Ayala Corp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Ayala Corp navigates a complex landscape shaped by intense rivalry and significant buyer bargaining power, particularly in its diverse sectors. Understanding these forces is crucial for any strategic player in its operating environment.

The complete report reveals the real forces shaping Ayala Corp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For Ayala Land's real estate operations, the supplier landscape for construction materials, labor, and specialized services is largely fragmented. This means there are many suppliers available, which generally weakens the bargaining power of any single supplier. This broad availability of options allows Ayala Land to secure better pricing and terms for its extensive projects.

While some specialized or imported materials might have a more limited supplier pool, the overall market still presents alternatives. This diversification in sourcing prevents over-reliance on any one vendor, further strengthening Ayala Land's negotiating position. For instance, in 2023, the Philippine construction sector saw a steady supply of key materials like cement and steel, with domestic production meeting a significant portion of demand, thereby limiting the leverage of individual material suppliers.

Globe Telecom, like many in the industry, depends on a relatively small group of global providers for essential network gear, software, and specialized telecom services. These suppliers, often holding unique technological advantages and deep expertise, wield considerable influence.

For instance, major players like Nokia and Ericsson are key providers of 5G infrastructure, a critical area for Globe's expansion. The proprietary nature of their advanced solutions means Globe has limited alternatives, tipping the scales towards moderate to high supplier bargaining power. This concentration is a recurring theme across the telecom landscape.

However, Globe's substantial market presence and its ability to enter into lengthy, high-volume contracts do offer some counter-leverage. By committing to significant purchases and long-term partnerships, Globe can negotiate more favorable terms, mitigating some of the suppliers' inherent power.

Ayala Corporation's banking arm, Bank of the Philippine Islands (BPI), relies on various financial technology providers for its digital operations, cybersecurity, and data analytics. The increasing specialization and innovation within the fintech sector can indeed grant significant leverage to certain providers, particularly those offering advanced, in-demand solutions.

For instance, the global fintech market was valued at approximately $11.2 trillion in 2023 and is projected to grow substantially. This expansion means specialized providers of cloud infrastructure, AI-driven fraud detection, or advanced payment gateways can command higher prices or more favorable terms.

However, BPI's substantial market share and its strategic capacity to develop solutions internally or integrate offerings from multiple vendors serve as crucial counterbalances. This allows BPI to negotiate more effectively and reduce its dependence on any single technology supplier, thereby moderating the bargaining power of these fintech providers.

Energy Sector Equipment and Fuel Suppliers

Ayala Corporation's significant expansion into the energy sector, especially with ACEN's focus on renewables, places it in direct engagement with suppliers of critical components such as solar panels and wind turbines. The bargaining power of these suppliers can be moderate, influenced by global supply chain dynamics and the specialized nature of the technology. For instance, in 2023, the global solar panel market saw prices fluctuate due to raw material costs and manufacturing capacity, impacting supplier pricing power.

Ayala's strategy to mitigate supplier leverage involves forging long-term supply agreements and diversifying its sourcing across multiple manufacturers and regions. This approach helps to secure consistent supply and potentially negotiate more favorable terms, especially as demand for renewable energy infrastructure continues to grow. The company's commitment to sustainability also means a focus on suppliers with robust environmental and social governance (ESG) practices, which can sometimes align with cost-effectiveness.

- Supplier Concentration: The market for specialized renewable energy equipment can have a limited number of key manufacturers, potentially granting them higher bargaining power.

- Input Costs: Fluctuations in the cost of raw materials like polysilicon for solar panels or rare earth metals for wind turbines directly affect supplier pricing.

- Switching Costs: For Ayala, the cost and complexity of switching to alternative suppliers for highly specialized equipment can be substantial, reinforcing existing supplier relationships.

- Availability of Substitutes: While direct substitutes for advanced solar panels or wind turbines are limited, technological advancements can shift the competitive landscape over time.

Healthcare Equipment and Pharmaceutical Suppliers

The bargaining power of suppliers for AC Health, Ayala Corporation's healthcare arm, is a critical factor. These suppliers range from medical equipment manufacturers to pharmaceutical companies. The leverage these suppliers hold often hinges on factors like product exclusivity, patent status, and the overall concentration within their respective markets. For instance, in 2024, the pharmaceutical sector saw continued innovation, with a significant number of new drug patents being granted, potentially increasing the bargaining power of those specific suppliers.

When it comes to generic medical supplies or widely available equipment, supplier power tends to be relatively low. This is because AC Health can often source these items from multiple vendors, fostering a competitive environment that keeps prices in check. However, the landscape shifts dramatically when dealing with specialized, patented medical devices or proprietary pharmaceuticals. In these cases, suppliers can command higher prices due to limited alternatives and the essential nature of their offerings.

AC Health's strategic sourcing and long-term partnerships play a role in mitigating supplier power. By diversifying its supplier base where possible and negotiating favorable terms, the company aims to balance the influence of its supply chain partners. The global healthcare supply chain, particularly in 2024, has experienced volatility due to geopolitical factors and raw material availability, further emphasizing the need for robust supplier relationship management.

- Supplier Concentration: Markets with few dominant manufacturers for specific equipment or drugs grant suppliers higher bargaining power.

- Product Uniqueness and Patents: Patented pharmaceuticals or proprietary medical technologies significantly elevate supplier leverage.

- Availability of Substitutes: For non-patented, readily available items, AC Health benefits from a wider choice of suppliers, reducing individual supplier power.

- Cost of Switching: High switching costs for AC Health to change suppliers for specialized equipment can also empower existing suppliers.

For Ayala Corporation's diverse portfolio, the bargaining power of suppliers varies significantly across its business units. While some sectors face highly concentrated supplier markets with substantial leverage, others benefit from fragmented supply chains offering greater negotiation flexibility.

The overall impact on Ayala Corporation is a mixed bag, requiring tailored strategies for each subsidiary to manage supplier relationships and costs effectively. This dynamic is crucial for maintaining profitability and operational efficiency across the group.

| Ayala Corp Business Unit | Supplier Bargaining Power Assessment | Key Influencing Factors |

|---|---|---|

| Ayala Land (Real Estate) | Low to Moderate | Fragmented market for most construction materials; limited suppliers for specialized components. |

| Globe Telecom (Telco) | Moderate to High | Concentration among global network gear providers; proprietary technology. |

| BPI (Banking) | Moderate | Specialized fintech providers; BPI's scale and internal development capabilities. |

| ACEN (Energy) | Moderate | Global supply chain for renewables; specialized technology; ESG focus. |

| AC Health (Healthcare) | Low to High | Generic supplies vs. patented pharmaceuticals/devices; supplier concentration. |

What is included in the product

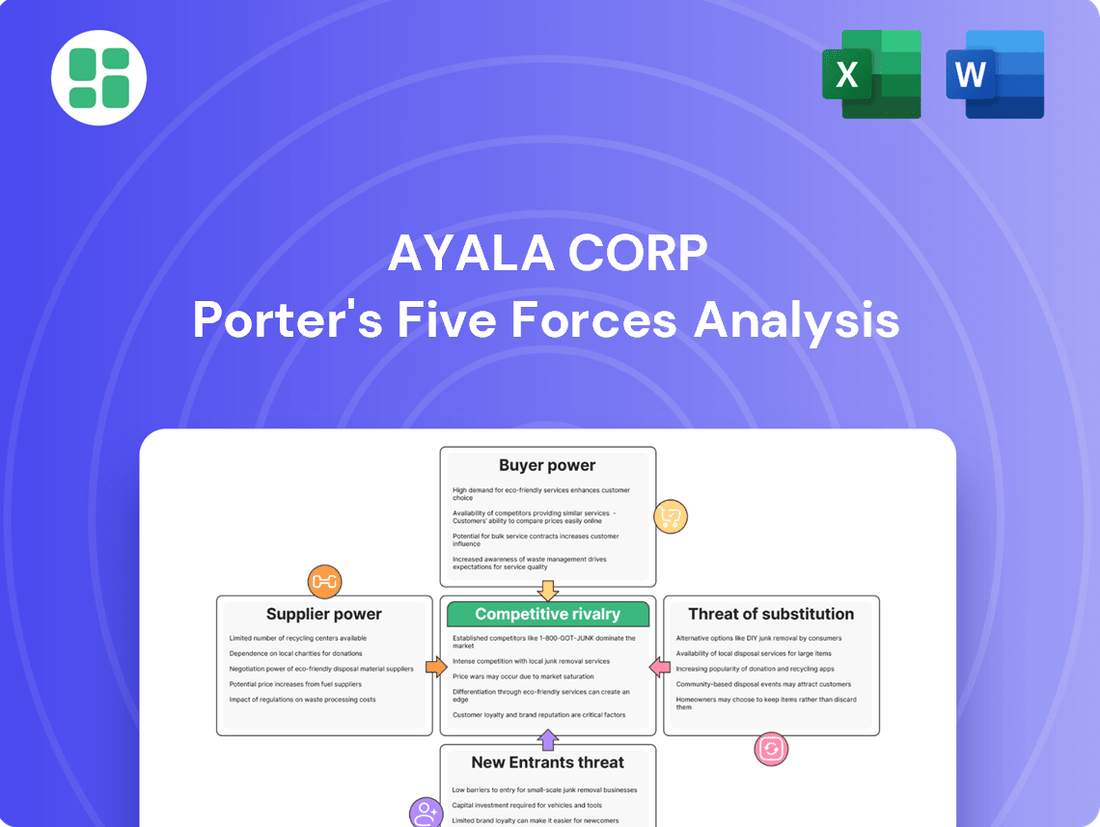

This Porter's Five Forces analysis for Ayala Corp dissects the competitive intensity within its diverse business segments, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly visualize competitive intensity across all five forces, enabling rapid identification of strategic vulnerabilities and opportunities for Ayala Corp.

Customers Bargaining Power

Ayala Land caters to a wide array of clients, including individual homeowners, major corporate tenants, and various commercial enterprises. This broad customer base, combined with robust demand for property in prime Philippine locations, generally keeps individual customer bargaining power in check.

While significant corporate clients might negotiate more favorable terms, the vast majority of retail customers possess limited leverage to dictate prices or terms. For instance, in 2024, Ayala Land reported a 15% year-on-year increase in revenue, indicating sustained demand across its segments despite potential negotiations with larger clients.

Globe Telecom's customers, especially in the prepaid mobile sector, are highly price-sensitive. This is driven by the intense competition from other major telecommunications providers. In 2024, the Philippine telecommunications market continues to see aggressive pricing strategies from all major players, including Globe, Smart, and DITO, making it easy for consumers to switch for better deals.

The ease of switching providers, coupled with the growing availability of more affordable prepaid fiber broadband options, further amplifies customer bargaining power. This means Globe must constantly innovate and offer competitive pricing to retain its subscriber base, particularly in the high-volume prepaid segment.

BPI's diverse customer base, from individual savers to large corporations, finds their ability to negotiate terms enhanced by a growing array of digital banking and fintech alternatives. This heightened competition, exemplified by the emergence of digital banks, grants customers greater leverage to seek out more favorable rates and superior service offerings, compelling BPI to continuously adapt.

Energy Consumers with Limited Direct Influence

For Ayala Corporation's energy ventures, the bargaining power of individual energy consumers is generally low. This is primarily because electricity distribution is a heavily regulated sector, meaning prices and terms are often set by governmental bodies rather than direct negotiation with each consumer. For instance, in the Philippines, the Energy Regulatory Commission (ERC) plays a crucial role in approving power rates.

However, larger entities can exert some influence. Major industrial or commercial users, due to their significant energy consumption, may have a degree of negotiation power, particularly when considering long-term supply agreements or exploring the feasibility of on-site power generation. This can create a more nuanced dynamic within the broader customer base.

- Limited Individual Consumer Power: Direct negotiation power for residential and small commercial energy consumers is minimal due to regulated pricing structures.

- Bulk Consumer Influence: Large industrial and commercial clients may possess some bargaining leverage for bulk energy purchases or by considering captive power generation.

- Regulatory Oversight: The ultimate price setting and terms for energy supply are significantly influenced by regulatory bodies like the Energy Regulatory Commission (ERC) in the Philippines.

Healthcare Patients and Managed Care

The bargaining power of individual patients within the healthcare sector, particularly for critical or emergency services, is typically quite limited. However, this dynamic shifts significantly with the increasing influence of managed care organizations and large corporate purchasers. These entities, representing substantial patient volumes, actively negotiate for favorable pricing and contract terms with healthcare providers like those under AC Health.

For instance, in 2024, major health insurance providers and large employers continued to consolidate their purchasing power, demanding greater transparency and cost-effectiveness from healthcare systems. This trend puts pressure on providers to optimize operations and manage expenses to maintain competitive service agreements.

- Low Individual Patient Power: Essential healthcare services often leave patients with little room to negotiate prices.

- HMO and Corporate Influence: Health Maintenance Organizations (HMOs) and large corporate clients wield significant bargaining power due to aggregated patient demand.

- Pricing and Service Pressure: These powerful buyers can exert considerable pressure on AC Health regarding pricing structures and the scope of services offered.

- 2024 Market Trends: Consolidation among payers and employers in 2024 amplified their ability to negotiate favorable terms with healthcare providers.

Customers of Ayala Corporation's various subsidiaries exhibit varying degrees of bargaining power. For Ayala Land, while individual buyers have limited sway, large corporate tenants can negotiate terms, and sustained demand in 2024, reflected in a 15% revenue increase, generally offsets this. Globe Telecom faces price-sensitive prepaid customers due to intense competition, making switching easy, a trend amplified by affordable broadband options in 2024.

BPI customers benefit from digital banking alternatives, increasing their leverage for better rates and service, pushing BPI towards continuous adaptation. In energy, individual consumers have minimal power due to regulated pricing, but large industrial users can negotiate long-term contracts. For AC Health, individual patients have low bargaining power for essential services, but HMOs and large employers, consolidating their influence in 2024, exert significant pressure on pricing and service agreements.

| Ayala Corp Subsidiary | Customer Segment | Bargaining Power Level | Key Influencing Factors (2024) |

|---|---|---|---|

| Ayala Land | Individual Homeowners | Low | High demand for prime locations |

| Ayala Land | Corporate Tenants | Moderate | Volume of space leased, negotiation for terms |

| Globe Telecom | Prepaid Mobile Users | High | Price sensitivity, ease of switching providers, competitive market |

| BPI | Individual Savers/Borrowers | Moderate | Availability of digital banking and fintech alternatives |

| Ayala Corp Energy | Individual Consumers | Low | Regulated pricing structures (e.g., ERC approval) |

| Ayala Corp Energy | Industrial/Commercial Users | Moderate | Significant consumption volume, long-term contracts |

| AC Health | Individual Patients | Low | Critical/emergency service needs |

| AC Health | HMOs/Corporate Purchasers | High | Aggregated patient volumes, demand for cost-effectiveness and transparency |

Preview the Actual Deliverable

Ayala Corp Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Ayala Corporation, providing a detailed examination of its competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can be confident that this professionally formatted analysis is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The Philippine telecommunications sector is a battleground, with Globe Telecom, PLDT, and Converge ICT leading the charge. This intense rivalry means companies are constantly duking it out through aggressive pricing strategies and rapid network build-outs, especially with the rollout of 5G and fiber broadband. For instance, in 2023, the capital expenditures of these major players reflected this competitive pressure, with PLDT investing PHP 89 billion and Globe Telecom spending PHP 89.1 billion on their networks, underscoring the need for continuous, substantial investment to stay ahead.

Ayala Land, a titan in Philippine real estate, navigates a fiercely competitive arena. Developers like SM Prime Holdings and Robinsons Land Corporation are formidable rivals, constantly innovating and expanding their portfolios across residential, commercial, and leisure sectors. This intense rivalry means constant pressure to secure prime land, offer attractive pricing, and deliver superior project quality.

The banking sector, BPI's primary arena, is intensely competitive. Traditional giants, nimble local banks, and burgeoning digital banks and fintech firms all vie for market share. This rivalry is fueled by aggressive pricing on interest rates, a relentless pursuit of service innovation, rapid digital transformation, and a sharp focus on enhancing customer experience.

BPI's robust financial performance in 2024, marked by a reported net income of PHP 49.4 billion for the first nine months, underscores its resilience and strategic positioning within this dynamic and challenging landscape. This financial strength allows BPI to invest in digital capabilities and customer-centric initiatives, crucial for staying ahead.

Emerging Competition in Energy and Infrastructure

Ayala Corporation's significant investments in energy through ACEN and its infrastructure projects are encountering robust competition. This rivalry stems from both other major Philippine conglomerates with diversified portfolios and highly specialized firms focusing exclusively on these capital-intensive sectors.

The energy and infrastructure landscapes, while typically characterized by high barriers to entry like substantial capital requirements and complex regulatory hurdles, are seeing intensified competition. This is particularly evident in the renewable energy segment, where government initiatives to boost growth are attracting new players and encouraging existing ones to expand their operations.

For instance, ACEN's 2023 performance, which saw significant capacity additions, operates within a market where competitors like San Miguel Corporation are also aggressively pursuing large-scale energy and infrastructure development. The Philippine government's push for renewable energy, aiming for a 35% share in the power generation mix by 2030, creates a dynamic environment where multiple entities vie for market share and project opportunities.

- Intensified Rivalry: Ayala's energy (ACEN) and infrastructure businesses face strong competition from diversified conglomerates and specialized industry players.

- Sector Dynamics: High capital needs and regulatory approvals define these sectors, yet new entrants and expansions by incumbents are increasing competitive pressure.

- Renewable Energy Focus: Government promotion of renewables is a key driver, intensifying rivalry as more companies, including existing conglomerates, expand their presence in this growth area.

Fragmented yet Growing Healthcare Market

The competitive rivalry within the Philippine healthcare sector is intense, characterized by a fragmented landscape that is nonetheless experiencing significant growth and attracting new players. Ayala Corporation's health arm, AC Health, navigates this environment by contending with a diverse array of competitors, including established private hospital groups, numerous standalone clinics, and various pharmaceutical firms. This dynamic is further shaped by the ongoing implementation of the Universal Health Care Act, which is projected to boost demand for healthcare services across the board.

The Philippine healthcare market is a prime example of a fragmented yet rapidly expanding industry. In 2023, the healthcare sector's contribution to the Philippine GDP was substantial, with continued growth anticipated in the coming years. This expansion fuels investment, drawing in both domestic and international entities. AC Health's competitive set includes major private hospital operators like Metro Pacific Health, which manages a significant number of hospitals nationwide, as well as smaller, specialized clinics and a vast network of pharmaceutical distributors and manufacturers.

Key competitive factors include service quality, pricing, accessibility, and the ability to integrate technology. The Universal Health Care Act, enacted in 2019, is a significant driver of demand, aiming to provide all Filipinos with access to health services. This policy shift intensifies competition as providers vie to serve an expanded patient base, particularly in primary and outpatient care settings. For instance, the Department of Health reported a notable increase in PhilHealth benefit utilization in 2023, underscoring the growing demand for subsidized healthcare services.

- Fragmented Market: Numerous private hospitals, clinics, and pharmaceutical companies operate across the Philippines.

- Rapid Growth: The healthcare sector is a key growth area, attracting substantial investment.

- Diverse Competitors: AC Health faces competition from large hospital groups, independent clinics, and pharmaceutical players.

- UHC Act Influence: The Universal Health Care Act is increasing demand and reshaping competitive dynamics by emphasizing accessible healthcare.

Ayala Corporation's diverse business units operate in markets with varying levels of competitive rivalry. In telecommunications, intense competition among Globe, PLDT, and Converge ICT drives aggressive pricing and network expansion, as evidenced by their substantial 2023 capital expenditures. Similarly, Ayala Land faces formidable rivals like SM Prime and Robinsons Land in the real estate sector, necessitating continuous innovation and strategic land acquisition.

The banking sector, where BPI is a key player, is highly competitive, with traditional banks, digital banks, and fintech firms vying for market share through service innovation and digital transformation. BPI's strong financial performance in the first nine months of 2024, with a net income of PHP 49.4 billion, highlights its ability to compete effectively in this dynamic environment.

| Ayala Corp. Business Unit | Key Competitors | Competitive Intensity | Key Competitive Factors | Relevant 2023/2024 Data Point |

|---|---|---|---|---|

| Telecommunications (Globe) | PLDT, Converge ICT | High | Pricing, Network Expansion (5G, Fiber) | Globe's 2023 Capex: PHP 89.1 billion |

| Real Estate (Ayala Land) | SM Prime Holdings, Robinsons Land | High | Land Acquisition, Pricing, Project Quality | N/A (General Market Dynamics) |

| Banking (BPI) | Other Banks, Digital Banks, Fintech | High | Pricing, Service Innovation, Digitalization | BPI's Jan-Sep 2024 Net Income: PHP 49.4 billion |

SSubstitutes Threaten

The rise of digital communication platforms presents a significant threat of substitutes for traditional telecom services like those offered by Globe Telecom. Over-the-top (OTT) applications, such as WhatsApp, Viber, and Telegram, allow users to send messages and make voice/video calls using internet data, often at no additional cost beyond their data plan. This directly erodes Globe's revenue from traditional SMS and voice services, which historically formed a substantial portion of their income. For instance, in 2023, while mobile data revenue continued to grow, the shift towards OTT services meant that the average revenue per user (ARPU) for traditional services saw continued pressure.

In the real estate sector, alternatives to outright property ownership are emerging, notably long-term rentals and co-living arrangements. These options, especially prevalent in urban centers, can significantly impact demand and pricing, particularly within the mid-market and affordable housing segments. For instance, the rental market in Metro Manila saw a median rent increase of 4.5% in early 2024 compared to the previous year, indicating a sustained demand for rental solutions.

Fintech and digital wallets present a substantial threat to traditional banking, offering streamlined payment and remittance services. For instance, GCash, an affiliate of Ayala's Globe Telecom, saw its user base surge to over 60 million by the end of 2023, demonstrating the growing adoption of these digital alternatives.

These platforms effectively substitute for many core banking functions, including person-to-person transfers and bill payments, often at a lower cost and with greater convenience than traditional bank channels.

The increasing functionality of these digital wallets, extending into micro-lending and investment products, further erodes the traditional banking sector's market share, compelling banks to innovate and adapt to remain competitive.

Alternative Energy Sources and Energy Efficiency

For Ayala Corporation's energy segment, the threat of substitutes is primarily driven by the increasing viability of alternative energy sources and improvements in energy efficiency. Rooftop solar installations for residential and commercial users, along with decentralized small-scale renewable projects, offer alternatives to traditional grid-supplied power. For instance, the Philippines saw a significant increase in distributed generation capacity, with rooftop solar alone contributing to the grid in various regions, potentially impacting demand for larger utility-scale projects.

Advancements in energy efficiency technologies further exacerbate this threat. Innovations in building insulation, smart grid management, and more efficient appliances reduce overall energy consumption, thereby lessening the need for new power generation capacity. This trend is global, with many countries, including those in Southeast Asia, actively promoting energy efficiency programs to meet climate goals and reduce energy bills.

- Alternative Energy Adoption: Growing consumer interest and decreasing costs for rooftop solar in markets like the Philippines directly substitute grid electricity.

- Energy Efficiency Gains: Technological advancements in appliances and building design reduce overall energy demand, impacting the need for traditional power sources.

- Policy Support: Government incentives for renewables and energy efficiency further encourage the adoption of these substitutes.

Home-based Care and Self-Medication in Healthcare

The threat of substitutes in healthcare, particularly for Ayala Corporation's AC Health, is significant. Home-based care and self-medication are readily available alternatives, especially for minor ailments, directly impacting the demand for traditional clinic and hospital services. For instance, the global telehealth market, a facilitator of home-based care, was valued at approximately USD 116.1 billion in 2023 and is projected to grow substantially, indicating a clear shift in patient behavior.

These substitutes can siphon off patients who might otherwise seek formal medical attention, thereby limiting AC Health's market share for certain services. Consider the rise of over-the-counter medications and readily accessible health information online; these empower individuals to manage their health without professional intervention for many conditions. This trend is further amplified by increasing health consciousness and a desire for convenience.

- Home-based care: Offers convenience and can be more cost-effective for managing chronic conditions or post-operative recovery.

- Self-medication: Patients often opt for over-the-counter drugs or remedies for common illnesses, bypassing professional consultations.

- Traditional and alternative medicine: Practices like acupuncture, herbal remedies, and chiropractic care are gaining traction as substitutes for conventional treatments.

- Telehealth growth: The expanding telehealth sector, with an estimated CAGR of over 15% in recent years, directly enables more home-based care solutions.

The threat of substitutes for Ayala Corporation's diverse portfolio is multifaceted, impacting its various business segments. For Globe Telecom, over-the-top (OTT) applications like WhatsApp directly substitute traditional voice and SMS services, a trend evident in the continued pressure on ARPU for these legacy offerings. In real estate, long-term rentals and co-living arrangements provide alternatives to property ownership, with Metro Manila's rental market seeing a 4.5% median rent increase in early 2024.

Fintech solutions, exemplified by GCash's over 60 million users by end-2023, substitute core banking functions, offering convenience and lower costs for transactions. For the energy sector, rooftop solar and energy efficiency measures act as substitutes for grid electricity, with distributed generation capacity growing in the Philippines. In healthcare, home-based care and telehealth, a market valued at USD 116.1 billion in 2023, offer alternatives to traditional clinic visits, impacting AC Health's service demand.

| Ayala Corp Segment | Threat of Substitute | Example/Data Point |

|---|---|---|

| Telecommunications (Globe) | Over-the-Top (OTT) Communication Apps | Erosion of traditional SMS/voice revenue; continued pressure on ARPU. |

| Real Estate | Long-term Rentals, Co-living | Metro Manila median rent up 4.5% (early 2024), indicating rental demand. |

| Financial Services (Fintech) | Digital Wallets, Online Payments | GCash user base exceeded 60 million by end-2023. |

| Energy | Rooftop Solar, Energy Efficiency | Growth in distributed generation capacity in the Philippines. |

| Healthcare (AC Health) | Home-based Care, Telehealth | Global telehealth market valued at USD 116.1 billion (2023). |

Entrants Threaten

The telecommunications sector in the Philippines presents a formidable challenge for newcomers, primarily due to the immense capital needed to build and maintain network infrastructure. This includes the costs associated with cell towers, fiber optic cables, and spectrum licenses, which can run into billions of dollars.

Furthermore, significant regulatory hurdles, such as the complex and often lengthy process of spectrum allocation by the National Telecommunications Commission (NTC), act as a substantial barrier. Establishing extensive distribution and customer service networks also requires considerable investment and time.

While government efforts to foster greater competition, like the recent entry of DITO Telecommunity, aim to slightly reduce these barriers, the sheer scale of investment and regulatory compliance still keeps the threat of new entrants relatively low for most potential players.

Entering the real estate development arena, particularly in creating integrated communities akin to Ayala Land's projects, demands immense capital. This is primarily for securing land, covering construction expenses, and robust marketing campaigns. For instance, in 2024, the Philippine real estate market continued to see significant investment, with major developers like Ayala Land investing billions in new projects and land banking activities to secure future growth opportunities.

Established players benefit from a strong brand reputation and substantial land banks, which serve as considerable entry barriers. Newcomers find it challenging to match the scale and established trust that incumbents possess, making it difficult to gain market traction and compete on a level playing field.

The banking sector is a prime example of high barriers to entry due to stringent regulations. Traditional banks must meet substantial capital requirements, comply with complex legal frameworks, and earn the public's trust. For instance, in 2024, the Basel III endgame proposals continued to emphasize robust capital adequacy ratios, making it costly for new players to establish themselves.

While fintech and digital banks have disrupted the landscape, they are not immune to these entry barriers. They still face rigorous regulatory oversight and the significant challenge of cultivating customer confidence and achieving critical mass. Building a trusted brand and a scalable operational infrastructure in banking takes considerable time and investment, limiting the immediate threat from new entrants.

Infrastructure and Investment in Energy and Infrastructure

New companies entering the energy and infrastructure sectors face significant hurdles. These include the massive capital required for initial investments, navigating intricate government regulations, and possessing specialized technical skills for long-term project execution. For instance, a single large-scale power plant project can easily cost billions of dollars, a sum prohibitive for most new players.

Ayala Corporation, with its established presence and extensive track record in these areas, holds a distinct advantage. Their existing infrastructure, deep understanding of project lifecycles, and established relationships within the industry create substantial barriers to entry for potential competitors.

The threat of new entrants for Ayala Corporation in energy and infrastructure is generally considered low due to these high barriers.

- High Capital Requirements: Projects like renewable energy farms or major transportation networks demand billions in upfront investment, deterring smaller or less capitalized entrants.

- Regulatory Complexity: Obtaining permits, adhering to environmental standards, and securing land rights involve lengthy and complex processes that favor established entities.

- Technical Expertise and Experience: Successful infrastructure development requires specialized engineering knowledge, project management skills, and a proven history of delivery, which new entrants often lack.

- Economies of Scale: Existing players like Ayala can leverage their scale to achieve cost efficiencies, making it difficult for new, smaller operations to compete on price.

Regulatory and Capital Requirements in Healthcare

The healthcare industry, while attractive, presents considerable hurdles for newcomers. Establishing a new hospital or a significant chain of clinics, akin to AC Health's operations, demands immense capital outlays. For instance, the cost to build and equip a modern hospital can easily run into hundreds of millions of dollars.

Beyond the financial investment, stringent licensing and regulatory compliance are paramount. In 2024, navigating the complex web of healthcare regulations, including patient safety standards and operational permits, adds significant time and expense for any new entrant.

Furthermore, attracting and retaining qualified medical professionals, such as specialized doctors and experienced nurses, is a constant challenge. The scarcity of certain medical expertise can inflate labor costs, acting as another barrier.

- Substantial Capital Investment: Building a new hospital can cost upwards of $200 million.

- Strict Regulatory Compliance: Obtaining necessary licenses and adhering to healthcare laws is time-consuming and costly.

- Talent Acquisition Challenges: Recruiting and retaining skilled medical staff, especially specialists, is a significant operational hurdle.

- Moderate to High Barriers: These combined factors create moderate to high barriers for new, large-scale entrants into the healthcare market.

The threat of new entrants for Ayala Corporation is generally low across its key business segments due to substantial barriers. These include high capital requirements for infrastructure and technology, complex regulatory environments, and the need for established brand reputation and extensive distribution networks.

In telecommunications, the cost of spectrum and network build-out, estimated in billions, creates a significant hurdle. Similarly, real estate development demands massive upfront capital for land acquisition and construction, with major players like Ayala Land investing billions in 2024 to secure future growth.

The banking sector, regulated by capital adequacy requirements like Basel III, also presents high entry barriers, even for fintech challengers. Energy and infrastructure projects require billions in investment and specialized expertise, while healthcare necessitates significant capital for facilities and talent acquisition, with hospital construction easily costing hundreds of millions.

| Industry | Estimated Capital Barrier (USD) | Key Barriers |

|---|---|---|

| Telecommunications | Billions | Spectrum costs, network infrastructure |

| Real Estate Development | Billions (for large projects) | Land acquisition, construction, brand reputation |

| Banking | Significant capital requirements (e.g., Basel III) | Regulatory capital, customer trust |

| Energy & Infrastructure | Billions (for large projects) | Initial investment, regulatory approvals, technical expertise |

| Healthcare | Hundreds of millions (for a hospital) | Facility costs, licensing, skilled personnel |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ayala Corporation leverages data from publicly available sources including the company's annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable industry research firms and macroeconomic databases to provide a comprehensive view of the competitive landscape.