cold Chain, Cross-Border Logistics | High | Developing | High | Global cold chain market ~$200 billion (2023), >15% CAGR. |

| Infrastructure Projects (e.g., Ayala Greenfield Interchange) | Infrastructure | High (Corridor Growth) | Nascent | High | Focus on connectivity; aligns with government infrastructure spending priorities in early 2024. |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market intelligence, and industry trend analysis to provide a comprehensive view of Ayala Corporation's business units.