Ayala Corp Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Discover the strategic engine behind Ayala Corp's diversified success with our comprehensive Business Model Canvas. This in-depth analysis breaks down how they connect with key customer segments and build robust value propositions across various industries. Unlock the full blueprint to understand their competitive advantages and revenue streams.

Partnerships

Ayala Corporation actively engages with government entities like the Department of Transportation (DOTr) and the Department of Public Works and Highways (DPWH) for its infrastructure projects. These collaborations are vital for obtaining necessary permits and aligning with national development strategies, such as the Build, Better, More program.

Working with regulatory bodies such as the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP) ensures compliance across Ayala's financial services arm, BPI. This is critical for maintaining operational integrity and fostering investor confidence.

In 2024, Ayala's participation in public-private partnerships (PPPs) continued to be a significant driver for growth, particularly in sectors like water distribution through Manila Water and telecommunications via Globe Telecom. These partnerships are essential for large-scale project execution and service delivery.

Ayala Corporation actively cultivates strategic alliances with technology providers, a crucial element for driving its digital transformation and innovation objectives. These partnerships span critical areas such as fintech, telecommunications infrastructure, and the development of smart city solutions, ensuring Ayala remains at the forefront of technological advancement.

A prime example of this strategy in action is Ayala's collaboration with companies like Bosch. This partnership specifically aims to enhance their mobility solutions and accelerate the development of their electric vehicle (EV) platform. Such alliances are vital for integrating cutting-edge technologies and expanding their service offerings in rapidly evolving markets.

Ayala Corporation actively cultivates relationships with a diverse network of local and international investors and financial institutions. These partnerships are crucial for securing the substantial capital required for its ambitious, large-scale projects, including significant capital expenditures across its various business segments. For instance, in 2024, Ayala Land, a key subsidiary, continued to tap into debt markets, with its bond issuances attracting strong interest from institutional investors, reflecting confidence in its development pipeline.

These financial collaborations extend beyond mere funding. They provide Ayala with invaluable access to global best practices in project finance and capital market strategies, enabling more efficient and cost-effective execution of its growth initiatives. Furthermore, partnerships with multilateral organizations often come with technical assistance and expertise, bolstering the sustainability and impact of Ayala's ventures, particularly in infrastructure and renewable energy projects that are critical for the Philippines' development.

Joint Venture Partners and Developers

Ayala Corporation actively forms joint ventures with other developers, energy companies, and logistics firms, particularly in real estate, energy, and infrastructure sectors. These collaborations are crucial for managing the inherent risks of large-scale projects, leveraging diverse expertise, and gaining broader market access.

These strategic alliances allow Ayala to pool resources and share technical know-how, which is vital for undertaking complex developments. For instance, in 2024, Ayala Land continued its strategy of partnering with local and international developers for various residential and commercial projects across the Philippines, aiming to accelerate growth and market penetration.

In the energy sector, Ayala’s ACEN Corporation has been a prominent player in forming joint ventures for renewable energy projects. As of early 2024, ACEN announced several new partnerships to expand its solar and wind farm portfolio, aiming to contribute significantly to the country's clean energy transition.

- Joint Ventures in Real Estate: Ayala Land collaborates with various partners to develop integrated communities and commercial centers, enhancing its project execution capabilities and market reach.

- Renewable Energy Partnerships: ACEN Corporation partners with global and local players to accelerate the development of solar, wind, and battery storage projects, bolstering its clean energy targets.

- Infrastructure and Logistics Alliances: Ayala leverages joint ventures to participate in significant infrastructure projects and expand its logistics network, improving operational efficiency and market access.

- Risk Sharing and Expertise Pooling: These partnerships allow Ayala to share financial burdens and access specialized technical and operational expertise, crucial for the successful delivery of complex projects.

Suppliers and Service Providers

Ayala Corporation relies on a vast network of suppliers and service providers to keep its diverse operations running smoothly. This includes everything from the raw materials needed for construction projects by Ayala Land to the sophisticated network equipment essential for Globe Telecom's services. For ACEN, reliable suppliers of renewable energy components are crucial, while for AC Health, consistent access to medical supplies and pharmaceuticals is paramount.

Maintaining these relationships is key to ensuring quality and cost-effectiveness. For instance, strong supplier partnerships can lead to better pricing on construction materials, directly impacting the profitability of real estate developments. Similarly, in telecommunications, securing favorable terms for network infrastructure can significantly reduce capital expenditure.

- Supplier Network: Ayala's businesses depend on a wide array of suppliers, from raw material providers to specialized technology and service vendors.

- Operational Efficiency: Strong supplier relationships are vital for maintaining consistent product quality and operational uptime across all Ayala's sectors.

- Cost Management: Strategic sourcing and partnerships with service providers help Ayala manage costs effectively, contributing to better financial performance.

- Supply Chain Resilience: A robust network of reliable suppliers enhances supply chain resilience, mitigating risks associated with disruptions.

Ayala Corporation's Key Partnerships are foundational for its diversified business model, enabling it to execute large-scale projects and expand its market reach. These collaborations span government entities, financial institutions, technology providers, and joint venture partners, all critical for growth and operational efficiency.

The company actively engages in public-private partnerships (PPPs) and joint ventures, particularly in infrastructure and real estate, to share risks and leverage specialized expertise. For example, in 2024, Ayala Land continued its strategy of partnering with developers for various projects, while ACEN Corporation formed several new joint ventures to expand its renewable energy portfolio.

Furthermore, strong relationships with investors and financial institutions are essential for securing capital, as demonstrated by Ayala Land's successful bond issuances in 2024, which attracted significant institutional investor interest. These financial collaborations also provide access to global best practices, enhancing project finance and capital market strategies.

Ayala also relies on a robust network of suppliers and service providers to ensure operational continuity and cost-effectiveness across its sectors, from construction materials for Ayala Land to network equipment for Globe Telecom.

| Partner Type | Key Collaborations | 2024 Focus/Examples | Strategic Importance |

|---|---|---|---|

| Government Entities | DOTr, DPWH, LGUs | Aligning with Build, Better, More program; securing permits for infrastructure. | Facilitating large-scale project execution and national development alignment. |

| Financial Institutions | Banks, Investment Funds, Multilateral Orgs | Ayala Land's bond issuances attracting institutional investors; securing project finance. | Capital acquisition, access to global finance best practices, risk mitigation. |

| Technology Providers | Global & Local Tech Firms | Fintech, telecom infrastructure, smart city solutions; Bosch for mobility solutions. | Driving digital transformation, innovation, and competitive advantage. |

| Joint Venture Partners | Developers, Energy Firms, Logistics Companies | Ayala Land's residential/commercial projects; ACEN's renewable energy projects. | Risk sharing, expertise pooling, market access, resource optimization. |

| Suppliers & Service Providers | Raw Materials, Network Equipment, Medical Supplies | Ensuring quality and cost-effectiveness for construction, telecom, and health sectors. | Operational efficiency, cost management, supply chain resilience. |

What is included in the product

Ayala Corporation's Business Model Canvas outlines its diversified conglomerate strategy, focusing on key customer segments like consumers and businesses across its core sectors of real estate, financial services, telecommunications, and utilities.

It details value propositions centered on essential services and lifestyle solutions, supported by robust infrastructure and strategic partnerships, all managed through efficient cost structures and revenue streams.

Ayala Corp's Business Model Canvas offers a clear, structured way to identify and address the inherent complexities within its diverse portfolio, acting as a pain point reliever by simplifying strategic overview.

It provides a concise, one-page snapshot of Ayala's multi-faceted operations, alleviating the pain of navigating intricate organizational structures and diverse business units.

Activities

Ayala Land's primary activities revolve around the comprehensive lifecycle of real estate, from acquiring land and meticulous planning to the actual development and ongoing management of diverse properties. This encompasses creating integrated mixed-use communities, building residential units, and establishing commercial centers and office buildings.

The company's operations also include the strategic development of master-planned estates, driving residential sales, and managing leasing operations for its extensive portfolio. In 2023, Ayala Land reported a net income of PHP 32.2 billion, showcasing its robust performance in these key activities.

Ayala Corporation’s financial services and banking operations are primarily driven by its key subsidiary, Bank of the Philippine Islands (BPI). BPI offers a wide spectrum of services, encompassing retail and corporate banking, alongside robust asset and investment management capabilities.

Core activities within this segment include the crucial processes of loan origination, where BPI assesses and disburses credit, and deposit-taking, managing customer funds. Wealth management services are also a significant focus, catering to individuals seeking to grow and preserve their assets.

As of the first quarter of 2024, BPI reported a net income of PHP 15.1 billion, showcasing strong operational performance. The bank's total assets reached PHP 3.7 trillion by the end of 2023, underscoring its substantial market presence and capacity to serve a diverse client base.

Globe Telecom's core activities center on the continuous development, upkeep, and expansion of its robust mobile and broadband infrastructure. This foundational work enables the delivery of essential voice, data, and a growing suite of digital services to its customer base.

A significant part of these operations involves the strategic development and active management of innovative digital platforms, most notably the highly successful GCash mobile wallet. This fintech arm is crucial for expanding Globe's digital ecosystem and revenue streams.

In 2023, Globe Telecom reported a consolidated service revenue of PHP 159.1 billion, underscoring the scale of its network operations and digital service offerings. The company's sustained investment in network upgrades is vital for maintaining its competitive edge.

Energy Generation and Infrastructure Development

Ayala Corporation, through its subsidiary ACEN, is a major player in energy generation and infrastructure development. ACEN focuses on building and operating renewable energy facilities, such as solar and wind farms, across the Philippines and in other countries. This commitment to clean energy is a core part of their strategy.

Beyond renewables, Ayala Corporation also invests in a diverse range of infrastructure projects. These include critical sectors like logistics, enhancing supply chain efficiency, and healthcare facilities, improving access to essential services. This diversification strengthens their overall infrastructure portfolio.

- Renewable Energy Focus: ACEN is actively developing, constructing, and operating solar and wind power projects, contributing significantly to the renewable energy landscape.

- International Expansion: The company's renewable energy initiatives extend beyond the Philippines, with a growing international presence in key markets.

- Diversified Infrastructure: Ayala Corporation's infrastructure development also encompasses logistics and healthcare facilities, broadening its impact on national development.

- Capacity Growth: As of early 2024, ACEN has a substantial attributable capacity of over 4,000 MW, with a significant portion from renewables, and continues to expand its pipeline.

Strategic Investments and Portfolio Management

Ayala Corporation actively manages its diverse portfolio, focusing on strategic investments in high-growth sectors like healthcare, logistics, and education. This proactive approach aims to maximize shareholder value and ensure sustained growth across its various business units.

The conglomerate's portfolio management strategy includes key activities such as mergers, acquisitions, and divestments. For instance, in 2023, Ayala Corporation continued to refine its holdings, with significant capital allocation towards expanding its presence in digital solutions and renewable energy.

- Strategic Investments: Ayala Corporation's investment focus in 2023 and early 2024 has been on sectors demonstrating strong long-term potential, including healthcare infrastructure and sustainable logistics solutions.

- Portfolio Optimization: The company regularly reviews its business units, undertaking divestments of non-core assets to reallocate capital towards strategic growth areas, enhancing overall portfolio efficiency.

- Mergers and Acquisitions: Ayala Corporation actively pursues M&A opportunities to consolidate market positions, acquire new technologies, and expand its geographical reach, as seen in its ongoing efforts within the digital services space.

- Value Enhancement: The overarching goal of these strategic activities is to drive sustainable value creation and ensure the long-term competitiveness and profitability of the Ayala conglomerate.

Ayala Corporation's key activities involve strategic portfolio management, focusing on investments in high-growth sectors like healthcare, logistics, and digital solutions. This includes actively pursuing mergers and acquisitions to enhance market position and acquire new technologies. The company also optimizes its holdings through divestments of non-core assets, reallocating capital to strategic growth areas to drive sustainable value creation.

| Business Segment | Key Activities | 2023/2024 Data Highlight |

|---|---|---|

| Real Estate (Ayala Land) | Land acquisition, development, property management, residential sales, leasing | PHP 32.2 billion net income (2023) |

| Financial Services (BPI) | Retail & corporate banking, loan origination, deposit-taking, wealth management | PHP 15.1 billion net income (Q1 2024), PHP 3.7 trillion total assets (end of 2023) |

| Telecommunications (Globe) | Network infrastructure development, digital services, GCash platform management | PHP 159.1 billion consolidated service revenue (2023) |

| Energy & Infrastructure (ACEN) | Renewable energy generation (solar, wind), infrastructure development (logistics, healthcare) | Over 4,000 MW attributable capacity (early 2024), with significant renewable portion |

| Portfolio Management | Strategic investments, M&A, divestments in growth sectors | Capital allocation towards digital solutions and renewable energy (2023) |

Delivered as Displayed

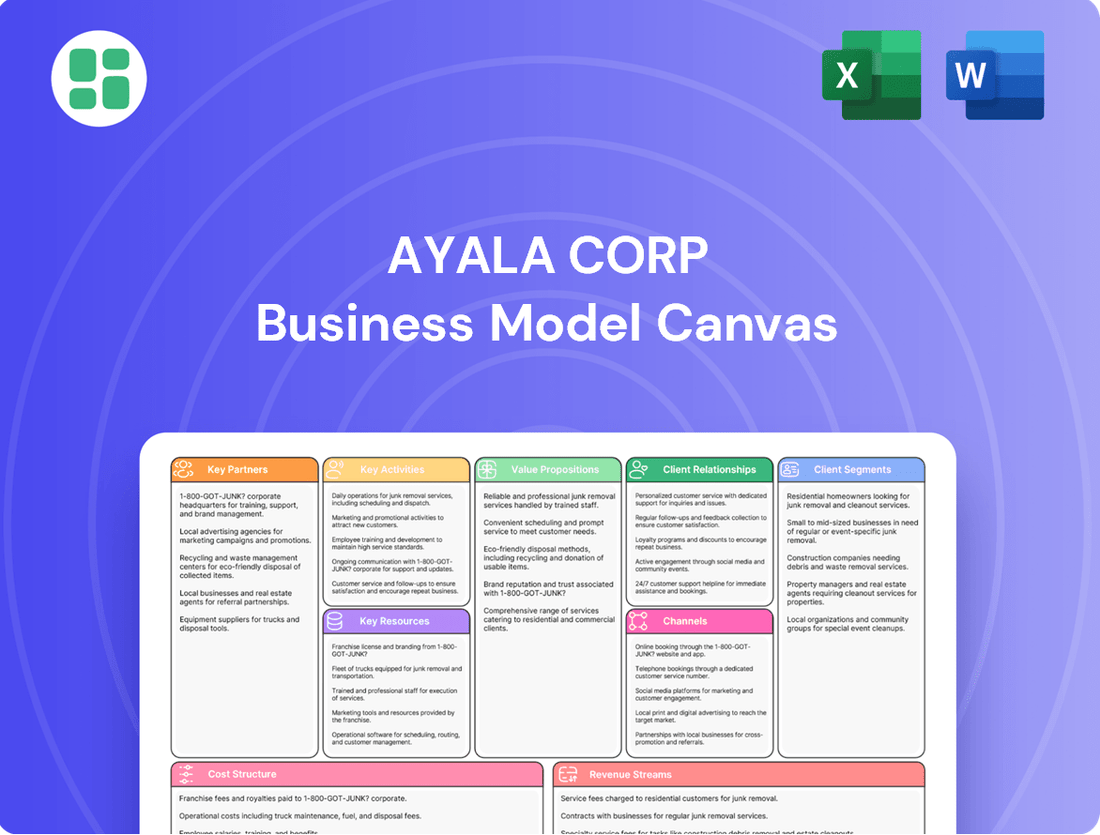

Business Model Canvas

The Ayala Corporation Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive. This is not a sample; it is a direct snapshot from the actual, comprehensive file. Upon purchase, you will gain full access to this same professionally structured and ready-to-use Business Model Canvas, ensuring no discrepancies and immediate usability.

Resources

Ayala Land's extensive land bank, strategically positioned throughout the Philippines, is a cornerstone of its business model, enabling the creation of integrated communities. This vast portfolio includes prime real estate for residential, commercial, and industrial purposes, driving both immediate sales revenue and consistent rental income streams.

As of the first quarter of 2024, Ayala Land reported a robust land bank, a critical resource for its ongoing and future development projects. This asset base directly supports its strategy of building sustainable and diversified estates, contributing significantly to its market leadership.

Ayala Corporation and its subsidiaries, especially Bank of the Philippine Islands (BPI), possess significant financial capital. This strong financial footing, coupled with established relationships in both domestic and international capital markets, allows for substantial investments and project financing.

In 2024, BPI continued to demonstrate robust financial health, reporting a net income of PHP 49.4 billion for the first nine months of the year. This financial strength underpins Ayala's ability to fund large-scale projects and maintain operational liquidity across its diverse business segments.

Ayala Corporation's established brand reputation and trust are cornerstones of its business model, built over decades of consistent performance and ethical conduct. This deep-seated trust translates into significant customer loyalty across its various sectors, from real estate and banking to telecommunications and energy.

In 2024, this brand equity continues to be a critical asset, enabling Ayala to attract and retain customers even in competitive markets. For instance, Bank of the Philippine Islands (BPI), a key Ayala subsidiary, consistently ranks high in customer satisfaction surveys, reflecting the trust placed in the Ayala name.

This strong brand equity also significantly eases the formation of strategic partnerships and joint ventures. Potential partners are more inclined to collaborate with Ayala due to its proven track record of reliability and strong corporate governance, which was further underscored by its consistent inclusion in sustainability indices throughout 2024.

Human Capital and Expertise

Ayala Corporation’s human capital is a cornerstone of its business model, encompassing a vast and highly skilled workforce. This includes seasoned management teams, specialized technical experts, and dedicated service professionals operating across Ayala’s diverse industry portfolio. Their collective knowledge and experience are vital for maintaining operational excellence and effectively executing the company's strategic initiatives, directly fueling innovation and driving efficiency throughout the organization.

The company's commitment to developing its talent is evident in its continuous investment in training and development programs. For instance, in 2024, Ayala continued to emphasize upskilling and reskilling its employees to adapt to evolving industry demands and technological advancements. This focus ensures that their human capital remains a competitive advantage.

Key aspects of Ayala's human capital and expertise include:

- A diverse talent pool: Employees span various sectors like telecommunications, banking, real estate, and infrastructure, bringing a wide range of specialized skills.

- Experienced leadership: A strong cadre of experienced managers and executives guides strategic direction and operational execution.

- Technical proficiency: A significant number of engineers, IT professionals, and other technical experts underpin the company's technological infrastructure and service delivery.

- Customer-centric service professionals: A large workforce dedicated to customer service ensures quality delivery across all Ayala businesses.

Advanced Technology and Digital Infrastructure

Ayala Corporation's advanced technology and digital infrastructure are foundational to its business model, enabling efficient service delivery across its diverse segments. This includes significant investments in state-of-the-art telecommunications networks and robust digital platforms, such as GCash, which is a leading digital payments and financial services provider in the Philippines. The company's integrated IT systems further streamline operations and enhance customer experiences.

These technological assets are crucial for maintaining a competitive edge and driving innovation. Ayala Corp actively invests in green network solutions and data centers, aiming to boost operational efficiency and promote sustainability within its digital ecosystem. For instance, Globe Telecom, a key Ayala subsidiary, has been expanding its fiber network and 5G capabilities, reaching over 16.6 million homes passed with fiber broadband as of the first half of 2024.

- Telecommunications Networks: Globe Telecom's extensive fiber and 5G infrastructure forms a core component, supporting connectivity needs across various industries.

- Digital Platforms: GCash, a prominent digital wallet, facilitates millions of transactions daily, demonstrating the reach and impact of Ayala's digital services.

- Integrated IT Systems: These systems underpin the operational efficiency of all Ayala's business units, from utilities to real estate.

- Sustainable Infrastructure: Investments in green data centers and energy-efficient network solutions reflect a commitment to environmental responsibility in digital operations.

Ayala Corporation's key resources are its extensive land bank, robust financial capital primarily through BPI, strong brand reputation, skilled human capital, and advanced technology infrastructure. These elements collectively enable the company to develop integrated communities, fund large-scale projects, attract and retain customers, drive innovation, and maintain operational efficiency across its diverse business segments.

Value Propositions

Ayala Land crafts master-planned communities, seamlessly blending living, working, and leisure. This holistic approach, evident in developments like Nuvali, prioritizes convenience and enhances quality of life for residents.

The company's commitment to sustainability is a core value proposition. For instance, Nuvali, a 2,400-hectare eco-city, aims to be a carbon-neutral development, showcasing Ayala Land's dedication to environmentally responsible urban planning.

These integrated communities foster a sense of belonging and offer a complete lifestyle. By 2024, Ayala Land's portfolio includes numerous such developments across the Philippines, demonstrating their successful model for sustainable urban living.

BPI, a key player in Ayala Corp's business model, champions reliable and innovative financial services. They offer secure, accessible, and forward-thinking solutions across banking, investments, and wealth management, truly empowering both individuals and businesses.

In 2024, BPI's commitment to digital innovation is evident. Their digital banking services saw significant uptake, with transactions through their mobile app and online platforms continuing to grow, offering unparalleled convenience and efficiency to their customer base.

Globe Telecom, a key player for Ayala Corporation, ensures seamless connectivity by providing widespread mobile and internet services across the Philippines. In 2023, Globe reported a 12% increase in data traffic, highlighting their network's growing capacity to serve millions of users.

This commitment extends to fostering digital inclusion. Globe actively works to expand its network into remote and underserved regions, bringing essential digital services to more Filipinos. By the end of 2023, Globe had already connected over 1.5 million homes to its fiber network, a significant step towards bridging the digital divide.

Essential and Accessible Healthcare Services

AC Health is committed to making quality healthcare readily available across the Philippines. They are actively expanding their network, which in 2024 includes a significant number of hospitals, clinics, and pharmacies, ensuring a broad reach for their services.

Their core value proposition centers on delivering comprehensive care that addresses various health needs and ultimately aims to improve the overall health and well-being of the Filipino population. This focus on improved health outcomes is a key differentiator.

- Expanded Network: By the end of 2023, AC Health operated 10 hospitals, 13 clinics, and 14 pharmacies, with plans for continued growth throughout 2024 to enhance accessibility.

- Comprehensive Care Model: AC Health offers integrated services from primary care to specialized treatments, aiming to be a one-stop solution for patient health needs.

- Focus on Affordability: Efforts are underway to ensure that these essential healthcare services are not only accessible but also affordable for a wider segment of the population.

Clean Energy and Sustainable Infrastructure

Ayala Corporation, through its subsidiary ACEN, is a significant player in the clean energy sector. ACEN is actively developing and operating renewable energy projects, primarily in solar and wind power, across the Philippines and internationally. This focus directly addresses the growing demand for sustainable energy sources, contributing to national energy security and environmental protection efforts. For instance, as of early 2024, ACEN had a substantial renewable energy capacity, showcasing its commitment to this value proposition.

Beyond energy, Ayala's infrastructure arm is crucial for national development. These ventures encompass a range of essential services, from water supply and management to transportation networks and digital infrastructure. By investing in and operating these vital systems, Ayala supports economic expansion and enhances the overall quality of life for communities. Their involvement in projects like the North-South Commuter Railway Extension further exemplifies this commitment to building a more connected and efficient nation.

- Renewable Energy Generation: ACEN's portfolio includes significant operational solar and wind farms, contributing to a cleaner energy mix.

- Energy Security: By diversifying energy sources with renewables, Ayala helps reduce reliance on imported fossil fuels.

- Economic Growth Support: Infrastructure projects like toll roads and water systems facilitate business and improve daily living conditions.

- Environmental Stewardship: The company's investments in clean energy align with global sustainability goals and national environmental targets.

Ayala Land provides integrated communities that enhance living, working, and leisure, exemplified by developments like Nuvali. Their sustainability focus is demonstrated by Nuvali's goal of carbon neutrality, underscoring a commitment to eco-friendly urban planning. By 2024, Ayala Land's extensive portfolio of these developments across the Philippines highlights their successful model for sustainable urban living.

Customer Relationships

Ayala Land, a key subsidiary of Ayala Corporation, actively cultivates community through its extensive lifestyle programs and estate management. In 2024, these initiatives, including events and resident services across its various developments, aimed to foster a deeper sense of belonging and strengthen customer loyalty.

By managing its properties and malls with a focus on creating engaging experiences, Ayala Land goes beyond mere transactions. This approach, evident in its 2024 operational strategies, builds lasting connections and enhances the overall value proposition for its customers, contributing to sustained engagement.

BPI cultivates strong customer relationships through highly personalized financial advisory services. For their most valuable clients, BPI assigns dedicated relationship managers who offer tailored guidance and proactive support, fostering a sense of exclusivity and trust.

Furthermore, BPI ensures responsive customer support across various channels, addressing client needs efficiently. This commitment to personalized attention and accessible support aims to build enduring financial partnerships, as evidenced by BPI's consistent customer satisfaction ratings.

Globe Telecom, a key subsidiary of Ayala Corporation, significantly enhances customer relationships through robust digital self-service platforms. Their mobile app and online portals allow customers to manage accounts, pay bills, and access support instantly, offering unparalleled convenience.

This digital-first approach is complemented by traditional call centers, ensuring comprehensive support. In 2023, Globe reported a substantial increase in digital transactions, with over 70% of customer interactions occurring through these online channels, highlighting their effectiveness in providing immediate assistance and managing customer needs efficiently.

Patient-Centric Care and Wellness Programs

Ayala Corporation, through its health arm AC Health, cultivates patient-centric relationships by prioritizing compassionate care and offering integrated medical services. This approach fosters trust and encourages individuals and families to view AC Health as a long-term partner in their well-being.

Wellness programs are a cornerstone of this strategy, aiming to proactively manage health and prevent illness. This focus on holistic care, extending beyond immediate treatment, strengthens customer loyalty and builds enduring connections.

- Patient-Centricity: AC Health's commitment to putting patients first drives its service design and delivery.

- Integrated Services: Offering a spectrum of healthcare solutions under one umbrella simplifies patient journeys.

- Wellness Focus: Proactive health management and preventative care are key to fostering long-term patient partnerships.

- Trust Building: Compassionate interactions and reliable care are fundamental to establishing deep patient trust.

Corporate and Institutional Client Management

Ayala Corporation cultivates robust relationships with its corporate and institutional clients across its energy, infrastructure, and corporate banking divisions. This is achieved through dedicated account management teams who understand client needs deeply.

Tailored solutions are a cornerstone of these relationships, ensuring that services and products precisely match the requirements of large organizations. This client-centric approach fosters loyalty and repeat business.

Long-term contractual agreements provide a stable foundation for these partnerships, offering predictability for both Ayala and its clients. For instance, in 2024, Ayala's infrastructure arm secured several multi-year concessions, demonstrating this strategy in action.

- Dedicated Account Management: Specialized teams focus on understanding and serving the unique needs of each corporate and institutional client.

- Tailored Solutions: Customized offerings in energy, infrastructure, and banking are developed to meet specific client objectives.

- Long-Term Contracts: Agreements spanning multiple years ensure consistent revenue streams and client commitment.

- Stability and Repeat Business: These strong relationships translate into predictable revenue and a reduced need for constant new client acquisition.

Ayala Land's customer relationships are built on creating vibrant communities and delivering exceptional lifestyle experiences. This strategy, evident in their 2024 operations, fosters strong loyalty through events and resident services.

BPI prioritizes personalized financial advice and dedicated relationship managers for its key clients, building trust through tailored support. Their responsive customer service across multiple channels ensures enduring financial partnerships.

Globe Telecom leverages digital self-service platforms for convenience, with over 70% of customer interactions occurring online in 2023. This digital-first approach, combined with traditional support, efficiently manages customer needs.

AC Health focuses on patient-centricity and integrated medical services, fostering trust through compassionate care and wellness programs. This holistic approach positions them as a long-term health partner.

Ayala Corporation's energy, infrastructure, and banking divisions cultivate strong corporate relationships through dedicated account management and tailored solutions, reinforced by long-term contracts.

Channels

Ayala Land leverages its integrated mixed-use estates and retail malls as crucial physical channels. These vibrant communities act as direct points of sale for their diverse property offerings, from residential units to commercial spaces. In 2024, Ayala Land reported significant revenue from its property development and leasing operations, with its malls playing a central role in driving foot traffic and sales for tenants.

These meticulously planned estates and sprawling retail malls are more than just shopping destinations; they are designed as self-sustaining ecosystems. They foster community engagement and provide a platform for a wide array of services, enhancing customer loyalty and creating recurring revenue streams. The company's commitment to creating these integrated environments underscores their strategy to capture value across multiple touchpoints.

BPI's extensive branch network and ATMs are a cornerstone of its customer reach. As of the first quarter of 2024, BPI operated over 800 branches and more than 3,000 ATMs nationwide, providing convenient access to banking services for millions of Filipinos.

This physical presence is crucial for serving diverse customer needs, from simple cash withdrawals to more complex financial transactions. The widespread distribution ensures that even in remote areas, customers have a touchpoint for their banking requirements, fostering trust and loyalty.

Ayala Corporation leverages a robust digital ecosystem, with its subsidiaries extensively utilizing websites, mobile applications, and social media. For instance, Globe Telecom's GCash platform is a prime example, boasting over 70 million registered users by the end of 2023, facilitating a wide array of financial transactions and services.

These digital channels are critical for customer interaction and transaction processing across Ayala's diverse portfolio. Bank of the Philippine Islands (BPI) offers its BPI mobile app, which saw a significant increase in active users, enabling convenient banking for millions. This digital presence is key to efficient service delivery and deepening customer relationships.

Direct Sales Forces and Broker Networks

Ayala Corporation leverages direct sales forces and extensive networks of accredited brokers and agents as primary channels for its real estate and financial product offerings. This multi-pronged approach ensures broad market reach and facilitates personalized customer engagement.

For instance, Ayala Land, a key subsidiary, relies heavily on its in-house sales teams and a vast network of accredited real estate brokers to connect with buyers. In 2024, the company continued to prioritize these channels to drive sales for its diverse property portfolio, from residential condominiums to commercial developments. This strategy allows for direct feedback loops and the ability to offer customized solutions, a key differentiator in competitive markets.

Similarly, BPI, Ayala's banking arm, utilizes its branch network and a dedicated team of financial advisors, complemented by partnerships with independent financial advisors and brokers. This ensures that a wide range of financial products, from loans to investment vehicles, are accessible to various customer segments. The company reported significant growth in its customer acquisition through these channels in the first half of 2024, underscoring their continued importance.

- Direct Sales Teams: Provide personalized consultations and tailored product recommendations, fostering stronger customer relationships.

- Accredited Broker Networks: Expand market reach and tap into specialized sales expertise for real estate and financial products.

- Customer Engagement: Facilitate direct feedback and customized solutions, crucial for high-value transactions.

- Market Penetration: These channels were instrumental in driving sales growth for Ayala Land and BPI in 2024.

Healthcare Facilities and Pharmacies

Ayala Corporation's Health segment, AC Health, directly engages customers through its owned network of hospitals, clinics, and pharmacies. This includes Generika Drugstores and St. Joseph Drug, serving as key channels for both medical services and pharmaceutical distribution, ensuring accessible healthcare delivery.

This integrated approach allows AC Health to offer a comprehensive patient journey, from initial consultation to medication fulfillment. In 2024, Generika Drugstores, a significant part of this channel strategy, continued its expansion, with plans to reach over 1,000 outlets nationwide, underscoring its commitment to widespread accessibility.

- Direct Patient Access: AC Health's owned facilities provide a direct touchpoint for patients seeking medical care and pharmaceuticals.

- Brand Presence: Generika Drugstores and St. Joseph Drug represent strong, recognizable brands within the Philippine pharmaceutical retail landscape.

- Service Integration: These channels facilitate the seamless delivery of integrated healthcare services, from diagnostics to prescription fulfillment.

Ayala Corporation's channels are a blend of physical and digital touchpoints, designed to reach diverse customer segments. These include extensive retail and property networks, robust banking infrastructure, and a growing digital ecosystem. Direct sales and broker networks are also vital for high-value transactions, while AC Health utilizes its own healthcare facilities for direct patient engagement.

| Channel Type | Key Subsidiaries/Examples | 2024 Data/Key Facts |

|---|---|---|

| Physical Retail & Property | Ayala Land (Malls, Estates) | Malls drive significant foot traffic and tenant sales. Integrated estates serve as direct sales points. |

| Physical Banking | BPI (Branches, ATMs) | Over 800 branches and 3,000 ATMs nationwide provide broad access. |

| Digital Ecosystem | Globe (GCash), BPI (Mobile App) | GCash: Over 70 million registered users (end 2023). BPI app sees increased active users. |

| Direct Sales & Networks | Ayala Land, BPI | In-house sales teams and accredited brokers are crucial for property and financial product sales. |

| Healthcare Services | AC Health (Generika Drugstores, Clinics) | Generika Drugstores expanding, targeting over 1,000 outlets nationwide. |

Customer Segments

Ayala Land's core customer base comprises affluent and middle-income households, a segment actively pursuing high-quality residential properties and integrated communities that offer a superior lifestyle. This focus reflects a strategic understanding of consumer preferences for exclusivity and meticulously managed living spaces.

In 2024, the Philippine real estate market continued to see strong demand from these demographic groups, with Ayala Land's projects consistently attracting buyers who prioritize brand reputation and the assurance of well-developed amenities. For instance, the company's developments often feature premium finishes and extensive green spaces, catering directly to the desire for a refined living experience.

Ayala Corporation caters to a broad spectrum of corporate and institutional clients, including large corporations, small and medium enterprises (SMEs), and government entities. This diverse client base utilizes Ayala's offerings across its key business segments: banking, energy, and infrastructure.

For instance, in banking, BPI serves numerous corporations and SMEs with tailored financial solutions, from corporate lending to treasury services. In 2024, BPI continued to be a leading financial institution in the Philippines, supporting the growth of businesses nationwide through its extensive network and digital platforms.

Ayala's energy arm, ACEN Corporation, provides specialized energy solutions to industrial clients and government projects, focusing on renewable energy development. As of the first quarter of 2024, ACEN reported significant progress in its renewable energy capacity expansion, contributing to the nation's energy security and sustainability goals.

Furthermore, Ayala's infrastructure segment, through AC Infrastructure Holdings Corporation, engages in large-scale infrastructure development projects, partnering with government entities and private corporations to build and manage critical public utilities and transportation networks.

Ayala Corporation actively pursues the mass market and underserved communities by making essential services more accessible and affordable. Globe Telecom, for instance, is a key player in this effort, focusing on digital inclusion to bridge the connectivity gap. In 2023, Globe reported a significant increase in its subscriber base, reaching over 100 million mobile customers, demonstrating their reach into these segments.

AC Health complements this by providing affordable healthcare solutions tailored to the needs of these communities. Their initiatives aim to bring essential medical services to geographically isolated and disadvantaged areas (GIDAs). This focus on affordability and accessibility is crucial for a segment that prioritizes value and reliable access to fundamental needs.

Individuals and Consumers Seeking Connectivity

Globe Telecom, a key player within Ayala Corporation's ecosystem, directly addresses the needs of individuals and consumers who are actively seeking connectivity solutions. This segment is vast, encompassing everyone from individual mobile subscribers to entire households dependent on reliable broadband internet.

The company's offerings are designed to cater to this diverse consumer base, providing essential mobile services, high-speed broadband internet, and increasingly, digital financial services. This multi-faceted approach ensures that Globe remains a central provider for everyday digital life.

In 2024, Globe Telecom reported a significant customer base, with its mobile subscriber count reaching over 100 million.

- Mobile Services: Catering to over 100 million mobile subscribers in 2024, offering voice, data, and messaging.

- Broadband Internet: Providing fixed broadband services to millions of households, enhancing digital access.

- Digital Financial Services: Expanding into areas like GCash, which serves tens of millions of users for payments, transfers, and other financial needs.

- Content and Entertainment: Offering access to various digital content platforms and entertainment services to enhance user experience.

Patients and Healthcare Seekers

Ayala Corporation's AC Health division directly serves patients and healthcare seekers across the Philippines. This encompasses individuals requiring routine medical consultations, those needing specialized treatments for specific conditions, and people looking for accessible pharmaceutical products.

The customer base spans diverse income levels, all united by a demand for quality and affordability in healthcare services and medicines. In 2024, AC Health continued to expand its network of clinics and pharmacies to reach more communities, aiming to bridge gaps in healthcare access.

- Broad Reach: Serves a wide demographic seeking general and specialized medical care.

- Accessibility Focus: Prioritizes making quality healthcare and pharmaceuticals available to various income groups.

- Growing Network: Continues to expand its physical presence through clinics and pharmacies to enhance patient access.

- Comprehensive Services: Offers a spectrum of healthcare needs, from initial consultations to prescription fulfillment.

Ayala Corporation's customer segments are diverse, ranging from affluent individuals seeking premium real estate to mass market consumers needing accessible essential services. This broad reach is supported by its various subsidiaries, each targeting specific demographic and economic groups.

The company's financial services arm, BPI, caters to both retail and corporate clients, providing banking and lending solutions. In 2024, BPI continued its digital transformation, enhancing services for millions of individual account holders and supporting thousands of businesses.

Globe Telecom serves a vast consumer base with mobile and broadband services, with over 100 million mobile subscribers as of 2024. AC Health focuses on providing accessible healthcare to a wide spectrum of the population, from those in urban centers to underserved rural communities.

| Customer Segment | Key Offerings | 2024 Relevance/Data Point |

|---|---|---|

| Affluent & Middle-Income Households | High-quality residential properties, integrated communities | Continued demand for premium lifestyle developments. |

| Corporate & Institutional Clients | Banking, energy solutions, infrastructure partnerships | BPI supporting business growth; ACEN providing industrial energy solutions. |

| Mass Market & Underserved Communities | Affordable connectivity, accessible healthcare | Globe's 100M+ mobile subscribers; AC Health expanding clinic network. |

| Individual Consumers (Connectivity) | Mobile services, broadband internet, digital financial services | Globe's extensive reach across households and individuals for daily digital needs. |

Cost Structure

Ayala Corporation's property development and construction segment incurs substantial costs, primarily driven by land acquisition and the physical building of residential, commercial, and mixed-use properties. These are inherently capital-intensive endeavors, demanding significant upfront financial commitments to secure land and commence construction.

For instance, in 2024, the real estate sector, a major contributor to Ayala Corp's revenue, continued to see elevated material and labor costs impacting project budgets. Ayala Land, the group's property arm, reported significant capital expenditures for ongoing and new developments, reflecting the scale of these investments.

Ayala Corporation, through its subsidiary Globe Telecom, faces significant expenses in maintaining and expanding its telecommunications network. These costs are essential for providing reliable mobile and internet services. In 2023, Globe Telecom reported capital expenditures of approximately PHP 165 billion, a substantial portion of which is allocated to network infrastructure development.

These investments cover the deployment of new cell sites, the expansion of fiber optic networks, and the continuous upgrading of digital platforms to support growing data demands. Furthermore, a key focus for Ayala Corp and Globe Telecom is integrating green technologies, reflecting a commitment to sustainability within their operational cost structure.

Ayala Corporation’s operational expenses are a significant component, encompassing salaries and benefits for its extensive workforce, administrative overhead, marketing initiatives, and essential utilities across all its diverse business units. These general operating expenses are fundamental to maintaining the conglomerate's widespread activities.

Each subsidiary within the Ayala portfolio, from real estate and banking to telecommunications and water utilities, maintains its own distinct operational cost base, reflecting the unique demands of their respective industries. For instance, in 2024, Globe Telecom, a key subsidiary, reported substantial operational expenditures related to network expansion and maintenance, crucial for its telecommunications services.

Financial Costs and Interest Expenses

Ayala Corporation's cost structure is significantly impacted by financial costs, especially interest expenses arising from its substantial debt financing across its diverse portfolio of businesses. This is a crucial consideration, particularly for its banking arm, Bank of the Philippine Islands (BPI).

For instance, in 2023, Ayala Corporation reported consolidated interest expenses of PHP 35.5 billion. This reflects the cost of servicing the debt used to fund major projects and operations across its subsidiaries, including real estate, telecommunications, and energy.

- Interest Expenses: The cost of borrowing funds to finance operations and expansion.

- Financial Fees: Costs associated with managing and maintaining debt, such as loan origination fees or advisory services.

- Other Financing Costs: Expenses related to foreign exchange hedging or other financial instruments used to manage risk.

Maintenance and Utilities for Facilities

Ayala Corporation's cost structure is significantly influenced by the ongoing expenses associated with maintaining its diverse portfolio of properties, facilities, and equipment. These include regular upkeep, repairs, and scheduled servicing to ensure operational efficiency and asset longevity across all business segments.

Utility expenses, such as electricity and water consumption across its various operational assets, also represent a substantial recurring cost. Ayala Corporation is actively pursuing a transition towards renewable energy sources, aiming to mitigate the impact of fluctuating utility prices and enhance sustainability.

- Property Maintenance: Costs cover routine upkeep, repairs, and capital expenditures for facilities like offices, manufacturing plants, and retail spaces.

- Utility Expenses: Significant outlays for electricity, water, and other essential services across all operational sites.

- Renewable Energy Initiatives: Investments in solar and other renewable sources to reduce long-term energy costs and environmental impact.

- Equipment Servicing: Ongoing costs for maintaining and repairing machinery, vehicles, and technological infrastructure crucial for operations.

Ayala Corporation's cost structure is heavily influenced by capital expenditures in property development and network infrastructure, as seen with significant investments by Ayala Land and Globe Telecom. Operational expenses, including labor and administrative overhead, are also substantial across its varied business units.

Financial costs, particularly interest expenses on debt financing, represent a key outlay, with consolidated interest expenses reaching PHP 35.5 billion in 2023. Ongoing maintenance of assets and utility costs, increasingly incorporating renewable energy initiatives, further shape the company's spending.

| Cost Category | Key Components | 2023 Data/Notes |

|---|---|---|

| Property Development & Construction | Land acquisition, materials, labor | Elevated costs in 2024 impacting project budgets. |

| Telecommunications Infrastructure | Network expansion (cell sites, fiber), technology upgrades | Globe Telecom's 2023 CapEx: ~PHP 165 billion. |

| Operational Expenses | Salaries, benefits, administration, marketing, utilities | Significant across all diverse business units. |

| Financial Costs | Interest expenses on debt financing | Consolidated interest expenses: PHP 35.5 billion (2023). |

| Asset Maintenance & Utilities | Property upkeep, repairs, electricity, water | Focus on renewable energy to mitigate costs. |

Revenue Streams

Ayala Land, a key player in the Philippines' real estate sector, draws significant income from the sale of various property types. In 2023, for instance, the company's revenue from property development, which includes sales of residential and commercial lots, reached PHP 150.5 billion, showcasing the substantial contribution of these transactions to their overall financial performance.

Beyond outright sales, Ayala Land also benefits from a steady stream of recurring revenue through its leasing operations. This includes income generated from its extensive portfolio of shopping malls, prime office spaces, and hospitality ventures like hotels, providing a stable financial base that complements its development-driven sales.

For Ayala Corporation's banking arm, Bank of the Philippine Islands (BPI), net interest income is the cornerstone. This comes from the spread between the interest earned on its loans and investments and the interest paid on its deposits. In 2023, BPI reported a net interest income of PHP 140.6 billion, a significant increase from the previous year, reflecting strong loan growth and effective asset-liability management.

Beyond interest income, BPI generates substantial revenue from service fees and commissions. These non-interest income streams include fees from credit card transactions, wealth management services, foreign exchange dealings, and various banking transactions. In 2023, BPI's non-interest income reached PHP 64.1 billion, showcasing the bank's ability to diversify its revenue sources and capitalize on its extensive customer base.

Globe Telecom, a key subsidiary of Ayala Corporation, generates substantial revenue from its core telecommunications offerings, including mobile and broadband subscriptions. This segment also benefits from data usage, voice calls, and SMS services, forming a foundational income stream.

Beyond traditional services, Globe is increasingly capitalizing on digital services. Mobile money platforms like GCash are becoming significant revenue contributors, alongside tailored enterprise solutions designed for businesses, reflecting a strategic shift towards value-added digital offerings.

In 2023, Globe Telecom reported a consolidated service revenue of PHP 157.7 billion, with mobile services accounting for a significant portion. GCash, in particular, has seen remarkable growth, reaching over 10 million monthly active users by the end of 2023, showcasing its expanding impact on revenue diversification.

Energy Sales and Power Generation

Ayala Corporation's subsidiary, ACEN Corporation, a major player in renewable energy, generates significant revenue through the sale of electricity. This power comes from its diverse portfolio of solar, wind, and geothermal facilities.

ACEN sells this generated electricity to a broad customer base. This includes government-owned distribution utilities and large industrial companies that require a steady and often green power supply.

In 2024, ACEN's commitment to expanding its renewable capacity directly translated to increased energy sales. The company reported substantial growth in its energy output, driven by the commissioning of new projects and the improved performance of existing ones.

- Electricity Sales: Revenue is primarily derived from selling electricity generated by ACEN's renewable energy assets.

- Customer Segments: Key customers include distribution utilities and industrial clients, both domestically and internationally.

- Capacity Growth: ACEN's ongoing investments in new solar, wind, and geothermal projects in 2024 directly contribute to higher energy sales volumes.

- Market Presence: The company's expanding footprint across various geographies diversifies its revenue streams from energy sales.

Healthcare Services and Pharmaceutical Sales

Ayala Corporation's healthcare segment, primarily through AC Health, brings in money from a variety of sources. This includes income generated from patients utilizing their hospital services, seeking consultations at their clinics, and undergoing medical procedures.

Beyond direct patient care, AC Health also earns revenue from the sale of pharmaceutical products. This occurs through its network of drugstores and its pharmaceutical distribution businesses, ensuring a steady flow of income from both services and product sales.

For instance, in 2023, AC Health's revenue streams were bolstered by its expanding network of healthcare facilities and its growing pharmaceutical distribution operations. The company continues to invest in expanding its reach and service offerings within the Philippine healthcare landscape.

- Hospital Services: Revenue from inpatient and outpatient care, surgeries, and diagnostic services.

- Clinic Consultations: Income derived from doctor's appointments and specialist visits across its clinic network.

- Pharmaceutical Sales: Earnings from the sale of medicines and health products through its retail pharmacies and distribution channels.

- Medical Procedures: Revenue generated from specialized treatments and diagnostic tests performed at its facilities.

Ayala Corporation's diverse revenue streams are built upon the strengths of its key subsidiaries. These include property development and leasing from Ayala Land, banking services and interest income from BPI, telecommunications and digital services from Globe Telecom, renewable energy sales from ACEN, and healthcare services and pharmaceutical sales from AC Health.

| Subsidiary | Primary Revenue Streams | 2023 Revenue Contribution (PHP Billions) |

| Ayala Land | Property Sales, Leasing (Malls, Offices, Hotels) | 150.5 (Property Development) |

| BPI | Net Interest Income, Service Fees & Commissions | 140.6 (Net Interest Income), 64.1 (Non-Interest Income) |

| Globe Telecom | Mobile & Broadband Subscriptions, Data Usage, Digital Services (GCash) | 157.7 (Consolidated Service Revenue) |

| ACEN | Electricity Sales from Renewable Energy Assets | Significant growth in 2024 driven by capacity expansion |

| AC Health | Hospital Services, Clinic Consultations, Pharmaceutical Sales | Growth driven by expanding network and distribution |

Business Model Canvas Data Sources

The Ayala Corporation Business Model Canvas is informed by a robust mix of financial disclosures, comprehensive market research, and internal strategic planning documents. These sources provide the foundational data for each component of the canvas, ensuring a data-driven approach to strategy.